Get Zanesville City Tax Form

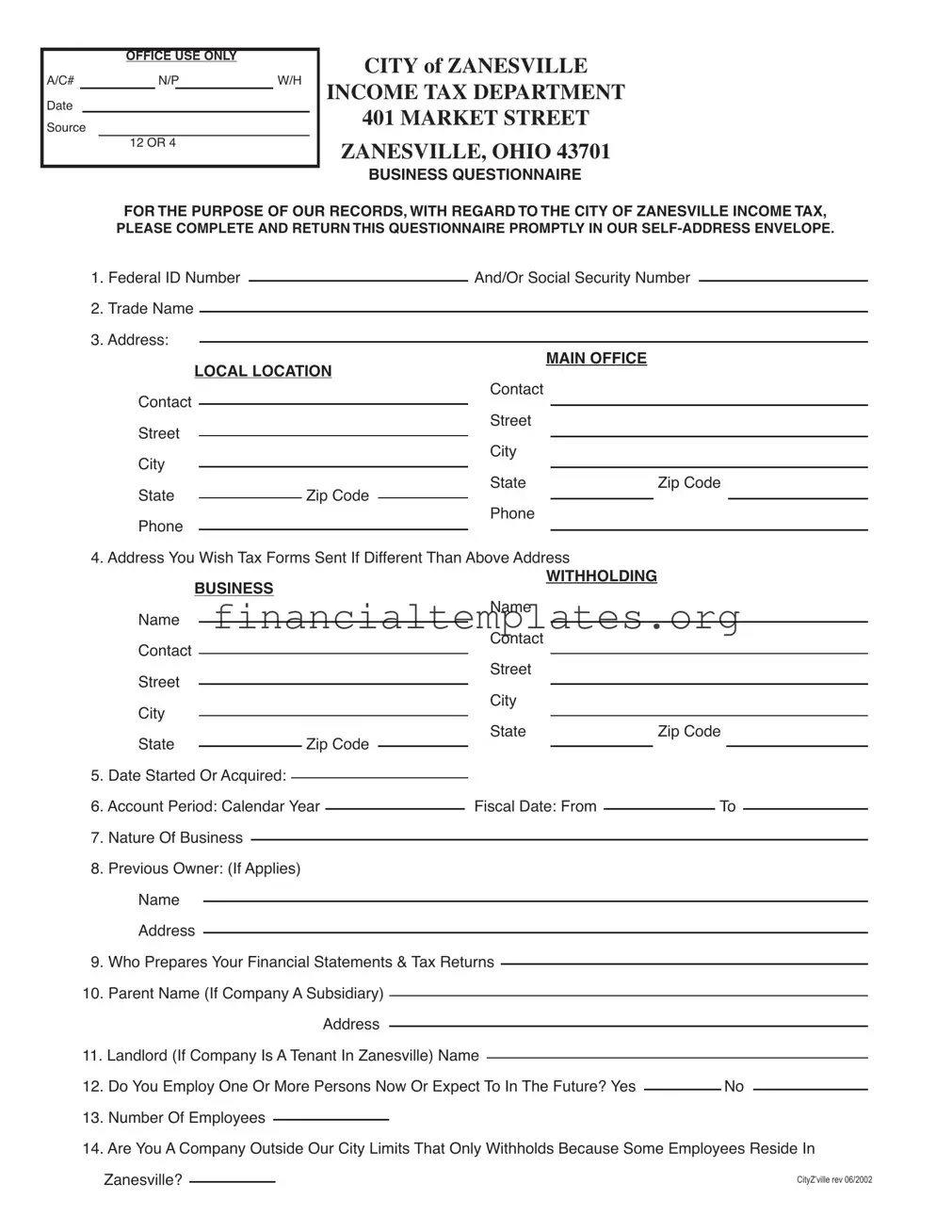

The Zanesville City Tax form serves as a critical tool for businesses operating within the city limits of Zanesville, Ohio, facilitating the accurate reporting and compliance with local income tax requirements. Designed by the Zanesville Income Tax Department located at 401 Market Street, this comprehensive questionnaire requests detailed information, ensuring that businesses contribute appropriately to the city's fiscal health. Essential data gathered includes Federal ID or Social Security Numbers, trade names, pertinent addresses, and contact information, aiming to streamline communication and tax form delivery. The form delves into the business's structure and operations by asking for the date of establishment or acquisition, account periods, the nature of the business, and any previous ownership details. Moreover, it inquires about financial oversight, parental company information if applicable, and landlord details for businesses renting space in Zanesville. A crucial section addresses employment, querying whether the business currently employs or plans to employ individuals, shedding light on withholding obligations. This attention to whether a company employs residents or operates from outside city limits, yet has tax liabilities due to employee residency, underscores the form's role in capturing the full spectrum of business engagements within the city. Through this meticulous collection of information, the Zanesville City Tax form ensures both businesses and the city can fulfill their financial and regulatory responsibilities efficiently.

Zanesville City Tax Example

OFFICE USE ONLY

A/C# |

|

N/P |

W/H |

|

|

|

|

|

|

Date

Source

12 OR 4

CITY OF ZANESVILLE

INCOME TAX DEPARTMENT

401 MARKET STREET

ZANESVILLE, OHIO 43701

BUSINESS QUESTIONNAIRE

FOR THE PURPOSE OF OUR RECORDS, WITH REGARD TO THE CITY OF ZANESVILLE INCOME TAX, PLEASE COMPLETE AND RETURN THIS QUESTIONNAIRE PROMPTLY IN OUR

1. Federal ID Number |

|

|

|

|

|

|

|

|

And/Or Social Security Number |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

2. Trade Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3. Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

MAIN OFFICE |

|

|

|

|

|

|

|

|

|||||||

LOCAL LOCATION |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Contact |

|

|

|

|

|

|

|

|

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

|||||||||||||||

State |

|

|

|

|

|

|

Zip Code |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

|

||||||||||

Phone |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4. Address You Wish Tax Forms Sent If Different Than Above Address |

|

|

|

|

|

|

|

|

||||||||||||||||||

BUSINESS |

|

|

|

|

|

|

|

WITHHOLDING |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

||||||||

Contact |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Street |

|

|

|

|

|

|

|

|

||||||||

Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

State |

Zip Code |

|||||||||||||||

State |

|

|

|

|

|

|

Zip Code |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. Date Started Or Acquired: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

6. Account Period: Calendar Year |

|

|

|

Fiscal Date: From |

|

|

|

|

To |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||

7. Nature Of Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. Previous Owner: (If Applies) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9. Who Prepares Your Financial Statements & Tax Returns |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

10. Parent Name (If Company A Subsidiary) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. Landlord (If Company Is A Tenant In Zanesville) Name |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

12. Do You Employ One Or More Persons Now Or Expect To In The Future? Yes |

|

|

|

|

No |

|

||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||

13.Number Of Employees

14.Are You A Company Outside Our City Limits That Only Withholds Because Some Employees Reside In

Zanesville? |

|

CityZ’ville rev 06/2002 |

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Type | This document is a Business Questionnaire intended for the Zanesville Income Tax Department. |

| Addressed to | The form is designated for businesses within the City of Zanesville, Ohio, directed to be returned to 401 Market Street, Zanesville, Ohio 43701. |

| Required Information | Businesses must provide details such as Federal ID or Social Security Number, trade name, official addresses, date business started or was acquired, nature of business, and information on taxable employees. |

| Special Conditions | The questionnaire inquires if the business is a subsidiary, has previous owners, employs one or more persons, or withholds taxes for employees residing in Zanesville but working outside city limits. |

| Governing Law | Although not explicitly stated within the provided details, such a form is likely governed by municipal income tax laws specific to the City of Zanesville, and broadly by the State of Ohio's tax regulations. |

Guide to Writing Zanesville City Tax

Filling out the Zanesville City Tax Form is a straightforward process that businesses operating within Zanesville, Ohio, must complete. This document is crucial for ensuring your business complies with local tax regulations. Below, you'll find a detailed guide to assist you through each step. It's important to complete each section accurately to avoid any potential issues with the city's Income Tax Department.

- Enter your Federal ID Number or Social Security Number at the top of the form.

- Fill in your Trade Name, ensuring it matches the name registered with the IRS.

- For the Address section, write your main office address under "MAIN OFFICE" and your local Zanesville location under "LOCAL LOCATION" if applicable. Include the street address, city, state, and zip code. Also, provide a contact phone number for each.

- If you wish tax forms to be sent to a different address, provide this alternative address under the "Address You Wish Tax Forms Sent If Different Than Above Address" section.

- Under "BUSINESS WITHHOLDING," repeat the process of filling out the name and contact information if it differs from the information provided above.

- Indicate the date your business started or was acquired in the area provided.

- Specify your account period by indicating whether you operate on a Calendar Year or Fiscal Date, and fill in the "From" and "To" dates for the fiscal year if applicable.

- Describe the nature of your business as clearly as possible.

- If your business was previously owned by another entity, provide the previous owner's name and address.

- Identify who prepares your financial statements and tax returns. Include their name and contact information.

- If your company is a subsidiary, provide the Parent Name and Address.

- For businesses renting space in Zanesville, fill in the landlord's name under "Landlord (If Company Is A Tenant In Zanesville)."

- Answer whether you currently employ one or more persons, or expect to in the future, by marking "Yes" or "No."

- Specify the number of employees.

- If your company is outside city limits but withholds taxes for employees residing in Zanesville, confirm by answering the final question.

After completing the form, review all sections to ensure accuracy. This careful review can help prevent the need for corrections and potential delays. Once finalized, return the questionnaire using the provided self-addressed envelope to the City of Zanesville Income Tax Department. By following these steps, you'll ensure that your business meets its local tax obligations efficiently and effectively.

Understanding Zanesville City Tax

-

What is the purpose of completing the Zanesville City Business Questionnaire?

The Zanesville City Business Questionnaire is designed to gather essential information for the City of Zanesville Income Tax Department records. It ensures that your business is properly registered for city income tax purposes, allowing the department to accurately assess and collect taxes in accordance with local regulations.

-

Where should I send the completed questionnaire?

You should return the completed questionnaire using the self-addressed envelope provided by the City of Zanesville Income Tax Department. If you've misplaced the envelope, send it to the Income Tax Department at 401 Market Street, Zanesville, Ohio 43701.

-

What information is required to fill out the questionnaire?

- Federal ID Number or Social Security Number

- Trade Name

- Main and local office addresses and contact information

- Address for sending tax forms, if different

- Date your business started or was acquired

- Account period (calendar year or fiscal dates)

- Nature of your business

- Previous owner's information, if applicable

- Details on who prepares your financial statements and tax returns

- Parent company information, if your company is a subsidiary

- Landlord information if your company is a tenant in Zanesville

- Employment information, including potential future employment plans

-

What if my business address is different from where I want my tax forms sent?

In the questionnaire, you have the option to provide a separate mailing address specifically for receiving tax forms. This ensures that important documents reach the correct location promptly.

-

How should I determine the account period for my business?

The account period could either be the calendar year or specific fiscal dates. Select the calendar year if your business follows a January to December fiscal year. If your financial year begins and ends on dates other than January and December, then specify those fiscal dates in the questionnaire.

-

Do I need to complete this questionnaire if I don't currently employ anyone but plan to in the future?

Yes, you are required to complete the questionnaire even if you do not currently have employees but expect to hire in the future. This helps the City of Zanesville Income Tax Department anticipate and track business growth and employment within the city.

-

What if my business is located outside Zanesville but employs residents of Zanesville?

Businesses outside city limits that withhold taxes for employees residing in Zanesville are also required to complete the questionnaire. This ensures compliance with local tax regulations that apply to your employees who are Zanesville residents.

-

Who can I contact for help with the questionnaire?

If you have questions or need assistance with the questionnaire, you can contact the City of Zanesville Income Tax Department directly. Their office is located at 401 Market Street, Zanesville, Ohio 43701, or you can reach them by phone for direct support.

Common mistakes

Filling out the Zanesville City Tax form accurately is critical for individuals and businesses to ensure compliance with local tax laws. However, mistakes can occur, which may lead to processing delays or incorrect tax assessments. Here are common errors to avoid:

Incorrect Federal ID Number or Social Security Number: One common mistake is entering an incorrect Federal ID or Social Security Number. This is the primary identifier and must be accurate to ensure your tax information is correctly processed.

Not specifying the Trade Name clearly: If your business operates under a name different from its legal name, failing to clearly specify this can cause confusion and misalignment with city records.

Address discrepancies: It's essential to provide accurate and current addresses for the main office and local location, if applicable. Errors here can lead to misdirected correspondence.

Incorrect or outdated contact information: Ensuring the phone numbers and email addresses are current is crucial for timely communication regarding your tax status.

Inaccurate date business started or acquired: This date affects your tax filings and obligations. Providing an incorrect date can affect your tax calculations.

Misunderstanding the Account Period: Mixing up calendar and fiscal year dates can lead to filing errors and misinterpretation of tax liabilities.

Failing to accurately describe the Nature of Business: This information helps the tax department understand your business activities and apply relevant tax laws.

Omitting details about the Previous Owner or Parent Company when applicable: This is especially important if the ownership structure impacts your tax responsibilities.

Understanding and avoiding these common mistakes can help in the preparation of your Zanesville City Tax form, ensuring it is completed accurately and submitted on time. Remember to review your form carefully before submission to avoid these and other potential errors.

Documents used along the form

When you're dealing with the Zanesville City Tax form, it's essential to have all your documentation in order. To streamline this process, there is a variety of other forms and documents often used alongside it. Understanding each of these documents can help ensure that your tax-related tasks are handled efficiently and accurately.

- W-2 Form: This wage and tax statement is issued by employers and shows the amount of taxes withheld from an employee's paycheck for the year. It's crucial for reporting individual earnings and tax withholdings.

- 1099-MISC Form: For independent contractors or freelancers, this document outlines the total income one has earned from a particular business that does not qualify as a traditional employee.

- Previous Year Tax Return: Having a copy of your last year's tax return can streamline the filing process, helping to quickly reference previous income, deductions, and credits.

- Schedule C: This form is for small business owners or sole proprietors. It's used to report the income or loss from a business you operated or a profession you practiced as a sole proprietor.

- Schedule E: Real estate investors and those who earn rental income use this form to report their rental property income, expenses, and depreciation.

- Quarterly Estimated Tax Payment Receipts: For those who make estimated tax payments throughout the year, keeping these receipts is crucial for accurately reporting the total amount of tax paid when filing.

- Records of Tax Deductible Expenses: Documents such as receipts, bills, and invoices related to tax-deductible expenses like office supplies, business travel, or charitable donations are important to have on hand to support deductions claimed on your tax return.

In conclusion, proper preparation and organization of your tax documents can make the process of filing your Zanesville City Tax form more straightforward. Keeping these documents readily accessible will not only save you time but can also help in maximizing your potential deductions and ensuring that your financial obligations to the city of Zanesville are met accurately and efficiently.

Similar forms

The Zanesville City Tax form shares similarities with the Federal Income Tax Return, particularly in the way it asks for identification numbers such as Federal ID Number or Social Security Number. Both forms require this information as a means to identify the taxpayer or the entity responsible for the tax. This fundamental requirement ensures that tax records are accurately matched with the correct individuals or businesses.

Similar to the State Income Tax Return, the Zanesville City Tax form requests detailed contact information, including addresses for the main office and the location where tax forms should be sent. This resemblance underscores the importance of having correct and up-to-date addresses in ensuring that taxpayers receive necessary correspondence and forms from the tax authority, be it at the city, state, or federal level.

Comparable to the Business License Registration forms, the Zanesville document inquires about the nature of the business and the date it started or was acquired. These forms gather basic yet essential information about businesses operating within their jurisdictions, which aids in the regulatory oversight and the provision of services to the business community.

The Employee Withholding Allowance Certificate (W-4) also bears resemblance to the Zanesville City Tax form, specifically in the section querying about employment. Both forms are interested in the employment status within an entity, such as the number of employees, to determine withholding requirements which are vital for the accurate collection of income taxes.

Land Registration or Update forms, used by municipalities to keep track of property ownership and occupancy details, are akin to the section in the Zanesville form that asks for landlord information if the company is a tenant. This information allows the city to maintain accurate records of business locations and property use within its limits.

The New Hire Reporting form that businesses must submit to state agencies shares similarities with the employee section of the Zanesville form. Both forms collect data on employment to ensure compliance with regulations, be it for tax withholding, benefits, or employment tracking purposes at different levels of government.

Vendor Information Forms, used by entities to collect data from suppliers, resemble the Zanesville City Tax form in the way it gathers information about businesses. Both kinds of forms collect detailed contact information and organizational details to facilitate financial transactions, whether for tax purposes or procurement.

The Zanesville form’s inquiry about the company's financial statement and tax return preparer is reminiscent of the IRS Form 2848, Power of Attorney and Declaration of Representative. Both forms touch upon the delegation of tax-related duties, highlighting the need to identify who is authorized to handle such sensitive matters on behalf of the taxpayer or entity.

Change of Address forms used by the Postal Service and other entities have a similar purpose to portions of the Zanesville document that allow businesses to specify a different mailing address for tax forms. Ensuring accurate mail delivery is crucial for both operational and compliance reasons, making this a common feature across various types of documents.

Lastly, the Subsidiary Information Form, used by parent companies to provide details about their subsidiaries, mirrors the part of the Zanesville form asking for parent company details. This similarity underscores the importance of understanding the broader corporate structure for regulatory, taxation, and compliance purposes.

Dos and Don'ts

When filling out the Zanesville City Tax form, paying attention to detail and following proper procedures can make a significant difference. Here are five things you should do, along with five things you should avoid, to ensure the process goes smoothly.

What You Should Do:

Double-check the completeness and accuracy of all provided information, including your Federal ID Number and/or Social Security Number, to ensure there are no delays due to incorrect data.

Clearly indicate if there is a different address where you wish the tax forms to be sent, to guarantee they reach the right destination.

Be precise about the nature of your business and provide detailed information about the start date or acquisition date, which helps in identifying the appropriate tax period.

Include updated contact information for your business and the person responsible for preparing financial statements and tax returns, facilitating direct communication if required.

If applicable, accurately list the number of employees to reflect your business’s obligations under Zanesville’s tax laws accurately.

What You Shouldn't Do:

Do not leave sections incomplete, especially concerning your business's nature and the previous owner details if applicable. Incomplete information can lead to processing delays.

Avoid using outdated contact information. Regularly review and update these details to ensure efficient communication.

Resist the temptation to guess information. If unsure, seek clarification or professional help rather than risking inaccuracies.

Do not disregard the importance of indicating whether your employees reside in Zanesville for withholding purposes, as it impacts your tax responsibilities.

Avoid sending the form without first reviewing it for errors. A quick check can save time and trouble later.

Properly completing the Zanesville City Tax form is not just a matter of legal compliance; it also reflects on your business's capacity to handle responsibilities diligently. Keeping these dos and don'ts in mind will facilitate a smoother process and avoid potential issues that could arise from incorrect or incomplete submissions.

Misconceptions

When it comes to the Zanesville City Tax form, several misconceptions frequently surface. Addressing these misunderstandings is essential for taxpayers to accurately complete their responsibilities.

- Misconception #1: Personal information is not essential. Many believe that providing Federal ID Numbers or Social Security Numbers is optional. In truth, these identifiers are crucial for accurate record-keeping and tax processing.

- Misconception #2: You only need to provide the main office address. The form asks for both the main and local office addresses if they differ, ensuring local tax obligations are met accurately.

- Misconception #3: Business withholding information is only for large businesses. Regardless of size, any business with employees must provide details about who manages withholding taxes for Zanesville employees.

- Misconception #4: The nature of the business is irrelevant. On the contrary, the city uses this information to categorize businesses for tax purposes and ensure they comply with local tax codes.

- Misconception #5: Information about previous ownership is optional. For new owners, disclosing the prior owner helps the city update records and ensures tax continuity and compliance.

- Misconception #6: Small businesses don't need to complete the entire form. Even small businesses must provide comprehensive details, including who prepares their financial statements and tax returns, to meet city tax regulations.

- Misconception #7: You don't need to specify if your business is a subsidiary. The form requires information about the parent company to understand the business's full economic contribution to the city.

- Misconception #8: Tenant information is only for large commercial entities. Small businesses leasing property in Zanesville must also provide landlord details to complete their tax profiles accurately.

- Misconception #9: Only Zanesville-based employees count for city taxes. In fact, any business with employees residing in Zanesville, even if the business itself is outside city limits, must report this for tax purposes.

Understanding these nuances is vital for accurate completion of the Zanesville City Tax form. It ensures compliance with local tax laws, supporting the community's financial health while avoiding possible penalties for inaccuracies or omissions.

Key takeaways

Filling out the Zanesville City Tax form accurately is paramount for businesses to ensure compliance with local tax obligations. Here are five key takeaways to guide you through the process:

- Every business entity must provide their Federal ID Number or Social Security Number, critical for identifying your business in tax documents and ensuring that your filings are correctly attributed to your organization.

- The form requires detailed contact information for both the main office and, if applicable, a local location within Zanesville. It's essential to determine the precise address where tax forms should be sent, especially if it differs from the business's primary address. This ensures that all communications from the Income Tax Department reach the correct destination promptly.

- Clarification of the business's operational dates and the accounting period (whether calendar year or a specified fiscal date range) is necessary for accurate tax calculation. This information helps the tax department understand your business's operational timeline, significantly affecting your tax liabilities.

- Understanding the nature of your business and any previous ownership details (if applicable) are crucial for the city's records. Should your business change hands, this history aids in maintaining continuity in tax assessment and obligations.

- Determining whether your company employs staff or expects to do so is pivotal. This information, alongside whether your business is physically located outside but employs residents within Zanesville, shapes your tax withholding responsibilities. It's important for businesses to disclose if they are operating within the city limits or only withhold taxes because of employees residing in Zanesville.

This overview offers a foundational guide to navigating the complexities of the Zanesville City Tax form. Adherence to these facets ensures that businesses meet their local tax obligations efficiently and accurately.

Popular PDF Documents

What Is a Payoff Letter for a Vehicle - Essential for borrowers looking to conclusively settle their loans, outlining a formal process to request the exact payoff amount from their lender.

IRS 8814 - Facilitates tax planning strategies for parents with children who have investment income.

Irs Form 2159 - Makes the electronic tax payment process accessible and manageable, promoting timely compliance with tax laws.