Get Wv Tax Exempt Form

Exploring the intricacies of the West Virginia Consumer Sales and Service Tax and Use Tax Exemption Certificate, commonly known as WV/CST-280, sheds light on a pivotal financial mechanism for various entities within the state. At its core, this document enables qualifying purchasers—ranging from businesses involved in resale activities, exempt commercial agricultural producers, tax-exempt organizations, to schools and churches—to legitimately bypass the otherwise applicable sales tax on purchases of tangible personal property or taxable services. Integral to the utilization of this exemption is the stipulation that all transactions presuppose taxability unless a properly completed exemption certificate, or a direct pay permit number, is presented. The form delineates specific categories under which exemptions may be claimed, including, but not limited to, purchases for resale, agricultural production, governmental, educational, and religious purposes, alongside exempt acquisitions of specific services and tangible personal property. It is essential that the purchaser, armed with a valid business registration certificate, meticulously fills out and submits this form to the vendor to legitimize the tax-exempt status of the purchase. Misuse or fraudulent application of this certificate carries significant repercussions, including liability for unpaid taxes, hefty penalties, and interest. Both vendors and purchasers are guided by detailed instructions on the form, ensuring the correct application of exemptions and compliance with West Virginia’s tax laws, emphasizing the form’s pivotal role in the fiscal landscape of exempt transactions within the state.

Wv Tax Exempt Example

|

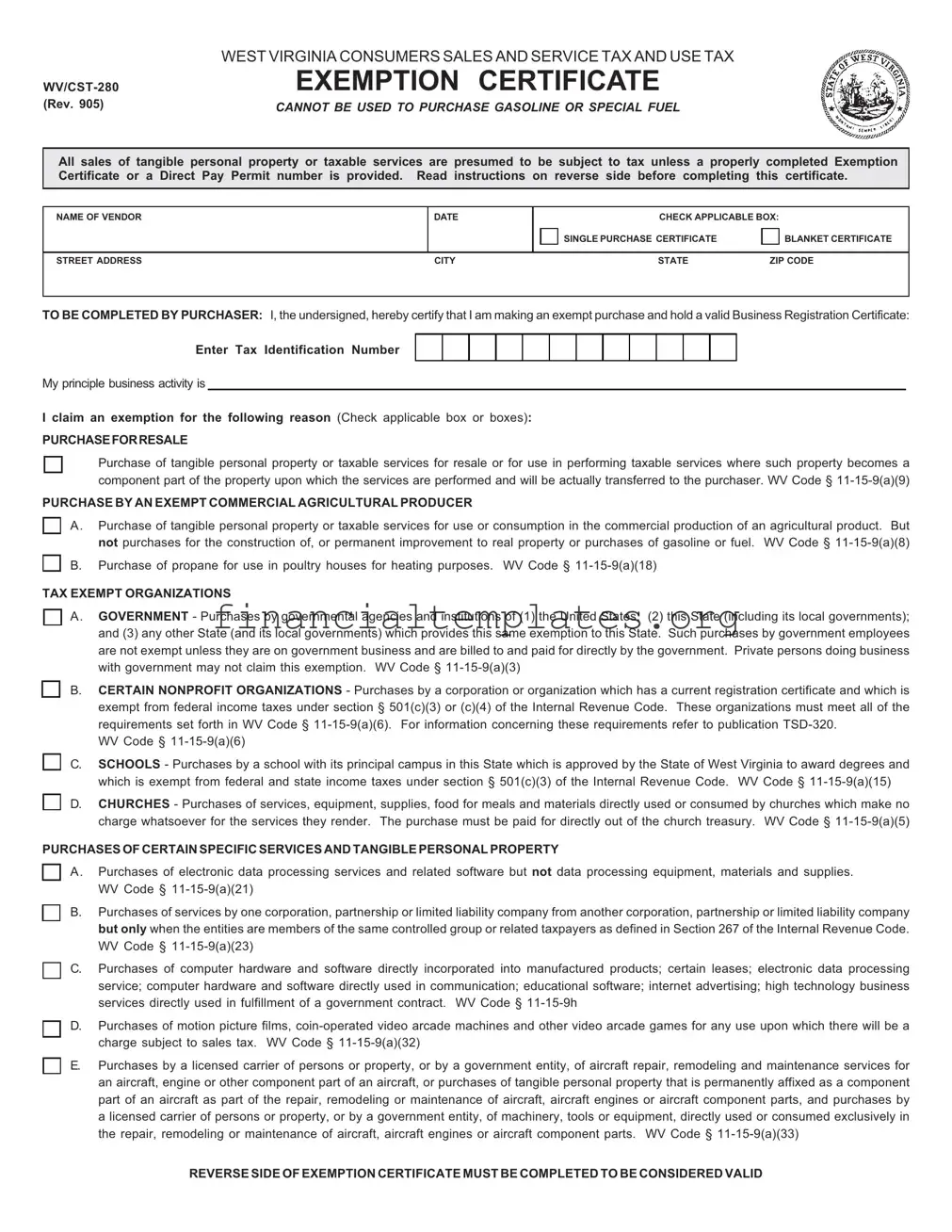

WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX AND USE TAX |

EXEMPTION CERTIFICATE |

|

(Rev. 905) |

CANNOT BE USED TO PURCHASE GASOLINE OR SPECIAL FUEL |

All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided. Read instructions on reverse side before completing this certificate.

NAME OF VENDOR

DATE

CHECK APPLICABLE BOX:

SINGLE PURCHASE CERTIFICATE

BLANKET CERTIFICATE

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

TO BE COMPLETED BY PURCHASER: I, the undersigned, hereby certify that I am making an exempt purchase and hold a valid Business Registration Certificate:

Enter Tax Identification Number

My principle business activity is

I claim an exemption for the following reason (Check applicable box or boxes):

PURCHASEFORRESALE

Purchase of tangible personal property or taxable services for resale or for use in performing taxable services where such property becomes a component part of the property upon which the services are performed and will be actually transferred to the purchaser. WV Code §

PURCHASE BY AN EXEMPT COMMERCIAL AGRICULTURAL PRODUCER

A. Purchase of tangible personal property or taxable services for use or consumption in the commercial production of an agricultural product. But not purchases for the construction of, or permanent improvement to real property or purchases of gasoline or fuel. WV Code §

B. Purchase of propane for use in poultry houses for heating purposes. WV Code §

TAX EXEMPT ORGANIZATIONS

A. GOVERNMENT - Purchases by governmental agencies and institutions of (1) the United States; (2) this State (including its local governments); and (3) any other State (and its local governments) which provides this same exemption to this State. Such purchases by government employees are not exempt unless they are on government business and are billed to and paid for directly by the government. Private persons doing business with government may not claim this exemption. WV Code §

B. CERTAIN NONPROFIT ORGANIZATIONS - Purchases by a corporation or organization which has a current registration certificate and which is exempt from federal income taxes under section § 501(c)(3) or (c)(4) of the Internal Revenue Code. These organizations must meet all of the requirements set forth in WV Code §

WV Code §

C. SCHOOLS - Purchases by a school with its principal campus in this State which is approved by the State of West Virginia to award degrees and which is exempt from federal and state income taxes under section § 501(c)(3) of the Internal Revenue Code. WV Code §

D. CHURCHES - Purchases of services, equipment, supplies, food for meals and materials directly used or consumed by churches which make no charge whatsoever for the services they render. The purchase must be paid for directly out of the church treasury. WV Code §

PURCHASES OF CERTAIN SPECIFIC SERVICES AND TANGIBLE PERSONAL PROPERTY

A. Purchases of electronic data processing services and related software but not data processing equipment, materials and supplies. WV Code §

B. Purchases of services by one corporation, partnership or limited liability company from another corporation, partnership or limited liability company but only when the entities are members of the same controlled group or related taxpayers as defined in Section 267 of the Internal Revenue Code. WV Code §

C. Purchases of computer hardware and software directly incorporated into manufactured products; certain leases; electronic data processing service; computer hardware and software directly used in communication; educational software; internet advertising; high technology business services directly used in fulfillment of a government contract. WV Code §

D. Purchases of motion picture films,

E. Purchases by a licensed carrier of persons or property, or by a government entity, of aircraft repair, remodeling and maintenance services for an aircraft, engine or other component part of an aircraft, or purchases of tangible personal property that is permanently affixed as a component part of an aircraft as part of the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts, and purchases by a licensed carrier of persons or property, or by a government entity, of machinery, tools or equipment, directly used or consumed exclusively in the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts. WV Code §

REVERSE SIDE OF EXEMPTION CERTIFICATE MUST BE COMPLETED TO BE CONSIDERED VALID

I understand that this certificate may not be used to make tax free purchases of items or services which are not for an exempt purpose and that I will pay the Consumers Sales or Use Tax on tangible personal property or services purchased pursuant to this certificate and subsequently used or consumed in a taxable manner. In addition, I understand that I will be liable for the tax due, plus substantial penalties and interest, for any erroneous or false use of this certificate.

NAME OF PURCHASER |

STREET ADDRESS |

|

|

|

|

SIGNATURE OF OWNER, PARTNER, OFFICER OF CORPORATION, ETC. |

CITY |

|

|

|

|

TITLE |

STATE |

ZIP CODE |

|

|

|

GENERALINSTRUCTIONS

An Exemption Certificate may be used only to claim exemption from tax upon a purchase of tangible personal property or services which will be used for an exempt purpose as stated on the front of this form.

ApurchasermayfileablanketExemptionCertificatewiththevendortocoveradditionalpurchasesofthesamegeneraltypeofproperty or service. However, each subsequent sales slip or purchase invoice evidencing a transaction covered by a blanket Exemption Certificate must show the purchaser’s name, address and Business Registration Certificate Number for purposes of certification.

INSTRUCTIONSFORPURCHASER

To purchase tangible personal property or services tax exempt, you must possess a valid Business Registration Certificate and you must properly complete this Exemption Certificate and present it to your supplier. To be properly completed, all entries on this Exemption Certificate must be filled in.

Your Business Registration Certificate (and any duplicates) may be suspended or revoked if you or someone acting on your behalf willfully issues this certificate for the purpose of making a tax exempt purchase of tangible personal property and/or services that is not used in a tax exempt manner (as stated on the front of this form).

When property or services are purchased tax exempt with an Exemption Certificate, but later used or consumed in a non exempt manner, the purchaser must pay Sales or Use Tax on the purchase price.

The willful issuance of a false or fraudulent Exemption Certificate with the intent to evade Sales or Use Tax is a misdemeanor.

Your misuse of this Certificate with intent to evade the Sales or Use Tax shall also result in your being subject to:

A penalty of fifty percent of the tax that would have been due

had there not been a misuse of such certificate.

This is in addition to any other penalty imposed by the Law.

In the event you make false or fraudulent use of this Certificate with intent to evade the tax, you may be assessed for the tax at any time subsequent to such use.

INSTRUCTIONSFORVENDOR

At the time the property is sold or the service is rendered, you must obtain from your customer this Certificate, properly completed, (or a Direct Pay Permit number issued by the West Virginia Department of Tax and Revenue), or the sale will be deemed a taxable sale, unless the property or service sold is exempt per se from Sales Tax. Your failure to collect tax on such taxable sale will make you personally liable for the tax, plus penalties and interest.

Additionalinformationmayberequiredtosubstantiatethatthesalewasforexemptpurposes. InorderforthisCertificatetobeproperly completed, it must be issued by a purchaser who has a valid Business Registration Certificate and must have all entries completed by the purchaser.

A timely received certificate which contains a material deficiency will be considered satisfactory if such deficiency is subsequently corrected.

You must keep this certificate for at least three years after the due date of the last return to which it relates, or the date when such return was filed, if later.

You must maintain a reasonable method of associating a particular exempt sale to a customer with the Exemption Certificate you have on file for such customer.

INSTRUCTIONSFORVENDORANDPURCHASER

If you, as vendor or as a purchaser, engage in any business activity in West Virginia without possessing a valid Business Registration Certificate (and you do not clearly qualify for an exemption), you shall be subject to a penalty in an amount not exceeding $100 for the first day on which such sales or purchases are made, plus an amount not exceeding $100 for each subsequent day on which such sales or purchases are made.

Please begin using this Certificate immediately.

Document Specifics

| Fact | Description |

|---|---|

| Form Title | West Virginia Consumers Sales and Service Tax and Use Tax Exemption Certificate (WV/CST-280) |

| Exclusions | Cannot be used to purchase gasoline or special fuel. |

| Presumption of Taxability | All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided. |

| Usage | For exempt purchases, the purchaser must have a valid Business Registration Certificate and complete this Exemption Certificate. |

| Governing Laws | Specific exemptions are defined under various sections of WV Code § 11-15-9, including agricultural production, government purchases, non-profit organizations, schools, churches, and specific services and tangible personal property. |

| Liability for Misuse | Improper use of the Exemption Certificate results in the purchaser being liable for the tax due, plus potential penalties and interest for any erroneous or false use of this certificate. |

| Vendor and Purchaser Instructions | Vendors must obtain a properly completed certificate at the time of sale, and purchasers must fill all entries to properly complete the Exemption Certificate for tax-exempt purchases. |

Guide to Writing Wv Tax Exempt

Filling out the WV Tax Exempt form is a straightforward process but requires attention to detail to ensure accuracy. This form is crucial for entities that are eligible to purchase goods or services without paying sales tax, under specific conditions laid out by the West Virginia State Tax Department. Entities such as nonprofit organizations, government agencies, schools, and agricultural producers often use this form. Ensuring the form is filled out correctly is essential to avoid the misuse of the exemption, which can lead to penalties and interest charges. Below are the steps to properly complete the WV/CST-280 Exemption Certificate.

- Start by entering the NAME OF VENDOR, along with the DATE of the transaction at the top of the form.

- Choose the type of certificate you are filling out by checking either the SINGLE PURCHASE CERTIFICATE box for a one-time purchase or the BLANKET CERTIFICATE box for multiple purchases over time.

- Under the vendor’s information, provide the STREET ADDRESS, CITY, STATE, and ZIP CODE of the vendor.

- In the section titled "TO BE COMPLETED BY PURCHASER," write the name of the purchasing entity as the NAME OF PURCHASER.

- Input the Tax Identification Number where indicated.

- Describe the principal business activity of the purchaser in the provided space.

- Select the reason for claiming tax exemption by checking the appropriate box next to the exemption reason. Multiple boxes can be checked if more than one reason applies.

- Complete the purchaser’s information including the STREET ADDRESS, CITY, STATE, and ZIP CODE.

- Sign the form in the space provided for the SIGNATURE OF OWNER, PARTNER, OFFICER OF CORPORATION, ETC.

- Write the title of the person signing the form next to the signature field.

After filling out the form, it's crucial to read the GENERAL INSTRUCTIONS and INSTRUCTIONS FOR PURCHASER on the reverse side of the form to ensure compliance with the laws and regulations governing tax-exempt purchases in West Virginia. The instructions provide guidance on proper form completion, the obligations of the purchaser, and the potential consequences of misuse. Keep a copy of this form for your records and submit the original to your vendor as required. Remember, the accurate and lawful use of this form helps maintain the integrity of tax-exempt transactions in West Virginia.

Understanding Wv Tax Exempt

-

What is a West Virginia Tax Exempt Form?

A West Virginia Tax Exempt Form, specifically the WV/CST-280, is a document that allows qualified purchasers to buy tangible personal property or taxable services without paying sales tax. It is applicable for specific purposes like resale, use in agriculture, government, educational, and certain non-profit organization purchases, among others.

-

Who can use the WV Tax Exempt Form?

The form can be used by entities that hold a valid Business Registration Certificate in West Virginia, including commercial agricultural producers, non-profit organizations, schools, churches, and government agencies. However, it cannot be used for personal purchases or to buy gasoline or special fuel.

-

How do you qualify for tax-exempt status?

Qualification involves holding a valid Business Registration Certificate and potentially meeting federal tax-exempt status under sections such as § 501(c)(3) or (c)(4) of the Internal Revenue Code. Specific qualifications depend on the exemption category, such as educational, agricultural, or government purposes.

-

Can the WV Tax Exempt Form be used for all purchases?

No, the form cannot be used for personal purchases or to buy gasoline or special fuel. It is strictly for purchases of tangible personal property or taxable services that will be used in a manner qualifying for exemption, such as resale or direct use in exempt activities.

-

Is there a penalty for misuse of the WV Tax Exempt Form?

Yes, misuse of the form, such as using it to make tax-free purchases of items or services not intended for an exempt purpose or for personal gain, can result in liability for the tax due plus substantial penalties and interest. Willful issuance of a false or fraudulent exemption certificate is considered a misdemeanor.

-

How does a vendor verify tax-exempt purchases?

Vendors are responsible for collecting properly completed exemption certificates at the time of sale or rendering services. They must verify that the purchaser holds a valid Business Registration Certificate. Failure to collect tax on taxable sales due to not obtaining the certificate makes the vendor personally liable for the tax, plus penalties and interest.

-

What steps must be taken if taxable items are purchased using the WV Tax Exempt Form but are later used in a non-exempt manner?

If items or services bought tax-exempt are later used in a taxable manner, the purchaser must report and pay Sales or Use Tax on the purchase price. This ensures compliance and prevents the misuse of tax-exempt privileges for non-qualified purposes.

Common mistakes

When filling out the West Virginia Tax Exempt Form (WV/CST-280), individuals often make several mistakes that could invalidate their exemption claims. Understanding these mistakes can help ensure that your exemptions are processed accurately.

- Not providing a valid Business Registration Certificate number.

- Leaving the principal business activity section blank.

- Failure to check the applicable exemption reason box or checking the wrong one.

- Using the form to claim exemption on prohibited items, such as gasoline or special fuel.

- Incomplete purchaser information (name, address).

- Not specifying if the certificate is for a single purchase or a blanket certificate.

- Misunderstanding the taxable nature of the purchased items or services, leading to improper claims.

- Not having the certificate signed by an authorized individual (owner, partner, officer of corporation, etc.).

- Failing to complete the reverse side of the exemption certificate, which is necessary for the document to be considered valid.

It's crucial for both purchasers and vendors to pay close attention to the details required on the form to ensure compliance with West Virginia tax laws. Avoiding these common pitfalls can prevent issues such as delays, penalties, and possible legal consequences.

Documents used along the form

When navigating the complexities of tax exemption in West Virginia, understanding the WV Tax Exempt Form is just the beginning. This form, crucial for entities like non-profit organizations, schools, and agricultural producers, allows for certain purchases to be made without the added cost of sales tax. However, to effectively leverage this tax advantage, it's often necessary to pair the exempt form with a variety of other documents and forms that ensure compliance, clarify fiscal responsibilities, and streamline financial operations. Here's a brief look at 10 other forms and documents often used alongside the WV Tax Exempt form, creating a robust toolkit for managing tax-exempt procurements.

- Business Registration Certificate: Essential for proving a business's legal standing and eligibility for tax exemptions in West Virginia.

- IRS Determination Letter: A must-have for non-profit organizations, this letter confirms the entity's tax-exempt status under the IRS code.

- Annual Financial Report: Often required to maintain exemption status, this report outlines the organization's financial activities and status.

- Direct Pay Permit Number: Used by certain businesses to directly pay use tax to the state, bypassing the vendor collection process.

- Purchase Order Documentation: Provides detailed information on purchases made under the tax exemption, critical for audits and financial tracking.

- Articles of Incorporation: For corporations, this document establishes the business's identity and operational scope, which can be critical for exemption qualifications.

- Resale Certificate: For businesses purchasing goods to resell, this certificate prevents tax from being applied on the initial purchase.

- Proof of Property Use: Documentation showing how the purchased property is used, ensuring it aligns with the exempt purposes claimed.

- IRS Form 990: Required from most tax-exempt organizations, this form provides the IRS with annual financial information.

- Vendor's License: While not a direct part of tax exemption, vendors need to maintain this license to legally sell goods and services, including exempt transactions.

This compilation of forms and documents not only supports the process of applying and qualifying for a tax exemption but also assures adherence to legal and fiscal regulations. Entities seeking to benefit from West Virginia’s tax exemption opportunities would do well to familiarize themselves with these instruments, ensuring smoother transactions and compliance. Remember, handling exemptions accurately is key to reaping the full benefits while avoiding legal pitfalls and financial penalties.

Similar forms

The WV Tax Exempt Form, designed to verify tax exemption on certain purchases within West Virginia, shares similarities with a range of documents utilized in diverse sectors for tax exemption or reduction purposes. Each document serves a specific role in ensuring compliance with tax laws while supporting various entities in availing of tax benefits. Understanding these documents can provide valuable insight into the complex world of financial and tax regulations.

Similar to the WV Tax Exempt Form is the Resale Certificate, widely used by retailers. When making purchases for business inventory that will be resold, the retailer provides this certificate to the supplier to buy goods without paying sales tax at the point of purchase. Just like the WV Tax Exempt Form, the intention behind the Resale Certificate is to avoid the cascading effect of taxes, ensuring tax is only applied to the end consumer.

The Certificate of Exemption is another document akin to the WV Tax Exempt Form, commonly used by nonprofits and other tax-exempt organizations. This certificate substantiates the organization’s exemption from sales and use tax on purchases related to their exempt function, emphasizing the similarity in their purpose of supporting eligible organizations in maintaining their financial integrity by saving on taxes.

Direct Pay Permit documents, while less common, resemble the WV Tax Exempt Form by allowing certain businesses to purchase items or services without paying sales tax at the time of purchase. The permit holders are then responsible for assessing and paying use tax directly to the state, showcasing a trust-based approach to tax compliance similar to the use of exemption certificates.

The Agriculture Exemption Certificates offer a similar advantage for individuals or businesses engaged in farming and agriculture, allowing them to purchase supplies and machinery without sales tax. These certificates recognize the essential role of agriculture in the economy and the community, echoing the principle behind the WV Tax Exempt Form of supporting sector-specific activities through tax exemptions.

The Government Purchase Order, often employed by government entities to make tax-exempt purchases, also shares common ground with the WV Tax Exempt Form. This document ensures that government purchases, essential for public services and functions, are not burdened by taxes, reflecting the form's objective of facilitating officially exempted transactions.

Another related document is the Use Tax Payment Form used by businesses and individuals who have purchased items without sales tax. This form is for reporting and paying use tax to the state, highlighting the responsibility of taxpayers to comply with tax laws, akin to the proper use of the WV Tax Exempt Form to ensure tax-exempt purchases are duly qualified.

The Streamlined Sales and Use Tax Agreement Certificate of Exemption, which facilitates sales tax exemption in multiple states for eligible purchases, shares the WV Tax Exempt Form’s multi-use approach. It simplifies the exemption process across state lines, underscoring the effort to harmonize tax exemption processes nationally, similar to the intent behind the WV form’s design.

Lastly, the Exempt Organization Purchase Order is used by tax-exempt entities, such as charities, educational institutions, and religious organizations, to make exempt purchases. Like the WV Tax Exempt Form, it is based on the principle that supporting these organizations' activities through tax exemptions contributes to the public good.

Each of these documents serves a unique purpose in the realm of tax compliance and exemptions, but all share the common goal of facilitating specific tax benefits under specified conditions, much like the West Virginia Consumers Sales and Service Tax and Use Tax Exemption Certificate.

Dos and Don'ts

Filling out the WV Tax Exempt form is crucial for those eligible for tax exemptions. Here's a guide to ensure it's done correctly:

Do:- Read the instructions on the reverse side before completing the form. This ensures you understand the criteria and process.

- Confirm your eligibility for an exemption. Make sure your purchase or your organization qualifies under the West Virginia code specified.

- Use a valid Business Registration Certificate. This is required to complete the Exemption Certificate accurately.

- Check the correct exemption reason that applies to your purchase. This is crucial for the form to be processed correctly.

- Provide accurate and complete information about your purchase, including your Tax Identification Number and principal business activity.

- Keep a copy of the completed form for your records. This is important for accounting and if any questions arise later.

- Notify the vendor if the status of your exemption changes or if you use the purchased items in a manner that is no longer tax-exempt.

- Review the form for correctness before submission. This includes checking that all sections are fully and accurately completed.

- Use the form to purchase gasoline or special fuel, as these are not eligible for exemption with this certificate.

- Leave sections incomplete. Every part of the Exemption Certificate must be filled in for it to be valid.

- Use the form for personal purchases. It's intended for specific exempt purposes outlined in the WV Code.

- Forget to sign and date the form. This is required for the form to be considered valid and processed.

- Assume all purchases are exempt without checking the specific exemptions listed on the form and the WV Code.

- Misrepresent your purchase or business activity. False or fraudulent use of this certificate can lead to penalties.

- Overlook the expiration of your Business Registration Certificate. Ensure it's valid at the time of purchase.

- Delay submitting your form when making a purchase. The certificate or Direct Pay Permit number must be provided at the time of sale.

Following these do's and don'ts will streamline the process of using your West Virginia Tax Exempt form and help avoid any potential issues.

Misconceptions

Understanding the West Virginia Tax Exempt Form, or WV/CST-280 Exemption Certificate, is crucial for businesses and non-profit organizations to navigate tax exemptions properly. However, several misconceptions can lead to misuse or underuse of this certificate. Here are seven common misunderstandings and the truth behind each:

- Misconception 1: The exemption certificate applies to all purchases, including gasoline and special fuel.

Contrary to this belief, the WV/CST-280 specifically states that it cannot be used to purchase gasoline or special fuel. This limitation underscores the importance of understanding the scope of tax-exempt purchases allowed under this certificate.

- Misconception 2: Any organization can claim tax exemption just by completing this form.

In reality, organizations must meet certain criteria to qualify for tax-exempt status. For example, non-profit organizations should be registered and recognized under sections §501(c)(3) or (c)(4) of the Internal Revenue Code to be eligible for the exemption.

- Misconception 3: A single exemption certificate is enough for multiple business locations.

Each business location must obtain its exemption certificate to ensure compliance with West Virginia laws. This means that businesses operating in multiple locations cannot rely solely on a single certificate for tax-exempt purchases across all sites.

- Misconception 4: Government purchases are always exempt, no matter the circumstances.

While purchases by governmental agencies may be exempt, this does not extend to government employees making personal purchases, even if they claim to be conducting government business. Proper documentation and direct billing to the government agency are required for the purchase to be considered exempt.

- Misconception 5: The exemption certificate is permanent and does not require renewal.

The truth is, exemption statuses can change, and it's vital for organizations to ensure their information is current and accurate. Regularly updating the exemption certificate with any changes in business activities or status helps maintain valid tax-exempt privileges.

- Misconception 6: Misuse of the exemption certificate carries no penalties.

Improper use of the WV/CST-280 can lead to significant penalties, including being liable for the tax due, substantial fines, and interest. The willful issuance of a false or fraudulent exemption certificate with the intent to evade tax is considered a misdemeanor.

- Misconception 7: The exemption certificate immediately grants tax-exempt status upon submission.

Merely submitting the exemption certificate does not automatically confer tax-exempt status. The form must be properly completed, and eligibility criteria met. Vendors are also required to verify the validity and completeness of the certificate before honoring tax-exempt purchases.

Clearing up these misconceptions about the West Virginia Tax Exempt Form is pivotal for businesses and organizations to accurately navigate the complexities of tax exemption, ensuring compliance while benefiting from eligible savings.

Key takeaways

Understanding the West Virginia (WV) Tax Exempt Form, officially known as WV/CST-280 Exemption Certificate, is crucial for entities aiming to purchase goods or services tax-exempt within the state. Here are eight key takeaways to guide you through accurately completing and utilizing this form:

- The form cannot be used for purchasing gasoline or special fuel, emphasizing its limitation to tangible personal property or taxable services.

- All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided, underlining the necessity of providing this form for tax-exempt transactions.

- The form offers options for either a single purchase certificate or a blanket certificate, allowing buyers to adapt the documentation to their purchasing needs.

- To qualify, purchasers must hold a valid Business Registration Certificate and provide their Tax Identification Number, ensuring that the process is strictly followed by legitimate businesses.

- The form accommodates a range of exemptions, including purchases for resale, certain agricultural producers, tax-exempt organizations (like government agencies, nonprofits, and schools), and specific services or tangible personal property (like electronic data processing services or aircraft maintenance services).

- Purchasers are warned against the misuse of this certificate for non-exempt purchases, with penalties for erroneous or false use, including tax liability, substantial penalties, and interest—highlighting the legal implications of incorrect or fraudulent use.

- The reverse side of the exemption certificate must be completed for validity, pointing out the necessity of thorough documentation for exemption qualification.

- Instructions for both purchasers and vendors are provided to ensure compliance and substantiate the tax-exempt sale, which involves retaining the certificate for at least three years after the related return’s due date or filing date, whichever is later.

In closing, properly leveraging the WV Tax Exempt Form requires attention to detail, honesty in declarations, and an understanding of the specific qualifications for tax-exempt purchases within West Virginia. By following these guidelines, organizations can navigate the complexities of tax-exempt purchases more effectively.

Popular PDF Documents

United States Gift (and Generation-Skipping Transfer) Tax Return - Failure to file Form 709 when required can result in penalties and interest on any taxes due.

IRS 1099-C - A critical form for both the creditor, who must issue it, and the debtor, who must include it in their tax filing.