Get Wv Tax Form

The intricate landscape of tax forms transforms annually, and West Virginia's Personal Income Tax Forms for the 2020 fiscal year is no exception, providing a comprehensive guide for residents navigating their tax responsibilities. As the April 15, 2021, deadline approaches, individuals are required to acquaint themselves with the plethora of components contained within this document, ranging from the foundational IT-140 West Virginia Personal Income Tax Return to a series of schedules designed to address specific income modifications and tax credit computations. Among these, Schedule UT throws light on Use Tax obligations, whereas various instructions for Schedules M, A, E, and IT-210 clarify additions and subtractions to income, alongside detailed criteria for deductions and credits aimed at supporting families, seniors, and homeowners. The document also encapsulates adjustments related to federal adjusted gross income, tax tables, rate schedules, and a special focus on modifications for military members, reflecting West Virginia's dedication to accommodating diverse taxpayer circumstances. Furthermore, the introduction of measures such as the Family Tax Credit Tables and provisions for direct deposit of refunds showcases the state's commitment to leveraging accessible tools and resources to enhance the filing experience. In essence, this array of forms and schedules, complemented by practical filing tips and specific credit instructions, meticulously outlines the process, ensuring taxpayers are well-prepared to fulfill their state obligations effectively.

Wv Tax Example

2021

Wൾ ඌ ඍ V උ ඇ ൺ

Personal Income Tax Forms & Instructions

2021 PERSONAL INCOME TAX IS DUE APRIL 18, 2022

WE S T V I R G I N I A S TAT E TA X D E PA RT M E N T

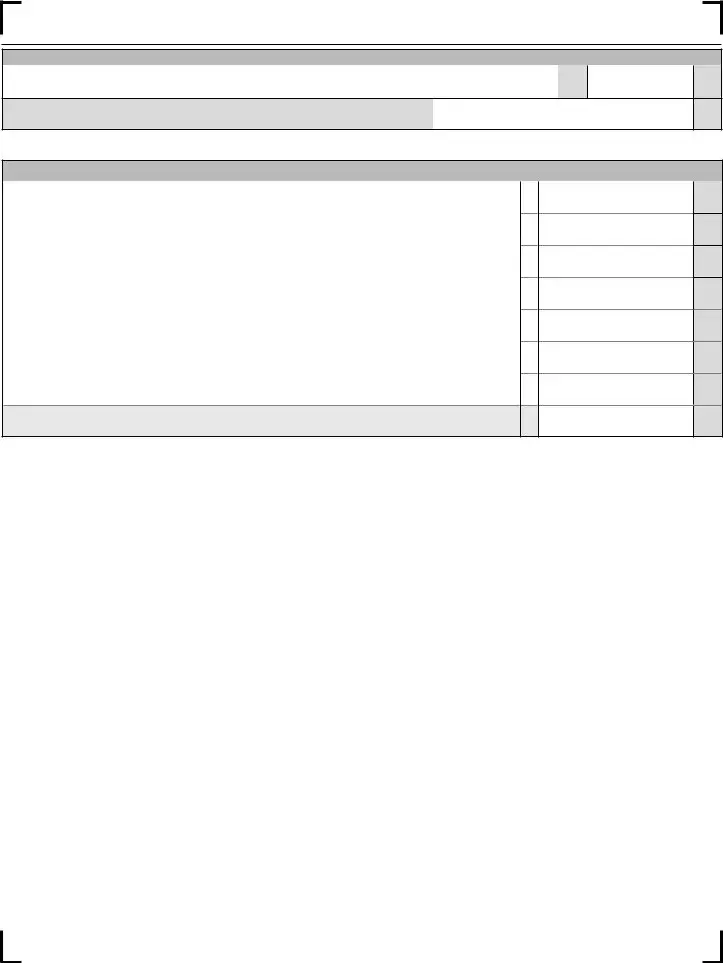

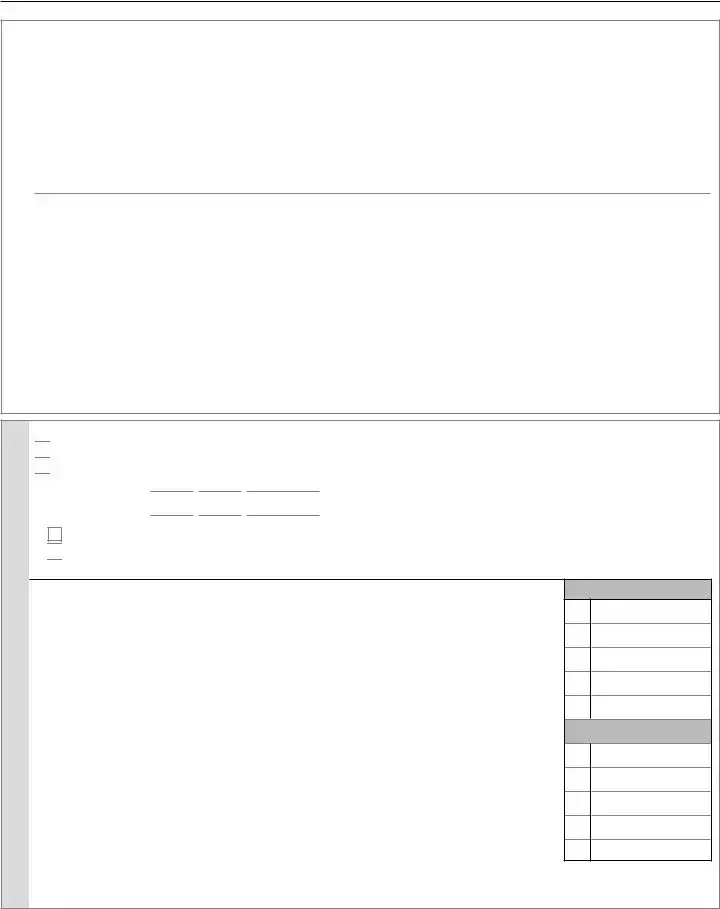

TABLE OF CONTENTS

Schedule UT Instructions |

10 |

|

Important Information for 2021 |

13 |

|

Tips on Filing a Paper Return |

14 |

|

General Information |

15 |

|

Form |

19 |

|

Schedule M Instructions |

21 |

|

Schedule A Instructions |

24 |

|

Schedule E Instructions |

26 |

|

Form |

27 |

|

2021 |

Family Tax Credit Tables |

31 |

2021 |

West Virginia Tax Table |

32 |

2021 |

Tax Rate Schedules |

37 |

Index |

49 |

|

COVER PHOTOGRAPH BY JINDALAY

|

|

W |

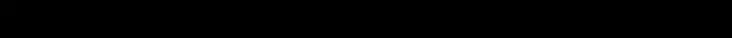

WEST VIRGINIA PERSONAL INCOME TAX RETURN |

2021 |

|

|

|

|

REV |

|

|

SOCIAL

SECURITY

NUMBER

LAST NAME

SPOUSE’S

LAST NAME

FIRST LINE OF

ADDRESS

CITY

TELEPHONE

NUMBER

Deceased |

|

|

*SPOUSE’S |

|

|

Deceased |

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

|

Date of Death: |

|

|

Date of Death: |

|||||||

NUMBER |

|

|

||||||||

|

|

|

|

|

YOUR |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

SPOUSE’S |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

SECOND LINE |

|

|

|

|

|

|

|

|

|

|

OF ADDRESS |

|

|

|

|

|

|

|

|

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

EXTENDED DUE DATE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

MM/DD/YYYY |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended return

Check before 4/18/22 if you wish to stop the original debit (amended return only)

Nonresident Special

Nonresident/

Form

1

2

3

4

5

FILING

STATUS

(Check One)

Single

Head of Household

Married, Filing Joint

Married, Filing

Separate

*Enter spouse’s SS# and name in the boxes above

Widow(er) with dependent child

|

|

|

|

Enter “1” in boxes a |

Yourself |

(a) |

|

|

Exemptions |

(If someone can claim you as a dependent, leave box (a) blank.) |

{ Spouse |

|

|

||||

and b if they apply |

(b) |

|

||||||

c. List your dependents. If more than five dependents, continue on Schedule DP on page 6. |

|

|

|

|

|

|||

First name |

|

Last name |

Social Security |

|

Date of Birth |

|

|

|

|

|

Number |

|

(MM DD YYYY) |

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Additional exemption if surviving spouse (see page 17) |

Enter total number of dependents |

(c) |

Enter decedents SSN: ______________________ Year Spouse Died: _____________________ |

(d) |

|

e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. |

(e) |

|

1.Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule

2.Additions to income (line 56 of Schedule M).............................................................................................

3.Subtractions from income (line 48 of Schedule M)....................................................................................

4.West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)......................................................

5.

6.Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 ........................................

7.West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............

8.Income Tax Due (Check One) .................................................................................................................

Tax Table |

|

Rate Schedule |

|

1

2

3

4

5

6

7

8

.00

.00

.00

.00

.00

.00

.00

.00

TAX DEPT USE ONLY

PAY COR SCTC NRSR HEPTC PLAN

MUST INCLUDE WITHHOLDING

FORMS WITH THIS RETURN

*P40202101W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

1 |

W |

|

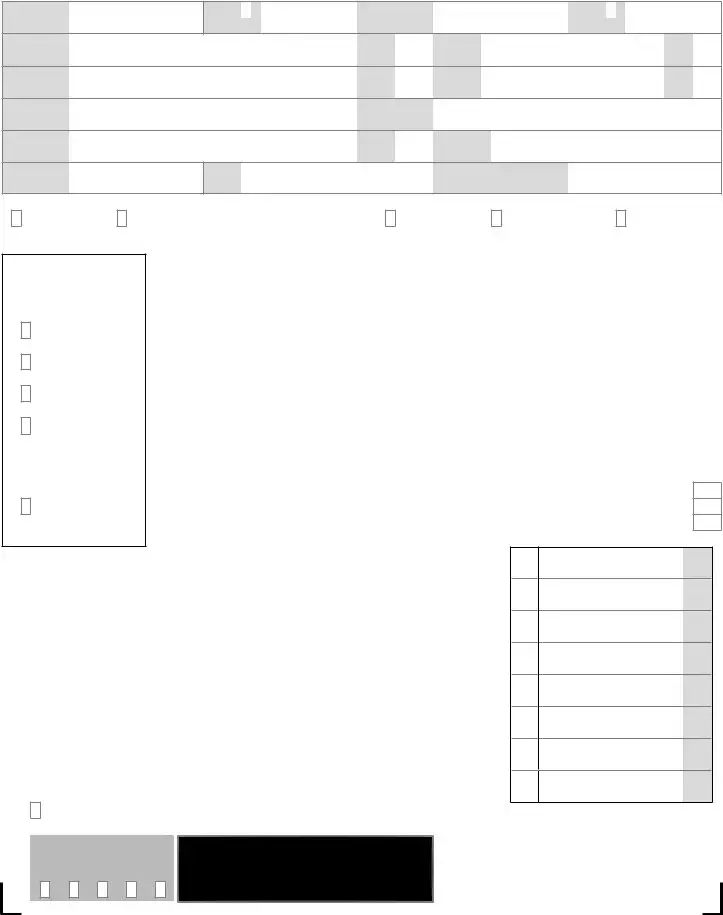

PRIMARY LAST NAME |

|

|

|

|

|

|

SOCIAL SECURITY |

|

8.Total Taxes Due |

|

|

SHOWN ON FORM |

|

|

|

|

|

|

NUMBER |

|

(line 8 from previous page) |

|

|

|

|

|

|

|

|

|

|

|

|

8 |

9. |

Credits from Tax Credit Recap Schedule (see schedule on page 5 ) (now includes the Family Tax Credit) |

9 |

|||

10. |

Line 8 minus 9. If line 9 is greater than line 8, enter 0 |

|

|

10 |

|

11. |

Overpayment previously refunded or credited (amended return only) |

........................................................... |

11 |

||

|

|

CHECK IF REQUESTING WAIVER/ANNUALIZED |

|

||

12. |

Penalty Due from Form |

WORKSHEET ATTACHED |

|

If you owe penalty, enter here |

12 |

13. |

West Virginia Use Tax Due on |

|

|

|

|

|

(See Schedule UT on page 9). |

|

CHECK IF NO USE TAX DUE |

13 |

|

14. |

Add lines 10 through 13. This is your total amount due |

|

14 |

||

|

|

|

Check if withholding from NRSR |

|

|

15. |

West Virginia Income Tax Withheld (See instructions) |

(Nonresident Sale of Real Estate) |

15 |

||

16. |

Estimated Tax Payments and Payments with Schedule 4868 |

|

16 |

||

17. |

17 |

||||

18. |

Senior Citizen Tax Credit for property tax paid (include Schedule |

18 |

|||

19. |

Homestead Excess Property Tax Credit for property tax paid (include Schedule |

19 |

|||

20. |

Amount paid with original return (amended return only) |

|

20 |

||

21. |

Payments and Refundable Credits (add lines 15 through 20) |

|

21 |

||

22. |

Balance Due (line 14 minus line 21). If Line 21 is greater than line 14, complete line 23 |

..... PAY THIS AMOUNT |

22 |

||

23. |

Line 21 minus line 14. This is your overpayment |

|

23 |

||

24. |

Donations of part or all of line 23. Indicate below and enter the sum of columns 24A, 24B, and 24C on Line 24 |

|

|||

|

24A. WEST VIRGINIA |

24B. WEST VIRGINIA DEPARTMENT OF |

|

24C. DONEL C. KINNARD MEMORIAL |

|

|

CHILDREN’S TRUST FUND |

VETERANS ASSISTANCE |

|

STATE VETERANS CEMETERY |

|

|

|

|

|

|

24 |

25. |

Amount of Overpayment to be credited to your 2022 estimated tax |

|

25 |

||

26. |

Refund due to you (line 23 minus line 24 and line 25) |

REFUND |

|

||

|

|

|

|

|

26 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Direct Deposit of Refund

CHECKING

SAVINGS

ROUTING NUMBER |

ACCOUNT NUMBER |

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Department to discuss my return with my preparer

YES

NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature |

|

|

Date |

Spouse’s Signature |

Date |

Telephone Number |

||||

|

|

Preparer: Check |

|

|

|

|

|

|

|

|

|

|

HERE if client is |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

requesting that form |

|

|

|

|

|

|

|

|

|

|

NOT be |

|

|

|

|

|

|

|

|

|

|

Preparer’s EIN |

Signature of preparer other than above |

Date |

Telephone Number |

|||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|||

Preparer’s Printed Name |

|

|

Preparer’s Firm |

|

|

|||||

|

|

|

FOR REFUND, MAIL TO THIS ADDRESS: |

|

FOR BALANCE DUE, MAIL TO THIS ADDRESS: |

|

|

|||

|

|

|

WV STATE TAX DEPARTMENT |

|

|

WV STATE TAX DEPARTMENT |

|

|

||

|

|

|

|

P.O. BOX 1071 |

|

|

P.O. BOX 3694 |

|

|

|

|

|

|

CHARLESTON, WV |

|

|

CHARLESTON, WV |

|

|

||

Payment Options: Returns filed with a balance of tax due may pay through any of the following methods:

•Check or Money Order payable to the WV State Tax Department - Enclose check or money order with your return.

•Electronic Payment - May be made by visiting mytaxes.wvtax.gov and clicking on “Pay Personal Income Tax”.

•Credit Card Payment – May be made by visiting the Treasurer’s website at: epay.wvsto.com/tax

*P40202102W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

2 |

W |

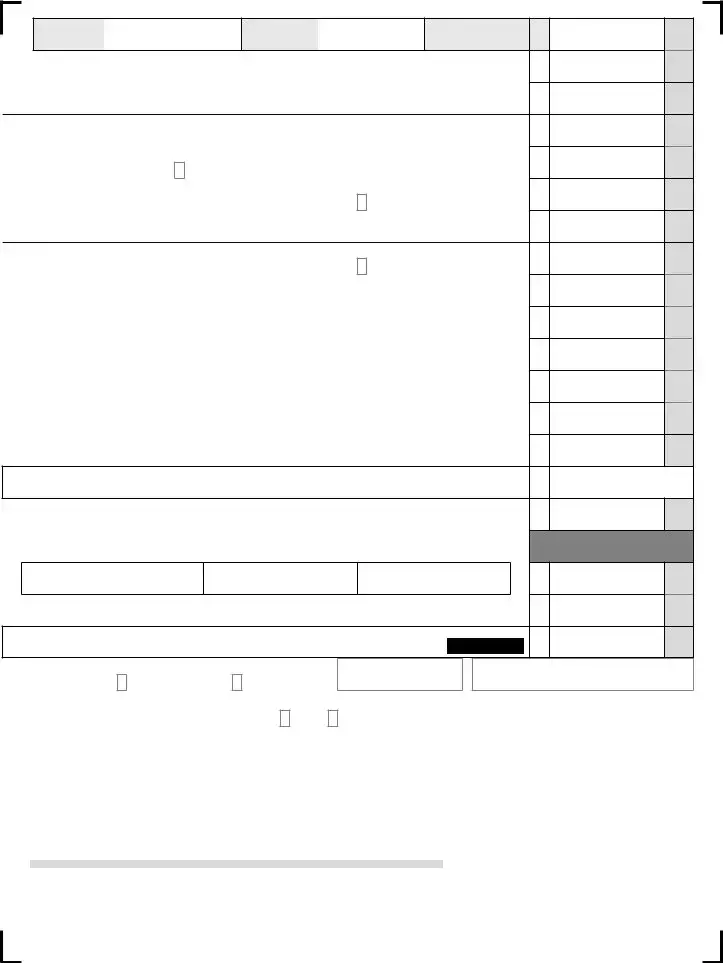

Schedule

Form

M W MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

|

Modifications Decreasing Federal Adjusted Gross Income |

|

|

Column A (You) |

Column B (Spouse) |

|||||||||||||||||

|

27. |

Interest or dividends received on United States or West Virginia obligations, or |

|

|

|

|

|

|

||||||||||||||

|

|

|

allowance for government obligation income, included in federal adjusted gross income |

27 |

|

.00 |

|

.00 |

||||||||||||||

|

|

|

but exempt from state tax |

|

|

|

|

|

|

|

|

|

||||||||||

|

28. |

Total amount of any benefit (including survivorship annuities) received from certain |

28 |

|

|

|

|

|

||||||||||||||

|

|

|

federal retirement systems by retired federal law enforcement officers |

|

|

.00 |

|

.00 |

||||||||||||||

|

29. |

Total amount of any benefit (including survivorship annuities) received from WV state |

29 |

|

|

|

|

|

||||||||||||||

|

|

|

or local police, deputy sheriffs’ or firemen’s retirement system, Excluding PERS |

|

.00 |

|

.00 |

|||||||||||||||

|

|

|

page 22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. |

.....................................................................................Military Retirement Modification |

|

|

|

|

|

30 |

|

.00 |

|

.00 |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

31. |

Other Retirement Modification |

|

|

Column A (You) |

Column B (Spouse) |

|

|

|

|

|

|

||||||||||

|

(a) West Virginia Teachers’ and |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Public Employees’ Retirement |

|

|

|

.00 |

|

.00 |

|

Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000 |

|||||||||||

|

(b)Federal Retirement Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

(Title 4 USC §111) |

|

|

|

|

|

|

|

.00 |

|

.00 |

31 |

|

.00 |

|

.00 |

||||

|

32. |

Social Security Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(a) TOTAL Social Security Benefits. |

|

|

|

.00 |

|

.00 |

|

You cannot claim this modification if your Federal AGI exceeds |

|||||||||||||

|

(b) Benefits exempt for Federal tax |

|

|

|

|

|

|

|

$ 50,000 for SINGLE or MARRIED SEPARATE filers |

|||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

$100,000 for MARRIED JOINT filers |

||||||||||||||

|

|

|

purposes |

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

Multiply 32 (c) by 0.65 |

|

|

|

||

|

(c) Benefits taxable for Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

purposes (line a minus line b) |

|

|

|

|

.00 |

|

.00 |

32 |

|

.00 |

|

.00 |

|||||||

|

33. |

Certain assets held by subchapter S Corporation bank |

.................................................. |

|

|

33 |

|

.00 |

|

.00 |

||||||||||||

|

34. |

Active Duty Military pay for personnel with West Virginia Domicile |

|

34 |

|

.00 |

|

.00 |

||||||||||||||

|

|

|

(See instructions on page 22) |

........................................................................................ |

|

|

|

|

|

|

|

|

||||||||||

|

35. |

Active Military Separation (see instructions on page 22) |

|

|

35 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

Must enclose military orders and discharge papers |

|

|

|

|

|||||||||||||||

|

36. |

Refunds of state and local income taxes received and reported as income to the IRS ... |

36 |

|

.00 |

|

.00 |

|||||||||||||||

|

37. |

Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds |

|

37 |

|

.00 |

|

.00 |

||||||||||||||

|

38. |

Railroad Retirement Board Income received |

.................................................................. |

|

|

|

38 |

|

.00 |

|

.00 |

|||||||||||

|

39. |

|

|

|

|

|

|

39 |

|

.00 |

|

.00 |

||||||||||

|

40. |

IRC 1341 Repayments |

|

|

|

|

|

|

|

40 |

|

.00 |

|

.00 |

||||||||

|

41. |

Autism Modification (instructions on page 22) |

|

|

41 |

|

.00 |

|

.00 |

|||||||||||||

|

42. |

ABLE Act |

....................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

42 |

|

.00 |

|

.00 |

||||

|

43. |

PBGC Modification |

..................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(a) retirement benefits that would have been |

|

|

|

.00 |

|

.00 |

|

Subtract line 43 (b ) from (a) |

|

|

|

||||||||||

|

|

|

paid from your |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(b) retirement benefits actually received |

|

|

|

.00 |

|

.00 |

43 |

|

.00 |

|

.00 |

||||||||||

|

|

|

from PBGC |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

44. |

Qualified Opportunity Zone business income |

|

|

44 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

(a) Year |

of birth |

(b) |

Year |

of |

(c) Income not included in |

(d) Add lines 27 through 32 |

|

|

|

|

|

|

||||||

|

45. |

|

(65 or older) |

|

disability |

|

lines 33 to 44 |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Subtract line 45 column (d) from (c) (If less than zero, enter zero) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

(NOT TO EXCEED $8000) |

|

|

|

|||||||||

|

You |

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

|

.00 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Spouse |

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

45 |

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

*P40202103W* |

46. Surviving spouse deduction |

46 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

Continues on next page |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(instructions on page 23) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications Decreasing Federal Adjusted Gross Income |

||||||||

|

|

|

|

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

3 |

W |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

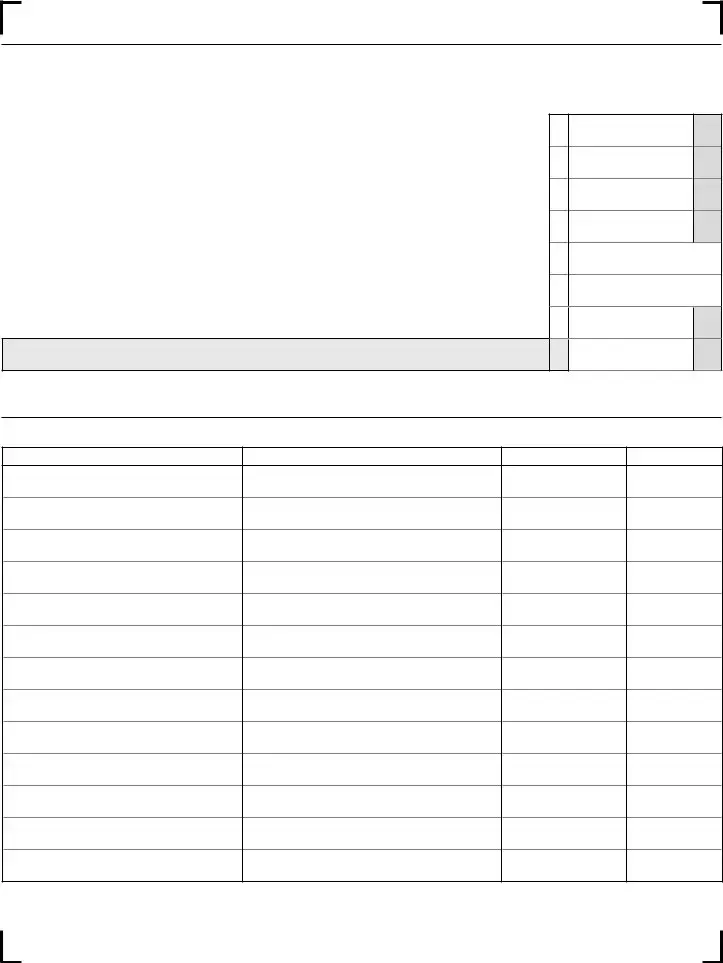

Schedule

Form

M W MODIFICATIONS TO ADJUSTED GROSS INCOME 2021

Modifications Decreasing Federal Adjusted Gross Income |

Column A (You) |

Column B (Spouse) |

47. Add lines 27 through 46 for each column |

47 |

|

.00 |

48.Total Subtractions (line 47, Col A plus line 47,Col B) Enter here and on line 3 of FORM |

48 |

|

|

|

|

|

|

.00

.00

Modifications Increasing Federal Adjusted Gross Income |

|

|

49. |

Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax |

49 |

50. |

Interest or dividend income on state and local bonds other than bonds from West Virginia sources |

50 |

51. |

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax |

51 |

52. |

Qualifying 402(e) |

52 |

53. |

Other income deducted from federal adjusted gross income but subject to state tax |

53 |

54. |

Withdrawals from a WV Prepaid Tuition/Savings Plan Trust Funds NOT used for payment of qualifying expenses |

54 |

55. |

ABLE ACT withdrawals not used for qualifying expenses |

55 |

56.TOTAL ADDITIONS (Add lines 49 through 55). Enter here and on Line 2 of Form |

56 |

|

.00

.00

.00

.00

.00

.00

.00

.00

*P40202104W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

4 |

W |

RECAP |

W |

TAX CREDIT RECAP SCHEDULE |

2021 |

Form |

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this sum- mary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no longer required to enclose the other state(s) return(s) or the

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

|

|

TAX CREDIT |

SCHEDULE |

APPLICABLE CREDIT |

|||||||

1. |

................................................Credit for Income Tax paid to another state(s) |

E |

1 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

** For what states? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

....................................................................Family Tax Credit (see page 39) |

2 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

3. |

......................................................General Economic Opportunity Tax Credit |

WV |

3 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

4. |

..........................................WV Environmental Agricultural Equipment Credit |

WV |

4 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

5. |

............................................................................WV Military Incentive Credit |

J |

5 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

6. |

.....................................................Neighborhood Investment Program Credit |

6 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

7. |

........................................Historic Rehabilitated Buildings Investment Credit |

RBIC |

7 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

8. |

...................Qualified Residential Rehabilitated Buildings Investment Credit |

8 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

9. |

................................................................Apprenticeship Training Tax Credit |

WV |

9 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

10. |

10 |

|

.00 |

|

|||||||

|

|

|

|

|

|

|

|||||

11. |

..................................................................Conceal Carry Gun Permit Credit |

11 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

.........................................................................12. Farm to Food Bank Tax Credit |

|

12 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

13. |

.................Downstream Natural Gas Manufacturing Investment Tax Credit |

DNG- 2 |

13 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

14. |

Post Coal Mine Site Business Credit |

14 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

15. |

.......................................................................................Natural Gas Liquids |

15 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

16. |

Donation or Sale of Vehicle to Qualified Charitable Organizations |

16 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

17. |

Small Arms And Ammunition Manufacturers Credit |

17 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

18.TOTAL CREDITS — add lines 1 through 17. Enter on Form |

18 |

|

.00 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202105W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

0 |

5 |

W |

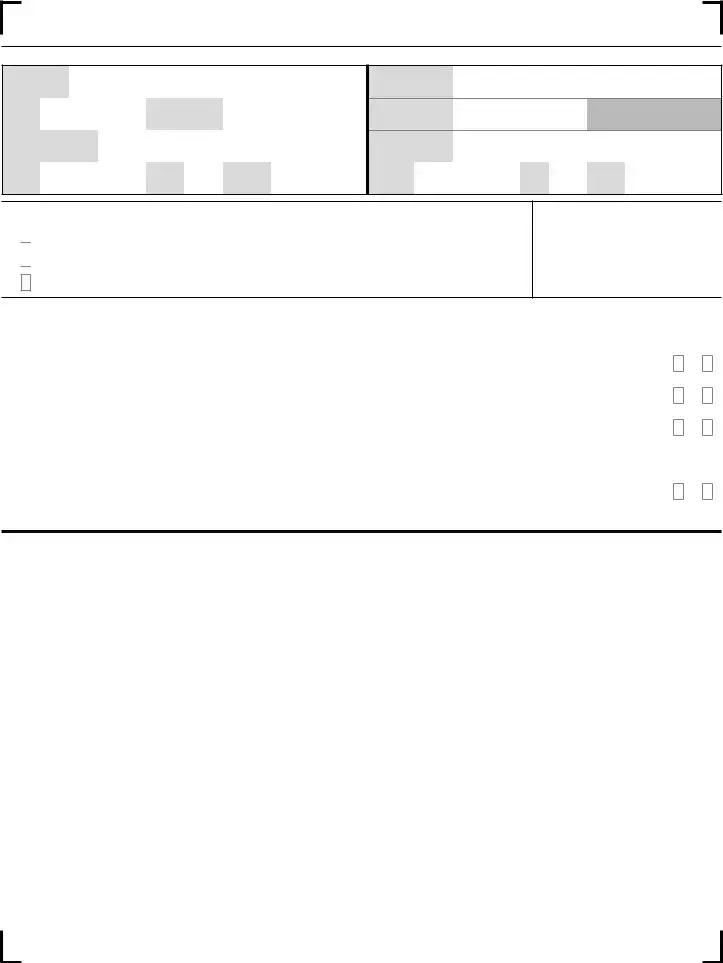

Schedule

Form

FAMILY TAX CREDIT |

2021 |

A Family Tax Credit is available to certain individuals or families that may reduce or eliminate their West Virginia personal income tax. You may be entitled to this credit if you meet certain income limitations and family size. Individuals who file their income tax return with zero exemptions cannot claim the credit. Persons who pay the federal alternative minimum tax are not eligible to claim this credit. In order to determine if you are eligible for this credit, complete the schedule below and attach to Form

If this schedule is not enclosed with Form

1.Federal Adjusted Gross Income (enter the amount from line 1 of Form

2.Increasing West Virginia modifications (enter the amount from line 2 of Form

3.

4.Add lines 1 through 3. This is your Modified Federal Adjusted Gross Income for the Family Tax Credit............

5.Enter the number of exemptions claimed from Form

6.Enter the Family Tax Credit Percentage for your family size AND Modified Federal Adjusted Gross Income level from the tables on page 31. If the exemptions on line 5 are greater than 8, use the table for a family size of 8

7.Enter your income tax due from line 8 of Form

8.Multiply the amount on line 7 by the percentage shown on line 6

This is your Family Tax Credit. Enter this amount on line 2 of Form

1

2

3

4

5

6

7

8

.00

.00

.00

.00

.00

.00

Schedule

Form

DPSCHEDULE OF ADDITIONAL DEPENDENTS 2021

Use this schedule to continue listing dependents. If space is needed for more than 18 dependents, a copy of this form may be obtained from the West Virginia State Tax Department’s website: tax.wv.gov.

First Name

Last Name

Social Security Number

Date of Birth

MM DD YYYY

*P40202110W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

1 |

0 |

W |

Schedule

F

Form

STATEMENT OF CLAIMANT |

2021 |

TO REFUND DUE DECEASED TAXPAYER |

Attach completed schedule to decedent’s return

NAME OF

DECEDENT

DATE OF |

SOCIAL SECURITY |

|

|

DEATH |

NUMBER |

|

|

|

|

|

|

ADDRESS |

|

|

|

(permanent residence or |

|

|

|

domicile at date of death) |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

NAME OF

CLAIMANT

SOCIAL SECURITY

NUMBER

ADDRESS

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return

Surviving wife or husband, claiming a refund based on a joint return

B. Administrator or executor. Attach a court certificate showing your appointment.

Administrator or executor. Attach a court certificate showing your appointment.

C.Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach a copy of the death certificate or proof of death*

ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME AND ADDRESS OF THE SURVIV- ING SPOUSE AND CHILDREN OF THE DECEDENT.

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3.Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu- tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202116W*

P |

4 |

0 |

2 |

0 |

2 |

1 |

1 |

6 |

W |

Schedules

H & E

Form

CERTIFICATION FOR PERMANENT AND TOTAL DISABILITY |

2021 |

AND CREDIT FOR INCOME TAX PAID TO ANOTHER STATE |

SCHEDULE H CERTIFICATION OF PERMANENT AND TOTAL DISABILITY

TAXPAYERS WHO ARE DISABLED DURING 2021 REGARDLESS OF AGE

If you were certified by a physician as being permanently and totally disabled during the taxable year 2021, OR you were the surviving spouse of an individual who had been certified disabled and DIED DURING 2021, read the instructions to determine if you qualify for the income reducing modification allowed on Schedule M.

If you qualify, you must (1) enter the name of and social security number of the disabled taxpayer in the space provided on this form, (2) have a physician complete the remainder of the certification statement and return it to you, (3) enclose the completed certification with your West Virginia personal income tax return, and (4) complete Schedule M to determine your modification.

A COPY OF YOUR FEDERAL SCHEDULE R (PART II) MAY BE SUBSTITUTED FOR THE WEST VIRGINIA SCHEDULE H.

If you have provided the West Virginia State Tax Department with an approved Certification of Permanent and Total Disability for a prior year AND YOUR DISABILITY STATUS DID NOT CHANGE FOR 2021, you do not have to submit this form with your return. However, you must have a copy of your original disability certification should the Department request verification at a later date.

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2021.

|

Name of Disabled Taxpayer |

Social Security Number |

|

||

|

|

|

|

|

|

|

Physician’s Name |

Physician's FEIN Number |

|

||

|

|

|

|

|

|

|

Physician’s Street Address |

|

|

||

|

|

|

|

|

|

|

City |

State |

Zip Code |

||

Physicians |

|

Date |

|

|

|

|

|

|

|||

|

|

|

|

|

|

Signature |

|

|

MM |

DD |

YYYY |

|

|

|

|||

|

|

|

|

|

|

INSTRUCTIONS TO PHYSICIAN COMPLETING DISABILITY STATEMENT

A PERSON IS PERMANENTLY AND TOTALLY DISABLED WHEN HE OR SHE IS UNABLE TO ENGAGE IN ANY SUBSTANTIAL GAINFUL ACTIVITY BECAUSE OF A MENTAL OR PHYSICAL CONDITION AND THAT DISABILITY HAS LASTED OR CAN BE EXPECTED TO LAST CONTINUOUSLY FOR AT LEAST A YEAR, OR CAN BE EXPECTED TO LEAD TO DEATH. IF, IN YOUR OPINION, THE INDIVIDUAL NAMED ON THIS STATEMENT IS PERMANENTLY AND TOTALLY DISABLED DURING 2021, PLEASE CERTIFY SUCH BY ENTERING YOUR NAME, ADDRESS, SIGNATURE, DATE, AND FEIN NUMBER IN THE SPACES PROVIDED ABOVE AND RETURN TO THE INDIVIDUAL.

ANOTHER STATE

RESIDENCY STATUS

Resident

Resident

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

MM DD YYYY Moved into West Virginia

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia, but had West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

Moved out of West Virginia and had no West Virginia source income during your nonresident period

SCHEDULE E CREDIT FOR INCOME TAX PAID TO

1.INCOME TAX COMPUTED on your 2021 _________________ return. Do not report Tax Withheld State Abbreviation

2.West Virginia total income tax (line 8 of Form

3.Net income derived from above state included in West Virginia total income.....................................................

4.Total West Virginia Income

5.Limitation of Credit (line 2 multiplied by line 3 divided by line 4).........................................................................

6. Alternative West Virginia taxable income Residents – subtract line 3 from line 7, Form

7.Alternative West Virginia total income tax (Apply the Tax Rate Schedule to the amount shown on line 6).........

8.Limitation of credit (line 2 minus line 7)...............................................................................................................

9.Maximum credit (line 2 minus the sum of lines 2 through 17 of the Tax Credit Recap Schedule)

10.Total Credit (SMALLEST of lines 1,2, 5, 8, or 9) enter here and on line 1 of the Tax Credit Recap Schedule.

1

2

3

4

5

6

7

8

9

10

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

A SEPARATE SCHEDULE E MUST BE COMPLETED FOR EACH STATE FOR WHICH CREDIT IS CLAIMED. YOU MUST MAINTAIN A COPY OF THE OTHER STATE TAX RETURN IN YOUR FILES. IN LIEU OF A RETURN YOU MAY MAINTAIN AN INFORMATION STATEMENT AND THE WITHHOLDING STATEMENTS PROVIDED BY THE PARTNERSHIP, LIMITED LIABILITY COMPANY OR

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | Deadline for 2020 personal income tax is April 15, 2021. |

| 2 | Cover photo features the New River Gorge Bridge, WV, photo by Kenny Berry. |

| 3 | Form IT-140 is the West Virginia Personal Income Tax Return for 2020. |

| 4 | Filing status options include Single, Head of Household, Married (Filing Joint or Separate), and Widow(er) with dependent child. |

| 5 | Modified Schedule M instructions for additions and subtractions to income, indicating specific West Virginia adjustments. |

| 6 | Taxable income calculations are provided along with Low-Income Earned Income Exclusion details. |

| 7 | Options for tax payment include direct deposit, check/money order, electronic payment, and credit card payment. |

| 8 | Governing laws for the form include specific West Virginia State Tax Department codes and federal adjustments pertinent to WV residents. |

| 9 | Includes various schedules (e.g., UT, M, A, E) and instructions for additional tax credits, deductions, and taxable income adjustments. |

Guide to Writing Wv Tax

Before you start filling out the WV Tax Form IT-140 for Personal Income Tax, it's important to gather all necessary documents, including your Social Security number, your spouse's Social Security number (if filing jointly), W-2s, 1099s, and information on any deductions or credits you plan to claim. This form must be completed and filed by April 15, 2021. Follow the steps below carefully to ensure the accurate and timely submission of your tax return.

- Enter your Social Security number and your spouse’s Social Security number (if filing jointly) at the top of the form.

- Fill in your last name, spouse’s last name (if applicable), and the suffixes (if any) for both.

- Provide your complete address, including city, state, and zip code.

- Indicate your filing status by checking the appropriate box: Single, Head of Household, Married Filing Joint, Married Filing Separate, or Widow(er) with dependent child.

- Under the Exemptions section, check box a if you are claiming yourself, and box b for your spouse (if applicable). List your dependents in the space provided (if you have more than five dependents, continue on Schedule DP).

- Enter the total number of exemptions, adding up the totals from boxes a, b, c, and d. Input this figure in box e and also on line 6 below.

- Calculate your Federal Adjusted Gross Income and enter this amount on line 1.

- Add any additional income on line 2 as directed by instructions in Schedule M.

- Subtract any amounts that can be excluded from your income on line 3, as instructed in Schedule M.

- Compute your West Virginia Adjusted Gross Income on line 4 (Line 1 + Line 2 - Line 3).

- If you qualify, calculate the Low-Income Earned Income Exclusion and enter it on line 5.

- Multiply the total exemptions by $2,000 and enter this amount on line 6.

- To find your West Virginia Taxable Income, subtract lines 5 and 6 from line 4 and enter this on line 7.

- Determine the income tax due by using the Tax Table or Rate Schedule, and fill this in on line 8.

- Go through each step from lines 9 to 26 to calculate credits, overpayments, penalties, and taxes due or refunds.

- For direct deposit of your refund, provide your banking details including routing and account numbers. Check the appropriate box for checking or savings account.

- Review the return for accuracy, then sign and date the form along with your spouse (if filing jointly).

- Choose the correct address for submission depending on whether you are receiving a refund or owe a balance, and mail your completed form along with any required payments or withholding documents.

By following these instructions carefully, you can ensure the accurate completion and timely submission of your West Virginia Personal Income Tax Return for the year 2020.

Understanding Wv Tax

-

When is the 2020 West Virginia Personal Income Tax due?

The tax due date for the 2020 Personal Income Tax in West Virginia was April 15, 2021. It's important for taxpayers to mark this date on their calendar to avoid any late fees and penalties.

-

Can I file an amended return for my 2020 West Virginia Personal Income Tax?

Yes, taxpayers have the option to amend a previously filed return. If filing an amended return, remember to check the appropriate box on the form before April 15, 2021, especially if you want to cancel the original direct debit payment.

-

How do I claim exemptions on my West Virginia Personal Income Tax Return?

Exemptions are claimed in the Exemption Box of the tax form. Taxpayers should enter "1" for themselves and their spouse if applicable, list dependents, and add up the total. An additional exemption is available if the taxpayer is a surviving spouse. Make sure the total number of exemptions is entered correctly to ensure your tax calculation is accurate.

-

What are the methods available to pay my West Virginia Personal Income Tax?

- Check or Money Order: Make payable to the WV State Tax Department and enclose it with your return.

- Electronic Payment: Payments can be made online at the West Virginia Tax Department's website.

- Credit Card Payment: Payments can also be made via credit card through the Treasurer’s website.

-

How can I ensure my refund is directly deposited into my bank account?

For direct deposit of your refund, ensure to check the appropriate box for either checking or savings on your tax form. You must also provide the correct routing and account numbers. Double-check these details to prevent any errors that could delay your refund or result in a returned payment charge.

Common mistakes

Not checking the appropriate filing status box or incorrectly filling in the spouse's information can lead to errors in the processing of the return. Each filer's marital status and the inclusion of a spouse's details, when necessary, should be accurately provided to ensure proper tax calculation.

Forgetting to enter the total number of dependents on the form can significantly affect the total exemptions claimed. It's crucial to detail every dependent accurately to benefit from exemption amounts rightfully owed to the taxpayer.

Errors in calculating the West Virginia Adjusted Gross Income, by either incorrectly adding income or subtracting deductions, lead to inaccuracies in the owed or refundable tax amount. Proper attention must be given to each line item impacting the adjusted gross income to avoid these discrepancies.

Omitting to include all necessary withholding forms, such as W-2s and 1099s, with the tax return can delay processing times and affect the accuracy of the tax computed. It is essential to attach all relevant documents that support the income and tax withheld throughout the tax year.

Overlooking the West Virginia Use Tax on out-of-state purchases can result in an underreported tax liability. Taxpayers should carefully consider all applicable purchases that may require use tax payments to comply fully with state tax laws.

Incorrect direct deposit information for refunds not only delays the receipt of refunds but can also lead to funds being incorrectly deposited. Double-checking routing and account numbers ensures that any refund due is received promptly and securely.

In conclusion, attention to detail and thoroughness are pivotal when filling out the West Virginia Personal Income Tax Forms. Avoiding the listed mistakes can lead to a smoother filing process, ensure compliance with state tax laws, and safeguard against unnecessary delays or errors in tax return processing.

Documents used along the form

When filing your West Virginia (WV) Tax Form, you might find that it requires additional information or documentation to ensure a comprehensive and accurate tax return. These additional forms and documents play crucial roles in providing specific details about your financial situation, eligibility for credits, or adjustments to income:

- Schedule A (Itemized Deductions): Used to report itemized deductions such as medical expenses, state and local taxes, interest expenses, and charitable contributions, instead of taking the standard deduction.

- Schedule M (Modifications to Adjusted Gross Income): Details adjustments to your federal adjusted gross income for certain items that are treated differently for state tax purposes.

- Form IT-140: The main tax return form for individuals, used to report income, calculate tax liability, and claim exemptions and credits.

- Schedule UT (Use Tax): For reporting use tax due on out-of-state purchases not subject to WV sales tax, this schedule ensures compliance with state use tax laws.

- Schedule HEPTC-1 (Homestead Excess Property Tax Credit): A form for eligible senior citizens or permanently and totally disabled homeowners to claim a credit for property taxes paid in excess of a certain percentage of their income.

- Schedule SCTC-1 (Senior Citizen Tax Credit): Offers a state tax credit for qualifying senior citizens based on property tax paid on their principal residence.

- Form WV-8379 (Injured Spouse Allocation): When a joint return is filed and only one spouse owes past due debts that the state can collect from a tax refund, the injured spouse may file this form to protect their share of the refund from being applied to these debts.

- W-2s and 1099s: Wage and tax statements from employers (W-2s) and various 1099 forms reporting other income types such as self-employment, interest, dividends, government payments, and more are essential for accurate income reporting.

- Schedule E (Supplemental Income and Loss): Used by taxpayers to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

Gathering and completing these forms and documents in conjunction with the WV Tax Form can seem daunting. However, each plays a vital part in ensuring that individuals accurately report their income, claim eligible deductions and credits, and ultimately, comply with state tax laws. Proper preparation and understanding of each document's purpose can greatly streamline the tax filing process.

Similar forms

The 1040 Federal Income Tax Return resembles the WV Tax form closely because it serves a similar purpose at the federal level, detailing an individual's income, deductions, and credits to determine their tax liability. Both forms include sections for personal information, income details, deductions, credits, and a calculation section to arrive at the tax due or refund owed. The layout and specifics differ to accommodate federal versus state tax laws, but their structure and objectives align.

The Schedule C (Profit or Loss from Business) mirrors parts of the WV Tax form that accommodate adjustments to income, as it's used to report earnings and expenses from a sole proprietorship. Anyone filing the WV Tax form with self-employment income would navigate similar calculations and considerations found in Schedule C, such as determining net profit (or loss) which then impacts the adjusted gross income on both the state and federal levels.

The W-2 Form (Wage and Tax Statement) is a document that feeds directly into the information required for the WV Tax form. It outlines an employee's annual wages and the amount of taxes withheld from their paycheck. The direct relevance of this document is found in the necessity for taxpayers to accurately report their income on both state and federal tax returns, using details provided in the W-2.

The 1099-MISC Form, used for reporting miscellaneous income, shares a connection with the WV Tax form in terms of reporting income that may not be traditionally taxed at source. Freelancers, contractors, and others receiving income reported on a 1099-MISC must report this income on their tax returns, impacting their taxable income and tax liability similar to W-2 income.

Schedule A (Itemized Deductions) is akin to parts of the WV Tax form that deal with deductions. While different deductions may be available on state versus federal returns, the concept of itemizing deductions to reduce taxable income is consistent. Taxpayers use Schedule A to itemize deductible expenses such as mortgage interest and charitable donations, paralleling the process of deducting allowable expenses on state returns.

The Schedule E (Supplemental Income and Loss) parallels the WV Tax form in its treatment of income or loss from rental real estate, royalties, partnerships, S corporations, estates, and trusts. This schedule impacts the total income reported and taxed, similar to how various schedules attached to the WV form adjust gross income to arrive at a state taxable income figure.

The 4868 Form (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) is comparable to any extension request provision in the WV Tax form. Both offer taxpayers more time to file their returns without penalties for late filing, though not extending the time to pay taxes due. The principles behind this are consistent at both the federal and state levels.

The Schedule SE (Self-Employment Tax) shares a conceptual similarity with self-employment income considerations on the WV Tax form. It calculates the amount of self-employment tax owed on income that isn’t subject to employer withholding. Any entrepreneur or freelancer would encounter this on both their federal and state tax calculations, affecting overall tax liability.

The Child Tax Credit form (CTC) finds its state-level counterpart in any child or family tax credits offered through the WV Tax form. These credits are designed to reduce tax liability for taxpayers with dependent children, reflecting a consistent policy goal between federal and state tax codes to provide financial relief to families.

Finally, the W-4 Form (Employee's Withholding Certificate) indirectly relates to the WV Tax form by influencing the amount of state tax withheld from an employee’s paycheck. The information provided on the W-4 helps employers determine the correct amount of both federal and state taxes to withhold, thus affecting the taxpayer’s eventual refund or amount owed on the state return.

Dos and Don'ts

When filling out the West Virginia (WV) Tax Form, it's important to approach the task with care and accuracy. Here are 10 essential dos and don'ts to help ensure the process goes smoothly:

- Do verify your social security number and any other identification numbers carefully to prevent any delays in processing.

- Do double-check your filing status to make sure it reflects your current situation accurately.

- Do include all relevant income data, making sure to report income from all sources to comply with state tax laws.

- Do take advantage of deductions and credits for which you are eligible. Carefully review the instructions to not miss out on beneficial claims.

- Do calculate your exemptions correctly by following the guidelines provided for personal and dependent exemptions.

- Do ensure accuracy in calculating your West Virginia Adjusted Gross Income (AGI) by correctly adding or subtracting adjustments.

- Do review the tax tables or rate schedules carefully to determine your tax correctly, based on your taxable income.

- Do double-check all arithmetic for errors, as small mistakes can result in processing delays or incorrect tax calculations.

- Do sign and date your return. An unsigned return is like not filing at all, leading to penalties and delays.

- Do choose direct deposit for your refund if you want to receive it faster. Ensure that your bank account information is correct to avoid a $15.00 returned payment charge.

- Don't leave any fields blank. If a section does not apply to you, enter '0' or 'N/A' to show that you acknowledged the question.

- Don't guess on numbers or dates. Use exact figures and refer to official documents to ensure the information you provide is accurate.

- Don't overlook income, such as dividends or interest from out-of-state accounts, which could lead to underreporting and possible penalties.

- Don't forget to attach all necessary documentation, such as W-2s and 1099s, to support income, deductions, and credits claimed on your return.

- Don't ignore instructions related to specific schedules or additional forms that may be required for claiming deductions or credits.

- Don't use pencil or erasable ink to complete the form, as this could lead to information being lost or altered.

- Don't send your return without reviewing it completely. Errors or omissions can delay processing and affect your refund or tax liability.

- Don't overlook the West Virginia Use Tax due on out-of-state purchases if applicable.

- Don't miss the filing deadline. Late filing can result in penalties and interest on any owed taxes.

- Don't forget to request a filing extension if you cannot meet the April 15 deadline, to avoid late filing penalties.

Misconceptions

There are several common misconceptions about the West Virginia (WV) Tax Form that taxpayers might encounter. Understanding these can help in accurately preparing and filing state taxes.

- Misconception 1: The WV tax form is due much later in the year.

Many believe they have more time beyond April 15 to file the WV tax form without penalties. However, similar to federal taxes, the WV personal income tax form is also due on April 15.

- Misconception 2: Amendments can be filed anytime after April 15 without notifying the original payment intention.

If amendments to the return are necessary, indicating an election to stop original debit (if applicable) by the due date of April 15, is crucial to avoid errors in payment processing.

- Misconception 3: Nonresident tax status does not apply to part-year residents.

There is a belief that nonresident forms or tax calculations do not apply to those who lived in the state for only part of the year. However, part-year residents must file their taxes using specific nonresident/part-year resident calculations to accurately reflect their income earned while residing in the state.

- Misconception 4: The WV tax form does not offer deductions for senior citizens.

Contrary to what some may think, the WV tax form provides opportunities for senior citizens to claim a tax credit for property tax paid through Schedule SCTC-1, offering relief to eligible seniors.

- Misconception 5: Direct deposit information is optional for refunds.

While taxpayers can receive refunds via check, providing direct deposit information expedites the refund process. Moreover, ensuring that account information is accurate is essential to avoid delay or loss of the refund.

- Misconception 6: Social Security income is fully taxable by West Virginia.

Some taxpayers are under the impression that all Social Security benefits are taxable by the state. The truth is, West Virginia allows for a modification where certain Social Security benefits might not be fully taxed, depending on the taxpayer's federal adjusted gross income.

- Misconception 7: Filing status does not impact the state tax calculation significantly.

Many overlook the importance of selecting the correct filing status. The chosen status affects the calculation of taxable income, exemptions, and credits, directly influencing the overall tax liability or refund.

Clarifying these misconceptions can lead to a smoother tax filing experience, ensuring that taxpayers meet their obligations accurately and receive any benefits for which they are eligible.

Key takeaways

Filling out tax forms can be daunting, but understanding the key points about the WV Tax form can simplify the process. Here are some important takeaways to keep in mind:

- Deadline: Personal income taxes are due by April 15, 2021.

- Filing statuses: Options include Single, Married (filing jointly or separately), Head of Household, and Widow(er) with a dependent child. Choose the one that best represents your situation to potentially optimize your tax benefits.

- When listing exemptions, make sure to consider yourself, your spouse (if applicable), and any dependents accurately. Incorrect exemptions can lead to issues or delays.

- Income adjustments are necessary for an accurate return. This includes both additions and subtractions as stated on Schedules M and A among others.

- West Virginia Adjusted Gross Income (WV AGI) is computed by adjusting your federal adjusted gross income with specific additions and subtractions relevant to state tax laws.

- The form facilitates calculations for the Low-Income Earned Income Exclusion, aimed at reducing the tax burden for qualifying residents.

- Exploring tax credits such as the Family Tax Credit, Senior Citizen Tax Credit, and others can significantly reduce your tax liability.

- Direct Deposit: For quicker refunds, opt for direct deposit by supplying your banking details carefully to avoid any delays or errors in receiving your refund.

- Overpayment: If you've overpaid, you can request the excess be refunded or credited towards your estimated taxes for the next year.

- Use tax must be considered for out-of-state purchases not already taxed by West Virginia. Reporting and payment of use tax contribute to compliance with state tax laws.

- The form allows for designated donations from your refund, supporting causes like child trust funds or veterans assistance directly through your tax return.

- If expecting a refund or owe a balance, precise documentation and adherence to payment instructions ensure smooth processing.

Remember, the key to a stress-free tax season is understanding the specifics of your tax form, taking advantage of applicable deductions and credits, and ensuring accuracy in your filing. Seeking clarification on confusing points or consulting a tax professional can also aid in successfully navigating tax obligations.

Popular PDF Documents

941 Taxes - The 941 is a key form that impacts a business’s financial health and legal compliance, making it indispensable in the landscape of U.S. employment taxes.

Power of Attorney Rhode Island - This authorization form is tailored to taxpayers requiring representation specifically for matters concerning Rhode Island taxation.

IRS Schedule 1 1040 or 1040-SR - For those involved in jury duty but had to hand their pay over to their employers, Schedule 1 allows you to deduct that amount from your income.