Get World Bank St Payment Request Form

For many short-term consultants and temporaries at the World Bank, the process of submitting payment requests is an essential, yet potentially complex task. It's crucial to understand not only how to fill out the ST (Short-Term) Payment Request form but also to grasp the comprehensive system designed to streamline and secure this process. The form serves as a pivotal online tool that automates the submission and approval of payment requests, ensuring accuracy and efficiency in handling financial matters. With features like online tracking of payment status and secure access through a passkey, the system is tailor-made to suit the needs of consultants operating both within headquarters and remotely. It accommodates those in areas with limited web access by allowing alternatives, and mandates the provision of detailed bank and personal email account information to facilitate smooth transactions and communication. The overarching payment procedure entails a series of steps starting from the issuance of a Letter of Appointment, through the submission and validation of payment requests, to the final approval by the relevant authorities. Furthermore, the system is framed within key policies on short-term appointments, covering aspects such as appointment status, work duration, and the specifics of payment process including direct deposits, advance fees, and record-keeping for multiple assignments. To access the ST Payment system, consultants are required to activate their PassKey, adhering to security protocols that safeguard their personal information and the integrity of the transaction process.

World Bank St Payment Request Example

S T Payment

S T Payment

Contents

A primer for

Overview of the Payment Request Form for |

2 |

What is the Payment Request Form? |

2 |

What are the benefits of using ST Request? |

2 |

What are the prerequisites for using ST Request? |

2 |

What is the payment process for consultants or temporaries? |

3 |

What are the key policies on |

3 |

Access |

5 |

Activate Your PassKey |

5 |

Log on to ST Payment |

6 |

ST Request Home: Current Assignments |

7 |

View Mailing Address and Bank Account Details |

8 |

Select a Task to Enter Time |

9 |

Resubmit a Rejected Payment Request (if applicable) |

12 |

Payment Request Form |

13 |

Review Project Details |

14 |

Complete a Payment Request |

15 |

Submit Overtime (for Temporaries Only) |

18 |

S

T Payment

Payment

For Official Use Only

Overview of the Payment Request Form for

What is the Payment Request Form?

The Payment Request Form is available on the ST Request site (http://strequest.worldbank.org). This form allows short term consultants and temporaries (STCs/STTs) to enter and submit their payment requests online.

In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

In countries where web access is limited (for example, remote areas or fragile states), Form 2370 or Request for Payment (RFP) will continue to be accepted. Approval of the task team leader (TTL)/ reviewer is required. The administrative contact then creates a service entry sheet (SES) in SAP. The SES is automatically routed to the approving manager.

What are the benefits of using ST Request?

•Streamlines the payment process by automating payment request entry and approval.

•Provides online tracking of payment status.

•Maintains confidentiality through a secure passkey, whether you are accessing ST Request outside of headquarters or country offices.

•Provides automatic validation of available days or hours of the STC/STT’s commitment noted against a purchase order and source of funding. This feature is particularly helpful when an STC/STT is working on multiple projects.

•Displays submitted payment requests, enabling you to filter by project and duration.

What are the prerequisites for using ST Request?

Bank Account |

|

Email Account |

|

|

|

Submit accurate and complete bank account details to the administrative contact.

•Full name and street address of bank branch

•Bank account number and/or IBAN number (for certain banks outside the United States)

•For banks in the United States: ABA or routing number

•For banks outside the United States: Bank routing number or SWIFT code

*International Bank Account Number

**Routing information is not required for Bank Fund Staff Federal Credit Union (BFSFCU) account holders.

•Submit only one personal

•If the hiring unit activates a Lotus Notes account, then this account overrides the personal

Payment updates are sent by

2 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

What is the payment process for consultants or temporaries?

By

In ST Payment

In SAP

1

Issue Letter of Appointment (LOA)

Human Resources Service Center (HRSSC) or Country Office HR Administrator or Officer

•Specify the terms and conditions of employment.

•Trigger the creation of accounts (for example, UPI, PassKey, Lotus Notes) through the hiring unit. A passkey is required to access select World Bank Group websites.

•Provide the contract details to access ST Request online.

2

Complete and Submit Payment Request

Consultant or Temporary

•Ensure LOA is signed and submitted. This is a one- time verification at the start of a contract.

•Enter payment request for specific task. Describe services rendered and deliverables.

•Validate bank account information.

•Track submitted payment requests.

3

Approve or Reject Payment Request

Task Team Leader (TTL)/ Reviewer

•Review payment request with corresponding deliverables.

•Enter comments for rejected payment requests.

•Reassign payment requests to alternate TTL/reviewer (if applicable).

4

Approve or Reject Payment

Manager

•Review SES in SAP. An SES is automatically created when the TTL/reviewer approves the payment request.

•Approve or reject payment.

What are the key policies on

1.Appointment Status – As an STC/STT, you hold a staff appointment. Consequently, you cannot be hired through a firm.

2.Allowed Number of Days – The maximum number of days you can work in a given fiscal year (FY) depends on your appointment type with the World Bank Group. The fiscal year for the Bank Group begins on July 1 and ends on June 30 of the following year. For additional information, consult the TTL or refer to your LOA.

3.Start Date – You can begin work on or after the start date in the contract and only after HR has received the signed letter of appointment issued to you. Failure to comply with this policy exposes both the Bank Group and the STC/STT to serious insurance and liability issues.

Payments cannot be processed for any work done before the start date in the contract.

Payments cannot be processed for any work done before the start date in the contract.

3 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

4.Payment

(a)Access – Your access to the ST Request site is limited to your contract end date.

For example, if your contract ends by June 30, you must submit your timesheet on or before June 30. Your access to ST Request will automatically be revoked on July 1, and you will no longer be able to enter your timesheet.

(b)Direct Deposit – Payments are made to a commercial bank account or a Credit Union account.

Submit your bank account information to the administrative contact assigned to your contract. This information is mandatory for HQ consultants and temporaries.

Exception: Local consultants in the country office, who may not have access to direct deposit, can call or send an

(c)Advance Fees – You can request for advance payment of fees to cover travel subsistence costs and services beyond June 30. These advance payments must be charged to the current fiscal year and are considered on a

Call or send an

(d)Record keeping – Keep a record of your time against each project, particularly if you are working on multiple assignments.

5.Overtime for Temporaries

•Secure authorization in advance from your approving manager.

•Verify the specific purchase order and line item for charging overtime with the administrative contact.

4 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Access

Activate Your PassKey

For security reasons, the ST Payment system is passkey protected. Follow these steps to activate your passkey:

1.Go to http://strequest.worldbank.org.

2.On the Sign In page, click Forgot/Request Password.

3.Enter the

4.Enter the characters displayed for Registration Verification.

5.Click Submit. You will receive an

Reset your password immediately for security reasons.

Reset your password immediately for security reasons.

For Additional Assistance

•For IBRD/MIGA, call ISG Global Support Center at (202)

•For IFC, call the IFC Helpdesk at (202)

Service centers Service centers are available 24 hours a day, 7 days a week.

•A series of

•A UPI is necessary to activate the account.

The PassKey site automatically:

The PassKey site automatically:

•locks you out after you type the incorrect password five times successively.

•times out if you are inactive for more than one hour.

Access to the ST Payment system is tied to the start and end dates of your contract.

Access to the ST Payment system is tied to the start and end dates of your contract.

5 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Log on to ST Payment

The user profile determines the type of access and actions you can perform in the ST Payment system.

•Access is confined to active projects in the current fiscal year.

•Each profile (for example, consultants/temporaries, task team leader/reviewer, or administrative contact) has a unique site to carry out specific actions.

Consultants and Temporaries

Can perform these tasks online:

•Verify mailing address and bank account

•Review project details

•Complete a payment request

•Attach a deliverable

•Submit overtime (for temporaries only)

•Display a submitted payment request

For

Access is tied to the start and end dates of your contract.

Access is tied to the start and end dates of your contract.

Task Team Leaders (TTLs) or Reviewers

Can perform these tasks online:

•Review project details

•Approve or reject a payment request

•Download a deliverable

•Reassign TTL

•Display a submitted payment request

Administrative Contacts

•Can view submitted payment requests and track status for monitoring purposes

•Can reassign TTL when the primary TTL is unavailable

To log on as a consultant or temporary using:

•The intranet within the Bank, IFC, or MIGA offices, go to http://strequest.

•External access* (from any PC or Macintosh with internet access that is not on the Bank’s network), go to http://strequest.worldbank.org.

*Requires a passkey. If you encounter any errors, contact the service center for assistance.

To log on as a TTL/reviewer using the intranet within the Bank, IFC, or MIGA offices, go to http://stapprove.

To log on and view timesheets using the intranet within the Bank, IFC, or MIGA offices, go to http://stapprove.

6 |

|

Updated April 3, 2012 |

|

S T Payment

Payment

Quick Reference Guide for Consultants and Temporaries

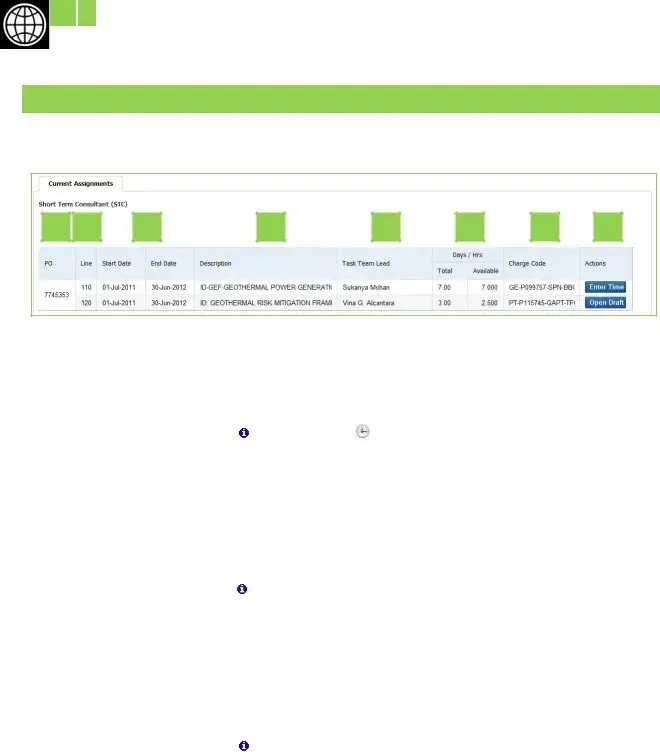

ST Request Home: Current Assignments

1 |

For Official Use Only

2 |

3 |

4 |

|

Contents |

1 |

View Mailing Address and Bank Account Details |

2 |

Select Task to Enter Time |

3 |

Display a Submitted Payment Request |

4Resubmit a Rejected Payment Request (if applicable)

7 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Profile

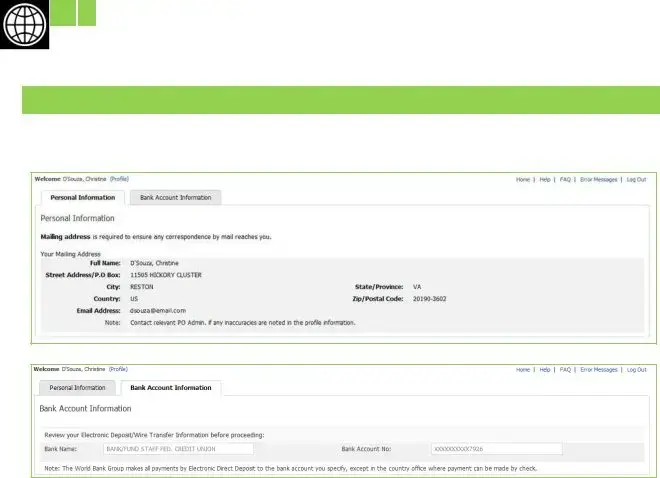

View Mailing Address and Bank Account Details

1.Click Profile to the right of your name on the home page.

2.Review the mailing address and bank information on the relevant tabs. Bank information is mandatory for HQ consultants and temporaries.

For security reasons, the last four digits of your Bank Account No. are displayed.

For security reasons, the last four digits of your Bank Account No. are displayed.

To update your records, send an

•Full name and street address of bank branch

•Bank account number and/or IBAN* number (for certain banks outside the United States)

•For banks in the United States – ABA or routing number**

•For banks outside the United States – Bank routing number or SWIFT code

*International Bank Account Number

**Routing information is not required for Bank Fund Staff Federal Credit Union (BFSFCU) account holders.

8 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

Current Assignments Section

Select a Task to Enter Time

A |

B |

C |

D |

E |

F |

G |

H |

|

Label |

|

|

Field |

Description |

|

|

|

|

|

A purchase order (PO) number is generated in SAP*. A PO is a legal |

|

|

|

|

|

document specifying the type of services, conditions, |

|

A |

|

|

PO |

predetermined rate, and delivery dates. |

|

|

|

|

||

|

|

|

|

|

An Overtime icon displays next to the PO number for pre- |

|

|

|

|

|

authorized overtime. This applies only to temporaries. |

|

|

|

|

|

|

|

B |

|

|

Line |

PO line item number in SAP* |

|

C |

|

|

Start Date and |

Duration of each task or PO line item |

|

|

|

End Date |

||

|

|

|

|

|

|

|

D |

|

|

Description |

Brief description of the assignment(s) or task(s) to be performed |

|

|

|

|

|

|

|

|

|

|

|

Designated approver of your payment request and deliverables (if |

|

|

|

|

|

any) in ST Payment. |

|

E |

|

|

Task Team Lead |

|

|

|

|

|

|

Note that manager approval in SAP is still required for payment |

|

|

|

|

|

to be processed. |

|

|

|

|

|

The number of days or hours depends on the terms of your |

|

|

|

|

|

contract. |

|

F |

|

|

Days/Hrs |

• Total hours or days allocated for each task or PO line item. |

|

|

|

|

|

• Available balance is the maximum number of hours or days |

|

|

|

|

|

that can be claimed against the task or PO line item. |

|

|

|

|

|

|

|

|

|

|

|

Indicates how the PO is funded or where services are charged. |

|

G |

|

|

Charge Code |

A PO may be broken down into various line items charged |

|

|

|

|

|

|

|

|

|

|

|

against different charge codes. |

|

|

|

|

|

|

|

|

|

|

|

• Enter Time – to enter timesheet details |

|

H |

|

|

Actions |

• Open Draft – to modify details in a timesheet that was saved as |

|

|

|

|

|

draft |

*SAP is the financial and accounting system used by the World Bank Group.

9 |

|

Updated April 3, 2012 |

|

S

T Payment

Payment

For Official Use Only

1.Review the fields under Current Assignments to ensure that you enter time against the correct task for the current fiscal year.

For additional information, check with the administrative contact listed in your Letter of Appointment.

For additional information, check with the administrative contact listed in your Letter of Appointment.

2.Click Enter Time or Open Draft against the relevant task under the Actions column. The Payment Request Form displays.

Submitted Timesheets Section

A |

B |

C

D |

E |

F |

G |

H |

I |

J |

Display a Submitted Payment Request

|

Label |

Field |

|

Description |

|

A |

PR Number |

|

A payment request (PR) number is generated when the consultant |

|

|

or temporary submits the request. |

||

|

|

|

|

|

|

|

|

|

A purchase order (PO) number is generated in SAP*. A PO is a legal |

|

|

|

|

document specifying the type of services, conditions, |

|

B |

PO Number |

|

predetermined rate, and delivery dates. |

|

|

|

||

|

|

|

|

An Overtime icon displays next to the PO number for pre- |

|

|

|

|

authorized overtime. This applies only to temporaries. |

|

|

|

|

|

|

C |

Line |

|

PO line item number in SAP* |

|

|

|

|

|

|

D |

Description |

|

Brief description of the assignment(s) or task(s) to be performed |

|

|

|

|

• From and To indicate the period specified in the payment |

|

E |

Date |

|

request for the completed work. |

|

|

• Submitted is the date when the payment request is sent for TTL |

||

|

|

|

|

|

|

|

|

|

approval. |

|

|

|

|

|

|

F |

Claimed Qty |

|

Number of days or hours claimed against a task or PO line item |

|

|

|

|

|

|

G |

Payment Amt |

|

Automatically displays the amount based on the Claimed Quantity |

|

|

multiplied by the rate |

||

|

|

|

|

|

|

|

|

|

|

10 |

|

Updated April 3, 2012 |

|

Document Specifics

| Fact | Detail |

|---|---|

| Form Access | The Payment Request Form is accessible online via the ST Request site for STCs/STTs. |

| Alternative Format | Form 2370 or Request for Payment (RFP) is used where internet access is restricted. |

| Benefits | Automates payment entry/approval, tracks payment status, and maintains confidentiality. |

| Prerequisites | Requires submission of accurate bank and email account details to the administrative contact. |

| Payment Process | Includes issuance of Letter of Appointment, payment request submission by consultant, and approvals by TTL/Reviewer and Manager. |

| Key Policies | Covers appointment status, allowed working days, start date, access to ST Request site, direct deposit, advance fees, and record-keeping. |

| Overtime Policy | Overtime for temporaries requires prior authorization and verification of specific purchase order. |

| Passkey Activation | Details the steps to activate a passkey for security, including contacting service centers for assistance. |

| System Access Limits | Access to ST Payment system is limited by the start and end dates of the consultant's/temporary's contract. |

Guide to Writing World Bank St Payment Request

Filling out the World Bank ST Payment Request form is a crucial step for short-term consultants (STCs) and short-term temporaries (STTs) to ensure they are compensated for their services. This process, designed to streamline and secure the payment procedure, incorporates several checks and stages, from ensuring proper documentation is submitted to verifying the correctness of bank account details. By following these instructions, consultants and temporaries can navigate the system efficiently and submit their payment requests without hiccups.

- Visit http://strequest.worldbank.org to access the ST Payment system. This is where the journey begins for submitting your payment request.

- If it's your first time or if you've forgotten your password, click on Forgot/Request Password on the Sign In page. This step is critical for ensuring your account's security.

- In the field provided, enter the E-mail address you have on file with the World Bank Group. It's essential that this matches the records exactly to avoid any delays.

- Type in the characters displayed for Registration Verification accurately. This step helps in preventing unauthorized access to your account.

- Click Submit to proceed. Following this action, be on the lookout for an E-mail from the system providing you with a temporary passkey alongside further instructions.

- Upon receiving the passkey, it's imperative that you reset your password immediately. This not only enhances your account's security but also ensures that your access remains uncompromised.

- For any issues encountered during this process, whether technical or related to account access, don't hesitate to reach out for assistance. For IBRD/MIGA queries, the ISG Global Support Center at (202) 473-2121 is available, and for IFC concerns, contact the IFC Helpdesk at (202) 522-3000. Remember, help is just a call away, available 24/7.

Once logged into the ST Payment, follow through by filling in your timesheet with the specific tasks completed, ensuring all information regarding services rendered and deliverables is accurately captured. Before submission, double-check your bank account details for correctness to avoid any delays in payment processing. Upon submission, your request will go through an approval process, initially by the Task Team Leader (TTL)/Reviewer and finally by the Manager post-review in SAP. Adhering to these stepsmeticulously not only streamlines the payment request process but also aids in the timely receipt of your compensation.

Understanding World Bank St Payment Request

-

What exactly is the World Bank ST Payment Request Form?

The World Bank ST Payment Request Form is an online tool designed for short-term consultants and temporaries (STCs/STTs) to submit their payment requests digitally. It's accessible via the ST Request site, ensuring a streamlined process for inputting and tracking payment requests. For areas with limited web access, Form 2370 or Request for Payment (RFP) is also accepted.

-

What are the major benefits of using the ST Request portal?

The ST Request Portal offers significant advantages such as automating the submission and approval of payment requests, providing real-time tracking of payment status, ensuring data confidentiality through secure access, and allowing automatic validation of the STC/STT’s commitments against available funding. Additionally, it facilitates viewing and filtering submitted payment requests by project and duration.

-

Are there prerequisites for using the ST Request system?

Yes, before using the ST Request system, STCs/STTs must have a bank account and an email account set up. They must provide accurate bank details, including the full name and address of the bank, account number, and the relevant routing information (ABA or routing number for US banks and SWIFT code or bank routing number for international banks). A personal email address should also be submitted to receive notifications about payment updates.

-

How does the payment process work for consultants or temporaries?

The payment process involves several steps starting from the issuance of the Letter of Appointment, submission of the payment request on the ST Payment system, and completion of the payment request with relevant details about the services rendered. The Task Team Leader (TTL) or reviewer then approves or rejects the request, followed by a manager's approval or rejection in the SAP system.

-

What key policies should be considered for short-term appointments?

Several key policies affect short-term appointments, including appointment status, the maximum number of working days allowed per fiscal year, the start date for the contract, access to the ST Request site, direct deposit information, conditions for advance fee requests, and record-keeping requirements. Additionally, temporaries have to secure authorization for any overtime work in advance.

-

How can I activate my PassKey for the ST Payment system?

To activate your PassKey, visit the ST Request website and follow the "Forgot/Request Password" link. You'll need to enter your email address provided to the World Bank Group and complete the registration verification process. A temporary passkey will be emailed to you, which you should reset immediately for security reasons.

-

Where can I go for additional assistance if I encounter issues with the ST Payment system?

For assistance with the ST Payment system, IBRD/MIGA users can contact the ISG Global Support Center, and IFC users can reach out to the IFC Helpdesk. Service centers are available 24/7 to provide support and help with account activation and troubleshooting.

-

What happens if my payment request is rejected?

If your payment request is rejected, the TTL/reviewer will provide comments for the rejection. You may need to resubmit your payment request after addressing any issues that led to the rejection. It's important to carefully review the feedback and ensure that your resubmission meets all required criteria and includes any requested clarifications or additional documentation.

-

What should I do if I need to submit overtime as a temporary?

As a temporary employee seeking to submit overtime, you must first secure prior authorization from your approving manager. You should also verify the specific purchase order and line item to charge the overtime to with the administrative contact. It's essential to ensure all overtime work is properly authorized to avoid any issues with payment.

-

How can I track the status of my submitted payment request?

Once you've submitted your payment request through the ST Request portal, you can track its status online in real time. The system provides detailed tracking and status updates, allowing you to see when your request is approved, rejected, or pending further action. This feature helps in managing your expectations and planning accordingly.

Common mistakes

Filling out the World Bank ST Payment Request form is a critical step for short-term consultants and temporaries (STCs/STTs) to get compensated for their work. However, mistakes can happen, leading to delays or even non-payment. Here are nine common mistakes to avoid:

- Entering incorrect bank details: Ensure the full name and address of the bank branch, the correct account number or IBAN, and the ABA or routing number (for US banks) or SWIFT code (for banks outside the US) are accurately provided.

- Using multiple email addresses: You should submit only one personal email address to the administrative contact. If a Lotus Notes account is activated by the hiring unit, it takes precedence over your personal email account.

- Forgetting to sign and submit the Letter of Appointment (LOA): The LOA is a mandatory one-time verification at the start of a contract. Make sure it’s signed and submitted to avoid payment delays.

- Omitting service details and deliverable descriptions in payment requests: Clearly describe the services rendered and the deliverables provided as part of the payment request.

- Not tracking submitted payment requests: Keep an eye on the status of your payment requests. This feature is available online and helps you manage your expectations regarding payment timelines.

- Waiting until the contract’s end date to submit timesheets: Your access to the ST Request site is restricted by your contract’s end date. Submit timesheets before the contract ends to ensure payment.

- Overlooking the need for advance fee authorization: If you require an advance payment for travel or services beyond your contract period, you must seek approval from your administrative contact well in advance.

- Poor record-keeping: Maintain accurate records of your time spent on each project, especially if you are juggling multiple assignments. This simplifies the payment request process and ensures you’re compensated for all your work.

- Ignoring overtime authorization procedures: For temporaries eligible for overtime, ensure you have prior authorization from your managing officer and verify the specific project and line item to charge the overtime.

By sidestepping these common errors, STCs and STTs can streamline their payment process, making their consulting experience with the World Bank Group smoother and more rewarding.

Documents used along the form

When you're handling the World Bank ST Payment Request form, it's like assembling a puzzle. Each piece, or document, plays a vital role in painting the full picture of your contractual agreement and ensuring that your payment process flows smoothly. Here’s a guide to other forms and documents that often accompany the World Bank ST Payment Request form.

- Letter of Appointment (LOA): This formal document spells out the terms and conditions of your contract with the World Bank. It's the green light signaling the start of your professional relationship, outlining everything from your role to your remuneration details.

- Bank Account Details: Essential for direct deposits, this information links your hard-earned money to the correct account. Include the full name and address of your bank, your account number, and if you're banking outside the United States, the IBAN or SWIFT/BIC code.

- Email Address Confirmation: A simple yet crucial piece of your toolkit. This ensures you're in the loop with all payment notifications, actions on your payment request, and any other important communication.

- Service Entry Sheet (SES) in SAP: Generated upon the approval of your payment request, this internal document plays a pivotal role in the World Bank's ERP system for tracking the services rendered.

- Signed Time Sheets: For temporaries, this document proves the hours you've dedicated. It's your claim to the time spent on your assigned tasks and a crucial part of the payment validation process.

- Travel Subsistence Costs: If your contract covers travel, this document details the expenses incurred, essential for claiming those costs back. It’s particularly important for consultants who find themselves on the move.

- Advance Payment Request: Sometimes, there's a need to have funds disbursed before the completion of your assignment. This document lays out the justification for such requests, whether for covering upfront costs or other agreed expenses.

- Project Deliverables Submission: A breakdown of the outputs or results from your consultancy. This could range from reports to software developed, serving as a tangible testament to your contributions.

Navigating the nuances of World Bank consultancy documents need not be a labyrinth. With a clear understanding of each component, from your LOA to your bank account details all the way to your submitted project deliverables, you're well-equipped to ensure that the payment process is as smooth as your consultancy work. Understanding these pieces not only simplifies your administrative workload but sets a clear path for your professional journey within the World Bank framework.

Similar forms

The World Bank ST Payment Request form shares similarities with an Invoice form traditionally used in various business transactions. Like an invoice, the ST Payment Request details services rendered, project deliverables, and financial compensation expected. This form specifies the consultant's or temporary worker's bank details for the processing of payments, much like how an invoice would list payment information for the purchaser. Both documents serve as requests for payment, providing a structured way for entities to report work done in exchange for financial compensation, while also facilitating a record-keeping and tracking process of the payments due or paid.

A Timesheet is another document that closely resembles the World Bank ST Payment Request form, particularly in its function of recording hours or days worked by a consultant or temporary staff. The ST Request system requires the submission of detailed work records, akin to a timesheet where employees log their working hours against specific tasks or projects. Both documents are integral to validating work performed before processing payroll or consulting fees, ensuring accurate and fair compensation for time invested in work-related activities.

The Reimbursement Form used by many organizations for processing claims related to business expenses parallels the ST Payment Request form. Both documents require detailed submission of information to justify the payment or reimbursement request. While the ST Payment form is designed for consultant fee payment requests, a reimbursement form typically caters to employee requests for out-of-pocket expenses. Each serves a pivotal role in financial transactions within organizations, ensuring transparency and accountability in fund disbursement for work-related expenses or compensation.

The Direct Deposit Authorization form bears resemblance to the bank account information section of the ST Payment Request form, where consultants and temporaries must provide their banking details for payment processing. Both documents collect essential data like bank name, account number, and routing information to facilitate electronic fund transfers. The purpose of gathering such information is to streamline payment processes, enhancing efficiency and security for both the issuing organization and the recipient by leveraging the benefits of direct deposit systems.

The Contract Summary Report, although not a request form, shares conceptual similarities with the World Bank ST Payment Request form in terms of content aggregation and overview purposes. The ST Payment form includes an overview of project details, payment terms, and consultant work commitments, akin to how a contract summary might encapsulate the key elements of a work agreement. Both types of documents are designed to provide a comprehensive snapshot of the engagements and expectations between parties, serving as a reference point for terms agreed upon for the duration of a project or employment period.

Dos and Don'ts

Filling out the World Bank ST (Short-Term) Payment Request form is an important process for short-term consultants and temporaries. To ensure this process is smooth and successful, here are 10 dos and don'ts to keep in mind:

Things You Should Do:

- Ensure your Bank Account and Email Account information is accurate and complete before submission.

- Check that your Letter of Appointment (LOA) is signed and submitted to confirm the start of your contract.

- Describe the services rendered and deliverables accurately when entering your payment request.

- Track the status of your submitted payment requests to stay informed.

- Keep a record of your time against each project, especially if working on multiple assignments.

- Follow the process to activate your Passkey for secure access to the ST Payment system.

- Reset your Passkey immediately for security reasons upon receiving the temporary one.

- Always verify specific purchase order and line item for charging overtime (for temporaries only).

- Contact your administrative contact for any clarifications or questions about advance fees.

- Adhere to the deadline for submitting your timesheet according to your contract end date.

Things You Shouldn't Do:

- Don’t submit incomplete or inaccurate bank details to avoid payment delays.

- Avoid sending multiple Email Accounts; only provide one personal E-mail address to the administrative contact.

- Don’t forget to validate your bank account information regularly to ensure correctness.

- Do not ignore the importance of securing authorization for any overtime work in advance.

- Avoid working before your contract's start date as it can lead to insurance and liability issues.

- Do not wait until the last moment to submit your timesheet; always aim to do this well before your access is revoked.

- Avoid sharing your Passkey with others to maintain the confidentiality of your information.

- Do not disregard instructions for passkey reset and activation to prevent being locked out of the system.

- Don’t hesitate to contact service centers for assistance if you encounter technical difficulties.

- Avoid overlooking emails from the World Bank Group for important notifications about your payment requests.

Misconceptions

Many people who work as short-term consultants or temporaries (STCs/STTs) for the World Bank may encounter certain misconceptions about the ST Payment Request form. These misunderstandings can lead to confusion and delays in receiving payments. Here, we aim to clarify some of these misconceptions:

- It's only accessible online: While the ST Payment Request Form is readily available on the ST Request site for ease of use and efficiency, it's not solely restricted to online access. For those located in areas with limited web access, such as remote locations or fragile states, the traditional paper form (Form 2370 or Request for Payment) continues to be accepted. This ensures all consultants and temporaries can submit their payment requests, regardless of their internet accessibility.

- Approval is automatic: Some may believe that submitting a payment request through the ST Request platform guarantees automatic approval. However, each payment request requires approval from both the task team leader (TTL)/reviewer and subsequently from the approving manager once the service entry sheet (SES) is created in SAP. This two-step approval process ensures that all payment requests are carefully reviewed for accuracy and compliance with the World Bank's policies.

- Bank account details are flexible: A common misconception might be that bank account details can be casually submitted or updated. In reality, providing accurate and complete bank account details to the administrative contact is a prerequisite for using ST Request. These details include the full name and street address of the bank branch, account number, and for banks outside the United States, either a Bank routing number or SWIFT code. This meticulous requirement ensures that payments are processed efficiently and securely.

- Overtime payments are readily available for all: Many might assume that STCs and STTs can easily claim overtime payments. However, overtime submissions and payments are exclusively for temporaries, not consultants. Moreover, obtaining approval for overtime pay isn't as straightforward as regular payment requests. Temporaries must secure authorization for overtime in advance from their approving manager, and verify the specific purchase order and line item with the administrative contact. This distinction highlights the different policies applicable to consultants and temporaries under the ST Payment system.

Understanding these facets of the ST Payment Request process is crucial for STCs and STTs to navigate the system effectively and avoid potential delays or issues in receiving their payments.

Key takeaways

Understanding the nuances of the World Bank ST Payment Request form is crucial for short-term consultants and temporaries (STC/STTs) aiming for a smooth transaction process. Here are key takeaways:

- Using the ST Request form, accessible online, makes it easier to enter and submit payment requests. This service ensures that those in remote or fragile states, who might face web access issues, are also considered, allowing them to use Form 2370 or Request for Payment (RFP) instead.

- The benefits of using the ST Request form are manifold. It not only automates the entry and approval process of payment requests but also provides online tracking of payment status, maintains confidentiality with secure passkey access, offers automatic validation of work days or hours against commitments, and allows viewing and filtering of submitted payment requests.

- Before leveraging the ST Request, certain prerequisites must be met including possessing a bank account and an email account. Accurate bank details and a personal email address should be submitted to the administrative contact to facilitate payment updates and notifications.

- The payment process is delineated into four straightforward steps: issuing a Letter of Appointment, completing and submitting the Payment Request, having the Task Team Leader/Reviewer approve or reject the request, and finally, manager approval or rejection in SAP which is contingent upon the Task Team Leader/Reviewer's approval.

- Key policies must be adhered to, respecting appointment status, allowed number of working days per fiscal year, contract start date adherence to avoid insurance and liability issues, and fulfillment of payment procedures including access limitations post-contract, direct deposit requirements, advance fee requests, and maintaining time records for multiple assignments.

- For temporaries, it's important to secure overtime authorization in advance and verify chargeable purchase orders and line items with administrative contacts.

- To access the ST Payment system, activating a PassKey is essential for security. This involves a simple process of requesting or resetting a password on the ST Request website and necessitates a functional email address provided to the World Bank Group.

By keeping these detailed insights in mind, both STCs and STTs can navigate the Payment Request process more effectively, minimizing potential hiccups and ensuring timeliness in compensation.

Popular PDF Documents

Charging Sales Tax - This form allows taxpayers to officially document their entitlement to refunds or credits due to overpaid sales or use taxes.

How to Fill Out W4 Married Filing Jointly No Dependents - Completing the W-4 accurately can prevent owing a large amount of taxes or receiving a significant refund during tax season.

License and Permits - Navigates businesses in Oakland through the process of confirming their alignment with zoning regulations.