Get Wisconsin Wt 7 Tax Form

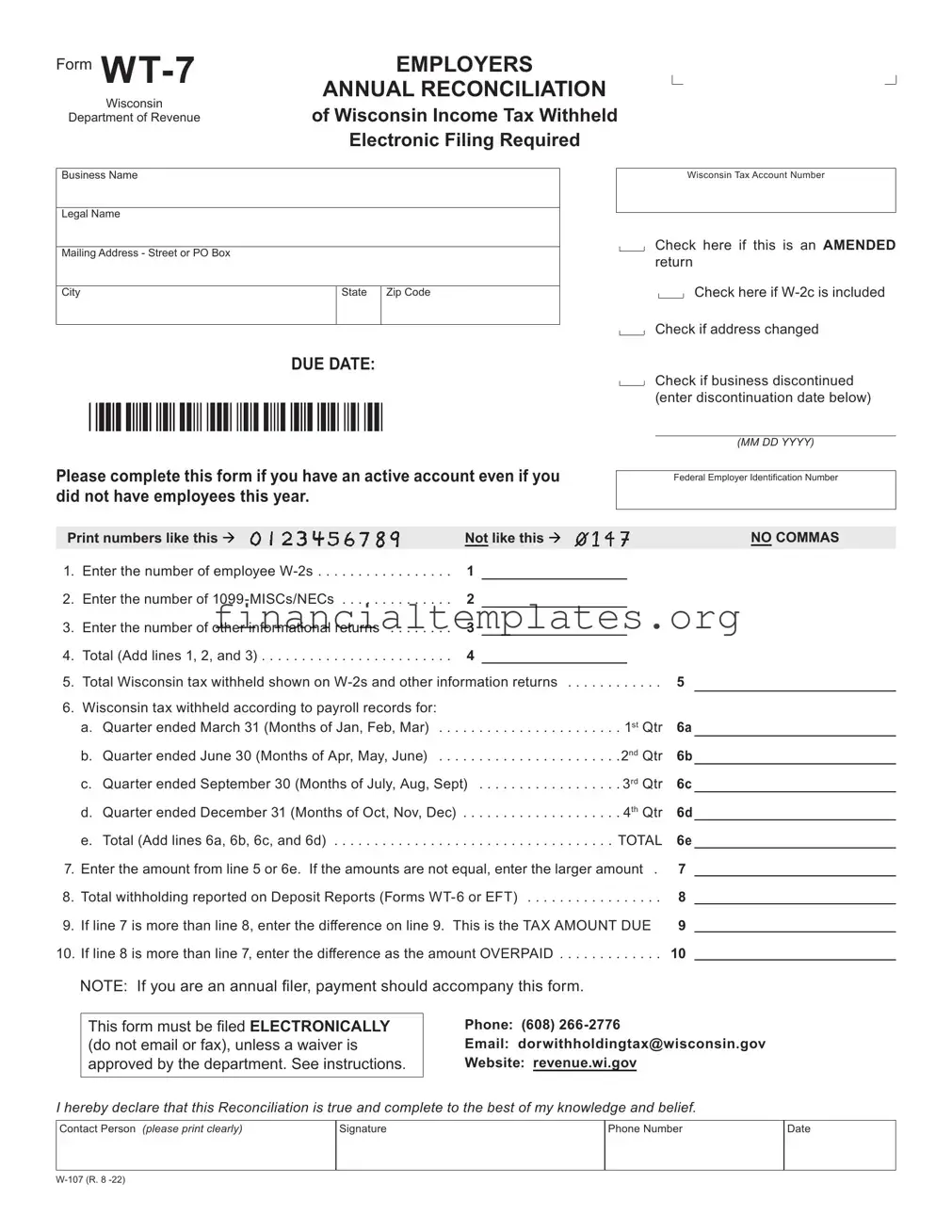

The Wisconsin WT-7 Tax Form, known as the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, plays a vital role for employers within the state. This document, managed by the Department of Revenue, is crucial for businesses to reconcile the total state income tax withheld from their employees against what was actually paid to the state over the fiscal year. With an emphasis on accuracy and compliance, the form requires details such as the business and legal name, mailing address, and the Wisconsin Tax Account Number. It also mandates the inclusion of vital data such as the number of W-2s, 1099-MISCs/NECs, other informational returns issued, and the total Wisconsin tax withheld as shown by these documents. Additionally, it breaks down the withheld tax by quarter, compares it to the total reported on deposit reports, and calculates either the tax amount due or overpaid. Filing this form is strictly electronic unless a special waiver is obtained, underscoring the state's push towards modernizing and streamlining tax administration processes. This requirement, paired with deadlines and specifics on amendments and business changes, underscores the form's critical role in ensuring businesses correctly report and reconcile their income tax withholding, thus maintaining compliance with Wisconsin's tax laws.

Wisconsin Wt 7 Tax Example

Form |

EMPLOYERS |

|

|

ANNUAL RECONCILIATION |

|

|

Wisconsin |

|

|

of Wisconsin Income Tax Withheld |

|

Department of Revenue |

||

Electronic Filing Required

Business Name

Legal Name

Mailing Address - Street or PO Box

City |

State |

Zip Code |

|

|

|

DUE DATE:

Wisconsin Tax Account Number

Check here if this is an AMENDED return

Check here if

Check if address changed

Check if business discontinued (enter discontinuation date below)

Please complete this form if you have an active account even if you did not have employees this year.

(MM DD YYYY)

Federal Employer Identification Number

Print numbers like this |

Not like this |

|

|

|

NO COMMAS |

||

1. |

Enter the number of employee |

1 |

|

|

|

|

|

2. |

Enter the number of |

2 |

|

|

|

|

|

3. |

Enter the number of other informational returns |

3 |

|

|

|

|

|

4. |

Total (Add lines 1, 2, and 3) |

4 |

|

|

|

|

|

5. |

Total Wisconsin tax withheld shown on |

. . . . . . |

5 |

|

|||

6. |

Wisconsin tax withheld according to payroll records for: |

|

|

|

|

|

|

|

a. Quarter ended March 31 (Months of Jan, Feb, Mar) . . . |

. . . . . . . . . . . . . . . . . . . |

. 1st Qtr |

6a |

|

||

|

b. Quarter ended June 30 (Months of Apr, May, June) . . . |

. . . . . . . . . . . . . . . . . . . |

.2nd Qtr |

6b |

|

||

|

c. Quarter ended September 30 (Months of July, Aug, Sept) |

6c |

|

||||

|

d. Quarter ended December 31 (Months of Oct, Nov, Dec) |

. . . . . . . . . . . . . . . . . . . |

. 4th Qtr |

6d |

|

||

|

e. Total (Add lines 6a, 6b, 6c, and 6d) |

. . . . . . . . . . . . . . . . . . . |

TOTAL |

6e |

|||

7. |

Enter the amount from line 5 or 6e. If the amounts are not equal, enter the larger amount . |

7 |

|

||||

8. |

. . . . . . . . . . .Total withholding reported on Deposit Reports (Forms |

. . . . . . |

8 |

|

|||

9. |

If line 7 is more than line 8, enter the difference on line 9. This is the TAX AMOUNT DUE |

9 |

|

||||

. . . . . . .10. If line 8 is more than line 7, enter the difference as the amount OVERPAID |

. . . . . . |

10 |

|

||||

NOTE: If you are an annual filer, payment should accompany this form.

This form must be filed ELECTRONICALLY

(do not email or fax), unless a waiver is approved by the department. See instructions.

Phone: (608)

Email: dorwithholdingtax@wisconsin.gov

Website: revenue.wi.gov

I hereby declare that this Reconciliation is true and complete to the best of my knowledge and belief.

Contact Person (please print clearly)

Signature

Phone Number

Date

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form WT-7 | This form is used by employers for the Annual Reconciliation of Wisconsin Income Tax Withheld from employees' wages. |

| Electronic Filing Requirement | Filing this form electronically is mandatory, unless a waiver is granted by the Wisconsin Department of Revenue. |

| Amendment and Address Change Indicators | Employers can indicate if the form is an amended return and if there has been a change in business address. |

| Business Discontinuation | This section allows for the indication of business discontinuation along with the date it occurred. |

| Reporting Requirements | Employers must report the number of W-2s, 1099-MISCs/NECs, and other informational returns, along with the total Wisconsin tax withheld. |

| Quarterly Withholding Reconciliation | The form requires a breakdown of Wisconsin tax withheld per quarter, summing up to an annual total. |

| Reconciliation of Withholding | Employers must reconcile the total tax withheld according to W-2s and other informational returns against their payroll records to report any discrepancy. |

| Tax Amount Due or Overpaid | The form calculates the difference between tax amounts reported and amounts deposited to identify if there is tax due or overpaid. |

| Governing Laws | The WT-7 form is governed by the tax laws and regulations set forth by the Wisconsin Department of Revenue. |

Guide to Writing Wisconsin Wt 7 Tax

Filing the Wisconsin WT-7 Tax Form is a crucial step for employers in ensuring compliance with state tax regulations. This form serves as an annual reconciliation of Wisconsin income tax withheld from employees. Employers must file this document electronically to accurately report and reconcile the total Wisconsin tax withheld over the year with the amounts reported on deposit reports and employee W-2 forms. If you are ready to undertake this important responsibility, follow these detailed steps to ensure that your filing is complete and accurate.

- Access the Wisconsin Department of Revenue website or your electronic filing portal to start the electronic filing process for Form WT-7.

- Enter your Business Name and Legal Name as it appears on your tax records.

- Provide the Mailing Address (Street or PO Box), City, State, and Zip Code for your business.

- If this is an amended return, check the box labeled "Check here if this is an AMENDED return."

- Check the appropriate box if a Form W-2c is included with your filing.

- Indicate if there has been a change of address since your last filing by checking the box, or if your business has been discontinued, check the respective box and enter the discontinuation date (MM DD YYYY).

- Fill in your Wisconsin Tax Account Number and your Federal Employer Identification Number (FEIN), ensuring that numbers are printed clearly without commas.

- Enter the number of employee W-2s issued in the tax year.

- Report the number of Form 1099-MISCs/NECs issued, if applicable.

- State the number of other informational returns provided.

- Add the amounts from the previous three steps to get the total number of documents and report it on the form.

- Enter the Total Wisconsin tax withheld shown on W-2s and other information returns.

- Break down the Wisconsin tax withheld according to payroll records for each quarter of the year and enter the values in the respective fields (1st Qtr, 2nd Qtr, 3rd Qtr, 4th Qtr).

- Add the totals of quarterly withholdings and report the sum in the field provided.

- Determine the larger amount between the total tax withheld per your records and the amount from line 5, enter this in the designated field.

- Report the total withholding amount previously reported on deposit reports (Forms WT-6 or EFT).

- If the amount on line 7 is more than what was reported on deposit reports, calculate the difference and enter this as the tax amount due.

- Conversely, if deposit reports show a greater amount than line 7, calculate the difference to determine the amount overpaid and report this amount.

- Review the form to ensure accuracy, then print the names of the contact person, sign, and date the form.

- Submit the completed form electronically through the designated portal, unless a waiver has been approved for paper filing.

Completing the Wisconsin WT-7 Tax Form accurately is vital for maintaining compliance and ensuring proper tax withholding reconciliation. Take your time to review each section for accuracy before submitting the form electronically to the Wisconsin Department of Revenue. For assistance, the department provides resources and contact information for employers.

Understanding Wisconsin Wt 7 Tax

-

What is the Form WT-7 and who needs to file it?

Form WT-7, titled Employers Annual Reconciliation of Wisconsin Income Tax Withheld, is a document required by the Wisconsin Department of Revenue. Employers use this form to reconcile the total Wisconsin income tax withheld from employees with the quarterly amounts reported throughout the year. Any business with an active Wisconsin tax account, even those without employees for the reported year, must complete this form.

-

When is Form WT-7 due?

This form is due annually. Although the specific due date is not mentioned within the provided details, it typically aligns with federal reporting deadlines for yearly employer tax documents. Employers should verify the exact due date for the current reporting year on the Wisconsin Department of Revenue website or by contacting their office directly to avoid penalties for late filing.

-

Is electronic filing mandatory for Form WT-7?

Yes, the Wisconsin Department of Revenue requires electronic filing for Form WT-7. This requirement helps streamline the process and ensures accuracy. However, a waiver may be granted in certain circumstances. If electronic filing poses a hardship, employers should contact the department directly to request a waiver.

-

What information is required on Form WT-7?

Employers must provide details including their business name, legal name, mailing address, and Wisconsin tax account number. The form also requires the federal employer identification number (FEIN) and specifics about Wisconsin income tax withheld. This includes the number of W-2s, 1099-MISCs/NECs, and other informational returns issued, along with total Wisconsin tax withheld as per these documents and payroll records.

-

How do employers handle discrepancies between withheld amounts and payroll records?

On Form WT-7, employers are instructed to report any discrepancies between the total Wisconsin tax withheld as shown on W-2s, 1099-MISCs/NECs, other informational returns, and their own payroll records. The form requires entering the larger amount between the total tax withheld according to documents issued and the total according to payroll records. If there is a tax amount due or an overpayment, it should be calculated and reported accordingly in the relevant sections of the form.

-

What should employers do if they need to amend a previously filed WT-7 form?

If an employer discovers that a previously submitted WT-7 form was incorrect or incomplete, they should file an amended return. The form includes a checkbox specifically for indicating that the submission is an amended return. Additionally, if W-2c forms are included with the amendment, this should also be noted. Careful review and completion of the amended form are crucial for ensuring compliance and rectifying any previous reporting errors.

Common mistakes

Filing tax forms correctly is crucial for compliance with state regulations. The Wisconsin WT-7, an Employer's Annual Reconciliation of Income Tax Withheld form, is no exception. This document requires careful attention to detail. Unfortunately, people often make mistakes when completing it. Understanding these common errors can help individuals ensure accurate submissions.

- Not filing electronically - The form mandates electronic filing unless a specific waiver is granted. Ignoring this requirement can lead to processing delays and potential fines.

- Inaccurate count of W-2s, 1099-MISCs/NECs, and other informational returns - Line 4 requires a total of these documents. Errors in tallying can lead to discrepancies in tax withheld amounts reported.

- Failing to report the correct total Wisconsin tax withheld - Line 5 needs the collective tax withheld shown on W-2s and other returns. Overlooking or miscalculating this figure can significantly affect the reconciliation.

- Misreporting quarterly withheld taxes - Lines 6a through 6d necessitate detailed quarterly withholding records. Misinterpretation or incorrect entry of these amounts may result in incongruent totals.

- Omitting to check necessary boxes - Forgetting to indicate if the return is amended, if a W-2c is included, or if there has been a change of address or business discontinuation can lead to administrative issues or a lack of communication from the Department of Revenue.

- Incorrect calculations of overpayment or amount due - Line 9 and 10 calculations rely on accurate data from previous sections. Errors here can lead to underpayments or delayed refunds.

- Neglecting the declaration section - The form must be signed, declaring that the information is accurate. Failure to sign or provide contact details can invalidate the entire submission.

Each mistake, though seemingly minor, can have significant implications for compliance and financial accuracy. It is vital for filers to review their forms thoroughly, double-check figures, and ensure all applicable sections are completed fully and correctly. Doing so helps maintain financial integrity and fosters trust in business operations.

Documents used along the form

When filing the Wisconsin WT-7 Tax Form, also known as the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, several other documents are often needed or used in conjunction to ensure comprehensive compliance and accurate reporting. These documents vary in their purpose, from detailing individual employee withholdings to amending previously filed information. Understanding each document's function can assist businesses and tax preparers in navigating the complexities of tax filing. Below is a list of documents frequently used alongside the WT-7 form, offering a glimpse into their distinctive roles within the tax preparation process.

- W-2 Forms: These are wage and tax statements that employers must provide to every employee from whom income, social security, or Medicare tax was withheld. They detail the employee's income and taxes withheld for the year.

- 1099-MISC/NEC Forms: These forms report non-employee compensation, such as payments to independent contractors. They are crucial for businesses that work with freelancers or independent contractors.

- WT-6, Wisconsin Withholding Tax Deposit Report: This form is used for reporting the quarterly or more frequent deposits of withheld income tax. It ensures that withheld taxes are appropriately reported and paid throughout the year.

- Form W-3: The Transmittal of Wage and Tax Statements accompanies the W-2 forms when submitting to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year.

- W-2c, Corrected Wage and Tax Statement: This is used to correct errors on the W-2 forms after they have been submitted to the Social Security Administration and distributed to employees.

- Schedule R, Allocation Schedule for Aggregate Form 941 Filers: This IRS form is utilized by employers who file Form 941, Employer's Quarterly Federal Tax Return, aggregately through an agent. It helps in allocating wages, tips, and taxes to each employer.

- 941, Employer's Quarterly Federal Tax Return: This form reports federal income tax withheld from employees, as well as the employer and employee's share of Social Security and Medicare taxes each quarter.

- State Unemployment Tax Act (SUTA) Reports: These quarterly reports are necessary for reporting wages and paying unemployment insurance taxes to the state. While specifics can vary by state, they are essential for businesses with employees.

- Personal Property Tax Listings: While not directly related to employee withholding, businesses often file these listings concurrently for reporting personal property used in business to local taxing authorities.

- Change of Business Address/Information Forms: These forms are critical for keeping state tax records updated, ensuring that all communications and filings are correctly directed and processed.

This collection of forms and documents plays an integral role in fulfilling an employer's tax-related responsibilities. From regular employee income reporting to correcting past mistakes, and ensuring timely tax payments, each document serves a pivotal purpose in the broader framework of tax compliance. Businesses should familiarize themselves with these documents, understand their requirements, and prepare them accordingly to ensure accurate and complete tax filings.

Similar forms

The Form 940, or Employer's Annual Federal Unemployment (FUTA) Tax Return, is quite similar to the Wisconsin WT-7 Tax Form in that both are annual reconciliations related to employment. While the WT-7 deals with state income tax withheld from employees' wages in Wisconsin, Form 940 addresses the employer's federal unemployment tax liability. Both forms require employers to report total amounts related to the specific taxes they cover, reconcile the amounts due, and report any overpayment or amount due. They play crucial roles in ensuring that employers meet their respective state and federal tax obligations regarding employee compensation.

The W-3, Transmittal of Wage and Tax Statements, serves a similar purpose to the WT-7 form but operates on the federal level. The W-3 is used to transmit W-2 forms to the Social Security Administration, summarizing the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the previous year. Like the WT-7, the W-3 is an annual summary report that supports the reconciling process between what was withheld and what was actually paid out to employees, albeit for different types of taxes and to different government agencies.

Form W-2, Wage and Tax Statement, is directly related to the Wisconsin WT-7 as it provides the detailed employee-specific data that underpins the summary information reported on the WT-7. Employers issue Form W-2 to report an employee's annual wages and the amount of taxes withheld from their paycheck. For the WT-7, this information is aggregated to report total amounts withheld and to reconcile these withholdings with the state. The relationship between these forms highlights the flow of information from individual employee data to summary reports for tax purposes.

Form 941, Employer's Quarterly Federal Tax Return, bears similarities to the WT-7, but it operates on a quarterly basis instead of annually. This form is used by employers to report income taxes, Social Security tax, or Medicare tax withheld from employees' paychecks. Additionally, Form 941 reports the employer's portion of Social Security or Medicare tax. The WT-7, in contrast, provides a yearly reconciliation for the state of Wisconsin. Both forms are critical for the proper reporting and payment of employment-related taxes but differ in their frequency and scope of reporting (state vs. federal).

Lastly, Form 1099-NEC, Nonemployee Compensation, is similar to the Wisconsin WT-7 in its purpose of reporting payments, but it focuses on non-employee compensation. It is used when businesses pay independent contractors $600 or more in a tax year. While the 1099-NEC is for reporting specific payments to non-employees, the WT-7 summarizes income tax withheld from employees' wages. Both are essential for accurate tax reporting and ensuring compliance with IRS and state tax laws, catering to different types of work relationships and compensation.

Dos and Don'ts

When preparing the Wisconsin WT-7 Tax Form, attention to detail and adherence to instructions are paramount. The accurate reporting of withheld income tax directly impacts both the employer's and employees' financial responsibilities. Below are critical dos and don'ts that should be followed:

Do:

Verify your business information, including the legal name, address, and Wisconsin Tax Account Number, to ensure they are current and correct. If there have been any changes, remember to mark the appropriate checkbox.

Include the correct number of W-2s, 1099-MISCs/NECs, and other informational returns. This accurate count is essential for the reconciliation process.

Ensure that the total Wisconsin tax withheld listed (line 5) and the total according to payroll records (line 6e) are entered accurately. These figures must be carefully calculated to avoid any discrepancies.

Electronically file the form unless you have received an approved waiver from the department. The Wisconsin Department of Revenue requires electronic filing to streamline the processing of these forms.

Don't:

Forget to check the box if this is an amended return or if you are including a W-2c. This information is crucial for the Department of Revenue to process your form correctly.

Use commas in any numeric fields. The form provides clear examples of the correct formatting. Adhering to these guidelines ensures the information is processed accurately.

Neglect to calculate the total withholding reported on Deposit Reports (Forms WT-6 or EFT) accurately. This figure should match your records and needs to be reported carefully on line 8 of the form.

Omit the signature, phone number, and date at the bottom of the form. This form is a legal document, and your signature attests to its accuracy to the best of your knowledge.

By following these guidelines, you can help ensure the timely and accurate processing of your Wisconsin WT-7 Tax Form. Accurate compliance not only fulfills your business obligations but also supports the efficient operation of our tax system.

Misconceptions

When dealing with the Wisconsin WT-7, Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, there are several misconceptions that can lead to confusion and errors. Understanding these misconceptions is key to ensuring that the form is filled out accurately and filed correctly.

Electronic filing is optional: It is a common misunderstanding that filing Form WT-7 electronically is optional. However, this form must be filed electronically unless a specific waiver is approved by the Department of Revenue.

Form WT-7 is only for employers with employees: Even if an employer did not have employees or did not withhold income taxes during the year, they must still complete the form if they have an active withholding account.

All withheld taxes are reported on Form WT-7: Some believe that only taxes withheld from employees' wages are reported. However, the form also requires information on taxes withheld from non-employee compensation reported on 1099 forms.

Amending requires a new form: There’s a misconception that to amend a return, one needs to submit an entirely new form. In reality, checking the "amended return" box on the form suffices.

Reporting zero withholdings or employees is unnecessary: Regardless of whether there were employees in a given year or if any tax was withheld, employers with an active account must file the form, even indicating zero employees or withholdings if that is the case.

WT-7 is due at the fiscal year-end: The misconception here is around timing; Form WT-7 is due based on the calendar year, not the employer's fiscal year, specifically after the year-end.

Only numeric data is essential: Beyond numerical data, such as amounts of tax withheld, the form requires comprehensive information including business name, mailing address, and the number of W-2s and 1099s issued.

WT-7 filing does not require detail on individual withholdings: Contrary to this belief, the form demands detailed quarterly withholding totals, ensuring that employers accurately report the withholdings according to payroll records.

WT-7 is for reporting Wisconsin state tax only: While it's true the form deals with Wisconsin state taxes, it requires the reporting of all withholding, including federal withholdings reported on W-2s and 1099s.

Address or business changes do not need to be reported on WT-7: If there has been a change in the business address or if the business has been discontinued, this must be indicated on the form, contrary to the misconception that these changes can be reported separately or at a later time.

By addressing these common misconceptions, employers can ensure that they are compliant with Wisconsin's Department of Revenue requirements when filing Form WT-7 and avoid potential issues that might arise from incorrect filing.

Key takeaways

Understanding the Wisconsin WT-7 Tax form is crucial for employers in Wisconsin. Here are seven key takeaways that every employer should know:

- This form is an Annual Reconciliation of Wisconsin Income Tax Withheld, necessary for all businesses with an active account, regardless of employee status within the year.

- Electronic filing is required for this form, ensuring a more efficient and secure submission process. Employers should seek a waiver from the department if they are unable to file electronically.

- The form requests detailed information including business name, mailing address, and Federal Employer Identification Number, emphasizing the importance of accurate business identification.

- Employers must indicate if the submission is an amended return and if it includes W-2c forms, which are used to correct information on previously filed W-2 forms.

- Accuracy in reporting the number of W-2s, 1099-MISCs/NECs, and other informational returns, along with the total Wisconsin tax withheld, is paramount to avoid discrepancies.

- Payment should accompany the form for annual filers, if applicable, highlighting the importance of reconciling reported withholding with actual tax dues or overpayments.

- Contact information for the signatory is required at the end of the form, ensuring accountability and a point of contact for any questions or issues that the Wisconsin Department of Revenue might have.

By paying attention to these details, employers can ensure compliance with Wisconsin tax laws, thereby avoiding potential penalties and ensuring their employees' tax withholdings are correctly managed and reported.

Popular PDF Documents

4361 Form - Those exempted by Form 4361 are encouraged to plan alternative methods for retirement and medical emergencies.

What Is the Tax Form for Health Insurance - Employers who provide health insurance that is considered self-insured will send their employees a 1095-B form.