Get Wisconsin Tax Exempt Form

In the heart of the American Midwest, Wisconsin presents a unique opportunity for businesses and individuals engaging in certain transactions to benefit from tax exemptions, a practice made feasible through the Wisconsin Sales and Use Tax Exemption Certificate. This essential form serves as a gateway for qualifying entities to bypass state, county, baseball or football stadium, local exposition, and premier resort sales or use taxes on eligible purchases, leases, or rentals. The document intricately details the nature of transactions exempt from taxation, outlining criteria for a diverse array of items ranging from tangible personal property to specific taxable services. By declaring the intent for a single purchase or signaling the start of a continuous purchasing relationship, the form adapts to the user’s needs. Whether acquiring tractors for agricultural endeavors, investing in livestock care, or stocking up on materials crucial for farming activities like seeds and fertilizers, this certificate underscores Wisconsin's commitment to supporting various sectors by alleviating tax burdens. Additionally, it mandates the purchaser's responsibility to compensate use tax if the provided exemptions no longer apply, underscoring a balance between fiscal incentive and accountability. Navigating through the nuances of this tax exemption process reveals the state's intricate approach to fostering economic growth while ensuring compliance and fairness in tax liabilities.

Wisconsin Tax Exempt Example

Instructions

Save

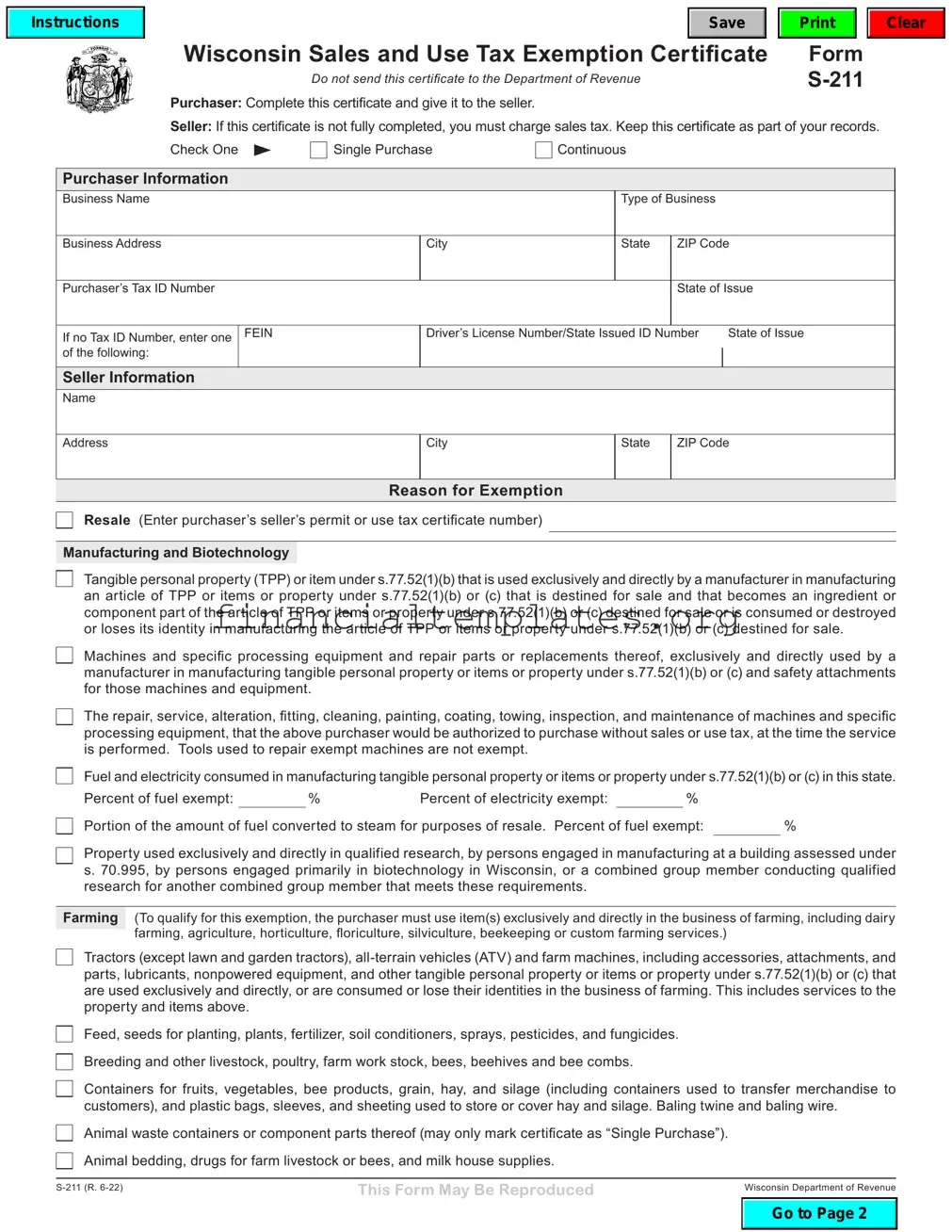

Wisconsin Sales and Use Tax Exemption Certificate

Do not send this certificate to the Department of Revenue

Purchaser: Complete this certificate and give it to the seller.

Form

Clear

Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records.

Check One |

Single Purchase |

Continuous |

|

|

||||

|

|

|

|

|

|

|

|

|

Purchaser Information |

|

|

|

|

|

|

|

|

Business Name |

|

|

|

|

Type of Business |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

City |

|

|

State |

ZIP Code |

||

|

|

|

|

|

|

|

|

|

Purchaser’s Tax ID Number |

|

|

|

|

|

State of Issue |

||

|

|

|

|

|

|

|

||

If no Tax ID Number, enter one |

FEIN |

|

Driver’s License Number/State Issued ID Number |

State of Issue |

||||

of the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Seller Information |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

Address

City

State

ZIP Code

Reason for Exemption

Resale (Enter purchaser’s seller’s permit or use tax certificate number)

Manufacturing and Biotechnology

Tangible personal property (TPP) or item under s.77.52(1)(b) that is used exclusively and directly by a manufacturer in manufacturing an article of TPP or items or property under s.77.52(1)(b) or (c) that is destined for sale and that becomes an ingredient or component part of the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale or is consumed or destroyed or loses its identity in manufacturing the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale.

Machines and specific processing equipment and repair parts or replacements thereof, exclusively and directly used by a manufacturer in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) and safety attachments for those machines and equipment.

The repair, service, alteration, fitting, cleaning, painting, coating, towing, inspection, and maintenance of machines and specific processing equipment, that the above purchaser would be authorized to purchase without sales or use tax, at the time the service is performed. Tools used to repair exempt machines are not exempt.

Fuel and electricity consumed in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) in this state.

Percent of fuel exempt: |

|

% |

Percent of electricity exempt: |

|

% |

|

|

Portion of the amount of fuel converted to steam for purposes of resale. Percent of fuel exempt: |

|

% |

|||||

Property used exclusively and directly in qualified research, by persons engaged in manufacturing at a building assessed under s. 70.995, by persons engaged primarily in biotechnology in Wisconsin, or a combined group member conducting qualified research for another combined group member that meets these requirements.

Farming (To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping or custom farming services.)

Tractors (except lawn and garden tractors),

Feed, seeds for planting, plants, fertilizer, soil conditioners, sprays, pesticides, and fungicides. Breeding and other livestock, poultry, farm work stock, bees, beehives and bee combs.

Containers for fruits, vegetables, bee products, grain, hay, and silage (including containers used to transfer merchandise to customers), and plastic bags, sleeves, and sheeting used to store or cover hay and silage. Baling twine and baling wire.

Animal waste containers or component parts thereof (may only mark certificate as “Single Purchase”). Animal bedding, drugs for farm livestock or bees, and milk house supplies.

This Form May Be Reproduced |

Wisconsin Department of Revenue |

|

|

|

Go to Page 2 |

|

|

|

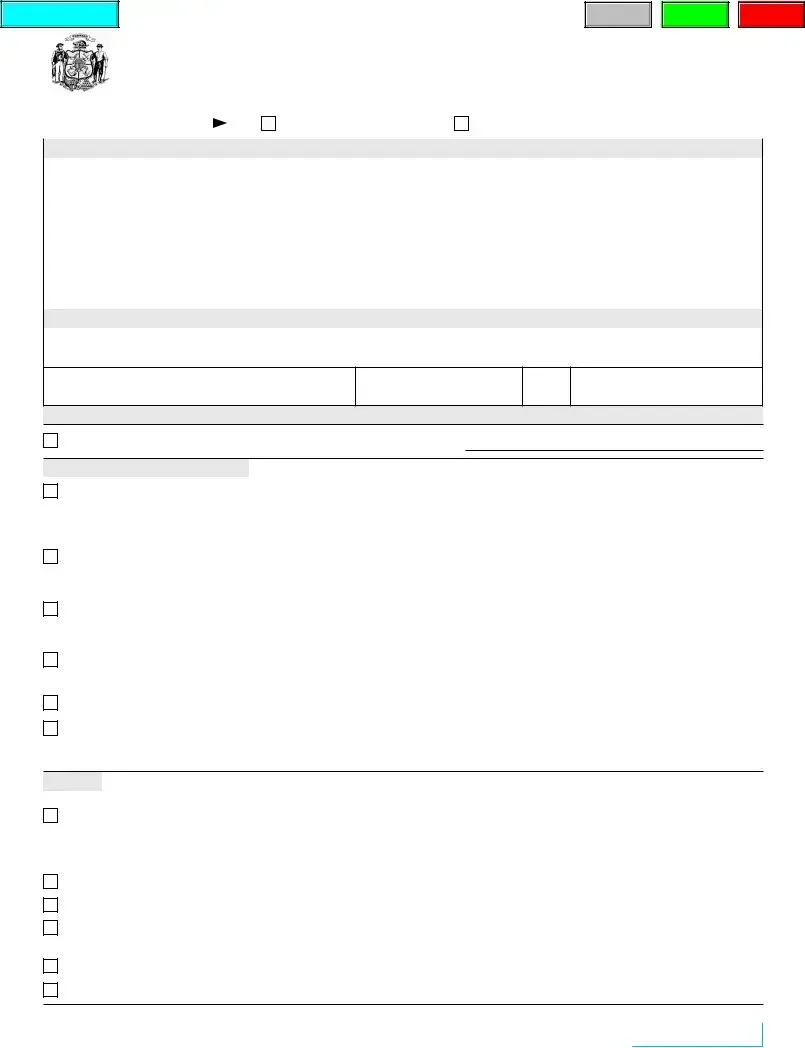

Governmental Units and Other Exempt Entities |

|

Enter CES No., if applicable |

|

|

The United States and its unincorporated agencies and instrumentalities. Any federally recognized American Indian tribe or band in this state.

Wisconsin state and local governmental units, including the State of Wisconsin or any agency thereof, Wisconsin counties, cities, villages, or towns, and Wisconsin public schools, school districts, universities, or technical college districts.

Organizations meeting the requirements of section 501(c)(3) of the Internal Revenue Code. Wisconsin organizations must enter a CES number above.

Other

Containers and other packaging, packing, and shipping materials, used to transfer merchandise to customers of the purchaser. Trailers and accessories, attachments, parts, supplies, materials, and service for motor trucks, tractors, and trailers which are

used exclusively in common or contract carriage under LC, IC, or MC No. (if applicable) |

|

. |

Machines and specific processing equipment used exclusively and directly in a fertilizer blending, feed milling, or grain drying operation, including repair parts, replacements, and safety attachments.

Building materials acquired solely for and used solely in the construction or repair of holding structures used for weighing and dropping feed or fertilizer ingredients into a mixer or for storage of such grain, if such structures are used in a fertilizer blending, feed milling, or grain drying operation.

Tangible personal property purchased by a person who is licensed to operate a commercial radio or television station in Wisconsin, if the property is used exclusively and directly in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Fuel and electricity consumed in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Percent of fuel exempt: |

|

% |

Percent of electricity exempt: |

|

% |

Tangible personal property, property, items and goods under s.77.52(1)(b), (c), and (d), or services purchased by a Native American

with enrollment #, who is enrolled with and resides on the Reservation, where buyer will take possession of such property, items, goods, or services.

Tangible personal property and items and property under s.77.52(1)(b) and (c) becoming a component of an industrial or municipal waste treatment facility, including replacement parts, chemicals, and supplies used or consumed in operating the facility. Caution: Do not check the “continuous” box at the top of page 1.

Portion of the amount of electricity or natural gas used or consumed in an industrial waste treatment facility.

(Percent of electricity or natural gas exempt %)

Electricity, natural gas, fuel oil, propane, coal, steam, corn, and wood (including wood pellets which are 100% wood) used for fuel

for residential or farm use. |

% of Electricity |

% of Natural Gas |

% of Fuel |

|||||

|

|

Exempt |

|

Exempt |

Exempt |

|||

Residential |

. |

|

% |

|

|

% |

|

% |

Farm |

|

% |

% |

% |

||||

Address Delivered: |

|

|

|

|

|

|

|

|

Percent of printed advertising material solely for

Catalogs, and the envelopes in which the catalogs are mailed, that are designed to advertise and promote the sale of merchandise or to advertise the services of individual business firms.

Computers and servers used primarily to store copies of the product that are sent to a digital printer, a

Purchases from

Other purchases exempted by law. (State items and exemption).

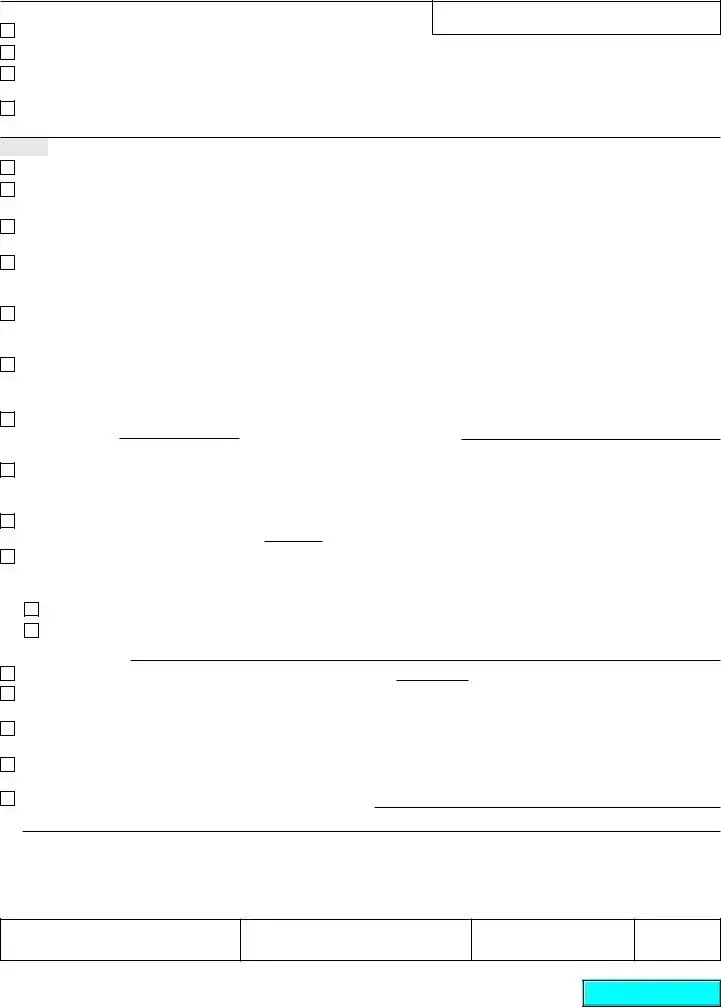

(DETACH AND PRESENT TO SELLER)

I declare that the information provided is complete and accurate to the best of my knowledge, and that the product(s) purchased will be used in the exempt manner indicated. If a product is not used in an exempt manner, I will remit use tax on the purchase price at the time of first taxable use. I understand that failure to remit the use tax may result in a future liability, including tax, interest, and penalty.

CAUTION: Using this certificate to avoid paying sales tax may result in a fine of $250 for each transaction for which the certificate is used

Signature of Purchaser

Print or Type Name

Title

Date

- 2 - |

Wisconsin Department of Revenue |

Return to Page 1

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Wisconsin Sales and Use Tax Exemption Certificate |

| Purpose | To claim exemption from Wisconsin state, county, baseball or football stadium, local exposition, and premier resort sales or use tax on certain purchases, leases, or rentals. |

| Use Options | Can be used for either a single purchase or for continuous purchases. |

| Purchaser Information | Includes the purchaser’s business name, phone number, and address. |

| Exempt Uses | Covers various categories including resale, farming, and specific farming-related items and activities. |

| Exemption Conditions | Purchasers must use the items exclusively and directly in the qualifying business activities, such as farming, or be prepared to remit use tax on non-exempt usage. |

| Governing Law | Governed by the Wisconsin Department of Revenue's regulations on sales and use tax. |

Guide to Writing Wisconsin Tax Exempt

When organizations in Wisconsin make purchases for resale, farming, or other exempt purposes, they can avoid paying sales tax by completing the Wisconsin Sales and Use Tax Exemption Certificate. This document serves as proof that the purchase should not include sales tax due to its intended exempt use. For accurate completion and submission, follow the steps below.

- Decide on the type of exemption - Single Purchase or Continuous, and check the appropriate box at the top of the form.

- Enter the Purchaser’s Business Name as it appears on legal documents.

- Provide the Purchaser’s Phone Number including area code.

- Fill in the Purchaser’s Address, including street, city, state, and zip code.

- On the reverse side of the form, the purchaser must sign to validate the claim for exemption. Ensure the Signature of Purchaser is included.

- Beneath the signature, Print or Type Name of the person signing the certificate.

- State the signee’s Title within the company or organization.

- Record the Date when the form was filled out.

- In the section titled Description of Property or Services Sold by Purchaser, describe the general type of goods or services your business provides.

- For the General description of property or services purchased, itemize the specific goods or services being purchased if it is a single purchase.

- Enter the Seller’s Name and Address from whom the goods or services are being purchased.

- Choose the appropriate PROPOSED EXEMPT USE category that fits the purchase, such as Resale or Farming, and provide any additional details required, such as a seller’s permit or use tax certificate number for resale.

- If selecting the Farming exemption, check off the specific farming-related items that apply to your purchase.

- Close by certifying that if the item(s) purchased are not used in an exempt manner, you agree to remit use tax on the purchase price at the time of first taxable use.

Upon completion, review the form for accuracy to ensure all necessary information is correctly filled in. This certificate should then be presented to the seller at the time of purchase. Keep a copy for your records to maintain compliance with Wisconsin Department of Revenue requirements.

Understanding Wisconsin Tax Exempt

-

What is the purpose of the Wisconsin Sales and Use Tax Exemption Certificate?

The Wisconsin Sales and Use Tax Exemption Certificate allows purchasers to claim exemption from Wisconsin state, county, baseball or football stadium, local exposition, and premier resort sales or use tax. This exemption applies to the purchase, lease, or rental of tangible personal property or taxable services that are directly related to the purchaser's business operations as specified on the form. The form can be used for either a single purchase or continuous purchases.

-

Who can use the Wisconsin Sales and Use Tax Exemption Certificate?

Businesses engaged in selling, leasing, or renting tangible personal property or taxable services, which use the items exclusively and directly in their operations, can use this certificate. For example, items purchased for resale or exclusively used in farming may qualify. The purchaser must clearly indicate the nature of their business and the intended exempt use of the purchased items on the certificate.

-

What types of purchases are exempt under this certificate?

The certificate covers a wide range of items when used in an exempt manner, including but not limited to:

- Tractors, farm machines, and certain all-terrain vehicles, along with their accessories, attachments, and parts.

- Farming supplies such as feed, seeds, plants, fertilizer, and pesticides.

- Livestock, poultry, and farm work stock.

- Packaging materials for agricultural products.

- Animal waste containers and bedding.

- Farm-specific machinery and supplies.

It's important that the items are used exclusively and directly in the qualified business operations to be eligible for exemption.

-

How do I complete the form?

To correctly fill out the form, provide the following information:

- Indicate whether it's for a single purchase or continuous.

- Include the purchaser’s business name, phone number, and address.

- Describe the property or services being purchased.

- List the seller’s name and address.

- Specify the proposed exempt use of the purchased items, for example, resale or farming.

- If applicable, enter the purchaser’s seller’s permit or use tax certificate number.

- Sign and date the form, ensuring to print or type the name and title.

-

What are the consequences of not using the items as stated?

If the items purchased with this exemption certificate are not used in an exempt manner as stated, the purchaser is responsible for remitting use tax on the purchase price at the time of the first taxable use. Failure to do so can result in a future liability, including tax, interest, and penalties. It's crucial for purchasers to adhere to the conditions of the certificate to avoid these consequences.

-

Where can I obtain the Wisconsin Sales and Use Tax Exemption Certificate?

The Wisconsin Department of Revenue provides the exemption certificate. Businesses can download the form from the department’s website or request a paper copy. It's essential to use the most current form to ensure compliance with the latest tax laws and regulations.

Common mistakes

-

Not checking the correct exemption reason: One common mistake is failing to accurately check the box that corresponds with the exemption reason for the purchase, lease, or rental. The form offers multiple options, such as resale or farming, and selecting the incorrect one can invalidate the certificate.

-

Forgetting to provide a description of the property or services: The form requires a description of the property or services being purchased. Failing to itemize or adequately describe these items, especially for a single purchase, can lead to the rejection of the exemption claim.

-

Omitting the purchaser’s business information: Another mistake is not filling in the purchaser's business name, phone number, and address. This information is crucial for validating the identity and eligibility of the purchaser for tax exemption.

-

Neglecting to provide the seller’s information: Just as the purchaser’s information is needed, the seller’s name and address must also be provided. This omission can lead to processing delays and possible denial of the exemption.

-

Incorrectly identifying the use of purchased items: When claiming an exemption, it's imperative to correctly specify how the items will be used. This includes checking the appropriate use category and providing specific details, where necessary, to avoid confusion and ensure approval.

-

Failure to sign and date the form: An unsigned form is incomplete and will not be processed. The signature, printed name, and title of the purchaser, along with the date, must be provided on the form to certify the exemption claim.

-

Not understanding the tax liability: Some individuals might not fully comprehend that if the purchased items are not used in an exempt manner, they are responsible for remitting use tax on the purchase price. Ignoring this responsibility can result in future liabilities including tax, interest, and penalties.

When filling out the Wisconsin Sales and Use Tax Exemption Certificate, attention to detail and a thorough understanding of the requirements are key to avoiding these mistakes. Missteps can lead to the denial of the tax exemption or additional financial liabilities down the line. Therefore, it is crucial to review the form carefully, provide accurate and complete information, and understand the tax implications of your purchase.

Documents used along the form

When entities in Wisconsin seek to ensure their transactions are compliant with tax exemption status, they often gather a variety of documents in addition to the Wisconsin Sales and Use Tax Exemption Certificate. These documents serve as both verification of their eligibility for tax-exempt purchases and as a safeguard against any potential disputes regarding their exempt status. The assortment ranges from forms demonstrating the nature of the business to official state acknowledgments of tax-exempt status. The following list encapsulates commonly used forms and documents that accompany the Wisconsin Tax Exempt form to complete a thorough and compliant documentation package.

- Application for Business Tax Registration: This form is used to register a business with the Wisconsin Department of Revenue, a step often necessary before applying for a sales tax exemption.

- Certificate of Exempt Status (CES): Issued by the Wisconsin Department of Revenue, this document certifies that an organization is exempt from paying state sales and use taxes on eligible purchases.

- Purchase Order: A formal document between a buyer and a seller detailing the products or services being purchased under the exempt status. It serves as a record of transactions that are claimed to be exempt from sales tax.

- Exemption Claim for Building Materials: For those who are constructing or improving facilities for exempt organizations, this form is crucial to purchasing materials without sales tax.

- Direct Pay Permit: Organizations with this permit are allowed to purchase goods and services without sales tax at the point of purchase and instead directly remit the use tax to the state.

- Annual Exempt Purchase Report: Some tax-exempt entities are required to file an annual report detailing their exempt purchases throughout the year, ensuring transparency and compliance.

- Seller's Permit Verification: This document proves that the seller is authorized to conduct taxable sales in Wisconsin, which is crucial for exempt organizations to verify before conducting tax-exempt transactions.

- Nonprofit Articles of Incorporation or Organization: These documents prove the legal status of a nonprofit organization, which is vital in substantiating its eligibility for tax-exempt purchases.

- Financial Statements or Budget: While not always required, providing financial documents can help in demonstrating the nonprofit or tax-exempt nature of the business, especially in ambiguous cases.

The compilation of these documents, in conjunction with the Wisconsin Sales and Use Tax Exemption Certificate, furnishes a robust foundation for any tax-exempt purchasing process. It not only simplifies compliance checks but also substantially mitigates the risk of post-transaction tax liabilities. For organizations, maintaining organized, accessible records of these documents alongside their exemption certificate is a practice that promotes both efficiency and fiscal responsibility.

Similar forms

The Uniform Sales & Use Tax Exemption/Resale Certificate coordinated by the Multistate Tax Commission is one document that bears similarity to the Wisconsin Tax Exempt form. This certificate allows businesses to purchase goods tax-free, provided they are to be resold in the regular course of operations. Much like the Wisconsin form, it requires the purchaser to provide detailed information about their business and the nature of the tax-exempt purchase. Both forms necessitate a declaration from the buyer regarding the intended use of the purchased items, ensuring compliance with tax exemption regulations.

Another document related to the Wisconsin Tax Exempt form is the Streamlined Sales and Use Tax Agreement Certificate of Exemption. This certificate is designed for use across multiple states that are members of the Streamlined Sales and Use Tax Agreement, making it easier for businesses to manage sales tax obligations in participating states. Similar to the Wisconsin-specific form, it requires buyers to specify their eligibility for tax exemption and describe the nature of the exempt purchases. Both documents play a pivotal role in tax regulation, ensuring that exemptions are properly documented and justified.

The California Resale Certificate is akin to Wisconsin's tax exemption form in that it allows businesses to buy goods without paying state sales tax if those goods are to be resold. The California document, like the Wisconsin form, asks for specific details about the purchaser and a declaration regarding the resale of the items purchased tax-free. Both documents serve to streamline tax exemption claims for resale purposes, ensuring that businesses comply with state tax laws.

New York's Resale Certificate similarly enables businesses to purchase items without sales tax for the purpose of resale. Comparable to the Wisconsin Tax Exempt form, it necessitates the provision of detailed business information and a statement of the goods' intended resale use. Both forms are crucial for tax compliance, enabling businesses to document and validate their claims for tax exemption on purchases intended for resale.

The Florida Annual Resale Certificate for Sales Tax shares the purpose and functionality with Wisconsin's exemption form by allowing businesses to make tax-exempt purchases that will be resold. The Florida certificate and the Wisconsin form both require identification of the purchaser's business and a declaration related to the resale of the items. They are essential tools for businesses to navigate tax obligations efficiently, ensuring that tax-exempt purchases are properly documented and justified.

The Texas Sales and Use Tax Resale Certificate is another document that parallels the Wisconsin Tax Exempt form in its purpose and requirements. Businesses can purchase goods without paying sales tax, intending to resell those goods. Both the Texas and Wisconsin forms require specifics about the business making the purchase and a clear statement of the goods' intended resale, ensuring that tax exemption is correctly claimed and applied.

Illinois' Certificate of Resale bears resemblance to the Wisconsin Tax Exempt form by facilitating tax-free purchases for resale. Both documents necessitate comprehensive information from the purchaser about the nature of their business and the specific use of the items bought. This critical documentation supports the transparent management of tax exemptions, aiding businesses in adhering to state tax regulations.

Lastly, the Colorado Sales Tax Exemption Certificate closely relates to the Wisconsin exemption form by permitting tax-free purchases for items intended for resale. Like its Wisconsin counterpart, the Colorado certificate requires detailed purchaser information and a declaration regarding the intended tax-exempt use of the products. Both are instrumental in ensuring that businesses comply with state tax laws while rightfully claiming tax exemptions for resale activities.

Dos and Don'ts

Filing the Wisconsin Tax Exempt form correctly is crucial for businesses aiming to leverage tax exemptions on their purchases. To navigate this process more smoothly, it’s helpful to know what actions should and shouldn't be taken.

Do:Provide accurate information about your business, including the Purchaser’s Business Name, Phone Number, and Address. Accuracy is key to avoiding delays or rejections.

Check the correct box indicating whether the purchase is a Single Purchase or a Continuous basis. This distinction impacts how your exemption is processed and maintained.

Itemize property purchased if the form is being used for a single purchase to ensure clarity and compliance with tax exemption requirements.

Enter the appropriate exemption reason in the PROPOSED EXEMPT USE section, such as resale or farming, and provide supporting documentation if necessary.

Sign and date the reverse side of the form to certify the information provided. An unsigned form is considered invalid.

Retain a copy of the completed form for your records. Keeping thorough records can help in the case of any future audits or inquiries.

Be prepared to remit use tax on the purchase price if the items are not used in an exempt manner, acknowledging your understanding that failure to do so may result in tax, interest, and penalties.

Don’t leave any required fields blank. Incomplete forms can lead to processing delays or outright denial of the tax exemption request.

Don’t make assumptions about eligibility for exemptions without consulting the guidelines or, if necessary, a tax professional. Misclassification can lead to complications down the road.

Don’t use the form for purchases that clearly do not qualify for a tax exemption under Wisconsin law. Doing so could result in penalties or fines.

Don’t forget to enter the purchaser’s seller’s permit or use tax certificate number when claiming a resale exemption. This information is crucial for validating your exemption claim.

Don’t overlook the specific use conditions required for farming exemptions. Items must be used exclusively and directly in farming operations to qualify.

Don’t submit the form without thoroughly reviewing all the information provided for accuracy and completeness. Errors or omissions can invalidate your exemption.

Don’t hesitate to consult with the Wisconsin Department of Revenue or a tax professional if you have questions about filling out the form or about your eligibility for tax-exempt status.

Misconceptions

When it comes to navigating tax-exempt forms in Wisconsin, several misconceptions frequently arise. Understanding these can help individuals and businesses correctly apply for exemptions, thereby ensuring compliance while taking advantage of applicable tax benefits.

Misconception 1: Any purchase made by a business is automatically tax-exempt. Many believe that if a business is registered in Wisconsin, all its purchases are free from sales tax. However, the exemption applies only to items or services intended for resale, or for use in farming, manufacturing, and specific nonprofit activities as outlined by the Wisconsin Department of Revenue. The purchaser must prove the item's exempt use by clearly indicating the purpose on the Wisconsin Sales and Use Tax Exemption Certificate.

Misconception 2: Exemption is granted based solely on the type of item purchased. While the form lists categories like farming equipment, feed, and livestock as eligible for exemption, the crucial factor is how the purchased items are used. For instance, farm equipment used directly in farming activities can be exempt, but similar items used for personal landscaping tasks do not qualify. The purchaser must certify that the items will be used exclusively in an exempt manner.

Misconception 3: A single tax exemption certificate covers all future purchases. The form provides options for "Single Purchase" or "Continuous" exemptions. Selecting "Continuous" does not mean all future purchases automatically qualify for tax exemption. This option requires businesses to maintain records of eligible transactions and ensure that each purchase meets the specific conditions of the exemption certificate.

Misconception 4: Compliance with exemption criteria is a one-time effort. Businesses and individuals often underestimate the importance of ongoing compliance. After certifying an exemption, the purchaser must remain vigilant about its use. If the tax-exempt items are later used in a manner that does not qualify for exemption, Wisconsin law requires the purchaser to remit use tax on the items' purchase price. This underscores the necessity of keeping detailed records and being prepared to report and pay use tax if the circumstances surrounding the exempt use change.

Correctly understanding and applying these principles not only helps in avoiding the common pitfalls associated with tax exemption claims in Wisconsin but also ensures businesses and individuals remain compliant with state tax laws. Remember, the responsibility to justify an exemption lies with the purchaser, requiring both accurate certification at the time of purchase and diligent tracking of item use thereafter.

Key takeaways

Filling out and using the Wisconsin Tax Exempt form correctly is crucial for organizations and individuals eligible for tax exemptions on purchases. Here are key takeaways to ensure compliance and accurate application:

- The form applies to exemptions from Wisconsin state, county, baseball or football stadium, local exposition, and premier resort sales or use tax.

- It can be used for both single purchases and for continuous purchasing needs.

- Accurate details of the purchaser’s business name, phone number, and address are required to validate the exemption claim.

- The purchaser must sign the form to certify their exemption claim. The signature and the signer’s title are necessary components on the reverse side of the form.

- Specify the general description of property or services purchased. If it’s a single purchase, itemization of the property is a must.

- There are specific categories for exemption such as resale, farming, and purchases related to animal bedding, medicine for farm livestock, and milk house supplies, among others.

- To qualify for the farming exemption, items must be used exclusively and directly in the business of farming. This includes a wide range of activities and items, such as tractors (excluding lawn and garden tractors), seeds for planting, feed, and certain types of containers.

- Purchasers are responsible for remitting use tax on the purchase price if the items bought are not used in an exempt manner. Awareness that failure to remit the use tax may result in liability including tax, interest, and penalties is critical.

Understanding and following these guidelines when filling out the Wisconsin Tax Exempt form will help ensure that your tax exemption process is smooth and compliant with state requirements.

Popular PDF Documents

2848 Poa - Use of the D-2848 form is common among taxpayers facing complex tax situations, seeking expert negotiation and problem-solving skills.

Form 843 Irs - This document is vital for facilitating the correction of clerical or administrative errors in tax assessments.

Ohio Declaration of Tax Representative - Use this form to enable a trusted person to manage all or specific aspects of your tax affairs.