Get Wisconsin Tax A 771 Form

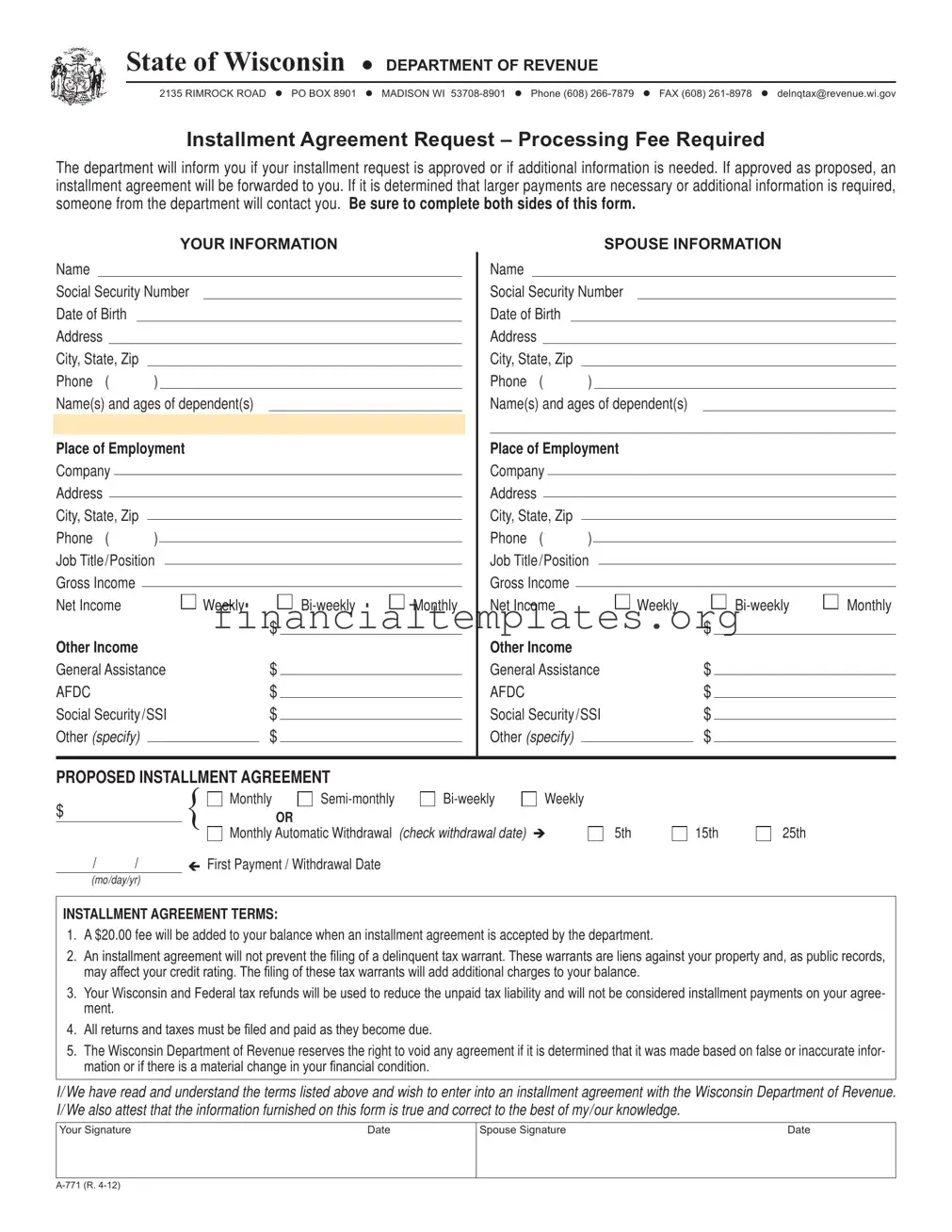

Navigating financial obligations can be challenging, especially when dealing with tax liabilities. In Wisconsin, individuals who find themselves unable to pay their taxes in full have the option of requesting an installment agreement with the Department of Revenue by using the Wisconsin Tax A 771 form. This form serves as a formal agreement between the taxpayer and the state, allowing taxes to be paid over a period in a more manageable manner. Required information includes personal and spouse details, employment and income data, proposed installment terms, and a comprehensive list of assets and expenses. It's vital for applicants to provide accurate information to avoid any potential voiding of the agreement due to inaccuracies or changes in financial condition. A processing fee, potential impacts on property liens, and credit rating due to delinquent tax warrants, along with clear stipulations on tax refunds and future returns, are key aspects outlined. The form also highlights the importance of full disclosure regarding assets and ongoing expenses, underpinning the agreement's viability and ensuring a transparent pathway to fulfilling tax obligations without undue strain.

Wisconsin Tax A 771 Example

STATE OF WISCONSIN DEPARTMENT OF REVENUE

2135 RIMROCK ROAD PO BOX 8901 MADISON WI

Installment Agreement Request – Processing Fee Required

The department will inform you if your installment request is approved or if additional information is needed. If approved as proposed, an installment agreement will be forwarded to you. If it is determined that larger payments are necessary or additional information is required, someone from the department will contact you. Be sure to complete both sides of this form.

YOUR INFORMATION

Name

Social Security Number

Date of Birth

Address

City, State, Zip |

|

Phone ( |

) |

Name(s) and ages of dependent(s)

Place of Employment

Company

Address

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Phone ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Job Title /Position |

|

|

|

|

|

|||

|

|

|

|

|

||||

Gross Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

|

Weekly |

|

Monthly |

||

Other Income |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

General Assistance |

|

$ |

|

|

||||

|

|

|

||||||

AFDC |

|

|

|

|

$ |

|

|

|

Social Security /SSI |

|

$ |

|

|

||||

|

|

|

||||||

Other (specify) |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||

SPOUSE INFORMATION

Name

Social Security Number

Date of Birth

Address

City, State, Zip |

|

Phone ( |

) |

Name(s) and ages of dependent(s)

Place of Employment

Company

Address

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Phone ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Job Title /Position |

|

|

|

|

|

|||

|

|

|

|

|

||||

Gross Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

|

Weekly |

|

Monthly |

||

Other Income |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

General Assistance |

|

$ |

|

|

||||

|

|

|

||||||

AFDC |

|

|

|

|

$ |

|

|

|

Social Security /SSI |

|

$ |

|

|

||||

|

|

|

||||||

Other (specify) |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||

PROPOSED INSTALLMENT AGREEMENT

$

/ /

(mo/day/yr)

{ |

Monthly OR |

Weekly |

||

|

Monthly Automatic Withdrawal |

(check withdrawal date) |

|

|

First Payment / Withdrawal Date |

|

|

||

5th

15th

25th

INSTALLMENT AGREEMENT TERMS:

1.A $20.00 fee will be added to your balance when an installment agreement is accepted by the department.

2.An installment agreement will not prevent the iling of a delinquent tax warrant. These warrants are liens against your property and, as public records, may affect your credit rating. The iling of these tax warrants will add additional charges to your balance.

3.Your Wisconsin and Federal tax refunds will be used to reduce the unpaid tax liability and will not be considered installment payments on your agree- ment.

4.All returns and taxes must be iled and paid as they become due.

5.The Wisconsin Department of Revenue reserves the right to void any agreement if it is determined that it was made based on false or inaccurate infor- mation or if there is a material change in your inancial condition.

I/ We have read and understand the terms listed above and wish to enter into an installment agreement with the Wisconsin Department of Revenue. I/ We also attest that the information furnished on this form is true and correct to the best of my/our knowledge.

Your Signature |

Date |

Spouse Signature |

Date |

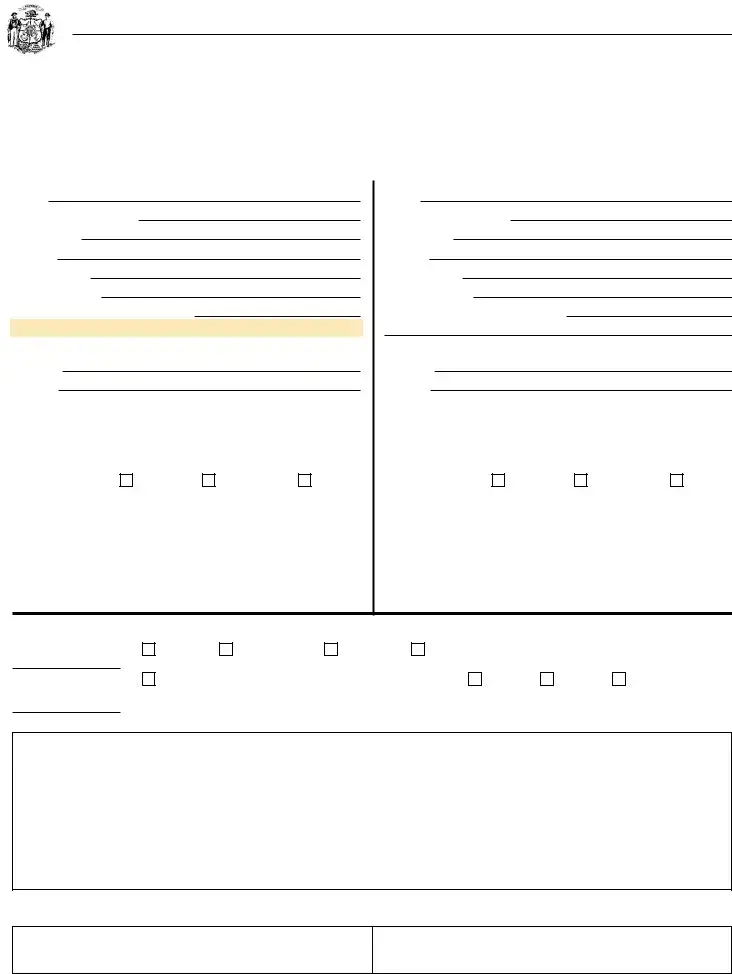

Please indicate both separate and combined assets and expenses.

Financial Institutions |

Balance |

Name and address of institution |

|

||||||||

Checking Account |

$ |

|

|

|

|

|

|

|

|

|

|

Savings Account |

$ |

|

|

|

|

|

|

|

|

|

|

Other (IRA, CD, |

$ |

|

|

|

|

|

|

|

|

|

|

Money Market, etc.) |

|

|

|

|

|

|

|

|

|

|

|

Life Insurance Policies |

|

|

|

|

|

|

|

|

Cash |

Balance Due |

|

Company |

|

|

|

|

Beneiciary |

Amount |

Value |

on Loan |

|||

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

Yes

No |

Have premiums been paid to date? |

Motor Vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Make |

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

Year |

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||||

License Plate # |

|

|

|

|

|

Lien Holder |

|

|

|

|

|

Address |

|

|

|

|

|

||||||||||||

Make |

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

Year |

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||||

License Plate # |

|

|

|

Lien Holder |

|

|

|

|

|

Address |

|

|

|

|

|

||||||||||||||

Other personal property (boat, motorcycle, snowmobile, etc.): |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Real Estate (If you rent, list name and address of landlord) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||

Mortgage Holder |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|||||||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

Please note any payments you |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

|

|

Balance Due |

|

|

are behind in and by how much |

|||||

Mortgage or Rent |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Property tax escrow |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Auto payments |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Gasoline/oil |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Utilities: Home Heating |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Electrical |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

Telephone |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Water |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Cable / internet access |

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Loans (list) |

1. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Credit Cards |

. . . . . . . . . Is card still in use? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

VISA |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

MasterCard |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Discover |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

Other: |

|

|

|

|

|

|

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Food |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Entertainment |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

Insurance (all) |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

IRS – Delinquent Payment |

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Other (list) |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

Total Monthly Expenses. . . . . . . . . . . . . . . . . . . .$

Total Net Monthly Income . . . . . . . . . . . . . . . . . .$

Net Difference . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The form facilitates taxpayers in requesting an installment agreement for paying their taxes due to the State of Wisconsin. |

| Processing Fee | A $20.00 fee is added to the taxpayer's balance upon acceptance of an installment agreement by the Wisconsin Department of Revenue. |

| Impact on Credit | Filing for an installment agreement does not prevent the filing of a delinquent tax warrant, which may affect the taxpayer's credit rating since these warrants are liens against property and are public records. |

| Conditions for Voiding Agreement | The Wisconsin Department of Revenue reserves the right to void any installment agreement if it is based on false or inaccurate information, or if there is a material change in the taxpayer's financial condition. |

Guide to Writing Wisconsin Tax A 771

Filling out the Wisconsin Tax Form A-771, the Installment Agreement Request, is a straightforward procedure if you know what information is required. This form is crucial for individuals looking to arrange a payment plan for their tax liabilities with the State of Wisconsin. A processing fee is mandatory, and approval details or a request for further information will follow from the Department of Revenue. Below are step-by-step instructions to guide you through each section of the form, ensuring it's completed accurately.

- Begin with YOUR INFORMATION section:

- Enter your full name, Social Security Number, and Date of Birth.

- Provide your complete address, including the city, state, and zip code.

- Include a phone number where you can be reached.

- List the name(s) and age(s) of any dependents.

- Fill out your place of employment details, company address, phone number, job title, and both gross and net income. Specify the frequency of your income (weekly, bi-weekly, monthly).

- Add any other income you receive and specify the source (General Assistance, AFDC, Social Security/SSI, etc.).

- Fill the SPOUSE INFORMATION (if applicable):

- Repeat the process for your spouse's information, including Name, Social Security Number, Date of Birth, employment details, and income.

- PROPOSED INSTALLMENT AGREEMENT:

- Choose your payment frequency (Monthly, Semi-monthly, Bi-weekly, Weekly) and indicate if you prefer Monthly Automatic Withdrawal.

- Select your first payment/withdrawal date by marking the appropriate box (5th, 15th, 25th).

- INSTALLMENT AGREEMENT TERMS: Review carefully, as this section outlines the terms you're agreeing to, including the additional $20.00 fee, the impact of delinquent tax warrants, and the requirements for ongoing tax filings and payments.

- Both you and your spouse (if filing jointly) must sign and date the form, indicating that you understand and agree to the terms of the installment agreement and that all information provided is accurate to the best of your knowledge.

- Please indicate both separate and combined assets and expenses: This section requires details about financial institutions, life insurance policies, motor vehicles, other personal property, real estate, and monthly expenses. Accurately fill in each field, including asset balances, payments, and any overdue amounts.

Once you've completed all the sections of the form, review your entries for accuracy before submission. Ensure that the form is signed and dated, as this is crucial for processing. Submitting a fully completed and accurate form is the first step towards establishing an installment agreement with the Wisconsin Department of Revenue. Good attention to detail and thoroughness can simplify this process, making it easier for both parties to manage the tax obligations.

Understanding Wisconsin Tax A 771

Frequently asked questions about the Wisconsin Tax A-771 form:

What is the purpose of the Wisconsin Tax A-771 form?

This form is used to request an installment agreement with the State of Wisconsin Department of Revenue for individuals who cannot pay their tax liabilities in full. It allows taxpayers to propose a plan to make monthly payments towards their debt.

Is there a processing fee for the installment agreement request?

Yes, there is a processing fee required when submitting the Tax A-771 form. The Wisconsin Department of Revenue will add a $20.00 fee to your balance if your installment agreement request is accepted.

Can filing an installment agreement prevent the filing of a delinquent tax warrant?

No, an installment agreement will not prevent the filing of a delinquent tax warrant. Tax warrants are liens against your property and, as public records, may affect your credit rating. Additional charges will be added to your balance with the filing of these tax warrants.

Will my Wisconsin and Federal tax refunds be used towards my installment payments?

Wisconsin and Federal tax refunds will be used to reduce the unpaid tax liability but will not be considered as installment payments on your agreement.

What happens if I fail to file or pay taxes after entering into an installment agreement?

All returns and taxes must be filed and paid as they become due. Failure to comply may result in the Wisconsin Department of Revenue voiding your installment agreement, especially if it's determined there was false or inaccurate information provided or if there is a material change in your financial condition.

What information is required on the Wisconsin Tax A-771 form?

You must provide personal and financial details, including your name, social security number, address, employment information, dependent information, proposed installment amounts, and comprehensive asset and liability information. Both separate and combined assets and expenses for you and your spouse (if applicable) must be disclosed.

How do I submit the Wisconsin Tax A-771 form?

After completing the form, including your signature and your spouse’s signature (if filing jointly), you should send it to the address provided by the Wisconsin Department of Revenue. Be sure to keep a copy for your records.

What should I do if I have further questions or need assistance with the form?

If you have further questions or require assistance completing the Tax A-771 form, contact the Wisconsin Department of Revenue by phone or email using the contact information provided on the form.

Common mistakes

When individuals fill out the Wisconsin Tax A 771 form, several common mistakes can hinder their request for an installment agreement with the Department of Revenue. It's crucial to avoid these errors to ensure a smooth processing of the request. Below are six common mistakes:

-

Not completing both sides of the form can lead to delays. The form requires detailed financial information, and skipping sections may result in an incomplete understanding of one’s financial situation by the Department of Revenue.

-

Filling in inaccurate or incomplete personal and spouse information, including names, Social Security numbers, addresses, and employment details. Precision here is important as it aids in correctly identifying the taxpayer.

-

Incorrectly reporting income, including the omission of additional income sources. All sources of income must be fully disclosed, whether it's from employment, general assistance, or other miscellaneous sources.

-

Proposing an unrealistic installment amount without considering the required $20.00 processing fee or misunderstanding the terms for the installment agreement terms. The amount proposed should be practical, considering one’s net monthly income and total monthly expenses.

-

Forgetting to sign and date the form. The taxpayers' signatures validate the information and express the agreement to the terms. Unsigned forms are incomplete and cannot be processed.

-

Omitting details of assets and liabilities in the section that requires indicating both separate and combined assets and expenses. Full disclosure of financial status, including checking accounts, savings, life insurance policies, and liabilities, is crucial for a thorough review.

To increase the chances of approval for an installment plan, it is important that the form is filled out carefully and thoroughly, with attention to detail and accuracy. Avoiding these common mistakes can help streamline the process and facilitate a stronger case for the installment agreement request.

Documents used along the form

When managing taxes in Wisconsin, particularly when setting up an installment agreement with the Wisconsin Department of Revenue using the A-771 form, individuals might need to prepare and submit additional documents. These documents can streamline the process, ensuring the smooth establishment of payment plans, compliance with tax obligations, and maintenance of financial stability. Below are several forms and documents often used alongside the Wisconsin Tax A 771 form, each serving a unique but complementary purpose.

- Form A-060: This form is known as the "Application for Certificate of Compliance." It is required for individuals or businesses that owe no outstanding taxes to the state and need to prove their tax compliance, often necessary when bidding for state contracts or during certain business transactions.

- Form WT-4: The "Employee's Withholding Certificate" is crucial for determining the correct amount of state income tax to withhold from employees' wages. This information is necessary to ensure that the anticipated tax liability aligns with withholdings, impacting installment agreements.

- Form WT-7: This "Employers Annual Reconciliation of Wisconsin Income Tax Withheld from Wages" is used by employers to report total annual wages paid and state income tax withheld. It can impact installment agreements by confirming accurate withholdings and payments throughout the year.

- Schedule I: A component of the Wisconsin income tax return, this schedule allows for adjustments to federal adjusted gross income. Given that installment agreements consider total income and ability to pay, accuracy on this form can affect payment plans.

- Form WT-6: Known as the "Withholding Tax Deposit Report," this document is used by employers to report and remit withheld state income tax. Regular and accurate filings of this form can influence installment agreement terms by showing compliance and timely payment of withholdings.

- Form WI-Z: This form is for Wisconsin residents filing their income tax with relatively simple tax situations. It demonstrates the taxpayer's annual income and tax liability, which are critical factors when establishing an appropriate installment agreement.

Utilizing these documents in conjunction with the Wisconsin Tax A 771 form ensures taxpayers can manage their liabilities effectively. Whether it's proving compliance, reporting income, or accurately detailing withholdings and adjustments, each form plays a significant role in the broader context of tax administration and individual financial planning in Wisconsin.

Similar forms

The Wisconsin Tax A 771 form, facilitating an installment agreement request for overdue taxes, bears similarity to the IRS Form 9465, "Installment Agreement Request." Both forms serve as official requests to pay tax liabilities over time rather than in a single lump sum. Each document requires detailed personal, employment, and financial information to assess the taxpayer's ability to pay. The necessary data includes income sources, monthly expenses, asset information, and the proposed payment plan details. This overlap in information helps taxation authorities in deciding the feasibility and terms of the installment agreements, ensuring that taxpayers can fulfill their obligations without undue hardship.

Form 433-F, the "Collection Information Statement" used by the IRS, is another document with notable parallels to the Wisconsin Tax A 771 form. While the A 771 focuses on setting up a payment plan, Form 433-F collects comprehensive financial information to determine how taxpayers can settle their outstanding tax debts. This includes exhaustive listings of income, expenditures, assets, and liabilities. Both forms are critical in the process of negotiating terms that are manageable for the taxpayer while also aiming to recover owed taxes, highlighting the importance of accurate and thorough financial disclosure.

State-specific tax compliance forms, such as California's FTB 3567 "Installment Agreement Request," also share commonalities with Wisconsin's Tax A 771 form. Like the A 771, California's form is a tool for taxpayers to negotiate payment plans for settling state tax obligations over time. They both gather similar types of personal and financial information, including income, debts, assets, and dependents' details, to create a viable payment arrangement. This comparison underscores a universal need across state tax administrations to implement flexible payment solutions tailored to individual taxpayer situations.

Lastly, the Wisconsin Department of Workforce Development's "UI Debit Agreement Form" for unemployment insurance contributions parallels the Wisconsin Tax A 771 form in its function as a negotiation tool for payment terms. Although serving different purposes—one for tax liabilities and the other for unemployment insurance contributions—both require detailed financial information from the applicant to establish a realistic payment arrangement. This ensures compliance while accommodating the financial realities of individuals and businesses struggling to meet their financial obligations to the state.

Dos and Don'ts

When you're preparing to fill out the Wisconsin Tax A 771 form, also known as the Installment Agreement Request, it's crucial to know what steps to take and what missteps to avoid. Here's a helpful list of dos and don'ts to ensure your form is completed accurately:

- Do read the entire form before beginning, to understand all the requirements and information needed.

- Do gather all necessary documents, such as your personal and, if applicable, your spouse's financial information before starting to fill out the form.

- Do use black or blue ink if filling out the form by hand to ensure legibility.

- Do include accurate and up-to-date information for both you and your spouse, if filing jointly, regarding your incomes, dependents, and financial assets and liabilities.

- Do double-check your math, especially in the sections detailing your income, expenses, and proposed installment amounts.

- Don't leave any required fields blank; if a section doesn't apply to you, it's better to indicate this with "N/A" (not applicable) than to leave it empty.

- Don't underestimate your monthly expenses or overestimate your income; being realistic with these figures is crucial for a feasible installment plan.

- Don't sign the form without reading the installment agreement terms carefully to ensure you fully understand your commitments.

- Don't hesitate to contact the Wisconsin Department of Revenue if you have questions or need clarification about filling out the form or the installment agreement process.

By following these guidelines, you'll be better prepared to complete the Wisconsin Tax A 771 form accurately, which can help facilitate a smoother process in setting up an installment agreement with the Department of Revenue.

Misconceptions

When dealing with the Wisconsin Tax A 771 form, which is crucial for setting up an installment agreement with the Department of Revenue, there are several common misconceptions. Understanding these can help ensure smooth interactions with the department and avoid unnecessary complications.

Every request for an installment agreement will automatically be approved. Approval is not guaranteed. The department reviews each request thoroughly and may require additional information or propose adjustments to the payment amounts.

A processing fee is optional. A processing fee is required for the installment agreement request to be processed. This fee adds to your balance when the agreement is accepted.

Installment agreements prevent the filing of delinquent tax warrants. Contrary to this belief, entering into an installment agreement does not stop the filing of delinquent tax warrants, which can impact your credit rating and add charges to your balance.

Your tax refunds will be paid to you under an installment agreement. Tax refunds, both Wisconsin and Federal, will be applied to reduce the unpaid tax liability and are not considered part of your installment payments.

Once approved, the installment agreement terms cannot change. The Wisconsin Department of Revenue reserves the right to void an agreement if false or inaccurate information was provided or if there's a significant change in the filer's financial condition.

Income information is the only financial data required. Applicants must provide comprehensive financial information, including income, expenses, assets, and liabilities, to assess their ability to make installment payments.

You can choose any installment amount. The department has the authority to adjust proposed installment amounts based on their assessment of what you can reasonably afford.

Submitting an installment agreement stops immediate collection actions. Until an installment agreement is approved and in place, collection actions can continue.

All information provided is kept confidential. While personal information is protected, remember that tax warrants become public records, potentially affecting your credit history.

Only the individual taxpayer needs to sign the installment agreement form. If filing jointly, both spouses must read, agree to the terms, and sign the form to enter into an installment agreement.

Correcting these misconceptions and providing accurate, complete information on the Wisconsin Tax A 771 form can help facilitate a smoother process in establishing an installment agreement with the Department of Revenue.

Key takeaways

Filling out and using the Wisconsin Tax A 771 form involves specific procedures and requirements if taxpayers wish to enter into an installment agreement with the Wisconsin Department of Revenue. This option allows individuals who cannot pay their taxes in full to make monthly payments. Below are five key takeaways about this form:

- Completeness is crucial: The form requires thorough information about the taxpayer's financial situation, including personal information, employment details, incomes (such as gross income, net income, general assistance, and any other income), and details about dependents. It is essential to fill out both sides of the form completely.

- Installment Agreement Proposal: Taxpayers must propose their installment payment plan, choosing from options such as monthly, semi-monthly, bi-weekly, or weekly payments. An option for automatic monthly withdrawal is also available, where taxpayers can specify the withdrawal date from their accounts.

- Non-refundable Processing Fee: Upon acceptance of an installment agreement by the department, a $20.00 processing fee will be added to the taxpayer's balance. It's important for applicants to be aware of this additional charge as part of their financial planning.

- Impact on Tax Liens and Refunds: Entering into an installment agreement does not prevent the filing of a delinquent tax warrant against the taxpayer's property. Such warrants are public records and can affect an individual's credit rating. Additionally, Wisconsin and federal tax refunds will be applied towards the unpaid tax liability and are not considered installment payments.

- Accuracy and Honesty: The form requires the taxpayer and, if applicable, the taxpayer's spouse to attest that all provided information is true and correct. The Wisconsin Department of Revenue reserves the right to void the agreement if it finds the information to be false or inaccurate, or if there's a significant change in the taxpayer's financial condition.

Understanding these key points can help taxpayers correctly fill out the Wisconsin Tax A 771 form and navigate the process of entering into an installment agreement with the Department of Revenue. It's important for taxpayers to provide accurate and complete information to avoid any potential issues with their agreement.

Popular PDF Documents

Income Tax Exemption - Advises on the potential consequences of not maintaining or incorrectly documenting an out-of-state abode for tax exemption purposes.

Income Based Repayment Eligibility - Applicants with recent income changes should use the IBR program’s alternative documentation option to reflect their current financial situation.