Get West Virginia Estimated Tax Form

In the heart of Charleston, West Virginia, the State Tax Department's Tax Account Administration Division is pivotal in administering taxpayer responsibilities, including the process of making estimated tax payments for individuals. As outlined in the recent letter to Donna J. Aaroe, the INDIVIDUAL ESTIMATED INCOME TAX PAYMENT form, or WV/IT-140ES, embodies the state's mechanism for taxpayers to prepay their taxes in instances where they expect to owe at least $600 upon filing their annual tax return. This form not only facilitates the accurate projection and submission of these payments, but it also provides a crucial avenue for updating taxpayer information, including changes of address, ensuring accuracy in the state's records. The guidance enclosed with this form, notably the IT-140ESI instruction brochure, aids taxpayers in calculating the minimum payment required to avoid penalties, while still offering the flexibility to pay beyond this amount if so desired. Payments are rigorously scheduled, with several due dates throughout the year to accommodate both calendar and non-calendar year taxpayers, ensuring that individuals can manage their tax liabilities in a manner that prevents end-of-year surprises and maintains fiscal responsibility. This detailed approach outlined by the West Virginia State Tax Department exemplifies a structured procedure to assist taxpayers in navigating their estimated tax obligations with greater ease and efficiency.

West Virginia Estimated Tax Example

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 342

Charleston, WV

_____________________________________________________________ |

Letter Id: |

L0045367296 |

||

DONNA J. AAROE |

|

|

||

Name |

|

|

|

|

17 CLUB HOUSE DR |

|

|

Issued: |

02/01/2019 |

_____________________________________________________________ |

||||

EVANS WV |

|

|

Account #: |

|

Address |

|

|

|

|

_____________________________________________________________ |

Period: |

12/31/2018 |

||

City |

State |

Zip |

||

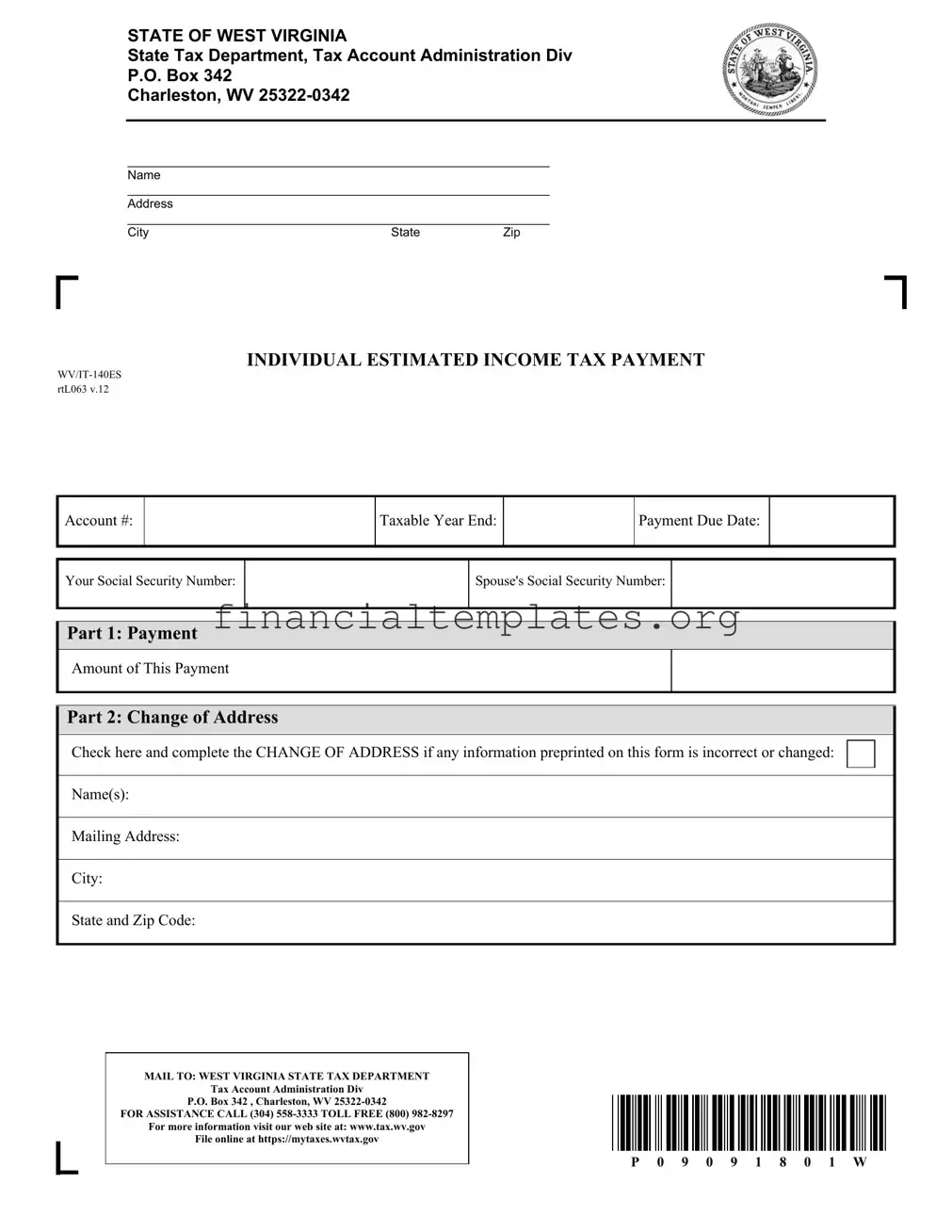

INDIVIDUAL ESTIMATED INCOME TAX PAYMENT

Account #:

Taxable Year End:

Payment Due Date:

Your Social Security Number:

Spouse's Social Security Number:

Part 1: Payment

Amount of This Payment

Part 2: Change of Address

Check here and complete the CHANGE OF ADDRESS if any information preprinted on this form is incorrect or changed:

Name(s):

Mailing Address:

City:

State and Zip Code:

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P.O. Box 342 , Charleston, WV

FOR ASSISTANCE CALL (304)

For more information visit our web site at: www.tax.wv.gov

File online at https://mytaxes.wvtax.gov

P 0 9 0 9 1 8 0 1 W

INSTRUCTIONS FOR MAKING ESTIMATED PAYMENTS

If you expect to owe at least $600 in State tax when you file your annual income tax return, you are required to make estimated tax payments using this form.

Determine your estimated tax using the instruction brochure (Form

Write the amount of your payment on this form. You must pay at least the minimum amount calculated using the instructions to avoid being penalized; however, you may pay more than the minimum if you wish.

Be sure to post your payment in the payment table. If you are not a calendar year taxpayer, you should see the instructions to determine the due dates of your payments.

Estimated tax payments should be mailed by the due date to:

State Tax Department

Tax Account Administration Division - EST P.O. Box 342

Charleston WV

Document Specifics

| Fact Name | Description |

|---|---|

| Document Title | Individual Estimated Income Tax Payment |

| Form Number | WV/IT-140ES |

| Issued By | State of West Virginia, State Tax Department, Tax Account Administration Div |

| Mailing Address | P.O. Box 342, Charleston, WV 25322-0342 |

| Payment Requirement | If you expect to owe at least $600 in State tax |

| Minimum Payment | Must pay at least the minimum calculated amount to avoid penalty |

| Change of Address Instruction | Check the box and complete the section if any preprinted information is incorrect or has changed |

| Online Resources | Payment instructions and tax information available at www.tax.wv.gov and online filing at https://mytaxes.wvtax.gov |

Guide to Writing West Virginia Estimated Tax

Fulfilling your tax obligations accurately and timely is crucial to ensuring compliance with state requirements and avoiding any potential penalties. When it comes to paying estimated taxes in West Virginia, individuals who anticipate owing at least $600 in state taxes for the year are required to make these payments in advance using the specific form provided by the West Virginia State Tax Department. Here are the necessary steps to correctly fill out the West Virginia Estimated Tax form, ensuring that your tax responsibilities are met in a straightforward and efficient manner.

- Locate your Letter ID, which can be found at the top of the form, and your personal information including your name and address to verify accuracy.

- Confirm your account number, prominently listed near your address, to ensure correct processing.

- Identify the period end date listed to understand the tax period for which you're making an estimated payment.

- Find the section labeled "Your Social Security Number" and enter your social security number. If applicable, enter your spouse's social security number in the designated area.

- In Part 1, titled "Payment Amount of This Payment," enter the amount of tax you are paying with this installment.

- If you have changed your address since the last filing, check the box in Part 2 under "Change of Address" and provide your new name(s), mailing address, city, state, and zip code to ensure the Tax Department has your current information.

- Refer to the instructions brochure (Form IT-140ESI) available at the official website to accurately determine your estimated tax payment amount. This document provides detailed guidance to calculate the minimum payment required to avoid penalties.

- Write the calculated payment amount on the provided line in the payment table within the form, ensuring the amount meets or exceeds the minimum payment required as per the instruction brochure.

- If your estimated taxes are based on a fiscal year rather than the calendar year, consult the special instructions listed to identify your specific payment due dates.

- Finally, mail your estimated tax payment to the Tax Account Administration Division at the provided address: State Tax Department Tax Account Administration Division - EST P.O. Box 342, Charleston, WV 25322-0342. Ensure your form is postmarked by the due date to avoid late fees.

By following these steps, individuals can accurately complete their West Virginia Estimated Tax form. It's very important not to overlook the due dates for each payment installment to maintain tax compliance and prevent any unnecessary penalties. Remember, if there are any doubts or questions regarding the form or how to calculate your estimated taxes, contacting the West Virginia State Tax Department directly or consulting with a tax professional could provide valuable assistance.

Understanding West Virginia Estimated Tax

Who needs to file a West Virginia Estimated Tax form?

Individuals who expect to owe at least $600 in State tax upon filing their annual income tax return are required to submit estimated tax payments using the West Virginia Estimated Tax form. This involves estimating the tax you owe for the year and making payments accordingly to avoid any penalties.

How do I determine the amount to pay for my estimated taxes?

To calculate your estimated tax, you should refer to the instruction brochure (Form IT-140ESI), which is available at the official West Virginia State Tax Department website (www.tax.wv.gov). The form provides guidelines on how to estimate your tax liability and ensures that you pay at least the minimum required amount. While you must pay this minimum to avoid penalties, you can opt to pay a higher amount if desired.

What happens if the information preprinted on my form is incorrect or has changed?

If there are any inaccuracies or changes in the preprinted information on your Estimated Tax form, you should check the "Change of Address" box. Following this, complete the relevant sections with the correct name(s), mailing address, city, state, and zip code to ensure that your records are up to date.

Where do I mail my West Virginia Estimated Tax Payment?

Estimated tax payments should be directed to the State Tax Department, Tax Account Administration Division - EST, at P.O. Box 342, Charleston, WV 25322-0342. Ensure that your payments are mailed by the due date to avoid any penalties for late payments.

Can I file my West Virginia Estimated Tax Payment online?

Yes, filers can submit their estimated tax payments online by visiting https://mytaxes.wvtax.gov. This convenient option allows for a more efficient payment process and immediate confirmation of your submitted payment.

What should I do if I need assistance with my West Virginia Estimated Tax form?

If you need help with your Estimated Tax form, you have several options. You can call the State Tax Department at (304) 558-3333 or toll-free at (800) 982-8297. Additionally, the West Virginia State Tax Department website offers resources and information that may answer your questions. Visit www.tax.wv.gov for more details or to access online assistance.

Common mistakes

Filling out the West Virginia Estimated Tax form requires careful attention to detail. Mistakes can lead to delays in processing and potential penalties. Here are four common errors individuals make when completing this form:

Incorrect Social Security Numbers: It's essential to double-check the social security numbers (SSNs) for both the individual and spouse, if applicable. An incorrect SSN can result in misfiled taxes and delays in processing. The form requests your SSN and, if filing jointly, your spouse's SSN. This information must be accurate to ensure your payment is credited to the correct account.

Failure to Update Address Information: Not updating address information can lead to missed communications from the West Virginia State Tax Department. If there's a change in address, it’s paramount to check the 'Change of Address' box and update the address details accordingly to ensure that all correspondence reaches you.

Miscalculating Payment Amount: The estimated tax payment amount must be calculated accurately, adhering to the instruction booklet (Form IT-140ESI). Overestimating or underestimating this amount can either lead to an unnecessary financial burden at the time of payment or penalties for underpayment. Ensure the amount of this payment within Part 1 of the form is correctly calculated based on your income estimations to avoid issues.

Omitting the Payment Due Date for Non-calendar Year Taxpayers: For those who do not follow a calendar year for tax purposes, it is critical to note and adhere to the specific due dates for estimated tax payments. Failing to do so can result in late payment penalties. Non-calendar year taxpayers should particularly pay attention to the instructions for determining their payment due dates and ensure timely payments are mailed.

Making accurate entries and ensuring timely submissions of the West Virginia Estimated Tax form can help avoid these common pitfalls. It's always recommended to review your form thoroughly before mailing it to the State Tax Department Tax Account Administration Division. For further assistance, individuals are encouraged to contact the provided support numbers or visit the official website.

Documents used along the form

When managing taxes in West Virginia, specifically with the Estimated Tax form (WV/IT-140ES), individuals often need to use additional forms and documents to accurately report and pay taxes. This guide provides an overview of related documents that individuals commonly use alongside the Estimated Tax form, enhancing the efficiency and accuracy of tax preparation and filing.

- Form IT-140: This is the West Virginia Personal Income Tax Return. It is used annually by residents to report their income for the state tax year and calculate taxes owed or refunds due.

- Form IT-140W: The West Virginia Withholding Tax Schedule. It accompanies the main tax return form to report state income tax withheld by employers throughout the year.

- Form IT-140ESI (Instruction Brochure): Provides detailed instructions for estimating taxes owed and completing the Estimated Tax Payment form. This brochure helps taxpayers accurately calculate their payments.

- Form IT-141: West Virginia Fiduciary Income Tax Return. This form is used by estates and trusts to report income earned at the state level.

- Schedule A: Itemized Deductions. Taxpayers who opt to itemize deductions instead of taking the standard deduction use this schedule to detail allowable expenses.

- Schedule B: Interest and Dividend Income. This schedule is for reporting income from interest and dividends that exceeds a certain threshold.

- Form IT-210: Credit for Income Tax Paid to Another State. West Virginia residents who pay income tax to another state can use this form to claim a credit against their West Virginia tax liability.

- Change of Address Form: For taxpayers who have moved and need to update their address with the West Virginia State Tax Department.

- Direct Deposit Authorization Form: Allows taxpayers to receive their tax refunds via direct deposit into their bank accounts, ensuring faster payment and enhanced security.

- Power of Attorney Form: Used to authorize another individual to handle tax matters on the taxpayer's behalf. This can include preparing and filing returns, making payments, and receiving confidential information.

Navigating tax responsibilities involves understanding and managing multiple forms and documents, especially for those paying estimated taxes in West Virginia. The key to a smooth tax process is ensuring all supporting documents are accurately completed and submitted in a timely manner, alongside the Estimated Tax form.

Similar forms

The Federal Estimated Tax Form 1040-ES is quite similar to the West Virginia Estimated Tax form, mainly because it serves the identical purpose at the federal level. Both documents are used by taxpayers to pay income tax on earnings that are not subject to regular withholding taxes. This includes income from self-employment, interest, dividends, and rental income. Each form provides a way to calculate the estimated tax due and outlines the payment schedule to ensure taxpayers can avoid penalties by making timely payments. Just like the state form, the 1040-ES requires taxpayers to estimate their earnings and make payments quarterly.

The Change of Address Form (Form 8822) issued by the IRS is another document similar to the West Virginia Estimated Tax form, specifically in the section that allows taxpayers to update their address details. While Form 8822 is dedicated entirely to notifying the IRS of a change in address, the West Virginia form includes a section for address updates to ensure ongoing correspondence and tax documents are sent to the correct location. Both forms acknowledge the importance of current contact information in maintaining clear, uninterrupted communication between taxpayers and tax authorities.

The State of West Virginia also utilizes the IT-140 form, which is the state’s regular income tax return form. It bears similarity to the Estimated Tax form as both are critical elements of a taxpayer’s annual obligations and require detailed financial information. The major difference lies in their timing and purpose; while the IT-140 is filed after the tax year ends and calculates the exact tax liability, the Estimated Tax form is used beforehand to prepay on expected tax liabilities. Both forms work in tandem to ensure that taxpayers fulfill their state tax obligations accurately and timely.

A Payment Voucher form often accompanies tax forms when taxpayers owe money to the state. In the context of West Virginia, a payment voucher would be similar to the Estimated Tax Payment section of the West Virginia Estimated Tax form. While the estimated tax form includes a specific payment voucher for its purposes, there are other standalone payment voucher forms for different types of tax payments. These vouchers are essential for correctly applying payments to the taxpayer’s account, ensuring that the payment is credited properly and on time.

Lastly, the Federal Extension Form 4868 provides a parallel to the West Virginia Estimated Tax form in that it is part of the tax filing process, offering taxpayers additional time to file their return without incurring penalties for late filing. Although the Estimated Tax form doesn't extend the filing deadline, both forms emphasize compliance with tax laws and the avoidance of penalties. Form 4868 does not extend the time to pay estimated taxes due, highlighting the importance of estimated tax payments for those who expect to owe tax beyond what is covered by withholding.

Dos and Don'ts

When it comes to fulfilling your tax obligations in West Virginia, accurately completing your Estimated Tax form is crucial. This process may seem daunting, but with the right guidance, it can be navigated smoothly. Here are several dos and don'ts to keep in mind:

Do:- Review the instruction brochure (Form IT-140ESI) available at the official website to accurately calculate your estimated tax. This ensures you're informed about how much to pay and avoid penalties.

- Use the correct form version, which is outlined on the West Virginia State Tax Department website, to ensure all provided information is current and relevant to the tax year you're filing for.

- Double-check your personal information such as your Social Security Number and address. If there are changes, use the provided section for updates to ensure all correspondence reaches you.

- Write the payment amount clearly on the form in the designated area to prevent any misinterpretation by the tax department.

- Post your payment timely, ideally before the due date, to avoid late fees or interest. Keep in mind the postal service delivery times to ensure your payment arrives on time.

- Estimate your payment blindly. Use the formula provided in the instruction brochure to calculate the minimum payment needed accurately. This avoids underpayment penalties.

- Ignore the due dates if you're not a calendar year taxpayer. These dates are crucial for ensuring that your payments are made on time and in full to avoid potential penalties.

Remember, the West Virginia Estimated Tax form is a tool to help taxpayers manage their obligations effectively. By following the dos and don'ts outlined above, you can ensure that this process is as seamless as possible, thereby keeping you in good standing with the State Tax Department.

Misconceptions

When it comes to handling taxes, especially estimated tax forms, there are a lot of misconceptions that can lead to confusion. In the case of the West Virginia Estimated Tax Form, separating fact from fiction is crucial for taxpayers. Here are some common misunderstandings:

Paying estimated taxes is optional for most taxpayers. In reality, if you anticipate owing at least $600 in state tax for the year, you're required to make these payments. It ensures you don't face penalties at the end of the tax year.

You need to pay the exact amount you think you will owe. While you should aim to be as accurate as possible, the law requires you to pay at least the minimum calculated using the provided instructions. Paying more is also an option to avoid a potential shortfall.

Estimated taxes are only for individuals who are self-employed. Not true. While self-employed individuals often need to make these payments, others who don’t have sufficient taxes withheld, like those with investment income, may also need to pay estimated taxes.

If your address changes, you need to complete a separate form. A change of address can be handled directly on the form itself. There's a specific section to update your address information.

Payments can only be made by mail. Though mailing is one option, West Virginia also allows you to file online via their tax website, providing convenience and efficiency in managing your taxes.

Estimated tax payments are due at the end of the tax year. Actually, payments are due quarterly. Not adhering to this schedule can result in penalties, so it’s important to know the due dates, which may vary for non-calendar year taxpayers.

The amount to pay is based on last year’s tax. Your estimated tax payment should be based on what you expect to owe for the current year. Using last year’s tax as a guide can help, but adjustments should be made for changes in income or deductions.

Penalties are applied after filing the annual return. Penalties can accrue throughout the year if you fail to make sufficient payments on time. Therefore, it’s beneficial to accurately calculate and make timely payments.

You only need to fill out the form if you receive it in the mail. Actually, any taxpayer who expects to owe at least $600 in state taxes should proactively use the form, regardless of whether the state has sent a pre-filled form.

Understanding these key points about the West Virginia Estimated Tax Form can help taxpayers navigate their obligations more effectively, avoiding common pitfalls and ensuring compliance with state tax requirements.

Key takeaways

Filling out and using the West Virginia Estimated Tax form is an essential process for individuals who anticipate owing at least $600 in state taxes beyond what is withheld from their income. This process, while mandatory for qualifying residents, offers several key considerations designed to streamline and clarify the procedure. Here are five key takeaways for efficiently handling this obligation:

- Determine Your Estimated Tax: Begin by accurately calculating your estimated tax. The State of West Virginia requires individuals to make estimated tax payments if they owe $600 or more when filing their annual income tax return. To avoid errors, make use of the instruction brochure (Form IT-140ESI), which is available on the state tax website, to calculate the amount you need to pay.

- Update Your Information: If there have been any changes to your name, mailing address, or other pertinent information preprinted on the form, it’s crucial to check the designated box for change of address and update your details accordingly. This ensures that your estimated tax payments are correctly recorded against your account.

- Payment Due Dates: Pay attention to the due dates for your estimated tax payments. These dates vary depending on whether you are a calendar year taxpayer or have a different fiscal reporting period. Missing these deadlines could result in penalties, making it important to mark these dates on your calendar and prepare your payments in advance.

- Payment Method: The form provides detailed instructions on where and how to mail your payment. Following these instructions when sending your payment to the State Tax Department, Tax Account Administration Division - EST, ensures that your payment is processed efficiently and correctly credited to your account.

- Online Payment Option: For convenience, West Virginia allows individuals to make their estimated tax payments online via the official tax website. This option can save time and provide instant confirmation of your payment, offering an alternative to mailing your payment. Visit https://mytaxes.wvtax.gov to take advantage of this service.

By closely following these guidelines, individuals required to make estimated tax payments in West Virginia can do so with confidence, ensuring compliance with state tax obligations while avoiding potential penalties for late or incorrect payments.

Popular PDF Documents

IRS 4136 - This form is part of the IRS's efforts to incentivize certain business activities and environmentally friendlier practices.

Tax Form 8829 - This form assesses the validity of home office deductions to ensure compliance with IRS rules and regulations.

Medical Lab Results Template - Demands the health practitioner’s initials against each entered item for verification purposes.