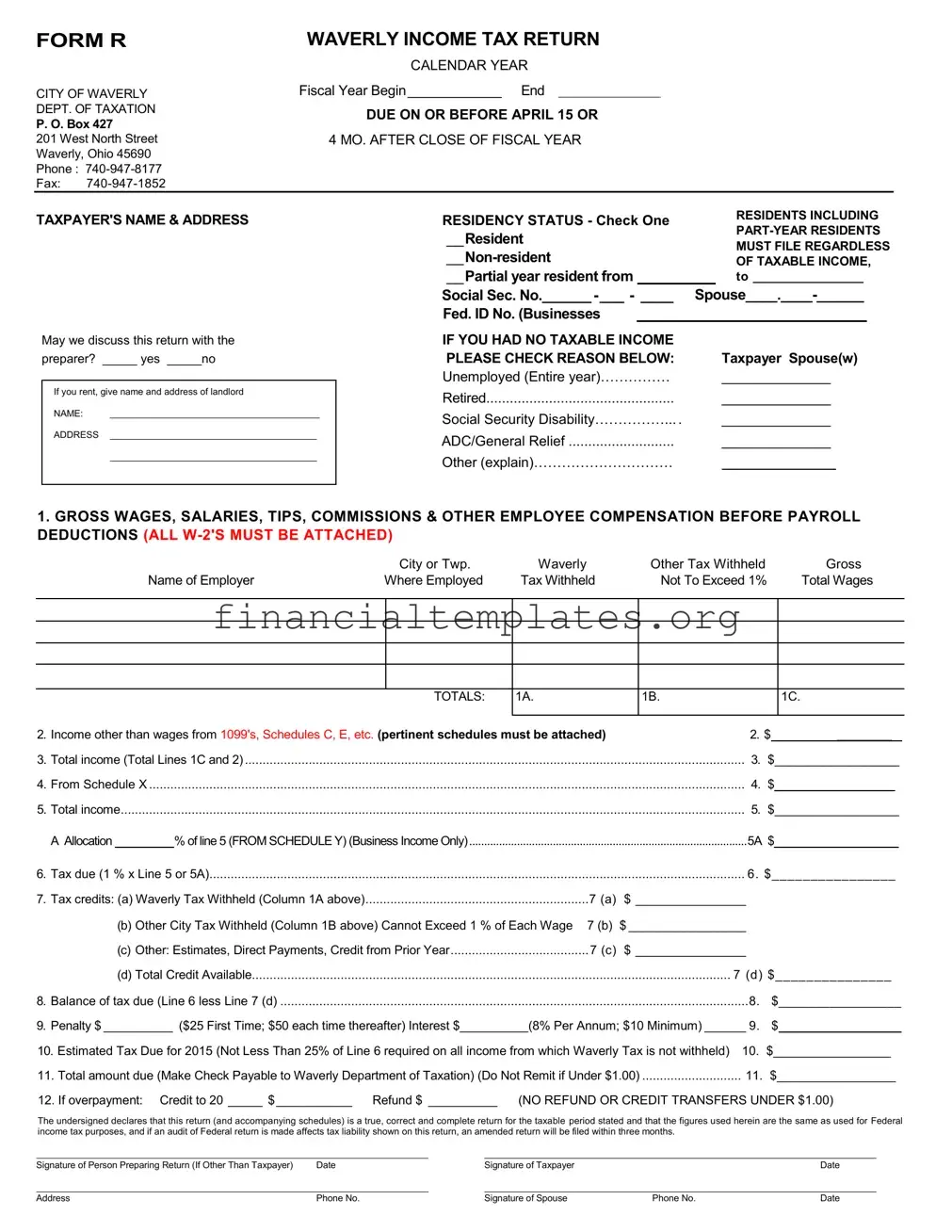

Get Waverly City Tax R Form

Filing taxes can often seem like navigating through a maze, with each form serving as a different turn or puzzle to solve. The Waverly City Tax R form is no exception, designed for residents and part-year residents, as well as non-residents of Waverly, Ohio, who have earned income during the fiscal year. This comprehensive form, due annually by April 15 or four months after the close of the fiscal year, seeks a detailed account of taxpayers' earnings, including wages, salaries, tips, and other compensation, as well as income from other sources such as business ventures reported through 1099s or schedules C, E, and others. Beyond simply reporting income, filers are tasked with calculating the tax due, applying credits for taxes already withheld, and accounting for any applicable penalties or interest for late payments. Importantly, the form also provides options for individuals with no taxable income to state their status, whether it be unemployment, retirement, or disability among others. With specifics like identification of the taxpayer and spouse, residency status, and detailed financial information, the Waverly City Tax R form serves as a critical tool in ensuring compliance with local tax obligations, ultimately supporting the municipal services that benefit the community.

Waverly City Tax R Example

FORM R |

WAVERLY INCOME TAX RETURN |

|

|

|

CALENDAR YEAR |

|

|

CITY OF WAVERLY |

Fiscal Year Begin____________ End |

|

|

|

|

||

DEPT. OF TAXATION |

DUE ON OR BEFORE APRIL 15 OR |

|

|

P. O. Box 427 |

|

||

|

|

|

|

201 West North Street |

4 MO. AFTER CLOSE OF FISCAL YEAR |

|

|

Waverly, Ohio 45690 |

|

|

|

Phone : |

|

|

|

Fax: |

|

|

|

TAXPAYER'S NAME & ADDRESS

May we discuss this return with the preparer? _____ yes _____no

If you rent, give name and address of landlord

NAME:

ADDRESS

RESIDENCY STATUS - Check One |

|

|

RESIDENTS INCLUDING |

|||

|

|

|||||

__Resident |

|

|

||||

|

|

MUST FILE REGARDLESS |

||||

|

|

|||||

|

|

OF TAXABLE INCOME, |

||||

__Partial year resident from |

|

|

|

to ________________ |

||

Social Sec. |

||||||

Fed. ID No. (Businesses |

|

|

|

|

|

|

IF YOU HAD NO TAXABLE INCOME |

|

|

|

|

|

|

PLEASE CHECK REASON BELOW: |

|

|

Taxpayer Spouse(w) |

|||

Unemployed (Entire year)…………… |

______________ |

|

|

|||

Retired |

______________ |

|

|

|||

Social Security Disability…………….... |

______________ |

|

|

|||

ADC/General Relief |

______________ |

|

|

|||

Other (explain)………………………… |

|

|

|

|

|

|

1.GROSS WAGES, SALARIES, TIPS, COMMISSIONS & OTHER EMPLOYEE COMPENSATION BEFORE PAYROLL DEDUCTIONS (ALL

|

City or Twp. |

Waverly |

Other Tax Withheld |

Gross |

Name of Employer |

Where Employed |

Tax Withheld |

Not To Exceed 1% |

Total Wages |

TOTALS: 1A.

1B.

1C.

2. |

Income other than wages from 1099's, Schedules C, E, etc. (pertinent schedules must be attached) |

2. $ |

________ |

|

||||||

3. |

Total income (Total Lines 1C and 2) |

3. |

$__________________ |

|||||||

4. |

From Schedule X |

........................................................................................................................................................................ |

|

4. $__________________ |

|

|||||

5. |

Total income |

|

|

5. $__________________ |

||||||

|

A Allocation |

|

% of line 5 (FROM SCHEDULE Y) (Business Income Only) |

5A $ |

||||||

|

|

|

|

|

|

|

|

|||

6. |

Tax due (1 % x Line 5 or 5A) |

6. $________________ |

|

|||||||

7. |

Tax credits: (a) Waverly Tax Withheld (Column 1A above) |

7 (a) $ ________________ |

|

|

|

|

||||

|

|

(b) Other City Tax Withheld (Column 1B above) Cannot Exceed 1 % of Each Wage 7 (b) $ _________________ |

|

|

|

|

||||

|

|

(c) Other: Estimates, Direct Payments, Credit from Prior Year |

7 (c) $ ________________ |

|

|

|

|

|||

|

|

(d) Total Credit Available |

7 (d) $_______________ |

|||||||

8. |

Balance of tax due (Line 6 less Line 7 (d) |

8. |

|

$_________________ |

||||||

9. |

Penalty $ __________ ($25 First Time; $50 each time thereafter) Interest $__________(8% Per Annum; $10 Minimum) ______ 9. |

|

$_________________ |

|||||||

10. Estimated Tax Due for 2015 (Not Less Than 25% of Line 6 required on all income from which Waverly Tax is not withheld) |

10. |

$_________________ |

|

|||||||

11. Total amount due (Make Check Payable to Waverly Department of Taxation) (Do Not Remit if Under $1.00) |

11. |

$_________________ |

|

|||||||

12. If overpayment: |

Credit to 20 _____ $___________ Refund $ __________ |

(NO REFUND OR CREDIT TRANSFERS UNDER $1.00) |

||||||||

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal income tax purposes, and if an audit of Federal return is made affects tax liability shown on this return, an amended return will be filed within three months.

Signature of Person Preparing Return (If Other Than Taxpayer) |

Date |

|

Signature of Taxpayer |

|

Date |

|

|

|

|

|

|

Address |

Phone No. |

|

Signature of Spouse |

Phone No. |

Date |

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | Form R is used for the Waverly Income Tax Return for individuals and businesses. |

| 2 | The deadline for submission is April 15 or 4 months after the close of the fiscal year. |

| 3 | The form is applicable for residents, part-year residents, and non-residents of Waverly, Ohio. |

| 4 | Taxable income includes gross wages, salaries, tips, commissions, and other employee compensation. |

| 5 | All W-2 forms must be attached for incomes reported. |

| 6 | Other incomes such as from 1099's, Schedules C, E, etc., must be reported, and pertinent schedules attached. |

| 7 | The tax rate applied is 1% of total income or appropriate business income allocation. |

| 8 | Credits may include Waverly Tax Withheld, Other City Tax Withheld, and other eligible credits. |

| 9 | Penalties and interest apply for late payments, set at $25 for the first time, $50 thereafter, and 8% per annum respectively. |

| 10 | The form declares the information provided must be true, correct, and consistent with Federal income tax returns. |

Guide to Writing Waverly City Tax R

Filling out the Waverly City Tax R form requires careful attention to detail and an understanding of your income and residency status within the specified tax year. This process involves providing personal information, detailing your income from various sources, and calculating the tax due based on Waverly's tax regulations. It's important for residents, part-year residents, and even non-residents who have earned income within Waverly to complete this form, when applicable, to ensure compliance with local tax obligations.

- Start by entering the fiscal year's beginning and end dates at the top of the form.

- Fill in your name, address, and phone number, and specify if the tax preparer is allowed to discuss this return with the Department of Taxation by checking 'yes' or 'no'.

- If you rent your residence, provide the name and address of your landlord.

- Indicate your residency status by checking the appropriate box: Resident, Non-resident, or Partial year resident, and fill in the dates for partial-year residency.

- Provide Social Security Numbers for yourself and your spouse, if applicable, and a Federal ID Number if you are filing for a business.

- Check the appropriate box if you had no taxable income, clearly stating the reason among the choices provided or offering an explanation if you select 'Other'.

- For line 1, list all sources of gross wages, salaries, tips, commissions, and other employee compensation. Attach all W-2 forms.

- Enter income from other sources, such as 1099s, Schedules C, E, etc., and attach pertinent schedules.

- Calculate your total income by adding the amounts from lines 1C and 2.

- Enter any adjustments from Schedule X.

- Calculate your total income, including adjustments, and if applicable, determine the allocation percentage for business income on line 5A.

- Compute the tax due by applying Waverly's 1% tax rate to line 5 or 5A.

- Detail tax credits for Waverly and other city taxes withheld, as well as estimates, direct payments, or credit from the previous year. Compute the total credit available.

- Subtract total credits from the tax due to find the balance of tax due.

- Include details of any penalty and interest, if applicable.

- Estimate the tax due for the next fiscal year.

- Determine the total amount due, making a check payable to Waverly Department of Taxation, and indicate the preferred method of handling any overpayment.

- Sign and date the form, ensuring that the preparer does the same if different from the taxpayer. Provide contact phone numbers.

Once these steps are completed, reviewing the form for accuracy is essential before submission. The form and any attachments should then be mailed or delivered to the Waverly Department of Taxation by the specified deadline to avoid potential penalties or interest on late payments.

Understanding Waverly City Tax R

- Who needs to file the Waverly City Tax R form?

All residents of Waverly, including those who reside in the city for part of the year, must file the Waverly City Tax R form. This also applies to non-residents who have earned income from Waverly sources. Regardless of your taxable income, if you fall into one of these residency categories, you are required to file the form.

- What kinds of income need to be reported on the Waverly City Tax R form?

All earned income must be reported, which includes wages, salaries, tips, commissions, and other forms of employee compensation before payroll deductions. Additionally, income from other sources such as those reported on 1099 forms, Schedules C, E, and similar should be included if they apply to your situation.

- What if I had no taxable income for the year?

If you had no taxable income during the year, you should still file the form but check the appropriate reason for having no taxable income. Options include being unemployed for the entire year, retirement, receiving Social Security Disability, ADC/General Relief, or other reasons that should be explained on the form.

- How do I calculate the tax due?

The tax due is calculated by applying a 1% tax rate to your total income or the appropriate allocation percentage of your business income. Total income is the sum of your wages and other income as calculated on the form. Make sure to attach all required schedules or forms that support your income claims.

- What tax credits are available?

Tax credits that may reduce the amount of tax due include Waverly tax withheld, other city tax withheld (which cannot exceed 1% of each wage), estimates, direct payments, and credit from a prior year. The total of these credits can be deducted from your tax due.

- What should I do if I have overpaid or if I am entitled to a refund?

If your calculations show an overpayment, you have the option to have this amount credited to the next tax year or to request a refund. However, it is important to remember that no refunds or credits for transfers under $1.00 will be processed.

- What are the penalties for late filing or underpayment?

Penalties for late filing start at $25 for the first time and increase to $50 for each subsequent occurrence. Interest on underpayments is calculated at an 8% per annum rate with a minimum of $10. It is crucial to file on time and accurately calculate your tax due to avoid these penalties.

- What is the due date for filing the Waverly City Tax R form?

The form must be filed on or before April 15th or four months after the close of your fiscal year. If you require more time to file, it is essential to contact the Waverly Department of Taxation before the due date to inquire about possible extensions.

- Where do I send my completed Waverly City Tax R form?

The completed form along with any payment due should be sent to the Department of Taxation at the City of Waverly. The mailing address is P.O. Box 427, 201 West North Street, Waverly, Ohio 45690. For further assistance, you can contact them by phone or fax.

Common mistakes

Filling out tax forms can sometimes feel like navigating a maze. When it comes to the Waverly City Tax R form, there are common pitfalls that people often encounter. Here’s a breakdown of six mistakes to avoid for a smoother tax return process:

- Not checking the correct residency status: It's crucial to correctly identify whether you're a resident, non-resident, or part-year resident. This affects your tax obligations and can lead to errors in your return.

- Forgetting to include all W-2s: If you've worked multiple jobs, ensure that you attach all relevant W-2 forms. Missing out on some can result in underreporting your income.

- Omitting 1099 and other schedules: Income other than wages must be reported accurately. This includes freelancing, investments, and business earnings documented on 1099s, Schedules C, E, etc.

- Incorrectly calculating total income: It's important to sum up all sources of income correctly. Adding up lines 1C (total wages) and 2 (other incomes) should be done carefully to avoid discrepancies.

- Miscalculating the tax due: Tax is calculated at 1% of line 5 or 5A (for business income). A common mistake is incorrectly calculating this percentage, leading to either overpaying or underpaying your tax.

- Failing to claim all eligible tax credits: Ensure you’ve included all Waverly tax withheld, other city tax withheld that doesn’t exceed 1%, and other credits such as estimates, direct payments, and credits from the prior year. This can significantly impact your tax outcome.

By keeping an eye out for these errors, you can help ensure your Waverly City Tax R form is completed accurately, potentially saving you time and money.

Documents used along the form

When filing the Waverly City Tax R form, individuals and businesses often find themselves needing additional documents and forms to accurately report and calculate their tax responsibilities. Whether to provide detailed income information, verify tax payments, or claim various credits, these accompanying documents are crucial for a comprehensive and compliant tax return process. Below is a list of some of the forms and documents commonly used alongside the Waverly City Tax R form.

- Form W-2 (Wage and Tax Statement): This form is essential for employees as it outlines wages earned and taxes withheld by the employer. It is a critical document for verifying income and tax withholdings on the Waverly City Tax R form.

- Form 1099: Various 1099 forms report income other than wages, such as freelance or contract work (1099-MISC), interest and dividends (1099-INT and 1099-DIV), and other sources of income. These forms are necessary for individuals who have income from sources other than traditional employment.

- Schedule C (Profit or Loss from Business): Used by self-employed individuals to report profits or losses from their business operations. This schedule is crucial for accurately reporting business income on the Waverly City Tax R form.

- Schedule E (Supplemental Income and Loss): This document is used to report income from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It's important for taxpayers with these types of income to provide a complete tax picture.

- Schedule SE (Self-Employment Tax): For those who are self-employed, this schedule calculates the tax due on net earnings from self-employment. It's essential for self-employed individuals to calculate the correct amount of tax they owe.

- Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return): If taxpayers need more time to file their Waverly City Tax R form, this form is used to request an extension, granting them additional time to gather and submit their documents.

- Prior Year’s Tax Return: Reviewing last year's return can help taxpayers ensure consistency in reporting and utilize any carry-over amounts such as losses or credits. It's a useful reference for completing the current year's tax documents accurately.

- Direct Deposit Information: Though not a form, providing bank account information for direct deposit can speed up the refund process. Individuals expecting a refund from their Waverly City tax return may want to include this information with their filing.

Filing taxes can be a complex process, requiring careful attention to detail and thorough documentation. Individuals in Waverly utilizing the Tax R form must gather the necessary supporting documents to ensure their tax filings are accurate and comprehensive. Bringing together forms like the W-2, various 1099s, and Schedules C, E, and SE, among others, allows taxpayers to present a full picture of their financial situation for the tax year. This preparation aids in the smooth filing process and can help in maximizing potential refunds or minimizing tax liabilities.

Similar forms

The Federal 1040 Tax Return form, used by individuals to file their annual income tax with the Internal Revenue Service (IRS), shares similarities with the Waverly City Tax R form. Both forms are designed to calculate taxes owed based on the individual's gross income, including wages, salaries, tips, and other forms of compensation. Additionally, each form provides space for taxpayers to claim deductions or credits that could reduce their overall tax liability. However, the Federal 1040 form is used for national tax obligations, while the Waverly form is specific to local city taxes.

The Schedule C form, often used by self-employed individuals or sole proprietors to report their business income and expenses to the IRS, also parallels the Waverly City Tax R form in its purpose of reporting income. Like the Waverly form, which includes sections for income from 1099s and Schedules C and E, Schedule C is aimed at calculating the taxable income after business expenses are subtracted. This similarity underscores the forms’ roles in ensuring accurate tax reporting for different sources of income.

The 1099-MISC form, issued to freelancers or independent contractors to report income received for services performed, relates to the Waverly City Tax R form in its handling of non-wage income. Both documents require individuals to report earnings not subject to standard payroll tax withholdings, thereby aiding in the accurate calculation of taxes due based on a broader spectrum of income sources. This facilitates comprehensive tax reporting and compliance for various types of income earners.

The W-2 form, which employers provide to employees to report annual wages and the amount of taxes withheld, has a direct connection to the Waverly form. The Waverly City Tax R form necessitates the attachment of all W-2s to verify gross wages, salaries, and tax withheld, mirroring the process of how employment income is reported and taxed at both the local and federal levels. This ensures that taxpayers receive credit for any taxes already paid to the government.

The State Individual Income Tax Return forms, which vary by state, share a common goal with the Waverly City Tax R form: assessing tax based on income at a jurisdictional level. Both forms require detailed income reporting and allow for deductions or credits specific to their governing body's tax laws. The primary difference lies in their scope, with state forms addressing state taxes and the Waverly form focusing on municipal taxes.

The Estimated Tax Payment form (1040-ES), used for paying estimated taxes on income not subject to withholding, is akin to the section of the Waverly City Tax R form that addresses estimated tax due for the following year. Both documents anticipate future income and aim to prevent underpayment penalties by calculating a provisional tax amount based on projected earnings. This parallels their function of facilitating ongoing tax payments throughout the year.

The Schedule E form, utilized to report income from rental property, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs, reflects aspects of the Waverly City Tax R form's inclusion of income beyond wages. Like the Waverly form, which requires attachment of pertinent schedules for additional sources of income, Schedule E addresses the complexity of taxing diverse income types, ensuring comprehensive income reporting for tax purposes.

The Schedule SE form, necessary for calculating the self-employment tax owed by individuals who work for themselves, shares similarities with the Waverly form's broader approach to income reporting. Both forms cater to individuals with varied income sources, including self-employment, and ensure that the appropriate taxes are calculated and paid on all forms of income, reflecting a thorough taxation process.

The Local Earned Income Tax Return, which residents of certain municipalities are required to file in addition to federal and state returns, closely matches the Waverly City Tax R form in function and purpose. Both forms assess taxes due based on income earned within a specific locality, ensuring that taxpayers contribute to the funding of local services and infrastructure. This highlights the role of local tax forms in maintaining community resources and services.

The Property Tax Return, though primarily concerned with real estate and property values, also complements the income-focused Waverly City Tax R form in the broader context of tax obligations. While the Property Tax Return calculates taxes due based on property assessment, the Waverly form deals with income taxation. Together, they represent the spectrum of tax liabilities individuals may encounter, encompassing both property and income taxes at various governmental levels.

Dos and Don'ts

When preparing to fill out the Waverly City Tax R form, it is essential to approach the task with attention to detail and thoroughness. To ensure a smooth process, here are key dos and don'ts to keep in mind:

- Do gather all necessary documents, including all W-2s, 1099s, schedules C, E, etc., before starting the form. This ensures accuracy in reporting income.

- Do double-check residency status and select the correct option, whether you're a resident, non-resident, or part-year resident, as this affects your tax obligations.

- Do accurately report your gross wages, salaries, tips, commissions, and other employee compensation, as these figures form the basis of your tax calculation.

- Do attach pertinent schedules and documentation as required, particularly for income other than wages and for business income, to substantiate the figures reported.

- Do calculate carefully the total income and tax due, applying the correct percentage and taking into account any Waverly tax withheld, to arrive at the balance of tax due or refund due accurately.

- Do verify the accuracy and completeness of the return before signing and dating the form, ensuring that the information aligns with that used for federal income tax purposes.

Conversely, there are several practices to avoid:

- Don't leave sections blank or assume figures without verifying against your documentation. Incomplete or inaccurate entries can lead to processing delays or incorrect tax assessments.

- Don't forget to check whether you had any taxable income and, if not, clearly indicate the reason as provided in the form options.

- Don't neglect to include your landlord's name and address if you rent your home, as this information is part of the residency status verification.

- Don't exceed the tax withholding amount to more than 1% of wages for Waverly City and other cities, following the guidelines for credit calculations.

- Don't overlook the section on tax credits, including direct payments or credits from the prior year, as these can significantly impact the amount owed or refunded.

- Don't send payment if your total amount due is under $1.00, complying with the form's instructions and helping streamline processing.

By following these dos and don'ts, you can avoid common pitfalls and ensure your Waverly City Tax R form is correctly completed and submitted on time.

Misconceptions

One common misconception is that the Waverly City Tax R form is optional for residents of Waverly. In reality, all residents, including part-year residents, are required to file the form, irrespective of their taxable income levels.

Many people mistakenly believe that non-residents of Waverly need not file Form R. However, non-residents who earn income within Waverly must file the form to report such earnings.

It's incorrectly assumed that if someone had no taxable income for the year, they do not need to communicate this to the Waverly Department of Taxation. In fact, the form specifically requests that taxpayers check a reason if they had no taxable income, reinforcing the requirement to file regardless of income status.

Another misconception is that Form R covers only wage and salary income. Actually, the form is designed to capture a broad range of income types, including wages, salaries, tips, commissions, and earnings from 1099s, along with business and investment income.

Some believe that the tax rate applied through Form R is variable. However, the form clearly states a 1% tax rate on total income, illustrating a set taxation rate.

There's a false belief that tax withheld by employers will automatically satisfy the taxpayer’s obligations for city taxes. While employer-withheld taxes can be credited against the tax due, taxpayers are responsible for ensuring their total city tax liability is met, which might require additional payment.

A misconception exists that penalties are negotiable or can be waived at discretion. The Form R outlines specific penalties for late payments and underestimations, indicating these are standard fees applied to late or insufficient payments.

Some taxpayers think that they cannot receive a refund if they overpay their taxes through withholding or estimated payments. However, the form offers options for refunds or credits toward future taxes for overpayments, debunking this myth.

Lastly, there is an incorrect belief that the Waverly City Tax R form does not need to be updated for changes in federal tax liability. The form clearly requires taxpayers to file an amended return if a federal audit changes their tax liability, highlighting the importance of accuracy and consistency between federal and city tax filings.

Key takeaways

When completing the Waverly City Tax R form, taxpayers must adhere to specific requirements to ensure accuracy and compliance with local tax obligations. Here are key takeaways regarding the process:

- Due dates are vital: The form is due on April 15 or 4 months after the close of the fiscal year, aligning with many tax return deadlines, ensuring synchronization with broader financial obligations.

- Residency status matters: Taxpayers need to identify their residency status as full-year residents, part-year residents, or non-residents, affecting tax liability and filing requirements.

- Income reporting is comprehensive: It encompasses wages, salaries, tips, and other compensation. Pertinent documentation like all W-2s must be attached, reflecting an effort to prevent underreporting of income.

- Diverse income sources: Beyond traditional employment income, the form requires details on other income streams such as earnings from 1099 forms, business income (Schedule C), rental income, etc., ensuring a holistic view of an individual's fiscal health.

- Deductions: The form allows for specific deductions, indicated by allocations and credits, which can reduce overall tax liability. This includes credit for taxes withheld by employers or paid to other cities, highlighting the system's design to avoid or mitigate double taxation.

- Tax calculation: Tax is assessed at a 1% rate, with taxpayers needing to calculate their due tax based on total adjusted income, demonstrating the city's straightforward approach to local income tax.

- Tax Credits: Credits can be claimed for taxes already withheld by Waverly or other city taxes withheld, effectively preventing double taxation and reducing the amount owed.

- Penalties and interest: The form prescribes penalties for late filing and interest on overdue taxes, emphasizing the city's discouragement of tax evasion and the importance of meeting filing deadlines.

- Declaration of accuracy: Taxpayers, along with the individual preparing the tax form (if applicable), must sign the form, declaring the information provided is accurate. This underscores the legal responsibility of filers to submit truthful and precise information.

In conclusion, the Waverly City Tax R form requires detailed attention to income, residency status, and allowable credits to accurately compute the tax obligation. Taxpayers need to be diligent in gathering requisite documentation and adhering to the specified timelines to ensure compliance with the local tax regulations.

Popular PDF Documents

New Idr Plan - It involves an application process for the Income-Based Repayment Plan, requiring alternative proof of income under the FFEL Program.

Ptax 401 - This form enables businesses to outline the type of pollution control facility they operate, including air, water, or low-sulfur dioxide emission devices.