Get Wage Tax Refund Petititon Form

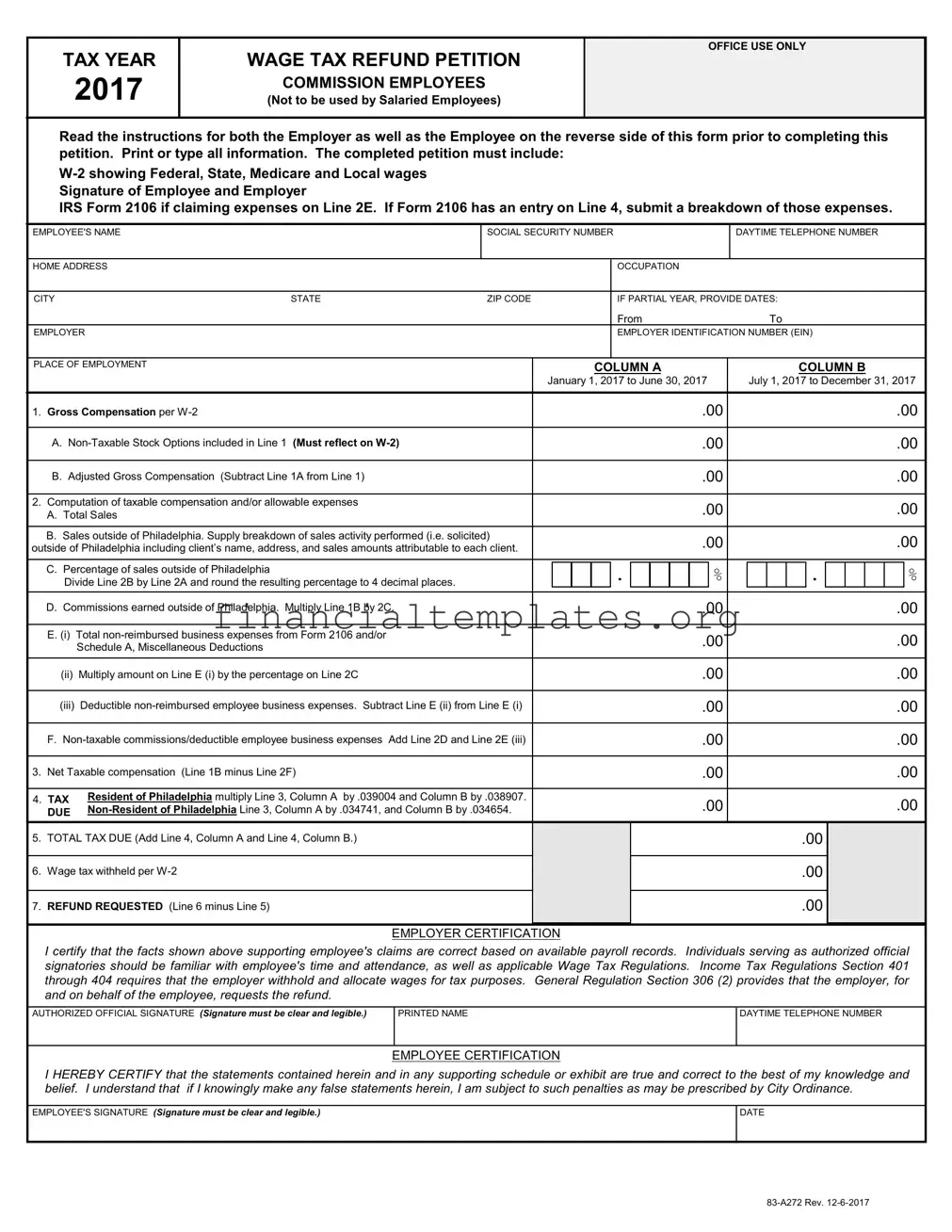

Navigating the complexities of tax requirements can be a daunting task for anyone, especially when it comes to understanding specific forms like the Wage Tax Refund Petition form. This form is a critical tool for commission-based employees in the city who believe they might have overpaid their wage taxes. Commission employees, as opposed to their salaried counterparts, have the unique opportunity to claim a refund for taxes paid on income earned outside of their jurisdiction or for specific allowable business expenses. The form requires meticulous information, including personal details, employment and compensation data, and a detailed breakdown of the sales and business expenses that justify the refund request. Additionally, the requirement of signatures from both the employee and employer underscores the importance of the accuracy of the information provided. A notable aspect of this process is the inclusion of certain documents like the W-2 form and IRS Form 2106, which further substantiate the claim. Understanding the eligibility criteria, such as residency status and the specific timeframes for tax rates, as well as the necessity of filing within the three-year statute of limitations, is crucial for a successful petition. With its detailed instructions and clear delineation of the computation process for taxable compensation and allowable expenses, this form serves as a vital resource for potentially reclaiming overwithheld taxes, making the daunting task of navigating tax refunds a little more manageable for commission-based employees.

Wage Tax Refund Petititon Example

TAX YEAR |

|

WAGE TAX REFUND PETITION |

|

|

|

|

|

|

|

OFFICE USE ONLY |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

2017 |

|

COMMISSION EMPLOYEES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(Not to be used by Salaried Employees) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Read the instructions for both the Employer as well as the Employee on the reverse side of this form prior to completing this |

|

|

|||||||||||||||||||||||||

petition. Print or type all information. The completed petition must include: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Signature of Employee and Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

IRS Form 2106 if claiming expenses on Line 2E. If Form 2106 has an entry on Line 4, submit a breakdown of those expenses. |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

EMPLOYEE'S NAME |

|

|

SOCIAL SECURITY NUMBER |

|

|

DAYTIME TELEPHONE NUMBER |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

HOME ADDRESS |

|

|

|

|

|

|

|

|

OCCUPATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CITY |

|

|

STATE |

|

ZIP CODE |

|

|

IF PARTIAL YEAR, PROVIDE DATES: |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

From |

|

|

|

|

To |

|

|

|||||||||

EMPLOYER |

|

|

|

|

|

|

|

|

EMPLOYER IDENTIFICATION NUMBER (EIN) |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PLACE OF EMPLOYMENT |

|

|

|

|

|

|

|

COLUMN A |

|

|

|

|

|

COLUMN B |

|

|

|||||||||||

|

|

|

|

|

|

January 1, 2017 to June 30, 2017 |

|

July 1, 2017 to December 31, 2017 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1. Gross Compensation per |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

A. |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

B. Adjusted Gross Compensation (Subtract Line 1A from Line 1) |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2. Computation of taxable compensation and/or allowable expenses |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||

A. Total Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

B. Sales outside of Philadelphia. Supply breakdown of sales activity performed (i.e. solicited) |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||||

outside of Philadelphia including client’s name, address, and sales amounts attributable to each client. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

C. Percentage of sales outside of Philadelphia |

|

|

|

|

|

|

|

. |

|

|

|

|

% |

|

|

|

|

. |

|

|

|

|

|

% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Divide Line 2B by Line 2A and round the resulting percentage to 4 decimal places. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D. Commissions earned outside of Philadelphia. Multiply Line 1B by 2C. |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

E. (i) Total |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

Schedule A, Miscellaneous Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(ii) Multiply amount on Line E (i) by the percentage on Line 2C |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(iii) Deductible |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

F. |

Add Line 2D and Line 2E (iii) |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

3. Net Taxable compensation (Line 1B minus Line 2F) |

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4. TAX |

Resident of Philadelphia multiply Line 3, Column A by .039004 and Column B by .038907. |

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|

|

|

.00 |

||||||

DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

5. TOTAL TAX DUE (Add Line 4, Column A and Line 4, Column B.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. Wage tax withheld per |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7. REFUND REQUESTED (Line 6 minus Line 5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYER CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

I certify that the facts shown above supporting employee's claims are correct based on available payroll records. Individuals serving as authorized official signatories should be familiar with employee's time and attendance, as well as applicable Wage Tax Regulations. Income Tax Regulations Section 401 through 404 requires that the employer withhold and allocate wages for tax purposes. General Regulation Section 306 (2) provides that the employer, for and on behalf of the employee, requests the refund.

AUTHORIZED OFFICIAL SIGNATURE (Signature must be clear and legible.) |

PRINTED NAME |

DAYTIME TELEPHONE NUMBER |

|

|

|

EMPLOYEE CERTIFICATION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to such penalties as may be prescribed by City Ordinance.

EMPLOYEE'S SIGNATURE (Signature must be clear and legible.) |

DATE |

|

|

INSTRUCTIONS FOR FILING WAGE TAX REFUND PETITION

(Commission Employees Only)

You must attach the applicable

2017 TAX RATES

Resident Rates: January 1, 2017 to June 30, 2017 = 3.9004% (.039004)

July 1, 2017 to December 31, 2017 = 3.8907% (.038907)

July 1, 2017 to December 31, 2017 = 3.4654% (.034654)

Statute of Limitations - any claim for refund must be filed within three (3) years from the date the tax was paid or due, whichever date is later.

Only

The taxability of sales by commission employees is based on the place of solicitation. You may exclude sales outside of Philadelphia if you are out of Philadelphia when the sale is solicited and the order taken. If you are selling by phone from Philadelphia, these sales are taxable no matter where the customer is located.

Both the employer and employee must sign the petition for refund. A petition for refund of "erroneously withheld wage tax from an employee must be made by the employer for and on behalf of the employee" (General Regulations Section 306 (2)). The authorizing official signing this form should do so only if they know of the employee's whereabouts as they relate to this petition, as well as an understanding of how this information applies to Sections 401, 402, 403, 404, 405 and 407 of the Philadelphia Income Tax Regulations. These regulations are available at www.phila.gov/revenue.

Partial Year: In the context of this form, a partial year is one in which your liability or status for Wage Tax changes. It could be the result of becoming a resident, starting a new job, terminating a job, etc. In any of these situations you need to indicate the period for which you

were liable for Wage Tax with a particular employer.

Line 1: Enter your Gross Compensation (generally the highest compensation figure on the

Line 1A: The only income excludable from gross compensation would be income received as the result of exercising an employee stock option. Stock option must reflect on

Line 2: This line should reflect Total Sales for the year. If your compensation is based on more than one commission or a combination of salary, commissions, fee, etc., prepare a worksheet calculating the amount due and attach it to the petition, marking this line "see attached".

Line 2B: This line should reflect Sales Outside of Philadelphia as noted above. Supply breakdown of sales activity performed (i.e. solicited) outside of Philadelphia including client’s name, address, and sales amounts attributable to each client.

Line 2E - Expenses: An entry on Line 2E must be supported by Federal Form #2106. If unreimbursed employee expenses are claimed on Federal Schedule A, you must also include Schedule A. Photocopies are acceptable. Expenses are deductible if the total expenses are reduced by any amounts reimbursed by your employer and they are ordinary, necessary and reasonable. Examples of expenses which are not deductible are: transportation to and from work, educational expenses, dues, subscriptions, and pension plan payments. Note: If your Federal #2106 has an entry on Line 4, you must submit a breakdown of those expenses.

Mail completed petition to:

CITY OF PHILADELPHIA DEPARTMENT OF REVENUE

P.O. BOX 53360

PHILADELPHIA, PA 19105

For further information you may reach the Revenue Department Refund Unit at:

Fax:

Send

8 www.phila.gov/revenue

Document Specifics

| Fact Name | Detail |

|---|---|

| Eligibility for Filing | This form is specifically designed for commission-based employees seeking a wage tax refund, not applicable to salaried employees. |

| Documentation Requirement | Submissions must include the employee's W-2, signatures from both the employee and employer, and, if claiming expenses on Line 2E, IRS Form 2106. |

| Governing Laws | The process is guided by Philadelphia Income Tax Regulations Sections 401 to 407 and General Regulation Section 306 (2), focusing on wage withholding and allocation for tax purposes. |

| Specific Instructions for Non-Residents | Only non-resident employees can file for refunds based on work performed outside of Philadelphia, reflecting the city's unique approach to taxing income based on the location of work solicitation. |

Guide to Writing Wage Tax Refund Petititon

Filling out the Wage Tax Refund Petition form correctly is essential for commission employees seeking a refund for the tax year 2017. This form is specific to scenarios where wage tax may have been over-withheld by an employer. To ensure a smooth refund process, carefully read the instructions provided on the reverse side of the form before beginning. The submission must include a W-2 form and, if applicable, IRS Form 2106 for claiming non-reimbursed business expenses.

- Start by inputting the tax year as 2017 at the top of the form.

- Under "EMPLOYEE'S NAME," enter your full name as it appears on your Social Security card.

- Provide your Social Security Number in the designated space.

- Enter your Daytime Telephone Number, where you can be reached for any clarifications.

- Under "HOME ADDRESS," fill in your current home address, including City, State, and Zip Code.

- If you were a partial-year resident or worked partially throughout the year, furnish the dates From and To under the "IF PARTIAL YEAR" section.

- Enter your occupation in the space provided.

- For the "EMPLOYER" section, provide the Employer Identification Number (EIN) and Place of Employment.

- In the COLUMN A and COLUMN B sections, accurately fill out your gross compensation, nontaxable stock options (if applicable), adjusted gross compensation, computation of taxable compensation and/or allowable expenses, and the calculation of net taxable compensation as instructed on the form.

- Based on your residency status, calculate the TAX DUE using the rates provided for either resident of Philadelphia or non-resident of Philadelphia, and fill in the respective fields.

- Enter the total TAX DUE, the amount of wage tax withheld as per your W-2, and the REFUND REQUESTED in the designated fields.

- Under "EMPLOYER CERTIFICATION," ensure that the authorized official of your employer signs and provides their details including printed name and daytime telephone number.

- Complete the "EMPLOYEE CERTIFICATION" section by signing and dating the petition to certify that all information provided is accurate.

- Attach the required W-2 form, and if claiming expenses on Line 2E, include IRS Form 2106 or a breakdown of expenses if there’s an entry on Line 4 of the form.

- Review the entire form to ensure all information is accurate and complete before mailing the petition to the City of Philadelphia Department of Revenue at the address provided in the instructions.

After submitting your petition, the Department of Revenue's Refund Unit will process your request. This procedure may take some time, so patience is advisable. For any inquiries or updates regarding the status of your petition, contact the Revenue Department Refund Unit using the provided contact details. Properly following these steps and submitting the required documentation will facilitate a timely review and refund of your wage tax, if applicable.

Understanding Wage Tax Refund Petititon

-

Who needs to file a Wage Tax Refund Petition form?

Commission employees who believe their employer may have overwithheld Wage Tax need to file a Wage Tax Refund Petition. This includes those with allowable business expenses or those who have performed sales activities outside of Philadelphia.

-

What documents are required to file this petition?

To file, you must attach your W-2 showing Federal, Medicare, State, and Local wages. If claiming expenses on Line 2E, IRS Form 2106 must be included. For any amounts listed on Form 2106 Line 4, a detailed breakdown of those expenses is also required.

-

Can salaried employees use this form to request a refund?

No, this form is exclusively for commission employees. Salaried employees cannot use this form to request a wage tax refund.

-

What should I do if I had multiple employers or W-2 forms?

A separate petition must be filed for each W-2 issued by your employers. Ensure that each petition is complete with the required documents attached for each employment.

-

How is the taxable compensation calculated for commission employees?

Taxable compensation is calculated based on gross compensation, adjusted by non-taxable stock options, and commissions earned outside of Philadelphia. Deductible non-reimbursed employee business expenses are also considered to arrive at the net taxable compensation.

-

What if part of my income comes from sales outside Philadelphia?

You may exclude sales made outside of Philadelphia if the sale was solicited and the order taken while you were physically outside of Philadelphia. These exclusions should be properly documented and reported on the petition form.

-

Are there any expenses that are not deductible?

Yes, expenses that are not deductible include transportation to and from work, educational expenses, dues, subscriptions, and pension plan payments. Only ordinary, necessary, and reasonable expenses are deductible.

-

What is the deadline for filing the Wage Tax Refund Petition?

You must file your claim for a refund within three years from the date the tax was paid, or the date it was due, whichever is later. It's important to adhere to this statute of limitations to be eligible for a refund.

-

Where should I send the completed petition?

Send your completed petition to the City of Philadelphia Department of Revenue, P.O. Box 53360, Philadelphia, PA 19105. Ensure all necessary documentation is included to avoid delays in processing your refund request.

Common mistakes

Filling out the Wage Tax Refund Petition form is crucial for commission employees seeking a refund on their wage taxes. However, it's easy to make mistakes that can delay or even jeopardize your refund. Here are seven common pitfalls to avoid:

Not reading instructions carefully: Before you start filling out the form, take time to thoroughly read the instructions provided for both the employer and employee. This ensures you understand what's required and helps to prevent errors.

Incorrectly calculating Gross Compensation: It's important to enter your Gross Compensation correctly as it appears on your W-2. Remember, this figure should include all compensation before any deductions, except for non-taxable stock options which should be listed separately.

Omitting Non-Taxable Stock Options: If any income was received from exercising an employee stock option, this must be documented separately on Line 1A and should be reflected on your W-2.

Failing to provide a breakdown of Sales Outside of Philadelphia: For sales activities performed outside of Philadelphia, a detailed breakdown including client's name, address, and sales amounts for each client is mandatory to compute taxable and non-taxable sales accurately.

Not attaching Form 2106 or Schedule A for expenses: If you're claiming any unreimbursed employee business expenses on Line 2E, you must attach IRS Form 2106 or your Schedule A, Miscellaneous Deductions. Without these documents, your claimed expenses cannot be verified.

Miscalculating taxable compensation: Ensure that the computation of your taxable compensation and/or allowable expenses is done correctly. This involves accurately totaling your sales, determining the percentage of sales outside of Philadelphia, and properly applying this calculation to find your commissions earned outside of Philadelphia and deductible non-reimbursed expenses.

Forgetting signatures: The petition requires the signatures of both the employee and the employer. Missing signatures will result in the petition being incomplete and can lead to delays in processing your refund.

Avoid these common mistakes to ensure that your Wage Tax Refund Petition is processed smoothly and efficiently. If you have questions or need further clarification on any part of the form, don't hesitate to contact the Revenue Department Refund Unit for assistance.

Documents used along the form

When submitting a Wage Tax Refund Petition, it is crucial to include all necessary forms and documents to ensure a thorough review and processing of your claim. These documents not only support your petition but also comply with local regulations. Below is a concise list of other forms and documents often used alongside the Wage Tax Refund Petition form, each with a brief description to help you understand their purpose and importance in your application process.

- W-2 Form: This form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It is essential for verifying your income and tax withheld.

- IRS Form 2106: Used by employees to deduct ordinary and necessary expenses incurred while performing their duties. This form is relevant if claiming expenses on the Wage Tax Refund Petition.

- Schedule A (Itemized Deductions): If you itemize deductions on your federal tax return, this form details those deductions, including unreimbursed employee expenses if claimed.

- Form 1040: The standard IRS form that individuals use to file their annual income tax returns. It may be required to provide context or supplemental information regarding your income and deductions claimed.

- Pay Stubs: These are used to provide additional verification of income and tax withholdings, especially pertinent if W-2 forms are not fully reflective of the claim.

- Proof of Employment: This could include employment contracts or letters from your employer, substantiating your employment period, especially for partial year claims.

- Residence Verification: Documents such as utility bills or a driver's license that prove your residency status during the tax year in question.

- Work Schedule/Log: Detailed records proving days worked outside of Philadelphia if claiming a refund based on non-resident workdays.

- Employer Certification: A signed statement from your employer verifying the accuracy of the information provided in your refund petition, including your claim of unreimbursed expenses.

- Direct Deposit Form: If opting for a direct deposit of your refund, this form provides the necessary bank details to process the transaction efficiently.

It is essential to accurately complete and attach all applicable documents to your Wage Tax Refund Petition to facilitate a smooth review process by the tax authority. Failure to include necessary documentation could result in delays or denial of your refund claim. Each document plays a critical role in substantiating your eligibility for a refund, making it imperative to review each requirement and ensure completeness and accuracy in your submission.

Similar forms

The Federal Tax Return form, particularly the 1040 form, shares key similarities with the Wage Tax Refund Petition form. Both documents require detailed income information, including wages, salaries, and other forms of compensation. Furthermore, both forms ask for deductions and adjustments to income, akin to the non-reimbursable expenses mentioned in the Wage Tax Refund Petition. The critical purpose uniting these documents is to ascertain the taxpayer's correct liability, whether it leads to a determination of income tax due or a refund claim.

A State Income Tax Return is another document closely related to the Wage Tax Refund Petition. Similar to the Federal Tax Return, state returns require income details, tax payments, and applicable refunds or amounts owed. The crucial difference lies in the jurisdiction; while the Wage Tax Refund Petition is specific to Philadelphia's local wage tax, state income tax returns operate within individual state tax systems. Both documents, however, aim to rectify or reconcile taxes that have been overpaid or under-assessed.

The IRS Form 2106, Employee Business Expenses, has a direct connection to the Wage Tax Refund Petition form since the latter explicitly mentions the necessity of including Form 2106 if claiming expenses. IRS Form 2106 is designed for taxpayers to document and calculate deductible business expenses not reimbursed by their employer. This similarity manifests in the detailed recording of expenses that directly affect the calculation of taxable income or refunds due, illustrating their mutual importance in ensuring tax accuracy.

The Unemployment Benefit Statement often mirrors aspects of the Wage Tax Refund Petition, especially regarding the reporting of income and determining tax obligations. Although the Wage Tax Refund Petition focuses on wages and related expenses for employed individuals, the unemployment statement accounts for benefits received during unemployment. Both documents are crucial for accurately reporting annual income to the relevant tax authorities and ensuring correct tax treatment of different income types.

W-2 Forms, which employers issue to report an employee's annual wages and the amount of taxes withheld from their paycheck, are particularly connected to the Wage Tax Refund Petition. The Wage Tax Refund Petition requires the attachment of a W-2 form to substantiate the claim for a refund, indicating a reliance on the detailed earnings and withholding information that the W-2 provides. This showcases the W-2's role in both certifying income and verifying tax payments pertinent to refund claims.

A Payroll Deduction Form that employees fill out for their employers, specifying various withholdings and deductions from their paycheck, shares similarities with the Wage Tax Refund Petition. While the Payroll Deduction Form influences the initial calculation of withholdings for taxes, retirement, and other benefits, the Wage Tax Refund Petition can serve as a corrective mechanism, ensuring any overwithheld taxes are identified and refunded. Both forms play distinct but interconnected roles in managing and reconciling the financial transactions related to employment income.

The Schedule A (Itemized Deductions) form bears relevance to the Wage Tax Refund Petition through its focus on deductions, which can reduce taxable income. Specifically, in cases where the Wage Tax Refund Petition form refers to expenses that might also appear on Schedule A, such as unreimbursed employee expenses. This overlap shows how both documents feed into the broader process of pinpointing the taxpayer's adjusted gross income by considering various deductible expenses.

Lastly, the Direct Deposit Authorization form, often used to facilitate tax refunds, echoes the logistical aspect of the Wage Tax Refund Petition, which culminates in a refund request. Although the content of these forms diverges—the Direct Deposit Authorization focuses on banking information for refund transactions—the end goal of swiftly and safely returning overpaid taxes to the taxpayer links them closely. Their shared focus on the refund process underscores the broader aim of accurate and efficient tax reconciliation.

Dos and Don'ts

When filling out the Wage Tax Refund Petition form, it is essential to pay close attention to detail and follow specific guidelines to ensure your form is accepted and processed efficiently. Below are some recommended dos and don'ts to guide you through this process.

- Do thoroughly read the instructions provided on the form before you start filling it out. These instructions are critical for understanding how to correctly complete the form.

- Do print or type all information clearly to prevent any misinterpretation of your entries.

- Do ensure that you attach all required documents, such as your W-2 form and IRS Form 2106 if claiming expenses on Line 2E. Failing to do so could delay the processing of your refund.

- Do verify all calculations, especially the computation of taxable compensation and allowable expenses, to avoid errors that could lead to an incorrect refund amount.

- Do sign and date the petition. Your petition cannot be processed without your signature certifying the accuracy of the information provided.

- Don't leave any required fields blank. If a particular section does not apply to you, indicate this with a "N/A" rather than leaving it empty.

- Don't guess or estimate figures. Use precise amounts as reported on your supporting documents to ensure the accuracy of your petition.

- Don't ignore the statute of limitations. Remember, claims for refunds must be filed within three years from the date the tax was paid or due.

- Don't send your petition without proofreading it. Take a moment to review all the information for completeness and accuracy before submission.

Following these guidelines can significantly increase the likelihood of a smooth and successful refund process. If you have questions or need clarification on certain aspects of the form, don't hesitate to contact the Revenue Department Refund Unit for assistance.

Misconceptions

When dealing with the Wage Tax Refund Petition form, there are several common misconceptions that individuals may have. Understanding the realities behind these myths can help ensure the process is handled correctly and efficiently.

Only for Full-Year Employees: Many people believe that the Wage Tax Refund Petition is only for employees who have worked the entire tax year. However, partial-year employees can also file this petition if they have had a change in employment status, moved in or out of the city, or started or ended a job within the tax year.

Salaried Employees Not Eligible: There is a misconception that this petition is exclusively for commission-based employees and not for those who are salaried. In truth, the petition is focused on commission employees, but salaried individuals with allowable business expenses are also eligible to file for a refund under specific conditions detailed in the form instructions.

All Types of Compensation Are Taxable: It's wrongly assumed at times that all forms of compensation are taxable. The truth is, certain non-taxable benefits, like income from the exercise of employee stock options that are reflected on the W-2, can be excluded from the gross compensation.

No Need for Employer Certification: Another common misunderstanding is that the petition does not require employer certification. Actually, the employer's certification is a crucial part of the petition to verify the employee's claims about their wage tax withheld and to ensure compliance with city regulations.

Deductions Are Automatically Calculated: Some believe that the form or the taxing authority automatically calculates the deductions for non-reimbursed business expenses. In reality, the employee must accurately calculate and provide the necessary breakdown of these expenses, using forms like IRS Form 2106 if applicable.

Only Current Year Taxes Are Refundable: There's a misconception that only taxes from the current year are eligible for a refund. However, the statute of limitations allows for claims to be filed within three years from the date the tax was paid, or due, whichever date is later.

Residents Aren't Eligible for Refunds: A common myth is that city residents cannot apply for a refund. Residents are indeed subject to wage tax, whether working inside or outside Philadelphia, yet they may qualify for refunds based on allowable employee business expenses.

Phone Sales Are Exempt from Tax: There is also a misconception that sales conducted over the phone are not subject to tax. The fact is, if the sale is solicited by phone from within Philadelphia, it is taxable, regardless of where the customer is located.

Only One W-2 is Needed for Multiple Jobs: Some individuals wrongly assume that if they have multiple jobs, they only need to submit one W-2 form with their petition. Each job and corresponding W-2 requires a separate petition to accurately determine the wage tax refund.

Expenses Don't Need To Be Itemized: Lastly, there's a false belief that business expenses don't need to be itemized. In contrast, detailed documentation and itemization of business-related expenses are necessary for the calculation of allowable deductions and should be attached to the petition.

By clarifying these misconceptions, employees and employers can better navigate the Wage Tax Refund Petition process and ensure that all eligible refunds are accurately requested and processed.

Key takeaways

Understanding the process and requirements of filling out the Wage Tax Refund Petition form is essential for commission employees seeking a refund. Below are key takeaways to guide you through completing and submitting this form:

- Ensure all sections of the form are completed accurately, including personal details, employment information, and the specific computations of taxable compensation and allowable expenses.

- Attachment of the W-2 form is mandatory to show Federal, Medicare, State, and Local wages. This serves as supporting documentation for the petition.

- For claims regarding non-reimbursed business expenses on Line 2E, IRS Form 2106 or Schedule A must be attached, including a detailed breakdown if there are entries on Line 4 of Form 2106.

- The form must carry the signatures of both the employee and the employer. The employer certification verifies the accuracy of the information provided based on payroll records. This collaboration is vital for the petition's credibility.

- Understanding the tax rates for residents and non-residents for the relevant tax year is crucial. This affects the computation of taxable compensation and, subsequently, the refund due.

- A separate petition is required for each W-2 issued by employers. This is particularly relevant for employees who may have multiple sources of income or have changed jobs within the tax year.

- The statute of limitations dictates that a claim for refund must be filed within three years from the date the tax was paid or due, whichever is later. Time is of the essence to ensure eligibility for a refund.

- For commission employees, the taxability of sales is contingent upon the place of solicitation. Sales solicited outside Philadelphia may be excluded, affecting the overall taxable compensation.

It's paramount to recognize the importance of each requirement and adhere to the guidelines precisely to facilitate a smooth refund process. For further assistance, reaching out to the Revenue Department Refund Unit is recommended.

Popular PDF Documents

Does Oklahoma Have Personal Property Tax - The form includes sections for reporting leased assets, either leased to others or from others.

Tax Form 4506-t - The document is a vital resource for forensic accountants and auditors probing into financial discrepancies or investigating fraud.