Get W 8Exp Tax Form

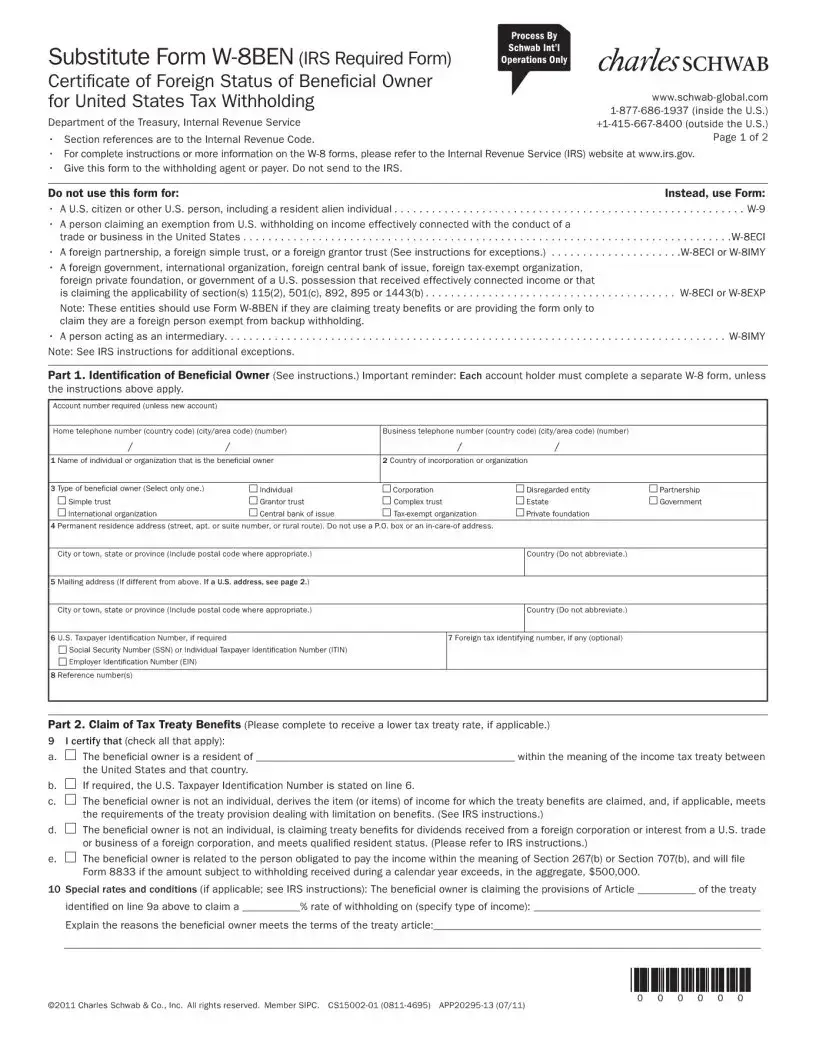

In today's global economy, taxation complexities can often feel overwhelming, particularly for foreign individuals and entities engaging in transactions that involve the United States. A pivotal aspect of navigating this intricate landscape includes understanding the nuances of the W-8BEN form, a critical document designed by the IRS to address the taxation of foreign entities' US-sourced income. At its core, the form serves to establish foreign status, affirm beneficial ownership of the income, and paves the way for potentially claiming reduced withholding rates or exemptions under U.S. tax treaties. Determining beneficial ownership, a key concept on the form, varies depending on the nature of the income and the entity receiving it, which requires careful consideration of U.S. tax principles and treaty provisions. Moreover, foreign individuals and entities must meticulously provide their permanent residence address and the country they claim residency in for tax treaty purposes, fulfilling extensive requirements that ensure compliance while protecting against overwithholding. Entities claiming treaty benefits must also navigate the "limitation on benefits" provisions, a preventative measure against treaty shopping that necessitates a thorough understanding of applicable treaties. With stringent reporting requirements, notifying withholding agents of any changes in circumstances and understanding the form's expiration are also critical for maintaining compliance. As global financial transactions continue to proliferate, the importance of accurately completing the W-8BEN form, and staying abreast of its requirements, cannot be overstated for those looking to manage their tax obligations efficiently and effectively.

W 8Exp Tax Example

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of Form | Used by foreign persons to establish foreign status and to claim beneficial ownership of the income, and if applicable, claim a reduced rate of, or exemption from, withholding. |

| Beneficial Owner Definition | Generally, the beneficial owner of income is the one who must report the income on their U.S. tax return. Exceptions include nominees, agents, conduits, or entities such as foreign trusts and partnerships under certain conditions. |

| Foreign Person Defined | Includes nonresident alien individuals, foreign corporations, partnerships, trusts, estates, and any other non-U.S. entities, including foreign branches of U.S. financial institutions if qualified. |

| Permanent Residence Address | The country where the individual claims residency for income tax purposes. Cannot be a P.O. box, an in-care-of address, or solely a mailing address. |

| Treaty Country Residency Claim | Entities or individuals must indicate their country of residency for income tax treaty benefits and ensure they meet the treaty's residency requirements. |

| Claiming Treaty Benefits | Entities claiming a reduced rate of withholding under a treaty must derive the income and meet any limitation on benefits provisions of the treaty. |

| Income Derived by Resident | An income item is considered derived by a treaty resident if the entity receiving it meets the conditions, or if the interest holders in the entity are not fiscally transparent in their jurisdiction. |

| Change in Circumstances | If information on the W-8BEN becomes incorrect due to changes in circumstances, the form issuer must inform the withholding agent or payer within 30 days and submit a new form. |

| Form Expiration | Without a U.S. Taxpayer Identification Number (TIN), the W-8BEN remains valid from the date it's signed until the end of the third succeeding calendar year, unless circumstances change. |

| Notification of Status Change | If the form issuer becomes a U.S. citizen or resident after submitting the W-8BEN, they must notify the withholding agent or payer within 30 days and may be required to provide a Form W-9. |

Guide to Writing W 8Exp Tax

After receiving the Substitute Form W-8BEN, it signifies the necessary step for a foreign individual or entity to accurately declare their tax status and claim benefits under an income tax treaty with the United States, if applicable. It is vital to fill out this form correctly to ensure compliance with U.S. tax laws and potentially reduce withholding taxes on U.S.-sourced income. Below are detailed, step-by-step instructions to assist in the completion of this form. It is important to provide all requested information accurately and to consult the income tax treaty relevant to your country, if claiming treaty benefits. Notify the withholding agent or payer promptly if your circumstances change.

- Begin by gathering your personal and tax information, including your name, country of citizenship, and tax identification number(s).

- On Line 4, enter your permanent residence address. This should be the address in the country where you claim residency for income tax purposes. Avoid using the address of a financial institution, PO Box, or an address used solely for mailing purposes.

- Proceed to Part 2 of the form. Here, focus on determining your eligibility for any claims under an income tax treaty between your country of residence and the United States.

- In Line 9a, specify the country where you claim residency for the purposes of an income tax treaty.

- For Line 9c, if you are an entity (not an individual) claiming a reduced rate of withholding under an income tax treaty, you must attest that you (1) derive the item of income for which the treaty benefit is claimed, and (2) meet any limitation on benefits provisions specified in the treaty. To confirm whether you meet the treaty’s limitation on benefits provisions, refer to the specific articles within the treaty agreements accessible on the IRS website.

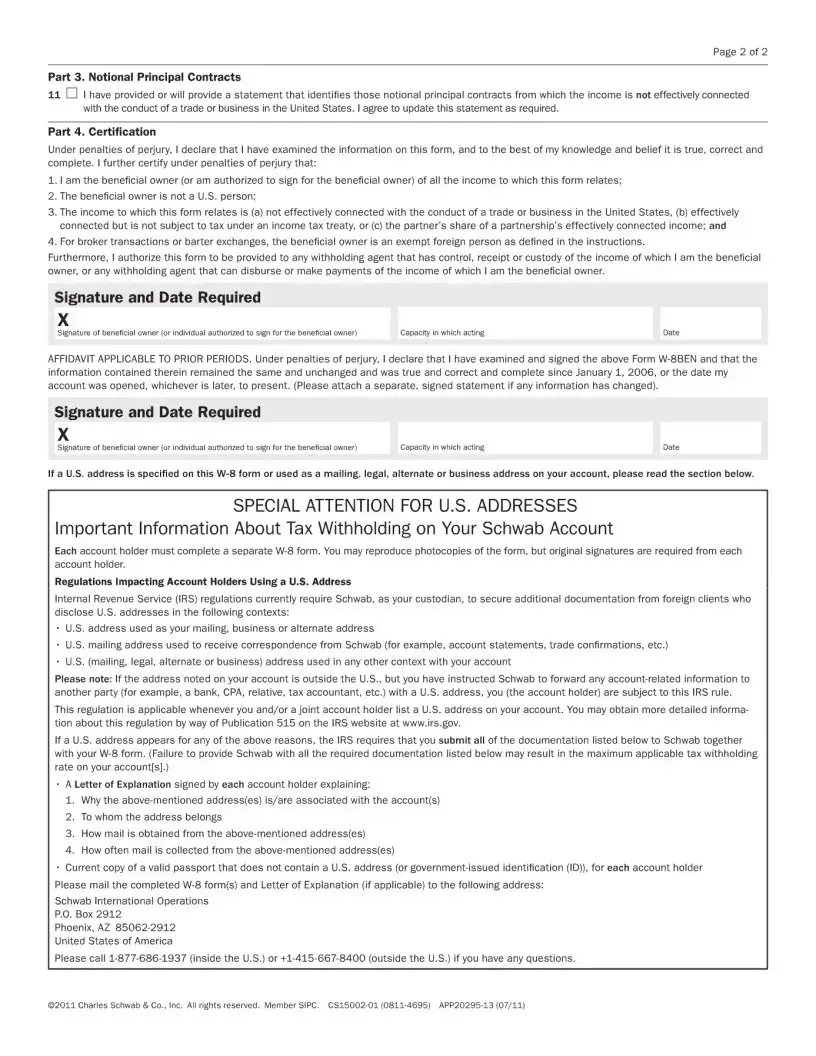

- If there is a change in your circumstances after submitting Form W-8BEN, such as a change in address, becoming a U.S. citizen, or any other factor that alters the correctness of the form, you must inform the withholding agent or payer and submit a new Form W-8BEN within 30 days of the change.

- Remember, a Form W-8BEN without a U.S. Taxpayer Identification Number (TIN) is valid from the date it is signed until the end of the third succeeding calendar year. Regularly review the form for accuracy and update it as necessary.

Once the Substitute Form W-8BEN is duly completed, it should be submitted to the withholding agent or the financial institution requesting it, not to the IRS. It acts as a declaration of your tax status and supports any claims for treaty benefits, thereby potentially reducing the tax withheld from your U.S.-sourced income. Keep a copy for your records in case of disputes or queries regarding your tax withholding.

Understanding W 8Exp Tax

-

What is the purpose of the W-8BEN form?

The W-8BEN form is completed by foreign individuals or entities to establish their status as non-U.S. persons. It's used to claim beneficial ownership of income and, if applicable, to claim a reduced rate of or exemption from withholding tax due to a tax treaty between their country of residence and the United States.

-

Who should use the W-8BEN form?

Foreign individuals or entities, including nonresident alien individuals, foreign corporations, partnerships, trusts, estates, and any other person that is not a U.S. person should use this form. It's also applicable to a foreign branch or office of a U.S. financial institution or clearing organization if the branch qualifies as a foreign person.

-

What constitutes beneficial ownership?

Beneficial ownership generally means the person who is required by U.S. tax principles to include the income in their gross income on a tax return. This excludes those receiving income as nominees, agents, or custodians, or conduits whose participation in a transaction is disregarded. Specific rules apply to determine the beneficial owner for foreign partnerships, trusts, estates, and certain other entities.

-

How do I determine my residency for the W-8BEN form?

Your permanent residence address is needed for Line 4, indicating the country where you're a resident for income tax purposes. Individuals should provide their normal residence if they don't have a tax residence in any country. Entities without a tax residence should use their principal office address.

-

How do I claim treaty benefits with the W-8BEN form?

To claim treaty benefits, enter your residence country on Line 9a, which must have a tax treaty with the U.S. Entities, but not individuals, must also check that they meet the treaty's limitation on benefits provisions, if any, on Line 9c.

-

What should I do if my circumstances change?

If there's a change in your circumstances that makes any information on the Form W-8BEN incorrect, you must notify the withholding agent or payer within 30 days of the change and submit a new W-8BEN or appropriate form. A notable example of a circumstance change is moving to the U.S. or changing your country of residence.

-

When does the W-8BEN form expire?

Without a U.S. Taxpayer Identification Number, the form is valid from the date it's signed until the last day of the third succeeding calendar year. For instance, a form signed on January 10, 2021, would be valid until December 31, 2024. Any change in circumstances requires the submission of a new form.

-

What happens if I become a U.S. citizen or resident after submitting the W-8BEN?

If you become a U.S. citizen or resident, you need to notify the withholding agent or payer within 30 days and may be required to provide a Form W-9, as your tax obligations will change significantly.

Common mistakes

Filling out the W-8BEN form can be tricky, and making mistakes can lead to problems with your tax situation. Here are seven common mistakes people often make:

Not using the correct form version: People sometimes use an outdated form without realizing that tax regulations and forms can change. Always check that you are using the most recent version of the W-8BEN form.

Failing to provide a permanent residence address: Some individuals mistakenly enter a temporary address or a P.O. box instead of their permanent residence address, as required in Line 4 of the form.

Inaccurately determining tax residency: In Part II, Line 9a, you must accurately declare your country of tax residency. Errors here can lead to incorrectly applied treaty benefits or withholding rates.

Not understanding treaty benefits: Claiming a reduced rate of withholding under an income tax treaty requires a good understanding of the treaty between your country and the United States. Misinterpretation can lead to incorrect claims in Line 9c.

Overlooking the ‘Limitation on Benefits’ (LOB) article: Entities often miss that they need to meet the LOB provisions to qualify for treaty benefits. This involves understanding specific treaty articles, which can be complex.

Not updating the form after changes in circumstances: Any change in your situation, like moving to a new country or changing your immigration status, requires you to notify the withholding agent within 30 days and submit a new W-8BEN form, if necessary.

Providing incorrect information about beneficial ownership: It's crucial to correctly determine and declare whether you are the beneficial owner of the income for which the W-8BEN form is being submitted. Misunderstanding the definition can result in incorrect withholding.

These mistakes can have significant implications, such as unnecessary withholding or even penalties. Paying close attention to the form's instructions and seeking guidance if uncertain can help avoid these common errors.

Documents used along the form

Completing the W-8EXP form is a critical process for foreign entities seeking exemption from U.S. tax withholding under specific circumstances. However, to ensure full compliance and leverage tax benefits fully, it's important to be aware of additional forms and documents that may be required alongside the W-8EXP form. Here's a list of commonly used forms that can play a crucial role in the tax reporting and withholding process for foreign entities and individuals.

- Form W-8BEN: Used by foreign individuals to claim foreign status and, if applicable, to claim a reduced rate or exemption from withholding on income tied to U.S. sources.

- Form W-8BEN-E: Tailored for entities, enabling them to assert their foreign status and claim treaty benefits or exemptions from withholding.

- Form W-8ECI: Submitted by foreign entities or individuals to declare that the income linked to the form is effectively connected with the conduct of a trade or business within the U.S.

- Form W-8IMY: Used by intermediaries, such as foreign financial institutions or agents, to certify their status and obligations under the withholding and reporting regime.

- Form W-9: A form used by U.S. persons (including entities) to provide their Taxpayer Identification Number (TIN) to entities that are required to file information returns with the IRS.

- Form 1042: An annual tax return for any U.S. entity that pays income from U.S. sources to foreign persons, including royalties, dividends, and scholarships.

- Form 1042-S: Complements Form 1042, detailing individual payments to foreign persons, and must be provided to both the payee and the IRS.

- Form 8233: Allows nonresident aliens working in the U.S. to claim tax treaty benefits on compensation received for personal services performed.

- Form 8805: Used to report income effectively connected with a U.S. trade or business allocated to foreign partners, alongside the actual amount of the withholding.

Understanding and properly utilizing these forms is instrumental for foreign entities and individuals aiming to navigate the complexities of U.S. tax regulations effectively. Keeping abreast of the requirements for each, and how they interlink with the W-8EXP form, ensures compliance and optimizes tax obligations under U.S. law.

Similar forms

The W-8BEN form is akin to the Form W-8BEN-E, which is utilized by entities to declare their foreign status and, if applicable, claim a reduced withholding tax rate or exemption based on tax treaty benefits. Both forms serve to establish the non-U.S. status of the individual or entity and to assert entitlement to beneficial owner status, though the W-8BEN is for individuals and the W-8BEN-E is for entities. They are designed to ensure compliance with U.S. tax laws by identifying the correct withholding tax rate or exemption under income tax treaties.

Similarly, Form W-9, "Request for Taxpayer Identification Number and Certification", parallels the W-8BEN in its purpose of taxpayer identification, but is used by U.S. persons, including citizens and entities. Where the W-8BEN helps foreign individuals assert their right to certain tax benefits, the W-9 is provided by U.S. taxpayers to inform payers of their tax ID number. The significant distinction lies in the residency status of the individual or entity filling out the form, impacting the withholding tax obligations.

Form 8233, "Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual", shares a common goal with the W-8BEN: to claim exemptions from withholding. However, Form 8233 is specifically aimed at nonresident aliens receiving compensation for personal services performed in the U.S. It allows these individuals to claim a tax treaty exemption that might reduce or eliminate U.S. withholding tax on their income, directly linking the exemption to the individual’s role and activities rather than solely to their investor status.

The Form W-8ECI, "Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States", also parallels the W-8BEN in its design to inform payers about the tax treatment of payments made to foreign persons. However, the W-8ECI specifically relates to income connected with a U.S. trade or business, which is subject to taxation in a manner different from the passive income typically associated with the W-8BEN. The W-8ECI, by specifying that the income is effectively connected, indicates a different tax calculation that considers the net income after allowable deductions.

Similarly, Form W-8IMY, "Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting", shares traits with the W-8BEN in that both are used by entities to declare their status in the context of U.S. tax withholding. The W-8IMY is provided by intermediaries (such as brokers or nominees) or entities that pass income to their investors, necessitating the disclosure of their role in the income payment process. Like the W-8BEN, it helps in applying the correct withholding tax rates but is tailored for the situations where the payee is not the beneficial owner.

Form 1042-S, "Foreign Person's U.S. Source Income Subject to Withholding", while not a form filled out by foreign individuals or entities themselves, is related to the information declared on the W-8BEN. It is used by the withholding agent to report amounts paid to foreign persons, including those who have submitted a W-8BEN form, to the IRS. This form reports the income paid and the withholding taken, acting as a complement to the tax compliance efforts initiated by the W-8BEN, by finalizing the reporting circle from withholding to tax reporting.

Lastly, the Form 8805, "Foreign Partner's Information Statement of Section 1446 Withholding Tax", is another document that shares some functional similarities with the W-8BEN, as it pertains to foreign persons investing in U.S. partnerships. It is particularly used to report and transmit withheld tax on effectively connected income allocable to foreign partners. Though the W-8BEN is not specific to partnership income, like the 8805, it lays the groundwork for identifying the beneficial owner's status and entitlements under tax treaties, influencing how various incomes are taxed and reported to the IRS.

Dos and Don'ts

When completing the W-8EXP tax form, it's essential to adhere to guidelines that ensure accuracy and compliance. Below are four important do's and don'ts to keep in mind:

Do:- Ensure accuracy in representation: Confirm that all provided information accurately represents your status as a foreign individual or entity. This includes your residency and beneficial ownership status.

- Verify treaty eligibility: Before claiming benefits under an income tax treaty, verify your eligibility. Make sure you meet the treaty's residency requirements and any limitation on benefits provisions.

- Update changes promptly: Should any circumstances change that affect the information on your form, notify the withholding agent or payer within 30 days and provide an updated W-8BEN or appropriate form.

- Provide permanent residence address: Always include your permanent residence address in the country where you claim residency for income tax purposes, excluding addresses of financial institutions, P.O. boxes, or mailing addresses.

- Use the form for U.S. persons: The W-8BEN form is strictly for foreign individuals or entities. U.S. persons should provide a Form W-9 instead.

- Omit part of your address: Do not leave out parts of your permanent residence address or use an address not indicative of your tax residency.

- Claim benefits without due eligibility: Do not claim benefits under an income tax treaty without being sure of your eligibility based on residency and other treaty conditions.

- Ignore changes in circumstances: Failing to report changes in circumstances, such as a change in residency status or becoming a U.S. citizen, may lead to incorrect withholding and could result in penalties.

Misconceptions

Misconceptions about the W-8BEN Tax Form can cause confusion for foreign entities and individuals dealing with U.S. income. Here are six common misunderstandings:

- Only Individuals Need to Complete It: While the W-8BEN form is specifically designed for individuals to certify their foreign status and, when applicable, claim treaty benefits, entities such as corporations, partnerships, and trusts may also need to complete a similar form, like the W-8BEN-E, to claim exemptions or benefits under a tax treaty.

- It Grants Exemption from All U.S. Taxes: Completing a W-8BEN form does not automatically exempt a foreign person or entity from all U.S. taxes. It primarily relates to income from U.S. sources that might be subject to withholding. The form can help claim a reduced rate or exemption under a tax treaty, but does not cover all types of U.S. taxation.

- Beneficial Ownership Is Always Clear: The concept of beneficial ownership is significant for the W-8BEN form, especially in determining who is subject to withholding taxes. However, identifying the beneficial owner can be complex, especially with entities like trusts or partnerships where income may be attributed to multiple individuals.

- Any Change of Address Is a Change in Circumstances: Although a change in address can be significant, not every change necessitates an updated W-8BEN. Moving within the same country or to another foreign country doesn't generally require a new form. However, moving to the U.S. or a change that affects treaty eligibility does require updating the withholding agent with a new form.

- A U.S. Taxpayer Identification Number (TIN) Is Always Required: A TIN is not mandatory for the W-8BEN form to be valid, especially if the individual or entity is claiming benefits under a tax treaty that doesn't require a TIN. The form can still be effective for withholding purposes without one, under certain conditions.

- The Form Is Permanently Valid: The W-8BEN form does not have indefinite validity. It typically expires on the last day of the third year following the year it was signed. Furthermore, any change in circumstances that affects the information provided on the form should prompt the submission of a new W-8BEN.

Understanding these aspects of the W-8BEN form can help foreign individuals and entities navigate U.S. tax laws more effectively, ensuring compliance and potentially reducing withholding taxes where applicable.

Key takeaways

Understanding the W-8BEN form is crucial for foreign individuals and entities in establishing their status and navigating U.S. tax obligations effectively. Here are nine key takeaways that can guide through the process:

- The purpose of the W-8BEN form is to establish foreign status, claim beneficial ownership of the income, and, where applicable, to claim a reduced rate of, or exemption from, withholding tax.

- A beneficial owner refers to the person who is required by U.S. tax principles to include the income in their gross income on a tax return, with specific clarifications for entities such as foreign partnerships, trusts, and estates.

- The term "foreign person" encompasses a wide range of entities, including nonresident alien individuals, foreign corporations, foreign partnerships, and estates, among others.

- Your permanent residence address must be provided in Part 1 Line 4 of the form, indicating where you claim residency for tax purposes. This should not be a mailing address but your actual residence.

- To claim a reduced rate of withholding under an income tax treaty, enter the country where you are a resident for tax treaty purposes in Part 2 Line 9a.

- Entities, not individuals, claiming tax treaty benefits must assert that they derive the income and meet any limitation on benefits provision specified by the treaty.

- Income derived by an entity is determined by the fiscal transparency of the entity under the laws of its jurisdiction, with specific provisions for income attribution to interest holders.

- A change in circumstances, such as a change in residency status or becoming a U.S. citizen or resident, requires the submission of a new W-8BEN or applicable form within 30 days.

- The W-8BEN form generally remains effective from the date of signature until the end of the third succeeding calendar year unless invalidated by a change in circumstances.

By understanding these key points, individuals and entities can more accurately complete and utilize the W-8BEN form to comply with U.S. tax regulations while potentially benefiting from tax treaty provisions.

Popular PDF Documents

1099 Forms - Payers must also send a copy of the 1099-MISC form to the state tax department, if required.

IRS 4506T-EZ - With this form, you can request a transcript that shows line items like your adjusted gross income, making tax verification for loans straightforward.