Get Virginia State Tax Return 760 Form

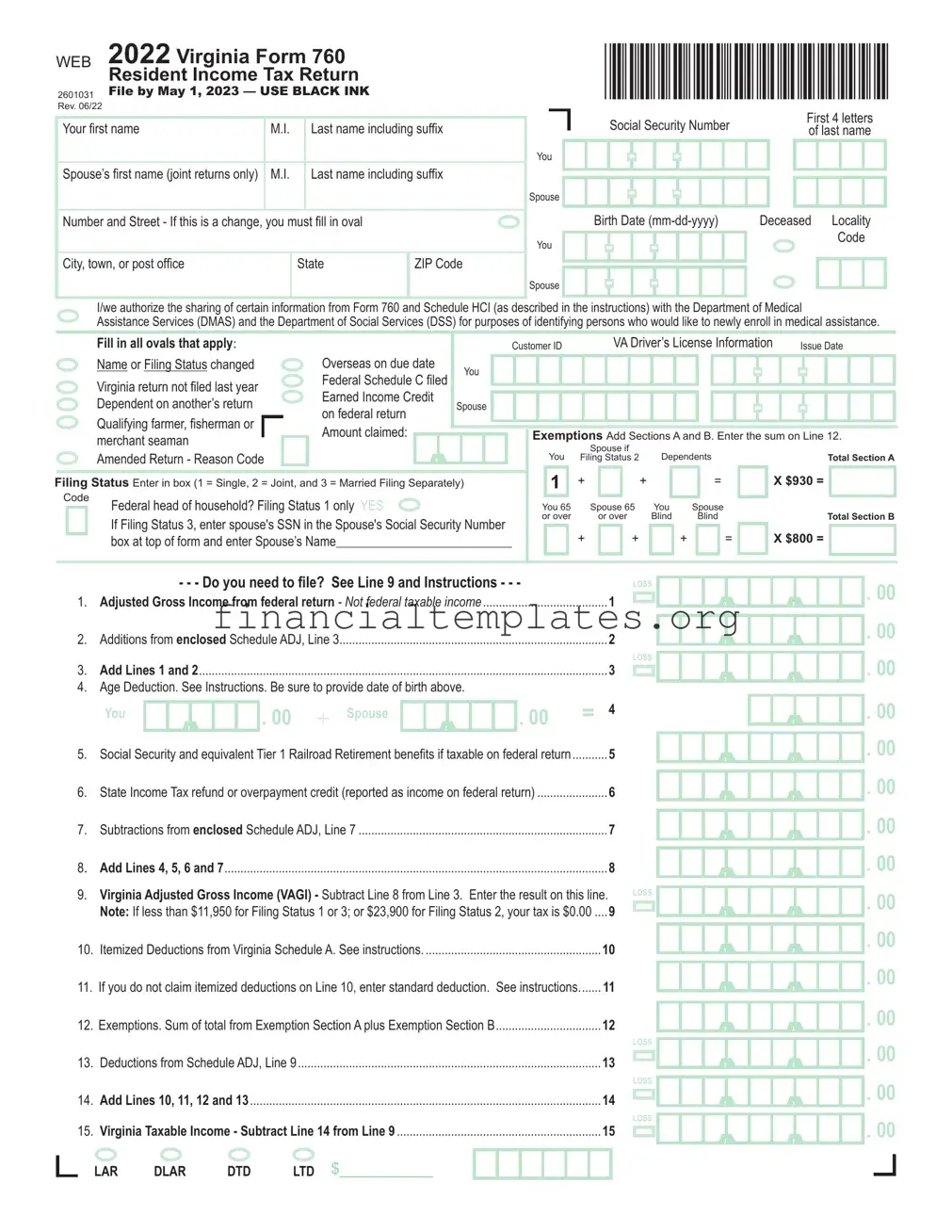

Preparing and filing taxes is an essential responsibility for residents of Virginia, and the Virginia State Tax Return 760 form plays a crucial role in this annual process. This form is designed for residents to declare their income tax for the year 2022, with a filing deadline meticulously set for May 1, 2023. Instructions clearly state the necessity of using black ink for submissions, ensuring clarity and legibility. The Virginia Form 760 covers a wide range of information including personal details such as Social Security numbers, names, addresses, and specifics regarding marital status that directly influence tax computation. It also requires detailed financial data, from adjusted gross income from federal returns to deductions, exemptions, and credits, all aimed at determining the final state income tax liability. Additionally, the form makes provisions for various scenarios — including amendments, considerations for age or blindness, and the option to contribute to Virginia529 and ABLE savings plans or other voluntary contributions. For those seeking refunds or having special instructions around payment methods, such as direct bank deposits, the form accommodates these preferences, emphasizing the state's effort to streamline and personalize the tax return process for its residents.

Virginia State Tax Return 760 Example

2601031 |

File by May 1, 2023 — USE BLACK INK |

*VA0760122888* |

WEB |

2022 Virginia Form 760 |

|

|

Resident Income Tax Return |

|

Rev. 06/22 |

|

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

First 4 letters |

||||||||||||

Your first name |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

of last name |

||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

Spouse’s first name (joint returns only) |

M.I. |

|

Last name including suffix |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Number and Street - If this is a change, you must fill in oval |

|

|

|

|

|

|

|

Birth Date |

Deceased |

Locality |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

||

|

|

|

|

|

You |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City, town, or post office |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

Spouse |

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/we authorize the sharing of certain information from Form 760 and Schedule HCI (as described in the instructions) with the Department of Medical

Assistance Services (DMAS) and the Department of Social Services (DSS) for purposes of identifying persons who would like to newly enroll in medical assistance.

|

|

|

Fill in all ovals that apply: |

|

Overseas on due date |

|

|

|

|

|

Customer ID |

|

|

|

|

VA Driver’s License Information |

|

|

Issue Date |

||||||||||||||||||||||||||||

|

|

|

Name or Filing Status changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

You |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|||||||||

|

|

|

|

Federal Schedule C filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Virginia return not filed last year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Earned Income Credit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Dependent on another’s return |

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|||||||

|

|

|

|

on federal return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Qualifying farmer, fisherman or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

merchant seaman |

|

|

Amount claimed: |

|

|

|

|

|

|

|

|

|

Exemptions Add Sections A and B. Enter the sum on Line 12. |

|||||||||||||||||||||||||||||||

|

|

|

|

|

, |

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

Amended Return - Reason Code |

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

Spouse if |

Dependents |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status 2 |

|

|

|

|

|

Total Section A |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filing Status Enter in box (1 = Single, 2 = Joint, and 3 = Married Filing Separately) |

|

|

|

1 |

|

|

+ |

|

|

|

+ |

|

|

= |

|

|

|

|

|

X $930 = |

|||||||||||||||||||||||||||

Code |

Federal head of household? Filing Status 1 only YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

You 65 |

|

|

Spouse 65 |

You |

Spouse |

|

|

|

|

|

Total Section B |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

If Filing Status 3, enter spouse's SSN in the Spouse's Social Security Number |

|

|

or over |

|

|

|

or over |

Blind |

|

Blind |

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

+ |

|

|

|

+ |

|

+ |

|

|

|

= |

|

|

|

|

|

X $800 = |

|

|

|

|

||||||||||||||||||

|

|

|

box at top of form and enter Spouse’s Name_______________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- - - Do you need to file? See Line 9 and Instructions - - - |

|

|

|

|

|

loss |

|||||||||||||||

1. |

........................................Adjusted Gross Income from federal return - Not federal taxable income |

|

1 |

|

|

|

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

2. |

Additions from enclosed Schedule ADJ, Line 3 |

|

|

|

|

|

|

|

2 |

|

|

|

|||||||||||||

3. |

Add Lines 1 and 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

loss |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4. |

Age Deduction. See Instructions. Be sure to provide date of birth above. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

You |

|

|

|

|

|

. 00 |

+ |

Spouse |

|

|

|

|

|

. 00 |

|

= |

4 |

|

|

|

|||

|

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

............ |

|

5 |

|

|

|

|||||||

5. |

Social Security and equivalent Tier 1 Railroad Retirement benefits if taxable on federal return |

|

|

|

|

|

|||||||||||||||||||

6. |

State Income Tax refund or overpayment credit (reported as income on federal return) |

|

6 |

|

|

|

|||||||||||||||||||

7. |

Subtractions from enclosed Schedule ADJ, Line 7 |

|

|

|

|

|

|

|

7 |

|

|

|

|||||||||||||

8. |

Add Lines 4, 5, 6 and 7 |

........................................................................................................................ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|||||

9. |

Virginia Adjusted Gross Income (VAGI) - Subtract Line 8 from Line 3. |

Enter the result on this line. |

loss |

||||||||||||||||||||||

|

|

Note: If less than $11,950 for Filing Status 1 or 3; or $23,900 for Filing Status 2, your tax is $0.00 |

9 |

|

|

|

|||||||||||||||||||

|

|

|

|

||||||||||||||||||||||

10. |

Itemized Deductions from Virginia Schedule A. See instructions |

|

|

|

|

|

|

|

10 |

|

|

|

|||||||||||||

11. If you do not claim itemized deductions on Line 10, enter standard deduction. See instructions |

|

11 |

|

|

|

||||||||||||||||||||

12. Exemptions. Sum of total from Exemption Section A plus Exemption Section B |

|

12 |

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

13. |

Deductions from Schedule ADJ, Line 9 |

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add Lines 10, 11, 12 and 13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

loss |

|||||||||||

15. |

Virginia Taxable Income - Subtract Line 14 from Line 9 |

|

|

|

|

|

|

|

|

15 |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

LAR |

DLAR |

DTD |

LTD |

|

$_________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

, |

, |

, |

, |

, |

|

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

WEB Page 2 |

*VA0760222888* Your SSN |

2022 Form 760 |

-

-

16. |

Amount of Tax from Tax Table or Tax Rate Schedule (round to whole dollars) |

.................................... |

|

|

|

16 |

||||||||||||

17. |

Spouse Tax Adjustment (STA). Filing Status 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 17 |

|||

|

only. Enter Spouse’s VAGI in box here |

è |

loss |

|

|

|

, |

|

|

|

, |

|

|

|

||||

|

and STA amount on Line 17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

18. |

Net Amount of Tax - Subtract Line 17 from Line 16 |

|

|

|

|

|

|

|

|

18 |

||||||||

19. |

Virginia income tax withheld for 2022. Enclose copies of Forms |

|||||||||||||||||

|

19a. |

Your Virginia withholding |

........................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

19a |

|

|

19b. |

Spouse’s Virginia withholding (Filing Status 2 only) |

|

|

|

|

|

|

|

|

19b |

|||||||

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

.................................................... |

|

|

|

|

|

|

|

20 |

||||

20. |

Estimated tax payments for taxable year 2022 (from Form 760ES) |

|

|

|

|

|||||||||||||

21. |

Amount of 2021 overpayment applied toward 2022 estimated tax |

|

|

|

21 |

|||||||||||||

22. |

Extension Payments (from Form 760IP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|||

23. |

Tax Credit for |

23 |

||||||||||||||||

24. |

Credit for Tax Paid to Another State from Schedule OSC, Line 21 |

|

|

|

24 |

|||||||||||||

|

You must enclose Schedule OSC and a copy of all other state returns. |

|

|

|

|

|||||||||||||

25. |

Credits from enclosed Schedule CR, Section 5, Part 1, Line 1A |

|

|

|

25 |

|||||||||||||

26. |

Add Lines 19a through 25 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

||

27. |

If Line 26 is less than Line 18, subtract Line 26 from Line 18. |

This is the Tax You Owe |

27 |

|||||||||||||||

28. |

If Line 18 is less than Line 26, subtract Line 18 from Line 26. |

This is Your Tax Overpayment |

........... 28 |

|||||||||||||||

29. |

Amount of overpayment you want credited to next year’s estimated tax |

|

|

|

29 |

|||||||||||||

30. |

Virginia529 and ABLE Contributions from Schedule VAC, Section I, Line 6 |

|

|

|

30 |

|||||||||||||

31. |

Other Voluntary Contributions from Schedule VAC, Section II, Line 14 |

|

|

|

31 |

|||||||||||||

32. |

Addition to Tax, Penalty, and Interest from enclosed Schedule ADJ, Line 21 |

|

|

|

32 |

|||||||||||||

|

See instructions |

enclose 760C or 760F and fill in oval. |

|

|

|

|

||||||||||||

33. Sales and Use Tax is due on Internet, mail order, and

|

See instructions. |

............................ fill in oval if no sales and use tax is due |

33 |

|

34. |

Add Lines 29 through 33 |

34 |

||

35. |

If you owe tax on Line 27, add Lines 27 and 34. OR If Line 28 is less than Line 34, subtract Line 28 |

|

||

|

from Line 34. Enclose payment or pay at www.tax.virginia.gov |

AMOUNT YOU OWE |

35 |

|

|

|

fill in oval if paying by credit or debit card - see instructions |

|

|

36. If Line 28 is greater than Line 34, subtract Line 34 from Line 28 |

YOUR REFUND |

36 |

||

|

If the Direct Deposit section below is not completed, your refund will be issued by check. |

|

||

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

. 00

DIRECT BANK DEPOSIT |

Bank Routing Transit Number |

||||||||

Domestic Accounts Only. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No International Deposits. |

|

|

|

|

|

|

|

|

|

I (We) authorize the Dept. of Taxation to discuss this return with my (our) preparer.

Bank Account Number |

Checking |

Savings |

I agree to obtain my Form

I (We), the undersigned, declare under penalty of law that I (we) have examined this return and to the best of my (our) knowledge, it is a true, correct, and complete return.

Your Signature |

Date |

Spouse’s Signature |

Date |

Your |

- |

- |

Spouse‘s |

- |

- |

ID Theft |

Phone |

Phone |

PIN |

|

|

Preparer’s Name |

Firm Name |

Phone Number |

Filing Election |

|

|

|

Preparer’s PTIN |

||||||

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The document is identified as the 2022 Virginia Form 760 Resident Income Tax Return. |

| Revision Date | The form was revised in June 2022. |

| Filing Deadline | Taxpayers are required to file by May 1, 2023. |

| Governing Law | This tax return form is under the jurisdiction of Virginia state laws and regulations. |

Guide to Writing Virginia State Tax Return 760

Filling out the Virginia State Tax Return Form 760 correctly is crucial for ensuring accurate taxation and avoiding potential penalties. This document, used for filing individual resident income tax, requires attention to detail and an understanding of one's financial activities over the past year. The following steps are structured to guide you through this process efficiently.

- Gather all necessary documents, including Social Security numbers, W-2 forms, 1099 forms, and any other relevant income or deduction information.

- Using black ink, begin by entering your and, if applicable, your spouse's Social Security Numbers in the designated spaces. Do this carefully to avoid errors.

- Fill in your first name, middle initial, and last name, along with the same information for your spouse if you are filing jointly. Ensure that the first four letters of your first name are clearly written.

- Indicate any changes in your address by filling in the Number and Street section and checking the corresponding box if applicable. Then, fill in the City, town, or post office, State, and ZIP Code.

- Input your birth date and, if applicable, that of your spouse in the format mm-dd-yyyy. Mark the “Deceased” box if relevant.

- Select your locality code from the provided instructions and enter it in the designated space.

- Mark any applicable circles that describe your filing situation, such as being overseas on the due date, having a change in name or filing status, having filed a Federal Schedule C, etc.

- Under "Filing Status," choose the appropriate status by entering 1 for Single, 2 for Joint, and 3 for Married Filing Separately in the box provided.

- Determine your exemptions and enter the totals in Section A for yourself and your spouse, if applicable. Calculate the total exemptions and enter this amount on Line 12.

- Report your adjusted gross income from your federal return on Line 1.

- Add any additional income as instructed on the form and enter the total on Line 2.

- Calculate your Virginia Adjusted Gross Income (VAGI) by following the form's instructions and entering the amount on Line 9.

- Decide whether to itemize deductions or take the standard deduction, filling the appropriate line on the form.

- Subtract your deductions from your VAGI and report your Virginia Taxable Income on Line 15.

- Use the Tax Table or Tax Rate Schedule to determine your tax amount and enter this on Line 16. Remember to calculate and add any relevant adjustments for a spouse if filing jointly.

- Fill in your Virginia income tax withheld, estimated tax payments, and any tax credits as per the instructions on the form.

- Calculate your tax due or overpayment by following the form's instructions and enter the amounts on the respective lines.

- Provide your banking information for a direct deposit refund or calculate the amount you owe, including any penalties or interest.

- Review the form for completeness and accuracy. Sign and date it, along with your spouse if filing jointly.

- Attach all required documentation, such as W-2s, 1099s, and schedules, and mail your completed form to the address provided in the instructions by May 1, 2023.

Ensure that the information provided is accurate and complete to facilitate a smooth processing of your tax return. Incomplete or incorrect forms may lead to delays or inquiries from the Virginia Department of Taxation. Take your time with each step and refer to the provided instructions for clarification on any specific line items or requirements.

Understanding Virginia State Tax Return 760

Who needs to file a Virginia Form 760?

Any resident of Virginia who has earned income during the tax year must file Form 760. This requirement includes individuals who are employed, self-employed, or receiving income from other sources such as pensions or investments that exceed the state's filing thresholds. Specifically, if your Virginia Adjusted Gross Income (VAGI) is more than $11,950 for single filers or Married Filing Separately, or $23,900 for joint filers, you must file a return.

What is the deadline for filing Form 760?

The deadline for filing your Virginia Form 760 is May 1st of the year following the tax year. For the 2022 tax year, for example, the filing deadline is May 1, 2023. If you are overseas on the due date, additional provisions may apply.

How do exemptions work on Form 760?

Exemptions reduce your taxable income. On Form 760, exemptions are calculated in two sections: Section A for personal and spousal exemptions, and Section B for dependents, age 65 or over, or blindness. The sum of these sections is entered on Line 12, which then contributes to determining your Virginia Taxable Income.

Can deductions be itemized on the Virginia tax return?

Yes, taxpayers can choose to itemize deductions if it is more beneficial than taking the standard deduction. You must complete the Virginia Schedule A and attach it to your Form 760 if you opt for itemized deductions. Remember, the choice should be based on which option lowers your taxable income the most.

What is Virginia Schedule ADJ and who must file it?

Schedule ADJ is used to make any adjustments to your income or to claim any deductions or credits not accounted for on the main Form 760. If you have specific adjustments such as deductions for contributions to a Virginia529 plan, subtractions for certain types of income, or adjustments for penalty on early withdrawal of savings, you will need to file Schedule ADJ alongside your Form 760.

Is there a provision for tax credits for low-income individuals or families?

Yes, Virginia offers tax credits for low-income individuals or families, which can be claimed on Schedule ADJ, Line 17. This includes the Earned Income Credit (EIC), which is a refundable tax credit aimed at aiding those with lower incomes. It's important to fill out all applicable sections if you believe you qualify for these credits.

What if I need to amend a previously filed Form 760?

If you need to amend a previously filed Form 760, you should check the "Amended Return" box on the form and provide a reason code for the amendment. You will then adjust your income, deductions, credits, or payments as necessary to correct the original filing. It's critical to include all relevant documentation with your amended return.

How does one pay any tax owed or receive a refund?

If you owe additional taxes, you can make payments online at the Virginia Department of Taxation website or via traditional mail. If you are expecting a refund, you can opt for direct bank deposit by providing your bank routing and account numbers, ensuring a faster and secure way to receive your refund. Alternatively, refunds can be issued by check.

What are the regulations around filing for an extension?

To file for an extension, you must submit Form 760IP by the original filing due date, May 1. This grants you an additional six months to file your return, though it's important to note that the extension only applies to the filing of the return, not to any payment due. Thus, estimated taxes should still be paid by May 1 to avoid penalties and interest.

Common mistakes

Filling out tax forms can often be challenging and is a process where mistakes can easily happen. When completing the Virginia State Tax Return Form 760, individuals might encounter issues that can affect the accuracy of their return. Some of these errors include:

- Not using black ink as instructed, which may lead to processing delays or errors in reading the form.

- Incorrectly reporting Social Security numbers or omitting them altogether, which is crucial for identity verification and accurate processing of the tax return.

- Failing to accurately report the filing status, or changing it without proper indication, can lead to discrepancies in tax calculations and liabilities.

- Omitting or inaccurately reporting income, deductions, and credits, including but not limited to the Earned Income Credit, Deductions from Schedule ADJ, and tax payments already made. This mistake can significantly alter the tax calculation, resulting in underpayment or overpayment of taxes.

- Not attaching required documents, such as copies of Forms W-2, 1099, VK-1, or the Schedule OSC for claiming credit for tax paid to another state. These documents are essential for verifying income and tax credits.

- Forgetting to sign and date the return or not providing the preparer’s information if applicable. The signature verifies that the taxpayer agrees with the information submitted, and it is a legal requirement for the tax return to be processed.

Making sure to avoid these common pitfalls can help ensure the tax return process is smooth and error-free. Taking time to review the form carefully, double-checking all entries, and ensuring all required documentation is attached are critical steps in this process.

Documents used along the form

When preparing and filing the Virginia State Tax Return 760 form, several other forms and documents often accompany it to ensure the accuracy and completeness of an individual's tax records. These additional forms may include those for reporting specific types of income, claiming deductions or credits, and adjusting previously filed tax information. Understanding these documents can simplify the tax filing process.

- Form 760ES, Estimated Income Tax Payment Vouchers: Used by individuals to make quarterly estimated tax payments throughout the year if they expect to owe tax on income not subject to withholding.

- Schedule ADJ, Virginia Adjustments and Deductions: Allows filers to make adjustments to their federal adjusted gross income and to claim any deductions not included on the federal return, such as certain state tax refunds or other specific deductions allowed by Virginia.

- Schedule OSC, Credit for Tax Paid to Another State: This schedule is for residents who have paid income tax to another state. It helps them calculate the credit they can claim on their Virginia return to avoid double taxation of the same income.

- Form W-2, Wage and Tax Statement: Employers provide this form to employees, detailing the employee's income and taxes withheld during the year. Filers must attach this document to their return to report their earnings and the taxes already paid.

- Schedule CR, Credits: Used to claim various credits for which a taxpayer may be eligible, such as the credit for low-income individuals or families, or credits related to education expenses, contributions to Virginia529 accounts, or energy efficiency improvements.

Together with the Virginia Form 760, these documents form a comprehensive tax filing that reflects an individual's total income, tax adjustments, withholdings, and credits for a given year. By accurately completing and including all relevant forms, taxpayers can ensure they meet their tax obligations while taking advantage of any allowances or credits for which they may be eligible. This careful attention to detail can help in avoiding common tax filing errors and in some cases, may lead to a more favorable tax outcome.

Similar forms

The IRS Form 1040, U.S. Individual Income Tax Return, shares notable similarities with the Virginia State Tax Return Form 760. Both forms collect comprehensive personal and financial information to determine the amount of tax owed to the government. This includes income details, deductions, credits, and personal exemptions. The structure and purpose align closely, offering a federal and state-level view on taxpayers' obligations.

Form 760ES, Virginia Estimated Income Tax Payment Vouchers, is akin to Form 760 in that it deals with income tax within Virginia but is used for estimating and paying taxes on income not subject to withholding. This includes earnings from self-employment, interest, dividends, and other sources. Both forms require an understanding of one’s income and tax rates to correctly calculate the tax due.

The Schedule ADJ (Virginia Schedule of Adjustments) works directly with Form 760 to adjust gross income through deductions and additions specific to Virginia’s tax laws. It mirrors the relationship between the federal Schedule A (Itemized Deductions) and Form 1040, where taxpayers can itemize deductions to lower taxable income, thus affecting the final tax calculation on the main return form.

The Virginia Schedule CR (Credits) that supplements Form 760 is similar to the various federal tax credit forms, such as Form 8863 for Education Credits or Form 5695 for Residential Energy Credits. Both sets of forms allow taxpayers to claim credits for certain qualified expenses, which can directly reduce the amount of tax owed rather than just taxable income.

Form 760PMT, Payment Voucher for Previously Filed Individual Income Tax Returns, is designed for submitting payments after filing Form 760 if taxes are owed. This parallels the IRS Form 1040-V (Payment Voucher), utilized when mailing payments for taxes due on the federal return. Both serve as a mechanism for facilitating tax payments separate from the initial return filing.

The Schedule OSC (Credit for Tax Paid to Another State) is a companion to Form 760 for taxpayers who need to account for taxes paid to other states. This form mirrors the concept of the federal Foreign Tax Credit, though the latter applies to taxes paid to foreign governments. The underlying principle is to prevent double taxation on the same income.

Virginia Form 763, Nonresident Individual Income Tax Return, shares a core purpose with Form 760 but is specifically tailored to nonresidents who have income sourced from Virginia. This form closely relates to the federal Form 1040NR, U.S. Nonresident Alien Income Tax Return, which serves nonresidents with U.S. sourced income. Despite the different target demographic, both forms address state and federal tax requirements for nonresident income.

Dos and Don'ts

When preparing your Virginia State Tax Return using Form 760, efficiency and accuracy are paramount. To help guide you through this process, here is a list of dos and don'ts that could save you time and help avoid common pitfalls.

- Do use black ink when filling out the form, as specified in the instructions. This ensures your form is legible and machine-readable.

- Do not estimate or round off numbers. Report exact amounts to ensure accuracy of your tax calculations.

- Do double-check your Social Security Number (SSN) and the SSN of your spouse if filing jointly. Incorrect or missing SSNs can lead to processing delays.

- Do not leave any fields blank that apply to your tax situation. If a particular field does not apply, make sure to enter “0” instead of leaving it empty.

- Do remember to sign and date your return. Both you and your spouse (if filing jointly) need to sign. An unsigned tax return is like not filing at all, leading to delays and possible penalties.

- Do not forget to include documentation such as W-2 forms, 1099 forms, and schedules that support your income, deductions, and credits claimed.

- Do check if you qualify for any deductions or credits that you have not claimed. Reviewing the instructions and schedules could potentially reduce your tax liability.

- Do not disregard the deadlines. Filing late can result in penalties and interest on any taxes owed. Remember, the due date for filing is May 1.

By adhering to these guidelines, you can help ensure a smoother process for filing your Virginia State Tax Return, potentially avoiding common errors that could lead to delays or an audit. Remember, when in doubt, refer to the official instructions or consult with a tax professional.

Misconceptions

There are several misconceptions surrounding the Virginia State Tax Return 760 form. Understanding these can help taxpayers file more accurately and efficiently.

- Misconception #1: The form is only for Virginia residents. While Form 760 is designated for Virginia residents, it's crucial for anyone who has earned income in Virginia to review whether they need to file, as different circumstances may necessitate filing this form.

- Misconception #2: All income is taxable in Virginia. While Virginia does tax a wide range of income, there are specific types of income that are subtracted from the federal adjusted gross income to arrive at the Virginia Adjusted Gross Income (VAGI), such as certain social security and railroad retirement benefits.

- Misconception #3: You can't file an amended return using Form 760. If you discover an error on your original filing, you can indeed file an amended return. There's a specific section on the form for indicating it's an amended submission and reason codes to describe the amendment basis.

- Misconception #4: Taxpayers must itemize deductions if they did on their federal return. Virginia allows taxpayers to decide whether to itemize deductions or take the standard deduction regardless of their choice on their federal return. This provides flexibility in optimizing tax liability.

- Misconception #5: Filing status on the Virginia return must match the federal return. Although often the case, there are scenarios, especially concerning married couples, where filing statuses might differ between federal and state returns to the tax advantage of the filer.

- Misconception #6: The due date is always April 15. The form clearly states the due date as May 1, providing Virginia taxpayers with additional time beyond the typical federal deadline.

- Misconception #7: Direct deposit is not available for refunds. Virginia offers direct deposit for tax refunds. Taxpayers can have their refunds deposited directly into their checking or savings account, ensuring faster access to their funds.

- Misconception #8: A professional tax preparer must fill out the form. While using a tax professional can be helpful, Virginia's Form 760 is designed to be accessible for individuals to complete on their own. Instructions are provided to guide taxpayers through the process, and additional help is available through the Virginia Tax website.

Understanding the specifics of the Virginia State Tax Return 760 form can demystify the process and help taxpayers file more confidently and accurately.

Key takeaways

When it comes to filling out your Virginia State Tax Return 760 form, understanding the basics can make the process smoother and ensure accuracy on your submission. Here are six key takeaways:

- Deadline Matters: It's crucial to file by May 1, 2023. Missing this deadline could lead to penalties or interest charges on any taxes owed.

- Use Black Ink: For clarity and scanning purposes, fill out the form using black ink. This ensures your information is readable and properly processed.

- Accurate Social Security Numbers: Double-check the social security numbers for both you and, if applicable, your spouse. Mistakes here can lead to processing delays or errors in your tax assessment.

- Report All Income Accurately: Include all sources of income, as required on the form. This includes wages, salaries, and any additional earnings, to ensure your tax liability is calculated correctly.

- Understand Your Deductions: Make sure to claim any applicable deductions correctly. This includes standard deductions, itemized deductions, and any adjustments for age or blindness. Understanding these can significantly impact your taxable income.

- Direct Deposit for Refunds: For a faster refund, opt for direct deposit by providing your banking details. Ensure the account and routing numbers are accurate to avoid any delays in receiving your refund.

By keeping these key points in mind, you can navigate the 760 form more confidently and fulfill your tax responsibilities effectively. Remember, when in doubt, consulting the instructions provided or seeking professional advice can help clarify any confusions and avoid common pitfalls.

Popular PDF Documents

Types of Non Profits - Requires detailed documentation of financial transactions to ensure accurate public support calculations.

Form 8823 Instructions - Corrections to previously reported noncompliance can also be documented using this form, ensuring up-to-date records.

Lancaster County Tax Collection Bureau - Special instructions are provided for taxpayers who work in areas with non-resident tax rates that exceed their home jurisdiction, ensuring fair tax practices.