Get Virginia Sales Tax Exemption Form

In the state of Virginia, the intricacies of sales and use tax exemptions are navigated with the help of the Virginia Sales Tax Exemption Form, known as Form ST-12. This critical document serves an essential role, facilitating tax-free purchases of tangible personal property by certain entities, effectively streamlining the process for governmental bodies and the United States government to acquire goods without the additional burden of tax. The form outlines that such exemptions are specifically earmarked for use or consumption by the Commonwealth of Virginia, its political subdivisions, or the United States. Notably, it draws a clear boundary, specifying that these exemptions do not extend to private corporations, regardless of their charter origins. For transactions under this exemption, the form necessitates the provision of an official purchase order, ensuring that all acquisitions are transparently documented and are to be settled with public funds. It encompasses a variety of purchases, including but not limited to, prepared meals and catering, alongside other tangible goods and taxable services, thereby covering a broad spectrum of potential government procurement needs. To maintain its validity, this certificate must be properly executed by an authorized representative of the government entity involved, thereby testifying to the accuracy and integrity of the intention to adhere to the stipulations laid out by the Virginia Retail Sales and Use Tax Act.

Virginia Sales Tax Exemption Example

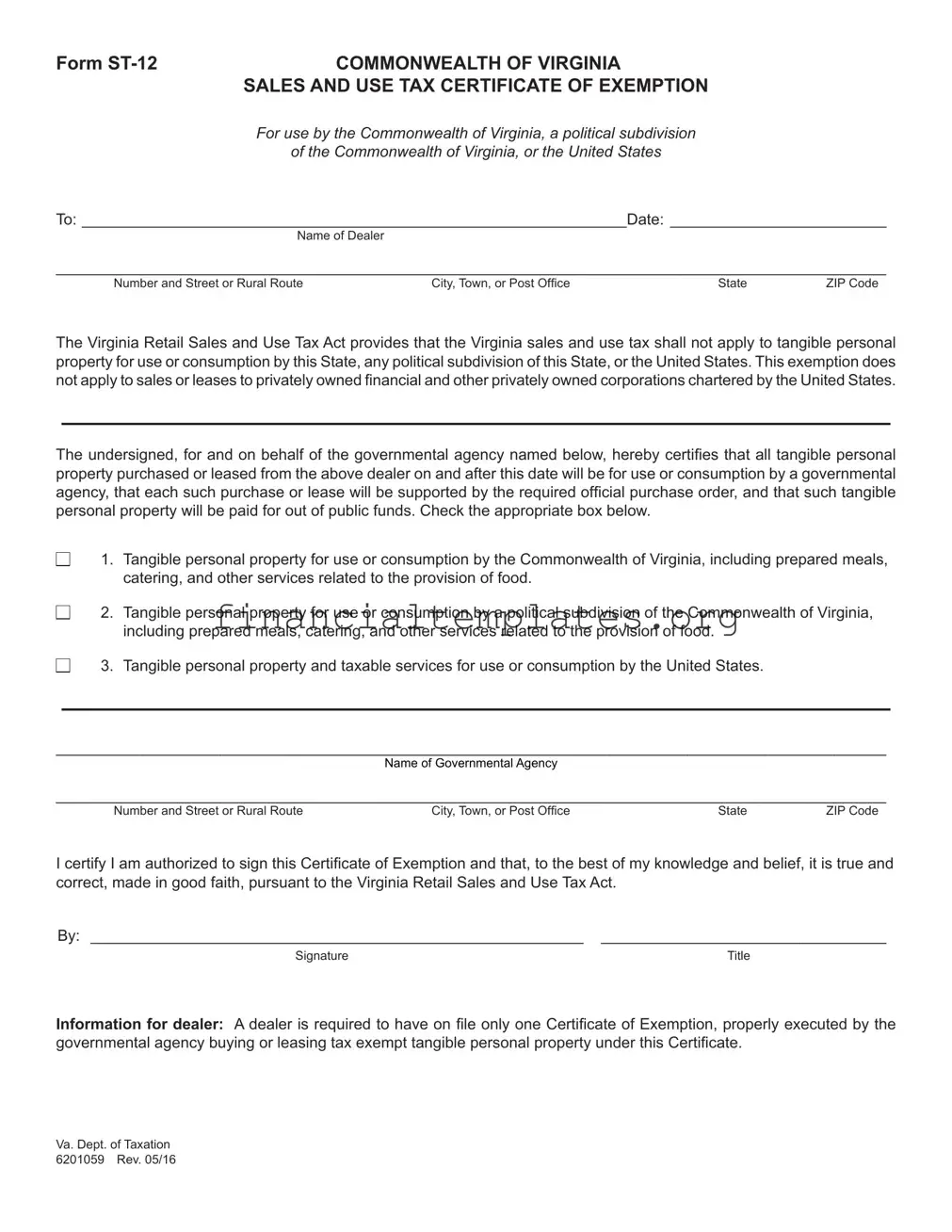

FORM |

COMMONWEALTH OF VIRGINIA |

|

SALES AND USE TAX CERTIFICATE OF EXEMPTION |

|

For use by the Commonwealth of Virginia, a political subdivision |

|

of the Commonwealth of Virginia, or the United States |

To: _______________________________________________________________Date: _________________________

Name of Dealer

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Ofice |

State |

ZIP Code |

The Virginia Retail Sales and Use Tax Act provides that the Virginia sales and use tax shall not apply to tangible personal property for use or consumption by this State, any political subdivision of this State, or the United States. This exemption does not apply to sales or leases to privately owned inancial and other privately owned corporations chartered by the United States.

The undersigned, for and on behalf of the governmental agency named below, hereby certiies that all tangible personal property purchased or leased from the above dealer on and after this date will be for use or consumption by a governmental agency, that each such purchase or lease will be supported by the required oficial purchase order, and that such tangible personal property will be paid for out of public funds. Check the appropriate box below.

1. Tangible personal property for use or consumption by the Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

2. Tangible personal property for use or consumption by a political subdivision of the Commonwealth of Virginia, including prepared meals, catering, and other services related to the provision of food.

3. Tangible personal property and taxable services for use or consumption by the United States.

________________________________________________________________________________________________

Name of Governmental Agency

________________________________________________________________________________________________

Number and Street or Rural Route |

City, Town, or Post Ofice |

State |

ZIP Code |

I certify I am authorized to sign this Certiicate of Exemption and that, to the best of my knowledge and belief, it is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _________________________________________________________ |

_________________________________ |

Signature |

Title |

INFORMATION FOR DEALER: A dealer is required to have on ile only one Certiicate of Exemption, properly executed by the governmental agency buying or leasing tax exempt tangible personal property under this Certiicate.

Va. Dept. of Taxation 6201059 Rev. 05/16

Document Specifics

| Fact | Description |

|---|---|

| Form Title | FORM ST-12 COMMONWEALTH OF VIRGINIA SALES AND USE TAX CERTIFICATE OF EXEMPTION |

| Purpose | For use by the Commonwealth of Virginia, political subdivisions, or the United States to certify exemption from Virginia sales and use tax. |

| Governing Law | Virginia Retail Sales and Use Tax Act |

| Exemption Scope | The exemption applies to tangible personal property for use or consumption by eligible governmental entities. |

| Limitations | The exemption does not apply to sales or leases to privately owned financial and other privately owned corporations chartered by the United States. |

| Requirements for Exemption | The purchase or lease must be supported by an official purchase order and paid for out of public funds. |

| Dealer Obligations | A dealer is required to keep on file one properly executed Certificate of Exemption from each governmental agency. |

Guide to Writing Virginia Sales Tax Exemption

Filling out the Virginia Sales Tax Exemption form is a critical process for governmental agencies that wish to purchase or lease tangible personal property without being charged sales tax. This exemption applies strictly to agencies of the Commonwealth of Virginia, its political subdivisions, or the United States, but not to privately owned corporations, even if chartered by the U.S. government. Understanding the correct way to complete this form ensures that transactions are processed smoothly, allowing these entities to benefit from tax exemptions as intended by the Virginia Retail Sales and Use Tax Act.

- Start by entering the Date of the transaction on the designated line at the top of the form.

- Complete the Name of Dealer section with the full name and address of the dealer from whom the property is being purchased or leased. This includes the dealer's number and street or rural route, city, town or post office, state, and ZIP code.

- In the section provided, check the appropriate box to indicate whether the tangible personal property is for use or consumption:

- by the Commonwealth of Virginia, including prepared meals, catering, and other food-related services;

- by a political subdivision of the Commonwealth of Virginia, including similar food services; or

- by the United States, including both tangible personal property and taxable services.

- Fill in the Name of Governmental Agency making the purchase or lease, ensuring to provide its detailed address, including number and street or rural route, city, town or post office, state, and ZIP code in the spaces provided.

- The individual authorized to certify the exemption must sign in the designated "By" section and provide their title in the adjacent space. This affirms that the information is accurate, complete, and made in good faith, adhering to the regulations set forth in the Virginia Retail Sales and Use Tax Act.

- Lastly, be mindful that the dealer is required to keep this Certificate of Exemption on file. It only needs to be submitted once, properly executed, by the governmental agency engaging in tax-exempt transactions under this certificate.

After the completion and submission of the Virginia Sales Tax Exemption form, the governmental agency may proceed with the purchase or lease of tangible personal property, leveraging the exemption provided. Dealers are advised to retain a copy of this duly completed form for record-keeping and compliance purposes. This documentation serves as a critical step in ensuring the transparency and legality of tax-exempt transactions conducted by eligible government entities.

Understanding Virginia Sales Tax Exemption

What is the purpose of the Virginia Sales Tax Exemption form?

The Virginia Sales Tax Exemption form, also known as FORM ST-12, is designed for use by the Commonwealth of Virginia, its political subdivisions, or the United States to certify that purchases of tangible personal property or certain services are exempt from Virginia sales and use tax. This exemption is intended for goods and services to be used or consumed by the governmental agency making the purchase, thereby not applying to sales or leases to privately owned financial institutions and other privately owned corporations chartered by the United States.

Who can use the Virginia Sales Tax Exemption form?

This form is explicitly designed for use by governmental agencies within Virginia or the federal government. It applies to the Commonwealth of Virginia itself, any political subdivisions of the Commonwealth, and any United States government entities making purchases or leases for governmental use.

What type of purchases does this exemption cover?

The exemption covers all tangible personal property purchased or leased by eligible governmental agencies. This includes prepared meals, catering, and other services related to the provision of food, intended for use or consumption by the agency. Taxable services purchased for governmental use are also covered under this exemption.

How does a governmental agency apply for this exemption?

An authorized representative of the governmental agency must fill out the FORM ST-12, indicating the specific use of tangible personal property or services. They must certify that all purchases or leases made from the dealer mentioned in the form will be for governmental use or consumption and will be paid for with public funds. Upon completion, the form is given to the vendor from whom the goods or services are being purchased or leased.

Is it necessary to fill out a new form for each purchase?

No, dealers are required to keep only one properly executed Certificate of Exemption on file for each governmental agency. This means once a form has been completed and submitted to the dealer, it covers all subsequent purchases or leases by that governmental agency, provided the conditions of exemption are continuously met.

Can privately owned corporations use this form to claim exemption?

No, the form and the corresponding tax exemption do not apply to privately owned corporations, even if they are chartered by the United States. The exemption is solely for the consumption or use by governmental agencies.

What is the dealer's responsibility in this process?

Dealers are responsible for keeping a properly executed Certificate of Exemption on file for each governmental agency they do business with. This record-keeping ensures that the tax exemption is applied correctly to all eligible purchases by the agency. It is part of the dealer's duty to maintain accurate tax records and comply with the Virginia Retail Sales and Use Tax Act.

What happens if the information on the form changes?

If any of the information pertaining to the governmental agency changes, such as the address or the authorized representative, a new Virginia Sales Tax Exemption form must be completed and submitted to the dealer. This ensures that the exemption is correctly applied to future purchases under the updated information.

Common mistakes

When dealing with the Virginia Sales Tax Exemption form, certain pitfalls frequently trip up individuals. Recognizing and avoiding these mistakes can streamline the process, ensuring that transactions remain compliant with the Commonwealth's stipulations. Herein, we delineate four common errors to beware:

Not verifying the eligibility of the organization. An oversight often encountered is the assumption that all purchases or leases by governmental entities are exempt without scrutinizing the specific criteria laid out by the Virginia Retail Sales and Use Tax Act. It's crucial to understand that this exemption distinctly does not extend to sales or leases to privately owned financial and other privately owned corporations chartered by the United States.

Inadequately detailing the nature of the purchase. The form requires the purchaser to check the appropriate box indicating whether the tangible personal property or taxable services are for use or consumption by the Commonwealth of Virginia, a political subdivision of the Commonwealth, or the United States. Neglecting to provide this specificity can lead to ambiguity about the exemption's applicability, potentially resulting in the rejection of the exemption claim.

Failing to ensure the signatory is authorized. The certification at the bottom of the form necessitates that the individual signing is authorized to do so on behalf of the governmental agency. An all-too-common error is having the form signed by someone without the requisite authority, which invalidates the certificate. Confirming the signatory's authority beforehand can preempt this issue.

Omitting the official purchase order. Each purchase or lease made under this exemption must be backed by the required official purchase order. A lapse here, where transactions are executed without this critical documentation, constrains the transparency and traceability of the exempted purchases, leaving room for compliance complications.

In sum, when filling out the Virginia Sales Tax Exemption form, meticulous attention to detail and a thorough understanding of the underlying requirements are indispensable. Organizations must vigilantly validate their eligibility, accurately describe the nature of their purchases, ensure the signatory has proper authorization, and maintain the necessary official purchase orders. By sidestepping these frequent mistakes, entities can effectively navigate the exemption process, ensuring that their transactions align with the stipulations of the Virginia Retail Sales and Use Tax Act.

Documents used along the form

When navigating the complexities of tax exemptions in Virginia, particularly under the realm governed by the Virginia Sales Tax Exemption form (FORM ST-12), it's essential to familiarize oneself with various other documents and forms that frequently accompany this certificate. These documents are pivotal in ensuring compliance, facilitating smooth transactions, and ultimately safeguarding the interests of all parties involved, from governmental agencies to the supplying dealers. Below is a concise list and description of these crucial documents.

- Certificate of Incorporation or Organization: Verifies the legal existence of the business or non-profit engaging in transactions and may be required to establish eligibility for certain exemptions.

- Business License: Demonstrates that the business is authorized to operate within the municipality or jurisdiction, potentially relevant when claiming exemptions tied to locality-specific rules.

- IRS Determination Letter: For non-profits, this document confirms the organization's tax-exempt status under the IRS code, which could be pertinent when exemptions are claimed based on federal tax exemption.

- Use Tax Certificate: Accompanies purchases that are exempt from sales tax but might be subject to use tax under certain circumstances, ensuring compliance with state use tax regulations.

- Purchase Order: Indicates the specifics of the transaction, including the exemption claim. It should match the details on the exemption certificate to validate the exemption's applicability to the purchase.

- Annual Financial Statement: Although not directly related, it might be requested to provide evidence of the qualifying activities that support the claimed exemption, particularly for organizations claiming exemptions based on the nature of their operations.

- Exemption Application Form: Some exemptions require a pre-approval process, necessitating this form to be completed and approved by the Virginia Department of Taxation before making exempt purchases.

- Vendor's License: While not directly related to the purchaser's exemption status, it’s evidence that the dealer is authorized to collect sales tax and, therefore, to acknowledge exemptions.

- Power of Attorney (POA): A legal document granting an individual the authority to act on behalf of the agency or business in tax-related matters, potentially useful in handling complex exemption claims or audits.

Together, these documents form a comprehensive toolkit that, alongside the Virginia Sales Tax Exemption form, ensures organizations can confidently navigate tax regulations. They protect against non-compliance risks and streamline the process of claiming exemptions. Understanding and preparing these documents in advance can significantly ease the administrative burden and facilitate a smoother transaction process for all parties involved.

Similar forms

The Federal Tax Exemption Certificate is quite similar to the Virginia Sales Tax Exemption form in its functional purpose. Both documents are designed to grant tax-exempt status to eligible organizations or entities, ensuring they are not charged taxes on their purchases. The Federal Tax Exemption Certificate, however, is used on a national level for entities that meet federal tax exemption criteria, such as nonprofit organizations and charities, as opposed to the Virginia-specific designation for state, political subdivisions, or the United States as listed in the Virginia sales tax exemption form.

Another document resembling the Virginia Sales Tax Exemption form is the State Resale Certificate. Businesses use this certificate when purchasing goods they intend to resell, thereby exempting them from paying sales tax on such items. While both certificates prevent the payment of sales tax, the Resale Certificate specifically targets goods for resale versus the broader use exemption for government-related purchases detailed in the Virginia exemption form.

The Nonprofit Organization Exemption Certificate also shares similarities with the Virginia exemption form, as both serve to exempt qualified entities from tax liabilities on purchases. The key distinction lies in the eligibility criteria, where the Nonprofit Organization Exemption Certificate is specifically reserved for organizations recognized as exempt under federal law (e.g., 501(c)(3) entities), focusing on charitable, religious, educational, or scientific purposes, contrasting with the Virginia form's government-focused exemption.

The Agricultural Exemption Certificate offers tax relief similar to that of the Virginia Sales Tax Exemption form, but it is tailored for individuals or entities engaged in farming and agriculture-related activities. This certificate allows for the tax-free purchase of items directly used in agricultural production, highlighting sector-specific tax relief compared to the broader government and public funds emphasis in the Virginia document.

The Direct Pay Permit is another related document that authorizes a business to directly pay sales or use tax on taxable purchases instead of the seller collecting it at the time of purchase. This permits businesses with complex tax situations to manage their tax liabilities directly with the state. Though it shares the concept of tax handling with the Virginia Sales Tax Exemption form, the Direct Pay Permit is based on direct tax payment rather than exemption.

The Streamlined Sales Tax Exemption Certificate facilitates tax-exempt purchases across multiple states, adhering to the Streamlined Sales and Use Tax Agreement. It's akin to the Virginia Sales Tax Exemption form in providing tax exemptions but differs in its multi-jurisdictional application, unlike the Virginia-specific use. This broad applicability makes it convenient for entities operating in multiple states.

The Manufacturer's Sales Tax Exemption Certificate closely parallels the Virginia exemption form by offering a tax exemption for goods used in manufacturing. This certificate specifically exempts items used directly in the production process, ensuring that manufacturers can procure necessary materials or machinery without incurring state sales tax, thus highlighting a targeted exemption approach akin to but more specific than the Virginia form's application.

The Energy or Utility Use Tax Exemption Certificate, which exempts qualifying organizations or activities from taxes on energy, fuel, or utility use, mirrors the Virginia Sales Tax Exemption form in its provision of tax exemption. Though both certificates aim to reduce tax liabilities for eligible parties, the Energy or Utility Use Exemption focuses on utilities and energy, reflecting environmental or cost-saving motivations distinct from the governmental and public service orientation of the Virginia form.

Lastly, the Governmental Agencies Property Tax Exemption form, similar to its sales tax counterpart, exempts property owned and used by governmental entities from property taxes. While the Virginia Sales Tax Exemption form pertains to sales and use tax on purchases, the Property Tax Exemption is concerned with taxes levied on property ownership. Both forms share the commonality of granting tax advantages to government entities, illustrating varied facets of tax exemption within government operations.

Dos and Don'ts

When filling out the Virginia Sales Tax Exemption form, there are specific actions that should and should not be done to ensure the process is completed correctly and efficiently. It is crucial to pay attention to these dos and don'ts to prevent any complications that might arise from incorrect submissions.

Do:

- Ensure that you are an authorized representative of the governmental agency, the Commonwealth of Virginia, or a political subdivision of the Commonwealth of Virginia, to fill out the form.

- Accurately and completely fill in the name and address of the dealer from whom the tangible personal property or services are being purchased or leased.

- Select the appropriate box that identifies the type of governmental entity making the purchase or lease, to clarify the exemption status under the Virginia Sales and Use Tax Act.

- Provide a clear and accurate description of the governmental agency, including its address and contact information, to validate the exemption request.

- Sign and date the form to certify that the information provided is true and correct to the best of your knowledge and belief.

Don't:

- Fail to check the appropriate exemption box for the type of governmental entity making the purchase, as this is essential for the exemption to be processed correctly.

- Overlook the requirement to support each purchase or lease with the required official purchase order. This documentation is crucial for validating the tax-exempt status of each transaction.

- Leave any sections incomplete, especially those requiring detailed information about the governmental agency or the specific items being purchased or leased.

- Attempt to use this form for purchases or leases by privately owned financial and other privately owned corporations chartered by the United States, as the exemption does not apply to these entities.

- Forget to keep a copy of the filled-out form for your records, as dealers are required to have a properly executed Certificate of Exemption on file.

Misconceptions

Understanding the Virginia Sales Tax Exemption form (Form ST-12) is crucial for both dealers and purchasers. However, several misconceptions surround its provisions and applicability. Clarifying these misconceptions ensures compliance and proper utilization of the exemptions provided under the Virginia Retail Sales and Use Tax Act.

- Misconception 1: The exemption applies to all purchases made by nonprofit organizations.

This is incorrect. The exemption specifically applies to the Commonwealth of Virginia, any political subdivision of the Commonwealth, or the United States. Nonprofit organizations, unless they are governmental agencies, are not automatically exempt under this form.

- Misconception 2: Any purchase made by a governmental agency is exempt, regardless of the nature of the use.

Contrary to this belief, the exemption only covers tangible personal property or taxable services intended for use or consumption by the governmental entity. Items for personal use or those not directly related to governmental services do not qualify.

- Misconception 3: Privately owned financial institutions chartered by the United States are eligible for exemption.

Despite being chartered by the United States, privately owned financial and other corporations do not qualify for this exemption. This exception ensures that the exemption is targeted towards governmental entities and their essential functions.

- Misconception 4: A verbal assertion of exemption is sufficient at the point of sale.

Verbal claims are not acceptable. The law requires that every exempt purchase or lease be supported by an official purchase order and a properly executed Certificate of Exemption foiled with the dealer.

- Misconception 5: Once a dealer has a Certificate of Exemption on file, it applies to all transactions with the concerned government agency.

While it's true that a dealer needs to maintain only one Certificate of Exemption per governmental agency, each transaction must still be justified as exempt based on its own merits, including an official purchase order.

- Misconception 6: The exemption covers all forms of purchases, including services.

The form does extend to some taxable services but only when these services are for use or consumption by the Commonwealth, its political subdivisions, or the United States. However, not all services might qualify; each service needs to be evaluated individually.

- Misconception 7: The Certificate of Exemption does not require regular renewal.

The form itself does not explicitly state an expiration or renewal period, leading to the assumption it's once and done. However, it behooves the governmental entity and the dealer to ensure that the authorization remains accurate and in compliance with any changes in the law or the entity's status.

By dispelling these misconceptions, dealers and governmental agencies can steer clear of inadvertent misapplications of the Virginia Sales Tax Exemption form and ensure both compliance with the law and the integrity of public resources.

Key takeaways

Understanding the Virginia Sales Tax Exemption form is crucial for properly conducting transactions that are exempt from sales and use tax within the Commonwealth. Here are key takeaways for using this form effectively:

- Who Can Use It: This form is specifically designed for the Commonwealth of Virginia, its political subdivisions, or the United States when they are the purchasers. Private entities do not qualify for this exemption.

- Exemption Scope: The exemption applies to tangible personal property intended for use or consumption by qualifying governmental bodies. This includes everything from office supplies to prepared meals and catering services.

- Non-Eligible Entities: It's important to note that sales or leases to privately owned financial institutions and other corporations chartered by the United States are not covered by this exemption.

- Documentation: A valid, official purchase order is required to support each purchase or lease claiming exemption under this certificate. This serves as proof that the transaction is authorized and for use by a governmental agency.

- Payment Information: All purchases or leases made under this exemption must be paid for with public funds. This reinforces that the transaction is genuinely for public, not private use.

- Dealer Responsibility: Dealers selling or leasing items under this exemption must retain a properly executed Certificate of Exemption. Only one certificate per governmental agency is necessary.

- Accuracy and Compliance: The person signing the Certificate of Exemption must be authorized to do so. By signing, they certify that the information provided is accurate, true, and in compliance with the Virginia Retail Sales and Use Tax Act.

- Periodic Verification: While the document does not specify a validation period, it's imperative for both dealers and governmental agencies to ensure that their exemption certifications remain current and reflect any changes in regulation or status.

The Virginia Sales Tax Exemption form is a critical document for eligible governmental purchasers. Proper completion and usage ensure compliance with the state's sales and use tax laws, preserving public funds and ensuring that tax exemptions are applied correctly and responsibly.

Popular PDF Documents

IRS 8959 - This form helps individuals determine if they owe extra taxes on wages, compensation, and self-employment income exceeding specific limits.

IRS Schedule K-1 1065 - Partners rely on the Schedule K-1 1065 form to make informed financial decisions and for future tax planning.

Zanesville City Tax - By indicating the nature of the business, companies help the city tailor its economic development and support strategies.