Blank Vehicle Repayment Agreement Form

In the landscape of automotive financing, the Vehicle Repayment Agreement form emerges as a pivotal document, harmonizing the interests of lenders with those of borrowers. This integral piece of paperwork, serving as a binding agreement, charts out the repayment terms for a vehicle loan in clear, unambiguous language. It meticulously outlines the loan amount, interest rate, repayment schedule, penalties for late payments, and the conditions under which a vehicle may be repossessed in the event of default. By doing so, it not only provides a solid framework for financial transactions but also ensures transparency and trust between the parties involved. Through its establishment of clear expectations and legal responsibilities, this form plays a critical role in protecting the rights of both the lender and the borrower, thereby facilitating a smoother path to vehicle ownership.

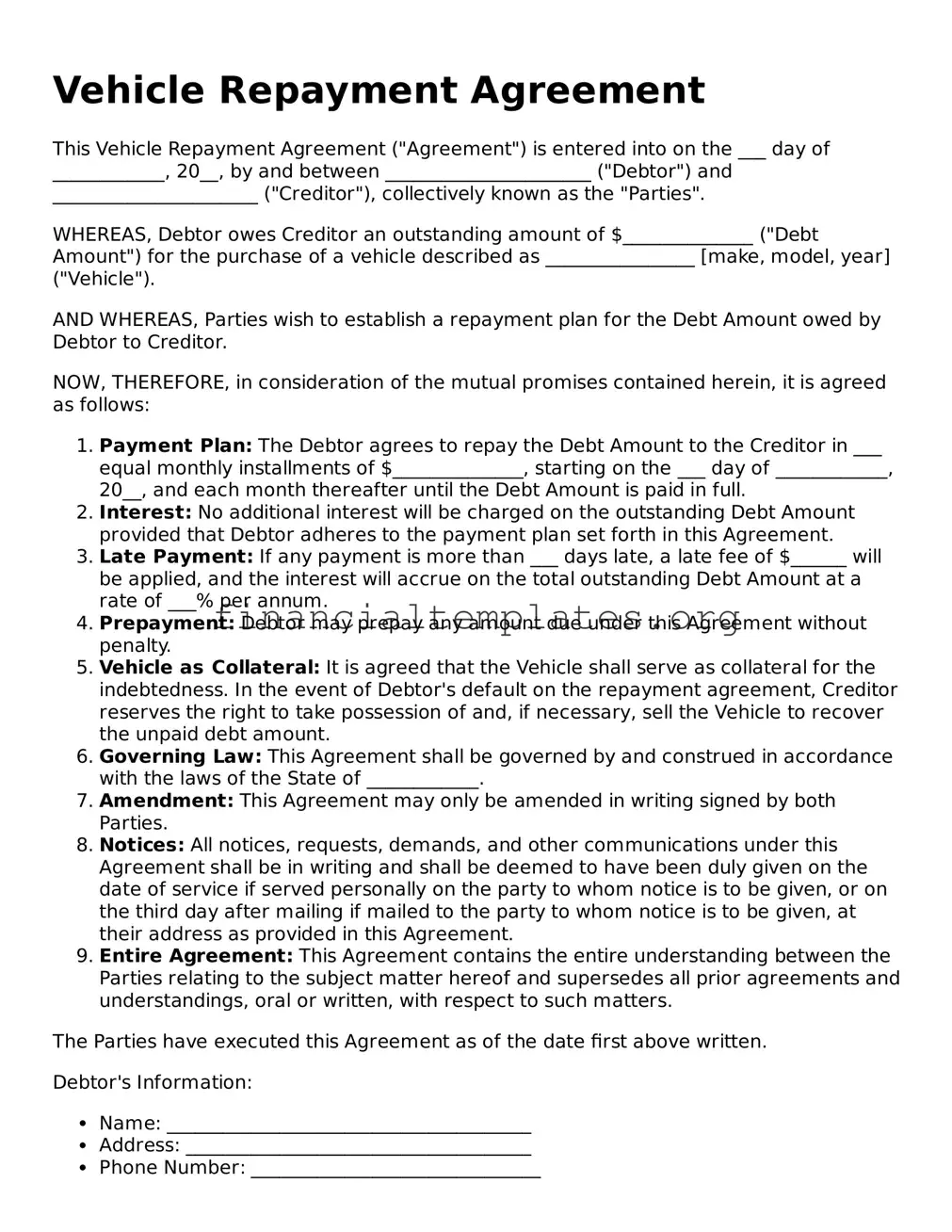

Vehicle Repayment Agreement Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is entered into on the ___ day of ____________, 20__, by and between ______________________ ("Debtor") and ______________________ ("Creditor"), collectively known as the "Parties".

WHEREAS, Debtor owes Creditor an outstanding amount of $______________ ("Debt Amount") for the purchase of a vehicle described as ________________ [make, model, year] ("Vehicle").

AND WHEREAS, Parties wish to establish a repayment plan for the Debt Amount owed by Debtor to Creditor.

NOW, THEREFORE, in consideration of the mutual promises contained herein, it is agreed as follows:

- Payment Plan: The Debtor agrees to repay the Debt Amount to the Creditor in ___ equal monthly installments of $______________, starting on the ___ day of ____________, 20__, and each month thereafter until the Debt Amount is paid in full.

- Interest: No additional interest will be charged on the outstanding Debt Amount provided that Debtor adheres to the payment plan set forth in this Agreement.

- Late Payment: If any payment is more than ___ days late, a late fee of $______ will be applied, and the interest will accrue on the total outstanding Debt Amount at a rate of ___% per annum.

- Prepayment: Debtor may prepay any amount due under this Agreement without penalty.

- Vehicle as Collateral: It is agreed that the Vehicle shall serve as collateral for the indebtedness. In the event of Debtor's default on the repayment agreement, Creditor reserves the right to take possession of and, if necessary, sell the Vehicle to recover the unpaid debt amount.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

- Amendment: This Agreement may only be amended in writing signed by both Parties.

- Notices: All notices, requests, demands, and other communications under this Agreement shall be in writing and shall be deemed to have been duly given on the date of service if served personally on the party to whom notice is to be given, or on the third day after mailing if mailed to the party to whom notice is to be given, at their address as provided in this Agreement.

- Entire Agreement: This Agreement contains the entire understanding between the Parties relating to the subject matter hereof and supersedes all prior agreements and understandings, oral or written, with respect to such matters.

The Parties have executed this Agreement as of the date first above written.

Debtor's Information:

- Name: _______________________________________

- Address: _____________________________________

- Phone Number: _______________________________

- Email: _______________________________________

Creditor's Information:

- Name: _______________________________________

- Address: _____________________________________

- Phone Number: _______________________________

- Email: _______________________________________

IN WITNESS WHEREOF, the Parties have signed this Agreement on the date specified at the beginning of this document.

______________________________ ______________________________

Debtor's Signature Creditor's Signature

______________________________ ______________________________

Date Date

PDF Properties

| Fact Number | Fact Detail |

|---|---|

| 1 | A Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan used to purchase a vehicle. |

| 2 | This agreement typically includes important details such as the total loan amount, interest rate, repayment schedule, and any late fees. |

| 3 | The agreement serves as a binding commitment between the lender, often a financial institution or a dealership, and the borrower, ensuring the terms of the loan are clearly defined and agreed upon by both parties. |

| 4 | State-specific forms may incorporate specific legal requirements and protections based on the governing law of the state where the agreement is executed. For instance, interest rates might be capped at a certain percentage in some states. |

| 5 | In the event of a dispute, the Vehicle Repayment Agreement can serve as a critical piece of evidence in court to determine the intent and agreement of the parties involved. |

| 6 | For a Vehicle Repayment Agreement to be legally binding, it must be signed by both the lender and the borrower. Witness signatures and/or notarization may also be required depending on state laws. |

| 7 | Defaulting on the terms of the agreement, such as failing to make payments on time, can result in severe consequences including repossession of the vehicle or legal action. |

| 8 | The agreement may also specify whether the borrower is allowed to sell the vehicle before the loan is fully repaid and under what conditions. |

| 9 | Some Vehicle Repayment Agreements may include a 'prepayment penalty' clause, which charges the borrower a fee if they pay off the loan early. |

Guide to Writing Vehicle Repayment Agreement

After deciding to formalize the terms of a vehicle repayment, participants are required to accurately complete a Vehicle Repayment Agreement form. This document is essential for ensuring all parties have a clear understanding of their rights and obligations regarding the financial arrangement. It provides a structured outline for specifying the amount borrowed, interest rates, repayment schedule, and the consequences of non-compliance. Following the right steps to fill out this form not only legalizes the agreement but also serves as a vital record that can be referenced in the event of a dispute.

- Begin by entering the date the agreement is being made at the top of the form.

- Fill out the full names and addresses of both the lender and the borrower in the designated sections.

- Specify the principal amount of the loan, which is the total amount of money being borrowed, without including any interest.

- Detail the interest rate being applied to the principal amount, if any, and ensure it complies with the state's legal maximum if applicable.

- Outline the repayment schedule. This includes the frequency of payments (e.g., monthly), the amount of each payment, and the total number of payments. If there's a final lump sum payment, also known as a balloon payment, include this information as well.

- Include a clause on late payment fees and the grace period, specifying the amount due for late payments and the time frame the borrower has to make a payment before a fee is imposed.

- Clearly state the consequences if the borrower fails to meet the repayment terms, such as repossession of the vehicle or other legal actions.

- Describe any collateral securing the loan. In most cases, the vehicle itself acts as collateral. Detail the make, model, year, and VIN (Vehicle Identification Number) of the vehicle.

- Both parties should carefully review the agreement to ensure all information is correct and complete. Any amendments should be made prior to signing.

- Have both the borrower and the lender sign and date the form. Depending on your state's requirements, you may also need a witness or notary public to sign the agreement.

Once the Vehicle Repayment Agreement form is fully executed, both parties should keep a copy for their records. It is advisable to also consider filing a copy with the relevant government body that handles vehicle registrations and liens, ensuring that the agreement is recognized and can be enforced according to law. Completing this form is a critical step in affirming a mutual understanding and commitment to the repayment plan, laying a foundation for a transparent and structured financial relationship.

Understanding Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement?

A Vehicle Repayment Agreement is a legally binding document between two parties, typically the borrower and the lender, regarding the financing of a vehicle. It outlines the loan amount, interest rate, repayment schedule, and the rights and responsibilities of each party. This type of agreement ensures that both sides understand the terms of the loan and what is expected to avoid any misunderstandings or disputes related to the vehicle's repayment.

Why do I need a Vehicle Repayment Agreement?

Having a Vehicle Repayment Agreement is crucial because it provides a clear, enforceable record of the loan's terms. It can protect both the lender and borrower's interests, ensuring that the lender receives payments on time and the borrower understands their repayment obligations. Additionally, in case of disagreements, this document can serve as evidence in legal proceedings to support the agreed-upon terms between the parties.

What should be included in a Vehicle Repayment Agreement?

- Detailed information about the borrower and lender (names, addresses, contact information).

- Description of the vehicle (make, model, year, VIN).

- Loan amount and financing details (interest rate, repayment schedule).

- Signatures of both parties, indicating their agreement to the terms.

- Any additional terms or conditions pertinent to the loan or the vehicle itself.

Can I modify a Vehicle Repayment Agreement after it's been signed?

Yes, a Vehicle Repayment Agreement can be modified after it's been signed, but any changes must be agreed upon by both the lender and borrower. The modifications should be put in writing, and both parties should sign the amendment. This ensures that the agreement remains enforceable and reflects the new terms accurately.

What happens if the borrower fails to make payments as agreed?

If the borrower fails to make payments as outlined in the Vehicle Repayment Agreement, they may face consequences as specified in the agreement, such as late fees, repossession of the vehicle, or legal action. The lender has the right to enforce the agreement's terms to recover the owed amount or regain possession of the vehicle.

Is a Vehicle Repayment Agreement legally binding in all states?

Yes, a Vehicle Repayment Agreement is considered legally binding if it meets the legal requirements in the state where it's executed. This includes being signed by both parties and, in some cases, being notarized. However, the specific regulations and enforcement can vary by state, so it's essential to ensure the agreement complies with local laws.

Do I need a lawyer to draft a Vehicle Repayment Agreement?

While you don't necessarily need a lawyer to draft a Vehicle Repayment Agreement, consulting one can be beneficial. A lawyer can ensure that the agreement complies with state laws and fully protects your rights. They can also help address any complex issues or negotiations involved in the agreement process.

How do I ensure my Vehicle Repayment Agreement is enforceable?

To make sure your Vehicle Repayment Agreement is enforceable, ensure that it is clearly written, outlines all loan terms, and is signed by both parties. It's also essential to follow any state-specific requirements, such as notarization, if applicable. Keeping accurate records and a copy of the agreement is also crucial for enforcement purposes.

What are the benefits of having a Vehicle Repayment Agreement?

The benefits of having a Vehicle Repayment Agreement include clear communication of the loan terms, protection of both the lender's and borrower's interests, and provision of a legal document to resolve any disputes. It adds a level of professionalism and ensures that both parties are committed to the terms of the repayment plan.

Can the Vehicle Repayment Agreement be used for any type of vehicle?

Yes, a Vehicle Repayment Agreement can be used for any type of vehicle, including cars, motorcycles, boats, and RVs. The important aspect is to clearly describe the vehicle in the agreement and ensure that all other terms and conditions are appropriately set and agreed upon by both parties.

Common mistakes

When filling out the Vehicle Repayment Agreement form, it's crucial to provide accurate and complete information. Nevertheless, several common mistakes often occur during this process. Identifying and understanding these mistakes can help individuals avoid potential complications and ensure their agreements are valid and enforceable.

Not specifying the full names of all parties involved. It's important for the document to clearly identify the buyer and the seller (or borrower and lender) by their full legal names to avoid any confusion.

Overlooking the vehicle details. The make, model, year, VIN (Vehicle Identification Number), and any other identifiable information should be accurately listed to ensure the specific vehicle is legally bound by the agreement.

Failing to detail the loan amount and repayment plan. The agreement must distinctly outline the total amount being financed and the schedule of repayments, including dates and amounts for each installment.

Omitting interest rates, if applicable. If the loan carries an interest, the exact rate and how it's applied should be explicitly mentioned.

Ignoring late fees and consequences of default. The agreement should clearly describe any late fees and detail what constitutes a default and the subsequent steps that may be taken.

Not stating the jurisdiction governing the agreement. Clearly specifying the state laws that will govern the agreement is essential for legal clarity.

Forgetting signatures and dates. Both parties need to sign and date the agreement for it to be enforceable. Missed signatures or dates can render the document legally void.

Lack of witness or notary acknowledgments, if required. Some agreements may need to be witnessed or notarized to be valid; failing to include this step when necessary can be a critical error.

Misunderstanding "As Is" clause implications. If the vehicle is being sold "as is," this needs to be clearly stated, so the buyer understands they accept the vehicle in its current condition, without guarantees.

Not keeping a copy of the signed agreement. Both parties should keep a signed copy of the agreement for their records. Not doing so can lead to disputes down the line with no documentation to refer back to.

Avoiding these mistakes not only makes the Vehicle Repayment Agreement legally sound but also protects the interests of all parties involved. Paying careful attention to each item can ensure a smoother and more secure transaction.

Documents used along the form

When entering into a Vehicle Repayment Agreement, various other documents are frequently involved to ensure a comprehensive and legally sound process. These documents serve different purposes, from verifying the condition and ownership of the vehicle to ensuring the agreement is legally binding and enforceable. Understanding the role each document plays can provide individuals with a clearer perspective on what to expect and prepare for during the process.

- Bill of Sale: This document acts as a receipt, showing that the vehicle has changed hands from the seller to the buyer. It typically includes the vehicle's make, model, year, VIN (Vehicle Identification Number), and the sale price.

- Promissory Note: Similar to the Vehicle Repayment Agreement, a Promissory Note outlines the borrower's promise to repay the seller according to the terms agreed upon, such as the loan amount, interest rate, and payment schedule.

- Loan Agreement: This formalizes the loan terms for the vehicle, detailing the obligations of both borrower and lender. It's more detailed than a promissory note and includes clauses about default and repossession.

- Vehicle Title: This document proves ownership of the vehicle. It needs to be transferred from the seller to the buyer once the vehicle is fully paid for, according to the terms of the Vehicle Repayment Agreement.

- Odometer Disclosure Statement: Federal law requires this statement when transferring a vehicle to document the mileage at the time of sale. This helps prevent odometer fraud.

- As-Is Sale Agreement: When a vehicle is sold "as-is," it means that the seller is not making any guarantees about the vehicle's condition. This agreement clarifies that the buyer accepts the vehicle in its current state.

- Insurance Proof: This is proof of the vehicle's insurance coverage, which may be required by the lender to protect their investment until the loan is fully repaid.

- Release of Liability: This form is filed with the state's DMV, notifying them of the vehicle's sale and releasing the seller from liability for what the buyer does with the vehicle.

- Credit Report Authorization Form: This form is used by the lender to check the borrower's credit history, ensuring they have the financial capability to repay the loan.

Together with the Vehicle Repayment Agreement, these documents create a network of legal safeguards and checkpoints that protect all parties involved in the vehicle transaction. Whether selling a car privately or buying one through a dealership with financing, understanding and properly executing these documents can mitigate risks and foster a smooth and transparent transaction process.

Similar forms

The Vehicle Lease Agreement is similar to the Vehicle Repayment Agreement in that both pertain to the use of a vehicle under specific conditions. However, while the Vehicle Repayment Agreement focuses on the financial aspects and repayment terms for purchasing the vehicle, the Lease Agreement outlines the terms for renting the vehicle over a fixed period. Both documents establish the payment schedule, usage limits, and responsibilities of each party but differ in the end goal—ownership versus temporary use.

A Personal Loan Agreement shares similarities with the Vehicle Repayment Agreement as both are formal contracts that outline the terms of a loan and its repayment. They specify the loan amount, interest rate, repayment schedule, and the consequences of non-payment. However, the Personal Loan Agreement is broader and can be used for various purposes, not limited to the acquisition of a vehicle, making it more versatile.

The Installment Sale Agreement, much like the Vehicle Repayment Agreement, dictates the conditions under which an asset is sold and paid for in installments over a period. This agreement ensures that the ownership of the asset—often a vehicle—transfers to the buyer only after the full payment is made. Both documents protect the seller's interest by detailing the repayment terms and securing the asset until fully paid.

A Promissory Note is another document similar to the Vehicle Repayment Agreement as it represents a written promise to pay a specific sum of money to someone else under agreed terms. While Promissory Notes can cover various loans or debts, the Vehicle Repayment Agreement is specific to the financing of a vehicle. Both include details on repayment schedules, interest rates, and the consequences of defaulting.

The Mortgage Agreement shares common elements with the Vehicle Repayment Agreement since both involve a borrowing and lending arrangement secured by an asset. In the Mortgage Agreement, the property is used as collateral for the loan, just as a vehicle may secure the loan in a Vehicle Repayment Agreement. Each document lays out the terms of the loan, including repayment, interest, and actions in the event of non-payment, albeit for different types of property.

A Credit Sale Agreement is closely related to the Vehicle Repayment Agreement, focusing on the sale of goods on credit. This agreement typically involves payment in installments, similar to the repayment structure for a vehicle loan. Both parties agree on the terms of payment over time, interest rates, and the delivery of goods—in this case, a vehicle—prior to the final payment, with specifics tailored to the nature of the transaction.

The Conditional Sale Agreement bears resemblance to the Vehicle Repayment Agreement with its focus on the conditional transfer of ownership. The buyer does not receive full ownership of the vehicle until the terms of the agreement, usually including full repayment, are met. Both agreements protect the seller’s rights to reclaim the asset if the buyer fails to meet the agreed repayment conditions.

The Debt Settlement Agreement is somewhat similar to the Vehicle Repayment Agreement in the context of resolving an outstanding debt. This type of agreement usually comes into play when the debtor is unable to fulfill the original repayment terms and negotiates for a reduction or restructuring of the debt. Unlike the Vehicle Repayment Agreement, which is structured around regular payments for a vehicle, the Debt Settlement Agreement often involves negotiating to lower the debt amount and settle it with a lump sum payment or a new payment plan.

A Cosigner Agreement, which can accompany a Vehicle Repayment Agreement, involves a third party agreeing to take responsibility for the debt if the original borrower fails to pay. This agreement adds a layer of security for the lender, akin to the primary repayment agreement but specifically outlines the responsibilities and obligations of the cosigner, not the primary borrower. While it relates directly to the repayment of the vehicle, its focus is on ensuring an additional form of guarantee for the loan.

Dos and Don'ts

When it comes to filling out the Vehicle Repayment Agreement form, there's a right way and a wrong way. Making sure you're on the correct path not only speeds up the process but also prevents potential headaches down the line. Here's a list of do's and don'ts to guide you through the process:

Do's:

- Read the form thoroughly before starting to fill it out. Understanding every section ensures that you know what information is required.

- Gather all necessary documents beforehand, such as your driver's license, vehicle registration, and loan details. This saves time and helps provide accurate information.

- Use black or blue ink for handwritten agreements. These colors are universally accepted and ensure legibility.

- Be precise and clear with the information you provide. Ambiguity can lead to misunderstandings or delays.

- Double-check the math, especially when detailing the repayment schedule, interest rates, and total owed.

- Include all relevant parties in the agreement to ensure everyone's responsibilities are clearly defined and understood.

- Sign and date the form in the designated areas. This might seem obvious, but it's a crucial step to make the document legally binding.

- Keep a copy of the signed agreement. Having proof of the contract is important for your records.

- Consult with a professional if you have any doubts. Legal or financial advice can prevent problems in the future.

- Notify the other party of any changes to your situation that might affect the agreement. Open communication maintains trust and avoids conflict.

Don'ts:

- Rush through the process. Taking the time to fill out the form correctly is crucial to its effectiveness.

- Leave blank spaces. If a section doesn't apply, write "N/A" (not applicable) to indicate that you didn't overlook it.

- Use corrections fluid or tape on the form. Mistakes should be neatly crossed out, and the correction should be initialed by all parties.

- Ignore state-specific requirements. Some states may have additional requirements or forms that need to be completed.

- Underestimate the importance of a witness or notary. Having a third party sign the form can add an extra layer of legal protection.

- Forget to specify the vehicle's details, like make, model, year, and VIN. This information distinguishes your agreement from just any vehicle contract.

- Skip the fine print. Pay attention to the terms and conditions to avoid agreeing to something unfavorable.

- Assume verbal agreements will hold up. If it's not written down in the agreement, it's not legally binding.

- Overlook the repayment schedule's feasibility. Ensure that the terms won’t lead to financial strain on either party.

- Delay sending a copy of the agreement to the other party. Prompt sharing demonstrates transparency and good faith.

Misconceptions

When it comes to navigating the complexities of vehicle repayment agreements, misunderstandings can often complicate the process for both the lender and the borrower. Clearing up common misconceptions is essential for ensuring that all parties enter these agreements with the correct information and realistic expectations.

Misconception #1: The agreement doesn't need to be in writing if both parties trust each other. Contrary to popular belief, trust does not negate the need for a written agreement. A written vehicle repayment agreement provides a legally binding document that outlines the terms and conditions of the repayment plan, protecting the interests of both parties.

Misconception #2: Signing a vehicle repayment agreement means you're getting a better deal than with a loan from a bank. This is not necessarily true. Although a vehicle repayment agreement can offer more flexible terms, it doesn't always mean the financial terms are more favorable than what a bank might offer. It's important to compare the total costs and terms before making a decision.

Misconception #3: There's no need to check the borrower's credit history since the vehicle secures the loan. Even with the vehicle as collateral, checking the borrower’s credit history is vital. This helps in assessing the borrower's ability to repay the loan, potentially saving the lender from future complications should repayment issues arise.

Misconception #4: The lender automatically owns the vehicle if the borrower defaults on the loan. Ownership rights in the event of default depend on the specific terms outlined in the repayment agreement. Typically, the lender must follow certain legal processes to take possession of the vehicle, which may include repossession procedures and notifying the borrower of the default.

Misconception #5: Vehicle repayment agreements are only for used vehicles. These agreements can be used for both new and used vehicles. The condition or type of the vehicle does not limit the applicability of a repayment agreement, as long as both parties agree to the terms.

Misconception #6: Any changes to the agreement must be approved by a legal professional. While consulting with a legal professional can ensure that amendments are made correctly, parties can mutually agree to modify the terms of the agreement. It's critical, however, that any modifications are documented in writing and signed by both parties to avoid future disputes.

Understanding these misconceptions can help borrowers and lenders make more informed decisions regarding vehicle repayment agreements. By ensuring clarity and adherence to legal requirements, both parties can foster a more secure and mutually beneficial agreement.

Key takeaways

Engaging in an understanding of the Vehicle Repayment Agreement is essential for both the seller and buyer within the context of a vehicle transaction that involves payment terms extended over time. This contract delineates the responsibilities, conditions, and terms both parties agree to, ensuring a legally binding framework that secures the transaction. Here are key takeaways to bear in mind when filling out and utilizing the Vehicle Repayment Agreement form:

- Accuracy of Information: It is paramount that all information provided on the form is accurate and truthful. This includes personal details of both the buyer and seller, specifics about the vehicle (make, model, year, VIN), and the terms of the repayment (amount, interest rate, duration, and frequency of payments).

- Clear Payment Terms: The agreement must explicitly outline the payment conditions. These encompass the total purchase price, down payment, interest rate (if applicable), the schedule of payments (including due dates and amounts), and the final payment date. Clarity on these terms helps avoid potential disputes.

- Legal Provisions: The form should include relevant legal clauses that protect both parties. These may involve late payment penalties, consequences of default, warranty information, and the procedure for resolving disputes. Understanding these provisions ensures both parties are aware of their rights and obligations.

- Signatures: For the agreement to be legally binding, it must be signed by both the buyer and seller. The signatures validate that both parties acknowledge and accept the terms of the agreement. Witness signatures or notarization may be required depending on state laws.

- State Laws Compliance: The agreement must comply with the laws of the state where the transaction is conducted. Since vehicle repayment laws can vary significantly from one state to another, it is advisable to consult legal guidance to ensure the agreement meets all legal requirements specific to the state.

- Document Retention: Both parties should retain a copy of the signed agreement for their records. This document serves as a verifiable reference in case any questions arise regarding the terms of sale or legal issues need to be addressed in the future.

Popular Documents

How to Avoid California Health Insurance Penalty - The sequence in which this form is filed, as indicated by its sequence number, facilitates orderly processing alongside your main tax return forms.

Tax Computation Worksheet - Insights into categories of income, aiding in the accurate reporting and understanding of taxable earnings.