Get Utah Tax Exemption Form

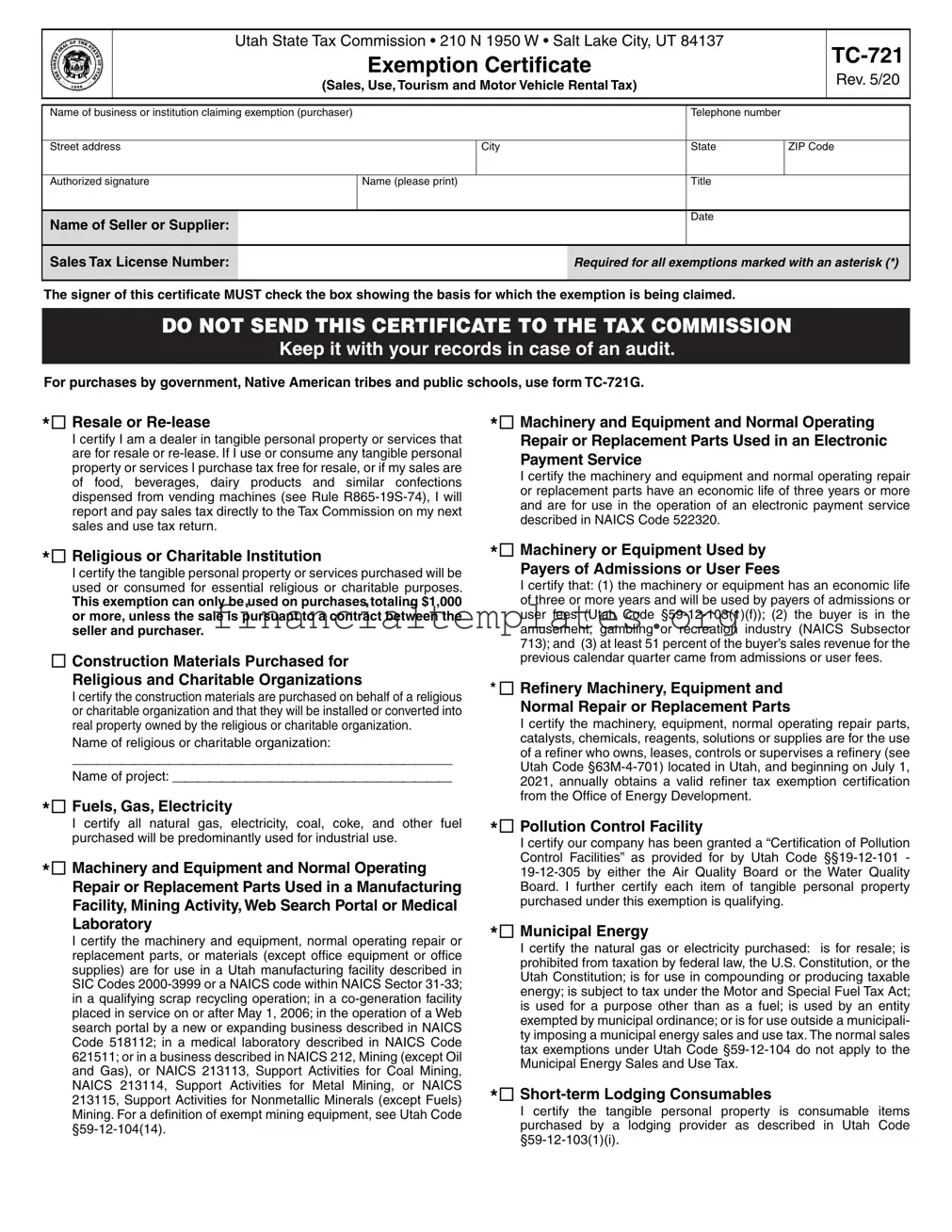

The Utah Tax Exemption form, as facilitated by the Utah State Tax Commission, is a crucial document for businesses and institutions that qualify for sales, use, tourism, and motor vehicle rental tax exemptions. Located in Salt Lake City, this form, identified as TC-721 Rev. 5/20, requires detailed information such as the name of the business or institution claiming the exemption, contact details, and an authorized signature. There are specific categories under which exemptions can be claimed, each marked with an asterisk for mandatory sales tax license numbers, emphasizing the need for the signer to accurately represent their eligibility for claimed exemptions. Categories range from resale or re-lease, religious or charitable purposes, to more specialized exemptions like those for machinery and equipment used in manufacturing or research, pollution control facilities, and sectors such as agriculture, commercial airlines, filmmaking, and more. The form also outlines the necessity for keeping the certificate for audit purposes, rather than sending it to the Tax Commission, signaling the importance of record-keeping for exemption claims. It intricately details various exemptions that accommodate a wide spectrum of activities and entities, from construction materials for religious and charitable organizations, fuels and energy for industrial use, to items specific to sectors like telecommunications and ski resorts. This form acts not only as a record-keeping tool but also as a comprehensive guide, ensuring that eligible parties can navigate through the prerequisites and responsibilities entailed in claiming tax exemptions.

Utah Tax Exemption Example

Utah State Tax Commission • 210 N 1950 W • Salt Lake City, UT 84137

Exemption Certificate

(Sales, Use, Tourism and Motor Vehicle Rental Tax)

Rev. 5/20

Name of business or institution claiming exemption (purchaser) |

|

|

|

Telephone number |

|

|

|

|

|

|

|

|

|

Street address |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

Authorized signature |

Name (please print) |

|

|

Title |

|

|

|

|

|

|

|

|

|

Name of Seller or Supplier: |

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales Tax License Number: |

|

|

|

Required for all exemptions marked with an asterisk (*) |

||

|

|

|

|

|

|

|

The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed.

DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION

Keep it with your records in case of an audit.

For purchases by government, Native American tribes and public schools, use form

* Resale or

I certify I am a dealer in tangible personal property or services that are for resale or

* Religious or Charitable Institution

I certify the tangible personal property or services purchased will be used or consumed for essential religious or charitable purposes.

This exemption can only be used on purchases totaling $1,000 or more, unless the sale is pursuant to a contract between the seller and purchaser.

Construction Materials Purchased for

Religious and Charitable Organizations

I certify the construction materials are purchased on behalf of a religious or charitable organization and that they will be installed or converted into real property owned by the religious or charitable organization.

Name of religious or charitable organization:

________________________________

Name of project: _______________________

* Fuels, Gas, Electricity

I certify all natural gas, electricity, coal, coke, and other fuel purchased will be predominantly used for industrial use.

* Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in a Manufacturing Facility, Mining Activity, Web Search Portal or Medical Laboratory

I certify the machinery and equipment, normal operating repair or replacement parts, or materials (except office equipment or office supplies) are for use in a Utah manufacturing facility described in SIC Codes

* Machinery and Equipment and Normal Operating Repair or Replacement Parts Used in an Electronic Payment Service

I certify the machinery and equipment and normal operating repair or replacement parts have an economic life of three years or more and are for use in the operation of an electronic payment service described in NAICS Code 522320.

* Machinery or Equipment Used by Payers of Admissions or User Fees

I certify that: (1) the machinery or equipment has an economic life of three or more years and will be used by payers of admissions or user fees (Utah Code

* Refinery Machinery, Equipment and Normal Repair or Replacement Parts

I certify the machinery, equipment, normal operating repair parts, catalysts, chemicals, reagents, solutions or supplies are for the use of a refiner who owns, leases, controls or supervises a refinery (see Utah Code

* Pollution Control Facility

I certify our company has been granted a “Certification of Pollution Control Facilities” as provided for by Utah Code

* Municipal Energy

I certify the natural gas or electricity purchased: is for resale; is prohibited from taxation by federal law, the U.S. Constitution, or the Utah Constitution; is for use in compounding or producing taxable energy; is subject to tax under the Motor and Special Fuel Tax Act; is used for a purpose other than as a fuel; is used by an entity exempted by municipal ordinance; or is for use outside a municipali- ty imposing a municipal energy sales and use tax. The normal sales tax exemptions under Utah Code

*

I certify the tangible personal property is consumable items purchased by a lodging provider as described in Utah Code

* Direct Mail

I certify I will report and pay the sales tax for direct mail purchases

on my next Utah SALES AND USE TAX RETURN.

* Commercial Airlines

I certify the food and beverages purchased are by a commercial airline for

* Commercials, Films, Audio and Video Tapes

I certify that purchases of commercials, films, prerecorded video tapes, prerecorded audio program tapes or records are for sale or distribution to motion picture exhibitors, or commercial television or radio broadcasters. If I subsequently resell items to any other customer, or use or consume any of these items, I will report any tax liability directly to the Tax Commission.

* Alternative Energy

I certify the tangible personal property meets the requirements of UC

* Locomotive Fuel

I certify this fuel will be used by a railroad in a locomotive engine. Starting Jan. 1, 2021, all locomotive fuel is subject to a 4.85% state tax.

* Research and Development of Alternative Energy Technology

I certify the tangible personal property purchased will be used in research and development of alternative energy technology.

* Life Science Research and Development Facility

I certify that: (1) the machinery, equipment and normal operating repair or replacement parts purchased have an economic life of three or more years for use in performing qualified research in Utah; or (2) construction materials purchased are for use in the construc- tion of a new or expanding life science research and development facility in Utah.

* Mailing Lists

I certify the printed mailing lists or electronic databases are used to send printed material that is delivered by U.S. mail or other delivery service to a mass audience where the cost of the printed material is not billed directly to the recipients.

* Semiconductor Fabricating, Processing or Research and Development Material

I certify the fabricating, processing, or research and development materials purchased are for use in research or development, manufac- turing, or fabricating of semiconductors.

* Telecommunications Equipment, Machinery or Software

I certify these purchases or leases of equipment, machinery, or software, by or on behalf of a telephone service provider, have a useful economic life of one or more years and will be used to enable or facilitate telecommunications; to provide 911 service; to maintain or repair telecommunications equipment; to switch or route telecommunications service; or for sending, receiving, or transport- ing telecommunications service.

* Aircraft Maintenance, Repair and Overhaul Provider

I certify these sales are to or by an aircraft maintenance, repair and overhaul provider for the use in the maintenance, repair, overhaul or refurbishment in Utah of a

* Ski Resort

I certify the

* Qualifying Data Center

I certify that the machinery, equipment or normal operating repair or replacement parts are: (1) used in a qualifying data center as defined in Utah Code

Leasebacks

I certify the tangible personal property leased satisfies the following conditions: (1) the property is part of a

(2) sales or use tax was paid on the initial purchase of the property; and, (3) the leased property will be capitalized and the lease payments will be accounted for as payments made under a financ- ing arrangement.

Film, Television, Radio

I certify that purchases, leases or rentals of machinery or equip- ment will be used by a motion picture or video production company for the production of media for commercial distribution.

Prosthetic Devices

I certify the prosthetic device(s) is prescribed by a licensed physician for human use to replace a missing body part, to prevent or correct a physical deformity, or support a weak body part. This is also exempt if purchased by a hospital or medical facility. (Sales of corrective eyeglasses and contact lenses are taxable.)

I certify this tangible personal property, of which I am taking posses- sion in Utah, will be taken

Agricultural Producer

I certify the items purchased will be used primarily and directly in a commercial farming operation and qualify for the Utah sales and use tax exemption. This exemption does not apply to vehicles required to be registered.

Tourism/Motor Vehicle Rental

I certify the motor vehicle being leased or rented will be temporarily used to replace a motor vehicle that is being repaired pursuant to a repair or an insurance agreement; the lease will exceed 30 days; the motor vehicle being leased or rented is registered for a gross laden weight of 12,001 pounds or more; or, the motor vehicle is being rented or leased as a personal household goods moving van. This exemption applies only to the tourism tax (up to 7 percent) and the

Textbooks for Higher Education

I certify that textbooks purchased are required for a higher education course, for which I am enrolled at an institution of higher education, and qualify for this exemption. An institution of higher education means: the University of Utah, Utah State University, Utah State University Eastern, Weber State University, Southern Utah Universi- ty, Snow College, Dixie State University, Utah Valley University, Salt Lake Community College, or the Utah System of Technical Colleges.

*Purchaser must provide sales tax license number in the header on page 1.

NOTE TO PURCHASER: You must notify the seller of cancellation, modification, or limitation of the exemption you have claimed. Questions? Email taxmaster@utah.gov, or call

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The form used is the Utah Exemption Certificate (Sales, Use, Tourism, and Motor Vehicle Rental Tax) TC-721, revision date 5/20. |

| Purpose | This certificate is utilized by businesses or institutions to claim tax exemption on qualifying purchases, including for resale, religious or charitable purposes, specific machinery and equipment, among others. |

| Mandatory Instruction | The certificate instructs holders not to send it to the Tax Commission but to retain it for audit purposes, ensuring compliance with the state's taxation rules. |

| Governing Laws | The exemptions claimed through form TC-721 are governed by several Utah Codes, depending on the nature of the exemption. Notable examples include Utah Code §59-12-104(14) for mining equipment and §63M-4-701 for refinery machinery and equipment. |

Guide to Writing Utah Tax Exemption

Filling out the Utah Tax Exemption form is straightforward if you follow the steps carefully. This form is essential for businesses and institutions in Utah that are eligible for tax exemption on purchases. These exemptions can include items for resale, religious or charitable purposes, construction materials for specific organizations, and more. Keeping the completed form for your records is crucial, as it might be needed for audits or verification purposes. Here are the steps to fill out the form correctly:

- Enter the Name of the business or institution claiming exemption in the designated field at the top of the form.

- Provide the Telephone number and complete address (street address, city, state, ZIP code) of the purchaser.

- Fill in the Authorized signature at the bottom section of the form where it is requested, along with the Name (please print) and Title of the person signing the form.

- Specify the Name of Seller or Supplier and input the Date on which this exemption certificate is being filled.

- If applicable, provide the Sales Tax License Number in the space provided. This is required for all exemptions marked with an asterisk (*).

- Check the appropriate box indicating the basis for which the exemption is being claimed. Make sure to read each exemption criteria carefully to ensure eligibility.

- If choosing exemptions that require additional information (such as "Construction Materials Purchased for Religious and Charitable Organizations" or certain equipment purchases), fill in the necessary fields related to the name of the organization, name of the project, or description of the qualifying equipment.

- Remember, do not send this certificate to the Tax Commission. Instead, keep it with your records to present in case of an audit.

Once the form is fully completed and double-checked for accuracy, maintain a copy for your records and provide the original to the seller or supplier from whom you are purchasing tax-exempt items. This documentation is crucial for both parties to justify the tax exemption in case of state audits. If your exemption status changes, or if there are any modifications to the information provided, it's important to notify the seller to update their records accordingly.

Understanding Utah Tax Exemption

Frequently Asked Questions About Utah Tax Exemption Form TC-721

Understanding tax exemption forms can be complicated. Here are answers to some common questions that will help simplify the Utah Tax Exemption Form TC-721 process.

- What is the Utah Tax Exemption Form TC-721 used for?

- Who needs to fill out Form TC-721?

- Do I need to submit the completed form to the Utah State Tax Commission?

- How do I know if I qualify for the resale or re-lease exemption?

- Can charitable or religious institutions use this form for all purchases?

- Charitable or religious institutions can use this form for purchases intended for essential purposes. However, there's a minimum purchase amount of $1,000 unless the sale is pursuant to a specific contract between the buyer and seller.

- Are there exemptions specific to certain types of organizations?

- What if I mistakenly claim an exemption I'm not eligible for?

- How long should I keep the completed Utah Tax Exemption Form TC-721?

- Who can I contact if I have questions about completing the form or about my eligibility for a tax exemption?

The Utah Tax Exemption Form TC-721 is utilized by businesses or institutions to claim exemption from sales, use, tourism, and motor vehicle rental tax on eligible purchases or leases. This form outlines various categories under which tax exemptions can be claimed, such as purchases for resale, charitable or religious organizations, and specific industries like manufacturing or agriculture.

Any business or institution that qualifies for a tax exemption on purchases or leases under the specific categories listed in the form needs to fill out and submit Form TC-721 to their vendor, not to the Utah State Tax Commission.

No, you do not need to send the completed form to the Utah State Tax Commission. Instead, keep it with your records for audit purposes and provide it to the seller or supplier from whom you are purchasing or leasing tax-exempt items.

To qualify for the resale or re-lease exemption, you must be a dealer in tangible personal property or services intended for resale or re-lease. If the items purchased tax-free are later used or consumed rather than resold or re-leased, you're required to report and pay sales tax directly to the Tax Commission on your next sales and use tax return.

Yes, several exemptions tailored to specific types of organizations are available, such as for government entities, Native American tribes, public schools (which should use form TC-721G), and others like agricultural producers, manufacturers, and non-profit organizations engaged in charitable or religious activities.

If you claim an exemption in error, you are responsible for reporting and paying any tax due to the Utah State Tax Commission. It’s important to carefully review the eligibility criteria for exemptions to prevent incorrect claims.

You should retain the completed form for at least three years as part of your tax records. Keeping forms for the recommended duration helps in case of an audit or if you need to verify past exemptions claimed.

For questions regarding the form or your eligibility for exemptions, you can email the Utah State Tax Commission at taxmaster@utah.gov or call them at 801-297-2200 or 1-800-662-4335 for assistance.

This FAQ aims to clear up common issues surrounding the Utah Tax Exemption Form TC-721. However, for detailed inquiries or unique situations, reaching out directly to the Utah State Tax Commission or consulting a tax professional is advised.

Common mistakes

When filling out the Utah Tax Exemption form, individuals and businesses can inadvertently make mistakes that could lead to complications or delays. Understanding and avoiding these common errors can streamline the process and ensure compliance with the state tax laws. Here are four mistakes often made:

Not Providing a Sales Tax License Number: This number is required for all exemptions marked with an asterisk (*) on the form. Failing to include this crucial piece of information can render the exemption claim incomplete or invalid.

Inaccurate Identification of the Exemption Basis: The form requires the signer to check the box indicating the basis for which the exemption is claimed. Misidentifying the exemption basis, such as claiming a religious or charitable institution exemption for personal purchases, can lead to misuse of the form and potential legal consequences.

Omitting Authorized Signature or Title: An authorized signature and the title of the signer are mandatory for validating the exemption certificate. Overlooking these fields may result in the form being considered nonexecutable due to questions about its authenticity.

Not Maintaining Records for Audit Purposes: The instructions explicitly state not to send the certificate to the Tax Commission but to keep it with your records in case of an audit. Neglecting to retain this document and other relevant purchase records can lead to challenges in substantiating exemption claims during an audit.

Addressing these errors before submission can help in avoiding delays and ensuring that tax exemption processes are smoothly executed. Proper attention to detail and adherence to the instructions set forth by the Utah State Tax Commission are essential for the correct and efficient use of the exemption certificate.

Documents used along the form

When you're working with the Utah Tax Exemption form, it's essential to have a complete understanding of the various other forms and documents that often accompany this certificate in many transactions. Whether you're applying for a tax exemption for a business, charitable organization, or for specific purchases like machinery or agricultural inputs, several other documents play crucial roles in ensuring compliance and substantiating your eligibility for a tax exemption. Here’s a list of some of those important forms and documents.

- Application for Sales Tax Exemption Certificate (Form TC-160): This form is necessary for organizations seeking to obtain a Sales Tax Exemption Certificate. It's a prerequisite for applying for the TC-721 exemption certificate.

- Business Registration Form (Form TC-69): Required for any business to legally operate in Utah, this form registers the business with the Utah State Tax Commission and is necessary before applying for any tax exemptions.

- Exempt Organization Eligibility Affidavit (TC-160E): An affidavit required for non-profit organizations, certifying their eligibility for tax-exempt status. It supports the exemption claim by providing necessary organizational details.

- Purchase Order or Invoice: A purchase order or invoice showing the purchase of goods or services is often needed to support the claim for a tax exemption, indicating the items purchased and the intended use.

- Proof of Non-Profit Status: Documentation from the IRS, such as a determination letter, proving an organization's 501(c)(3) or similar tax-exempt status, is essential for entities claiming exemptions for charitable, religious, or educational purposes.

- Annual Financial Statement: Some exemptions may require an organization to provide its most recent financial statements to verify the nature and scale of operations, ensuring compliance with exemption requirements.

Having these forms and documents in order is crucial for any entity applying for a tax exemption in Utah. This paperwork not only establishes the legitimacy of the organization or business but also clarifies the purpose and use of the purchased goods or services, which is vital for maintaining transparency and adherence to Utah's tax laws. While the process may seem daunting, gathering these documents is a step toward efficient fiscal management and compliance with state regulations.

Similar forms

The Federal W-9 form, used to provide taxpayer identification number and certification, is similar to the Utah Tax Exemption form in function. Both forms are used in the context of tax documentation, but while the Utah form focuses on claiming tax exemptions for certain purchases, the W-9 is broader, gathering information for income reporting purposes.

The Nonprofit Organization's Certificate of Exemption mirrors the Utah form by serving nonprofit entities. These documents allow qualifying organizations to purchase goods or services without paying sales tax. The main similarity lies in their purpose to certify tax-exempt status, although the scope of exempt activities and items may vary between them.

The Resale Certificate also shares common ground with the Utah Tax Exemption form, particularly in the resale exemption section. Both certificates are used by businesses to buy goods without paying sales tax on items that will be resold. The essential function—to avoid a tax on goods not intended for final consumption—unites them.

Another related document is the Application for Federal Employer Identification Number (Form SS-4). Although its primary purpose is obtaining an EIN for tax administration, both this application and the Utah exemption form are crucial for businesses in managing their tax-related responsibilities. They differ in details but align in contributing to a business's tax compliance.

State-specific sales tax exemption forms, like those from other states, have a direct resemblance with the Utah exemption certificate. Each state has its version, tailored to its laws, but the fundamental purpose—to document eligibility for sales tax exemption on qualifying transactions—remains consistent across jurisdictions.

The Direct Pay Permit Application is another analogous document. Businesses holding a direct pay permit buy goods or services tax-free and then self-assess and remit the due tax. This process of direct tax remittance echoes the self-reporting aspect for certain exemptions in the Utah form, where the purchaser pledges to pay the tax if the exemption criteria are not met.

The Manufacturer's Declaration of Exemption shares commonality with sections of the Utah form regarding purchases of machinery and equipment for manufacturing. Both forms serve to certify that the equipment or machinery purchased will be used in a manner that qualifies for a tax exemption, focusing on the manufacturing sector.

The Exempt Organization Business Income Tax Return (Form 990-T) is related in its concern with tax-exempt entities. Though it deals with reporting and paying tax on unrelated business income for exempt organizations, it intersects with the Utah form's attention to such organizations' tax-exempt purchase activities.

The Streamlined Sales and Use Tax Agreement (SSUTA) Certificate of Exemption enables businesses to file a multi-state exemption certificate. This document, similar to the Utah form, facilitates tax-exempt purchases but on a broader, sometimes multi-state level, simplifying the exemption claim process for sellers and purchasers alike.

Finally, the Motor Vehicle Sales and Use Tax Exemption Certificate parallels the Utah form’s motor vehicle rental tax exemption section. While the focus varies—the former may exempt vehicle purchases and the latter exempts rentals—both certificates recognize specific tax exemptions within the context of motor vehicle transactions.

Dos and Don'ts

When handling the Utah Tax Exemption form, it's essential to tread carefully. Navigating the details with precision ensures that businesses or institutions can benefit from exemptions accurately, avoiding potential issues down the line. Here are some dos and don'ts to consider:

Do:

Thoroughly review the criteria for each exemption type before claiming. Matching your eligibility accurately prevents errors and ensures integrity in your filing.

Keep a detailed record of all purchases and related exemptions. Documentation is your best ally in case of an audit, delivering a clear trail of your tax exemption claims.

Ensure that the name of the business or institution, as well as the authorized signature, are correctly filled in. Accuracy in these areas lends credibility to your submission.

Regularly update the sales tax license number if applicable, especially for exemptions requiring this information. Keeping this current avoids potential processing delays.

Contact the Utah State Tax Commission with any queries regarding the exemptions. The guidance provided can clarify complex areas, ensuring compliance.

Don't:

Send this certificate to the Tax Commission. It must be retained for your records, serving as evidence of your exemption claims during audits.

Overlook the requirement to report and pay sales tax on items you purchase tax-free but end up using or consuming, rather than reselling. This oversight can lead to tax liabilities.

Claim exemptions without verifying the specific use of purchased items aligns with the exemption's intent. Misclassification can attract penalties.

Forget to promptly notify the seller of any changes regarding the exemption you have claimed. Timely communication is vital to maintain tax compliance.

Assume all exemptions are automatically applied. Some require a detailed review process or additional certifications, such as the “Certification of Pollution Control Facilities”.

Approaching the Utah Tax Exemption form with diligence ensures that your business or institution can fully utilize the tax benefits available, while also maintaining compliance with state tax laws.

Misconceptions

The Utah Tax Exemption form, often encountered by businesses and institutions, carries with it several misconceptions that can confuse or mislead taxpayers. Understanding these misconceptions is crucial for the correct application and compliance with Utah's tax laws. Here are four common misunderstandings:

- Misconception 1: All Purchases are Exempt Once Qualified

Many believe that once they qualify and receive a Utah Tax Exemption form, all their purchases are exempt from taxes. In reality, only the items or services that directly relate to the exempt purpose of the organization or business qualify. For example, a charitable institution’s purchase of office supplies for administrative use would not be exempt under the "Religious or Charitable Institution" exemption, as these are not used directly in charitable activities.

- Misconception 2: No Need to Keep Records

There's a misconception that once the exemption certificate is filled out and given to a seller, there's no need to retain any records regarding the tax-exempt transactions. However, the form itself states, "DO NOT SEND THIS CERTIFICATE TO THE TAX COMMISSION. Keep it with your records in case of an audit." This implies that keeping detailed records of all exempt purchases, including the exemption certificate, is essential for proving the legitimacy of the tax exemptions during an audit.

- Misconception 3: Exemption Applies to All Types of Taxes

Some taxpayers mistakenly believe that the Utah Tax Exemption form exempts them from all tax types listed on the form. However, certain exemptions, especially those marked with an asterisk (*), are specific to particular taxes like sales, use, tourism, and motor vehicle rental tax. For instance, the Municipal Energy Sales and Use Tax has its detailed exemptions that do not apply broadly like other sales tax exemptions.

- Misconception 4: Immediate Effect of Exemption Claims

Finally, a common misunderstanding is that the exemption effects are immediate upon claiming them on purchases. The reality is, some exemptions require additional verification or certification, such as the "Refinery Machinery, Equipment and Normal Repair or Replacement Parts" exemption, which mandates obtaining a valid refiner tax exemption certification annually from the Office of Energy Development. Hence, the process may not be instantaneous, and businesses should prepare accordingly.

Clearing up these misconceptions is pivotal to ensuring that businesses and institutions understand their responsibilities and rights under Utah's tax laws. Compliance and proper usage of the Utah Tax Exemption form not only prevent legal complications but also ensure the benefits of tax-exempt status are fully realized.

Key takeaways

Filling out and using the Utah Tax Exemption form correctly is crucial for businesses and institutions to ensure compliance with state regulations and to take advantage of eligible tax exemptions. Below are seven key takeaways to guide you through this process:

- Understand Eligibility: Not all purchases or lessees are eligible for tax exemption. The form outlines specific conditions under which tax exemptions apply, such as purchases made by governmental entities, nonprofit organizations, or for specific uses like manufacturing, research and development, or agriculture.

- Maintain Accurate Records: It is essential to keep the completed Tax Exemption form with your records and not to send it to the Utah State Tax Commission. These documents must be readily available in case of an audit.

- Detailed Information Requirement: When completing the form, you must provide detailed information such as the name of the business or institution claiming the exemption, contact details, and an authorized signature. This ensures the Tax Commission can accurately assess your eligibility for the exemption claimed.

- Special Forms for Specific Entities: Government agencies, Native American tribes, and public schools are required to use a separate form (TC-721G) specifically designed for these entities. This distinction ensures that the exemptions applicable to these organizations are properly claimed and processed.

- Clarify the Basis for Exemption: The form requires clear indication of the basis for claiming an exemption. It includes various checkboxes for different exemption categories such as resale, religious or charitable use, machinery and equipment for manufacturing, and more. Selecting the correct category is crucial for the validity of your claim.

- Pay Attention to Exemptions with Asterisks: Several exemptions marked with an asterisk (*) require the purchaser to provide their Sales Tax License Number. This is an important step to validate the exemption claim, especially for resale or specific business operations.

- Cancellation or Modification Notification: If there are any changes regarding the use of the purchased items or the status of your exemption claim, it is your responsibility to notify the seller. This ensures that all tax-related records between the buyer and seller are accurate and up to date.

Adhering to these guidelines when filling out the Utah Tax Exemption form will help streamline the tax exemption process, ensuring your organization leverages applicable benefits while remaining compliant with state laws.

Popular PDF Documents

Itr - Instructions specify the documents to attach for proof of income, deductions, and tax credits.

2253 Form - Understanding the tax benefits and responsibilities associated with S corporation status is crucial before submitting IRS form 2553.

Metlife Dog Insurance - A streamlined process to submit claims for accidents, illnesses, or routine care, requiring a fully completed form and all relevant receipts.