Get Us Tax Schedule E Form

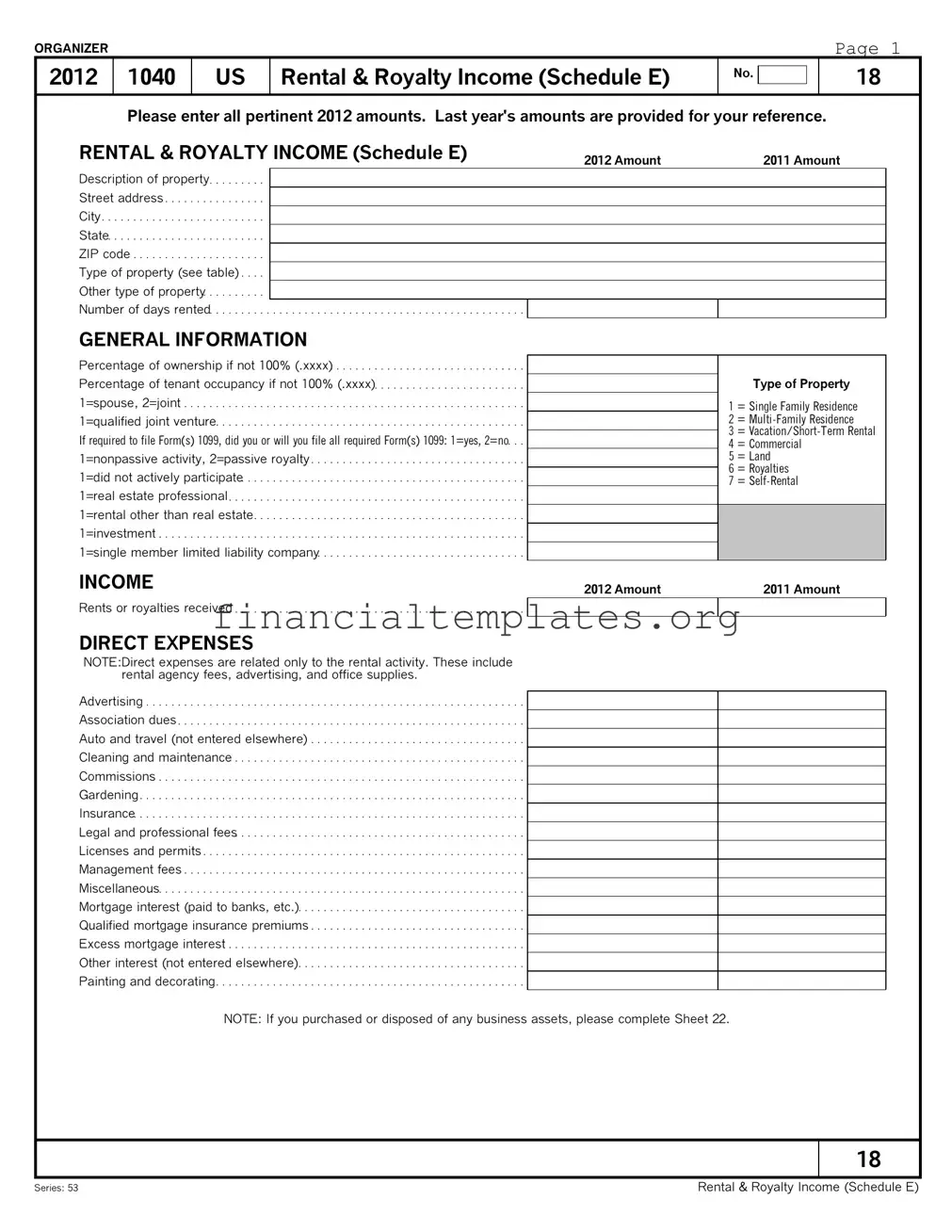

The US Tax Schedule E form is a crucial document for individuals reporting rental and royalty income for the fiscal year 2012. Acting as an organizer, this form meticulously categorizes income and expenses associated with property rentals, royalties, or a combination of both, reflecting the financial intricacies of property management. From detailing the description and location of the rental property to outlining the types of properties - be it single-family residences, commercial properties, or land - the form ensures a comprehensive reporting mechanism. Additionally, it accounts for various direct and indirect expenses - ranging from advertising to utilities, legal fees, and mortgage interests - all critical for calculating the exact taxable income. For those with partnerships or shared ownerships, the form requests the percentage of ownership and occupancy, alongside identifying the nature of the activity whether passive or nonpassive, and if it involves special scenarios like real estate professionals or investment properties. This detailed approach is designed to aid taxpayers in accurately reporting their rental and royalty income, potentially affecting their tax liabilities significantly.

Us Tax Schedule E Example

ORGANIZER |

Page 1 |

2012

1040

US

Rental & Royalty Income (Schedule E)

No.

18

Please enter all pertinent 2012 amounts. Last year's amounts are provided for your reference.

RENTAL & ROYALTY INCOME (Schedule E)

2012 Amount |

2011 Amount |

Description of property. . . . . . . . .

Street address . . . . . . . . . . . . . . . .

City. . . . . . . . . . . . . . . . . . . . . . . . . .

State. . . . . . . . . . . . . . . . . . . . . . . . .

ZIP code . . . . . . . . . . . . . . . . . . . . .

Type of property (see table) . . . .

Other type of property. . . . . . . . . .

Number of days rented. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GENERAL INFORMATION

Percentage of ownership if not 100% (.xxxx). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Percentage of tenant occupancy if not 100% (.xxxx). . . . . . . . . . . . . . . . . . . . . . . .

1=spouse, 2=joint. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=qualified joint venture. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If required to file Form(s) 1099, did you or will you file all required Form(s) 1099: 1=yes, 2=no. . .

1=nonpassive activity, 2=passive royalty . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=did not actively participate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=real estate professional. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=rental other than real estate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=investment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1=single member limited liability company. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INCOME

Rents or royalties received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Type of Property

1 = Single Family Residence

2 =

3 =

4 = Commercial

5 = Land

6 = Royalties

7 =

2012 Amount |

2011 Amount |

|

|

DIRECT EXPENSES

NOTE:Direct expenses are related only to the rental activity. These include rental agency fees, advertising, and office supplies.

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Association dues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Auto and travel (not entered elsewhere) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Cleaning and maintenance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gardening. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Legal and professional fees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Licenses and permits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Management fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Miscellaneous. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mortgage interest (paid to banks, etc.). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Qualified mortgage insurance premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Excess mortgage interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other interest (not entered elsewhere). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Painting and decorating. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOTE: If you purchased or disposed of any business assets, please complete Sheet 22.

18

Series: 53 |

Rental & Royalty Income (Schedule E) |

ORGANIZERPage 2

2012 |

1040 |

US |

Rental & Royalty Income (Sch. E) (cont.) |

No. |

|

|

18 p2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please enter all pertinent 2012 amounts. Last year's amounts are provided for your reference. The indirect

expense column should only be used for vacation homes or less than 100% tenant occupied rentals.

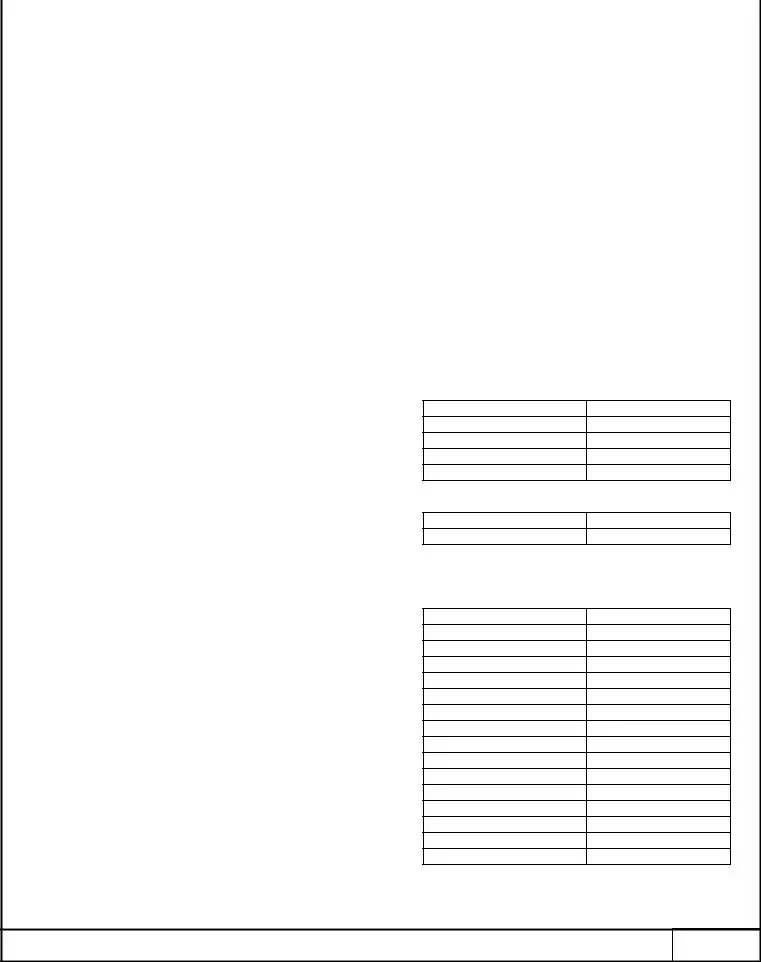

DIRECT EXPENSES (continued)

|

Direct expenses are related only to the rental activity. These include |

|

|

|

|

rental agency fees, advertising, and office supplies. |

2012 Amount |

2011 Amount |

|

|

|

|

||

Pest control |

|

|

||

Plumbing and electrical |

|

|

||

Repairs |

|

|

||

Supplies |

|

|

||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Taxes - real estate |

|

|

||

Taxes - other (not entered elsewhere) |

|

|

||

|

|

|||

Telephone |

|

|

||

|

|

|||

Utilities |

|

|

||

|

|

|||

Wages and salaries |

|

|

||

|

|

|||

Other: |

|

|

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL AND GAS

Production type (preparer use only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Cost depletion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Percentage depletion rate or amount. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State cost depletion, if different

State % depletion rate or amount, if different

VACATION HOME

Number of days personal use. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Number of days owned (if optional method elected). . . . . . . . . . . . . . . . . . . . . . . .

INDIRECT EXPENSES

NOTE:Indirect expenses are related to operating or maintaining the dwelling unit.

These include repairs, insurance, and utilities.

. .Advertising |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Association dues |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Auto and travel (not entered elsewhere) . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Cleaning and maintenance |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

THIS |

Commissions |

|

|

|

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

|

Gardening |

. . . . . . . . . . . . . . . . . |

....USE |

. . . . . |

Insurance |

. . . . . . . . . . . . . . . . . |

. . . . . |

|

Legal and professional fees |

. . . . . . . . . . . . . . . . . |

. . . . . |

|

Licenses and permits |

. . . . . . . . . NOT |

. . . . . |

|

Management fees |

|

|

|

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

|

Miscellaneous |

.. .. .. .. O |

. . . . . . . . . . |

. . . . . |

Mortgage interest (paid to banks, etc.). . . . |

. . . . . . . . . . |

. . . . . |

|

Qualified mortgage insurance premiums . . |

.D |

. . . . . . . . . . |

. . . . . |

Excess mortgage interest |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Other interest (not entered elsewhere). . . . |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

Painting and decorating |

. . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . . . . |

AREA

18 p2

Series: 53 |

Rental & Royalty Income (Sch. E) (cont.) |

Document Specifics

| Fact Name | Detail |

|---|---|

| Form Purpose | Schedule E is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. |

| 2012 Reporting | Contains fields for entering amounts from both 2012 and 2011 for comparative purposes. |

| Property Details | Requires detailed information about each property, including description, address, type, and number of days rented. |

| Ownership and Participation | Collects information on the percentage of ownership, tenant occupancy, spouse or joint ownership, and level of activity participation. |

| Income Types | Distinguishes between types of income sources, such as nonpassive or passive royalty income, and specifies various property types including single-family residences and commercial properties. |

| Direct and Indirect Expenses | Separates expenses into direct (specifically related to rental activity) and indirect (associated with operating or maintaining the dwelling unit), with specific examples provided for each. |

| Specialized Sections | Includes sections for reporting on oil and gas production and vacation home usage, highlighting the form's comprehensive approach to different types of rental and royalty income. |

Guide to Writing Us Tax Schedule E

Filing the US Tax Schedule E form requires careful attention to detail and accurate data entry. This form is designed for reporting income from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. The purpose of this guide is to walk you through filling out the Schedule E form correctly.

- Begin by entering all pertinent information for the tax year you are reporting, such as your name and address.

- Detail each property separately under the "Description of Property" section. Include the street address, city, state, Zip code, and the type of property. Refer to the types listed, ranging from single-family residences to royalties and select the number that corresponds to your property type.

- If you own a type of property not listed, describe it under "Other Type of Property."

- Enter the number of days each property was rented out during the year.

- Provide the percentage of ownership if not owned 100% under "Percentage of Ownership" and tenant occupancy percentage if not 100% under "Percentage of Tenant Occupancy."

- Indicate the nature of your rental activity by selecting the appropriate options for whether it's a spouse, joint, qualified joint venture, and if you are required to file Form(s) 1099.

- For each property, enter the "2012 Amount" of rents or royalties received. Do this using historical data for reference if available.

- List direct expenses related to the rental activity for each property. Direct expenses include advertising, association dues, auto and travel, cleaning and maintenance, commissions, gardening, insurance, legal and professional fees, licenses and permits, management fees, mortgage interest, qualified mortgage insurance premiums, and any other direct costs.

- Fill out the INDIRECT EXPENSES section if you have used the property as a vacation home or if it's less than 100% tenant-occupied. Include expenses such as advertising, association dues, auto and travel, cleaning and maintenance, commissions, and gardening among others listed.

- If your property includes oil and gas production, specify the production type, cost depletion, percentage depletion rate or amount, and if applicable, state cost and percentage depletion rates.

- For vacation homes, indicate the number of personal use days and, if using the optional method, the total days owned.

After completing these steps carefully, review the information for accuracy. Make sure all income and expenses are reported accurately to ensure compliance with tax laws and avoid potential penalties or audits.

Understanding Us Tax Schedule E

What is the purpose of the US Tax Schedule E form?

The US Tax Schedule E form is used to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It's designed for taxpayers to detail their earnings and expenses associated with these types of properties or entities.

Who needs to file Schedule E with their tax return?

Individuals who have received rental income from property they own, earned royalties, or have income from partnerships, S corporations, estates, trusts, or REMICs need to file Schedule E. This also applies if you're reporting income as a beneficiary of a trust or estate or part of a qualified joint venture.

Can Schedule E report income from all types of rental properties?

Yes, Schedule E is used to report income from various types of rental properties including single-family residences, multi-family residences, vacation or short-term rentals, commercial properties, and land. The form accommodates detailed reporting for each property type.

What are direct expenses on Schedule E, and how do they differ from indirect expenses?

Direct expenses on Schedule E are costs directly related to the rental activity, such as advertising, insurance, repairs, and utilities. These expenses are attributed solely to the rental operation. Indirect expenses, however, apply to properties not entirely used for rental purposes, like a vacation home used by the owner for part of the year. These can include similar types of expenses as direct, but are allocable based on the portion of time the property is rented versus used personally.

How does one report income or loss from partnerships, S corporations, or trusts on Schedule E?

Income or loss from partnerships, S corporations, or trusts should be reported on Schedule E in the sections allocated for these entities. You'll typically receive a Schedule K-1 form detailing your share of the income or loss from these entities, which you then report on your Schedule E.

Are there special considerations for reporting royalty income on Schedule E?

Yes, when reporting royalty income on Schedule E, taxpayers must distinguish between income received from natural resources (like oil and gas) and other types of royalties (such as patents or copyrights). The form allows for the reporting of cost or percentage depletion methods applicable to natural resources which can affect taxable income.

If a property was purchased or sold during the tax year, how is this reported on Schedule E?

Properties bought or sold during the tax year are reported by detailing the address, type of property, and dates of rental activity within the tax year. If the property was either purchased or disposed of, the individual must complete and attach the relevant sections or forms detailing the purchase or sale transaction, such as closing statements and depreciation calculations, to their Schedule E.

Common mistakes

When preparing the US Tax Schedule E Form for rental and royalty income, individuals commonly encounter a range of challenges. These missteps can lead to inaccuracies on the return, potentially resulting in penalties or missed deduction opportunities. The following list outlines nine common mistakes people make while filling out the Schedule E form.

- Not reporting all income received: This includes failing to declare rental payments or royalty revenues, which could result in underreported income and potential penalties.

- Incorrectly classifying the type of property: Misidentifying the property type (e.g., residential versus commercial) can affect the deductions and how income is reported.

- Omitting indirect expenses for vacation homes or partially tenant-occupied properties, leading to an inaccurate representation of the property’s financial performance.

- Forgetting to include all direct expenses associated with the rental activity, such as advertising, maintenance, and management fees, which can diminish the accuracy of reported net income.

- Miscalculating the percentage of ownership or tenant occupancy, which can impact the division of income and expenses on the form.

- Failure to accurately report days rented versus personal use days for vacation homes, which can affect the allowable deductions.

- Inaccurately reporting mortgage interest or not distinguishing between qualified mortgage insurance premiums and excess mortgage interest, potentially missing out on allowable deductions.

- Forgetting to check if they are required to file Form 1099 for service providers, potentially facing penalties for non-compliance.

- Incorrectly reporting activities as passive or nonpassive, or failing to indicate active participation in rental activities, which can affect loss deduction limits.

To avoid these and other mistakes, individuals should meticulously review all sections of Schedule E, ensure accuracy in their reporting, and consider consulting a tax professional if they are unsure about any aspects of their tax situation. Taking these steps can help in maximizing potential deductions and minimizing errors on tax returns.

Documents used along the form

To effectively manage rental and royalty income on the US Tax Schedule E, individuals must gather and correctly fill out several other forms and documents. These are crucial for accurately reporting income, expenses, and ultimately determining the correct tax liability.

- Form 1040: This is the standard IRS form taxpayers use to file their annual income tax returns. The information from Schedule E is used to complete sections of Form 1040, which calculates the taxpayer's total income tax for the year.

- Form 4562: This form is used for reporting depreciation and amortization. It details the depreciation expenses related to property listed on Schedule E, which affects the income reported and tax calculated on the property.

- Form 1099-MISC: Taxpayers use this form to report rental income received, and it is essential for accurately reporting income on Schedule E. It may also be required for reporting other types of payments made in the business.

- Form 8825: This form is required for taxpayers who own rental real estate as part of a partnership or S corporation. It reports income and deductible expenses related to the property, which impacts the information reported on Schedule E.

- Form 1098: Mortgage Interest Statement is issued to taxpayers by their mortgage lenders, detailing the mortgage interest paid during the year. This information is essential for completing Schedule E if the property is financed.

- Property Records: Keeping thorough records of purchases, expenses, and income related to the property is essential for accurately completing Schedule E. These documents don't get submitted with the tax return but are necessary for filling out the form accurately and substantiating claims during an audit.

Utilizing these forms and documents in conjunction with the US Tax Schedule E ensures thorough and accurate tax reporting for rental and royalty income. It also helps taxpayers to correctly calculate their tax liabilities and potentially maximize their allowable deductions and credits related to property ownership and management.

Similar forms

The US Tax Form 1040 Schedule C is quite similar to Schedule E, primarily because both are used for reporting types of income outside of wages, salaries, and tips. While Schedule E focuses on rental and royalty income, Schedule C is utilized by sole proprietors to report profits or losses from a business they operated or a profession they practiced as a sole proprietor. Both forms detail the necessity to outline income received, as well as allowable deductions to offset that income.

IRS Form 8825, "Rental Real Estate Income and Expenses of a Partnership or an S Corporation", shares many commonalities with Schedule E. This form is used by partnerships and S corporations to report rental real estate income and expenses, very much in line with Schedule E's purpose for individual taxpayers. Like Schedule E, Form 8825 requires detailed reporting of rental income received, as well as expenses incurred in the operation of rental property.

Form 1099-MISC, "Miscellaneous Income", while not a form filed by taxpayers, is related to Schedule E in the sense that it often documents the types of income reported there. Specifically, royalty payments reported on Form 1099-MISC need to be entered on Schedule E. This showcases the interconnectedness of IRS forms, where one form's reported payments become the income reported on another individual's income tax return.

Another counterpart to Schedule E is Schedule F, "Profit or Loss From Farming", which is used by individuals to report income and expenses related to farming operations. While Schedule E centers on rental and royalty income, Schedule F focuses on the agricultural sector, demonstrating the IRS’s approach to categorizing and taxing different income sources. Both schedules allow for the detailed deduction of expenses related to generating said income.

The US Tax Form 4562, "Depreciation and Amortization", can also be connected to Schedule E, mainly through the aspect of property depreciation. Owners of rental property use Schedule E to report their income and can use Form 4562 to calculate the depreciation of their property, a key expense that reduces taxable income. This form highlights the intersection between income reporting and expense documentation in the tax filing process.

Form 8582, "Passive Activity Loss Limitations", is intricately linked with Schedule E through the passive activity income rules. Income or losses reported on Schedule E from rental activities are subject to passive activity loss rules, and Form 8582 is used to calculate the allowable loss that can be deducted. This highlights the complexity of tax law when it comes to types of income and allowable deductions.

Schedule K-1 (Form 1065), "Partner's Share of Income, Deductions, Credits, etc.", is akin to Schedule E in that it deals with income from rentals, albeit indirectly. Partners in a partnership or S corporation members receive a Schedule K-1 detailing their share of the entity's income or loss, which they then report on their own tax returns, potentially on Schedule E if it pertains to rental real estate income.

IRS Form 5471, "Information Return of U.S. Persons With Respect to Certain Foreign Corporations", while serving a different purpose, touches on the Schedule E territory by involving foreign income. Taxpayers with interests in foreign real estate that generates rental income might need to navigate both Schedule E for their US tax return and Form 5471 if the property is held through a foreign corporation.

Lastly, Schedule D, "Capital Gains and Losses", also connects with Schedule E through the disposal of rental property. When a taxpayer sells a property reported on Schedule E, any capital gain or loss from the sale is reported on Schedule D. This crossover between schedules underscores the comprehensive nature of income tax reporting and the necessity for taxpayers to understand various reporting requirements.

In summary, while Schedule E specifically addresses rental and royalty income, its interconnections with other forms highlight the intricacy of tax reporting. Understanding these relationships ensures accurate and optimized tax filings.

Dos and Don'ts

Filling out Schedule E of the U.S. Tax Form accurately is crucial for reporting rental and royalty income. Here are essential dos and don’ts to consider:

- Do ensure all information is accurate and complete. Details such as property description, address, type of property, income received, and expenses related must be filled out with precision.

- Do report the correct number of days the property was rented and the percentage of ownership, if not solely owned. These details impact the income and expenses you can claim.

- Do accurately categorize direct and indirect expenses. Direct expenses are solely related to the rental activity, whereas indirect expenses pertain to the overall operation or maintenance of the dwelling.

- Do include all forms of rental income received during the year, not just monthly rent payments. This can also encompass advance payments, cancelation fees, or expenses paid by tenants.

- Don’t overlook the necessity to file Form(s) 1099 if you’ve paid more than $600 to a service provider, such as a property manager or a contractor, during the tax year.

- Don’t forget to classify your rental activity properly. Indicating whether it’s a nonpassive activity, passive royalty, or if you qualify as a real estate professional affects your tax obligations.

- Don’t neglect to report mortgage interest and other related expenses accurately. These are crucial deductions that can significantly impact your taxable income from the property.

- Don’t mix personal use expenses with rental expenses if your property is a vacation home or used personally for a part of the year. Accurately dividing these expenses is key to correct reporting.

Adhering to these guidelines will help ensure the Schedule E form is correctly filled out, potentially avoiding errors that could lead to audits or penalties from the IRS.

Misconceptions

Many people have misconceptions about the U.S. Tax Schedule E form, which is used for reporting rental and royalty income. Understanding these misconceptions can help taxpayers accurately report their income and expenses, potentially saving money and avoiding complications with the IRS. Here are nine common misconceptions about the Schedule E form:

- Only rental income needs to be reported: In addition to rental income, Schedule E is also used for reporting income from royalties, partnerships, S corporations, estates, trusts, and REMICs (Real Estate Mortgage Investment Conduits).

- Personal expenses can be deducted: Only expenses directly related to the rental activity or property can be deducted. Personal living expenses or general home improvements not directly tied to rental activities are not deductible on Schedule E.

- Total expenses are deductible in the year they're paid: Not all expenses can be deducted in the year they are paid. Some expenses, like the purchase price of a property, improvements, and equipment costs, must be depreciated over several years.

- Losses can always be deducted against other income: The ability to deduct rental losses against other types of income can be limited, especially for taxpayers who cannot qualify as real estate professionals or whose income exceeds certain thresholds.

- All rental property owners are considered passive: Rental activities are generally considered passive, meaning losses may be limited. However, exceptions exist for real estate professionals and active participants who meet certain criteria, potentially allowing more losses to be deducted.

- Only the income from fully rented properties should be reported: You must report income and expenses from all rental properties, even partially rented or vacant ones, as long as they were available for rent.

- The schedule isn't necessary for occasional or short-term rentals: If you rent a property for more than 14 days a year, you need to report the rental income and expenses, even if it's your personal residence or rented for short terms.

- Insurance and mortgage interest are fully deductible: While you can deduct insurance and mortgage interest related to your rental activity, only the portion allocable to the rental use and not personal use (in the case of a mixed-use property) is deductible.

- You must itemize deductions to deduct rental expenses: Since rental income and expenses are reported on Schedule E, they do not affect your choice to itemize or take the standard deduction on your personal return.

Correcting these misconceptions can help ensure that your tax filings are accurate and that you are taking advantage of all applicable deductions while complying with tax laws. Always consider consulting with a tax professional to get advice tailored to your specific situation.

Key takeaways

When filling out the US Tax Schedule E form, which is focused on rental and royalty income, there are several key points to remember to ensure accurate and compliant reporting to the IRS. Here’s what you need to know:

Provide detailed information about each property, including its description, street address, city, state, and ZIP code. This helps in identifying the property for tax purposes.

Clearly indicate the type of property you own. The IRS categorizes properties differently, ranging from single-family residences to commercial properties and land. This classification impacts the tax treatment of income and expenses related to the property.

Record the number of days each property was rented out. This is crucial for calculating deductible expenses accurately, especially for properties that are also used personally.

Document the percentage of your ownership in the property if it's not 100%. This affects the amount of income and expenses you can report.

For vacation homes or properties not fully occupied by tenants, you must specify this with the appropriate occupancy percentage. This also influences the deductibility of expenses.

If you're part of a qualified joint venture or if the property is held in a single-member LLC, this needs to be correctly identified for tax purposes.

List all income received from rents or royalties. Accurate reporting of income is essential for proper tax calculation.

Detail direct expenses related only to the rental activity. These include advertising, maintenance, utilities, and more. Direct expenses are fully deductible, depending on your rental activity’s profitability.

Pay attention to indirect expenses, especially for vacation homes or properties not 100% tenant-occupied. Indirect expenses are allocated based on the number of days used for rental versus personal use.

Understand the difference between passive and nonpassive activity, and whether you actively participated in the rental activity. This may impact your ability to deduct losses against other types of income.

Properly filling out the Schedule E form requires meticulous record-keeping and a clear understanding of the tax rules. Whether you're reporting rental income, paying mortgage interest, or claiming depreciation, each section of the form plays a crucial role in how your rental and royalty income is taxed. Staying organized and keeping detailed records of income and expenses throughout the year can make this process much smoother.

This form is also a reminder of the importance of meeting IRS requirements, such as filing Form 1099 for certain payments made during your rental activity. Compliance with these requirements is critical to avoid penalties.

Overall, understanding and correctly completing the Schedule E form can help you take full advantage of the tax benefits available to property owners, while also ensuring compliance with the tax code. Reviewing the form carefully, along with the instructions provided by the IRS, can provide further guidance and clarification.

Popular PDF Documents

Philhealth Online - Encourages punctual premium remittance through a user-friendly format and clear instructions.

Sale of Donated Property Within 3 Years - Compliance with the filing requirements of Form 8282 reflects an organization's dedication to fiscal responsibility.

Irs Payment Plans - It's specifically designed for those who need more time to pay off their tax bill in smaller, more manageable amounts.