Get Unincorporated Business Tax Return Form

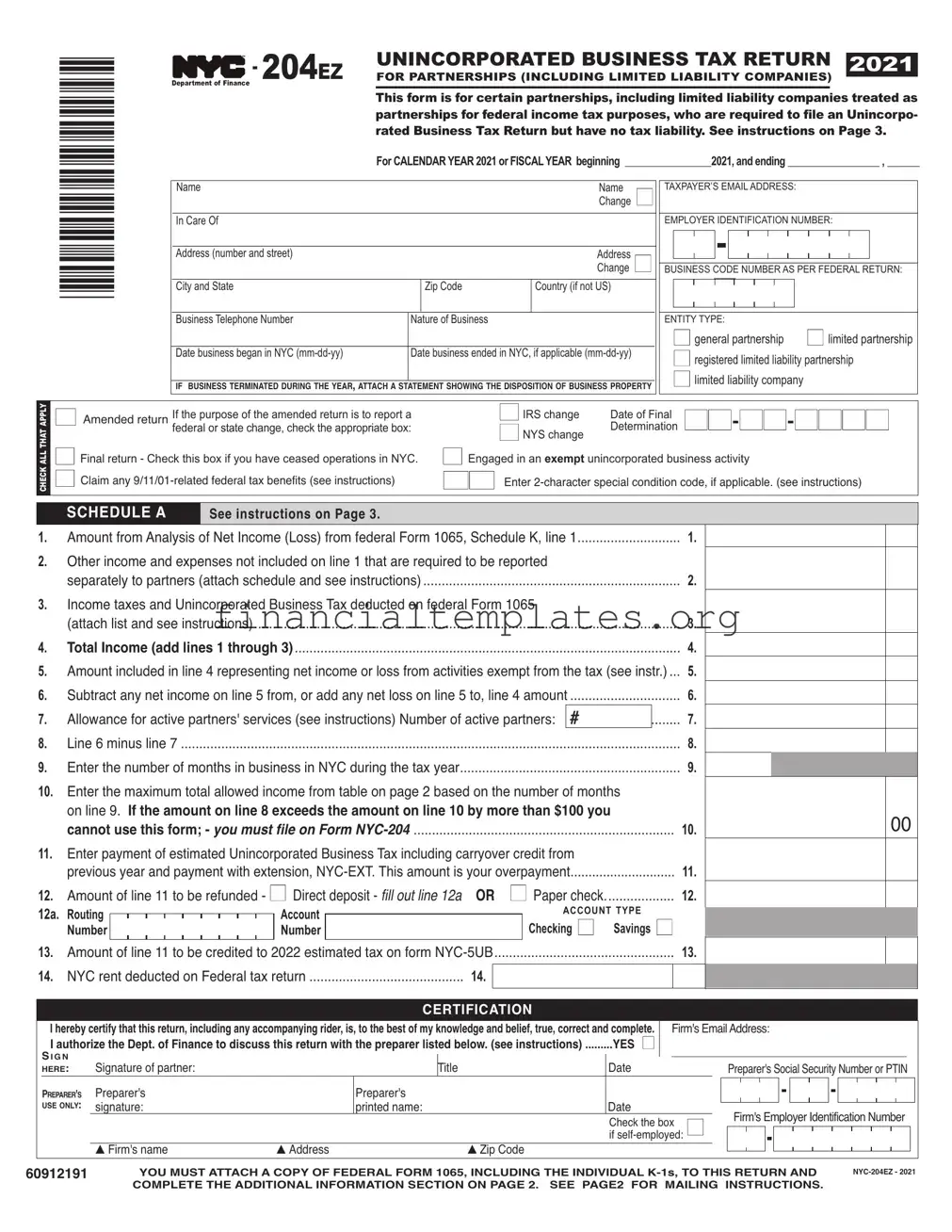

The Unincorporated Business Tax Return form, designated as form NYC-204EZ for the year 2021, serves as a crucial document for partnerships, including those structured as limited liability companies (LLCs) that are recognized as partnerships from a federal income tax perspective. It is specifically tailored for entities that have the obligation to file an unincorporated business tax return within New York City but find themselves without any tax liability for the specified period. The form guides partnerships through the process of reporting income, with explicit instructions given for deductions, income adjustments, and the allocation of tax credits. It provides a streamlined path for businesses that have ceased operations within the tax year to declare the final disposition of their business assets. Moreover, this form takes into consideration amendments following IRS or New York State adjustments, accommodating those who might need to report changes affecting their business tax status. Pertinent details such as taxpayer identification and direct deposit information for refunds illustrate the form’s comprehensive approach to ensuring businesses meet their tax obligations efficiently. Additionally, the requirement to attach a copy of the Federal Form 1065, along with individual K-1s, underscores the interconnectedness of federal and local tax reporting obligations. Through detailed instructions on maximum allowed business income and the implications for partnerships with varying revenue levels, the form encapsulates the essential elements businesses in New York City need to navigate their unincorporated business tax responsibilities effectively.

Unincorporated Business Tax Return Example

*60912191*

UNINCORPORATED BUSINESS TAX RETURN 2021 |

|

FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES) |

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an Unincorpo- rated Business Tax Return but have no tax liability. See instructions on Page 3.

For CALENDAR YEAR 2021 or FISCAL YEAR beginning ________________2021, and ending _________________ , ______

|

Name |

|

|

Name |

■ |

|

|

|

|

Change |

|

|

|

|

|

|

|

|

In Care Of |

|

|

|

|

|

|

|

|

|

|

|

Address (number and street) |

|

|

Address |

■ |

|

|

|

|

Change |

|

|

|

|

|

|

|

|

City and State |

|

Zip Code |

Country (if not US) |

|

|

|

|

|

|

|

|

Business Telephone Number |

Nature of Business |

|

|

|

|

|

|

|

|

|

|

Date business began in NYC |

Date business ended in NYC, if applicable |

|

||

IF BUSINESS TERMINATED DURING THE YEAR,ATTACH A STATEMENT SHOWING THE DISPOSITION OF BUSINESS PROPERTY

TAXPAYER’S EMAIL ADDRESS:

EMPLOYER IDENTIFICATION NUMBER:

BUSINESS CODE NUMBER AS PER FEDERAL RETURN:

ENTITY TYPE: |

|

■general partnership |

■limited partnership |

■registered limited liability partnership

■limited liability company

APPLY |

|

■ dedretur |

|

|

|

If the purpose of the amended return is to report a |

|

|

■IRS change |

|

Date of Final |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

federal or state change, check the appropriate box: |

|

|

■NYS change |

|

Determination |

|

|

||||||||||||||||||||||||||||||||||||||||||||||

ALLTHAT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

■ iaretur |

|

Check this box if you have ceased operations in NYC. |

|

■ Engaged in an exempt unincorporated business activity |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

CHECK |

|

■ aiayatedfederataxbeefitseistructi |

|

|

|

s |

|

■■ ter‑characterspeciacditicdeifappicabeeist |

|

|

|

|

|

|

|

|

|

|

|

ructis |

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

SCHEDULE A |

|

|

See instructions on Page 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

1. |

|

utfraysisfNetcssfrfederarSchedu |

|

|

|

|

|

|

eie |

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2. |

|

Othericadexpesesticudediethatarere |

|

uiredtbereprted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

separateytpartersttachschedueadseeistructis |

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

3. |

|

ctaxesadicrpratedsiessTaxdeductedfedera |

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

ttachistadseeistructis |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

4. |

|

Total Income (add lines 1 through 3) |

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

5. |

|

uticudediierepresetigeticrssfra |

|

|

|

|

|

ctivitiesexetfrthetaxeistr |

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

6. |

|

Subtractayeticiefrraddayetss |

|

|

|

|

ietieaut |

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

7. |

|

wacefractivepartersserviceseistructisNuerfactive |

|

|

|

parters |

|

# |

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

8. |

|

Lieusie |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9. |

|

tertheuerfthsibusiessiNYdurigthetaxyea |

|

|

r |

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

10. |

terthexittaawedicfrtabepageb |

|

|

|

|

|

asedtheuerfths |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

ie |

|

|

|

If the amount on line 8 exceeds the amount on line 10 by more than $100 you |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

cannot use this form; - |

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

11. |

terpaytfestitedicrpratedsiessTaxicudigca |

|

|

rryvercreditfr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

previusyearadpaytwithextesiNYThisautisy |

|

|

urverpayt |

|

|

|

|

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

12. |

utfietberefuded |

|

|

|

|

|

■ irectdepsit |

filloutline12a OR ■ percheck . |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

12a. Routing |

|

|

|

|

|

|

|

|

|

|

Account |

|

|

|

|

|

|

ACCOUNT TYPE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking ■ |

|

Savings ■ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

13. |

utfietbecreditedtestitedtax |

|

|

|

frNY |

|

|

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

14. |

NYretdeductedederataxretur |

|

|

|

|

14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CERTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Iherebycertifythatthisreturn,includinganyaccompanyingrider,is,tothebestofmyknowledgeandbelief,true,correctandcomplete. |

irsidress |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) .........YES ■ |

_____________________________________________ |

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

SIGN |

|

|

Sigaturefparter |

|

|

|

|

|

|

|

|

|

|

Tite |

|

|

ate |

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

parersSciaSecurityNuerrN |

|

||||||||||||||||||||||||||||||||||||

|

HERE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

parersparers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

PREPARER'S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

USE ONLY: |

|

sigature |

|

|

|

|

|

|

|

|

priteda |

|

|

|

|

|

|

|

ate |

|

|

|

|

|

irsyerdetificatiNuer |

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

heckthebx |

|

■ |

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ifsefyed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

s irsa |

|

|

|

|

|

|

|

|

|

s dress |

|

|

s Zipde |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

60912191 YOU MUST ATTACH A COPY OF FEDERAL FORM 1065, INCLUDING THE INDIVIDUAL

COMPLETE THE ADDITIONAL INFORMATION SECTION ON PAGE 2. SEE PAGE2 FOR MAILING INSTRUCTIONS.

Form |

|

|

|

|

Page 2 |

||

|

|

|

|||||

|

ADDITIONAL REQUIRED INFORMATION |

The following information must be entered for this return to be complete. |

|||||

1. |

NewYrkStateSaesTaxNuer________________________ |

____________________________________ |

|

||||

2. |

idyufieaNYrtershipReturi |

|

|

|

■Y |

■NO |

|

3. |

idyufieaNYrtershipReturi |

|

|

|

■Y |

■NO |

|

4. |

astheteraReveueServicertheNewYrkStateepart |

|

|

tfTaxatiadiaceicreased |

|

|

|

|

rdecreasedaytaxabeicssreprtediaytaxperid |

|

|

rareyucurretybeigaudited |

■Y |

■NO |

|

|

fsbywh |

teraReveueService |

■ |

NewYrkStateeparttfTaxatiadiace |

■ |

|

|

Stateperids_______________________________________ ________________________________________

5.f“Ytuesti

5a. |

ryearsprirthasrNYeprtfederaSta |

tehageiTaxabecbeefied |

■Y |

■NO |

|

5b. |

ryearsbegiigrafterhasaadedretur |

beefied |

■Y |

■NO |

|

6. |

aytidurigthetaxabeyeardidthepartershipha |

veaiterestireaprperty |

|

|

|

|

catediNYriaetitywigsuchreaprperty |

|

■Y |

■NO |

|

6a. ftuestiattachascheduefsuchprpertyid |

icatigtheatureftheiterestad |

|

|

||

|

icudigthestreetaddressbrughbckadtuer |

|

|

|

|

7. |

f |

t |

|

|

|

|

a) |

asthereapartiarceteiuidatifthepartersh |

ip |

■Y |

■NO |

|

b) |

asrrefthepartershipitereststrasferredithe |

astyearsraccrdigtapa |

■Y |

■NO |

8. |

ftarbwasaReapertyTrasferTaxReturfied |

|

■Y |

■NO |

9. |

fOtexpaittachadditiasheetifecessary_ |

__________________________________________________________ |

||

10. |

esthistaxpayerpayretgreatertha$frayprese |

siNYithebrughf |

|

|

|

hattasuthfthStreetfrthepurpsefcarryig |

aytradebusiessprfessivcati |

|

|

|

rcrciaactivity |

|

■Y |

■NO |

11. |

fwereareuiredrciaRetTaxRetursfied |

|

■Y |

■NO |

|

easeeteryerdetificatiNuerwhichwasusedth |

erciaRetTaxRetur |

_________________________________ |

|

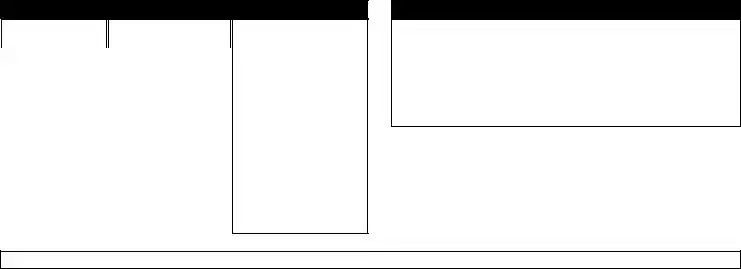

TABLE OF MAXIMUM ALLOWED INCOME FROM BUSINESS

MAILING INSTRUCTIONS

NUMBER OF MONTHS MAXIMUM TOTAL INCOME

IN BUSINESS |

FROM BUSINESS |

|

|

1 |

$85,416 |

2 |

$85,833 |

3 |

$86,250 |

4 |

$86,667 |

5 |

$87,083 |

6 |

$87,500 |

7 |

$87,917 |

8 |

$88,333 |

9 |

$88,750 |

10 |

$89,167 |

11 |

$89,583 |

12 |

$90,000 |

|

|

If total income from

business after

deduction for active

partners’services

is more than $90,000,

you must use Form

FIFTEEN OR MORE

CALENDAR DAYS

CONSTITUTES

ONE MONTH

The due date for calendar year 2021 is on or before March 15, 2022.

For fiscal years beginning in 2021 file by the

15th day of the third month following the close of the fiscal year.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return.

RETURNSCLAIMINGREFUNDS |

|

ALLOTHERRETURNS |

|

|

|

NYON |

|

NYON |

NNORRTSNT |

|

NNORRTSNT |

OX |

|

OX |

NONNY |

|

NONNY |

|

|

|

Download forms and instructions online at nyc.gov/finance or call 311. If calling from outside of the five NYC boroughs, please call

*60922191* 60922191

Form |

Page 3 |

INSTRUCTIONS

Who may use this formThisfrisfrcertaipartershipsicudig

itediabiitycaiestreatedaspartershipsfrfedera |

ictax |

|

purpseswharereuiredtfieaicrpratedsiessTa |

xRetur |

|

buthavetaxiabiityrtaxabeyearsbegiig |

rafterJauary |

|

apartershipegagediauicrpratedbusie |

ssisreuired |

|

tfieaicrpratedsiessTaxreturifitsuicrprat |

edbusi |

|

essgrssicisretha$Thisfryasbeused |

by |

|

apartershipthatistreuiredtfiebutwishestdi |

scaiayiabiity |

|

frtaxbecauseitisegagedseyiactivitiesexetfrth |

etax |

|

You may not use this form if: |

|

|

u |

YuhaveNYdificatistherthatheaddbackfica |

d |

|

icrpratedsiessTaxesSchedueiefrNY |

|

|

raceteistfdificatisseeistructisfrrNY |

|

u |

YuacatettabusiessicwithiadwithutNY |

fyua |

|

catefyurbusiessictNYyuyusethisfr |

|

uYucaiacreditfricrpratedsiessTaxider NYrthercreditserNYNYNY

rNY

uYucaiapartiaexetifrivesttactivitieseistruc tistrNYhisSubjectttheTax

uYuhaveayivestticrsseistructisfrNY SchedueLies

uYucaiaydeductifraetperatigsserNY Schedueie

uYuruicrpratedbusiessgrssicesstheawacefrac tivepartersservicesisretha$erNY Schedueie

urfederapurpsesaprtifyurbusiessiterestexpese de ductiisdisaweduderR§

urfederapurpsesyuhaveicuderRsectisr

beefit” thisfrifyucaiayfthefwigbeefitsyurfed

erareturbusdepreciatiradeductiuderR§ frprp

ertyitheResurgeceZewhetherrtyufiefrNYZi

R§treattfrprpertycvertedduettheattacksthe

rdTradeetertachederafradtthis returSeeistructisfrrNYSchiescad

ciacditicdesfappicabeeterthetwcharacter cdeithebx prvidedthefr

SPECIFIC INSTRUCTIONS

SCHEDULEA |

|

|

Line 2 |

tertheetautfthepartersdistributivesharesfi |

c |

|

addeductiiteticudediiebutreuiredt |

bere |

|

prtedseparateyfederartachaschedue |

|

Line 3 |

tertheautficaduicrpratedbusiesstaxes |

|

|

isedbyNewYrkityNewYrkStateraythertaxigju |

|

|

risdictithatwasdeductedicutigtheautsi |

es |

|

rtachaschedue |

|

Line 5 |

terthisietheauticudediiethatrep |

resets |

|

theeticretssfraactivitythatistaui |

cr |

|

pratedbusiesscarriedbythetaxpayerwhyrpartyi |

|

|

theitySeestructisfrrNYhisSubjectt |

|

|

theTaxrthispurpse |

|

|

i excudetheicrssfaetitytherthaade |

aeras |

|

defiedide§thatfritswaccut |

e |

gagedseyithepurchasehdigrsaefprperty |

|

|

trasactisipsitisiprpertyrtheacuisitih |

d |

|

igrdispsititherthaitherdiarycursefbusi |

|

|

essfiterestsitheruicrpratedetitiesthatare |

|

|

thevesegagedseyithefregigactivitiesNOT |

|

|

etitiesreceivig$ressfgrssreceiptsfrther |

|

|

activitiesystibeeigibefrthisexcuside§ |

|

|

weveretitieseigibefrthepartiasefra |

d |

|

igexetiuderde§areteigibe |

|

|

frthisexcusiadytusethisfr |

|

|

i frtaxabeyearsbegiigrafterJuyexcu |

de |

|

theicgairssfrreaprpertyhedtprduce |

|

|

retaicrfrthedispsitifsuchprpertybya |

|

|

etitytherthaadeaersexcudeicrssfr |

|

|

abusiesscductedattheprpertyseyfrthebeefitf |

|

|

teatsattheprpertythatistpetthepubica |

de |

|

igibeicfrparkigservicesrederedtteatsSee |

|

|

de§ |

|

|

ii excudethe |

icrssfrayseparateaddistict |

|

activitycarriedwhyutsidefNewYrkity |

|

|

vfrtaxyearsbegiigraftergustexcude |

|

|

afthefederataxabeicfpartershipsthatreceive |

|

|

rreftheirgrssreceiptsfrchargesfrthepr |

|

|

visifbieteecicatisservicestcustrs |

|

|

adexcudeapartersdistributiveshareficgais |

|

|

ssesaddeductisfraypartershipsubjectttax |

|

|

uderdeTitehasa“utiity”asdefied |

i |

|

desectiicudigitssharefseparateyre |

|

|

prtedite |

|

|

Line 7 deductiybecaidfrreasabecesatifr persaservicesrederedbythepartersTheawabede

ductiisthewerffiefgreaterthazerri $freachactiveparter

PreparerAuthorization |

|

tdiscussyurreturwiththepaidpreparerwhsigedityu |

stcheck |

thesbxithesigatureareafthereturThisauthri |

zatiappies |

yttheidividuawhsesigatureappearsithepare |

rsseOy |

sectifyurreturtdestappytthefirifa |

yshwithatsec |

ticheckigtheesbxyuareauthrizigtheepart |

tfi |

acetcathepreparertaswerayuestisthatyarise |

durig |

theprcessigfyurretursyuareauthrizigtheprep |

arert |

uivetheeparttayifrtissigfryurretur

uatheeparttfrifrtiabuttheprcessigfyurretur rthestatusfyurrefudrpaytad

uRespdtcertai noticesthatyouhavesharedwiththepreparer

abuttherrrsffsetsadreturpreparatiThetice |

s will |

notbesettthepreparer |

|

You are not authorizingthepreparertreceiveayrefudcheckbid

yutaythigcudigayadditiataxiabiityrtherwiserepre

setyubefretheeparttTheauthrizaticatberevked

hwevertheauthrizatiwiautticayexpireat erthathedue

dateithutregardtayextesisfrfiigextyearsre tur Fail- ure to check the box will be deemed a denial of authority.

uasfrwhtheyseekthisifrtiastwhetherciacewith

thereuestisvutaryrdatrywhythereuestisbeig dead

hwtheifrtiwibeusedThediscsurefSciaSe curityNu

bersfrtaxpayersisdatryadisreuiredbysectif

theistrativedeftheityfNewYrkfrtaxadistratipur

psesadwibeusedtfaciitatetheprcessigftaxre turs

NY

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | The form is designated for partnerships, including LLCs treated as partnerships for federal income tax purposes. |

| 2 | It is specifically utilized by entities with no tax liability for the filing year. |

| 3 | Applicable for both calendar and fiscal year filings starting in 2021. |

| 4 | Requires detailed information on business nature, inception in NYC, and if applicable, the termination date. |

| 5 | Entities must attach a copy of Federal Form 1065 along with individual K-1s to this return. |

| 6 | The form allows for direct deposit or paper check options for refunds. |

| 7 | Specific sections are dedicated to reporting changes in IRS or NYS determinations affecting the entity. |

| 8 | Entities with total income after deductions over $90,000 must use Form NYC-204 instead. |

| 9 | The form includes sections for declaring NYC-based business operations, including location and gross receipts. |

| 10 | Entities are required to report any real property interests in NYC along with detailed information on such property. |

Guide to Writing Unincorporated Business Tax Return

Ready to file your Unincorporated Business Tax Return for your partnership or limited liability company (LLC)? This tax form is essential for partnerships and LLCs that are treated as partnerships for tax purposes, operating without tax liability. Follow these simple steps to ensure your form is filled out correctly and submitted on time.

- Start by entering the fiscal year dates at the top of the form, including the beginning and end of the tax year.

- Fill in the business information including the name, address (and indicate any address changes), city, state, zip code, and country if outside the US.

- Add your business telephone number, nature of business, and relevant dates such as when the business began and ended operations in NYC, if applicable.

- Provide the taxpayer's email address and the employer identification number.

- Indicate the type of entity your business is classified as: general partnership, limited partnership, registered limited liability partnership, or limited liability company.

- If applicable, check the box for applying an amended return due to changes from the IRS, NYS, or other, and provide the date of the final determination.

- Complete Schedule A by listing net income, other income and expenses, and taxes from your federal return on the respective lines.

- Enter total income by adding lines 1 through 3, then list expenses exempt from tax and subtract to find your taxable income.

- Fill in information regarding wages for active partners and licenses, if applicable.

- Record the number of this business in NYC during the tax year.

- If you have payments for estimated Unincorporated Business Tax, including overpayment from previous years, record it accordingly.

- Decide if the refund is to be made by direct deposit or paper check and provide the routing and account numbers, specifying the account type.

- Indicate if the credit is to be applied to estimated tax for NY.

- Note any NY retained amount deducted on the federal tax return.

- Sign and date the certification section to verify the accuracy of the return. If you authorize, indicate consent to discuss the return with the preparer listed on the form.

- Attach a copy of the Federal Form 1065, including the individual K-1s, to this return.

- Fill out the additional required information section as needed.

- Review the mailing instructions on Page 2 to ensure correct submission to the NY Department of Finance.

Once you've completed all sections and attached the necessary documentation, it's time to mail your form. Make sure to send it to the appropriate address provided in the mailing instructions. If claiming a refund or submitting other returns, different addresses may apply. Filing your tax form correctly and on time is crucial to maintain good standing and ensure any potential refunds are processed efficiently. If you have any questions or need further assistance, consider consulting a tax professional or the Department of Finance directly.

Understanding Unincorporated Business Tax Return

- Who is required to file an Unincorporated Business Tax Return in New York City?

Partnerships, including limited liability companies (LLCs) treated as partnerships for federal income tax purposes, engaged in any unincorporated business within New York City with gross income over $95,000 are required to file an Unincorporated Business Tax Return. These entities must report their income and can file using Form NYC-204EZ if they meet certain conditions, aiming to disclose activities exempt from the tax.

- Can any partnership file using Form NYC-204EZ?

Not all partnerships can use Form NYC-204EZ. This form is designed for partnerships with no tax liability for the tax year because they are engaged solely in activities exempt from the tax. Additionally, to use Form NYC-204EZ, the partnership’s income after deductions for partner services must be more than $90,000. Partnerships cannot use this form if they require more complex tax situations, such as claiming credit for incorporated business taxes or any deductions for operating losses as outlined in the form's specific instructions.

- What are the deadlines for filing the 2021 Unincorporated Business Tax Return using Form NYC-204EZ?

The due date for filing the 2021 Unincorporated Business Tax Return using Form NYC-204EZ for the calendar year is March 15, 2022. For fiscal years that begin in 2021, the return must be filed by the 15th day of the third month following the close of the fiscal year. This timing ensures the appropriate reporting and payment (if applicable) of taxes based on the business's fiscal schedule.

- Are there any specific attachments required with Form NYC-204EZ?

Yes, partnerships filing Form NYC-204EZ must attach a copy of the Federal Form 1065, including the individual K-1s, to their return. This requirement helps correlate the partnership’s federal income reporting with their city tax obligations, providing a comprehensive view of the business's financial activities within the tax year.

- What happens if a partnership's income after deductions exceeds the threshold allowed on Form NYC-204EZ?

If a partnership's total income from business activities after deductions for partner services is more than $90,000, they cannot file the Unincorporated Business Tax Return using Form NYC-204EZ. Instead, they must file using Form NYC-204, which is designed for partnerships with higher income levels and potentially more complex tax situations that require additional information and calculations.

- How can partnerships obtain Form NYC-204EZ and its instructions?

Partnerships can download Form NYC-204EZ and its detailed instructions from the New York City Department of Finance website at nyc.gov/finance. This resource provides the most current forms and guidance for the tax year in question. For those outside the five NYC boroughs who cannot access the forms online, calling 212-NEW-YORK (212-639-9675) provides an alternative method to obtain the necessary documentation.

Common mistakes

- Not attaching a copy of the Federal Form 1065, including the individual K-1s. This document is essential as it provides detailed information about the partnership's income, deductions, and credits.

- Incorrectly reporting the business’s start or end date in New York City. These dates determine the tax period for which you are liable.

- Failure to accurately report the nature of the business. This information helps classify your business correctly and ensures it is taxed accordingly.

- Failing to check the appropriate boxes that apply to your entity type (e.g., general partnership, limited partnership, etc.). This affects how your business is viewed and taxed under the law.

- Omitting or inaccurately filling out the New York State Sales Tax Number, if applicable. This number is crucial for businesses that collect sales tax.

- Incorrectly calculating taxable income and deductions. Ensuring accurate math and proper adherence to guidelines helps avoid underpayment or overpayment of taxes.

- Not specifying whether the business has ceased operations in NYC. If your business has terminated, specific documentation and statements are required.

- Leaving the preparer's information blank or incomplete. If a preparer was used, the Department of Finance should be authorized to discuss the return with them for clarification or verification purposes.

- Incorrectly electing business activity exemptions without proper justification or documentation. Some businesses might be eligible for specific exemptions, but clear evidence and correct application procedures are necessary.

When individuals or partnerships fill out the Unincorporated Business Tax Return form, they often encounter issues that can lead to inaccuracies or delays in processing. Recognizing and avoiding these common mistakes can help ensure a smoother filing experience. Here are nine mistakes to be cautious of:

In conclusion, carefully reviewing the Unincorporated Business Tax Return form instructions and double-checking all entries can mitigate these common mistakes. Accuracy, completeness, and transparency are key to a successful filing process.

Documents used along the form

Filing an Unincorporated Business Tax Return can be complex, and often, additional forms and documents are necessary to ensure complete compliance with tax regulations. The following provides a brief overview of five commonly associated documents that businesses may need to utilize alongside the Unincorporated Business Tax Return form, aiding in a smooth filing process.

- Federal Form 1065: This form is a Return of Partnership Income. It's used by partnerships and multi-member LLCs treated as partnerships to report the income, deductions, gains, losses, etc., from their operations. Form 1065 helps to inform the IRS about the company's financial status and determines what portions of income or loss will be passed through to the partners' individual tax returns.

- Schedule K-1 (Form 1065): This document is a continuation of Form 1065. Schedule K-1 reports the distribution of income, deductions, and credits to each partner. It helps to break down each partner's share of the business's income or loss, which they must report on their individual tax returns.

- Employer Identification Number (EIN) Documentation: An EIN, also known as a federal tax identification number, is used to identify a business entity. It is essentially a social security number for the business. Documentation proving the business's EIN is essential for filing a variety of tax-related documents, including the Unincorporated Business Tax Return.

- New York State Sales Tax Number Registration: Businesses selling goods and certain services in New York State are required to collect sales tax from customers. The sales tax number or certificate of authority proves that the business is registered with the state to collect sales tax. This might be necessary to complete the tax filing process, particularly if the business operations impact the tax obligations.

- Estimated Tax Payment Records: Businesses often make estimated tax payments throughout the year. Keeping a record of these payments is crucial as they are accounted for in the final tax return to determine if the business owes additional taxes or has overpaid and is due a refund.

Each of these documents plays a vital role in accurately preparing and filing an Unincorporated Business Tax Return. By understanding and gathering these forms in advance, businesses can ensure they meet all legal requirements, potentially saving time and avoiding penalties for incorrect or incomplete tax filings.

Similar forms

The Unincorporated Business Tax Return for partnerships is closely related to the Federal Form 1065, U.S. Return of Partnership Income. Both forms serve as annual financial reporting tools for partnerships, detailing the income, gains, losses, deductions, and credits of the business. The purpose is to report the partnership's financial status to respective tax authorities. Federal Form 1065 requires partnerships to distribute individual K-1 forms to each partner, outlining their share of the partnership's profit and loss. This detail is paralleled in the Unincorporated Business Tax Return, which also necessitates attaching a copy of the federal 1065 form, highlighting how these documents work in tandem to ensure that partnerships accurately report their income at both federal and state or city levels.

Another document similar to the Unincorporated Business Tax Return is the Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. This form is a component of the Federal Form 1065 package and reports each partner's share of the partnership's income, deductions, and credits. It is directly linked to the Unincorporated Business Tax Return because it provides the detailed breakdown of individual partner's earnings and tax responsibilities. Ultimately, the information on K-1 forms is used by partners to complete their own tax returns, showing the interconnectedness between individual and partnership tax responsibilities.

The State Partnership Income Tax Return is also analogous to the Unincorporated Business Tax Return. Many states require partnerships to file an income tax return for the state in which they operate, similar to filing with the federal government. This state-level return reports the income, deductions, and credits of the business to the state tax department. The exact form and requirements vary by state, but the principal purpose is the same as the Unincorporated Business Tax Return – to account for and tax the earnings of partnerships within the jurisdiction.

Lastly, the Estimated Tax Payment form for partnerships, often referred to as the Form 1040-ES for individuals, parallels the Unincorporated Business Tax Return in that it deals with the taxation of earnings throughout the year. Instead of reconciling tax obligations after the close of the fiscal year, estimated tax payments require partnerships to pay taxes on income as it is earned quarterly. This preemptive approach to tax payment showcases how businesses manage tax responsibilities on an ongoing basis, highlighting another aspect of tax planning and management for partnerships akin to the yearly Unincorporated Business Tax Return process.

Dos and Don'ts

When navigating the complexities of filling out the Unincorporated Business Tax Return form, understanding what steps you should and shouldn't take can make the process smoother and help you avoid common mistakes. Here’s a rundown to guide you:

Things You Should Do:

Double-check all the information: Ensure that every detail, including your Employer Identification Number, business name, and address, is filled out accurately and matches your federal income tax return.

Attach required documentation: Make sure to include a copy of your federal Form 1065, along with the individual K-1s, to provide comprehensive details about your partnership or LLC.

Review the form’s instructions: The form comes with specific instructions helpful in clarifying what information is needed for each section. Refer to these instructions to minimize errors and provide correct details.

Sign and date the form: A signature is a critical part of the submission process, indicating that you certify the return as true, correct, and complete. Don’t forget to authorize a preparer, if applicable, to discuss the return with the Department of Finance.

Things You Shouldn't Do:

Do not overlook mailing instructions: Failing to follow the specific mailing instructions provided on the form can lead to delays in processing. Ensure you send the return to the correct address designated for returns claiming refunds versus all other returns.

Avoid late filing: Submit your return by the due date to prevent penalties. For calendar year filers, the due date is typically March 15 of the following year. For fiscal year filers, it's the 15th day of the third month after the fiscal year ends.

Do not leave mandatory fields blank: Ensure that no required sections are left unanswered. Incomplete forms may result in processing delays or requests for additional information, complicating your filing process.

Refrain from providing incorrect or incomplete documentation: Ensuring that all required documents, including federal forms and schedules, are complete and accurate when attached to your Unincorporated Business Tax Return is essential for a smooth review process.

Misconceptions

One common misconception is that the Unincorporated Business Tax Return form, specifically form NYC-204EZ, is applicable to all types of businesses. In reality, this form is specifically designed for partnerships, including limited liability companies treated as partnerships for federal income tax purposes, that have no tax liability.

Another mistaken belief is that any partnership with business activities in New York City must file this form. However, it is intended for those partnerships that are engaged solely in activities exempt from the unincorporated business tax.

It's often incorrectly assumed that if a business terminates during the year, the Unincorporated Business Tax Return form does not need to be completed. The instructions clearly require that business terminations include a statement showing the disposition of business property.

Some believe that this tax form can be used if the partnership's total income after deductions for active partners' services exceeds $90,000. This is inaccurate, as the form specifies that it cannot be used if the income surpasses this threshold.

There's a misconception that corrections to the form, such as the address or business code number changes, cannot be made directly on the form. Actually, there are checkboxes provided specifically for indicating a change in address.

Many think that filing the Unincorporated Business Tax Return form automatically requires payment of a tax. This form is unique because it's for businesses that have determined they do not owe tax due to their activities being fully exempt.

Finally, a prevalent error is the belief that this form alone is enough for the tax return process. In fact, the form instructions stipulate that a copy of the federal Form 1065, including individual K-1s, must be attached.

Key takeaways

Filling out an Unincorporated Business Tax Return form is a critical process for partnerships, including limited liability companies (LLCs) treated as partnerships for federal income purposes, operating without tax liability. These entities must navigate various sections and requirements to ensure compliance and accuracy. Here are five key takeaways that can guide you through this process:

- Eligibility Criteria: The form is designed for certain partnerships and LLCs that are required to file an Unincorporated Business Tax Return but have no tax liability for the specified tax year. Understanding whether your business entity meets these criteria is the first step in determining the applicability of this form to your situation.

- Documentation Requirement: Completing the Unincorporated Business Tax Return necessitates attaching a copy of the Federal Form 1065, including the individual K-1s. This documentation is essential for providing a comprehensive overview of the partnership's financial activities and for ensuring that all information is accurately represented on both federal and city tax returns.

- Income Limits and Calculations: The form includes a table of maximum allowed income from business, which varies depending on the number of months the business operated. If total income after deductions for active partners’ services exceeds $90,000, the partnership must use another form (NYC-204). Understanding these limits and properly calculating your business's total income is crucial for determining the correct form and ensuring compliance.

- Refund and Payment Instructions: For entities expecting a refund or needing to make a payment, detailed instructions are provided, including options for direct deposit or payment by check. It is essential to carefully follow these instructions to ensure that refunds are processed efficiently or that payments are correctly credited to your business’s account.

- Certification and Authorization: The form requires the certification of accuracy by the partner filling out the form, including authorization for the Department of Finance to discuss the return with the listed preparer. This section emphasizes the importance of the accuracy of the information provided and permits necessary communication between the preparer and the Department of Finance for any clarifications or corrections.

Understanding these key aspects of the Unincorporated Business Tax Return form can greatly aid in the accurate and efficient completion and submission of the document. It is imperative for partnerships and LLCs to carefully review and comply with the specified instructions to fulfill their tax obligations correctly.

Popular PDF Documents

Form 8888 Total Refund per Computer - Depositing refund money into a savings account through Form 8888 can serve as an emergency fund.

Formulario 1028 - The introduction of a streamlined process for cooperatives to apply for and renew their tax exemption certificates reflects the government's commitment to the cooperative movement and its potential to contribute to the national economy.