Get Uniform Sales Tax Certificate Form

In the realm of taxation and revenue compliance for businesses operating within New Mexico, understanding the intricacies of the Uniform Sales Tax Certificate, officially known as the Nontaxable Transaction Certificate (NTTC), is essential. This comprehensive guide serves as a crucial tool for New Mexico buyers and lessees, facilitating transactions that are exempt from sales tax under specific criteria outlined by the New Mexico Taxation and Revenue Department. The form, updated last in September 2015, delineates the procedures and requirements for obtaining these certificates, ensuring that eligible entities can conduct their transactions without being subject to sales tax. Registration with the Taxation and Revenue Department, completion of the NTTC application, and adherence to compliance standards set by the department are prerequisites for obtaining an NTTC. Moreover, the guide sternly cautions against fraudulent claims for certificates, underlining the severe penalties for misuse. It goes further to specify various NTTC types, each tailored to different transactions including but not limited to purchases for resale, services, construction materials, government purchases, and more. This elaborate system underscores the state's commitment to facilitating business operations while safeguarding tax revenues, and encourages the utilization of modern technology through their Taxpayer Access Point (TAP) system for the effective management of NTTCs.

Uniform Sales Tax Certificate Example

New Mexico Taxation and Revenue Department

P.O Box 5557

Santa Fe, New Mexico

www.tax.newmexico.gov/

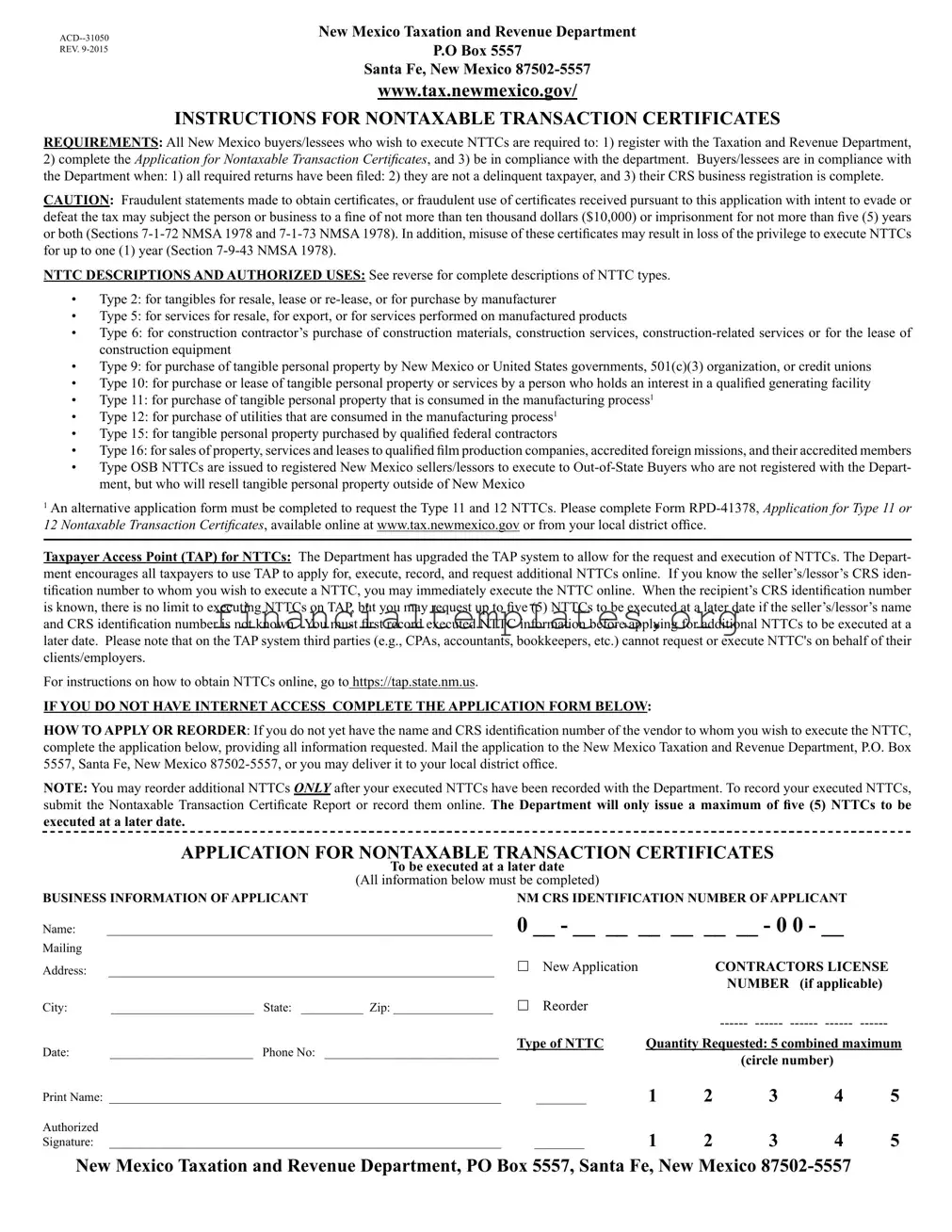

INSTRUCTIONS FOR NONTAXABLE TRANSACTION CERTIFICATES

REQUIREMENTS: All New Mexico buyers/lessees who wish to execute NTTCs are required to: 1) register with the Taxation and Revenue Department,

2)complete the Application for Nontaxable Transaction Certificates, and 3) be in compliance with the department. Buyers/lessees are in compliance with the Department when: 1) all required returns have been filed: 2) they are not a delinquent taxpayer, and 3) their CRS business registration is complete.

CAUTION: Fraudulent statements made to obtain certificates, or fraudulent use of certificates received pursuant to this application with intent to evade or defeat the tax may subject the person or business to a fine of not more than ten thousand dollars ($10,000) or imprisonment for not more than five (5) years or both (Sections

NTTC DESCRIPTIONS AND AUTHORIZED USES: See reverse for complete descriptions of NTTC types.

•Type 2: for tangibles for resale, lease or

•Type 5: for services for resale, for export, or for services performed on manufactured products

•Type 6: for construction contractor’s purchase of construction materials, construction services,

•Type 9: for purchase of tangible personal property by New Mexico or United States governments, 501(c)(3) organization, or credit unions

•Type 10: for purchase or lease of tangible personal property or services by a person who holds an interest in a qualified generating facility

•Type 11: for purchase of tangible personal property that is consumed in the manufacturing process1

•Type 12: for purchase of utilities that are consumed in the manufacturing process1

•Type 15: for tangible personal property purchased by qualified federal contractors

•Type 16: for sales of property, services and leases to qualified film production companies, accredited foreign missions, and their accredited members

•Type OSB NTTCs are issued to registered New Mexico sellers/lessors to execute to

1An alternative application form must be completed to request the Type 11 and 12 NTTCs. Please complete Form

12 Nontaxable Transaction Certificates, available online at www.tax.newmexico.gov or from your local district office.

Taxpayer Access Point (TAP) for NTTCs: The Department has upgraded the TAP system to allow for the request and execution of NTTCs. The Depart- ment encourages all taxpayers to use TAP to apply for, execute, record, and request additional NTTCs online. If you know the seller’s/lessor’s CRS iden- tification number to whom you wish to execute a NTTC, you may immediately execute the NTTC online. When the recipient’s CRS identification number is known, there is no limit to executing NTTCs on TAP, but you may request up to five (5) NTTCs to be executed at a later date if the seller’s/lessor’s name and CRS identification number is not known. You must first record executed NTTC information before applying for additional NTTCs to be executed at a later date. Please note that on the TAP system third parties (e.g., CPAs, accountants, bookkeepers, etc.) cannot request or execute NTTC's on behalf of their

clients/employers.

For instructions on how to obtain NTTCs online, go to https://tap.state.nm.us.

IF YOU DO NOT HAVE INTERNET ACCESS COMPLETE THE APPLICATION FORM BELOW:

HOW TO APPLY OR REORDER: If you do not yet have the name and CRS identification number of the vendor to whom you wish to execute the NTTC, complete the application below, providing all information requested. Mail the application to the New Mexico Taxation and Revenue Department, P.O. Box 5557, Santa Fe, New Mexico

NOTE: You may reorder additional NTTCs ONLY after your executed NTTCs have been recorded with the Department. To record your executed NTTCs, submit the Nontaxable Transaction Certificate Report or record them online. The Department will only issue a maximum of five (5) NTTCs to be

executed at a later date.

APPLICATION FOR NONTAXABLE TRANSACTION CERTIFICATES

To be executed at a later date

(All information below must be completed)

BUSINESS INFORMATION OF APPLICANT |

NM CRS IDENTIFICATION NUMBER OF APPLICANT |

|

||||||

Name: |

______________________________________________________________ |

0 __ - __ __ __ __ __ __ - 0 0 - __ |

|

|||||

Mailing |

|

|

|

|

|

|

|

|

Address: |

______________________________________________________________ |

New Application |

|

|

CONTRACTORS LICENSE |

|||

|

|

|

|

|

|

NUMBER |

(if applicable) |

|

City: |

_______________________ |

State: __________ Zip: ________________ |

Reorder |

|

|

|

||

|

|

|

|

|

|

|

||

Date: |

_______________________ |

Phone No: ____________________________ |

Type of NTTC |

Quantity Requested: 5 combined maximum |

||||

|

|

|

|

|

|

(circle number) |

|

|

Print Name: _______________________________________________________________ |

________ |

1 |

2 |

3 |

4 |

5 |

||

Authorized |

|

|

|

|

|

|

|

|

Signature: |

_______________________________________________________________ |

________ |

1 |

2 |

3 |

4 |

5 |

|

New Mexico Taxation and Revenue Department, PO Box 5557, Santa Fe, New Mexico

NTTC TYPE DESCRIPTIONS 1

TYPE 2 certificates may be executed:

1)By manufacturers for the purchase of tangible personal property that will become an ingredient or component of the manufactured product.

2)For the purchase of tangible personal property or licenses for resale either alone or in combination with other tangible personal property or licenses in the ordinary course of business.

3)By a lessee for the lease of tangible personal property or licenses for subsequent lease in the ordinary course of business, except for the lease of furniture or appliances, the receipts from the rental or lease of which are

deductible under Subsection C of Section

4)For the purchase of tangible personal property or licenses for subsequent lease in the ordinary course of business, except for the lease of furniture or appliances, the receipts from the rental or lease of which are deductible

under Subsection C of Section

5)By a person who is licensed to practice medicine, osteopathic medicine, dentistry, podiatry, optometry, chiropractic or professional nursing for the purchase of prosthetic devices.

6)By a common carrier for the purchase of fuel that is to be loaded or used in a locomotive engine.

TYPE 5 certificates may be executed:

1)For the purchase of services for resale if the subsequent sale by the buyer is in the ordinary course of business and the subsequent sale of the service is subject to gross receipts tax or governmental gross receipts tax.

2)For the purchase of services for export when sold to an

3)By manufacturers for the purchase of services performed directly upon tangible personal property they are in the business of manufacturing or upon ingredient or component parts thereof.

4)For the purchase of aerospace services for resale if the subsequent sale by the buyer is in the ordinary course of business and the services are sold to a 501(c)(3) organization, other than a national laboratory, or to the United States.

TYPE 6 certificates may be executed by a construction contractor:

1)For the purchase of construction materials that will become ingredients or components of a construction project that is either subject to gross receipts tax upon completion or that takes place on Indian tribal territory.

2)For the purchase of construction services that are directly contracted for or billed to a construction project that is either subject to gross receipts tax upon completion, upon the sale in the ordinary course of business of the real property upon which the project is constructed or that takes place on Indian tribal territory.

3)For the purchase of

Indian tribal territory.

4)For the lease of construction equipment that is used at the construction location of a construction project that is either subject to gross receipts tax upon completion, upon the sale in the ordinary course of business of the real property upon which the project is constructed or that takes place on Indian tribal territory.

TYPE 9 certificates may be executed for the purchase of tangible personal property only and may NOT be used for the purchase of services, the pur- chase of a license or other intangible property, for the lease of property or to purchase construction materials for use in construction projects (except as provided in #2 below). The following may execute Type 9 NTTCs:

1)Governmental agencies.

2)501(c)(3) organizations.

Taxation and Revenue Department and submit proof of Internal Revenue Service 501(c)(3) nonprofit determination before they may execute Type 9

NTTCs. Those 501(c)(3) organizations that are organized for the purpose of providing homeownership opportunities to

3)Federal or

4)Indian tribes, nations or pueblos when purchasing tangible personal property for use on Indian reservations or pueblo grants.

TYPE 10 certificates may be executed by a person that holds an interest in a qualified generating facility for the purchase or lease of tangible personal

property or services that are eligible generation plant costs. In addition to required reporting on the

Advanced Energy Deduction.

TYPE 11 certificates may be executed by manufactures for the purchase of tangible personal property that will be consumed in the manufacturing process and may not be used to purchase tools or equipment that may be used to create the manufactured product. The Type 11 NTTC is not to be used for the purchase of utilities.

TYPE 12 certificates may be executed by manufactures for the purchase of utilities that will be consumed in the manufacturing process.

TYPE 16 certificates may be executed by:

1)Qualified film production companies to purchase property, lease property or purchase services. A qualified production company must submit proof of registration with the New Mexico Film Division of the Economic Development Department.

2)Accredited diplomats or missions for the purchase of property or services or the leasing of property.

TYPE

1

2

3

For more information on the use of different types of NTTCs and special reporting requirements please see publication

at

Proof that a construction contractor's license is not required includes a detailed written statement explaining the circumstances that exclude the contractor from the jurisdiction

or application of New Mexico statutes which provide for construction contractor's licensing and regulation of construction activity.

Type 11 and 12 NTTCs require the completion of an alternative application, Form

Document Specifics

| Fact | Detail |

|---|---|

| Document Title | ACD--31050 REV. 9-2015 Uniform Sales Tax Certificate |

| Issuing Authority | New Mexico Taxation and Revenue Department |

| Application Requirement | New Mexico buyers/lessees must register, complete the application form, and comply with the department. |

| Penalties for Fraud | Fines up to $10,000 or imprisonment up to 5 years, or both, under Sections 7-1-72 NMSA 1978 and 7-1-73 NMSA 1978. |

| NTTC Types | Various, including Types 2, 5, 6, 9, 10, 11, 12, 15, and 16, each designed for specific qualifications and uses. |

| Online Application Process | Taxpayer Access Point (TAP) available for requesting, executing, and recording NTTCs. |

| Governing Laws for Specific NTTC Types | Includes Sections 7-9-46, 7-9-47, 7-9-50, 7-9-49, and others specifying conditions for issuing various NTTC types. |

Guide to Writing Uniform Sales Tax Certificate

Filling out the Uniform Sales Tax Certificate correctly is crucial for businesses to ensure they're complying with New Mexico state tax laws and taking advantage of applicable tax exemptions. This form, used by New Mexico buyers or lessees, helps to certify purchases that are exempt from sales tax. Following a precise series of steps will help you accurately complete the form, and thereby, stay in good standing with tax regulations.

- Begin by registering with the New Mexico Taxation and Revenue Department if you haven't done so already. This step is mandatory before you apply for any type of Nontaxable Transaction Certificates (NTTCs).

- Ensure all required returns have been filed and that there are no delinquent taxes owed. Your account must be in full compliance, including a complete Combined Reporting System (CRS) business registration.

- Determine the type of NTTC you need based on the goods or services being exempted from sales tax. The form includes descriptions for each certificate type, such as Type 2 for resale items or Type 5 for services, and so on.

- Fill in the "Business Information of Applicant" section, starting with the NM CRS Identification Number of the Applicant. Make sure this information is accurate to avoid processing delays.

- Provide your business’s name, mailing address, city, state, and zip code in the designated fields.

- Select whether this is a new application or a reorder by marking the appropriate checkbox.

- Enter the date and your phone number in the spaces provided.

- Specify the Type of NTTC and the quantity requested. You are allowed a combined maximum of five certificates at a time.

- Print your name in the space provided, indicating who is responsible for the completion of this form.

- Sign the form to certify that the information provided is accurate and that you are authorized to make this certification on behalf of the business.

- Mail the completed form to the New Mexico Taxation and Revenue Department, P.O. Box 5557, Santa Fe, New Mexico 87502-5557, or deliver it to your local district office.

Following these steps will guide you through the process of applying for or reordering Nontaxable Transaction Certificates in New Mexico. Each step is important to ensure the prompt and correct processing of your request. Remember to determine the correct type of NTTC for your purchase or lease to maintain compliance and avoid any potential fines or penalties associated with incorrect certificate use.

Understanding Uniform Sales Tax Certificate

Welcome to the FAQ section about the Uniform Sales Tax Certificate form. Here, you'll find answers to common questions that can help you understand how to properly use the form, the requirements for obtaining it, and its various applications.

What is a Uniform Sales Tax Certificate form?

The Uniform Sales Tax Certificate form is a document used by businesses and entities to certify that a purchase is not subject to sales tax because it is intended for resale, lease, or other nontaxable transactions as defined by New Mexico's Taxation and Revenue Department. Different types of certificates cover various transactions, including purchases for resale, manufacturing, governmental, and nonprofit organizations, among others.

Who needs to register for a Uniform Sales Tax Certificate?

Any buyer or lessee in New Mexico intending to make purchases that qualify for nontaxable status must register with the Taxation and Revenue Department. Compliance with the department, including timely filed returns and no tax delinquency, is also necessary to maintain eligibility for using these certificates.

How does one apply for the certificate?

Applicants can apply for Nontaxable Transaction Certificates (NTTCs) online through the Taxpayer Access Point (TAP) system or, if online access is not available, by completing the paper application form and mailing it to the New Mexico Taxation and Revenue Department. Initial and additional requests for NTTCs are subject to department verification and compliance checks.

Can the certificates be used for any purchase?

No. The certificates are designated for specific types of transactions, such as purchasing goods for resale, manufacturing inputs, services for resale, and purchases made by certain types of organizations like governments or nonprofits. Each type of certificate outlines authorized uses and restrictions.

What are the penalties for misuse or fraudulent use of NTTCs?

Misuse or fraudulent use of NTTCs to evade sales tax can result in severe penalties, including fines up to $10,000, imprisonment for up to five years, or both. Additionally, the Taxation and Revenue Department may revoke the privilege to use NTTCs for up to a year.

Are there any special requirements for out-of-state buyers?

Yes. Out-of-state buyers who are not registered with the New Mexico Taxation and Revenue Department but wish to purchase tangible personal property for resale outside of New Mexico must obtain a Type OSB NTTC issued to the seller. This ensures the transaction complies with New Mexico's tax exemption criteria for out-of-state resale.

How do construction contractors use NTTCs?

Construction contractors may use specific NTTC types for purchasing construction materials and services that will become part of a taxable real property improvement. The NTTC exempts them from paying sales tax on materials and services directly related to the construction project, subject to certain conditions, including providing a contractor’s license number or proof that such licensure is not required.

Can NTTCs be used for purchasing services?

Yes, there are specific NTTC types, such as Type 5, that can be used for purchasing services intended for resale, export, or those performed directly on manufactured products. The eligibility for using an NTTC for service purchases depends on the nature of the service and its relation to the buyer's business activities.

For any additional questions or detailed information, individuals and businesses are encouraged to refer to the New Mexico Taxation and Revenue Department's website or contact their local district tax office.

Common mistakes

- Not registering with the Taxation and Revenue Department before attempting to complete the Application for Nontaxable Transaction Certificates can lead to an invalid application. Registration is a prerequisite for compliance and eligibility.

- Failing to complete all required sections of the application can result in delays or the rejection of the application. Every field must be accurately filled out to ensure prompt processing.

- Overlooking the importance of being in compliance with the Department by not having all required returns filed, being a delinquent taxpayer, or not completing CRS business registration can make an applicant ineligible for NTTCs.

- Attempting to obtain certificates through fraudulent statements or with the intent to evade or defeat tax may not only result in the denial of the application but also subject the individual or business to severe penalties, including fines and imprisonment.

- Misunderstanding the specific uses of each NTTC type (e.g., Type 2 for tangible goods for resale or Type 5 for services for resale) and incorrectly applying for a certificate type that does not match the intended use of the purchased goods or services.

- Incorrectly believing that one NTTC type covers all purchasing scenarios. Each type has specific authorized uses, and applicants need to select the correct certificate type based on their specific circumstances.

- Not using the Taxpayer Access Point (TAP) system efficiently can delay the process. Applicants should use TAP for ease of applying for, executing, recording, and requesting additional NTTCs, whenever possible.

- Ignoring the limitation on the number of NTTCs that can be requested at a time. The Department only issues a maximum of five (5) NTTCs to be executed at a later date, after previously executed NTTCs have been recorded.

- Attempting to apply for Type 11 and 12 NTTCs using the conventional application form instead of completing the alternative application, Form RPD-41378, specifically designed for these types of certificates.

It is crucial for applicants to carefully review the specific requirements and authorized uses for each type of NTTC, ensure comprehensive compliance with the Department's guidelines, and accurately complete and submit the appropriate forms to avoid these common pitfalls.

Documents used along the form

When dealing with the complexities of tax compliance and documentation in business transactions, particularly in New Mexico, the Uniform Sales Tax Certificate is a key form used by businesses to certify the non-taxable nature of their transactions. However, this form does not stand alone in the realm of documentation needed for comprehensive tax compliance. Several other forms and documents are often utilized alongside the Uniform Sales Tax Certificate to ensure full adherence to tax laws and regulations.

- Application for Nontaxable Transaction Certificates (Form RPD-41378): Specifically required for obtaining Type 11 and Type 12 NTTCs, this application is intended for manufacturers to certify purchases of tangible personal property and utilities consumed in the manufacturing process. This document is crucial for those seeking exemptions related to production inputs.

- Taxpayer Access Point (TAP) Registration Confirmation: Although not a form, registration and confirmation through the TAP online system is necessary for businesses to apply for, execute, and manage NTTCs digitally. This system streamlines the request and use of NTTCs, making tax compliance more efficient for registered users.

- Nontaxable Transaction Certificate Report: After executing NTTCs, businesses must record them with the Taxation and Revenue Department. This report verifies the proper use of NTTCs and helps maintain eligibility for future certificate requests. It plays a crucial role in the documentation process to avoid penalties related to misuse or fraudulent reporting.

- Proof of IRS 501(c)(3) Nonprofit Determination (For Type 9 NTTCs): Organizations eligible to execute Type 9 NTTCs must provide documentation of their IRS 501(c)(3) status. This confirms their eligibility for tax-exempt purchases of tangible personal property, reinforcing the integrity of tax exemptions for nonprofit entities.

Collectively, these forms and documents support the execution and management of Nontaxable Transaction Certificates in New Mexico. They ensure that entities engaging in non-taxable transactions are appropriately registered, compliant, and documented. This network of documentation fosters a transparent and efficient tax compliance system, reflecting the importance of detailed record-keeping and reporting in upholding tax laws and regulations.

Similar forms

The Uniform Sales Tax Certificate closely resembles a Resale Certificate, which businesses use to purchase goods intended for resale without paying sales tax at the point of purchase. Similar to how a Type 2 NTTC allows for the procurement of tangible personal property for resale, a Resale Certificate indicates the buyer's intent to resell the purchased goods in the ordinary course of business. Both documents serve to streamline tax compliance by preventing the double taxation of goods—first, when purchased by the reseller, and again when sold to the end consumer.

Similarly, an Exemption Certificate, often used by nonprofit organizations or government entities to make tax-exempt purchases, parallels the Type 9 NTTC. These certificates enable qualified buyers, like 501(c)(3) organizations or federal and state agencies, to procure goods without paying sales tax, under the premise that their nature of business or mission justifies a tax-exempt status. This principle aligns with the intention behind Type 9 NTTCs, which are specifically structured for purchases by entities that are inherently exempt from sales tax obligations.

Another document akin to the Uniform Sales Tax Certificate is the Contractor’s Exemption Certificate. This certificate allows contractors to purchase materials and supplies tax-free for use in projects for tax-exempt entities or in situations that qualify for sales tax exemptions. Similarly, Type 6 NTTCs are executed for construction-related purchases, like construction materials that will be incorporated into a tax-exempt construction project, echoing the purpose and utility of a Contractor’s Exemption Certificate to avoid unnecessary taxation within the construction sector.

Manufacturing Exemption Certificates also share a common use with the Type 11 and Type 12 NTTCs. These certificates permit manufacturers to buy equipment, supplies, or utilities used directly in the production process without paying sales tax. The goal is to lower the cost of production by eliminating sales tax on items that directly contribute to manufacturing goods. Type 11 and 12 NTTCs extend a similar advantage to manufacturers for purchases that are consumed in the manufacturing process, thus highlighting their parallel purpose in promoting tax efficiency and fairness in manufacturing.

Finally, Direct Pay Permits, which allow businesses to purchase goods or services tax-free and then self-assess and pay the sales tax directly to the state, have functional similarities to the process of using NTTC types on the Taxpayer Access Point (TAP) system. Like a direct pay arrangement, the TAP system's facilitation of NTTCs allows businesses to efficiently manage how taxes are accounted for, streamlining the compliance process while ensuring accurate tax payments. Both methods give businesses a level of control and responsibility over their tax affairs, matching the fiscal prudence with administrative efficiency.

Dos and Don'ts

When filling out the Uniform Sales Tax Certificate form, it's important to follow the guidelines provided by the New Mexico Taxation and Revenue Department to ensure the process is completed correctly and efficiently. Here are four do's and don'ts to keep in mind during this process:

Do:- Register with the Taxation and Revenue Department: Before executing Nontaxable Transaction Certificates (NTTCs), ensure you are registered with the Department, as required.

- Complete all required fields: Provide all the requested information accurately on the Application for Nontaxable Transaction Certificates to avoid processing delays.

- Be in compliance with the Department: Make sure that all required returns have been filed, there are no delinquent taxes, and your CRS business registration is up to date before applying for NTTCs.

- Use the Taxpayer Access Point (TAP) system if possible: The Department encourages the use of TAP for applying for, executing, recording, and requesting NTTCs online for ease and convenience.

- Submit fraudulent statements: Avoid making fraudulent statements to obtain certificates, as this could lead to severe fines, imprisonment, or both.

- Misuse certificates: Do not use certificates received for purposes other than those authorized, as misuse may result in loss of privilege to execute NTTCs.

- Exceed request limits without proper execution: Remember, the system allows a maximum of five (5) NTTCs to be requested before executed NTTCs must be recorded with the Department.

- Request NTTCs on behalf of clients without access: Note that third parties such as CPAs, accountants, etc., cannot request or execute NTTCs on behalf of their clients or employers through TAP.

Misconceptions

Understanding the Uniform Sales Tax Certificate form can often lead to misconceptions, especially regarding its use and requirements. Highlighting and dispelling these myths can ensure more accurate compliance and application of tax laws.

- Misconception 1: Any business can use any type of Nontaxable Transaction Certificate (NTTC) for purchases.

Reality: Different types of NTTCs are designed for specific purposes and entities. For example, Type 9 is specifically for government agencies, 501(c)(3) organizations, and certain other qualified entities.

- Misconception 2: NTTCs exempt the holder from all forms of taxes.

Reality: NTTCs only exempt the holder from sales tax on purchases that qualify under the specific type of NTTC. They do not provide broad tax exemptions.

- Misconception 3: NTTCs can be used for personal purchases.

Reality: NTTCs can only be used for purchases related to the business or organization's qualifying activities. Personal purchases are not covered.

- Misconception 4: Once obtained, an NTTC is good for any purchase without restrictions.

Reality: The use of an NTTC is limited to the specific types of purchases outlined for each certificate type. Misuse can lead to penalties, including fines or imprisonment.

- Misconception 5: Out-of-state businesses cannot utilize NTTCs for purchases in New Mexico.

Reality: Out-of-state buyers can use Type OSB NTTCs for qualifying purchases that will be resold or incorporated as components of manufactured products outside of New Mexico.

- Misconception 6: You can obtain an unlimited number of NTTCs at any time.

Reality: The New Mexico Taxation and Revenue Department limits the issuance of NTTCs to five (5) to be executed at a later date if the seller's/lessor’s CRS identification number is not known at the time of application.

- Misconception 7: NTTC applications can be filled out and submitted by third parties, like accountants or CPAs, on behalf of their clients.

Reality: While third-party professionals can advise on NTTCs, the Taxpayer Access Point (TAP) system restricts them from requesting or executing NTTCs on behalf of businesses or individuals.

- Misconception 8: The process of obtaining an NTTC is complicated and requires manual paperwork.

Reality: The New Mexico Taxation and Revenue Department encourages the use of the TAP system for the application, execution, recording, and request of additional NTTCs online, streamlining the process.

Clearing up these misconceptions enhances understanding and compliance with the New Mexico Taxation and Revenue Department's regulations regarding the use of NTTCs.

Key takeaways

Filling out and using the Uniform Sales Tax Certificate, also known as a Nontaxable Transaction Certificate (NTTC), is essential for businesses engaging in tax-exempt transactions in New Mexico. Here are key takeaways to help businesses navigate the process effectively:

- Businesses must first register with the New Mexico Taxation and Revenue Department and be in compliance with all department requirements, including the filing of all required returns, not being a delinquent taxpayer, and having a complete CRS business registration.

- To obtain NTTCs, businesses must complete the Application for Nontaxable Transaction Certificates, which requires detailed business information, including the NM CRS Identification Number and, if applicable, the contractor's license number.

- There are several types of NTTCs, each serving different purposes, such as purchasing tangible personal property for resale, purchasing services for resale, or buying materials and services for use in construction. Understanding the specific authorized uses of each type is crucial for proper application.

- Fraudulent statements or misuse of NTTCs to evade taxes can lead to severe penalties, including fines up to ten thousand dollars, imprisonment for up to five years, or both. Misuse may also result in the loss of privilege to execute NTTCs for up to one year.

- The Taxpayer Access Point (TAP) system is encouraged for requesting and executing NTTCs. It allows taxpayers to apply for, execute, record, and request additional NTTCs online. It is important to note that third parties, such as CPAs or accountants, cannot request or execute NTTCs on behalf of their clients or employers through TAP.

- If internet access is not available, the application can be completed manually and mailed to the New Mexico Taxation and Revenue Department. However, businesses can only request a maximum of five NTTCs to be executed at a later date after previously executed NTTCs have been recorded with the Department.

- Type 11 and Type 12 NTTCs, which are for purchases consumed in the manufacturing process and for utilities consumed in the manufacturing process respectively, require the completion of an alternative application form, Form RPD-41378.

Understanding and following these guidelines will help ensure that businesses can effectively obtain and use NTTCs for eligible transactions, staying compliant with New Mexico tax laws.

Popular PDF Documents

IRS 8857 - This form assesses if one was truly innocent and unaware of the filing errors made by their spouse.

Irs Tax Lien - Form 12277 is the key to unlocking restrictions on financial growth imposed by previous tax liens, facilitating a clearer path forward.