Get Uniform Loan Application Form

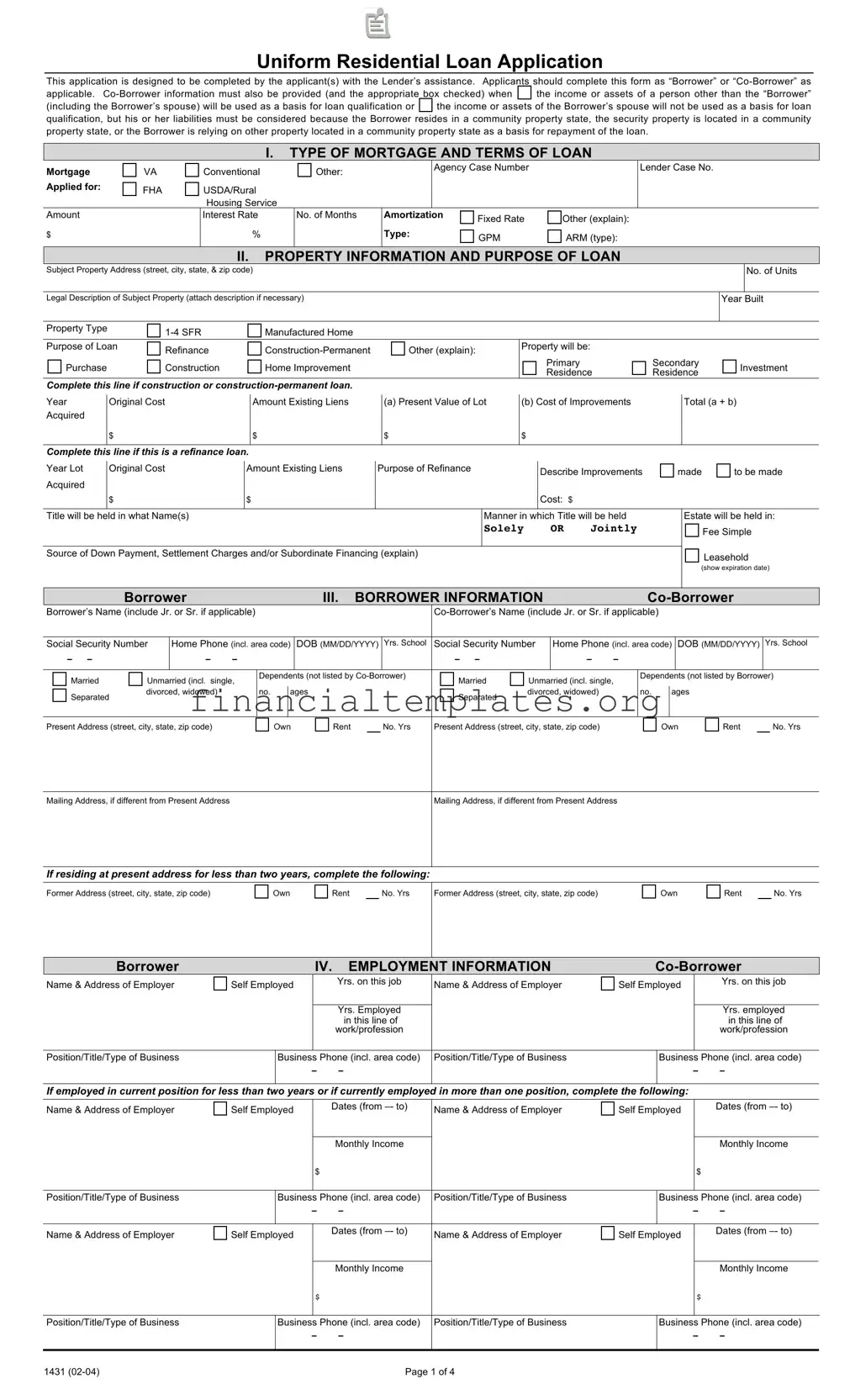

Embarking on the journey of securing a residential loan involves a detailed and critical process, among which the completion of the Uniform Residential Loan Application stands as a foundational step. This comprehensive form is not only meant to be filled out by the applicant(s) with the assistance of the lender but also presents a systematic approach to gather vital information. It covers a broad spectrum, beginning with the type of mortgage and loan terms, delving into property information and the purpose of the loan, and extending to borrower information, employment details, monthly income, combined housing expenses, and a meticulous rundown of the borrower’s assets and liabilities. What makes this application particularly significant is its attention to qualifications based on co-borrower information, details of the transaction, and declarations that might influence the loan approval process. Furthermore, it adheres to legal obligations by gathering information for government monitoring purposes, ensuring compliance with equal credit opportunity, fair housing, and home mortgage disclosure laws. Thus, providing accurate and truthful details on this form is not merely a procedural necessity but a crucial step towards achieving one’s real estate financing goals, making it an essential document for both borrowers and lenders in navigating the complexities of residential lending.

Uniform Loan Application Example

Uniform Residential Loan Application

This application is designed to be completed by the applicant(s) with the Lender’s assistance. Applicants should complete this form as “Borrower” or

applicable. |

|

the income or assets of a person other than the “Borrower” |

||

|

|

|

|

|

(including the Borrower’s spouse) will be used as a basis for loan qualification or |

|

the income or assets of the Borrower’s spouse will not be used as a basis for loan |

||

qualification, but his or her liabilities must be considered because the Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan.

I.TYPE OF MORTGAGE AND TERMS OF LOAN

Mortgage |

VA |

Applied for: |

FHA |

|

|

Amount |

|

$ |

|

Conventional |

Other: |

|

Agency Case Number |

|

Lender Case No. |

|

|

|

|

|

|

||

USDA/Rural |

|

|

|

|

|

|

Housing Service |

|

|

|

|

|

|

Interest Rate |

No. of Months |

Amortization |

Fixed Rate |

Other (explain): |

||

|

|

|

|

|||

% |

|

Type: |

|

GPM |

ARM (type): |

|

|

|

|

|

|||

|

|

|

|

|

|

|

II.PROPERTY INFORMATION AND PURPOSE OF LOAN

Subject Property Address (street, city, state, & zip code)

Legal Description of Subject Property (attach description if necessary)

Property Type |

Manufactured Home |

|

|

No. of Units

Year Built

Purpose of Loan

Purchase

Refinance

Construction

Home Improvement

Other (explain):

Property will be:

Primary

Residence

Secondary Residence

Investment

Complete this line if construction or

Year Acquired

Original Cost

Amount Existing Liens

(a) Present Value of Lot

(b) Cost of Improvements

Total (a + b)

$

$

$

$

Complete this line if this is a refinance loan.

Year Lot |

Original Cost |

Amount Existing Liens |

Purpose of Refinance |

Describe Improvements |

made |

to be made |

|||

|

|

|

|

|

|||||

Acquired |

|

|

|

|

|

|

|

|

|

|

$ |

$ |

|

|

Cost: $ |

|

|

|

|

|

|

|

|

|

|

|

|

||

Title will be held in what Name(s) |

|

|

Manner in which Title will be held |

|

Estate will be held in: |

||||

|

|

|

|

Solely |

OR |

Jointly |

|

|

Fee Simple |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Source of Down Payment, Settlement Charges and/or Subordinate Financing (explain) |

|

|

|

|

Leasehold |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(show expiration date) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrower |

|

|

|

|

III. BORROWER INFORMATION |

|

|

|

||||||||||||

Borrower’s Name (include Jr. or Sr. if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Social Security Number |

Home Phone (incl. area code) |

DOB (MM/DD/YYYY) |

Yrs. School |

Social Security Number |

Home Phone (incl. area code) |

DOB (MM/DD/YYYY) |

Yrs. School |

|||||||||||||||

- - |

|

- |

- |

|

|

|

|

|

|

- - |

|

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Married |

Unmarried (incl. single, |

Dependents (not listed by |

Married |

Unmarried (incl. single, |

Dependents (not listed by Borrower) |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Separated |

divorced, widowed) |

|

no. |

|

ages |

|

Separated |

divorced, widowed) |

|

no. |

|

ages |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Present Address (street, city, state, zip code) |

|

|

Own |

Rent |

|

No. Yrs |

Present Address (street, city, state, zip code) |

|

|

Own |

Rent |

|

|

No. Yrs |

||||||||

Mailing Address, if different from Present Address

Mailing Address, if different from Present Address

If residing at present address for less than two years, complete the following:

Former Address (street, city, state, zip code)

Own

Rent |

|

No. Yrs |

Former Address (street, city, state, zip code)

Own

Rent

Borrower |

|

|

IV. |

EMPLOYMENT INFORMATION |

|||||

Name & Address of Employer |

Self Employed |

|

Yrs. on this job |

Name & Address of Employer |

Self Employed |

|

Yrs. on this job |

||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yrs. Employed |

|

|

|

|

Yrs. employed |

|

|

|

|

in this line of |

|

|

|

|

in this line of |

|

|

|

|

work/profession |

|

|

|

|

work/profession |

|

|

|

|

|

|

|

|

||

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

||||

|

|

- |

- |

|

|

|

- - |

||

|

|

|

|

|

|

|

|

|

|

If employed in current position for less than two years or if currently employed in more than one position, complete the following:

Name & Address of Employer |

Self Employed |

|

Dates (from |

Name & Address of Employer |

Self Employed |

|

Dates (from |

||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Income |

|

|

|

|

Monthly Income |

|

|

|

$ |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

||

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

||||

|

|

- |

- |

|

|

- |

- |

||

|

|

|

|

|

|

|

|

|

|

Name & Address of Employer |

Self Employed |

|

Dates (from |

Name & Address of Employer |

Self Employed |

|

Dates (from |

||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly Income |

|

|

|

|

Monthly Income |

|

|

$ |

|

|

|

$ |

|

||

|

|

|

|

|

|

|

|

||

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

Position/Title/Type of Business |

|

Business Phone (incl. area code) |

||||

|

|

- |

- |

|

|

- |

- |

||

|

|

|

|

|

|

|

|

|

|

1431 |

|

|

|

Page 1 of 4 |

|

|

|

|

|

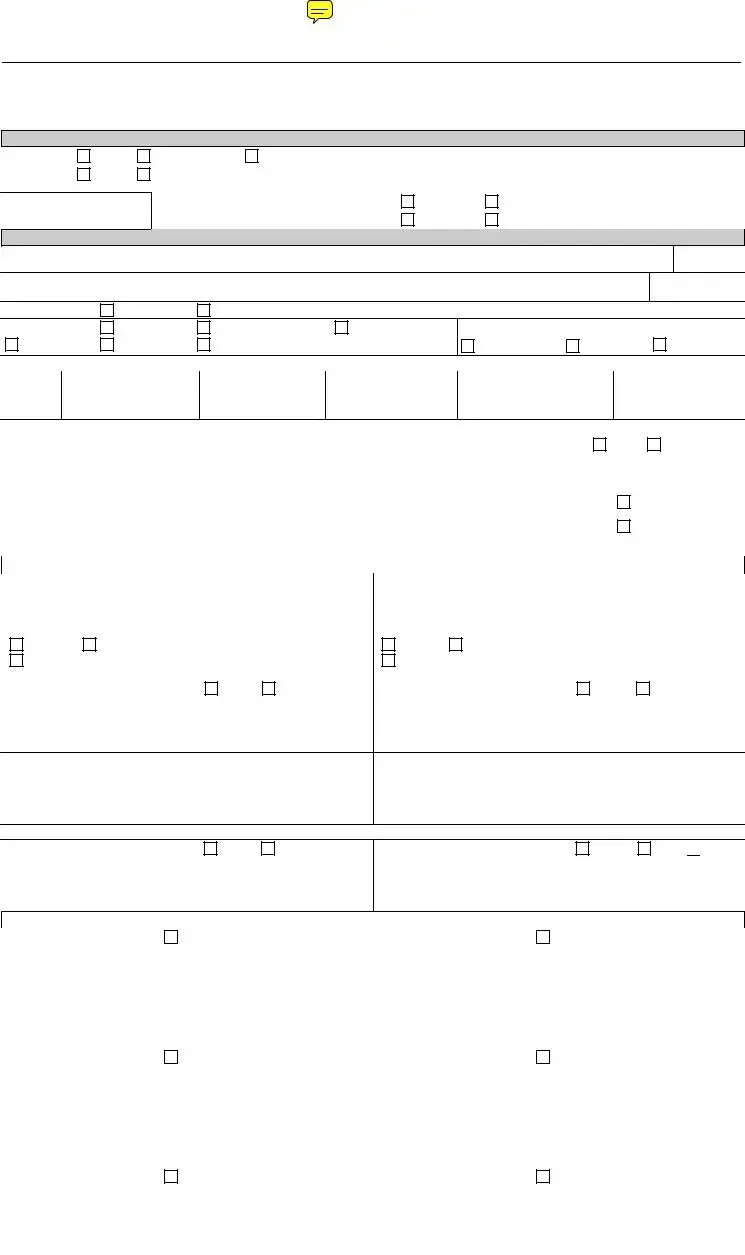

V.MONTHLY INCOME AND COMBINED HOUSING EXPENSE INFORMATION

Gross Monthly Income |

|

Borrower |

|

|

Total |

Combined |

Present |

|

Proposed |

|

|

|

|

|

|

|

|

Monthly Housing Expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Base Empl. Income* |

$ |

|

$ |

|

$ |

|

Rent |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Overtime |

|

|

|

|

|

|

First Mortgage (P&I) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Bonuses |

|

|

|

|

|

|

Other Financing (P&I) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions |

|

|

|

|

|

|

Hazard Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends/Interest |

|

|

|

|

|

|

Real Estate Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Rental Income |

|

|

|

|

|

|

Mortgage Insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (before completing, see |

|

|

|

|

|

|

Homeowner Assn. Dues |

|

|

|

the notice in “describe other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other: |

|

|

|

|

income,” below) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

$ |

|

$ |

|

Total |

$ |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

*

Describe Other Income Notice: Alimony, child support, or separate maintenance income need not be revealed if the Borrower (B) or

B/C

Monthly Amount

$

VI. ASSETS AND LIABILITIES

This Statement and any applicable supporting schedules may be completed jointly by both married and unmarried

Completed

Jointly

Not Jointly

ASSETS |

Cash or Market |

Liabilities and Pledged Assets. List the creditor’s name, address and |

account number for all |

|

||||||||||||||||||||||

Description |

outstanding debts, including automobile loans, revolving charge accounts, real estate loans, alimony, |

|

||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||

Value |

child support, stock pledges, etc. |

Use continuation sheet, if necessary. Indicate by (*) those liabilities |

|

|||||||||||||||||||||||

|

|

which will be satisfied upon sale of real estate owned or upon refinancing of the subject property. |

|

|||||||||||||||||||||||

VALUE |

|

|

|

|||||||||||||||||||||||

Cash deposit toward purchase held by: |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

LIABILITIES |

|

|

|

|

Monthly Payment & |

|

|

|

|

Unpaid |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Months Left to Pay |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance |

|

|||||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

List checking and saving accounts below |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of Bank, S&L, or Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. no. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of Bank, S&L, or Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. no. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of Bank, S&L, or Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

Acct. no. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of Bank, S&L, or Credit Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. no. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stocks & Bonds (Company |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

name/number & description) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Life insurance net cash value |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Face amount: $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal Liquid Assets |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate owned (enter market value |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

from schedule of real estate owned) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acct. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Vested interest in retirement fund |

$ |

Name and address of Company |

|

|

|

|

$ Payments/Months |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net worth of business(es) owned |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(attach financial statement) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobiles owned (make and year) |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Acct. no. |

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Alimony/Child Support/Separate Maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Payments Owed to: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Other Assets (itemize) |

$ |

Job Related Expense (child care, union dues, etc.) |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Total Monthly Payments |

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Total Assets a. |

|

Net Worth |

|

|

|

|

|

Total Liabilities b. |

|

|

|

|

|

|

|

|

|

|

||||||||

|

$ |

(a minus b) |

|

$ |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

1431 |

|

|

Page 2 of 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

VI. ASSETS AND LIABILITIES (cont.)

Schedule of Real Estate Owned (If additional properties are owned, use continuation sheet.)

Property Address (enter S if sold, PS if pending sale |

|

Type of |

Present |

Amount of |

or R if rental being held for income) |

Property |

Market Value |

Mortgages & Liens |

Gross

Rental Income

Mortgage Payments

Insurance,

Maintenance,

Taxes & Misc.

Net

Rental Income

$

$

$

$

$

$

Totals

$

$

$

$

$

$

List any additional names under which credit has previously been received and indicate appropriate creditor name(s) and account number(s):

Alternate Name |

Creditor Name |

Account Number |

|

|

|

|

|

|

VII. DETAILS OF TRANSACTION

a. Purchase price |

$ |

|

|

|

|

b. Alterations, improvements, repairs |

|

|

|

|

|

c. Land (if acquired separately) |

|

|

|

|

|

d. Refinance (incl. debts to be paid off) |

|

|

|

|

|

e. Estimated prepaid items |

|

|

|

|

|

f. Estimated closing costs |

|

|

|

|

|

g. PMI, MIP, Funding Fee |

|

|

|

|

|

h. Discount (if Borrower will pay) |

|

|

|

|

|

i. Total costs (add items a through h) |

|

|

|

|

|

j. Subordinate financing |

|

|

|

|

|

k. Borrower closing costs paid by Seller |

|

|

|

|

|

l. Other Credits (explain) |

|

|

|

|

|

m. Loan amount |

|

|

(exclude PMI, MIP, Funding Fee financed) |

|

|

|

|

|

n. PMI, MIP, Funding Fee financed |

|

|

|

|

|

o. Loan amount (add m & n) |

|

|

|

|

|

p. Cash from/to Borrower |

|

|

(subtract j, k, l & o from i ) |

|

|

|

|

|

|

|

|

VIII. DECLARATIONS

If you answer “yes” to any questions a through i, please |

Borrower |

|||

|

|

|

|

|

use continuation sheet for explanation. |

Yes |

No |

Yes |

No |

a. Are there any outstanding judgments against you?

b. Have you been declared bankrupt within the past 7 years?

c. Have you had property foreclosed upon or given title or deed in lieu thereof in the last 7 years?

d. Are you a party to a lawsuit?

e.Have you directly or indirectly been obligated on any loan which resulted in foreclosure, transfer of title in lieu of foreclosure, or judgment? (This would include such loans as home mortgage loans, SBA loans, home improvement loans, education loans, manufactured (mobile) home loans, any mortgage, financial obligation, bond, or loan guarantee. If “Yes,” provide details, including date, name and address of Lender, FHA, VA case number, if any, and reason for the action.)

f.Are you presently delinquent or in default on any Federal debt or any other loan, mortgage, financial obligation, bond, or loan guarantee? If “Yes,” give details as

described in the preceding question.

g. Are you obligated to pay alimony, child support, or separate maintenance? h. Is any part of the down payment borrowed?

i. Are you a

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

j. Are you a U.S. citizen?

k. Are you a permanent resident alien?

l. Do you intend to occupy the property as your primary residence? If “Yes,” complete question m below.

m. Have you had an ownership interest in a property in the last three years?

(1)What type of property did you

(2)How did you hold title to the

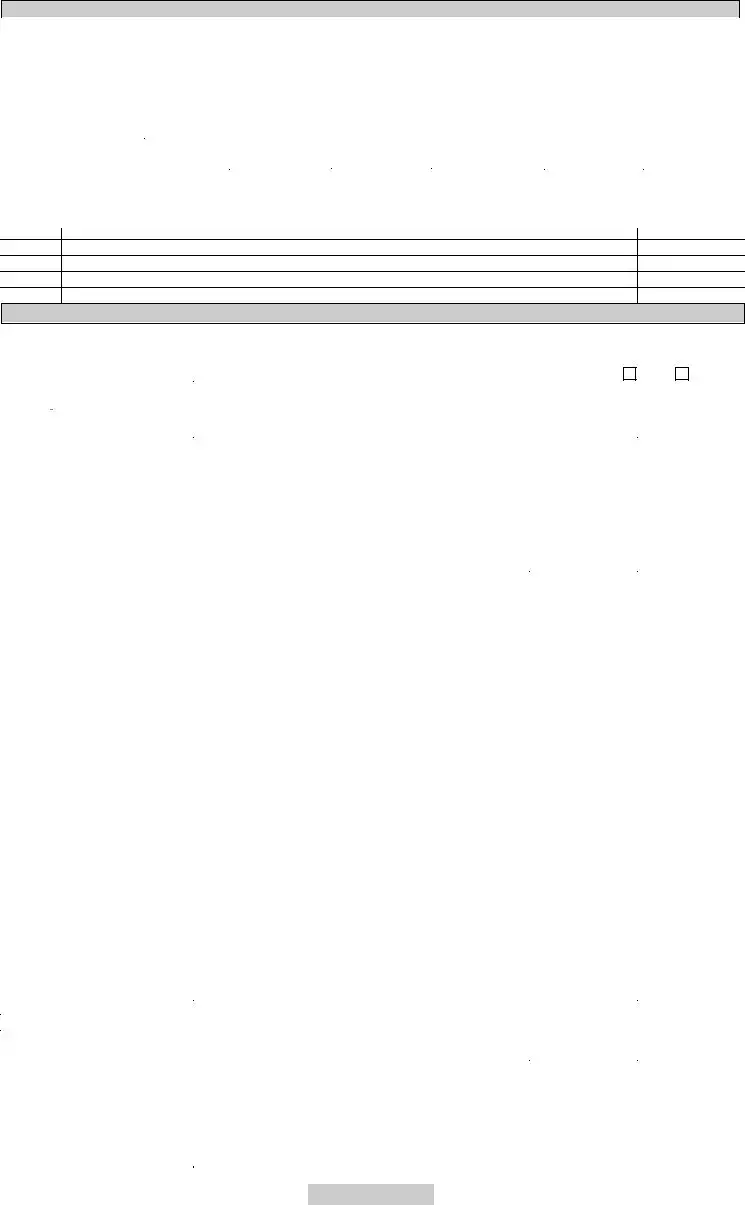

IX. ACKNOWLEDGMENT AND AGREEMENT

Each of the undersigned specifically represents to Lender and to Lender's actual or potential agents, brokers, processors, attorneys, insurers, servicers, successors and assigns and agrees and acknowledges that: (1) the information provided in this application is true and correct as of the date set forth opposite my signature and that any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001, et seq.; (2) the loan requested pursuant to this application (the "Loan") will be secured by a mortgage or deed of trust on the property described herein; (3) the property will not be used for any illegal or prohibited purpose or use; (4) all statements made in this application are made for the purpose of obtaining a residential mortgage loan; (5) the property will be occupied as indicated herein; (6) any owner or servicer of the Loan may verify or reverify any information contained in the application from any source named in this application, and Lender, its successors or assigns may retain the original and/or an electronic record of this application, even if the Loan is not approved; (7) the Lender and its agents, brokers, insurers, servicers, successors and assigns may continuously rely on the information contained in the application, and I am obligated to amend and/or supplement the information provided in this application if any of the material facts that I have represented herein should change prior to closing of the Loan; (8) in the event that my payments on the Loan become delinquent, the owner or servicer of the Loan may, in addition to any other rights and remedies that it may have relating to such delinquency, report my name and account information to one or more consumer credit reporting agencies; (9) ownership of the Loan and/or administration of the Loan account may be transferred with such notice as may be required by law; (10) neither Lender nor its agents, brokers, insurers, servicers, successors or assigns has made any representation or warranty, express or implied, to me regarding the property or the condition or value of the property; and (11) my transmission of this application as an "electronic record" containing my "electronic signature," as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or my facsimile transmission of this application containing a fascimile of my signature, shall be as effective, enforceable and valid as if a paper version of this application were delivered containing my original written signature.

Borrower’s Signature |

|

Date |

Date |

|

X |

|

|

X |

|

|

X. INFORMATION FOR GOVERNMENT MONITORING PURPOSES |

|

||

The following information is requested by the Federal Government for certain types of loans related to a dwelling in order to monitor the lender’s compliance with equal credit opportunity, fair housing and home mortgage disclosure laws. You are not required to furnish this information, but are encouraged to do so. The law provides that a lender may discriminate neither on the basis of this information, nor on whether you choose to furnish it. If you furnish the information, please provide both ethnicity and race. For race, you may check more than one designation. If you do not furnish ethnicity, race or sex, under Federal regulations this lender is required to note the information on the basis of visual observation or surname. If you do not wish to furnish the information, please check the box below. (Lender must review the above material to assure that the disclosures satisfy all requirements to which the lender is subject under applicable state law for the particular type of loan applied for.)

BORROWER |

I do not wish to furnish this information |

|

|

I do not wish to furnish |

this information |

|

||||

|

|

|

|

|

|

|

|

|

|

|

Ethnicity: |

Hispanic or Latino |

|

Not Hispanic or Latino |

|

Ethnicity: |

Hispanic or |

Latino |

Not Hispanic or Latino |

||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Race: |

American Indian or |

|

Asian |

Black or |

|

Race: |

American Indian or |

Asian |

Black or |

|

|

Alaska Native |

|

|

African American |

|

|

Alaska Native |

|

African American |

|

|

Native Hawaiian or |

|

White |

|

|

|

Native Hawaiian or |

White |

|

|

|

Other Pacific |

|

|

|

|

|

Other Pacific Islander |

|

|

|

Sex: |

Female |

Male |

|

|

Sex: |

Female |

Male |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

To be Completed by Interviewer |

|

Interviewer’s Name (print or type) |

|

|

Name and Address of Interviewer’s Employer |

|

||||

This application was taken by: |

|

Christian Chukwuma, MLO |

|

|

Bank of America Mortgage |

|

||||

|

|

|

|

|

|

|

||||

|

Interviewer’s Signature |

|

Date |

|

|

|||||

|

|

|

|

|

|

391 Diablo Rd, Suite 100 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Danville, CA 94526 |

|

|

||||

Telephone |

|

|

Interviewer’s Phone Number (incl. area code) |

|

|

|||||

Internet |

|

|

925 - 855 - 2146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1431 |

|

|

|

|

Page 3 of 4 |

|

|

|

|

|

Use this continuation sheet if you need more space to complete the Residential Loan Application.

Mark B for Borrower or C for

|

|

Continuation Sheet/Residential Loan Application |

|

|

Borrower: |

|

Agency Case Number: |

|

|

||

|

|

|

|

|

|

Lender Case Number: |

|

|

|

|

|

I/We fully understand that it is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements concerning any of the above facts as applicable under the provisions of Title 18, United States Code, Section 1001, et seq.

Borrower’s Signature

X

Date

Date |

X

1431 |

Page 4 of 4 |

Document Specifics

| Fact Name | Description |

|---|---|

| Application Purpose | The Uniform Residential Loan Application is crafted for completion by applicants, with or without the lender's assistance, designating roles as "Borrower" or "Co-Borrower" as appropriate. |

| Co-Borrower Information | Information for a Co-Borrower is necessary when the loan qualification relies on the income or assets of someone other than the Borrower or in specific scenarios involving community property states. |

| Loan and Property Types | Applicants can apply for various types of mortgages including FHA, VA, USDA/RHS, and conventional loans, while also specifying the intended property use and type. |

| Borrower Information | Collects detailed personal information of the applicant(s) including marital status, employment and income history, and details on dependents, if any. |

| Financial Information | Details on monthly income and combined housing expenses, assets and liabilities, and transactions relevant to the loan are required to provide a comprehensive financial overview. |

| Declarations Section | Applicants must disclose any judgments, bankruptcies, foreclosures, or pending lawsuits among other potential financial liabilities. |

| Acknowledgment and Agreement | Applicants affirm the accuracy of the information provided, understanding the legal consequences of misrepresentation, and agree to terms regarding the loan and property. |

| Government Monitoring Information | For certain loan types, applicants are asked to voluntarily provide demographic information to aid in monitoring compliance with fair lending laws, though provision of this information is optional. |

| State-Specific Forms and Governance | While the application is designed for universal use, applicants and lenders must ensure compliance with state-specific legal requirements and use additional forms as necessary. Laws governing these forms vary by state, with community property states having unique stipulations. |

Guide to Writing Uniform Loan Application

The Uniform Residential Loan Application is a critical step for those applying for a mortgage. This comprehensive form collects detailed information about the borrower and, if applicable, the co-borrower's financial and personal situation. It's a structured way for lenders to understand the applicant's ability to repay the loan. Preparing to fill out this form requires gathering financial documents, employment history, current debts, and assets. Below is a step-by-step guide to help navigate through this form, ensuring all necessary information is correctly provided to potential lenders.

- Identify whether you are applying as the "Borrower" or "Co-Borrower," checking the appropriate box. Include co-borrower information if their finances will contribute to the loan or if you’re applying with someone.

- Under "Type of Mortgage and Terms of Loan," select the type of mortgage you are applying for (e.g., FHA, VA, Conventional) and fill in related details such as the loan amount, interest rate, and loan term expressed in months.

- For "Property Information and Purpose of Loan," provide the address and details of the property, selecting the correct property type, and state the purpose of the loan (e.g., Purchase, Refinance).

- In the "Borrower Information" section, enter your name, social security number, phone number, date of birth, marital status, and details about dependents if any.

- Detail your current and previous addresses, including how long you have lived at each and whether you owned or rented.

- Under "Employment Information," list your current employer, position, time on the job, and business phone number. If you have been employed in your current position for less than two years, or have additional employment, provide details accordingly.

- Fill out the "Monthly Income and Combined Housing Expense Information" section with your current monthly income and your existing housing expenses.

- For "Assets and Liabilities," list all your current assets (e.g., bank accounts, real estate, vehicles) and liabilities (current debts, alimony, etc.). Use additional sheets if necessary.

- Complete the "Details of Transaction" with information about your intended transaction, including the purchase price and details about your down payment and closing costs.

- Answer all questions in the "Declarations" section honestly, which cover judgments, bankruptcies, foreclosures, lawsuits, and other financial and legal matters.

- Read the "Acknowledgment and Agreement" section carefully. By signing, you affirm that all provided information is true and you understand the legal implications of any falsehoods.

- Under "Information for Government Monitoring Purposes," you may choose to provide details regarding ethnicity, race, and sex for the purposes of government monitoring of compliance with fair lending laws. This is optional but encouraged.

- Ensure that both the borrower and co-borrower (if applicable) sign and date the application to validate the information provided.

- Lastly, fill out the interviewer's information section if the application was completed with the help of a loan officer or similar professional.

Once completed, review the form thoroughly to confirm accuracy and completeness before submitting it to your lender. Timely and accurate completion of this form plays a significant role in the mortgage application process, helping lenders make informed decisions regarding loan approval.

Understanding Uniform Loan Application

What is the Uniform Residential Loan Application?

The Uniform Residential Loan Application is a document that individuals fill out when applying for a mortgage. It collects detailed information about the borrower and co-borrower (if applicable), including their personal details, employment history, income, assets, and liabilities. This information helps lenders assess the applicants' creditworthiness and determine whether they qualify for the loan.

Who should complete the Uniform Residential Loan Application?

This form should be completed by the main applicant, referred to as the "Borrower," and the co-borrower, if there is one. The co-borrower's information is necessary when the income or assets of a person other than the borrower, like the borrower’s spouse, are used for loan qualification or in community property states where liabilities of the spouse must be considered.

What types of mortgages can I apply for using this form?

Applicants can use this form to apply for various types of mortgages including FHA, VA, USDA/Rural Housing Service loans, Conventional loans, and other specialized loan programs. The specific loan type you're applying for should be clearly indicated in the application.

What information will I need to provide about the property?

You’ll need to provide the address, type of property (e.g., single-family residence, manufactured home), number of units, year built, and legal description of the property. Additionally, the form requires details on the loan purpose (e.g., purchase, refinance), the property’s intended use (primary residence, investment, etc.), and information on current and proposed housing expenses.

How do I detail my monthly income and expenses?

In the application, there’s a section dedicated to your monthly income, including base employment income, overtime, bonuses, and any other sources of income like dividends or rental income. It also asks for your combined housing expense, both current and proposed, to evaluate your financial capability further.

What assets and liabilities should I include?

You must list all your assets, including bank account balances, real estate properties, stocks and bonds, as well as all liabilities such as outstanding debts, loans, and any alimony or child support responsibilities. This helps in assessing your net worth and financial stability.

How should I complete the section on declarations?

The declarations section asks several yes/no questions about legal and financial matters like outstanding judgments, bankruptcy history, foreclosures, lawsuits, and federal debt delinquency. Answer honestly and provide explanations where necessary, as these answers play a critical role in the loan decision process.

Can I apply for a loan without disclosing my ethnicity or race?

Yes, disclosing your ethnicity, race, or sex is voluntary. This information is requested for government monitoring purposes to ensure compliance with equal credit opportunity and fair lending laws. You can choose not to furnish this information, and the lender is required to note the information based on visual observation or surname if not provided.

What happens to the information I provide in this application?

The information you provide is used by the lender to assess your loan application. It may be verified or reverified by any source named in the application. If your application is approved, the details will be used in the administration of your loan. Be mindful that providing false information can lead to civil liability or criminal penalties.

Does completing this application guarantee loan approval?

No, completing the Uniform Residential Loan Application does not guarantee approval of a loan. The lender will review your application, along with your financial information and credit history, to make a lending decision. The process may also include property appraisal and additional documentation.

Common mistakes

Filling out the Uniform Residential Loan Application form accurately is crucial for loan approval. However, applicants often make mistakes that can impact their chances. Here are the top ten mistakes to avoid:

- Not checking “Borrower” or “Co-Borrower” correctly. It's vital to indicate the proper designation based on your role and contribution to the loan application.

- Omitting information about co-borrower's income or assets when applicable, especially if these are crucial for loan qualification.

- Incorrectly stating the type of mortgage and terms of the loan sought. Each loan type has specific requirements and implications.

- Providing an inaccurate or incomplete property address and legal description. This information must be precise for legal and valuation purposes.

- Failing to accurately describe the purpose of the loan, such as purchase, refinance, or construction, which could lead to processing delays.

- Misrepresenting employment information, including duration of employment, which is a critical factor in assessing financial stability.

- Overlooking details about monthly income and combined housing expenses, or inaccurately reporting income sources, can misrepresent financial capacity.

- Not fully disclosing assets and liabilities. Transparency about finances ensures the lender has a complete understanding of your economic situation.

- Incorrectly answering the declarations section, which includes important questions about judgments, bankruptcy, foreclosure, and other legal or financial issues.

- Skipping the government monitoring information section, which assists in compliance with equal credit opportunity, fair housing, and home mortgage disclosure laws. While not mandatory, this information is encouraged.

It is in an applicant’s best interest to review their loan application thoroughly, ensuring all provided information is accurate and complete. Mistakes or omissions can lead to delays or, even worse, denial of the loan. Seeking assistance from the lender when unsure about specific details on the form can prevent these common errors.

Documents used along the form

When applying for a mortgage, the Uniform Residential Loan Application is just the beginning. Several other documents are usually required to complete the application process, verify the information provided, and assess the borrower's creditworthiness and ability to repay the loan. Here's a brief overview of nine additional forms and documents often used alongside the Uniform Loan Application form.

- W-2 Forms: These forms from the past two years are used to verify an applicant's employment history and income stability.

- Pay Stubs: Most recent pay stubs, generally covering the last 30 days, provide current proof of income.

- Bank Statements: Checking and savings account statements from the last two to three months help lenders evaluate the applicant's savings and cash flow.

- Tax Returns: Federal tax returns from the past two years offer a comprehensive view of the applicant's financial situation.

- Photo ID: A government-issued photo ID, such as a driver's license or passport, is necessary to verify the identity of the applicant.

- Credit Report Authorization: This form allows the lender to pull the applicant's credit report and verify their credit history and scores.

- Proof of Additional Income: Documentation of any additional income sources, like alimony or bonuses, which might support the loan application.

- Divorce Decree: If applicable, this document is required to verify alimony or child support obligations or incomes.

- Self-Employment Documentation: For self-employed applicants, additional documentation such as profit and loss statements may be needed to verify income stability.

Gathering these documents in advance can significantly smooth the application process. Each document plays a crucial role in building a clear financial picture of the applicant, thereby helping lenders make informed decisions while ensuring that applicants receive the best possible loan terms based on their circumstances.

Similar forms

The Mortgage Application, officially known as the Uniform Residential Loan Application, shares similarities with the Personal Financial Statement form. Both documents require detailed information about the applicant's financial situation, including income, debts, and assets. The main difference lies in their purposes: while the Mortgage Application is used specifically for securing a home loan, the Personal Financial Statement is a more general document that can be used for various financial needs, including loan applications and financial planning.

Similar to the Rental Application form, the Mortgage Application also gathers applicant information to assess eligibility. However, while the Rental Application focuses on a person's rental history and current employment to ensure they can pay rent, the Mortgage Application dives deeper into financial details, including credit history, to approve a loan for buying a property.

Just like the Credit Application form, the Mortgage Application assesses an individual's creditworthiness. Both forms collect information on financial status, employment, income, and existing debts. The difference lies in their end goal: the Credit Application is broader, for various types of credit requests, whereas the Mortgage Application is specifically for home loan approvals.

Employment Verification forms and the Mortgage Application both require confirmation of an applicant's employment status and income. The key difference is that the Employment Verification form is usually a separate document requested by the lender to verify the employment details provided in the Mortgage Application, emphasizing the critical nature of employment status in loan qualifications.

The Loan Agreement shares similarities with the Mortgage Application by outlining terms and conditions under which the loan is provided. However, the Mortgage Application is the initial step to apply for the loan, focusing on applicant eligibility, while the Loan Agreement is a binding document that is signed after loan approval, detailing the loan’s terms, repayment schedule, and interest rates.

Debt-to-Income (DTI) Ratio forms, often used in credit counseling or financial assessments, and the Mortgage Application both evaluate financial health by examining income in relation to debts. The Mortgage Application uses this comparison as part of its process to determine borrowing eligibility, similar to how a DTI form assesses an individual’s financial stability.

Income Verification forms, like the Mortgage Application, require proof of income to establish financial reliability. While the Income Verification form may be used for various purposes, such as renting an apartment, the income details in a Mortgage Application specifically help lenders evaluate a borrower's ability to afford a mortgage.

The Asset and Liability Statement, not unlike the Mortgage Application, lists an individual’s assets and liabilities. This comprehensive financial snapshot aids in assessing net worth for various purposes, including loan approvals. In the context of the Mortgage Application, detailing assets and liabilities helps lenders understand the applicant’s financial foundation for mortgage affordability.

Lastly, the Home Equity Line of Credit (HELOC) Application, while designed for a specific type of loan against the equity in a home, requires similar financial details from the applicant as does the Mortgage Application. Both identify the borrower’s financial situation, property details, and intended use of funds to determine loan eligibility, although for distinctly different types of loans.

Dos and Don'ts

When filling out the Uniform Loan Application form, there are several important dos and don'ts to keep in mind to ensure the process goes smoothly. These guidelines can help you avoid common mistakes and improve your chances of loan approval.

Dos:- Do read all instructions carefully before starting to fill out the form.

- Do use black ink or type the information electronically if possible for clarity.

- Do provide accurate and complete information in every section to avoid delays.

- Do double-check your social security number and contact information for errors.

- Do include all requested documentation, such as proof of income and employment history.

- Do list both borrower and co-borrower information where applicable.

- Do sign and date the form where required to validate the application.

- Do ask questions if you're unsure about any part of the application process.

- Don't leave any sections blank. If a section doesn't apply, write "N/A" for not applicable.

- Don't provide false or misleading information, as this can lead to application denial or legal consequences.

- Don't forget to consider the role of assets and liabilities in your financial profile.

- Don't overlook the importance of declaring all sources of income, including alimony or child support if you choose to have it considered.

- Don't rush through filling out the form, as mistakes can lead to processing delays.

- Don't hesitate to disclose any co-borrowers or dependents, as their information may impact your application.

- Don't forget to include information on current housing expenses and any changes expected after the loan.

- Don't fail to update any information if your circumstances change before the loan closes.

Misconceptions

Navigating the path to securing a mortgage involves a myriad of steps, with the Uniform Residential Loan Application (URLA) being a critical one. Despite its common usage, there are several misconceptions surrounding this form. Let’s debunk some of them.

Only the borrower’s details are necessary: A common misconception is that only the person signing up for the loan needs to fill out the application. However, the URLA requires information on both the borrower and co-borrower (if applicable). This includes cases where the co-borrower's income or assets are relevant to the loan or when considering liabilities, particularly in community property states.

It’s purely for conventional loans: Another misunderstanding revolves around the assumption that the URLA is used exclusively for conventional mortgage applications. In reality, this form is versatile and used across various loan types, including FHA, VA, and USDA loans, as indicated in the "Type of Mortgage and Terms of Loan" section.

Purpose of the Loan section is straightforward: While it seems straightforward to indicate the loan purpose (e.g., purchase, refinance), applicants often misinterpret the necessity of detailing their intentions, especially for construction or improvements. The form demands specific details for such cases to accurately assess the loan's purpose and the financial implications.

Current employment information is enough: A prevalent belief is that only current employment details matter. Yet, the URLA asks for a comprehensive employment history if the current job has been held for less than two years. This broader snapshot of an applicant's employment stability and history is crucial for lenders evaluating loan eligibility.

Down payment sources are irrelevant: Lastly, there’s a myth that the source of a down payment doesn’t need to be disclosed. Contrary to this belief, the URLA has sections dedicated to the source of down payment, settlement charges, and subordinate financing. Transparency about these funds' origins is essential to lenders for compliance and loan underwriting processes.

Understanding these aspects of the Uniform Residential Loan Application can demystify the process, making it less daunting for applicants. It’s a step toward securing a mortgage with clarity and confidence.

Key takeaways

Filling out the Uniform Residential Loan Application (URLA) is a crucial step in the mortgage loan application process. Understanding how to complete this form accurately can significantly impact your loan approval process. Here are ten key takeaways to remember:

- The URLA is designed to be filled out by the applicant with assistance from the lender. It's important for applicants to provide accurate and complete information as “Borrower” or “Co-Borrower,” as applicable.

- Co-Borrower information is necessary when the income or assets of a person other than the “Borrower” will be used for loan qualification. This includes scenarios in community property states, affecting how liabilities and assets are considered.

- Details about the type of mortgage and terms of the loan, including mortgage type, loan amount, interest rate, and loan term, must be clearly specified in the application.

- Applicants should accurately describe the property information and the purpose of the loan, whether it’s for purchase, refinance, construction, or home improvement, among others.

- The form requires detailed borrower information, including name, social security number, date of birth, marital status, and dependents, ensuring thorough identification.

- Both current and previous employment information is necessary, especially if the current position is held for less than two years or if there is multiple employment.

- Income and housing expenses must be detailed, including all sources of monthly income against current housing expenses and the anticipated expenses of the new loan.

- Listing accurate assets and liabilities is crucial for assessing the financial situation of the borrower. This includes bank accounts, real estate owned, automobiles, and any other significant assets or liabilities.

- Applicants are required to answer a series of declarations regarding judgements, bankruptcies, foreclosures, lawsuits, and other potentially impacting financial circumstances.

- The form includes a section for government monitoring purposes, aimed at ensuring compliance with equal credit opportunity and fair housing laws. Providing ethnicity, race, and sex is voluntary but encouraged.

It’s imperative for borrowers to fully understand each section of the URLA and provide honest and accurate information. Misrepresentation may lead to civil or criminal penalties. This form plays a critical role in the mortgage application process and hence should be filled out with the utmost care and due diligence.

Popular PDF Documents

IRS 990-EZ - The schedule attachments included with the 990-EZ form allow for the reporting of additional activities such as gaming, fundraising events, and grant-making.

Revenue Portal Login - The form requires an affirmation statement to be signed under the penalties of perjury, ensuring all provided information is accurate and truthful.

IRS 6781 - Its existence underscores the intricate link between the financial markets and tax policy, guiding taxpayers through compliance.