Get Uk R40 Tax Form

In navigating the complexities of tax obligations, the UK R40 Tax Form emerges as a crucial instrument for individuals seeking reimbursement for tax deducted from various forms of savings and investments. This form facilitates claims for the repayment of taxes that have been overpaid or incorrectly deducted within a specific tax year, covering a broad spectrum of financial territories from employment income and pensions to dividends from shares and interest from savings accounts. Individuals are required to meticulously report incomes, taxes already paid, allowable expenses, and any relevant personal details such as National Insurance numbers and contact information. Additionally, the form caters to specific scenarios like claims by non-resident landlords and those with foreign income, highlighting its comprehensive scope in addressing taxpayer needs. Wisely, the accompanying guidance notes aim to simplify the process, although they fall short of covering every possible question that could arise from the vast array of fields to be completed, making accuracy and attention to detail paramount. With emphasis placed on swiftly and efficiently processing claims to facilitate repayments, the form underscores the importance of clarity and correctness in filling out requested information, from personal identifiers to intricate financial details.

Uk R40 Tax Example

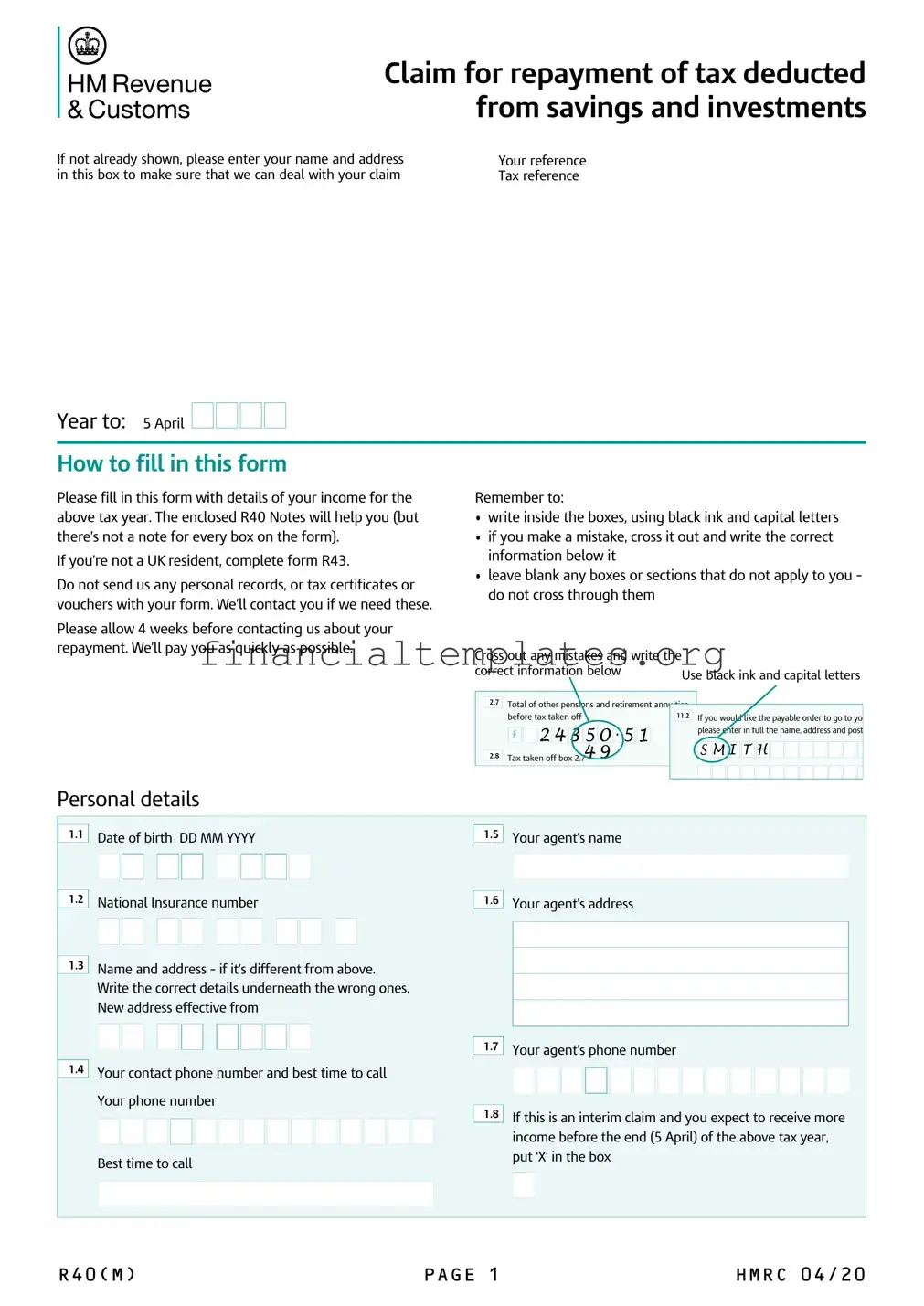

Claim for repayment of tax deducted from savings and investments

in this box to ma |

Tax reference |

to

How to fill in this form

Please fill in this form with details of your income for the above tax year. The enclosed R40 Notes will help you (but there’s not a note for every box on the form

you’re not a residentcomplete form R4

not send us any personal recordsor tax certificates or vouchers with your form. contact you if we need these.

Please allow 4 weebefore contactinus about your repayment. pay you as as possible.

Remember to

•write inside the boxesusinblacinand capital letters

•if you maa mistacross it out and write the correct information below it

•leave blanany boxes or sections that do not apply to you – do not cross throuthem

correct information below

2.7Total of other pensions and retirement annuities,

|

before tax taken off |

|

|

|

|

|

11.2 |

If you would like the payable order to go to yo |

||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

please enter in full the name, address and post |

||||||||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2.8 |

Tax taken off box 2.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Personal details

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.1 |

of birth |

|

1.5 |

aname |

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1.2 |

National number |

|

|

|

1.6 |

aaddress |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.3 |

Name and address – if it’s different from above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

the correct details underneath the wronones. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

New address effective from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.7 |

aphone number |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

1.4 |

contact phone number and best time to call |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

phone number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.8 |

this is an interim claim and you expect to receive more |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income before the end (of the above tax year |

||||||||||||||

|

time to call |

|

|

|

|

|

put ‘in the box |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R40(M) |

PAGE 1 |

HMRC 04/20 |

employment incomepensions and state benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.1 |

Total pay from all employmentsbefore tax taoff |

2.6 |

|

Tax taoff any taxable included |

|||||||||||||||||||||||

|

(from P |

|

|

|

|

|

|

|

|

|

in box |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2.2 |

Tax taoff box income |

|

|

|

|

|

|

|

2.7 |

|

Total of other pensions and retirement annuities |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

before tax taoff |

|

|

|

|

|

|

|

|||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

2.3 |

Pension – enter the amount you were entitled to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

receive in the year not the weeor 4 weeamount. |

2.8 |

|

Tax taoff box |

|

|

|

|

|

|

|

||||||||||||||||

|

Read the R40 notes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.9 |

rate expensesprofessional subscriptionsetc |

|||||||||||

2.4 |

you do not receive Pensionput ‘in the box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2.5 |

Total of other taxable state benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

interest and dividends

accountsonly enter your share of the interest received.

3.1 |

Net interest paid by banbuildinsocieties etcpurchased |

3.5 |

company dividends (but do not add on the tax credit |

||||||||||||||||||||||

|

life annuities and PPpayments – after tax taoff |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

3.6 |

from authorised unit trustsopen |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

3.2 |

Tax taoff |

|

|

|

|

|

|

|

investment companies and investment trusts (but do not |

||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

add on the tax credit |

|

|

|

|

|

|||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

3.3 |

amount – the amount before tax taoff |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3.7 |

dividends – enter the appropriate amount in cash |

|||||||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

cash eof the share capital – without any tax |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

3.4 |

interest not included in box (if you have more |

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||||||

|

|

||||||||||||||||||||||||

|

than one account – read the R40 notes for boxes to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trustsettlement and estate income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.1 |

Taxpayer Reference (of the trust |

4.7 |

|

Tax paid on box 4.income |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.2 |

Net amount taxed at trust rate – after tax taoff |

4.8 |

|

Net amount of dividend income |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4.3 |

Tax paid on box 4.income |

|

|

|

|

|

|

|

4.9 |

|

Tax credit on box 4.income |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4.4 |

Net amount of nonincome – after tax taoff |

4.10 |

payments from settlortrusts |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4.5 |

Tax paid or tax credit on box 4.4 income |

4.11 |

|

Net amount of dividend income – after tax taoff |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

4.6 |

Net amount of savinincome – after tax taoff |

4.12 |

|

Tax paid on box 4.income |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R40(M) |

PAGE 2 |

land and property

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.1 |

|

|

|

|

|

|

|

|

5.4 |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5.2 |

allowable for tax |

|

5.5 |

and property losses brouforward from |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

earlier years |

|

|

|

|

|

|||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

5.3 |

Profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

income

the sterlineof your foreiincome and tax paid. there’s more than one country of ori the additional details on a separate sheet. foreidividends of £or less.

6.1

6.2

6.3

6.4

6.5

6.6

f you’re a nonresident landlord then forein int

dividends (net amount

£

•

•

tax taoff box income

£

•

•

dividends elifor tax credit (net amount

£

•

•

tax taoff box income

£

•

•

property income – before expenses

£

•

•

property – expenses allowable for tax

£

•

•

erest and forein pensions need to be reported thro uh selfassessment.

6.7tax taoff box income

£

•

•

6.8interest and other savin

£

•

•

6.9tax taoff box income

£

•

•

6.10pensions and any other foreiincome

£

•

•

6.11tax taoff box income

£

•

•

6.12of ori

other income and benefits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.1 |

event |

|

|

|

|

|

|

7.4 |

income and benefits (amount |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.2 |

Number of years |

|

|

|

|

|

|

7.5 |

|

Tax taoff box |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.3 |

Tax treated as paid on box income |

7.6 |

of box income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8.1 |

payments made in the year of claim |

8.3 |

|

Total of any ‘onepayments included in box |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

8.2 |

payments made in the year of claim but |

8.4 |

payments made after the end of the year of |

|||||||||||||||||||||||||||||

|

treated as if made in the precedinyear |

|

|

claim but to be treated as if made in that year |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|

|

£ |

|

|

|

|

|

|

• |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R40(M) |

PAGE 3 |

Person’s

9.1

you’re reblind (severely siimpairedwith

a local authorityor other reput ‘in the box

Please also consider box below

9.2

the name of the local authorityor other re (or ‘or ‘Northern as appropriate

10.1

This allowance is only due if youor your spouse or civil partnerwere born before

To claim the full allowanceenter your spouse’s or |

10.5 |

the date of the marriaor civil partnership |

civil partner’s full name

10.6

10.2

10.3

10.4

as a coupleyou’ve already asus to

all of the minimum amount to your spouse or civil partnerput ‘in the box

you’ve already athat half of the minimum amount is to to your spouse or civil partnerput ‘in the box

spouse’s or civil partner’s date of birth if older than you and you filled in boxes or

or civil partner to the other – if you want us to send you a form to do this

or you can download it from www.

of

and attach it to this claim form.

Repayment instructions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11.1 |

should we send the repayment to |

|

11.2 |

you would lithe payable order to to your nominee |

|||||||||||||||||||||

|

address |

|

|

|

|

enter in full the nameaddress and postcode |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

nominee’s address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(to to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

11.3 |

your nominee is your adviserenter their reference |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

Please masure that you’ve read the R40 Notes at section before si |

||||||||||||||||||||||||

12.1

12.2

and date this form and then write your full name (in capital lettersin the space provided The information on this form is correct and complete to the best of my

Name and title in capital letters

you’ve sion behalf of someone elseenter the |

|

|

12.3 |

|

Ticthis box if you do not need a claim form in future |

|||||||||||||

capacityfor exampleparentexecutorreceiverattorney |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R40(M) |

PAGE 4 |

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The R40 Tax Form is used to claim repayment of tax deducted from savings and investments. |

| Sections | Includes sections for personal details, income from employment, pensions, savings, investments, and property income, among others. |

| Instructions for Filling | Applicants are advised to write in black ink, use capital letters, cross out mistakes and write the correct information below, and leave sections that do not apply blank. |

| Supporting Documents | Personal records, tax certificates or vouchers should not be sent with the form unless requested. |

| Processing Time | There is a four-week waiting period before contacting about repayment. |

| Repayment Method | Details for repayment such as payable order preferences and nominee information can be specified. |

Guide to Writing Uk R40 Tax

Filling out the UK R40 Tax Form requires careful attention to detail and a comprehensive understanding of your income and taxes over the fiscal year. The process involves providing personal information, detailing income and taxes paid, and, if applicable, nominating a recipient for any repayment due. Following the steps outlined ensures accurate submission and helps expedite any potential repayments.

- Start by writing your full name, date of birth, and National Insurance number in the designated boxes under the section titled "Personal details".

- Under "Personal details" again, fill in your current address if it differs from the one pre-filled on the form, and update your contact information including a phone number and the best time for HMRC to call.

- In the "Income" section, accurately input all employment income before tax (from P60 or P45) in box 2.1 and any tax already taken off in box 2.2.

- Report any pension amounts entitled in box 2.3, specifying the total of other pensions and retirement annuities before tax in box 2.7 and the tax taken off in box 2.8.

- Include details of any other taxable state benefits received in box 2.5.

- Under "Interest and dividends," declare net interest paid by banks, building societies, etc., in box 3.1 and any tax taken off in box 3.2. Input details of dividends from companies in box 3.5.

- For those with income from trusts, settlements, and estates, provide the taxpayer reference of the trust in box 4.1, net amount taxed, and tax paid or tax credit in the subsequent boxes (4.2 - 4.11).

- Input details of land and property income in section 5, including profit before expenses (box 5.1) and allowable expenses for tax purposes in box 5.2.

- If applicable, declare foreign income and tax paid in section 6, ensuring to specify the country of origin and fill in the net amount after tax and any relevant expenses.

- Under "Other income and benefits," specify any one-off events or benefits received in box 7.1 and the tax treated as paid on that income in box 7.3.

- For donations made under Gift Aid, fill in the total payments made in the year of the claim in box 8.1 and any other relevant details in the following boxes in section 8.

- If claiming allowances for being severely sight impaired, fill in box 9.1 and provide the name of the local authority in box 9.2.

- For those eligible for the marriage allowance, fill in details regarding your spouse or civil partner in section 10, including their full name and date of marriage or civil partnership.

- In the "Repayment instructions" section, fill in your preferred repayment details. If you wish the repayment to go to a nominee, provide their full name, address, and postcode in box 11.2.

- Finally, confirm the information is accurate and complete, sign, and date the form in section 12. Ensure to write your full name in capital letters and specify your capacity if signing on behalf of someone else.

After you have completed and double-checked the R40 form for accuracy, you should submit it to HMRC. Remember not to attach any personal records, tax certificates, or vouchers unless HMRC specifically requests them. Following submission, allow up to four weeks before contacting HMRC regarding the status of your repayment. This gives them ample time to process your claim and issue any repayment due.

Understanding Uk R40 Tax

What is the UK R40 Tax Form used for?

The UK R40 tax form is a document individuals use to claim a repayment of tax deducted from savings and investments. This form allows individuals to request a refund if they have paid more tax on their savings or investment income than they owe.

How do I fill out the R40 form?

When filling out the R40 form, you should include details of your income for the specified tax year. Use black ink and capital letters to write inside the boxes. If you make a mistake, cross it out and write the correct information below. Only fill in sections that apply to you, leaving others blank. Do not send any personal records, tax certificates, or vouchers with your form unless later requested by the HMRC.

Who should use the R40 form?

Individuals who have had tax deducted from their savings and investments and believe they have overpaid tax should use the R40 form. This includes, but is not limited to, retired individuals receiving pensions, beneficiaries of trusts, or those with income from dividends and savings accounts.

What information do I need to provide on the R40 form?

You need to include personal details like your name, date of birth, and National Insurance number. Also, details of your income, including total pay from employment, pensions, state benefits, interest and dividends from investments, and any overseas income if applicable, should be accurately provided. Remember to mention any allowable expenses and tax already paid.

How long does it take to get a repayment after submitting the R40 form?

After submitting the R40 form, please allow at least four weeks before contacting HMRC about your repayment. The exact time to receive your payment can vary, but HMRC aims to process repayments as quickly as possible.

Can I nominate someone else to receive my repayment?

Yes, you can nominate someone else, such as a relative or financial advisor, to receive your repayment. To do this, provide the name, address, and postcode of your nominee in the relevant section of the form. If the nominee is your adviser, include their reference number.

What should I do if I need help completing the R40 form?

If you need help completing the form, refer to the enclosed R40 Notes, which provide detailed guidance. Not every box on the form has a corresponding note, so if further assistance is needed, consider contacting a tax professional or HMRC directly for specific advice regarding your situation.

Common mistakes

Filling out the UK R40 Tax form, which is essential for claiming a refund on tax deducted from savings and investments, can sometimes be confusing. A few common mistakes can potentially delay the processing of your claim or even result in the incorrect refund amount being issued. By being aware of these common errors, individuals can ensure a smoother processing of their tax refund claims. Here are some of the most prevalent mistakes:

Incorrect Personal Details: One of the most basic yet frequently overlooked aspects is filling in personal information properly. Ensuring that your date of birth, National Insurance number, and contact details are accurate is crucial. Errors in this section can lead to processing delays or correspondence being sent to the wrong address.

Not Writing in Capitals: The form instructs to write inside the boxes using black ink and capital letters for clarity. Failing to comply with this request can make the handwriting difficult to read, leading to potential misinterpretations of the data provided.

Omitting Income Details: It's vital to accurately declare all sources of income, including all employments, pensions, and state benefits, as well as savings and investment income. Missed information can result in an inaccurate assessment of your tax refund.

Forgetting to Include Supporting Documents: While the form specifies not to send personal records or tax certificates with your claim, it's essential to keep these documents at hand. HMRC may contact you for these documents to support your claim, and not having them readily available can delay your refund.

Error in Repayment Instructions: Miscommunication regarding where and how you want the repayment made might occur if the repayment instructions are not clear. Whether it’s to be made to you directly or to a nominee, ensure the details are accurately and legibly filled out to avoid any repayments being sent to the wrong recipient or account.

To prevent these and other mistakes, thoroughly review your completed form against the R40 Notes provided. Understanding each section and what's required can significantly reduce the likelihood of errors and facilitate a timely processing of your tax refund request.

Documents used along the form

Filing a UK R40 form, which is used for claiming repayment of tax deducted from savings and investments, can seem daunting. However, accompanying this form with the correct additional documents and forms can streamline the process and ensure clarity in your tax affairs. Here is a list of other forms and documents often used alongside the UK R40 Tax form, each playing a crucial role in ensuring a comprehensive and accurate tax repayment claim.

- Form P60: This form summarises an individual's total income and the taxes paid on that income during the tax year, proving useful if your claim involves employment income.

- Form P45: Issued by your employer when you leave a job, this details your earnings and the tax paid up to your employment's end date within the financial year.

- Form P11D: Provided by your employer, this shows benefits in kind (such as a company car or healthcare) that might need reporting.

- Interest statements from banks or building societies: These are crucial for detailing the exact amount of interest earned on savings, which needs to be declared.

- Dividend vouchers: These confirm the dividend payments received from shareholdings, an essential addition if you have investment income.

- Capital Gains Tax calculations: If you have sold assets, such as property or shares, these calculations aid in reporting any capital gains or losses.

- Self-Assessment tax return: For those also completing a self-assessment, including this can help HMRC cross-reference and ensure all income has been declared.

- Trust or estate income documents: If you receive income from a trust or estate, these documents provide details on such income for accurate reporting.

- Rental income records: For landlords, detailed records of rental income and allowable expenses are necessary to accurately complete relevant sections.

- Social security documentation: Documents detailing received social security benefits can be relevant for declaring state benefits received throughout the tax year.

Properly compiling and cross-referencing these documents with your R40 claim can not only speed up the processing time but also ensure you claim the correct amount of tax repayment. While HMRC may not require all these documents to be submitted alongside your R40 form, keeping them organized and on hand is advisable should they request further information. Remember, accurate and complete documentation supports a smoother tax repayment process.

Similar forms

The United States equivalent to the UK R40 form is the IRS Form 1040, "U.S. Individual Income Tax Return." Both forms are used by individuals to report their income for the tax year. They help in determining the amount of tax to be paid or refunded. Just like the R40 form, Form 1040 requires detailed information about different sources of income, including employment, pensions, and investments. Taxpayers can also claim deductions and credits that could lower their taxable income, mirroring the R40's function of ensuring taxpayers are refunded any overpaid tax.

Form 1099-INT, "Interest Income," in the U.S. closely aligns with sections of the R40 form related to income from savings and investments. This document is issued by banks or financial institutions to report the interest a taxpayer has earned during the tax year. Similar to the R40, it accounts for tax deducted at the source on savings. While the R40 is a claim form for relief or refund, the information on a 1099-INT directly feeds into the computation of taxable income and tax liabilities on Form 1040.

The IRS Form 1099-DIV, "Dividends and Distributions," is akin to the R40's sections on dividends from investments. This form reports dividends and distributions received during the tax year, a vital part of understanding an individual's investment income, paralleling the UK's system. Both forms ensure that investment income is correctly reported and any applicable tax adjustments or refunds are made for overpayment, adhering to each country's tax laws and regulations.

IRS Form 5498, "IRA Contribution Information," resembles part of the R40 form concerning pensions and annuities. Both documents are crucial for retirement planning and tax calculations. Form 5498 details contributions to retirement accounts, serving a similar purpose as the R40 by providing essential information for accurately computing tax relief on retirement savings, thereby optimizing the taxpayer's financial situation in accordance with relevant tax rules.

The Schedule E (Form 1040), "Supplemental Income and Loss," is used in the U.S. for reporting income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs. It's similar to those sections of the R40 that deal with income from trusts, estates, and property. Both documents ensure taxpayers declare income from these sources properly, allowing for accurate tax calculation and any necessary adjustments for overpaid taxes.

IRS Form 4868, "Application for Automatic Extension of Time To File U.S. Individual Income Tax Return," although not a direct equivalent in function, shares a procedural similarity with the flexibility provided in the R40's submission timelines. It reflects the understanding in both the U.K. and U.S. tax systems that circumstances may necessitate additional time to accurately complete and submit tax documents, ensuring taxpayers can fulfill their obligations without penalty for delays.

Lastly, the IRS Form 8857, "Request for Innocent Spouse Relief," offers an interesting parallel to the nuanced approach of tax liability cases seen in the R40 form's intention. While the R40 helps claim back overpaid taxes, the Form 8857 is designed to protect taxpayers from undue liability due to actions taken by their spouse or former spouse. Both forms acknowledge individual circumstances in the tax system, aiming to ensure fair treatment of taxpayers.

Dos and Don'ts

When filling out the UK R40 Tax form, there are specific do's and don'ts that can help streamline the process and ensure accuracy. Here are the guidelines:

Do's:

- Read the R40 Notes carefully before starting the form. These notes contain crucial information not covered for every box on the form.

- Use black ink and CAPITAL letters when writing inside the boxes. This ensures your information is clear and readable.

- If you make a mistake, cross it out and write the correct information below it. Do not use correction fluid or tape.

- Leave blank any boxes or sections that do not apply to you. Do not strike through them; simply skip.

- For the Repayment Instructions section, if you wish the payable order to be issued to someone other than yourself, clearly fill in the name, address, and postcode of the nominee.

Don'ts:

- Do not send personal records, tax certificates, or vouchers with your form unless specifically requested by HMRC. They will contact you if these documents are needed.

- Avoid writing outside the provided boxes. Information written outside these areas may not be processed correctly.

- Do not assume all sections apply to you. Only fill out sections relevant to your income and deductions.

- Do not forget to sign and date the form in the designated area. An unsigned form may result in processing delays.

- Lastly, do not expect an immediate response. Allow 4 weeks before contacting HMRC about your repayment.

Misconceptions

Only people with savings and investments need to complete the R40: This is not true. The R40 form can be used by anyone who has had UK income tax deducted from savings, investments, or other sources and believes they are due a refund.

You must send personal records and tax certificates with your R40 form: Incorrect. The guidelines specify not to send personal records or certificates with the form. HMRC will request these if necessary.

The R40 form is only for UK residents: This is a misconception. Non-residents can also use the form to claim a refund on UK tax deducted, under specific circumstances.

It is complicated to fill out: While it may seem daunting, HMRC provides R40 Notes to assist with the form’s completion. These notes explain each section to simplify the process.

Corrections on the form are not allowed: If you make a mistake, you can correct it. Cross out the incorrect information and write the correct details below it, as instructed.

Expected future income should not be reported: This is not accurate. If you are making an interim claim and expect more income within the same tax year, you’re advised to indicate this by putting 'Yes' in the appropriate box.

Claims can only be made for the current tax year: You can make a claim for repayment of tax for previous years as well, not just the current tax year.

Repayment must go to the claimant: Not necessarily true. You can choose to have the repayment sent to a nominee by providing their details on the form.

Key takeaways

Filling out the UK R40 Tax Form accurately is crucial for individuals looking to claim repayment of tax deducted from savings and investments. Understanding the key elements of the form can simplify the process, ensuring that individuals maximize their chances of a successful claim.

Before starting the form, gather all relevant financial information for the specific tax year, including details on income, pensions, savings, and investments. This comprehensive approach ensures that you provide accurate and complete information, reducing the likelihood of delays or questions from HMRC.

Clearly and accurately fill in each section using black ink and capital letters as instructed. If a mistake is made, simply cross it out and write the correct information below it. Ensuring clarity can help prevent misunderstandings or the need for corrections later on.

Only complete the sections that apply to your financial situation. If a particular section does not apply, leave it blank. Do not cross through these sections. This helps in maintaining the form's readability and ensures that all provided information is relevant to your claim.

After completing the form, review the R40 Notes provided as they offer detailed instructions and valuable information for each part of the form. These notes can answer many common questions and clarify what information needs to be included for a successful tax repayment claim.

By following these guidelines and carefully preparing your R40 Tax Form, you can streamline the process of claiming a tax repayment, ensuring that all necessary information is provided clearly and correctly.

Popular PDF Documents

Irs Form 2159 - After completing the payment process, the form provides an EFT Acknowledgement Number for record-keeping.

Nj L8 Form - Understanding and completing the New Jersey Estate Tax Return requires careful attention to avoid errors that could delay processing or affect tax liabilities.