Get Tuscaloosa County Sales Tax Form

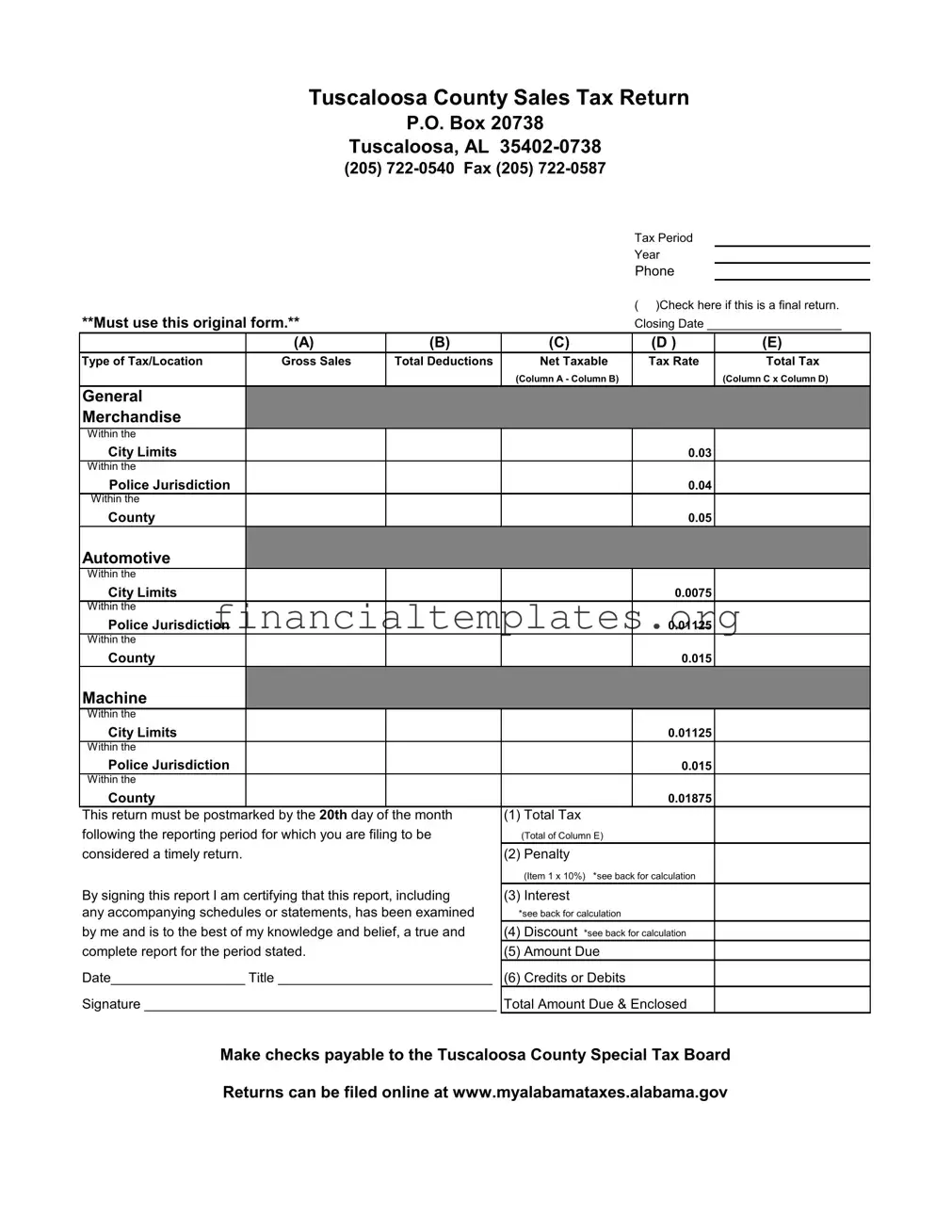

Understanding the intricacies of Tuscaloosa County's sales tax obligations forms a critical aspect of compliance for businesses operating within the area. The Tuscaloosa County Sales Tax Return, designated for submission to the P.O. Box 20738 in Tuscaloosa, AL, outlines a structured approach to reporting sales activities. This document demands meticulous attention to detail, covering various categories such as general merchandise, automotive, and machine sales across different jurisdictions within the county. It specifies the tax rates applicable to each category and area, alongside the formula for calculating net taxable sales, total tax, allowable deductions, and consequently the total amount due. The importance of submission timeliness is underscored by penalties for late filing, with the form stipulating a due date on the 20th day of the month following the reporting period. Furthermore, it provides a structure for computing deductions, penalties, interests, discounts, and adjusting for credits or debits, to arrive at the net amount payable to the Tuscaloosa County Special Tax Board. The form also hints at the availability of online filing, which simplifies the process for many. Moreover, it is imperative that the original document is used for submission, highlighting the county's stance against duplicates or replicated forms. Understanding these components not only ensures compliance but also prepares businesses for any financial obligations arising from their sales activities within Tuscaloosa County.

Tuscaloosa County Sales Tax Example

Tuscaloosa County Sales Tax Return

|

|

P.O. Box 20738 |

|

|

|

|

Tuscaloosa, AL |

|

|

||

|

(205) |

|

|

||

|

|

|

|

Tax Period |

|

|

|

|

|

Year |

|

|

|

|

|

Phone |

|

|

|

|

|

( )Check here if this is a final return. |

|

**Must use this original form.** |

|

|

Closing Date ____________________ |

||

|

(A) |

(B) |

(C) |

(D ) |

(E) |

Type of Tax/Location |

Gross Sales |

Total Deductions |

Net Taxable |

Tax Rate |

Total Tax |

|

|

|

(Column A - Column B) |

|

(Column C x Column D) |

General |

|

|

|

|

|

Merchandise |

|

|

|

|

|

Within the |

|

|

|

|

|

City Limits |

|

|

|

0.03 |

|

Within the |

|

|

|

|

|

Police Jurisdiction |

|

|

|

0.04 |

|

Within the |

|

|

|

|

|

County |

|

|

|

0.05 |

|

Automotive |

|

|

|

|

|

Within the |

|

|

|

|

|

City Limits |

|

|

|

0.0075 |

|

Within the |

|

|

|

|

|

Police Jurisdiction |

|

|

|

0.01125 |

|

Within the |

|

|

|

|

|

County |

|

|

|

0.015 |

|

Machine |

|

|

|

|

|

Within the |

|

|

|

|

|

City Limits |

|

|

|

0.01125 |

|

Within the |

|

|

|

|

|

Police Jurisdiction |

|

|

|

0.015 |

|

Within the |

|

|

|

|

|

County |

|

|

|

0.01875 |

|

This return must be postmarked by the 20th day of the month |

(1) Total Tax |

|

|

||

following the reporting period for which you are filing to be |

(Total of Column E) |

|

|

||

considered a timely return. |

|

|

(2) Penalty |

|

|

|

|

|

(Item 1 x 10%) *see back for calculation |

|

|

By signing this report I am certifying that this report, including |

(3) Interest |

|

|

||

any accompanying schedules or statements, has been examined |

*see back for calculation |

|

|

||

by me and is to the best of my knowledge and belief, a true and |

(4) Discount *see back for calculation |

|

|||

complete report for the period stated. |

|

(5) Amount Due |

|

|

|

Date__________________ Title ____________________________ |

(6) Credits or Debits |

|

|

||

Signature ______________________________________________ |

Total Amount Due & Enclosed |

|

|||

Make checks payable to the Tuscaloosa County Special Tax Board

Returns can be filed online at www.myalabamataxes.alabama.gov

Deductions Computation

(a)Total wholesale sales both cash and credit

(b)Credit for automotive vehicles and trailers as part payment on sales

(c)Credit for labor / nontaxable services

(d)Sales in interstate commerce

(e)Sales to U.S. Government, State of Alabama counties, and incorporated cities and towns in Alabama

(f)Sales of gasoline or lube oils

(g)Other allowable deductions

Total Allowable deductions = (a) + (b) + (c) + (d) + (e) + (f) + (g)

(1)Total Tax = Total of column E

(2)Penalty = 10% of tax if paid after the due date

(3)Interest = Interest through July 31, 2017: Total Tax x (1% x months late)

Interest after August 1, 2017: Total Tax x [(IRS rate divided by 365) x No. of days late]

(4)Discount = 5% on first $100.00 tax + 2% on tax over $100.00. Maximum $200.00 discount.

(5)Net Tax = Tax due less discount or plus penalty and interest

(6)Credits and Debits = Less any credit or plus any debit (additional amount due)

(7) Total Due = Total tax less discount or plus penalty and interest, less credits plus any additional amount due

STANDARD DEDUCTION SUMMARY TABLE

(SUMMARY BELOW MUST BE COMPLETED TO CORRESPOND WITH TOTAL DEDUCTIONS ON FRONT OF TAX REPORT)

Type of Tax |

Wholesale |

|

Sales |

Auto

Labor |

Deliveries out |

Gov’t |

|

of jurisdiction |

Agencies |

|

Other |

|

Gas or |

allowable |

Total |

lube oils |

deductions |

Deductions |

Total

Deductions

INSTRUCTIONS & INFORMATION CONCERNING THE COMPLETION OF THIS REPORT

•To avoid the application of penalty and/or interest amounts, this report must be filed on or before the 20th of the month following the period for which the report is submitted. Cancellation postmark by Post Office will determine timely filing.

•A remittance for the total amount due made payable to the tax jurisdiction must be submitted with this report.

•This report should be submitted on a monthly basis unless you have requested and been approved for a different filing frequency.

•Any credit for prior overpayment must be approved in advance by the taxing jurisdiction.

•NO DUPLICATE OR REPLICATED FORMS ARE ACCEPTED.

|

|

Indicate Any Account Changes Below |

|

|

|

Business Name ____________________________________ |

|

|

|

|

Physical Address __________________________________ |

Contact Person __________________ |

|

|

|

Mailing Address __________________________________ |

Phone _________________________ |

|

|

|

City |

__________________________________ |

Fax _________________________ |

|

|

|

|

|

|

*DISCOUNTS ARE ONLY ALLOWED ON SALES TAX RETURNS.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The document is the Tuscaloosa County Sales Tax Return. |

| Contact Information | The form lists a P.O. Box for mailing, a phone number, and a fax number for contact and queries. |

| Final Return Option | Businesses can indicate on the form if it is a final return by checking a specified box. |

| Timely Filing Requirement | The return must be postmarked by the 20th day of the month following the reporting period to be considered timely. |

| Penalties and Interest | It details how penalties and interest are calculated for late payments, including specific rates and calculation methods for interest before and after August 1, 2017. |

| Discount Policy | A discount is available for early payments, including a specific calculation method and a maximum discount amount. |

| Payment Instructions | Instructions include making checks payable to the Tuscaloosa County Special Tax Board and the availability of online filing. |

Guide to Writing Tuscaloosa County Sales Tax

Filling out the Tuscaloosa County Sales Tax form is a straightforward process that requires careful attention to detail. Whether you are a new business owner or have been in operation for years, it is crucial to accurately report your sales tax to avoid any penalties or interest charges. This guide walks you through each step of completing the form to ensure compliance with local regulations. Remember, this form is to be used for reporting sales within Tuscaloosa County and must be postmarked by the 20th day of the month following the reporting period to be considered on time.

- Begin by writing the tax period year at the top of the form.

- Provide a phone number where you can be reached.

- If this is your final return, check the box next to "Check here if this is a final return."

- Fill in the closing date if applicable.

- Under Type of Tax/Location for each category (General Merchandise, Automotive, Machine), enter your Gross Sales (Column A).

- Record Total Deductions for each category in Column B. These correspond to your allowable deductions such as wholesale sales, certain trade-ins, and non-taxable services.

- Calculate Net Taxable sales (Column C) by subtracting Total Deductions (Column B) from Gross Sales (Column A).

- Apply the appropriate Tax Rate (Column D) for each category and location. This could be within city limits, the police jurisdiction, or within the county.

- Calculate Total Tax (Column E) for each category by multiplying Net Taxable sales (Column C) by the Tax Rate (Column D).

- Sum up the values in Column E to find the Total Tax amount and fill it in at the bottom of the form.

- Calculate any applicable penalty, interest, and discounts according to the instructions on the back of the form and fill in items 2 through 4.

- If you have any credits or debits, list them in item 6.

- Calculate the Total Amount Due & Enclosed by considering the net tax, penalty, interest, discount, credits, or debits, and fill in item 7.

- Sign and date the form, providing your title and official signature.

- Ensure checks are made payable to the Tuscaloosa County Special Tax Board.

- Review the completed form for accuracy, then mail it to the provided address or file online as instructed.

Once the form is completed and submitted, your focus should shift to maintaining accurate sales records for future reporting periods. Staying organized and keeping detailed sales records will simplify the process of filling out your sales tax return in subsequent periods. It’s essential to be mindful of deadlines to avoid late fees and penalties. As regulations may change, it's also a good practice to stay informed about any updates to tax rates or filing procedures that may affect your business in Tuscaloosa County.

Understanding Tuscaloosa County Sales Tax

Understanding the Tuscaloosa County Sales Tax form can be daunting. Here are some frequently asked questions that might help clarify the process.

- How do I calculate my net taxable sales for the Tuscaloosa County Sales Tax Return?

To calculate your net taxable sales, start with your gross sales (the total amount of sales before any deductions). From this, subtract your total deductions, which can include wholesale sales, automotive trade-ins, labor, deliveries out of jurisdiction, sales to government agencies, sales of gasoline or lube oils, and other allowable deductions. The result gives you your net taxable sales, which is the amount subject to sales tax in Tuscaloosa County.

- What are the deadlines for submitting the Tuscaloosa County Sales Tax Return?

Your sales tax return must be postmarked by the 20th day of the month following the reporting period for it to be considered timely. For example, for sales made in January, your form must be postmarked by February 20th. Failing to meet this deadline may result in penalties and interest charges. The date when the Post Office cancels the postmark is used to determine if the filing is timely.

- Can I file the Tuscaloosa County Sales Tax Return online, and if so, how?

Yes, you can file your Tuscaloosa County Sales Tax Return online. To do so, visit the website www.myalabamataxes.alabama.gov. This method is efficient and ensures your information is processed quickly. Prior to filing online, ensure you have all the required information handy, including gross sales, deductions, and your business information, to complete the submission successfully.

- What should I do if this is my final Tuscaloosa County Sales Tax Return?

If you are filing your final sales tax return for Tuscaloosa County, make sure to check the box indicating that this is your final return. It's essential to include the closing date of your business. Completing this step accurately is crucial as it informs the Tuscaloosa County Special Tax Board of your business status change, ensuring that your account can be settled and closed appropriately.

Common mistakes

When filling out the Tuscaloosa County Sales Tax form, accurate completion is crucial for compliance and ensuring the correct tax payment. However, several common mistakes can lead to issues or delays. Highlighted below are ten of these errors:

- Not using the original form as required, which is explicitly stated on the form. Replicated or duplicate forms are not accepted.

- Entering incorrect gross sales figures in Column (A), which forms the foundation for calculating net taxable sales and the total tax.

- Failing to properly calculate total deductions in Column (B), which can lead to an inaccurate representation of net taxable sales.

- Misunderstanding the tax rate for different categories (General Merchandise, Automotive, Machine) and locations (Within the City Limits, Within the Police Jurisdiction, Within the County), leading to incorrect calculations in Column (D).

- Overlooking the need to accurately compute the net taxable amount in Column (C) by subtracting total deductions (Column B) from gross sales (Column A).

- Incorrectly calculating the total tax due in Column (E), which directly affects the total amount owed to Tuscaloosa County.

- Omitting or inaccurately documenting allowable deductions, such as wholesale sales, auto trade-ins, labor, and others in the Deductions Computation section.

- Incorrectly applying credits or debits on the form, which can affect the final amount due or result in discrepancies.

- Failure to properly calculate penalties, interest, and discounts for early or late payment, leading to incorrect final payment figures.

- Not signing or dating the form, which is necessary to certify the accuracy and completeness of the report.

To avoid these mistakes, it is essential to read the instructions carefully, double-check all calculations, and ensure that all required information is complete and accurate before submission. Proper attention to detail will facilitate a smooth processing of the Tuscaloosa County Sales Tax form.

Documents used along the form

When businesses prepare their Tuscaloosa County Sales Tax Returns, several additional forms and documents often complement the primary submission, aiding in a thorough and accurate financial reporting process. These documents play critical roles in ensuring that businesses report and pay the correct amount of sales tax, thus fulfilling their legal obligations while avoiding penalties for incorrect or incomplete filings.

- Business Privilege Tax Return: This form is essential for businesses operating within Tuscaloosa County, calculating tax based on the net worth and business activity within the jurisdiction.

- Employer's Quarterly Federal Tax Return (Form 941): Required for businesses with employees, this form reports federal withholdings from employee wages, including Social Security and Medicare taxes.

- Annual Summary and Transmittal of U.S. Information Returns (Form 1096): This document summarizes information returns like 1099 forms sent to the IRS, indicating non-employee compensations, dividends, and other payments made by the business.

- State of Alabama Department of Revenue Sales Tax Exemption Certificate: Used by businesses to purchase goods for resale tax-free. It certifies that the buyer is authorized to make tax-exempt purchases that will be resold.

- Use Tax Return: For businesses purchasing goods or services from out of state or online without paying Alabama sales tax, this form ensures the proper use tax is paid to Tuscaloosa County.

- Personal Property Tax Return: Required for businesses with personal property (equipment, machinery, etc.) that depreciates, this form calculates the tax owed based on the current value of these assets.

Together, these forms ensure businesses comply with various aspects of tax law, from payroll taxes to property taxes. Ensuring accuracy and timeliness in filing these documents protects businesses from fines, penalties, and audits, contributing to a healthy financial standing.

Similar forms

The Federal Income Tax Return (Form 1040) is similar to the Tuscaloosa County Sales Tax form in several ways. Both require the filer to report amounts related to specific categories, deductions are itemized to reduce the total taxable amount, and calculations are made to determine the total amount owed to the government. They both also incorporate penalties for late submissions and allow for deductions under certain conditions.

State Sales Tax Return forms, like the one used by businesses in New York, share similarities with the Tuscaloosa County Sales Tax form. These documents require businesses to report gross sales, taxable sales, and calculate the tax due based on specific jurisdictional rates. Each form includes sections for deductions and adjustments to ensure accurate tax liability is reported.

The Business License Renewal forms that many cities and counties issue annually resemble the Tuscaloosa County Sales Tax form. They both gather detailed information about the business, including sales figures and location specifics. Additionally, both forms calculate fees or taxes due based on the information provided, often considering various applicable rates or categories.

Employment Tax Returns, such as the Federal Form 941, demonstrate similarities to the Tuscaloosa County Sales Tax form. Both require the calculation of taxes due based on reported figures, adjustments, and applicable rates. They also include sections for penalties and interest for late payments, along with provisions for adjustments based on prior overpayments or credits.

The Use Tax Return forms used by several states to report and pay taxes on out-of-state purchases share elements with the Tuscaloosa County Sales Tax form. They require the filer to list taxable purchases, compute the tax due based on specific rates, and adjust the total tax liability with allowable credits or deductions.

Property Tax Statements issued at the county level have components in common with the Tuscaloosa County Sales Tax form. While they focus on real estate, both documents determine amounts due based on reported valuations and applicable rates, offer deductions or exemptions, and impose penalties for late payments. Furthermore, both require detailed information about the property or sales activities and the responsible party.

The Excise Tax Return forms, required for specific types of businesses, like those dealing in alcohol, tobacco, or firearms, exhibit similarities to the Tuscaloosa County Sales Tax form. These forms necessitate detailed reporting of sales or manufacturing volumes, calculation of tax due based on specific product rates, and itemization of deductions or credits.

Vehicle Registration Renewal forms, while primarily focused on vehicle-related fees, also resemble the Tuscaloosa County Sales Tax form in structure. They collect information about the registrant and the vehicle, calculate fees based on predetermined schedules, and accommodate adjustments or exemptions similar to the sales tax form's treatment of deductions and credits.

The Corporate Income Tax Return, like the Federal Form 1120, parallels the Tuscaloosa County Sales Tax form in its requirement for detailed financial reporting, calculation of tax liability using particular rates, and the possibility of reducing tax through deductions and credits. Both forms also have sections dedicated to penalties and interest for late filing.

Lastly, the Unemployment Insurance Tax Forms submitted by employers to state governments bear resemblance to the Tuscaloosa County Sales Tax form. They require employers to report wages paid, calculate taxes due based on those wages, and account for any adjustments, much like the sales tax form demands reporting of sales and calculation of tax liability.

Dos and Don'ts

When it comes to completing the Tuscaloosa County Sales Tax form, paying close attention to detail and adhering to the specified guidelines will ensure accuracy and timeliness in your submission. Below are key dos and don'ts to keep in mind:

Do:- Use the original form provided: It's crucial to fill out and submit the original document as duplications or replicas are not accepted.

- File on time: To avoid penalties and/or interest, ensure your form is postmarked by the 20th day of the month following the reporting period for which you are filing.

- Include accurate calculations: Ensure that all calculations, especially those related to deductions, tax rates, and total tax, are accurate to avoid errors in your reported amounts.

- Sign the form: Your signature certifies that the report is complete and accurate to the best of your knowledge. Don't forget to also fill in the date and your title alongside the signature.

- Forget to report any changes in account information: If there have been changes to your business name, address, or contact information, make sure to indicate these updates where specified.

- Ignore the instructions for penalty, interest, and discount calculations: These are critical for determining the correct amount due, especially if filing late.

- Omit important sections: Every section, from gross sales to deductions, plays a vital role in determining your net taxable amount. Skipping sections can lead to under or overestimating your tax liability.

- Miscalculate the amount due: Specifically, ensure that the total amount due reflects the net of taxes, penalties, discounts, credits, or debits accurately to avoid discrepancies.

Misconceptions

Understanding the intricacies of the Tuscaloosa County Sales Tax form is crucial for businesses operating in the area. However, several misconceptions can lead to errors in filing. Here are five common misunderstandings that need clarification:

- Photocopies or Digital Copies of the Form Are Acceptable: One of the most significant misconceptions is that businesses can use a photocopy, a scanned copy, or a digital version of the original Tuscaloosa County Sales Tax form for their filing. The mandate to "Must use this original form," explicitly requires the use of the original physical form provided by the county for filing. This is to ensure the authenticity and integrity of the information provided.

- Online Filing Exempts You from Using the Original Form: Although returns can be filed online through the Alabama Department of Revenue's website, it doesn't negate the requirement to use the original form if opting for physical submission. The option to file online is an added convenience, not a replacement. This distinction is crucial for businesses that prefer or are required to submit physical documentation.

- Late Penalties Are Negotiable: The form clearly states a "Penalty" calculation as "10% of tax if paid after the due date." Some might think this penalty is flexible or subject to negotiation. However, it is a fixed penalty applied to late submissions to ensure timely compliance with the tax obligations.

- All Sales Are Taxed at the Same Rate: The form provides different tax rates for general merchandise, automotive items, and machines based on their location (within city limits, within the police jurisdiction, or within the county). A common misconception is that the sales tax rate is uniform. In reality, it varies not only by product category but also by the geographical area of the sale, reflecting the nuanced nature of tax regulations in Tuscaloosa County.

- Deductions Are Unlimited: While the form lists several types of allowable deductions, such as for "Total wholesale sales both cash and credit" or "Sales of gasoline or lube oils," it doesn't mean deductions are unlimited or applicable under all circumstances. Each deduction type must meet specific criteria as defined by Tuscaloosa County regulations, and it is the responsibility of the filer to ensure their deductions are valid and accurately reported.

In summary, correctly understanding the requirements, limitations, and specifics of the Tuscaloosa County Sales Tax form is essential for accurate and compliant tax filing. Paying close attention to the form's instructions can save businesses from potential penalties and ensure they meet their tax obligations efficiently.

Key takeaways

When dealing with the Tuscaloosa County Sales Tax Form, it's essential to keep the following key takeaways in mind for a smooth and compliant filing process:

- Timeliness is crucial: Ensure the form is postmarked by the 20th day of the month following the reporting period to avoid penalties and interest charges.

- Use the original form: Copies or replicas of the form are not accepted, underscoring the necessity of using the original document provided.

- Payments must be made to Tuscaloosa County Special Tax Board, indicating the necessity of correctly addressing checks.

- Deductions are detailed and varied: With categories ranging from wholesale sales to sales to government agencies, understanding and correctly applying deductions can significantly affect the taxable amount.

- Online filing option: For convenience, returns can also be filed online through the Alabama taxes website, offering an alternative to paper submissions.

- Penalties, discounts, and interest calculations are specifically outlined, requiring careful attention to ensure accurate reporting and payment.

Bearing these points in mind can help avoid common errors and ensure that the process of filing the Tuscaloosa County Sales Tax Return is as straightforward and error-free as possible.