Get Tumwater Bo Tax Form

Navigating the complexities of local business taxes is a crucial task for entrepreneurs and business owners, and the City of Tumwater offers specific guidelines to ease this process. Focused on the City of Tumwater Business and Occupation Tax Return, the form stands as a significant document for businesses operating within the city's jurisdiction. It is designed to facilitate the accurate reporting and payment of taxes due on the gross sales generated by a business. The form requires businesses to categorize their gross sales by type of activity—including extracting, manufacturing, wholesale sales, retail sales, printing & publishing, and services among others—and apply the corresponding tax rate to calculate the tax owed. Exemptions apply, such as for gross sales under $5,000, indicating no tax is due, yet filing the return remains mandatory. The form also outlines penalty calculations for late submissions, emphasizing the importance of timely compliance. Furthermore, the tax return form serves not just as a financial obligation but also as a compliance certificate with the Tumwater Municipal Code, underscoring the city's efforts to maintain a transparent and fair business environment. With detailed sections on various business activities and explicit instructions on calculating taxes owed, the Tumwater Bo Tax form exemplifies the city's commitment to supporting local businesses while ensuring that they contribute fairly to the municipal infrastructure and services that benefit them.

Tumwater Bo Tax Example

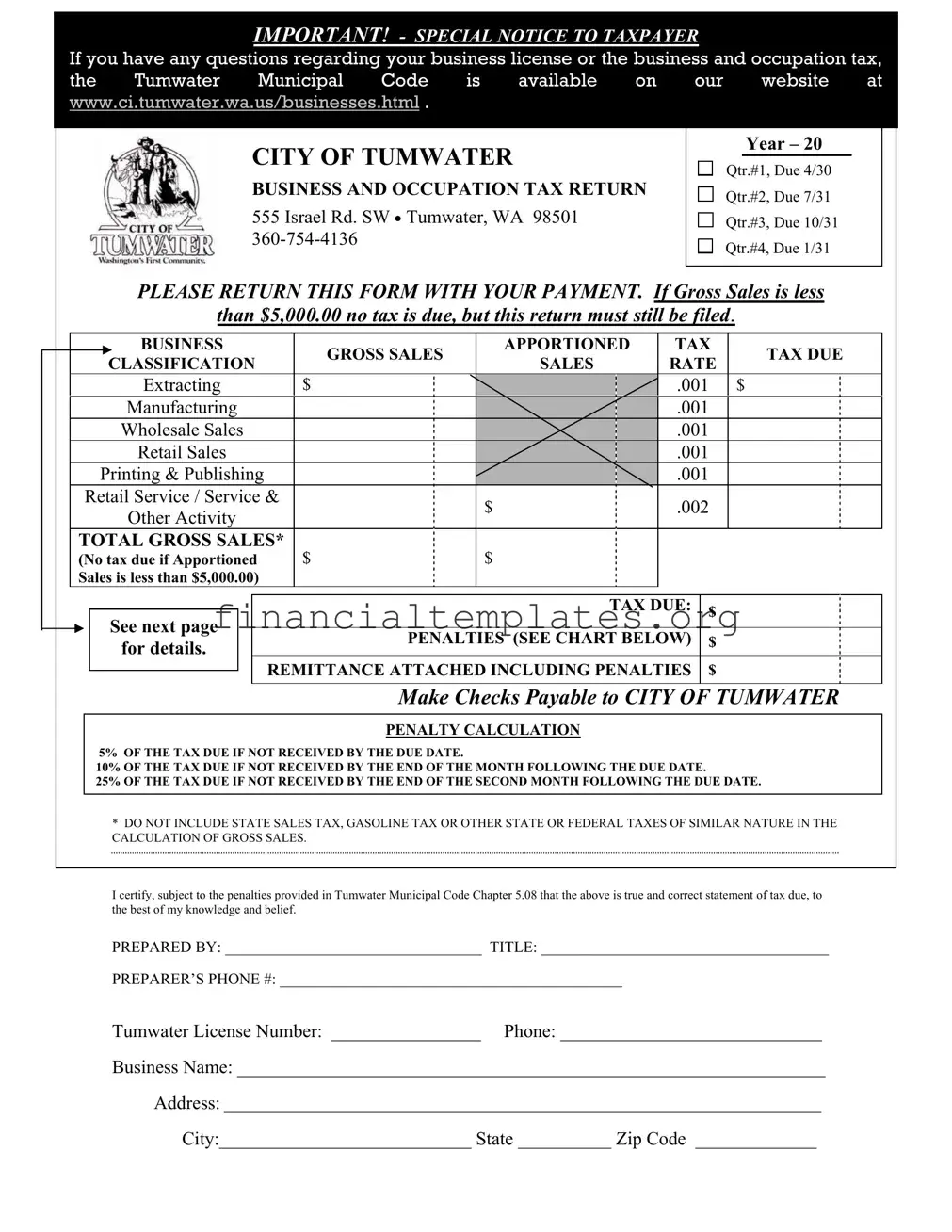

IMPORTANT! - SPECIAL NOTICE TO TAXPAYER

If you have any questions regarding your business license or the business and occupation tax, the Tumwater Municipal Code is available on our website at www.ci.tumwater.wa.us/businesses.html .

CITY OF TUMWATER

BUSINESS AND OCCUPATION TAX RETURN

555 Israel Rd. SW • Tumwater, WA 98501

Year – 20

Qtr.#1, Due 4/30

Qtr.#2, Due 7/31

Qtr.#3, Due 10/31

Qtr.#4, Due 1/31

PLEASE RETURN THIS FORM WITH YOUR PAYMENT. If Gross Sales is less than $5,000.00 no tax is due, but this return must still be filed.

|

|

BUSINESS |

GROSS SALES |

|

APPORTIONED |

TAX |

TAX DUE |

||||||||

|

|

CLASSIFICATION |

|

SALES |

RATE |

||||||||||

|

|

|

|

|

|

|

|||||||||

|

|

Extracting |

$ |

|

|

|

|

|

.001 |

$ |

|

||||

|

|

Manufacturing |

|

|

|

|

|

|

.001 |

|

|

||||

|

|

Wholesale Sales |

|

|

|

|

|

|

.001 |

|

|

||||

|

|

Retail Sales |

|

|

|

|

|

|

.001 |

|

|

||||

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

|

|

Printing & Publishing |

|

|

|

|

|

|

.001 |

|

|

||||

|

Retail Service / Service & |

|

|

$ |

|

|

.002 |

|

|

||||||

|

|

Other Activity |

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

TOTAL GROSS SALES* |

|

|

|

|

|

|

|

|

|

|

|

||||

(No tax due if Apportioned |

$ |

|

$ |

|

|

|

|

|

|

|

|||||

Sales is less than $5,000.00) |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

TAX DUE: |

|

$ |

|

|

||

|

|

See next page |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTIES (SEE CHART BELOW) |

|

$ |

|

|

||||||||||

|

|

for details. |

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMITTANCE ATTACHED INCLUDING PENALTIES |

|

$ |

|

|

|||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

Make Checks Payable to CITY OF TUMWATER |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

PENALTY CALCULATION |

|

|

|

|

|

|||||

|

|

5% OF THE TAX DUE IF NOT RECEIVED BY THE DUE DATE. |

|

|

|

|

|

|

|

|

|

||||

|

|

10% OF THE TAX DUE IF NOT RECEIVED BY THE END OF THE MONTH FOLLOWING THE DUE DATE. |

|

|

|

||||||||||

|

|

25% OF THE TAX DUE IF NOT RECEIVED BY THE END OF THE SECOND MONTH FOLLOWING THE DUE DATE. |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*DO NOT INCLUDE STATE SALES TAX, GASOLINE TAX OR OTHER STATE OR FEDERAL TAXES OF SIMILAR NATURE IN THE CALCULATION OF GROSS SALES.

I certify, subject to the penalties provided in Tumwater Municipal Code Chapter 5.08 that the above is true and correct statement of tax due, to the best of my knowledge and belief.

PREPARED BY: _________________________________ TITLE: _____________________________________

PREPARER’S PHONE #: ____________________________________________

Tumwater License Number: ________________ Phone: ____________________________

Business Name: _______________________________________________________________

Address: ________________________________________________________________

City:___________________________ State __________ Zip Code _____________

EXPLANATION OF CATEGORIES

Extracting

Directly or indirectly by contracting with others for labor and mechanical services to remove from your own land or land of others from mines or quarries coal, oil, natural gas, ore, stone, sand, grave, clay mineral or other natural resource product; or fells cuts or takes timber, Christmas Trees, other than plantation Christmas trees, or other products; or takes fish, shellfish, or other sea or inland water foods or products. The tax is based on the value of the product, including

Manufacturing

Every person who, either directly or by contracting with others for the necessary labor or mechanical services, manufactures for sale or for commercial or industrial use from the person’s own materials or ingredients any products. The measure of the tax is the value of the products, including

Wholesale Sales

Any sale of tangible personal property which is not a retail sale, and any charge made for labor and services rendered for persons who are not consumers, in respect to real or personal property and retail services, if such charge is expressly defined as a retail sale or retail service when rendered to or for consumers.

Retail Sales

The sale of or charge made for tangible personal property consumed and/or for labor and services rendered in respect to the following:

•The installing repairing, cleaning, altering, imprinting or improving of tangible personal property for consumers.

•The construction or repairing, decorating, painting, papering, repairing, furnace or septic tank cleaning, snow removal, sandblasting or improving of new or existing buildings or other structures for consumers.

•Service provided to clear land and the moving of earth.

•Cleaning, fumigating, razing or removing buildings or structures.

•Automobile towing and similar automotive transportation services.

•The sale and charge made for the furnishing of lodging and all other services by a hotel, rooming house, tourist court, motel or trailer camp. (Note: this does not include these services that are provided for a continuous period of one month or more.)

•Sale of canned software regardless of the method of delivery to the end user, but does not include custom software or the customization of canned software.

•Sales of labor and services rendered with respect to building, repairing, or improving of any street, easement, or any other vehicular, foot, or any other tangible transportation asset owned by the city, county, state, or any other political subdivision of the state.

•Sale of an extended warranty.

Printing & Publishing

Printing, printing and publishing of newspapers, magazines, periodicals, books, music, and other printed items.

IF YOU REPORT IN THE FOLLOWING TWO CATEGORIES (RETAIL SERVICE OR SERVICE & OTHER ACTIVITY) AND YOU PERFORM WORK OUTSIDE THE CITY LIMITS, YOU MUST USE THE APPORTIONMENT WORKSHEET TO DETERMINE YOR TAXABLE INCOME. THE FORM AND INSTRUCTIONS ARE AVAILABLE AT WWW.CI.TUMWATER.WA.US /BUSINESSES.HTML

Retail Service

Sale or charge made for personal, business, or professional services including amounts designated as interest, rents, fees, admissions, and other services by persons engaged in:

•Amusement and recreation services including but not limited to golf, pool, billiards, skating, bowling, swimming, bungee jumping, basketball, racquetball, handball, squash, tennis, batting cages, day trips for sightseeing.

•Abstract, title insurance, and escrow services.

•Credit bureau services.

•Automobile parking and storage garage services.

•Landscape maintenance and horticultural services.

•These specific personal services: Physical fitness services, tanning salons, tattoo parlor services, steam bath services, Turkish bath services, escort services, and dating services.

•Rental or lease of tangible personal property to consumers and the rental of equipment with an operator.

Service & Other Activity

Persons engaging within the city in any business activity other than or in addition to those enumerated in the above descriptions. This would include but not be limited to businesses or professionals that provide medical, legal, engineering, architectural, janitorial, instructional, consulting and accounting services.

THESE DESCRIPTIONS DO NOT REPRESENT ALL TYPES OF BUSINESS ACTIVITIES, BUT REPRESENT THE MAJORITY OF SERVICES PROVIDED BY BUSINESSES AND INDIVIDUALS SUBJECT TO BUSINESS AND OCCUPATION TAX. PLEASE REFER TO THE CITY WEBSITE, WWW.CI.TUMWATER.WA.US , FOR FURTHER DETAILS. IF YOU DO NOT HAVE ACCESS TO THE INTERNET, PLEASE CALL

Document Specifics

| Fact Name | Fact Detail |

|---|---|

| Governing Law | The Tumwater Business and Occupation Tax form is governed by the Tumwater Municipal Code. |

| Website Reference | For more information or to access the municipal code, visit www.ci.tumwater.wa.us/businesses.html |

| No Tax Due Threshold | If Gross Sales are less than $5,000.00, no tax is due, but the return must still be filed. |

| Quarterly Due Dates | Taxes are due quarterly with deadlines on April 30, July 31, October 31, and January 31. |

| Penalty Calculation | Penalties for late payment are 5% of the tax due if not received by the due date, 10% if not received by the end of the month following the due date, and 25% if not by the end of the second month following the due date. |

Guide to Writing Tumwater Bo Tax

Filling out the Tumwater Bo Tax form is essential for businesses operating within the city. It helps ensure compliance with local regulations and supports city infrastructure and services through taxation. Here's a step-by-step guide to make the process straightforward. Remember, even if your gross sales are less than $5,000 and no tax is due, you still need to file this return.

- Start by visiting the City of Tumwater's official website to access the most current Business and Occupation Tax form or call 360-754-4136 if you do not have internet access.

- At the top of the form, fill in the Year and identify which Quarter you're reporting for by checking the appropriate box.

- Enter your Tumwater Business License Number and Contact Phone Number in the spaces provided.

- Write your Business Name, Address, City, State, and Zip Code in the appropriate fields.

- Review the Explanation of Categories to accurately categorize your business activities based on the descriptions provided, such as Extracting, Manufacturing, Wholesale Sales, etc.

- In the BUSINESS GROSS SALES section, enter your gross sales next to the corresponding business activity classification. Do not include state sales tax, gasoline tax, or other state or federal taxes in your calculation.

- Calculate the Apportioned TAX for each category by applying the tax rate mentioned next to each classification.

- Add up the totals from each category to calculate your TOTAL GROSS SALES and enter it. If your total apportioned sales are less than $5,000, note that no tax is due but the form must still be submitted.

- If applicable, calculate your TAX DUE and note it down. Use the PENALTY CALCULATION part of the form to determine any penalties if your payment is late, and add this to your remittance.

- Sign and date the form, indicating your Title and providing your Preparer’s Phone Number. This certifies your acknowledgement and understanding of the information provided.

- If tax and penalties are due, prepare a check payable to CITY OF TUMWATER and attach it with your completed tax return form.

- Finally, mail the completed form and any payment to the address provided at the top of the form: 555 Israel Rd. SW, Tumwater, WA 98501, or as instructed on the city’s website.

By following these steps carefully, you can ensure your business remains in good standing within the City of Tumwater. Should you have questions or need clarification, the city has made resources available online and through their contact number. Compliance with local tax regulations contributes to community development and supports public infrastructure, benefitting all residents and businesses in Tumwater.

Understanding Tumwater Bo Tax

-

What is the purpose of the Tumwater Business and Occupation (B&O) Tax Form?

This form is used by businesses operating within Tumwater, WA, to calculate and report the B&O tax owed to the city based on their gross sales across various business classifications such as extracting, manufacturing, wholesale sales, retail sales, and other specific categories. It ensures compliance with the city's taxation requirements.

-

When are the quarterly due dates for submitting the Tumwater B&O Tax Return?

- Qtr.#1: Due by April 30

- Qtr.#2: Due by July 31

- Qtr.#3: Due by October 31

- Qtr.#4: Due by January 31 of the following year

-

Is it mandatory to file a return if gross sales are less than $5,000.00?

Yes, even if the gross sales are less than $5,000.00, and no tax is due, businesses are still required to file this return. It helps in maintaining accurate records and ensures compliance with city tax regulations.

-

How is the B&O tax calculated for different categories?

The tax rate varies by business classification, as indicated on the form. For example, extracting, manufacturing, and wholesale sales are taxed at a rate of .001, while retail service and other specified activities are taxed at .002. The tax due is determined by multiplying the gross sales by the applicable tax rate.

-

What penalties are imposed for late payment?

- 5% of the tax due if not received by the due date.

- 10% of the tax due if not received by the end of the month following the due date.

- 25% of the tax due if not received by the end of the second month following the due date.

-

Where can I find the apportionment worksheet mentioned for certain categories?

The apportionment worksheet, necessary for businesses that work outside the city limits and report in the categories "Retail Service" or "Service & Other Activity," can be found on the city's website. Instructions for its use are also provided on the site to correctly determine taxable income.

-

Who should I contact if I have questions regarding the Tumwater B&O Tax or need assistance?

For any queries or assistance related to the B&O Tax form or business licensing, individuals are encouraged to visit the city's official website or directly contact the City of Tumwater at the phone number provided on the form (360-754-4136).

-

Can state or federal taxes be included in the calculation of gross sales for the B&O tax?

No, gross sales for the purpose of the B&O tax calculation must not include state sales tax, gasoline tax, or any other state or federal taxes of a similar nature. This ensures that the tax is applied solely to the business's gross receipts from operations.

Common mistakes

Not filing the return even when gross sales are under $5,000. The form must be filed regardless of the amount grossed, as it is a common misunderstanding that no action is needed if below this threshold.

Incorrectly including state sales tax, gasoline tax, or other state or federal taxes in the calculation of gross sales. These taxes should not be part of the gross sales figure according to the instructions.

Omitting to apportion sales for work performed outside the city limits when reporting in the Retail Service or Service & Other Activity categories, leading to inaccurate taxable income calculations.

Misclassifying the business activity, affecting the tax rate applied. Each category has a specific tax rate, and incorrect categorization can result in either overpayment or underpayment of taxes.

Failing to calculate penalties accurately according to the due dates and the rate of tax due if payments are late, which can lead to unexpected additional costs.

Not using the apportionment worksheet for business activities conducted outside of the Tumwater city limits, as required for certain categories.

Signing the form without verifying the accuracy of the information provided, which could lead to discrepancies and potential legal issues due to certifying incorrect information.

Forgetting to include the Tumwater License Number, a crucial piece of information for associating the tax return with the correct business entity.

Inaccurately reporting the value of products manufactured or extracted, which should include by-products regardless of their sale location or delivery points outside the city.

Always double-check all categories that your business activities may fall into to ensure proper tax classification and rates are applied.

Ensure that all necessary sections of the form are completed, including the apportionment section for work performed outside of city limits where applicable.

Calculate penalties correctly and include them with your remittance if your payment is late, to avoid being surprised by further penalties later on.

Documents used along the form

When filing the Tumwater Business and Occupation (B&O) Tax Form, businesses often need to refer to and include additional forms and documents to ensure compliance and accuracy in their tax reporting. These documents can vary based on the specifics of each business’s operations, the categories of taxation they fall under, and any exemptions or deductions they may claim. Below is a compilation of other forms and documents that are commonly used in conjunction with the Tumwater B&O Tax form, along with a brief description of each.

- Business License Application: Required for new businesses or those updating their information, this form officially registers the business with the City of Tumwater, allowing it to operate legally.

- Quarterly Gross Sales Report: This document provides a detailed breakdown of the business's gross sales per quarter, which is crucial for calculating the owed B&O tax.

- Apportionment Worksheet: For businesses that operate both inside and outside of Tumwater city limits, this worksheet helps determine the portion of income subject to the city’s B&O tax.

- Exemption Certificate: Used by businesses that qualify for certain tax exemptions, this certificate must be filled out and submitted to receive exempt status.

- Deduction Detail Report: A form where businesses can list and calculate allowable deductions (such as out-of-state sales) from the gross income to accurately assess the taxable income.

- Extension Request Form: If a business cannot file its B&O tax by the due date, this form is used to request an extension, outlining the reason and proposed new filing date.

- Amended Tax Return: In instances where a business needs to correct an error or omission in a previously filed B&O tax return, this document is used to make the necessary adjustments.

It's important for businesses to be thorough and accurate when completing these forms and documents, as they play a crucial role in the tax reporting and payment process. Access to accurate records and a clear understanding of tax obligations can ensure compliance with city regulations, avoiding potential penalties or audits. For specific details, requisites, and advice on filling out and submitting these forms accurately, consulting the Tumwater Municipal Code or a professional tax advisor is recommended.

Similar forms

The Tumwater Business and Occupation (B&O) Tax form, in its essence, holds similarities to the IRS Form 941, which is the Employer's Quarterly Federal Tax Return. Both documents are required to be filed quarterly and serve the purpose of reporting earnings and taxes due from the operations within a specific period. The IRS Form 941 focuses on federal taxes related to employee wages, whereas the Tumwater B&O Tax form pertains to the gross sales of a business within the city limits, reflecting local taxation concerns rather than federal payroll tax obligations. Each form, in its respective jurisdiction, ensures compliance with tax regulations and assists in the government's collection of revenue necessary for public services.

State Sales Tax Return forms parallel the Tumwater B&O Tax form by requiring businesses to report sales revenue, but these documents focus on the collection of sales tax due to the state. Similar to the B&O Tax form, which separates gross sales into different categories depending on the nature of the business activity, state sales tax forms may require breakdowns of sales by type or location. Both forms are instrumental in calculating the tax owed based on business activities, albeit the state sales tax return specifically addresses the tax collected from customers at the point of sale, intended for state revenue.

Local Business License Renewal applications share an objective similarity with the Tumwater B&O Tax form in that they are both necessary for the legal operation of businesses within a city’s boundaries. While the B&O Tax form deals with the financial aspect of business operations, and specifically the taxes due from business activities, a Business License Renewal application is focused on the administrative status of a business, ensuring it remains in compliance with local regulations and is authorized to operate. Both documents, however, underscore the necessity of regular reporting and compliance with local governance.

The IRS Schedule C, Profit or Loss from Business, is a federal tax form used by sole proprietors that is akin to the Tumwater B&O Tax form in its purpose of reporting business income. Both forms require detailed information about the revenues and, for Schedule C, the expenses of business operations, albeit for different tax purposes. The Tumwater form is directed at local business and occupation taxes based on gross sales, whereas Schedule C is aimed at calculating net profit or loss for income tax purposes on a federal level. Each plays a crucial role in determining the tax responsibilities of business entities in their respective scopes.

Unemployment Insurance (UI) Quarterly Tax Reports, which businesses must submit to state labor departments, bear resemblance to the Tumwater B&O Tax form in their periodic nature and focus on business operations. UI reports typically detail the total wages paid to employees, necessary for calculating the employer’s unemployment tax liability. While tackling different aspects of taxation, both documents are essential for compliance with government requirements— the B&O Tax form addressing city tax based on sales, and UI reports covering state-mandated unemployment insurance contributions.

Excise Tax Returns, often filed with state revenue departments, also share characteristics with the Tumwater B&O Tax form. These returns are used to report and pay taxes on specific goods or services, such as gasoline, tobacco, or alcohol, predicated on the act of manufacturing or selling these items. Like the B&O Tax form, which separates business activities into categories for tax purposes, Excise Tax Returns require detailed reporting on the volume and type of products subject to the tax, highlighting the specificity of taxation based on business operations.

Lastly, the Department of Revenue’s (DOR) Business Tax Return forms, used for reporting and paying various state-level business taxes, parallel the Tumwater B&O Tax form in their comprehensive approach to taxing business activities. Both include detailed categorizations of business operations but serve different governmental levels— the DOR forms for state tax obligations and the Tumwater form for local city taxes. Compiling gross sales figures, and the taxes due thereupon, each document aids in the fair and effective collection of taxes critical for the provision of public services and infrastructure.

Dos and Don'ts

When completing the Tumwater Business and Occupation (B&O) Tax form, adhering to guidelines can streamline the process, ensuring accuracy and compliance. Below are key dos and don'ts to guide you through the process:

- Do review the Tumwater Municipal Code available on their website to understand relevant tax rates and classifications for your business.

- Don't skip the filing of the return even if your gross sales are less than $5,000.00 and no tax is due; submission is still required.

- Do ensure all information is accurately reported, including your business gross sales, tax due, and penalties, if applicable.

- Don't include state sales tax, gasoline tax, or other state or federal taxes in your gross sales calculation.

- Do use the apportionment worksheet if you perform work outside city limits for categories like retail service or service & other activities.

- Don't underestimate penalties; calculate them based on the due date of the tax return and the date of payment.

- Do make your check payable to CITY OF TUMWATER and attach it with your tax return form.

- Don't forget to sign and date the return, certifying the truthfulness and correctness of the information provided.

Following these guidelines not only helps in fulfilling legal obligations accurately but also avoids possible penalties for errors or late submissions. For further assistance or clarification, contact the City of Tumwater or consult with a tax professional well-versed in local B&O tax requirements.

Misconceptions

When it comes to filing taxes, especially for businesses, understanding the specifics of local tax forms like the Tumwater Business and Occupation (B&O) Tax Return is crucial. However, there are several misconceptions that frequently arise. Let’s clarify some of these common misunderstandings:

Only businesses located within Tumwater need to file: This misunderstanding can lead businesses operating outside of Tumwater but with taxable activities within the city limits to non-compliance. If your business activity extends into Tumwater, you may be obligated to file.

The form is only necessary if you owe tax: Even if your gross sales are less than $5,000 and you owe no tax, Tumwater still requires filing the return. Compliance is not just about paying taxes but also about filing returns properly.

All categories apply the same tax rate: Each business activity is taxed differently. While many categories might have the same rate, it's crucial to understand the specific rate for your business's primary activity to accurately calculate your tax due.

State sales tax should be included in Gross Sales: It's a common mistake to include state and federal taxes in the gross sales calculation. You should exclude state sales tax, gasoline tax, and other similar taxes when determining your gross sales for the B&O tax.

Penalties are negotiable or can be waived easily: The penalties for late payments are prescribed by municipal code and escalate the longer the delay in payment. It's important to understand that these penalties are enforced rigorously and should be taken seriously.

You can report and pay taxes once a year: The Tumwater B&O tax is a quarterly obligation, with specific due dates for each quarter. Waiting until the end of the year to report and pay can result in significant penalties.

The form is the same for every business: While the form might look similar, the way you report based on your business classification varies. It’s critical to understand the specific requirements and instructions relevant to your business activities.

Extracting and manufacturing are reported together: Though they might seem similar, extracting and manufacturing are distinct categories with different implications for the B&O tax. Each has to be understood and reported according to the specifics of your operations.

If you perform work outside the city limits, you don’t need to report it: If your business is based in Tumwater but performs work outside of the city, you still need to apportion your income and may owe tax on activities performed outside the city, based on specific apportionment formulas.

Once registered, you no longer need to check for updates or changes: Tax codes and rates can change. It’s essential to keep updated with the Tumwater Municipal Code and any amendments to ensure ongoing compliance.

Understanding these misconceptions and adhering to the specifics of the Tumwater B&O Tax Return can help businesses avoid unnecessary complications and penalties. For further clarification or assistance, it's advisable to refer directly to the city’s website or consult with a tax professional knowledgeable in local tax requirements.

Key takeaways

Filing the Tumwater Business and Occupation Tax form is an essential duty for businesses operating within the city limits. Understanding the process and requirements is crucial to ensure compliance and to avoid any unnecessary penalties. Here are five key takeaways about completing and using the Tumwater Bo Tax form:

- All businesses must file the Business and Occupation Tax Return irrespective of their gross sales volume. For those with gross sales under $5,000.00, no tax is due, but filing the return is still required.

- The due dates for quarterly returns are fixed: April 30th for Qtr.#1, July 31st for Qtr.#2, October 31st for Qtr.#3, and January 31st for the subsequent year's Qtr.#4. Timely submission is necessary to avoid late penalties.

- Penalties for late submission increase over time: 5% if not received by the due date, 10% if not received by the end of the month following the due date, and 25% if not received by the end of the second month following the due date.

- The tax rate applied depends on the business classification, with rates provided for various categories such as Extracting, Manufacturing, Wholesale Sales, Retail Sales, and others. Specific details can be found on the city's website or by contacting the provided phone number for further clarification.

- Applicable gross sales for taxation do not include any state sales tax, gasoline tax, or other state or federal taxes. Thus, businesses must ensure that these are not included in their gross sales calculation for the purpose of the Bo Tax form.

Businesses are encouraged to review the Tumwater Municipal Code for detailed information regarding business licensing and taxation, available on the city's website. For those without internet access, the city provides assistance via phone to obtain the necessary documents and guidance. Correctly and promptly filing the Tumwater Bo Tax form is fundamental to ensuring your business adheres to local regulations and contributes to the community's economic health.

Popular PDF Documents

Nj L8 Form - Applicants seeking a refund for overpayment must adhere to a strict three-year period, highlighting the importance of timely and accurate filing.

What Is 990 Tax Form - Includes a section for disclosing any non-cash contributions, offering a comprehensive view of an organization’s support structure.