Get Tsp 20 Loan Form

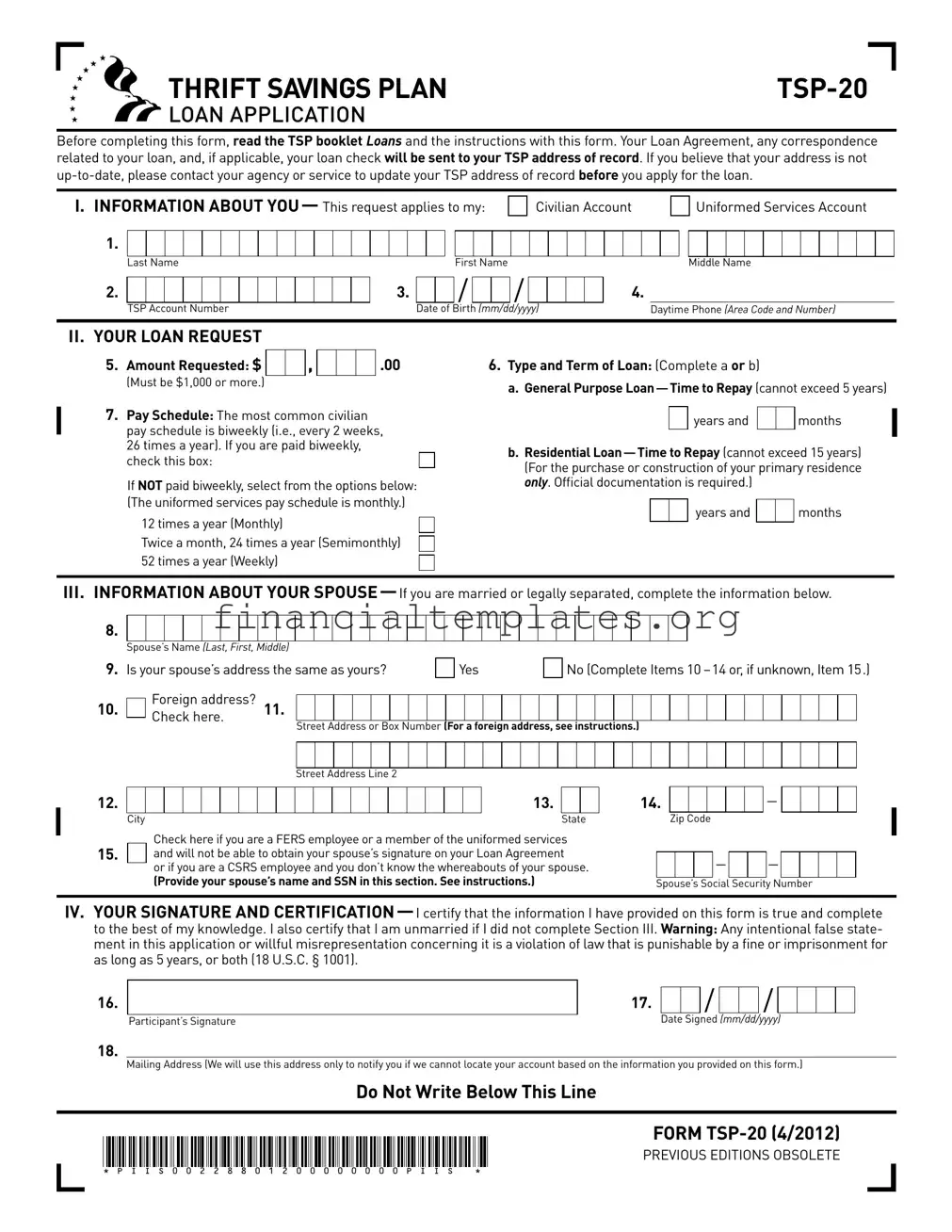

Individuals considering borrowing from their Thrift Savings Plan (TSP) account will find the TSP-20 Loan Application form to be an essential step in accessing their funds. This comprehensive document not only guides applicants through the process but also emphasizes the importance of understanding the loan's terms, which are outlined in the TSP booklet Loans. Applicants are encouraged to ensure their TSP address of record is current to prevent any delay in receiving necessary loan-related communications or the disbursement itself. The form covers several critical areas, including personal information, details of the loan request such as the amount requested and the loan type—either general purpose or residential—and terms governing repayment. Additionally, it addresses the requirement for spouse information and consent in the case of married applicants, acknowledging the legal implications and responsibilities involved in the borrowing process. The significance of accurate and truthful information is underscored by a certification section, where applicants attest to the completeness and veracity of the data provided, under penalty of law. As the form also highlights, understanding your pay schedule is crucial to accurately setting up loan repayments. Furthermore, for those who are married, the intricacies of spousal consent are carefully laid out, ensuring applicants are aware of their obligations and the potential need for specific exceptions under certain circumstances. By providing a clear pathway and detailed instructions, the TSP-20 Loan Application form plays a pivotal role in facilitating access to funds while ensuring participants are well-informed about the implications and requirements of taking a loan from their TSP account.

Tsp 20 Loan Example

THRIFT SAVINGS PLAN |

LOAN APPLICATION

Before completing this form, read the TSP booklet Loans and the instructions with this form. Your Loan Agreement, any correspondence related to your loan, and, if applicable, your loan check will be sent to your TSP address of record. If you believe that your address is not

I. INFORMATION ABOUT YOU— This request applies to my: |

|

Civilian Account |

||||||||||||||||||||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

|

|

|

|

|

|

|

|

|

||||||

Uniformed Services Account

Middle Name

2.

3.

/

/

4.

TSP Account Number |

Date of Birth (mm/dd/yyyy) |

Daytime Phone (Area Code and Number) |

|

|

|

|

|

II. YOUR LOAN ReqUeST

5. Amount Requested: $ |

|

|

, |

|

|

|

.00 |

(Must be $1,000 or more.)

7.Pay Schedule: The most common civilian pay schedule is biweekly (i.e., every 2 weeks, 26 times a year). If you are paid biweekly, check this box:

If NOT paid biweekly, select from the options below: (The uniformed services pay schedule is monthly.)

12 times a year (Monthly)

Twice a month, 24 times a year (Semimonthly)

52 times a year (Weekly)

6.Type and Term of Loan: (Complete a or b)

a. General Purpose

years and |

|

|

months |

b.Residential

years and |

|

|

months |

III.INFORMATION ABOUT YOUR

8.

|

|

Spouse’s Name (Last, First, Middle) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

9. |

Is your spouse’s address the same as yours? |

|

|

Yes |

|

|

No (Complete Items 10 |

|||||||||||||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||||||||||||||

10. |

|

|

Foreign address? |

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Check here. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address or Box Number (For a foreign address, see instructions.) |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street Address Line 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

Check here if you are a FERS employee or a member of the uniformed services

15.and will not be able to obtain your spouse’s signature on your Loan Agreement

or if you are a CSRS employee and you don’t know the whereabouts of your spouse.

(Provide your spouse’s name and SSN in this section. See instructions.)

14. |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

Zip Code |

|||||

– |

|

|

– |

|

|

|

|

Spouse’s Social Security Number

IV. YOUR SIGNATURe AND

16.

Participant’s Signature

18.

17.

/

/

/

Date Signed (mm/dd/yyyy)

Mailing Address (We will use this address only to notify you if we cannot locate your account based on the information you provided on this form.)

Do Not Write Below This Line

FORM

PREVIOUS EDITIONS OBSOLETE

* P I I S 0 0 2 2 8 8 0 1 2 0 0 0 0 0 0 0 0 P I I S |

* |

To ensure that your request is not delayed, type or print the requested information legibly inside the boxes using black or dark blue ink.

Your Loan Agreement and any correspondence related to your loan will be sent to your tsP address of record. Also, unless you request on the Loan Agreement to have your loan paid by direct deposit into your checking or savings account, your loan check will be sent to your ad- dress of record. This address will be provided on the Loan Agreement. If you believe that your address is not

Before completing this application, read the TSP booklet Loans to understand the features of the loan program, eligibility require- ments, and your responsibilities when you borrow from your TSP account. The booklet is available from your agency personnel of- fice, your service, or the TSP website (www.tsp.gov). Make a copy of this completed form for your records and mail the original form to the following address:

thrift savings Plan P.O. Box 385021 Birmingham, AL 35238

Or fax the form to

5:Amount Requested. You may not borrow more than the to- tal amount that you contributed to the TSP and the earnings on that amount. You may not borrow less than $1,000 or more than $50,000. To determine the maximum amount you may borrow, you can visit the TSP website at www.tsp.gov or call the

If you are not eligible to borrow the amount you requested, your Loan Agreement will be generated with the maximum amount you can borrow. Also, if you request a loan for less than $1,000, your loan amount will automatically become $1,000 as long as you have that amount available to borrow.

Note: Your loan will be disbursed proportionally from any tradition- al

6:type and term of Loan. If you are requesting a general purpose loan, complete the requested information in Item a. If you are ap- plying for a residential loan, fill in the information requested in Item b. You can request a residential loan only for the purchase or construction of your primary residence.

•For a General Purpose Loan, the minimum time to repay is 1 year; the maximum time is 5 years. No documentation is required.

•For a Residential Loan, the minimum time to repay is

1 year; the maximum time is 15 years. Documentation of the amount will be required when you return your Loan Agreement. Do not send documentation for the amount of the loan with this form.

If you indicated in Item 6 a payment term of less than 1 year, your loan term will automatically be changed to a term of 1 year. If you indicated more than 5 years for a general purpose loan or more than 15 years for a residential loan, your term will be changed to the maximum term allowed for that type of loan.

7:Pay schedule. Loan payments are deducted from your pay each pay period. Make sure you indicate the correct pay schedule or your loan payments will be incorrect.

First address line: Enter the street address or post office box number, and any apartment number.

Second address line: Enter the city or town name, other principal subdivision (e.g., province, state, county), and postal code, if known. (The postal code may precede the city or town.)

City/State/Zip Code fields: Enter the entire country name in the City field; leave the State and Zip Code fields blank.

If your spouse uses an Air/Army Post Ofice (APO) or Fleet Post Ofice (FPO) address, enter the address in the two available ad- dress lines (include the unit designation). Enter APO or FPO, as appropriate, in the City field. In the State field, enter AE as the state abbreviation for Zip Codes beginning with

15: Notiication or consent of spouse not possible. The TSP must notify the spouse of a CSRS participant before a loan can be made. Spouses of FERS participants and of members of the uniformed services must consent to the loan by signing the Loan Agreement. Check Item 15 and provide your spouse’s Social Security number only if you are:

•FERS or are a member of the uniformed services and you cannot obtain your spouse’s signature because your spouse’s whereabouts are unknown or exceptional circumstances make it impossible to obtain your spouse’s signature, or

•CSRS and your spouse’s whereabouts are unknown.

You may be able to obtain an exception to these spousal rights requirements, but you must submit Form

PRIVAcY Act NOtIcE. We are authorized to request the information you provide on this form under 5 U.S.C. chapter 84, Federal Employees’ Retirement System. We will use this information to identify your TSP account and to process your transac- tion. In addition, this information may be shared with other Federal agencies for statistical, auditing, or archiving purposes. We may share the information with law enforcement agencies investigating a violation of civil or criminal law, or agencies

implementing a statute, rule, or order. It may be shared with congressional offices, private sector audit firms, spouses, former spouses, and beneficiaries, and their at- torneys. We may disclose relevant portions of the information to appropriate parties engaged in litigation and for other routine uses as specified in the Federal Register. You are not required by law to provide this information, but if you do not provide it, we will not be able to process your request.

Form

PREVIOUS EDITIONS OBSOLETE

Document Specifics

| Fact Name | Description |

|---|---|

| Address of record importance | Before applying for a loan, it is crucial to ensure your TSP address of record is updated, as your Loan Agreement and related correspondence, including possibly your loan check, are sent to this address. |

| Minimum Loan Amount | The minimum amount that can be requested for a loan is $1,000. Requests for amounts below this threshold will be adjusted to the minimum. |

| Type and Term of Loan | There are two types of loans available: General Purpose, with a maximum repayment period of 5 years, and Residential, with a maximum repayment period of 15 years for purchasing or constructing your primary residence. |

| Spousal Consent or Notification | Married applicants must provide information about their spouse. Depending on the retirement system, the spouse’s consent for the loan or notification of the loan application is required unless certain exceptions apply. |

Guide to Writing Tsp 20 Loan

Filling out the TSP-20 Loan Application is a straightforward process that requires accurate and comprehensive personal information. This form is essential for applying for a loan from your Thrift Savings Plan (TSP) account. It is crucial to ensure that the information about your current TSP address of record is up to date to prevent delays in processing your application. Here's a detailed guide on how to complete your TSP-20 Loan Application.

- Information About You: Start by filling out your account type—either Civilian Account or Uniformed Services Account. Include your full name (Last, First, Middle), TSP Account Number, Date of Birth (mm/dd/yyyy), and Daytime Phone (Area Code and Number).

- Your Loan Request: Specify the Amount Requested, ensuring it is $1,000 or more. Choose the Type and Term of Loan you are applying for—either a General Purpose Loan (up to 5 years) or a Residential Loan (up to 15 years, for primary residence purchase or construction only).

- If you have a Pay Schedule other than biweekly, select the appropriate option from Monthly, Semimonthly, or Weekly.

- Information About Your Spouse: If you are married or legally separated, provide your spouse's Name (Last, First, Middle), indicate if your spouse's address is the same as yours, and if not, fill the address part. If your spouse has a foreign address, make sure to check the relevant box and complete the address fields accordingly.

- Indicate your employment status with FERS or the uniformed services and whether obtaining your spouse’s signature on your Loan Agreement is not possible due to unknown whereabouts or other exceptional circumstances.

- Your Signature and Certification: Sign your name, input the date (mm/dd/yyyy) you are signing the form, and provide a mailing address for any necessary communication related to locating your account based on the information provided.

Once you have completed the form, review all the information for accuracy. Making a copy of the completed application for your records is advisable. Finally, mail the original form to the Thrift Savings Plan PO Box address or fax it as directed in the form instructions. Paying attention to these steps ensures a smooth processing of your loan application.

Understanding Tsp 20 Loan

Frequently Asked Questions (FAQ) about the TSP-20 Loan Application

What is a TSP-20 Loan Application?

The TSP-20 Loan Application is a form used by participants of the Thrift Savings Plan (TSP) to request a loan from their TSP account. This application allows participants to borrow from their own contributions and earnings for either general purposes with a repayment term up to 5 years, or for the purchase or construction of a primary residence with a repayment term up to 15 years. Before applying, it’s important to read the TSP Loans booklet for detailed information.

How do I update my TSP address before applying for a loan?

Your Loan Agreement and any related correspondence will be sent to your TSP address of record. If your address is not current, you must contact your agency or service to update it before you submit the loan application. This ensures you receive all the necessary loan documentation and checks directly.

What is the minimum and maximum amount I can borrow?

Participants can borrow a minimum of $1,000. The maximum loan amount cannot exceed $50,000, but it also depends on the total amount you have contributed to the TSP along with the earnings on that amount. You can find tools to calculate the maximum amount you are eligible to borrow on the TSP website or by calling their helpline.

Can I take out a loan for any reason?

There are two types of loans available: a General Purpose Loan, which can be used for any reason and must be paid back within 1 to 5 years, and a Residential Loan, which is specifically for the purchase or construction of your primary residence and has a repayment term of up to 15 years. Documentation is not required for a general purpose loan, but you will need to provide proof for a residential loan.

How is my loan amount determined?

Your loan amount is based on your own contributions and earnings within your TSP account. It is disbursed proportionally from any traditional (non-Roth) and Roth balances you have. Similarly, if your contributions include tax-exempt amounts, your loan will include a proportional amount from these contributions as well.

What if I'm married or legally separated?

You are required to provide detailed information about your spouse, including their consent for the loan if you are a FERS employee or a member of the uniformed services. If your situation makes it impossible to provide this consent, you must indicate the specific reasons on the form. Additional documentation may be required.

What happens if I cannot obtain my spouse’s consent?

If obtaining your spouse’s consent is not possible due to their unknown whereabouts or other exceptional circumstances, you must check the relevant box on the application and may need to submit additional forms like the TSP-16 or TSP-U-16 for uniformed services, to request an exception to the spousal consent requirement.

Where do I send my completed TSP-20 Loan Application?

Once completed, you should mail the original form to the Thrift Savings Plan at P.O. Box 385021, Birmingham, AL 35238, or fax it to 1-866-817-5023. Ensure all your information is accurate and legible to avoid delays. It's also a good idea to keep a copy of the completed form for your records.

Remember, taking a loan from your TSP account is a decision that should not be taken lightly. Always read the provided literature and consider consulting with a financial advisor to understand how it may affect your future retirement savings.

Common mistakes

When filling out the TSP-20 Loan Application, individuals often make several common mistakes that can lead to delays in processing or even rejection of the application. Here are nine mistakes to avoid:

- Failing to read the TSP Loans booklet and instructions before completing the form, which can lead to misunderstandings about eligibility and requirements.

- Not updating the TSP address of record if it has changed, which is crucial as the Loan Agreement and related correspondence will be sent to this address.

- Incorrectly filling out personal information in Section I, such as the TSP account number or date of birth, which can prevent your application from being processed.

- Requesting a loan amount less than the minimum $1,000 or more than the maximum $50,000, or more than what is available in the account.

- Selecting the wrong type and term of loan, either general purpose or residential, or specifying a repayment term outside the allowed limits.

- Not understanding the pay schedule options and selecting a schedule that doesn't match with your actual pay frequency, leading to incorrect loan payment deductions.

- Omitting spouse information in Section III if you're married or legally separated, including not indicating if your spouse's address is the same as yours.

- Not checking the box in Item 15 when unable to obtain your spouse’s signature, when required, due to exceptional circumstances or unknown whereabouts.

- Not signing and dating the Participant's Signature and Certification section or providing a mailing address where you can be contacted if there are issues locating your account.

Avoiding these mistakes can help ensure that your TSP-20 Loan Application is processed smoothly and swiftly.

Documents used along the form

When participants decide to apply for a loan through the Thrift Savings Plan (TSP) using the TSP-20 Loan Application, they may find themselves navigating through a series of additional forms and documents which serve various purposes, from verifying identity to ensuring compliance with legal and policy requirements. Understanding these documents is crucial in ensuring a smooth and efficient application process.

- TSP-1: This is the Thrift Savings Plan Election Form. It allows new federal employees to choose the percentage of their salary that will be contributed to their TSP account.

- TSP-3: Designation of Beneficiary. Participants use this form to designate who will receive their TSP account in the event of their death, ensuring the funds are distributed according to their wishes.

- TSP-60: Request for a Transfer Into the TSP. This form is used when individuals wish to transfer or roll over existing retirement accounts into their TSP account, which can be a factor in determining loan availability.

- TSP-76: Financial Hardship In-Service Withdrawal Request. Although not directly related to loans, understanding the conditions for hardship withdrawals can help participants make informed decisions about borrowing from their TSP.

- Form W-4: Employee’s Withholding Certificate. Although primarily for tax withholding purposes, changes in loan repayments can affect take-home pay, making it necessary to adjust withholding amounts.

- Direct Deposit Sign-up Form (SF 1199A): For loan disbursements that are to be directly deposited into a bank account, this form is necessary to establish the connection between your TSP account and your bank.

- Loan Agreement: After processing the TSP-20, a loan agreement is generated which outlines the terms and conditions of the loan. This document is crucial and must be reviewed carefully before signing.

- Annual Participant Statement: While not a form, reviewing your annual TSP statements can help you understand your account's performance and available balance, which is important when considering a loan.

- Form TSP-16/U-16, Exception to Spousal Requirements: This form is necessary if obtaining spousal consent for a loan is not possible due to extraordinary circumstances, ensuring that participants can still proceed with their loan application under specific conditions.

In conclusion, while the TSP-20 Loan Application is the starting point for borrowing from one's TSP account, the associated forms and documents play a crucial role in the application process. These forms ensure compliance with rules, capture necessary personal and financial information, and set the terms for the loan itself. Participants are encouraged to familiarize themselves with these documents and consult with financial or legal advisors where necessary to make informed decisions about borrowing from their TSP accounts.

Similar forms

The TSP-20 Loan Application shares similarities with the Mortgage Application form used for applying for a home loan. Both require detailed personal information, such as full name, Social Security numbers, and addresses. They also require financial information relevant to the loan being sought, including the amount requested and repayment terms. Importantly, both forms consider the applicant's marital status and involve providing information about the spouse, which is fundamental in assessing the financial situation and obligations that might impact loan approval and repayment terms.

Similarly, the TSP-20 Loan Application resembles the Personal Loan Application form found at many financial institutions. These types of applications collect comprehensive personal and financial information to assess the borrower's ability to repay the loan. Both applications inquire about the loan purpose—with the TSP-20 distinguishing between a general purpose or residential loan—and set minimum and maximum amounts that can be borrowed. Documentation requirements, while varying in specifics, are central to both forms to validate the loan's intended use and the borrower’s repayment capacity.

The Auto Loan Application form parallels the TSP-20 Loan Application in that it is structured to finance a specific purpose—similar to the residential loan option in the TSP-20. Both necessitate the borrower to state the purpose of the loan explicitly and provide substantiating documents as needed (e.g., purchase agreement or construction plans for a TSP residential loan). Each form evaluates the borrower's financial status, including existing debts and assets, and details about the borrower's employment and income to secure repayment assurance.

Also akin to the TSP-20 Loan Application is the Application for a Line of Credit. Both applications assess the borrower's creditworthiness and ability to repay the borrowed funds based on the borrower's financial information. They require detailed personal information, employment, and income verification to calculate how much can be responsibly lent. Despite differences in the nature of the credit provided, both aim to ensure that borrowers do not take on more debt than they can manage, protecting both the lender's and borrower's interests.

Dos and Don'ts

Are you filling out a TSP-20 Loan Application? Here are 10 do's and don'ts to make sure your application sails through without any hiccups. Let's dive right in!

- Do read the TSP booklet Loans and the instructions accompanying the form. It’s your roadmap to understanding the essentials.

- Do ensure your address is up-to-date with your agency or service before applying. This avoids any mishaps in sending your Loan Agreement or check.

- Do fill out the “Information About You” section completely. Missing details here can delay your application.

- Do carefully determine the amount you request. Remember, it must be $1,000 or more but within your contributed amount and earnings limit.

- Do choose the correct type and term of your loan based on your need, whether it's a general purpose or a residential loan.

- Don't guess your TSP address of record. If in doubt, double-check to ensure it’s accurate.

- Don't leave parts of the form blank, especially regarding your spouse if you’re married or legally separated. This information is crucial.

- Don't forget to specify your pay schedule accurately. Incorrect information can affect your loan repayment setup.

- Don't ignore the need for your spouse's information or signature, if applicable. This is a requirement that can't be overlooked.

- Don't submit the form without checking for errors or omissions. A quick review can save a lot of time and effort.

Following these guidelines will help ensure that your TSP-20 Loan Application process is smooth and effective. Keep in mind, taking care at each step minimizes delays and sets you up for a favorable response.

Misconceptions

Understanding the Thrift Savings Plan (TSP-20) Loan Application can sometimes lead to confusion and misconceptions. Here are ten common misunderstandings about the form and the facts to correct them:

Misconception 1: You can borrow any amount. Contrary to this belief, the amount you can borrow is limited to a minimum of $1,000 and cannot exceed $50,000, depending also on the amount you have contributed and the earnings on those contributions.

Misconception 2: Pay schedules don’t affect loan repayment. In fact, your pay schedule is vital because loan payments are deducted each pay period, and selecting the incorrect pay schedule can lead to incorrect payment deductions.

Misconception 3: You do not need to report a spouse if separated. Even if separated, the form requires information about your spouse and may require their consent or notification, depending on your employment system (FERS, CSRS, or uniformed services).

Misconception 4: Loans can be used for any purpose. While general purpose loans offer more flexibility, residential loans specifically require the funds to be used for the purchase or construction of your primary residence only.

Misconception 5: Loan terms are flexible. The term for a general purpose loan caps at 5 years, while a residential loan can extend up to 15 years, with no deviations allowed.

Misconception 6: Spousal consent is always needed. While spousal consent is generally required for FERS employees and uniformed services members, exceptions exist, such as when the spouse's whereabouts are unknown or under exceptional circumstances.

Misconception 7: Paper applications slow down the process. The form emphasizes the importance of legible, correctly filled applications to prevent delays, and both mailing and faxing are valid submission methods, without one necessarily being faster than the other.

Misconception 8: Address updates after application submission are fine. Address accuracy is crucial at the time of application because loan checks and correspondences are sent to your TSP address of record. Updating it before applying is advised.

Misconception 9: Loan disbursement does not consider account types. Disbursements are made proportionally from traditional and Roth balances, and for uniformed services employees with tax-exempt contributions, it includes a proportional amount from those contributions as well.

Misconception 10: The form does not require detailed personal information. The application requires comprehensive personal information, including your TSP account number, to process your loan request accurately.

Correcting these misconceptions ensures a smoother application process, leading to a better understanding of the TSP-20 Loan Application requirements and conditions.

Key takeaways

When it comes to managing finances, taking a loan from your Thrift Savings Plan (TSP) can be a significant decision. Here are five key takeaways to consider when filling out and using the TSP-20 Loan Application form:

- Before applying for a loan, ensure your address is updated in the TSP system to avoid any delays or miscommunications. Contact your agency or service to update your TSP address of record if necessary.

- Understanding the type of loan you're applying for is crucial. The TSP-20 form allows for two types of loans: General Purpose Loans and Residential Loans. General Purpose Loans have a repayment term of up to 5 years, whereas Residential Loans, used for purchasing or constructing your primary residence, can extend up to 15 years.

- The minimum loan amount you can request is $1,000, and the maximum is limited to the total amount you contributed to the TSP and the earnings on those contributions, with a cap at $50,000. To avoid over-borrowing or underestimating your eligibility, use the tools available on the TSP website or contact the ThriftLine.

- If you're married, TSP requires information about your spouse, and depending on your employment status (Civil Service Retirement System (CSRS) or Federal Employees' Retirement System (FERS)/uniformed services), you may need your spouse's consent or have to notify them about the loan application. This step safeguards the interests of both partners in the relationship.

- Pay attention to the pay schedule you select on the form, as this will determine the frequency of loan repayments. Incorrectly indicating your pay schedule can result in improper loan payment deductions from your paychecks.

Filling out the TSP-20 Loan Application carefully and understanding the commitments tied to TSP loans can help manage your finances better and avoid potential legal or financial complications in the future. Always read the accompanying instructions and relevant TSP literature thoroughly before proceeding.

Popular PDF Documents

For Payment - This authorization form is critical for vendors who prefer electronic over manual payment methods, prioritizing efficiency and security.

IRS Schedule J 1040 - This form represents an approach to tax fairness, acknowledging that financial success can vary greatly from one year to the next.

Waverly City Tax R - Discover how to claim tax credits and calculate your dues with Waverly City's Form R, offering clear steps for a stress-free tax season.