Get Transfer Tax Form

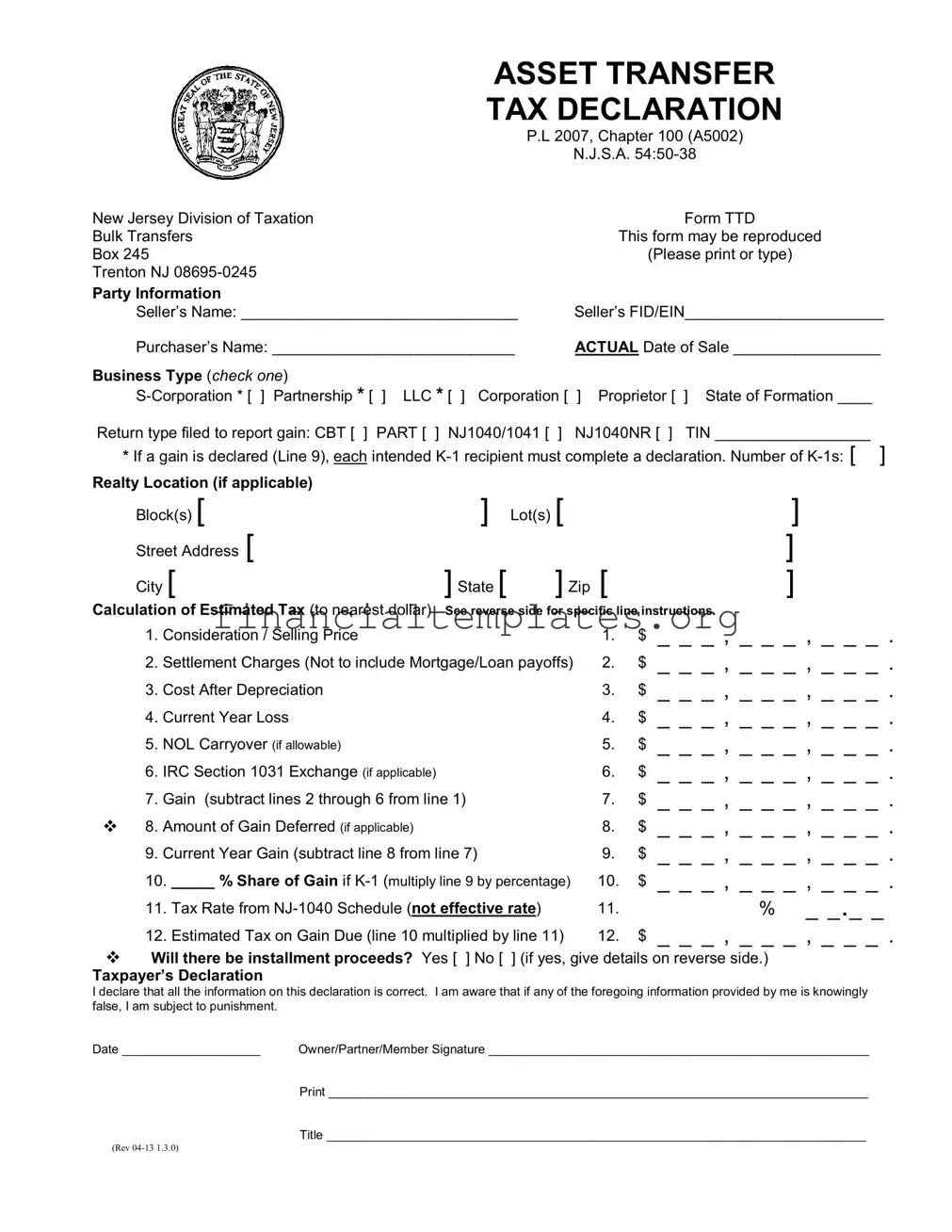

When it comes to handling asset transfer taxes, especially for businesses in New Jersey, the Transfer Tax Declaration form (Form TTD) under P.L 2007, Chapter 100 (A5002) administered by the New Jersey Division of Taxation is critical. This specialized form is designed for the declaration and estimation of taxes on the gains realized from the transfer of business assets. It comprehensively addresses the seller and purchaser information, the actual date of sale, type of business entity involved, and specifics of the asset location. Moreover, the form delves into the financial intricacies by prompting for detailed inputs on the sale price, settlement charges, depreciation costs, losses, and potential gains from the asset transfer. Uniquely, it also considers the implications of Section 1031 Exchanges, and a provision for declaring deferred gains, thereby affecting the estimated tax calculations. Importantly, the form outlines a process for calculating the estimated tax due on any gains from the sale, incorporating considerations for specific tax rates applicable to different business structures such as S-Corporations, Partnerships, LLCs, and sole proprietorships. It also provides space for acknowledging installment proceeds and includes a taxpayer's declaration to certify the accuracy of the provided information, underlining the seriousness of the declaration. The directives for the form ensure that both the transferor and transferee or assignee are aware of their tax obligations, facilitating a smooth process for reporting and paying any taxes due following the asset transfer, thereby avoiding potential legal complications.

Transfer Tax Example

|

ASSET TRANSFER |

||

|

TAX DECLARATION |

||

|

P.L 2007, Chapter 100 (A5002) |

||

|

|

N.J.S.A. |

|

New Jersey Division of Taxation |

|

|

Form TTD |

Bulk Transfers |

|

This form may be reproduced |

|

Box 245 |

|

(Please print or type) |

|

Trenton NJ |

|

|

|

Party Information |

|

|

|

Seller’s Name: ________________________________ |

Seller’s FID/EIN_______________________ |

||

Purchaser’s Name: ____________________________ |

ACTUAL Date of Sale _________________ |

||

Business Type (check one) |

|

|

|

] LLC * [ ] Corporation [ |

] Proprietor [ |

] State of Formation ____ |

|

Return type filed to report gain: CBT [ ] |

PART [ ] NJ1040/1041 [ ] |

NJ1040NR [ ] |

TIN __________________ |

* If a gain is declared (Line 9), each intended

Realty Location (if applicable) |

|

|

|

|

|

|

Block(s) [ |

] |

Lot(s) [ |

|

|

] |

|

Street Address [ |

|

|

|

|

] |

|

City [ |

] State [ |

] Zip [ |

|

] |

||

Calculation of Estimated Tax (to nearest dollar) |

See reverse side for specific line instructions. |

|||||

1. |

Consideration / Selling Price |

|

|

1. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

2. |

Settlement Charges (Not to include Mortgage/Loan payoffs) |

2. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

||

3. |

Cost After Depreciation |

|

|

3. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

4. |

Current Year Loss |

|

|

4. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

5. |

NOL Carryover (if allowable) |

|

|

5. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

6. |

IRC Section 1031 Exchange (if applicable) |

|

|

6. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

7. |

Gain (subtract lines 2 through 6 from line 1) |

|

7. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

|

8. Amount of Gain Deferred (if applicable) |

|

|

8. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

|

9. |

Current Year Gain (subtract line 8 from line 7) |

|

9. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

|

10. _____ % Share of Gain if |

10. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

|||

11. Tax Rate from |

11. |

|

% _ _._ _ |

|||

12. Estimated Tax on Gain Due (line 10 multiplied by line 11) |

12. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

|||

Will there be installment proceeds? Yes [ ] No [ ] (if yes, give details on reverse side.)

Taxpayer’s Declaration

I declare that all the information on this declaration is correct. I am aware that if any of the foregoing information provided by me is knowingly false, I am subject to punishment.

Date ____________________ |

Owner/Partner/Member Signature _______________________________________________________ |

|

Print ______________________________________________________________________________ |

|

Title ______________________________________________________________________________ |

(REV |

|

N.J.S.A.

Procedure

The estimated tax on the gain portion of the escrow to be held at closing is initially calculated by multiplying the gross consideration by the tax rate of the taxpayer.

Upon completion of this declaration, submission to and review by the Division, the estimated tax on the gain portion of the escrow may be reduced appropriately.

Upon closing of the transaction, the escrow will be held by the transferee’s attorney and the estimated tax on the gain portion of the escrow will be demanded by the Division to be applied to the appropriate tax type and year. A confirmation of receipt and the application of the estimated tax payment will be sent to the transferor’s attorney.

The taxpayer files their year end business tax return, claims credit for the payment and pays any additional tax due. They may request a refund or credit if an overpayment exists.

Specific Line Instructions for Estimated Tax Calculation

Special Note: Lines 1 through 9 establish gain. Line 10 assigns share.

Line 1: Total sale price or consideration of all assets currently being transferred.

Line 2: Total amount of settlement charges to transferor associated with this transaction.

Line 3: If fully depreciated enter zero.

Line 8: Calculate amount deferred based on installment or short term notes.

Line 9: For NJ1065 filers: If any member/partner is not an individual or if the number of nonresident member/partners exceeds five (5) stop here and attach the most current membership directory. The Division will calculate and communicate the estimated tax for resident filers and/or withholding amount for nonresident filers.

Line 11: Individual tax rates may be found in the most current

Line 12:

•

•

This is the declared amount that the Division will demand from escrow to be applied to the taxpayer’s account(s).

Details of Installment proceeds:

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

___________________________________________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Law | P.L 2007, Chapter 100 (A5002), N.J.S.A. 54:50-38 |

| Administering Body | New Jersey Division of Taxation |

| Form Type | Form TTD (Transfer Tax Declaration) - Bulk Transfers |

| Contact Information | Box 245, Trenton NJ 08695-0245 |

| Party Information Required | Seller and Purchaser Names, FID/EIN, Business Type, and State of Formation |

| Financial Information to be Declared | Sale Date, Sale Price, Settlement Charges, Depreciation, Losses, NOL Carryover, 1031 Exchange, and Estimated Taxes |

| Specific Instruction for Estimated Tax Calculation | Guidance provided for calculating deferred amounts, share of gain, and applicable tax rates based on NJ schedules |

| Signature Requirement | Taxpayer's Declaration with a signature of Owner/Partner/Member |

Guide to Writing Transfer Tax

Completing the Transfer Tax form requires careful attention to detail, as it plays a crucial role in ensuring that the appropriate tax is calculated and applied to any gains from the transfer of assets. This process involves entering specific information about the seller and purchaser, details of the sale, and calculations to determine the estimated tax due. Below is a step-by-step guide to assist in filling out the form accurately.

- Enter the Seller’s Name and Seller’s FID/EIN in the designated sections.

- Provide the Purchaser’s Name and the Actual Date of Sale.

- Select the Business Type by checking the appropriate box (S-Corporation, Partnership, LLC, Corporation, Proprietor).

- Fill in the State of Formation and the Return type filed to report gain, choosing from CBT, PART, NJ1040/1041, or NJ1040NR, and enter the TIN.

- If a gain is declared on Line 9, indicate the Number of K-1s needed.

- For realty transfers, include the Realty Location details such as Blocks, Lots, Street Address, City, State, and Zip.

- Under the section Calculation of Estimated Tax, start with entering the Consideration/Selling Price in Line 1.

- Add any Settlement Charges on Line 2 (excluding Mortgage/Loan payoffs).

- If the asset has been fully depreciated, enter zero on Line 3. Otherwise, input the Cost After Depreciation.

- Document any Current Year Loss on Line 4, and a NOL Carryover on Line 5 if applicable.

- If the transaction qualifies as an IRC Section 1031 Exchange, report the amount on Line 6.

- Calculate the Gain by subtracting Lines 2 through 6 from Line 1 and enter this on Line 7.

- For any amount of Gain Deferred (if applicable), fill this in on Line 8.

- Determine the Current Year Gain by subtracting Line 8 from Line 7 and input this on Line 9.

- If distributing Gain via K-1, calculate the percentage share of Gain and record on Line 10.

- Find the appropriate Tax Rate from the NJ-1040 Schedule and specify this on Line 11.

- Multiply the amount on Line 10 by the Tax Rate on Line 11 to find the Estimated Tax on Gain Due and place this figure on Line 12.

- Answer whether there will be installment proceeds and provide details if applicable.

- Complete the Taxpayer’s Declaration section by signing and dating the form. Ensure the Owner/Partner/Member prints their name and title.

After carefully following these steps, your Transfer Tax form should be accurately filled out. The next step involves submitting the form to the Division of Taxation. Upon submission and review, the estimated tax to be held in escrow may be adjusted. At the closing of the transaction, the escrow managed by the transferee’s attorney will include this estimated tax, which will then be applied to the taxpayer's account with the Division. A confirmation receipt of this payment will follow. Finally, the taxpayer will file their year-end business tax return, where they can claim credit for this payment and address any additional tax due or request a refund for any overpayment.

Understanding Transfer Tax

FAQs about the Transfer Tax Form

What is the Asset Transfer Tax Declaration Form?

This form is a critical document required by the New Jersey Division of Taxation for recording the transaction details anytime there's a transfer of business assets. It captures essential information such as the seller's and purchaser's details, the date of sale, business type, and a comprehensive calculation of the estimated tax due on gains from the sale. The purpose of this form is to ensure that the correct amount of tax is applied to any profit realized from the asset transfer, in compliance with P.L. 2007, Chapter 100 (A5002).

How is the Estimated Tax on Gain Calculated?

The calculation of the estimated tax on the gain involves subtracting the total amount of settlement charges, cost after depreciation, current year loss, NOL carryover (if permissible), and any amounts from an IRC Section 1031 Exchange, from the total sale price or consideration of the transferred assets. From this result, any gain deferred (for example, through installments or short-term notes) is subtracted to arrive at the current year gain. This gain is then appropriately multiplied by the tax rate, specific to the business entity's classification, to estimate the tax due.

When and How is This Form Submitted?

After completion, the Asset Transfer Tax Declaration Form needs to be submitted to the New Jersey Division of Taxation for review. The correct timing for submission is critical and is usually done as part of the closing process of the asset transfer transaction. Subsequently, an estimated tax, based on the calculated gain, is held in escrow by the transferee’s attorney until the Division demands its payment. This process ensures that the state’s claim on taxes due from the transaction is securely managed and settled in full compliance with tax laws.

What Happens After the Estimated Tax Payment is Made?

Upon the successful payment of the estimated tax on the gain from the asset transfer, the transferor’s attorney receives a confirmation receipt. This receipt is a crucial document for the taxpayer’s records, as it confirms the pre-payment of tax liabilities associated with the transaction. At the end of the business tax year, the taxpayer files their business tax return, claiming credit for the estimated tax payment made. If the actual tax due is less than the estimated payment, the taxpayer may request a refund or opt to have the excess applied as a credit towards future tax liabilities.

Common mistakes

When completing the Asset Transfer Tax Declaration Form, which is a critical document for the proper handling of tax obligations during the sale of business assets, attention to detail and accuracy are paramount. Mistakes can lead to delays, incorrect tax calculations, or even penalties. Here are ten common errors that individuals often make:

- Failing to clearly print or type information, which can lead to misinterpretation of the data provided.

- Incorrectly reporting the Seller’s Federal Identification Number (FID/EIN) or the Taxpayer Identification Number (TIN), which are crucial for identifying the entity in tax records.

- Overlooking to check the correct business type box. Each type of business entity has different tax implications, and this mistake can mislead the tax calculations.

- Not specifying the actual date of sale. Dates are essential for determining the tax year and deadlines.

- Miscalculating the Consideration/Selling Price or incorrectly deducting Settlement Charges, leading to an inaccurate declaration of the asset's selling price.

- Incorrectly calculating or failing to claim allowable deductions such as Cost After Depreciation, Current Year Loss, or NOL Carryover, which can affect the gain or loss reported.

- Not considering an IRC Section 1031 Exchange where applicable, which can significantly impact the taxable gain or loss.

- Forgetting to include or incorrect reporting of the amount of Gain Deferred in cases where installment payments are involved, leading to miscalculation of the current year gain.

- Entering an incorrect Tax Rate from NJ-1040 Schedule. The tax rate should reflect the tax bracket applicable to the gain, not the effective or average tax rate of the business or individual.

- Omitting details of installment proceeds when applicable. This information is essential for accurately calculating the tax due over the period of installment payments.

To ensure accuracy and compliance, reviewing these areas carefully before submission can save a great deal of time and avoid unnecessary complications with the New Jersey Division of Taxation.

Documents used along the form

When handling asset transfers and addressing the requirements of the Transfer Tax form, several other forms and documents typically come into play to ensure a smooth transaction and compliance with legal and tax obligations. These additional forms and documents complement the Transfer Tax form, each serving a distinct purpose in the asset transfer process.

- Deed of Sale: A legal document proving the transfer of property ownership from the seller to the buyer. It includes critical information such as the property description, the identities of both parties, and the sale price. This document is often required to be filed with the Transfer Tax form to substantiate the sale.

- Settlement Statement (HUD-1): This document provides a detailed financial breakdown of the transaction. It lists the purchase price, loan amounts, escrow sums, and the calculated Transfer Tax, among other financial details related to the sale. The Settlement Statement aids in the accurate completion of the Transfer Tax form.

- 1099-S Form: Used by the Internal Revenue Service (IRS) to report the proceeds from real estate transactions, the 1099-S form is essential for tax reporting purposes. It helps ensure that the seller reports the correct amount of income from the sale of the property.

- Property Disclosure Statement: While not directly related to the Transfer Tax, this document is critical in many real estate transactions. It outlines the condition of the property being sold, including any known defects or issues. The Property Disclosure Statement provides transparency and protects both parties in the transaction.

Together, these documents play an integral role in ensuring the legality, transparency, and financial accuracy of property transactions. They complement the Transfer Tax form by providing essential information needed for its completion, as well as fulfilling other legal and tax-related obligations in the asset transfer process.

Similar forms

The Transfer Tax form shares similarities with the Real Estate Deed. Both documents are essential in the transfer of ownership, the Transfer Tax form does so by calculating and declaring tax obligations arising from the sale of business assets, while the Real Estate Deed transfers property rights from one party to another. Each document serves as a formal record of transfer but focuses on different assets and legal requirements, highlighting the formalization of transfer processes in both personal and business contexts.

Another similar document is the 1099-S form, primarily used for reporting the sale or exchange of real estate. Like the Transfer Tax form, the 1099-S captures details about the transaction, including the seller’s information and the gross proceeds from the sale. Both forms play critical roles in ensuring tax compliance by providing necessary information to tax authorities, albeit for different types of transactions.

The UCC-1 Financing Statement also bears resemblance to the Transfer Tax form. The UCC-1 is filed to declare a secured interest in an asset, providing public notice. While the Transfer Tax form focuses on tax liabilities during asset transfer, the UCC-1 secures interests, both facilitating clear documentation of rights and obligations related to business assets, underlining the importance of transparency in transactions.

The W-2 form, commonly used for reporting employee wages and taxes withheld by employers, shares the objective of tax reporting with the Transfer Tax form. Though the W-2 pertains to employment and the Transfer Tax form to asset transactions, both ensure accurate tax reporting to governmental bodies, underscoring the breadth of tax-related documentation in varying contexts.

Similar in purpose to the Transfer Tax form, the Schedule K-1 document is used in the context of partnerships, S corporations, and trusts to report shares of income, deductions, and credits to the IRS. Both forms require detailed financial information to properly calculate and report tax obligations, supporting the fair assessment and collection of taxes within specialized transactions.

The Property Tax Statement, essential for property owners, shares its tax-focused nature with the Transfer Tax form. While the Property Tax Statement details the tax due on real estate, the Transfer Tax form calculates taxes due on the transfer of business assets, both emphasizing the role of tax documents in the administration of property and asset-related responsibilities.

Corporate Annual Reports, filed by companies to report on their financial status and operations, have in common with the Transfer Tax form the goal of transparency and compliance. Though serving different purposes—one for shareholder and regulatory insight, and the other for tax calculation—both contribute to a framework of accountability in business practice.

The Bill of Sale is another document akin to the Transfer Tax form, as it provides proof of purchase and transfer of ownership for a variety of items. Both documents are pivotal in recording transactions, but the Transfer Tax form specifically addresses the tax implications, enhancing the legal and fiscal accountability of asset transfers.

Last but not least, the Gift Tax Return (Form 709) parallels the Transfer Tax form in its focus on transfers that have tax implications. Whether transferring assets as a gift or through a business sale, these forms ensure that the respective obligations are met, highlighting the wide range of transactions subject to tax considerations.

Dos and Don'ts

Filling out the Transfer Tax form can seem daunting, but by following a series of do's and don'ts, you can navigate this process smoothly. Here’s a guide to help you along the way:

- Do ensure all the information you provide is accurate and truthful. Misrepresentation can lead to penalties.

- Do print or type clearly to prevent any misunderstandings or delays in processing your form.

- Do consult the specific line instructions for estimated tax calculation on the reverse side of the form for clarity and accuracy.

- Do include the correct Taxpayer Identification Number (TIN) for both the seller and purchaser to avoid processing issues.

- Don't overlook the requirement to declare if there will be installment proceeds. Failure to do so could complicate tax matters later.

- Don't forget to check the appropriate boxes that correspond to the business type and state of formation. This information is crucial for tax purposes.

- Don't omit any intended K-1 recipients if a gain is declared. Each one must complete a declaration to comply with tax laws.

- Don't skip the taxpayer's declaration at the bottom. Signing and dating confirm the veracity of the information provided.

By adhering to these guidelines, you can fill out the Transfer Tax form with confidence. Remember to double-check your work and ensure everything is complete before submission. When in doubt, consulting a tax professional can also provide additional peace of mind.

Misconceptions

Addressing misconceptions about the Transfer Tax form is crucial for both tax professionals and taxpayers alike. Misunderstandings can lead to errors in filing, which may result in penalties or delays. Below are four common misconceptions about the Transfer Tax form, demystified for clarity.

- Only applies to real estate transactions: A common misconception is that the Transfer Tax form is exclusively used for real estate transactions. While it is often associated with the transfer of property, the form applies to various assets under the Bulk Transfers section of the New Jersey Division of Taxation. It's designed to capture information on a broader spectrum of asset transfers, not just real estate.

- Estimation of tax is final: Another misunderstanding is that the estimated tax calculated and declared on the form is the final tax amount. However, the initial estimation serves as a placeholder. The actual tax can be adjusted based on the final calculation by the Division of Taxation after reviewing the declaration and applying it against the taxpayer’s year-end business tax return.

- Depreciation doesn't matter: Some may erroneously believe that depreciation is not a significant factor in calculating the tax. Contrary to this belief, the form requires a calculation of the cost after depreciation (Line 3), influencing the gain's computation and, consequently, the estimated tax due. If assets are fully depreciated, this may significantly impact the gain calculation.

- Uniform tax rate for all businesses: It’s incorrectly assumed that a single tax rate applies to all businesses, regardless of their structure. The form differentiates tax rates between individual business entities and their types, such as S-Corporations, LLCs, and partnerships. The tax rate used in the estimated tax calculation (Line 11) must correspond to the specific business type's applicable rate, reflecting the diverse tax treatment across different business structures.

Understanding these nuances is imperative for those engaged in business asset transfers. Misconceptions can lead to misfiling and unexpected financial implications. By clarifying these common misunderstandings, taxpayers can ensure a more accurate and compliant approach to handling Transfer Taxes.

Key takeaways

Understanding how to correctly fill out and utilize the Transfer Tax Form is crucial for any business involved in asset transfer. Below are six key takeaways designed to simplify the process and ensure compliance with the New Jersey Division of Taxation guidelines.

Accurate Party Information is Crucial: The form requires detailed information about both the seller and the purchaser, including names and tax identification numbers, to ensure all parties are properly identified.

Determine the Correct Business Type: It's important to check the appropriate box corresponding to your business structure, as this influences the return type to be filed and the calculation of the estimated tax.

Calculation of Estimated Tax: The form guides you through a step-by-step process for estimating the tax due on the gain from asset transfer. This includes considering the selling price, settlement charges, depreciation, losses, and any applicable 1031 exchanges.

Understanding Gain and Its Tax Implications: Gains are carefully calculated by subtracting allowable deductions from the total selling price. If an installment sale is involved, it's important to declare it, as it can affect the gain calculation and subsequent tax estimations.

Importance of Taxpayer’s Declaration: Completing the declaration section accurately is paramount. It serves as a formal acknowledgment that the information provided is correct and that the declarant understands the consequences of providing false information.

Final Steps After Form Submission: Upon the form's completion and its submission, an estimated tax amount is determined and must be held in escrow. Following the closing of the transaction, this escrow is used to settle the estimated tax liability, and the taxpayer can claim a credit or refund for any overpayment when filing their year-end business tax return.

Proper completion and timely submission of the Transfer Tax Form are essential to comply with state tax regulations and to ensure a smooth transaction process. Always refer to the most current form instructions and consult with a tax professional if in doubt.

Popular PDF Documents

Ifta Filing - Step-by-step guidance on filling out the IFTA quarterly tax return form, emphasizing the critical due dates for each quarter.

IRS 4506T-EZ - Its relevance extends beyond just loans and credit applications; it can also support applications for certain government programs.

Saanich School First Aid Record - Facilitates tracking of first aid incidents through sequence numbers and detailed reporting on the event and subsequent actions taken.