Get Transaction Privilege Severance Tax Return Form

Navigating the intricacies of taxes is crucial for businesses, and the Transaction Privilege Severance Tax Return form (TPT-1) serves as a foundational document for reporting and paying transaction privilege, use, and severance taxes in Arizona. Administered by the Arizona Department of Revenue, this form is utilized by businesses to comply with state tax requirements. Filing can be done either by mail or online, with online filing offering a streamlined and efficient process through the Arizona Department of Revenue's website, AZTaxes.gov. Important deadlines are outlined for submission, emphasizing the necessity for punctuality to avoid late filing penalties. The form accommodates various modifications including amendments and multipage submissions, catering for a wide range of business needs. Businesses are obligated to file a TPT-1 return even in periods with no tax liability, and they must meticulously calculate deductions and taxable amounts to ensure accurate reporting and payment. Penalties for late submissions underscore the importance of adhering to due dates, underscoring the broader implications of compliance and the role of accurate financial reporting in sustaining business operations within the legal frameworks set by the Arizona Department of Revenue.

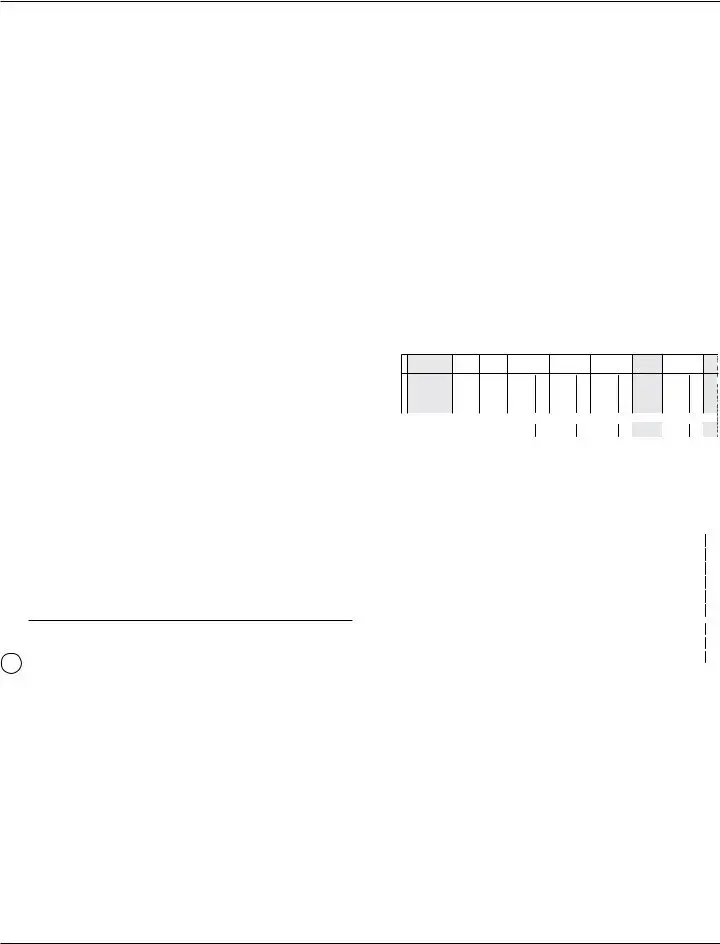

Transaction Privilege Severance Tax Return Example

GENERAL INSTRUCTIONS

Transaction Privilege, Use, and Severance Tax Return (TPT‑1)

ARIZONA DEPARTMENT OF REVENUE

www.azdor.gov

MAILING ADDRESS

Arizona Department of Revenue

PO Box 29010

Phoenix, AZ 85038‑9010

If you are mailing your Transaction Privilege Tax Return, it must received by the Department on or before the second to last business day of the month.

ONLINE FILING

Go to www.AZTaxes.gov

CUSTOMER SERVICE

CENTER LOCATIONS

8:00 a.m. ‑ 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Office

1600 W Monroe

Phoenix, AZ 85007

Tucson Office

400 W Congress

Tucson, AZ 85701

7:00 a.m. ‑ 6:00 p.m.

Monday through Thursday

8:00 a.m. ‑ 12:00 p.m.

Friday

(except Arizona holidays)

Mesa Office

55 N Center

Mesa, AZ 85201

(This office does not handle billing or account disputes.)

CUSTOMER SERVICE

TELEPHONE NUMBERS

8:00 a.m. ‑ 5:00 p.m.

Monday through Friday

(except Arizona holidays)

Phoenix Area

(602) 255‑3381

Within Arizona

1 (800) 352‑4090

Online Filing:

Form TPT‑1 may be filed online. www.AZTaxes.gov is the Arizona Department of

Revenue’s taxpayer service center web site that provides taxpayers with the ability to file tax returns and pay taxes due, conduct other transactions, and review tax

account information over the internet. Save time and expense and comply with due date requirements with ease and convenience. File and pay online by becoming a registered business at www.AZTaxes.gov. For taxpayers electing to file and pay taxes electronically, the Department must receive the filing and payment on or before the last business day of the month; therefore, this transaction must be initiated before 5:00 p.m. of the preceding day.

Who Must File:

All businesses with income subject to transaction privilege tax, county excise tax, use or severance tax must file a Form TPT‑1 return even if there is no tax liability due for the period. City tax for “program” cities is also reported on Form TPT‑1. A list of the “program” cities is found in Table II of the TRANSACTION PRIVILEGE AND OTHER TAX RATE TABLES (“TAX RATE TABLES”) which are available on the Department’s web site (www.azdor.gov).

Most of the larger cities administer their transaction privilege taxes independently

of the state and are called

TAX RATE TABLES.

Due Date for Form

Arizona Revised Statutes (A.R.S.) § 42‑5014 states that Form TPT‑1 is due on the 20th day of the month following the month (or other reporting period) in which the tax

is collected or accrued. (This date is used for the computation of penalties or interest that applies to returns or payments that are filed late.) However, A.R.S. § 42‑5014 allows that a return will be considered to be filed timely if it is received by the Department on or before the second to last business day of the month. A business

day is any day except Saturday, Sunday, or a legal Arizona state holiday. See “Online

Filing” above for the due date of electronically filed returns, .

Late Filing Penalty – Other Penalties

All returns that are not filed timely are subject to a late filing penalty. The late filing penalty imposed by A.R.S. § 42‑1125(A), as qualified by A.R.S. § 42‑5014(E),

is computed against the total amount of tax reported on the return, without any deduction for tax that was paid on or before the due date. A late payment penalty and

other penalties may apply as provided in A.R.S. § 42‑1125. Penalties and interest are assessed based on the statutory due date of the 20th day of the month.

Amended Returns:

Form TPT‑1 must also be used to amend original returns that were filed for any previous reporting periods. To amend a previously filed Form TPT‑1, check the box in Section I marked “Amended Return” and complete the return with the corrected numbers. Amended Form TPT‑1 returns require some changes in the reporting of certain lines on the return as specifically noted in these instructions. See the instruction items shown with an asterisk (*).

PLEASE NOTE: All of the lines in the

DUE DATE: An amended return which claims a refund or credit must be filed within

four years of the due date of the original return or four years from the date the original return was filed, whichever date is later. A taxpayer may not use an amended return

to change a payment of estimated tax or to change the application of a claimed estimated tax payment.

ADOR 10872 (4/19) |

Page 1 |

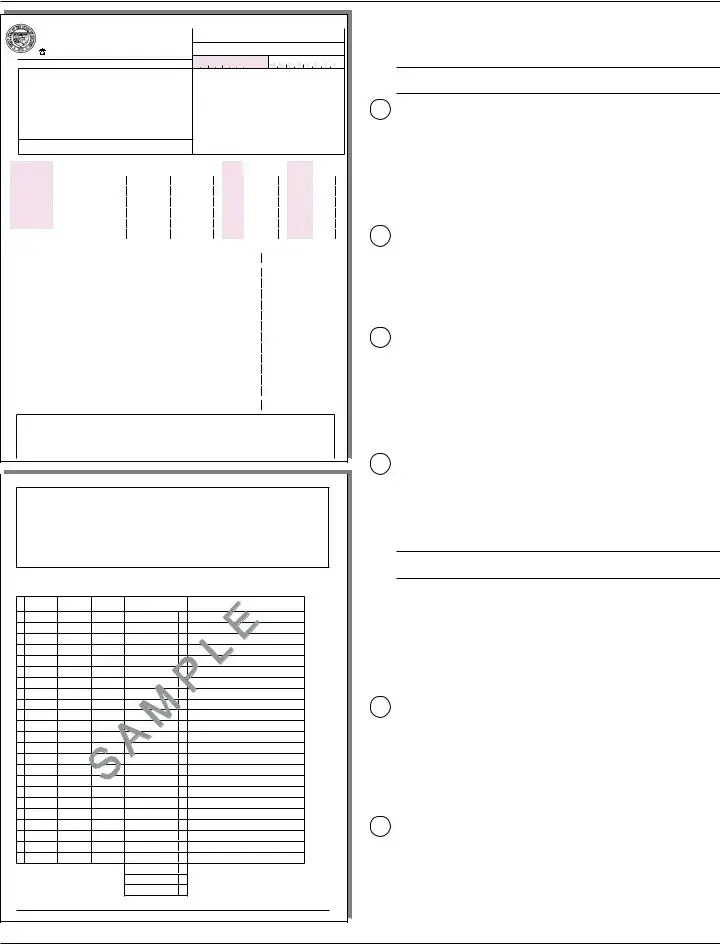

Transaction Privilege, Use,

and Severance Tax Return

TRANSACTION PRIVILEGE, USE, AND |

||

SEVERANCE TAX RETURN |

the reporting period. |

|

STATE LICENSE NUMBER: |

||

Arizona Department of Revenue |

||

|

PO BOX 29010 • PHOENIX, AZ |

|

TAXPAYER IDENTIFICATION NUMBER: |

|

|

|

|

||

FOR ASSISTANCE |

(602) |

|

|

|

|

|||

EIN |

SSN |

|

|

|

|

|

||

STATEWIDE, TOLL FREE FROM AREA CODES 520 AND 928: (800) |

PERIOD BEGINNING: |

PERIOD ENDING: |

|

|

|

|||

I. TAXPAYER INFORMATION |

|

M M D D Y Y Y Y |

M M D D |

Y |

Y |

Y |

Y |

|

Amended |

Multipage |

Final Return: DOR USE ONLY |

LABELED RETURN |

|||

Return |

Return |

Only Return |

(CANCEL LICENSE) |

|

||

BUSINESS NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

C/O |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

POSTMARK DATE |

|

|

|

|

|

|

|

|

CITY |

|

STATE ZIP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED DATE |

|

Address Changed

II. TRANSACTION DETAIL (If more reporting lines are necessary, please attach continuation pages.)

LINE |

|

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

|

|

(G) |

(H) |

(I) |

|

(J) = (F × I) |

|||

|

BUSINESS |

REGION |

BUSINESS |

|

|

|

|

|

|

|

|

|

ACCOUNTING |

|

ACCOUNTING |

||

|

DESCRIPTION |

CODE |

CODE |

GROSS AMOUNT |

DEDUCTION AMOUNT |

NET TAXABLE AMOUNT |

TAX RATE |

TOTAL TAX AMOUNT |

CREDIT RATE |

|

CREDIT |

||||||

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III. TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Total deductions from Schedule A |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

1 |

|

|

1 |

|

|

|

|

|

|

|

|

|

||||

|

|

Total Tax Amount (from column H) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

2 |

|

|

2 |

|

|

|

|

|

|

|

|

|

||||

|

3 |

State excess tax collected |

|

|

+ |

3 |

|

|

|

|

|

|

|

|

|

||

|

4 |

Other excess tax collected |

|

|

+ |

4 |

|

|

|

|

|

|

|

|

|

||

|

5 |

Total Tax Liability: Add lines 2, 3, and 4 |

|

= |

5 |

|

|

|

|

|

|

|

|

|

|||

|

6 |

..............................................................Accounting Credit (from column J) |

|

|

6 |

|

|

|

|

|

|

|

|

|

|||

|

7 |

State excess tax accounting credit: Multiply line 3 by .01 |

+ |

7 |

|

|

|

|

|

|

|

|

|

||||

|

8 |

Total Accounting Credit: Add lines 6 and 7 |

|

= |

8 |

|

|

|

|

|

|

|

|

|

|||

|

9 |

................................................Net tax due line: Subtract line 8 from line 5 |

|

|

9 |

|

|

|

|

|

|

|

|

|

|||

|

10 |

Penalty and interest |

|

|

|

+ |

10 |

|

|

|

|

|

|

|

|

|

|

|

11 |

TPT estimated payments to be used |

|

- |

11 |

|

|

|

|

AMENDED RETURN ONLY |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

ORIGINAL REMITTED AMOUNT |

|

|||

|

12 |

Total amount due this period |

....................................................................... |

|

= |

12 |

|

|

|

|

$ |

|

|

|

|

||

|

13 |

Additional payment to be applied (for other periods) |

+ |

13 |

|

|

|

|

|

|

|

|

|

||||

|

|

TOTAL AMOUNT REMITTED WITH THIS RETURN |

= |

|

|

|

|

|

$ |

DOR USE |

|

|

|||||

|

14 |

14 |

|

|

|

|

|

|

|

|

|||||||

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

|

|

|

|

|

|

► |

|

|

|||

|

|

|

|

|

|

|

PAID PREPARER’S SIGNATURE (OTHER THAN TAXPAYER) |

||||

|

|

|

► |

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER’S SIGNATURE |

DATE |

|

PAID PREPARER’S EIN OR SSN |

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

ADOR 10872 (2/16) |

Please make check payable to Arizona Department of Revenue. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction Privilege, Use, and Severance Tax Return |

|

LICENSE NO. ______________________ |

|

|

|||||

Schedule A: Deduction Detail Information

The deduction amounts that have been listed on the lines in Section II, Column E must be itemized by category for each Region Code and Business Code reported. The total of the amounts listed in Schedule A must equal the total of the Deduction Amounts listed on page 1. (See page 4 of the

Deduction Codes for itemizing deductions, with a paraphrased description of the deduction (or exemption), are listed at www.azdor.gov. Some of the codes may be used for more than one business code. Several additional Deduction Codes, as well as the statutory wording and any administrative guidance for each deduction code, are provided on the Department’s web site. The actual text of the statutory deduction, exemption or exclusion is controlling for amounts taken as deductions on Form

SCHEDULE A

Deduction Detail

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

DEDUCTION |

DEDUCTION |

DESCRIPTION OF |

||||

REGION CODE |

BUSINESS CODE |

|||||

CODE |

AMOUNT |

DEDUCTION CODE |

||||

|

|

|

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

A Subtotal of Deductions ..............................

B Deduction Totals from Additonal Page(s) ..

CTotal Deductions (line A + line B = line C)..

Total Must Equal Total on Page 1, Section III, line 1

ADOR 10872 (3/15)

INSTRUCTIONS

The following numbered instructions correspond to the numbered sections of the sample Form TPT‑1. An example of completing

Section II of Form TPT‑1 and Schedule A is provided on page 4. When completing this form, please print or type in black ink.

Section I – Taxpayer Information

1 *Business Name and Address

If you are preparing a blank form, write in the correct information. If you are completing a preprinted form, check the accuracy of the business name and mailing address printed on the form. Make corrections on the form as required. If you make changes to the address, check the “Address Changed” box. If the return is an *amended return, a multipage return, a one‑time only return, or if you are canceling your license and this is your final return, please check the appropriate

box.

2State License Number

If you are preparing a blank form, write in the correct number. If you are completing a preprinted form, check the accuracy of the Transaction Privilege Tax or Use Tax license number printed on the form. This number should include all eight (8) numerical digits. The state license number must also be placed in the top right hand corner

of all other pages of the return.

3Taxpayer Identification Number

In addition to the Transaction Privilege Tax License Number, a Taxpayer Identification Number is also required when filing any return. Check the accuracy of the Taxpayer Identification Number. The Taxpayer Identification Number is the number that the licensee uses to report federal income tax for the business: either the federal employer identification number (EIN) or social security number (SSN). Missing, incorrect or illegible Taxpayer Identification Numbers

may result in a penalty and will cause delays in processing the return.

4 Reporting Period

Check the accuracy of the PERIOD BEGINNING and the PERIOD ENDING boxes, and make corrections if necessary. If this

information is missing, write in the correct periods in an eight‑digit

format (MMDDYYYY). Taxpayers that have been authorized by the Department to file on a quarterly or annual basis must enter the first

and last months of the quarter or year in these periods.

Section II – Transaction Detail

*Note: For an amended return, complete Section II (and Schedule

A)with the corrected numbers. Include all lines that were present on the original return, even if there are no changes to some lines. See below for special instructions for certain lines in Section III Tax Computation.

For any return which requires more than five lines, use a continuation sheet to report the additional lines, and check the “multipage return” box in Section I.

5Business Code Description [Column A]

This column will identify your type of business, or “code.” For example, “retail,” “restaurant/bar,” “contracting,” etc. A list of business codes and other reporting categories, and the corresponding business code numbers, can be found in Table I of the TAX RATE TABLES.

When reporting “program” city tax on the TPT‑1, write the city name in this column. A list of “program” cities can be found in Table II of the

TAX RATE TABLES.

6Region Code [Column B]

This column identifies the county or city in which you conduct business, or the special region code required of some businesses. For counties or special regions, the region code will be three letters

(e.g., MAR for Maricopa County). For program cities, the region code

will be two letters (e.g., KM for Kingman). Please refer to the TAX RATE TABLES for the appropriate region codes. (See Tables II, IV,

or V.)

ADOR 10872 (4/19) |

Page 2 |

Transaction Privilege, Use, |

|

and Severance Tax Return |

INSTRUCTIONS |

7Business Code [Column C]

For reporting state and county tax, this column identifies the three‑digit number corresponding to your business codes, which can be found in Table I of the TAX RATE TABLES. (e.g., 017 is the business code number for a retail business).

For reporting program city tax, this column identifies the category of city tax that is being reported. These three‑digit numbers can be found in Table II of the TAX RATE TABLES. Please note that these numbers may vary by city.

8Gross (Receipts) Amount [Column D]

For each line item (reported business code or city), enter the gross

income in column D. Enter the gross amount of money, cash or other consideration you received during the reporting period of the return

(if you are using the cash receipts basis of accounting), or the total amount of revenue you invoiced, billed or otherwise recognized during this reporting period (if you are using the accrual basis of accounting). For both methods of reporting, the amount reported as gross income should include the tax amount collected. The tax will be deducted in column E.

9Deduction Amount [Column E]

Enter that portion of the reported gross receipts that is deductible or

exempt income. (For most deductions or exempt income, the seller

should retain appropriate documentation relating to the deductible or exempt income.) Deductions are to be itemized by category in Schedule A on page 2 of the TPT‑1 form. Unsubstantiated or incorrect deductions will be disallowed and penalties and interest may apply. (See separate instructions for completing Schedule A on page 4.) Common deductions include income from: sales for resale; labor or delivery charges for retail sales; sales of exempt manufacturing equipment; and exempt retail food sales.

Deduction for Taxes

The most common deduction is the deduction for tax itself. The gross receipts in column D should include whatever tax you have collected. Deduct this tax amount to avoid calculating tax on an amount that already includes tax. You are allowed to deduct state, county, and city taxes you collected and included in your gross amount. Or, if you did not separately charge and collect tax, you are allowed to assume that the tax collected is a part of the gross receipts amount, and you can factor that tax.

Accounting Credit

The State of Arizona provides a credit for accounting and reporting expenses. The accounting credit is applicable only to state

Transaction Privilege Tax or Severance Tax; it does not apply to city, county or other taxes. (See Table I of the TAX RATE TABLES for the state business codes eligible for the accounting credit.) The Department allows this credit to taxpayers who file and pay their

transaction privilege taxes timely and in full. If these conditions are not met, the accounting credit will be disallowed. The credit is equal to 1% of the amount of state tax due, but cannot exceed $10,000 for

a calendar year. [See A.R.S. § 42‑5017 and Arizona Administrative Code (A.A.C.) Rule R15‑5‑2007 for more information.]

13Accounting Credit Rate [Column I]

The accounting credit rate for your code should be preprinted on the form. If you are preparing a blank form, you can find the accounting credit rates in Table I of the TAX RATE TABLES.

14*Accounting Credit [Column J]

Multiply column F by column I. Enter the result in column J. This is

your accounting credit. (For an *amended return in which the state transaction privilege tax liability is increased, the accounting credit is limited to what was claimed on the original return.)

Subtotals

It is only necessary to add the amounts in columns E, H and J. For

multipage returns, you may enter the grand totals of all columns E, H and J on this line.

15Section III – Tax Computation

Line 1: Total Deductions from Schedule A

Enter the sum of the deduction amounts entered in Schedule A, which should equal the sum of all amounts entered in column E.

Line 2: Total Tax Amount

This amount should be the sum of the amounts entered in column H

on page 1 plus any additional pages.

Line 3: State Excess Tax Collected

By law, if you collected more tax than is calculated as due, the combined excess must be reported and paid to the Department of Revenue. Excess state tax collected should be entered on line 3.

Tax Factoring

Tax factoring is appropriate only when the taxes were not separately charged to the customer or charged to the customer at an incorrect rate.

Taxes can be factored from gross receipts by using a mathematical formula, or by using the “factors” provided on the Department’s web site. (Additional information about factoring is provided in the

Department’s TRANSACTION PRIVILEGE TAX PROCEDURES TPP 00‑1 and TPP 00‑2 available at www.azdor.gov.)

10Net Taxable Amount [Column F]

Subtract column E from column D. Enter the result in column F. This is the net income that is subject to tax.

11Tax Rate [Column G]

If you receive your tax returns by mail or file online, the tax rates for your code or for the cities for which you report should be preprinted on Form TPT‑1. If they are not preprinted or you obtain a blank form, you can find the tax rates by checking the TAX RATE TABLES, which are available on the Department’s web site

(www.azdor.gov) and are updated frequently. The tax rate shown on the return should be expressed as a decimal. (For example,

6.3% = .06300)

12Total Tax Amount [Column H]

Multiply column F by column G. Enter the result in column H.

Line 4: Other Excess Tax Collected

Other excess tax (city or county) collected/charged should be entered

on line 4.

Line 5: Total Tax Liability

Add lines 2, 3, and 4 and enter the sum on line 5.

Line 6: Accounting Credit

This amount should be the sum of the amounts entered in column J

on page 1 plus any additional pages.

Line 7: State Excess Tax Accounting Credit

Multiply line 3 by .01 and enter the result on line 7.

Line 8: Total Accounting Credit

Add lines 6 and 7 and enter the result on line 8.

Line 9: Net Tax Due

Subtract line 8 from line 5 and enter the result on line 9.

Line 10: Penalty and Interest

By law, returns that are filed late are assessed a late filing penalty of 4.5% per month or any portion of a month up to a maximum of 25% of

the amount of tax reported on the return without any deduction for tax paid on or before the due date. The late payment penalty is .5%

per month up to a maximum of 10%. The maximum total of these two penalties cannot exceed 25 percent of the tax due.

ADOR 10872 (4/19) |

Page 3 |

Transaction Privilege, Use,

and Severance Tax Return

Arizona’s interest rate is the same as the federal rate and continues to accrue until taxes are paid. Interest rate tables are available on the Department’s web site, or you may contact the Department at one of the phone numbers listed on page 1. Late payments of estimated tax are also subject to penalty and interest.

*Line 11: Estimated Tax Payments

Visit AZTaxes.gov to make your Transaction Privilege Tax Estimated

Payment. (Note: For an *amended return in which an estimated tax payment was claimed on the original, do not restate the payment.)

Annual Estimated Tax Payment Filing Requirements

Some taxpayers are required to make a single Annual Estimated Tax Payment on June 20th. These are taxpayers that have previously had an annual tax liability of $1,000,000 or more, or those who can reasonably anticipate such a liability in the current year. (See A.R.S.

§42‑5014, A.A.C. Rule R15‑5‑2215 for additional information and instructions.)

Line 12: Total Amount due this Period

Add lines 9 and 10. Subtract line 11 from this amount and enter the

result on line 12.

Line 13: Additional Payment to be Applied

If you owe a tax, penalty or interest liability originating from the filing of a previous TPT‑1 return, you may include payment of this liability

with this return. Please enter the amount of the additional payment on line 13.

*Line 14: Total Amount Remitted With This Return

Add lines 12 and 13 and enter the result on line 14. (For an *amended return, you may note the amount paid with the original return in the box to the right of line 12. On line 14, indicate only the additional amount remitted with the amended return. If the amended return is claiming a refund, leave line 14 blank and the Department will compute the refund due.)

Signature

Sign the return. Every return must be signed by the taxpayer or the taxpayer’s authorized agent as noted.

Paid preparer’s signature. If the return has been prepared by a paid preparer, the return must include the paid preparer’s signature and

Taxpayer Identification Number.

SCHEDULE A INSTRUCTIONS (Page 2)

16IN Schedule A, the deductions that have been taken in column E on page 1 must be itemized by category. The total of the amounts

listed in Schedule A should equal the total of the amounts listed in column E. The deductions taken on all lines in Section II, including lines that report city tax, must be itemized. To view all codes and the

statutory language of the deductions for which codes are provided, as well as any administrative guidance provided by the Department, please go to www.azdor.gov/Forms/TransactionPrivilegeTax.aspx and click on “TPT‑1 Deduction Codes.”

Schedule A should be completed as follows: In columns K (Region Code) and L (Business Code), list the region code and business code corresponding to the line on which the deduction was taken in Section II on page 1. In column M (Deduction Code), choose the appropriate deduction code from the Deduction Code List. In column

N (Deduction Amount), list the description of each deduction code. In column O (Description of Deduction Code), list the specific amount of each deduction.The total itemized deductions in Schedule A should equal the total of the deduction amounts in column E in Section II.

INSTRUCTIONS

Example: Completing Section II and Schedule A

A retailer located in Carefree (which has a 3% city privilege tax rate) has $2,174.50 of gross receipts which breaks down as follows:

GROSS RECEIPTS |

$2,174.50 |

DEDUCTIONS: |

|

Nontaxable Sales for Resale |

400.00 |

Exempt Delivery Charges |

120.00 |

State and County Tax ($1,500 × 7.3%) |

109.50 |

Carefree City Tax ($1,500 × 3.0%) |

45.00 |

TOTAL DEDUCTION AMOUNT |

<$674.50> |

NET TAXABLE AMOUNT |

$1500.00 |

Carefree is a “program” city (located in Maricopa County) whose city taxes are administered and collected by the Department on Form TPT‑1. Combined state and county taxes are reported on one line in

Section II, and city taxes are reported on a separate line in Section

II.In reporting the state transaction privilege tax and county excise taxes, MAR is the Region Code for Maricopa County, and 017 is the state Business Code for retail sales. In reporting the Carefree privilege tax, CA is the Region Code and 017 is the Business Code for Carefree’s city retail privilege tax.

In Section II on the front of the form, the income, deductions and tax are reported as follows:

II.TRANSACTION DETAIL (If more transaction locations, please attach additional sections.)

LINE |

(A) |

(B) |

(C) |

(D) |

(E) |

(F) |

(G) |

(H) |

|

BUSINESS |

REGION |

BUSINESS |

GROSS |

DEDUCTION |

NET TAXABLE |

|

TOTAL TAX |

ACC |

|

|

DESCRIPTION |

CODE |

CODE |

AMOUNT |

AMOUNT |

AMOUNT |

TAX RATE |

AMOUNT |

CRE |

1 |

Retail |

MAR |

017 |

2174 50 |

674 50 |

1500 00 .07300 |

109 50 |

|

|

2 |

Carefree |

CA |

017 |

2174 50 |

674 50 |

1500 00 .03000 |

45 00 |

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal |

|

|

1349 00 |

|

|

154 50 |

|

|

On Schedule A, the deductions are itemized as follows:

SCHEDULE A

Deduction Detail

LINE |

(K) |

(L) |

(M) |

(N) |

(O) |

|

|

DEDUCTION |

DESCRIPTION OF |

DEDUCTION |

|

||||

REGION CODE |

BUSINESS CODE |

|

|||||

CODE |

DEDUCTION CODE |

AMOUNT |

|

|

|||

|

|

|

|

|

|||

1 |

MAR |

017 |

551 |

Tax Collected or Factored |

154 |

50 |

|

2 |

MAR |

017 |

503 |

Sales for Resale |

400 |

00 |

|

3 |

MAR |

017 |

549 |

Services Provided by Seller |

120 |

00 |

|

4 |

CA |

017 |

551 |

Tax Collected or Factored |

154 |

50 |

|

5 |

CA |

017 |

503 |

Sales for Resale |

400 |

00 |

|

6 |

CA |

017 |

549 |

Services Provided by Seller |

120 |

00 |

|

A Subtotal of Deductions |

|

|

1349 |

00 |

|

||

|

|

|

|||||

B Deduction Totals from Additonal Page(s) |

0 |

00 |

|

||||

|

|

|

|

|

|||

C Total Deductions (line A + line B = line C) |

1349 |

00 |

|

||||

|

Total Must Equal Total on Page 1, Section III, line 1 |

|

|

|

|||

You will notice that the Total Deductions listed in Schedule A is equal

to the total of the amounts listed in column E in Section II. The total from Schedule A is also to be entered on line 1 in Section III on page 1 of Form TPT‑1. Unsubstantiated or incorrect deductions will be

disallowed and penalties and interest may apply.

ADOR 10872 (4/19) |

Page 4 |

Document Specifics

| Fact Name | Description |

|---|---|

| Governing Laws | The due date and penalties for late filing/payment are governed by Arizona Revised Statutes § 42‑5014 and § 42‑1125. |

| Online Filing Availability | Form TPT-1 can be filed online via the Arizona Department of Revenue's website, AZTaxes.gov, offering convenience and compliance with due date requirements. |

| Penalties for Late Filing | Failure to file the Form TPT-1 by the due date results in late filing penalties, calculated based on the total amount of tax reported on the return, as stipulated by A.R.S. § 42‑1125(A). |

| Amended Returns | Form TPT-1 must be used to amend previously filed returns. Amended returns require all lines to be reported again, not just the changes, and must be filed within four years of the original return's due date or filing date, whichever is later. |

Guide to Writing Transaction Privilege Severance Tax Return

Filing your Transaction Privilege, Use, and Severance Tax Return (Form TPT-1) timely and accurately is crucial for any business operating in Arizona. This form is necessary for reporting and paying any taxes owed on sales transactions within the state. The process may seem daunting, but breaking it down into steps can make it manageable. Below are the detailed steps you'll need to follow to fill out this form correctly. Please note, for detailed instructions including tax rates and codes, refer to the Arizona Department of Revenue’s website or contact their customer service for guidance.

- Register your business at www.AZTaxes.gov. If you've already done this, proceed to step 2.

- Prepare your documents: Before filling out the form, gather all necessary records of sales and any deductible transactions.

- Download or access Form TPT-1 through the Arizona Department of Revenue's website. You can also file online for quicker processing.

- Section I - Taxpayer Information: Fill in your business information, including name, address, state license number, taxpayer identification number, and reporting period. Mark any applicable boxes for amended, multipage, one-time, or final returns, and indicate if there has been an address change.

- Section II - Transaction Detail: Report your business code description, region code, business code, gross amount, deduction amount, net taxable amount, tax rate, total tax amount, and any credit in the corresponding columns.

- If necessary, attach Schedule A: Itemize your deductions by category for each reported region and business code. Ensure the total deductions match the amounts claimed in Section II.

- Section III - Tax Computation: Calculate your total tax liability, accounting for any deductions, excess tax collected, and applicable credits. Deduct any previous payments or credits to find out the net tax due, and include any penalties or interest if applicable.

- Payment Information: If due, calculate the total amount to be remitted with the return, including any additional payments for other periods or prior liabilities.

- Sign and Date: Ensure the form is signed by the taxpayer or authorized agent and, if prepared by someone other than the taxpayer, the preparer’s information is included.

- Submit the form: Mail your completed Form TPT-1 to the Arizona Department of Revenue before the deadline stated in the instructions to avoid penalties. Alternatively, you can file and pay online at www.AZTaxes.gov.

After successfully submitting Form TPT-1, keep a copy for your records and make note of the next filing deadline. Staying ahead of deadlines and maintaining accurate records will make the process smoother for future filings. Should you have questions or need assistance, the Arizona Department of Revenue offers resources and support through their customer service centers and online platform.

Understanding Transaction Privilege Severance Tax Return

Who is required to file the Transaction Privilege, Use, and Severance Tax Return (Form TPT-1)?

Every business that earns income subject to transaction privilege tax, county excise tax, use tax, or severance tax, is required to file Form TPT-1. This includes those without tax liability for the reporting period. Additionally, taxes for "program" cities should be reported on this form. Businesses in "non-program" cities should note that their city taxes are not reported on Form TPT-1.

What is the deadline for filing Form TPT-1?

Form TPT-1 must be submitted on or before the 20th day of the month following the collection or accrual of the tax. This means if the tax was collected or accrued in March, the form is due by April 20th. However, the law permits the form to be considered timely if received by the Department on or before the second to last business day of the month. For electronically filed returns, the Department must receive the filing and payment by the last business day of the month, with transactions initiated by 5:00 p.m. the preceding day.

What are the penalties for late filing or payment of taxes due on Form TPT-1?

Late filing of Form TPT-1 attracts a penalty computed against the total tax amount reported, without deduction for any tax that was paid on or before the due date. The late filing penalty, under A.R.S. § 42‑1125(A) and clarified by A.R.S. § 42‑5014(E), as well as a late payment penalty, will apply. These are assessed based on the statutory due date. Additional penalties and interest for late payment are also applicable, with rates based on the federal rate, and continue accruing until the tax is paid.

How can one file an amended Form TPT-1 return?

To amend a previously filed Form TPT-1, taxpayers should check the "Amended Return" box in Section I of the form and input the corrected figures. It's crucial to include all lines from the original return in the amended one, even those without changes, and special attention should be paid to lines requiring modifications as per the instructions. An amended Form TPT-1 that either claims a refund or credit must be filed within four years of the original return's due date or the date it was actually filed, whichever is later. Taxpayers cannot use an amended return to alter a payment or application of an estimated tax payment.

Common mistakes

Filing taxes can be daunting, and the Transaction Privilege, Use, and Severance Tax Return form (TPT-1) in Arizona is no exception. A small mistake can lead to penalties or a delay in processing. Here are five common missteps people often make when completing the TPT-1 form:

- Missing or incorrect Taxpayer Identification Number: It’s crucial to double-check the accuracy of the Taxpayer Identification Number, which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). An incorrect, missing, or hard to read number can lead to penalties and processing delays.

- Incorrect reporting period: People sometimes enter the wrong reporting period dates or format them incorrectly. It's important to use the eight-digit format (MMDDYYYY) to ensure the period is clearly understood. This mistake can cause confusion and delay the review process.

- Overlooking the “deductions”: Often, filers forget to itemize and substantiate their deductions properly in Schedule A. Each deduction must be listed by category for each Region Code and Business Code reported. Unsubstantiated or incorrect deductions will not be allowed. This not only potentially increases the tax due but can also lead to penalties.

- Miscalculating the tax: A common error is incorrectly factoring the tax or failing to deduct the collected tax from gross receipts. This results in an overestimate of the net taxable amount, leading to an overpayment of taxes or unnecessary complications.

- Failing to claim or incorrectly calculating the accounting credit: The state of Arizona provides an accounting credit for the expense of computing and reporting taxes. However, filers often overlook this credit or miscalculate the amount, which could reduce the amount of tax payable.

Knowing these common pitfalls can help ensure a smoother process when filing the TPT-1 form. Always take the time to review the entire form carefully before submitting it to avoid these and other potential mistakes.

Documents used along the form

When working with the Transaction Privilege Severance Tax Return form, various other forms and documents frequently accompany or support the filing process. Understanding these documents is crucial for ensuring accurate and complete compliance with tax obligations.

- Schedule A - Deduction Detail Information: This form is essential for itemizing deductions by category for each Region Code and Business Code reported on the TPT-1. It allows businesses to clarify the nature of deductions claimed, providing a necessary level of detail to ensure accuracy in tax reporting.

- Annual Financial Statements: These documents, including income statements and balance sheets, provide a comprehensive overview of the business's financial performance and position, valuable for accurately reporting income and deductions.

- Sales and Purchase Invoices: These documents are crucial for verifying the gross receipts reported on the tax return and the legitimacy of deductions for sales for resale and exempt transactions.

- Exemption and Resale Certificates: These certify that a purchase is made for resale or qualifies for a specific exemption. Keeping these certificates is vital for substantiating deductions taken for sales for resale or exempt sales.

- Payment Records: Evidence of tax payments, including electronic payment confirmations or canceled checks, is important to document the timely fulfillment of tax obligations and to reconcile with the amounts reported on the tax return.

- City and County Tax Returns: For businesses operating in "non-program" cities or needing to report specific local taxes, filing corresponding local tax returns is necessary alongside the TPT-1 form.

- Transaction Privilege Tax Exemption Certificate (Form 5000): This form is used to document the purchase of goods that are exempt from the transaction privilege tax, supporting deductions related to exempt sales.

- Estimated Tax Payment Records: For businesses making estimated tax payments throughout the year, keeping records of these payments is important for accurately completing the tax return and avoiding overpayment or underpayment of taxes.

Thoroughly understanding and accurately completing these forms and maintaining the supporting documents is imperative for correctly filing the Transaction Privilege Severance Tax Return form. This ensures compliance with tax laws and helps avoid penalties for underreporting or late payment of taxes.

Similar forms

The first document similar to the Transaction Privilege Severance Tax Return (TPT-1) form is the Sales and Use Tax Return form utilized in various states. Both documents require businesses to report gross receipts, taxable sales, and deductions or exemptions to determine the net taxable amount. Sales and Use Tax Returns also often involve itemizing sales in different categories based on statutory provisions, similar to how the TPT-1 form necessitates the detailing of transactions by business and region codes. Additionally, both types of forms may include provisions for amending filed returns and computing late fees or penalties for overdue submissions, emphasizing compliance with timely filing requirements.

Another comparable document is the Business License Renewal form, which, like the TPT-1, mandates businesses to provide detailed financial and operational information to a municipal or state authority. While the Business License Renewal doesn't directly calculate taxes owed, it often serves as a prerequisite for maintaining active tax accounts and is contingent upon accurate reporting of business activities, much like the TPT-1 form's role in tax compliance. Both documents affirm the business's ongoing eligibility to operate within the jurisdiction by ensuring up-to-date record-keeping and financial transparency.

The Corporate Income Tax Return is also akin to the TPT-1 form as it requires the reporting of income, deductions, and the computation of tax liabilities on a periodic basis. Both documents are critical in fulfilling statutory tax obligations and may necessitate detailed record-keeping to substantiate reported figures. Where the TPT-1 focuses on transaction-based taxes, Corporate Income Tax Returns concentrate on a company's overall earnings, with both forms potentially requiring amendments for previously filed returns to correct or update reported amounts.

Comparable to the TPT-1 is the Employer's Quarterly Federal Tax Return (Form 941) that businesses use to report income taxes withheld from employees' wages, along with Social Security and Medicare taxes. Although focusing on different tax obligations, both forms serve the essential function of calculating taxes due to government authorities and ensuring businesses comply with their tax reporting responsibilities on a regular basis. Amendments and adjustments to previously filed returns are features common to both, facilitating corrections to ensure accurate tax reporting and payment.

Lastly, the Property Tax Statement, similar to the TPT-1 form, involves reporting the value of taxable property to compute the tax liability. While the Property Tax Statement focuses on real estate and tangible assets, both it and the TPT-1 form require accurate valuation—of property in one case and business transactions in the other—to determine tax due. Both documents play a pivotal role in the financial obligations businesses owe to governmental authorities and necessitate meticulous record-keeping to ensure compliance and prevent penalties.

Dos and Don'ts

When preparing to fill out the Transaction Privilege Severance Tax Return form, it is important to approach the task with attention to detail and a clear understanding of the requirements. Here are essential do's and don'ts to help guide you through the process smoothly and accurately.

Do:

- Ensure all taxpayer information is correct and up to date, including the business name, address, state license number, and taxpayer identification number. This helps avoid processing delays.

- Carefully calculate your gross receipts and accurately report them in the form. Remember to include the total amount of money, cash, or other considerations received during the reporting period.

- Itemize and substantiate all deductions in Schedule A of the form, attaching additional pages if necessary. Precise documentation supports the legitimacy of the deductions claimed.

- Factor in the accounting credit accurately, if applicable, to benefit from allowed deductions for accounting and reporting expenses.

- Double-check the completed form for accuracy before submission, ensuring all figures and submitted information are correct, including signature and date.

Don't:

- Overlook the need to file a return even if there is no tax liability due for the period. All businesses with income subject to transaction privilege tax, county excise tax, use, or severance tax are required to file.

- Misinterpret the tax rates and tax calculations. Ensure you use the correct rates as per the TAX RATE TABLES and accurately compute your tax liability.

- Forgetting to include Schedule A for deductions, as unsubstantiated or incorrect deductions will lead to disallowance and may accrue penalties and interest.

- Miss the filing and payment deadlines. Late submissions are subjected to penalties and interest based on statutory due dates, which can significantly increase your tax liability.

- Submit incomplete forms or documentation. Carefully review the form and all attached documents for completeness to avoid delays in processing or potential penalties.

Following these guidelines will help ensure the accurate and timely filing of the Transaction Privilege Severance Tax Return form, helping to avoid common pitfalls and errors that can result in unnecessary penalties and interest.

Misconceptions

When navigating the complexities surrounding the Transaction Privilege Severance Tax Return form (TPT-1) in Arizona, it's common for businesses and individuals to run into misconceptions. Clearing up these misconceptions can ensure that filings are accurate and compliant with state regulations. Here are four common misunderstandings and clarifications:

- The notion that online filing is optional: Many assume that the choice between online and paper filing is merely a matter of preference. However, the state highly encourages online filing due to its efficiency, reliability, and convenience. Filing and paying taxes online through www.AZTaxes.gov ensures compliance with due date requirements, potentially saving time and money.

- Misunderstanding of the due date: There's confusion about the specific due date for the TPT-1 form. While the general rule states that returns are due on the 20th day of the month following the reporting period, Arizona law allows a return to be considered timely if it is received by the Department on or before the second to last business day of the month. For electronic filings, this transaction must be initiated before 5:00 p.m. of the preceding day.

- Confusion over who must file: A common misconception is that only businesses with taxable sales in the reporting period need to file a Form TPT-1. In reality, all businesses with income subject to transaction privilege tax, county excise tax, use, or severance tax must file a return for each period, even if no tax liability is due. This includes reporting on behalf of “program” cities as detailed in the TAX RATE TABLES.

- Assumptions about amended returns: There's a belief that when submitting an amended TPT-1 return, only the changes need to be reported. This is incorrect. For an amended return, all lines of the TPT-1 form must be completed, not just the ones that have changes. This ensures that the Department of Revenue has a full and accurate reflection of the amended tax liabilities and corresponding information for the reporting period.

Understanding these key aspects of the Transaction Privilege Severance Tax Return can help taxpayers avoid common pitfalls and ensure their dealings with the Arizona Department of Revenue are smooth and penalty-free. It's important for all businesses to keep abreast of the specifics related to their tax obligations to foster a compliant and efficient reporting environment.

Key takeaways

Filling out and using the Transaction Privilege Severance Tax Return form (TPT-1) in Arizona involves understanding key details and requirements to ensure compliance. This brief guide is prepared to help businesses navigate through the process effectively:

All businesses with income subject to transaction privilege tax, use tax, or severance tax in Arizona must file a Form TPT-1, even if there is no tax liability for the period.

Form TPT-1 can be filed online, a method encouraged by the Arizona Department of Revenue for its convenience and efficiency in meeting due date requirements.

The due date for filing and payment is the 20th day of the month following the tax period. However, when filing electronically, the Department must receive the filing and payment by the last business day of the month.

Late filings are subject to penalties computed against the total amount of tax reported on the return, without deduction for taxes paid by the due date.

Amended TPT-1 returns must include corrections throughout the form, not only for the lines being amended. They are subject to specific deadlines and limitations on changes to estimated tax payments and the application of such payments.

Taxpayers must provide detailed taxpayer information and ensure accuracy, especially regarding the state license number and taxpayer identification number, to avoid processing delays and potential penalties.

The form requires detailed transaction information, including gross receipts amount, deduction amount, and net taxable amount. Deductions must be substantiated and correctly classified according to the Department's guidelines.

Schedule A attached to the form provides detail on deductions by category for each region and business code reported, ensuring that deductions are properly documented and justifiable.

The form offers an accounting credit for state privilege tax or severance tax, applicable to businesses that file and pay taxes timely and in full, with limitations on the credit for amended returns where the tax liability increases.

Correct completion of the form, including signatures and proper identification of the preparer if applicable, is crucial for the return to be considered valid and complete under law.

Understanding these key aspects of the TPT-1 return is crucial for businesses operating in Arizona, ensuring that they meet their tax obligations efficiently and effectively while minimizing the risk of errors and penalties.

Popular PDF Documents

How to Look Up Property Taxes - File for an abatement of real or personal property tax in Massachusetts using the comprehensive Tax 128 form.

Ptax 300 - The Illinois Department of Revenue requires submission of this form for reviewing potential tax exemptions for properties not used as homesteads.