Get Transaction Privilege Sales Tax Return Form

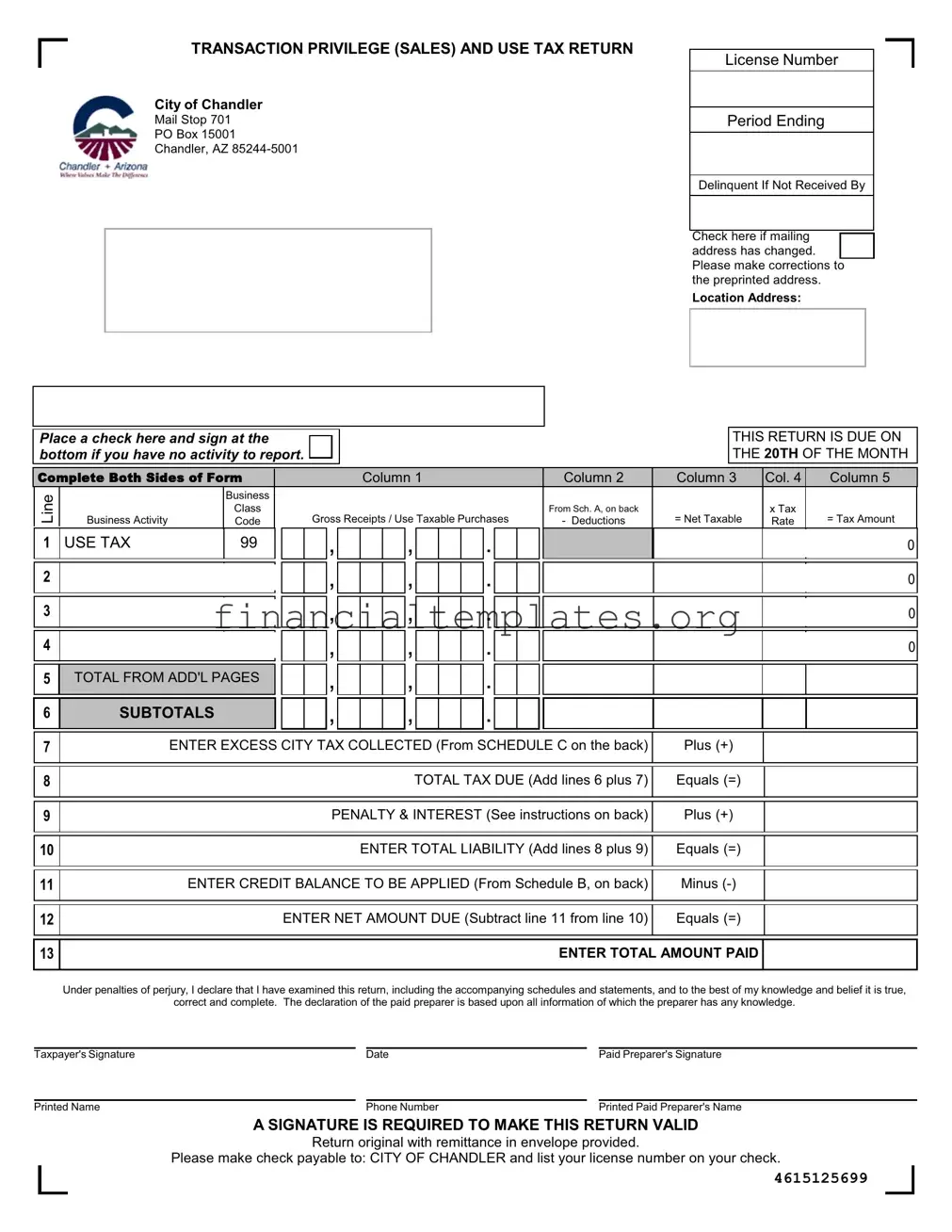

Navigating tax obligations can often feel complex and daunting, especially when dealing with specific forms like the Transaction Privilege (Sales) and Use Tax Return for the City of Chandler. This form, a crucial document for businesses within the jurisdiction, outlines the process for reporting and paying sales taxes to the city. Businesses are required to disclose their gross receipts, calculate taxable purchases after deductions, and ascertain the net taxable amount at a specified rate. This calculation culminates in determining the total tax due, accounting for any penalties, interest, or existing credits that may alter the final payment amount. Importantly, the form mandates completion and submission by a specific deadline—usually the 20th day of the month following the reporting period—to avoid penalties for late filing or payment, highlighting the necessity of prompt and accurate compliance. It also features sections for adjustments, such as credits from previous overpayments or excess tax collected, and stipulates the conditions under which various deductions and exemptions can be claimed, necessitating careful documentation and verification by businesses to ensure compliance and minimize their tax liabilities.

Transaction Privilege Sales Tax Return Example

TRANSACTION PRIVILEGE (SALES) AND USE TAX RETURN

City of Chandler

Mail Stop 701

PO Box 15001

Chandler, AZ

License Number

Period Ending

Delinquent If Not Received By

Check here if mailing address has changed. Please make corrections to the preprinted address.

Location Address:

Place a check here and sign at the bottom if you have no activity to report.

THIS RETURN IS DUE ON THE 20TH OF THE MONTH

Complete Both Sides of Form

Line |

|

Business |

|

Class |

|

Business Activity |

Code |

|

1 |

USE TAX |

99 |

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

4

5

TOTAL FROM ADD'L PAGES

TOTAL FROM ADD'L PAGES

6 |

SUBTOTALS |

|

|

|

|

|

|

Column 1 |

|

|

|

|

Column 2 |

Column 3 |

Col. 4 |

Column 5 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Sch. A, on back |

|

x Tax |

|

|

Gross Receipts / Use Taxable Purchases |

- Deductions |

= Net Taxable |

Rate |

= Tax Amount |

||||||||||||

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

1.5% |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7

ENTER EXCESS CITY TAX COLLECTED (From SCHEDULE C on the back)

Plus (+)

8 |

TOTAL TAX DUE (Add lines 6 plus 7) |

Equals (=) |

|

|

|

|

|

|

|

|

|

9 |

PENALTY & INTEREST (See instructions on back) |

Plus (+) |

|

|

|

|

|

|

|

|

|

10 |

ENTER TOTAL LIABILITY (Add lines 8 plus 9) |

Equals (=) |

|

|

|

|

|

|

|

|

|

11 |

ENTER CREDIT BALANCE TO BE APPLIED (From Schedule B, on back) |

Minus |

|

|

|

|

|

|

|

|

|

12 |

ENTER NET AMOUNT DUE (Subtract line 11 from line 10) |

Equals (=) |

|

|

|

|

|

13

ENTER TOTAL AMOUNT PAID

Under penalties of perjury, I declare that I have examined this return, including the accompanying schedules and statements, and to the best of my knowledge and belief it is true,

correct and complete. The declaration of the paid preparer is based upon all information of which the preparer has any knowledge.

Taxpayer's Signature |

Date |

Paid Preparer's Signature |

||

|

|

|

|

|

Printed Name |

|

Phone Number |

Printed Paid Preparer's Name |

|

A SIGNATURE IS REQUIRED TO MAKE THIS RETURN VALID

Return original with remittance in envelope provided.

Please make check payable to: CITY OF CHANDLER and list your license number on your check.

4615125699

License No. |

Report Period: |

9412125699 |

|

|

DUE DATE: City privilege tax returns are due on the 20th of the month following the reporting period. A return must be submitted even if no taxes are due. A return is considered delinquent if not received by the last business day of the month. A business day is any day except Saturday, Sunday or a legal City holiday.

Postmarks are not evidence of timely filing.

PENALTIES:

1.Failure to File - A penalty of 5% of the tax due will be assessed for each month, or fraction thereof, elapsing between the delinquency date of the return and the date received.

2.Failure to Pay - A penalty of 10% of any unpaid tax will be assessed if the tax due is not paid on or before the delinquency date.

3.Total Penalty - Combined Failure to File and Failure to Pay penalties assessed will not exceed 25%.

INTEREST: Taxes unpaid after the delinquency date are assessed interest that cannot be waived. Beginning 10/01/05, the interest rate is the rate in effect for the Arizona Depart- ment of Revenue, and outstanding interest is compounded annually on January 1.

SCHEDULE A - DETAILS OF DEDUCTIONS: All deductions and exemptions used in computing City transaction privilege tax must be entered below. Detailed records supporting all deductions and exemptions claimed must be maintained. Failure to maintain supporting records may result in the disallowance of claimed amounts.

Please note: Not all deductions are available for all business classifications.

SCHEDULE B - Credit Details: List credits to be used with this return. Documentation must be attached.

SCHEDULE C - Excess Tax Collected: List the excess tax collected by taxable activity.

NOTE: The line numbers at the top of each column below correspond with the line numbers listed on the front page.

|

|

|

|

|

|

|

|

Line 2 |

|

|

|

|

|

|

|

|

|

|

Line 3 |

|

|

|

|

|

|

|

|

|

|

Line 4 |

|

|

|

||||||||||||||||

SCHEDULE A |

Ded. |

|

|

|

|

Business Class Code |

|

|

|

|

|

Business Class Code |

|

|

|

|

Business Class Code |

||||||||||||||||||||||||||||||||

Deduction Description |

Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

|

Discounts and Refunds |

52 |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Sales for Resale |

54 |

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

55 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

Prescriptions / Prosthetics |

58 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

Gasoline & Use Fuel |

59 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

Retail Service Labor |

63 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

Tax Collected or Factored |

64 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Qualifying Healthcare Sales |

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Interstate Telecommunications |

66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Exempt Capital Equipment |

73 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

74 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

Food Stamps / WIC |

79 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bad debts on which tax was paid |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

82 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Other(explain)_____________ |

75 |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

Other(explain)_____________ |

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES TO U.S. GOVERNMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

50% of Retail |

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

100% of Manufacturing |

57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSTRUCTION CONTRACTING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

35% Standard Contracting |

70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

Subcontracting Income |

71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

. |

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

. |

|

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Deductions (copy totals to front)

, , .

, , .

, , .

SCHEDULE B Credit Details (must attach documentation)

|

1. Accounts Receivable Credit |

B |

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Speculative Builder Credit |

B |

|

|

, |

|

|

|

, |

|

|

|

. |

|

|

|

Total Schedule B (copy total to front, line 11) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

(For Taxes Paid By The Contractor) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SCHEDULE C Excess Tax Collected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Excess Tax by taxable activity |

C |

|

|

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

. |

|

|

|

|

|

, |

|

|

|

|

. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Schedule C (copy total to front, line 7) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR ASSISTANCE, CALL: City of Chandler (480) |

Fax: (480) |

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for reporting Transaction Privilege (Sales) and Use Tax to the City of Chandler. |

| Due Date | The form is due on the 20th of the month following the reporting period. |

| Delinquency Consequences | A return is considered delinquent if not received by the last business day of the month. Penalties apply for late filing and payment. |

| Governing Law | The form is regulated under the tax laws of the City of Chandler, as well as applicable Arizona state tax laws. |

| Penalties and Interest | Penalties include a 5% charge per month for failure to file and a 10% charge for failure to pay, not exceeding a 25% total. Interest accrues on unpaid taxes from the delinquency date. |

Guide to Writing Transaction Privilege Sales Tax Return

Filing the Transaction Privilege Sales Tax Return form is crucial for businesses operating within jurisdictions that require it, ensuring compliance with local tax regulations. It's a process that guarantees fair contribution towards city infrastructure and amenities, directly impacting the community's well-being. Accuracy in completing this form cannot be understated, as errors can lead to penalties, audits, or both. With a methodical approach and attention to detail, businesses can navigate this requirement smoothly and avoid common pitfalls associated with tax reporting.

- Locate your License Number and verify the Period Ending date to ensure that you're filing for the correct period. If not preprinted, fill these fields accurately.

- If there has been a change in your mailing address, tick the box indicating this change and update the address details accordingly.

- Check if the form shows the correct Location Address where your business operates. If incorrect, make the necessary corrections.

- If you had no business activity during the reporting period, indicate this by placing a check in the designated box and proceed to sign the form at the bottom. Otherwise, continue with detailing your transactions.

- Begin by filling out the information about your business on the provided lines:

- Enter your Business Class and corresponding Activity Code for each line.

- Detail any applicable USE TAX on line 1, following the instructions for calculating taxable purchases, deductions, and net taxable amounts.

- Add additional pages for detailed transactions if the space provided is insufficient.

- Transfer the totals from the additional pages, if any, to line 5 labeled TOTAL FROM ADD'L PAGES.

- Calculate your subtotal amounts across Columns 1 through 5 as instructed and input these into line 6 (SUBTOTALS).

- Complete the backside of the form, starting with SCHEDULE A, to detail deductions and exemptions. Transfer the totals to the front of the form as instructed.

- If you collected excess city tax, list this under SCHEDULE C on the back of the form. Again, transfer the totals to the front.

- Sum the subtotal and any excess tax collected to determine your TOTAL TAX DUE and enter this on line 8.

- Calculate any applicable PENALTY & INTEREST due to late filing or payment and enter the total on line 9.

- Deduct any credits listed on SCHEDULE B from your total liability to find the NET AMOUNT DUE, which you will enter on line 12.

- Confirm the TOTAL AMOUNT PAID matches the net amount due or rectify as necessary.

- Lastly, the form must be signed and dated to be considered valid. If someone prepared the form on behalf of the taxpayer, their signature, printed name, and phone number are also required.

- Ensure that your check for any tax owed is made payable to the CITY OF CHANDLER, with your license number noted, and submit the form and payment using the provided envelope.

Completing the Transaction Privilege Sales Tax Return entails meticulous attention to detail. Through careful review and adherence to the outlined steps, businesses can fulfill their tax obligations accurately and punctually. It's essential not just for legal compliance but for contributing to the local community's growth and sustainability. Don't hesitate to seek assistance from city officials or a professional tax advisor if you encounter difficulties or have questions during this process.

Understanding Transaction Privilege Sales Tax Return

What is the Transaction Privilege (Sales) and Use Tax Return form?

This form is a document businesses use to report and pay the sales tax and use tax they have collected or are liable for to the City of Chandler. The form includes sections to enter business information, calculate tax due, list deductions, credits, and excess tax collected, and certify the accuracy of the information provided under penalty of perjury.

How often do I need to file the Transaction Privilege (Sales) and Use Tax Return?

Businesses are required to file this tax return monthly. The due date for each return is the 20th of the month following the reporting period. For example, taxes collected in January would be reported and paid by February 20th. It's important to adhere to this schedule to avoid penalties and interest.

What happens if I miss the deadline for filing or payment?

If a business fails to file its return or pay the taxes due by the due date, penalties and interest will be assessed. The penalties include a 5% charge of the tax due for failure to file and a 10% charge for failure to pay, with the total penalty not exceeding 25% of the tax due. Interest on unpaid taxes begins accruing the day after the delinquency date and compounds annually. These charges can increase a business's tax burden significantly, so timely filing and payment are crucial.

Can I claim deductions on the Transaction Privilege (Sales) and Use Tax Return?

Yes, the form allows for various deductions depending on your business classification and activities. Common deductions include sales for resale, discounts and refunds, out-of-state sales, and government sales. Detailed records supporting all claimed deductions must be maintained as failure to do so may result in the disallowance of these deductions. Ensure you thoroughly review the deductions section (Schedule A) and only claim allowable deductions to avoid discrepancies.

What should I do if my mailing address changes?

If your mailing address changes, you must notify the City of Chandler by checking the designated box on the Transaction Privilege (Sales) and Use Tax Return form indicating a change of address. Then, make the necessary corrections to the preprinted address on the form. This ensures that all future communications and documents from the City regarding your tax obligations are sent to the correct location.

Common mistakes

Filling out tax forms accurately is essential to avoid errors that can lead to penalties, interest charges, or audits. The Transaction Privilege Sales Tax Return form, while straightforward for those familiar with its requirements, can still be a source of common mistakes. Here are six errors often encountered:

Incorrectly reporting gross receipts: Many individuals fail to accurately report all taxable and non-taxable sales in the gross receipts section. This mistake can distort the tax base and lead to incorrect tax calculations.

Not understanding deductions: It's common to see errors in applying deductions or exemptions that the form permits. Misinterpreting which deductions apply can either result in underpayment, which can attract penalties, or overpayment, which is financially unfavorable.

Ignoring the use tax liability: Some businesses overlook line 1 designated for use tax, not realizing that purchases from out-of-state vendors for use in the city must be reported and tax paid if the vendor did not charge Arizona sales tax.

Incomplete details in Schedules A, B, and C: These schedules require detailed information about deductions, credits, and excess tax collected. Omitting details or providing inaccurate information here can lead to the disallowance of claimed amounts or incorrect calculation of the tax due.

Failure to sign the form: The importance of the declaration at the bottom of the form is often overlooked. A signature is required to validate the return. Without it, the form is considered incomplete and could be rejected.

Incorrect or outdated mailing address: If the preprinted address is wrong or has changed, failing to check the box indicating a change of address and updating the information can lead to misdirected correspondence and possible misinterpretation of the taxpayer's compliance status.

To avoid these common pitfalls:

- Double-check all entered figures, especially gross receipts and deductions.

- Ensure understanding of all applicable deductions and how to properly document them.

- Don't overlook the use tax obligations—report and pay as necessary.

- Provide complete information in Schedules A, B, and C to support deductions, credits, and reported excess tax collected.

- Always sign the form before submission. An unsigned form is akin to not filing at all.

- Keep the business's mailing address up to date with the tax authority to ensure timely receipt of all correspondence.

While attention to detail might require additional time and resources, the cost of rectifying errors later on can be significantly higher, both in financial terms and in potential legal complications. Ensuring accuracy in filling out the Transaction Privilege Sales Tax Return form is essential for compliance and peace of mind.

Documents used along the form

When businesses prepare the Transaction Privilege (Sales) and Use Tax Return form, they often need to include additional forms and documents to complete their tax filing accurately. These documents play significant roles in detailing transactions, deductions, and other tax-related information that affects the total tax liability.

- Schedule A - Details of Deductions: This schedule is crucial for delineating all the deductions and exemptions claimed on the main tax return. It specifies types of deductions such as discounts, refunds, sales for resale, and out-of-state sales, which help in determining the actual taxable amount.

- Schedule B - Credit Details: Attached directly to the tax return, this document lists all the credits the taxpayer intends to claim. It must be supported with documentation, serving as proof for claims such as accounts receivable credit or speculative builder credits.

- Schedule C - Excess Tax Collected: This form identifies any surplus tax that has been collected beyond the taxable activity's liabilities. Accurate filing of this schedule ensures businesses do not wrongly retain or misreport excess sales tax collected.

- Annual Reconciliation Statements: Used once a year, this statement reconciles all monthly sales tax returns filed throughout the year, ensuring that the total tax paid matches the businesses' actual taxable revenue for the entire year.

- Exemption Certificates: Buyers intending to purchase goods for resale without paying sales tax must provide sellers with this certificate. It is crucial for businesses to keep these certificates on file as proof of nontaxable sales.

- Use Tax Payment Form: For businesses that purchase goods without paying sales tax at the time of purchase (often from out-of-state vendors), this form reports and pays use tax on those items.

- Adjusted Gross Income (AGI) Verification: Although not directly related to sales tax, AGI verification from the IRS can be required for certain tax credits that impact the overall tax liabilities of businesses.

- Documentation of Non-Taxable Transactions: Any records that substantiate non-taxable or exempt transactions must be available. This includes documentation for out-of-state sales, sales to nonprofit organizations, and government entities which are exempt from sales tax.

Taken together, these documents ensure that the Transaction Privilege (Sales) and Use Tax Return reflects an accurate account of a business's taxable activities. They support transparency and compliance, helping both businesses and tax authorities to streamline the tax reporting and payment process.

Similar forms

The Federal Income Tax Return (Form 1040) is markedly similar to the Transaction Privilege Sales Tax Return. Both documents require detailed financial information from the reporting entity, including income or sales, deductions, and calculating the net amount due to the government. While the Transaction Privilege Sales Tax Return focuses on sales activity, Form 1040 concentrates on personal income, showcasing their specificity to different tax obligations.

State Income Tax Returns share a common goal with the Transaction Privilege Sales Tax Return, aimed at calculating tax liabilities. However, they focus on personal or business income within a specific state. Both require the taxpayer to disclose income, applicable deductions, and compute the tax owed. They serve the purpose of ensuring that businesses and individuals meet their respective tax responsibilities within their jurisdiction.

The Business License Renewal forms, similar to the Transaction Privilege Sales Tax Return, often necessitate financial disclosures to calculate fees or taxes due based on business activity. Although the primary purpose is renewing the license to operate within a city or state, the financial data required echoes the transaction privilege form’s requirements for sales and deductions.

Sales and Use Tax Certificate of Registration applications bear resemblance to the Transaction Privilege Sales Tax Return in that they both deal with sales activities and the collection of taxes therein. While the former is about registering a business to legally collect sales tax from customers, the Transaction Privilege Sales Tax Return is about reporting and remitting those collected taxes to the tax authority.

Employer's Quarterly Federal Tax Return (Form 941) is akin to the Transaction Privilege Sales Tax Return as both are periodic disclosures to tax authorities. Form 941 requires businesses to report wages paid, taxes withheld from employees, and the employer's share of social security and Medicare taxes, aligning with the transaction privilege form's objective of reporting sales-based activities and tax liabilities.

The Annual Report and Personal Property Tax Return that many businesses file with their respective state departments share similarities with the Transaction Privilege Sales Tax Return. Both forms require financial information that impacts tax obligations, with the Personal Property Tax Return focusing on the valuation of business-owned property and the corresponding taxes.

Excise Tax Returns, like the Transaction Privilege Sales Tax Return, focus on specific business activities or products. These returns require companies to report on the production, sale, or use of certain goods subject to excise taxes, mirroring the transaction privilege form's detail in reporting sales and calculating taxes due based on specific business transactions.

The Value-Added Tax (VAT) Returns, applicable in many countries outside the United States, have a foundational similarity to the Transaction Privilege Sales Tax Return. Both involve calculating tax based on sales, albeit VAT is a tax on the value added at each stage of production or distribution. They share the process of reporting gross receipts and deductible expenses to determine the net tax due.

Unemployment Tax Returns, filed with state governments, have a connection to the Transaction Privilege Sales Tax Return through their focus on fiscal responsibilities of businesses. These returns calculate taxes based on payroll, akin to how the transaction privilege form calculates tax based on sales, emphasizing the business’s role in contributing to governmental funds.

The Property Tax Declaration documents, required by many local tax authorities, parallel the Transaction Privilege Sales Tax Return in their need for detailed asset information to calculate taxes. Property declarations require business owners to list the value of real estate and personal property, similar to how the transaction form records sales activities for tax assessment.

Dos and Don'ts

Filling out the Transaction Privilege Sales Tax Return form correctly is crucial for compliance with local regulations and to ensure accurate reporting of your business activities. Here are some guidelines to help you navigate the process:

Do:- Review the entire form before starting to ensure you understand all the requirements.

- Use accurate and complete information for your business, including the license number and period ending date.

- Check the box if your mailing address has changed and update the preprinted address as necessary.

- Sign and date the form to validate it. Remember, a signature is required to make this return valid.

- Forget to report even if you have no taxable activity for the period; place a check in the designated box and still submit the form.

- Omit any schedules or attachments that are relevant to your return, such as Schedule A for deductions or Schedule B for credit details.

- Delay submission past the due date. Returns are due on the 20th of the month following the reporting period, and penalties apply for late submissions.

- Disregard maintaining detailed records supporting all deductions and exemptions claimed, as failure to do so may result in disallowance.

Misconceptions

Understanding the Transaction Privilege Sales Tax Return form can often be overwhelming due to its complexity and the specific requirements involved. However, several common misconceptions can lead to errors when businesses attempt to file their taxes. Here's a list of four such misunderstandings and clarifications to help guide you:

- Misconception 1: If no sales were made, there’s no need to file a return.

Many believe that if their business didn’t make any sales during the reporting period, they don't need to submit a form. However, it's required to file a return for every period, even if there were no sales. The form provides a section to indicate that there was no activity, which still needs to be submitted by the due date to avoid penalties.

- Misconception 2: Penalties are only for late payment, not late filing.

This is incorrect. The City imposes penalties for both failing to file and failing to pay by the due date. The penalties can increase monthly for each infraction, making it costly for a business that overlooks these deadlines. Understanding the distinction and ensuring both timely filing and payment can save a business from unnecessary penalties.

- Misconception 3: Postmarks serve as proof of timely filing.

A common error is assuming that a postmark date is sufficient evidence that a return was filed on time. However, the City of Chandler specifies that a return is considered delinquent if not actually received by the last business day of the month, rendering the postmark irrelevant for timeliness. Businesses should plan to mail their returns with enough lead time or consider online filing options when available.

- Misconception 4: All deductions are available to every business.

Not every deduction listed on the Transaction Privilege Sales Tax Return form is applicable to all business types. Each deduction and exemption has specific qualifications that must be met. Businesses need to ensure that they only claim deductions that are relevant to their industry and activities to avoid errors in their tax return processing and potential issues with tax authorities.

Addressing these misconceptions and understanding the actual requirements for filing the Transaction Privilege Sales Tax Return form can help businesses avoid penalties, ensure compliance, and maintain smooth operations.

Key takeaways

Understanding the nuances of the Transaction Privilege Sales Tax Return form is crucial for anyone conducting business within the jurisdiction it applies. Here are five key takeaways to ensure accurate and timely filing:

- It is imperative to mark the due date on your calendar: Returns are expected on the 20th of the month following the reporting period. Compliance with this deadline avoids unnecessary penalties or interest charges.

- Even in periods of inactivity, submission of the report is mandatory. Checking the “no activity to report” box and signing at the bottom of the form fulfills this requirement, emphasizing the importance of filing regardless of business activity level.

- Accurate calculation of taxes due is essential; this includes diligent completion of all relevant sections. The form divides the process into clear segments — gross receipts, deductions, tax rate application, and excess tax collected, all of which contribute to the final tax liability.

- Penalties and interest are clearly stated to ensure transparency. A failure to file results in a 5% penalty of the due tax for each month delayed, while failure to pay on time attracts a 10% penalty of the unpaid tax. These penalties emphasize the cost of oversight and the importance of punctuality.

- Appropriate documentation is crucial, especially when it comes to deductions and credits. Schedules A and B on the form guide the taxpayer on how to list these amounts, and maintaining proper records to support these claims is a requirement not to be overlooked.

Finally, the signature at the bottom of the form underscores the declaration of accuracy and completeness to the best of one’s knowledge, making it a legal document. The City of Chandler emphasizes the importance of this process with a requirement for payment to be made payable directly to them, ensuring that transactions are streamlined and secure.

Popular PDF Documents

Library Loan - Choose from loan, photocopy, or estimate requests to tailor the ALA form to your specific borrowing needs.

What Is Amt Depreciation - Form 6251 plays a pivotal role in ensuring that tax benefits don't excessively benefit the wealthiest taxpayers at the expense of others.

Can I Stop Paying Sss After 10 Years - Mentions that the payment made section must specify the medium of payment used, ensuring clear communication about the method of payment.