Get Texas Sos Payment 807 Form

In today’s fast-paced business environment, understanding the intricacies of legal documentation is essential for ensuring seamless operational flows. Among the various forms required by the Texas Secretary of State, the Texas SOS Payment 807 form stands out for its critical role in the submission process of corporate documents. This form, revised as recently as June 2016, serves as a gateway for entities seeking to formally process documents through either expedited or regular handling. The provision for expedited handling, albeit with a fee attached depending on the document type, underscores the form’s flexibility and responsiveness to urgent business needs. It’s important for submitters to accurately fill out their information, including but not limited to company name, contact details, and the specifics of the document filing, such as the name on the document and the file number if applicable. Additionally, the form caters to a variety of payment options, integrating modern conveniences like credit card payments alongside traditional methods like checks or money orders. Notably, credit card payments incur a convenience fee, which is a percentage of the total fees—a detail of significant relevance for budget-conscious entities. Further emphasizing customer centricity, the form requests details on the return address, ensuring that processed documents are directed appropriately, thereby mitigating any post-submission confusion. In essence, the Texas SOS Payment 807 form encapsulates the details necessary for a smooth document submission experience to the Texas Secretary of State, attentive to the nuances of expedited processing, payment modalities, and return coordination.

Texas Sos Payment 807 Example

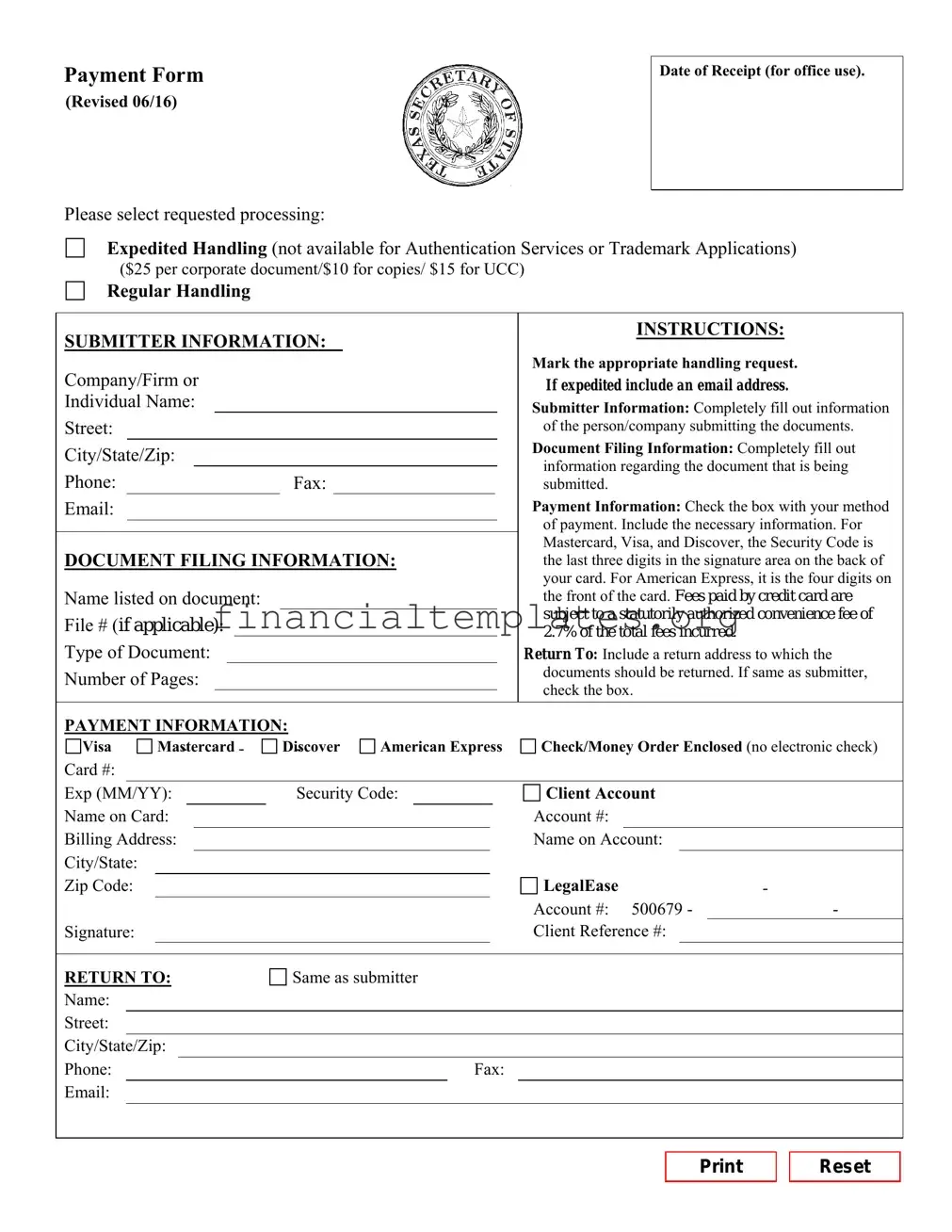

Payment Form

(Revised 06/16)

Please select requested processing:

Date of Receipt (for office use).

Expedited Handling (not available for Authentication Services or Trademark Applications)

($25 per corporate document/$10 for copies/ $15 for UCC)

Regular Handling

|

SUBMITTER INFORMATION: |

|

|

|

|

|

|

|

|

INSTRUCTIONS: |

||||||||||||||

|

|

|

|

|

|

|

|

Mark the appropriate handling request. |

||||||||||||||||

|

Company/Firm or |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

If expedited include an email address. |

||||||||||||

|

Individual Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Submitter Information: Completely fill out information |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of the person/company submitting the documents. |

|||

|

City/State/Zip: |

|

|

|

|

|

|

|

|

|

|

|

Document Filing Information: Completely fill out |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

information regarding the document that is being |

||||||||||||

|

Phone: |

|

|

|

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

submitted. |

|

||||||

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment Information: Check the box with your method |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of payment. Include the necessary information. For |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

DOCUMENT FILING INFORMATION: |

Mastercard, Visa, and Discover, the Security Code is |

||||||||||||||||||||||

|

the last three digits in the signature area on the back of |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your card. For American Express, it is the four digits on |

|||

|

Name listed on document: |

|

|

|

|

|

|

|

|

|

the front of the card. Fees paid by credit card are |

|||||||||||||

|

File # (if applicable): |

|

|

|

|

|

|

|

|

|

|

|

|

subject to a statutorily authorized convenience fee of |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2.7% of the total fees incurred. |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Type of Document: |

|

|

|

|

|

|

|

|

|

|

|

|

Return To: Include a return address to which the |

||||||||||

|

Number of Pages: |

|

|

|

|

|

|

|

|

|

|

|

documents should be returned. If same as submitter, |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

check the box. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

PAYMENT INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Visa |

Mastercard |

- |

|

Discover |

American Express |

Check/Money Order Enclosed (no electronic check) |

|||||||||||||||||

|

Card #: |

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Exp (MM/YY): |

|

|

|

Security Code: |

|

|

Client Account |

|

|||||||||||||||

|

Name on Card: |

|

|

|

|

|

|

|

|

|

|

|

|

Account #: |

|

|

||||||||

|

Billing Address: |

|

|

|

|

|

|

|

|

|

|

|

Name on Account: |

|

||||||||||

|

City/State: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zip Code: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LegalEase |

- |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account #: 500679 - |

|

- |

|

|

Signature: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Client Reference #: |

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

RETURN TO: |

|

|

Same as submitter |

|

|

|

|

||||||||||||||||

|

Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/State/Zip: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Phone: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fax: |

|

|

|

|

||||

|

Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reset

Document Specifics

| Fact | Description |

|---|---|

| Name of the form | Payment Form (Revised 06/16) |

| Options for processing speed | Expedited Handling and Regular Handling; Expedited Handling includes additional fees. |

| Submitter Information Requirement | Submitter must provide contact information, including company/firm or individual name, address, phone, fax, and email. |

| Document Filing Information Section | Requires details about the document being submitted, including name on document, file number, type of document, and the number of pages. |

| Payment Information Options | Payment can be made via Visa, Mastercard, Discover, American Express, check/money order, or LegalEase. Credit card payments are subject to a 2.7% convenience fee. |

| Expedited Handling Fees | $25 per corporate document, $10 for copies, and $15 for UCC (Uniform Commercial Code) filings. |

| Governing Law | The form is governed by Texas state law and regulations pertaining to the processing of legal documents and payments within the state. |

Guide to Writing Texas Sos Payment 807

Filling out the Texas Secretary of State Payment Form 807 is an essential step in the process of submitting various documents for corporate entities. These steps are designed to ensure your document gets processed efficiently, whether you're opting for regular or expedited handling. Follow these guidelines carefully to ensure your form is complete and accurate.

- First, decide on the processing speed required for your document: Expedited Handling (additional fees apply) or Regular Handling. Mark the appropriate box at the top of the form. For expedited processing, an email address is necessary.

- Under SUBMITTER INFORMATION, provide the name of the company, firm, or individual submitting the documents.

- Fill out the submitter’s Street, City/State/Zip to ensure proper communication and return of documents.

- Include a Phone number and a Fax number, if available, to enhance communication channels.

- Provide an Email address especially if expedited handling is requested, for timely updates and correspondence.

- Move on to the DOCUMENT FILING INFORMATION section. Here, write down the name as listed on the document you are submitting.

- If applicable, enter the File # associated with the document for easy reference and tracking by the state office.

- Specify the Type of Document you are submitting to ensure it is processed appropriately according to the specific requirements.

- Indicate the Number of Pages included in your submission for accurate document handling and billing.

- For the RETURN TO section, include an address (which can be the same as the submitter's) to specify where the processed documents should be sent.

- In the PAYMENT INFORMATION area, choose your method of payment by ticking the appropriate box: Visa, Mastercard, Discover, American Express, or Check/Money Order (note electronic checks are not accepted).

- Write down the Card #, Exp (MM/YY), and Security Code, or if paying by check/money order, include the relevant details. Remember, credit card payments incur a 2.7% convenience fee.

- If you selected a credit card, fill in the Name on Card, Account #, and Billing Address including City/State, and Zip Code accurately.

- For users of the LegalEase system, enter the Account # and Client Reference # if applicable.

- Finally, don’t forget to sign at the bottom of the form to validate the payment and submission request.

Upon completion, review the form to ensure all information is accurate and fully provided. This detailed approach helps prevent delays in processing your documents. Remember, accurate and complete forms lead to a smoother transaction with the Texas Secretary of State's office.

Understanding Texas Sos Payment 807

What is the Texas SOS Payment 807 form used for?

The Texas SOS (Secretary of State) Payment 807 form is utilized to submit payment for various services offered by the Texas Secretary of State's office. This form accompanies documents for corporate filings, requests for copies, Uniform Commercial Code (UCC) filings, and other transactions. It allows for the selection between regular and expedited handling, excluding services related to Authentication Services or Trademark Applications, and includes detailed submitter information, document filing information, and payment information.

How can I choose between regular and expedited processing for my documents?

On the Texas SOS Payment 807 form, two processing options are provided: Regular Handling and Expedited Handling. To choose, simply mark the appropriate box at the top of the form. Note that expedited processing incurs additional fees ($25 per corporate document, $10 for copies, and $15 for UCC filings) and is not available for Authentication Services or Trademark Applications. If expedited processing is selected, providing an email address is required.

What payment methods are accepted when using the Texas SOS Payment 807 form?

The form accepts Visa, Mastercard, Discover, and American Express credit cards, along with checks or money orders. Electronic checks are not accepted. Credit card payments are subject to a convenience fee of 2.7% of the total transaction amount. When providing credit card details, remember to include the card number, expiration date, security code, and name on the card as well as the billing address.

What information is required in the submitter information section?

In the submitter information section, you must provide the name of the company, firm, or individual submitting the documents. Also, complete your contact information such as street address, city, state, zip, phone number, fax, and email. This ensures that any communications or queries related to your submission can be efficiently directed back to you or your organization.

How do I fill out the document filing information section?

The document filing information includes the name that is listed on the document being submitted, the file number if applicable, the type of document, and the number of pages. Accurately filling out this section is crucial for the correct processing of your documents. If the return address is the same as the submitter's, simply check the corresponding box to avoid unnecessary duplication of information.

Where should I send the Texas SOS Payment 807 form and accompanying documents?

After completing the Texas SOS Payment 807 form and preparing your documents, send them to the Texas Secretary of State's office at the address provided for document submissions. If you are unsure of the correct address, it is recommended to visit the Secretary of State’s website or contact their office directly for the most up-to-date information.

What happens if I don't include all the necessary information or payment?

If the form is submitted without all the required information or payment, your document processing may be delayed or not completed. It is important to carefully review the form before submission to ensure all sections are correctly filled out and that the appropriate payment method is included. Missing or incorrect information can lead to communication from the Secretary of State’s office requesting clarification or additional details, further delaying the process.

Common mistakes

When filling out the Texas SOS Payment Form 807, individuals often encounter issues that can delay their document processing. Understanding these common mistakes can streamline your experience and ensure efficient handling of your filings. Here are six common errors:

- Not selecting a processing option: Failing to select between expedited or regular handling can lead to delays. Each option has different processing times and fees associated with it.

- Incomplete submitter information: Leaving sections within the submitter information blank might result in an inability to process the document or contact the submitter if clarification is needed.

- Incorrect or unclear document filing information: This part of the form requires precise details about the document being filed. Errors or vague descriptions can cause unnecessary hold-ups.

- Payment method issues:

- Not checking the box corresponding to the chosen method of payment can create confusion about how fees are intended to be settled.

- Entering incorrect card details, such as the card number, expiration date, or security code, can lead to payment processing failures.

- For those paying by credit card, forgetting to account for the 2.7% convenience fee can result in an insufficient payment.

- Omitting return address details: If a return address is not provided or if it is the same as the submitter's address but the box indicating so is not checked, it may complicate the document's return process.

- Signature omission: The form must be signed to be valid. Skipping this step can invalidate the entire submission, as a signature is required to authorize the processing and the payment.

Avoiding these mistakes promotes a smoother transaction with the Texas Secretary of State, ensuring your document handling needs are met promptly and accurately.

Documents used along the form

When dealing with the Texas Secretary of State (SOS), the Payment Form 807 is just the beginning. A range of additional documents and forms often accompany or are necessary for various business and legal interactions with the office. Each of these forms plays a crucial role in ensuring that your submissions are complete, accurate, and aligned with the state's legal requirements.

- Certificate of Formation: This foundational document is essential when forming a new business entity in Texas. It outlines the business structure, name, governance, and other pivotal details.

- Registered Agent Form (Form 401-A): Designates or changes the registered agent or registered office for a business. The registered agent is responsible for receiving legal documents on behalf of the entity.

- Change of Registered Agent/Office (Form 408): Used when an entity needs to update information about their registered agent or office location. This ensures all legal notices are correctly directed.

- Assumed Name Certificate (DBA): Required for businesses intending to operate under a name other than their legal registered name. It's also known as 'Doing Business As'.

- Annual Report: While Texas does not require an annual report for most businesses, those that are foreign entities or have special status might need to submit regular updates.

- Business Termination or Withdrawal Forms: Needed when a business entity is closing or withdrawing their registration from Texas. The specific form depends on the business structure.

- Application for Reinstatement: If a business entity has been involuntarily ended, this application is necessary for reinstatement in Texas.

- Certificate of Account Status: To terminate a business formally, a Certificate of Account Status for Dissolution/Termination is required, proving the entity is in good standing with the Texas Comptroller.

- Trademarks Application (Form 901): For businesses looking to register a trademark or service mark in Texas, this application is vital to protect brand identity.

- Franchise Tax Forms: Businesses in Texas may need to file franchise tax forms as part of their financial obligations. The specific form varies based on company structure and income.

Each document has its particular purpose, from starting a business, through changing its details, to possibly wrapping things up. They ensure your entity complies with state laws and maintains good standing. Keeping track of these forms and understanding their function is crucial for smooth operations and legal compliance within Texas.

Similar forms

The Texas SOS Payment 807 form, utilized for processing various types of official submissions to the Texas Secretary of State, shares similarities with a number of other forms in both structure and purpose. One of these similar forms is the IRS Form 1040, the U.S. Individual Income Tax Return form. Both forms require detailed personal and financial information to be filled out and submitted for processing. They also include sections for payment information and share the feature of allowing for expedited processing at an additional fee, illustrating their focus on accommodating different processing needs.

Another form that mirrors the Texas SOS Payment 807 in certain aspects is the Uniform Commercial Code (UCC) Financing Statement, commonly referred to as Form UCC1. This form, like the Payment 807, includes detailed submitter information, document filing details, and directives for handling and return instructions. Both forms are integral to the submission of official documents within the United States, serving key roles in business and legal proceedings by facilitating the recording of financial statements or business entity transactions.

Similarly, the Application for Employer Identification Number (EIN), known as Form SS-4, bears resemblances to the Texas SOS Payment 807 form. Both require the identification of the entity involved and necessitate detailed information regarding the submitter. Additionally, they include specific instructions for expedited processing and involve the inclusion of payment information, underlining the procedural similarities between applying for an EIN and submitting documents to the Texas Secretary of State.

The Articles of Incorporation form, utilized for establishing a corporation within various states, echoes the Texas SOS Payment 807 in structure. It includes requirements for detailed submitter and entity information, alongside specific document filing information. Both forms are crucial for the legal establishment and recognition of entities, emphasizing the need for precise and comprehensive information submission.

The Change of Registered Agent/Office form, another significant document in business operations, parallels the Texas SOS Payment 807. This form facilitates the official change of an entity’s registered agent or office location, necessitating detailed submission information similar to the Payment 807 form. Both require accurate submitter information and document details to ensure proper processing and recording of the submitted changes.

Additionally, the DBA (Doing Business As) registration form, used by businesses to register a trade name, shares commonalities with the Payment 807 form in terms of required submitter information and document filing specifics. The necessity for explicit instructions on processing and return information further aligns these forms in their purpose and structure, facilitating various business-related submissions.

The Trademark Application form, necessary for the registration of a trademark, aligns with the Texas SOS Payment 807 form in requiring detailed information on the submitter and the specifics of the submission. Although the Payment 807 specifies that it does not handle trademark applications with expedited service, both forms are integral to protecting business interests and intellectual property, underscoring their role in legal documentation processes.

Lastly, the Patent Application form parallels the Texas SOS Payment 807 in that it requires comprehensive details about the submitter, the invention, and the specifics of the patent being sought. Both forms are key to securing legal rights—whether for a business entity through the SOS Payment 807 or an inventor through the patent application process—demonstrating their critical role in safeguarding interests within their respective domains.

Dos and Don'ts

When completing the Texas SOS Payment Form 807, attention to detail and accuracy is paramount. Below is a guidance list detailing what you should and shouldn't do to ensure the process is smooth and error-free.

Do's:

- Review the form thoroughly before starting, to understand all the requirements.

- Use black ink for clarity and readability, whether filling out the form manually or electronically.

- Ensure all the information provided is current and accurate, especially the submitter's information and document filing details.

- Choose the correct processing option (Regular or Expedited Handling) based on your needs and include an email address if expedited service is selected.

- Include the appropriate fee with your payment method clearly indicated and all payment details correctly filled out.

- Double-check the security code on your credit card to prevent processing delays, noting the difference in location between Mastercard, Visa, Discover, and American Express.

- Sign the form to validate the submission. A missing signature can lead to unnecessary delays.

Don'ts:

- Don't leave sections blank that are applicable to your filing. Incomplete forms can be returned or rejected.

- Don't use highlighters or colored pens, as they can make the form hard to read when photocopied or scanned.

- Avoid making corrections using correction fluid or tape; if a mistake is made, it’s better to fill out a new form to maintain legibility.

- Don't forget the convenience fee when paying by credit card, calculated at 2.7% of the total fees incurred.

- Don't send electronic checks as they are not accepted; ensure the payment is by an approved method.

- Don't overlook the "Return To" section; if it’s the same as the submitter, simply check the box to indicate so.

- Don't rush through the form without double-checking all the information provided for accuracy and completeness.

Adhering to these do's and don'ts will help streamline the processing of the Texas SOS Payment Form 807, minimizing the chances of delays or rejection due to errors or omissions.

Misconceptions

When dealing with the Texas SOS Payment 807 form, several misconceptions may arise due to its detailed requirements and specific instructions. Clarifying these misunderstandings can streamline the filing process for individuals and businesses alike.

- Expedited services apply to all documents: A common misconception is that the expedited processing option is available for all types of submissions, including Authentication Services or Trademark Applications. However, this is not the case, as the form clearly states that expedited handling is not available for these particular document types.

- Email is mandatory for regular handling: While including an email address is highly recommended for expedited processing to receive updates, it is not a mandatory field for submissions under regular handling. Nonetheless, providing one can be beneficial for communication purposes.

- Any form of electronic payment is acceptable: Though the form accepts major credit cards and checks/money orders, it explicitly excludes electronic checks as a form of payment, contrary to what some might assume.

- Security codes are optional: For payments made by credit card, entering the appropriate security code—which varies depending on the card type—is compulsory. This detail is crucial for the validation and processing of payment.

- Fees are flat rates: Fees vary not only based on document type but also on the processing choice (regular vs. expedited). Moreover, credit card payments incur an additional 2.7% convenience fee on the total fees, contradicting the notion of a single, flat fee for services.

- Return address must be different from the submitter’s information: The form provides an option to indicate if the return address for the documents is the same as the submitter’s. This flexibility allows for direct return to the submitter or to an alternative address, as needed.

- Any part of the form can be left blank if not applicable: The form requires all pertinent sections to be completed accurately. Leaving sections blank, even if seemingly not applicable, can lead to processing delays or outright rejection of the submission.

- LegalEase account details are for specific users only: While the form includes a section for LegalEase account information, this is not strictly limited to a narrow user group. Individuals or entities with an account can use this payment method, debunking the idea that it's reserved for a specific demographic.

- The convenience fee is avoidable: The 2.7% convenience fee for credit card payments is mandated and cannot be waived or avoided, contrary to what some might hope or believe.

Correcting these misunderstandings emphasizes the importance of thoroughly reviewing and understanding the Texas SOS Payment 807 form's instructions to ensure accurate and efficient document processing.

Key takeaways

When filling out and using the Texas SOS Payment 807 form, there are several key takeaways to keep in mind to ensure that the process is smooth and error-free. Here are the top points to consider:

- The form allows for two types of processing: Expedited Handling and Regular Handling. Expedited handling incurs additional fees.

- Expedited handling is not available for Authentication Services or Trademark Applications, and the fees vary by document type.

- To request expedited handling, providing an email address is mandatory.

- Complete the submitter information section with the details of the person or company submitting the documents.

- When filling out the Document Filing Information, ensure all details regarding the document being submitted are included.

- In the Payment Information section, check the box corresponding to your method of payment and fill in the necessary information. Remember that credit card payments are subjected to a convenience fee of 2.7%.

- For credit card payments, the Security Code location varies with the type of card. It's found in the signature area on the back for Mastercard, Visa, and Discover, and on the front for American Express.

- If you want the documents returned to the same address as the submitter, simply check the "Same as submitter" box in the Return To section.

- Make sure to include a return address in the form to specify where the processed documents should be sent if it's different from the submitter's address.

- Completing the form accurately and thoroughly will help avoid delays or issues with the processing of your documents.

Remember, this form is a crucial part of ensuring your documents are processed according to your needs, be it in a regular or expedited manner. Paying close attention to each section and providing clear, accurate information will streamline the process.

Popular PDF Documents

Philhealth Online - Serves as a preventive measure against lapses in coverage by outlining payment responsibilities clearly.

IRS 1099-R - If there have been any recharacterizations of IRA contributions or conversions, they would be documented here as well.