Get Tc1 Tax Clearance Form

Understanding the intricacies of obtaining a Tax Clearance Certificate through the TC1 form is essential for individuals and entities engaging in various business activities or requiring specific licenses in compliance with tax laws. This vital document serves multiple purposes, from renewing licenses for liquor retailers, hydrocarbon dealers, auctioneers, and bookmakers, to participating in the Criminal Justice Legal Aid Scheme. Applicants must provide thorough information including personal or company tax reference numbers, details about partnerships if applicable, and previous business activity that connects to the current application. Particularly noteworthy is the requirement for non-resident applicants seeking government contracts, underscoring the form’s broad applicability across different jurisdictions and scenarios. Every section demands accurate details concerning the applicant’s tax status, with sections tailored for individuals, partnerships, and companies, ensuring a comprehensive assessment of one’s tax compliance. Completing the declaration accurately underlines the applicant's responsibility towards honest and complete disclosure, pivotal for the clearance process. This prerequisite mirrors the government’s effort to maintain tax compliance and integrity within the channel of business operations and legal engagements, demonstrating the TC1 form’s significance in fostering a transparent financial ecosystem.

Tc1 Tax Clearance Example

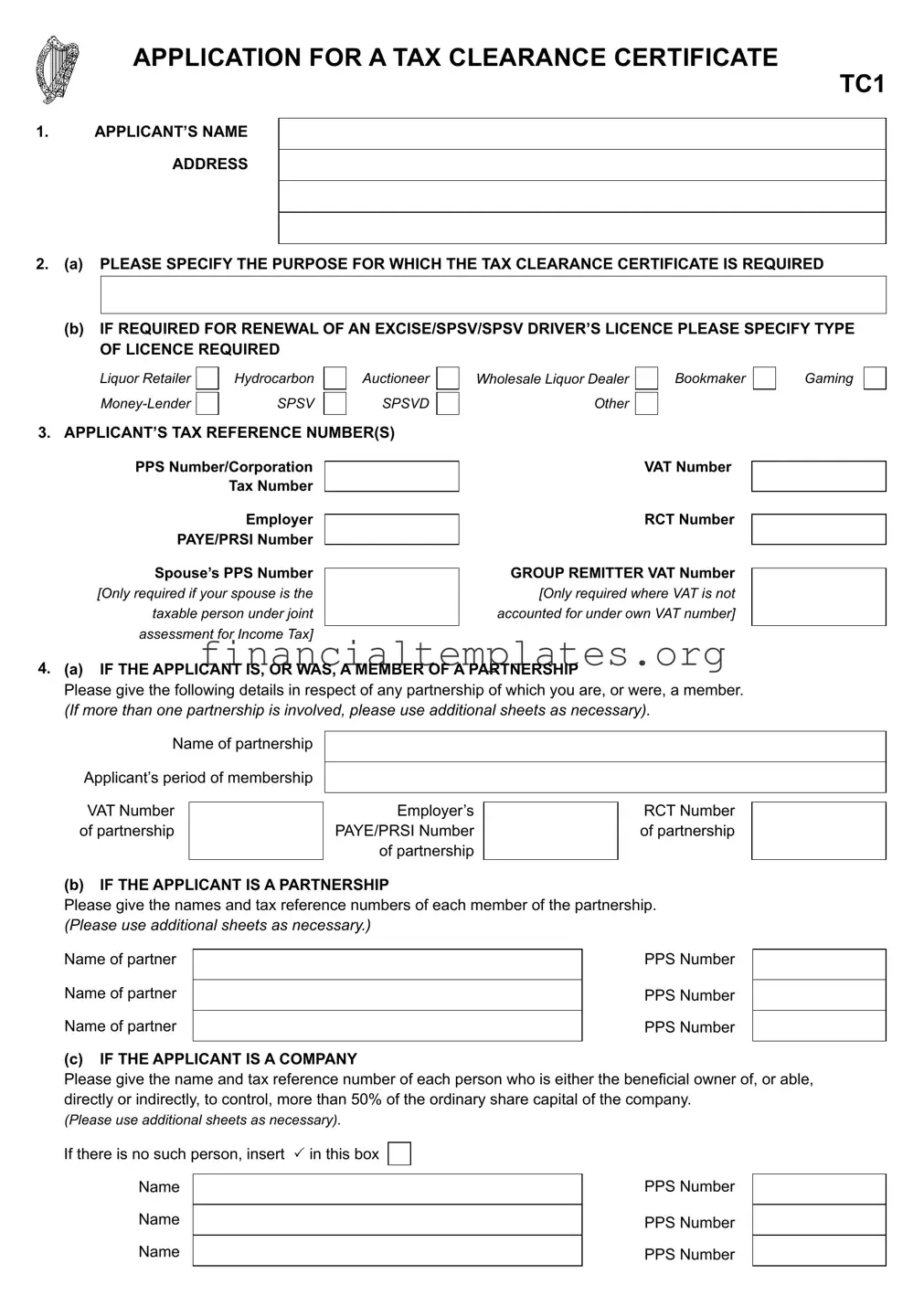

APPLICATION FOR A TAX CLEARANCE CERTIFICATE

TC1

1.APPLICANT’S NAME ADDRESS

2.(a) PLEASE SPECIFY THE PURPOSE FOR WHICH THE TAX CLEARANCE CERTIFICATE IS REQUIRED

(b)IF REQUIRED FOR RENEWAL OF AN EXCISE/SPSV/SPSV DRIVER’S LICENCE PLEASE SPECIFY TYPE OF LICENCE REQUIRED

Liquor Retailer |

Hydrocarbon |

Auctioneer |

SPSV |

SPSVD |

3.APPLICANT’S TAX REFERENCE NUMBER(S)

Wholesale Liquor Dealer

Other

Bookmaker

Gaming

PPS Number/Corporation Tax Number

Employer

PAYE/PRSI Number

Spouse’s PPS Number

[Only required if your spouse is the taxable person under joint assessment for Income Tax]

VAT Number

RCT Number

GROUP REMITTER VAT Number

[Only required where VAT is not accounted for under own VAT number]

4.(a) IF THE APPLICANT IS, OR WAS, A MEMBER OF A PARTNERSHIP

Please give the following details in respect of any partnership of which you are, or were, a member. (If more than one partnership is involved, please use additional sheets as necessary).

Name of partnership

Applicant’s period of membership

VAT Number of partnership

Employer’s

PAYE/PRSI Number

of partnership

RCT Number of partnership

(b)IF THE APPLICANT IS A PARTNERSHIP

Please give the names and tax reference numbers of each member of the partnership. (Please use additional sheets as necessary.)

Name of partner

Name of partner

Name of partner

PPS Number

PPS Number

PPS Number

(c)IF THE APPLICANT IS A COMPANY

Please give the name and tax reference number of each person who is either the beneicial owner of, or able,

directly or indirectly, to control, more than 50% of the ordinary share capital of the company.

(Please use additional sheets as necessary).

If there is no such person, insert P in this box

Name

Name

Name

PPS Number

PPS Number PPS Number

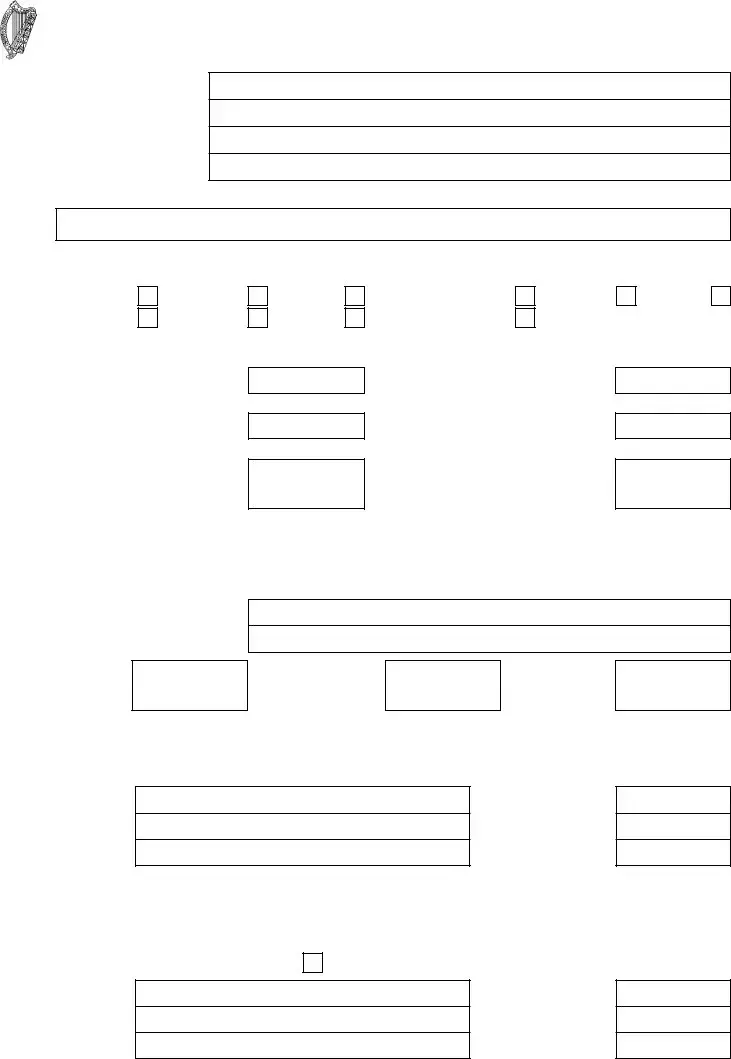

5. |

PREVIOUS BUSINESS ACTIVITY |

|

|

(a) Was the business activity to which this application relates previously carried on in the |

|

|

YES |

|

|

last ive years by another person, company or partnership connected to you? |

|

|

|

|

|

|

|

If the answer to (a) is YES please complete (b) to (d) below in respect of the previous person, company or partnership.

(b)Name & Address

(c)VAT Number

(d)Basis on which business was transferred and applicant’s relationship with previous trading entity

NO

6.TAX CLEARANCE TO PARTICIPATE IN THE CRIMINAL JUSTICE LEGAL AID SCHEME

If you are applying for tax clearance in your own name and you are an employee (paying tax under the PAYE system) please provide the following details in relation to your employer:

Name of your employer

VAT Number

Employer’s PAYE/PRSI Number

7.IF THE APPLICANT IS

(a)What is the nature of the contract?

(b)Where will the work be carried out?

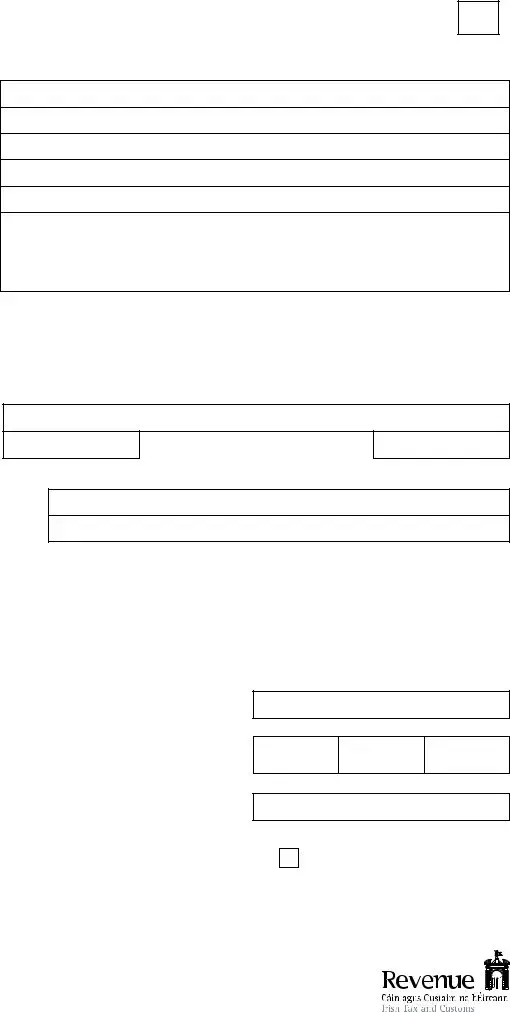

8.DECLARATION TO BE COMPLETED IN ALL CASES

If the applicant is an individual that individual must complete this declaration.

If the applicant is a partnership this declaration must be completed by one of the members of the partnership. If the applicant is a company this declaration must be completed by a Director or the Company Secretary.

The information provided in this form is true and correct to the best of my knowledge and belief. I have included all information relevant to this application.

Signatory’s Name

Signature |

|

|

in Block Capitals |

|

Position |

|

|

||

|

|

|

Date |

|

|

(Director, Company Secretary, Partner) |

|

||

|

|

|

||

|

|

|

|

|

Daytime Telephone |

|

|

Email address |

|

Number |

|

|

||

|

|

|

||

Day

Month

Year

Online veriication of your Tax Clearance Certiicate to Third Parties. Tick here

Note: This form should be sent to your Local Revenue District, the address of which is available on the Revenue Website at www.revenue.ie. The address for

RPC001418_EN_WB_L_1

Document Specifics

| Fact Number | Fact Detail |

|---|---|

| 1 | The TC1 form is an application for a Tax Clearance Certificate. |

| 2 | It requires the applicant's name and address for processing. |

| 3 | Applicants must specify the purpose for which the Tax Clearance Certificate is required. |

| 4 | The form accommodates various types of licences including Liquor Retailer, Hydrocarbon, Auctioneer, and others. |

| 5 | Applicants need to provide their tax reference number(s), which can include PPS Number, Corporation Tax Number, among others. |

| 6 | If the applicant is, or was, a member of a partnership, relevant details of the partnership are required. |

| 7 | For company applicants, it is necessary to list persons with significant control or ownership. |

| 8 | The form queries about previous business activity to ascertain any connections to prior entities. |

| 9 | Applicants associated with the Criminal Justice Legal Aid Scheme must provide employer details. |

| 10 | A declaration stating the truthfulness and completeness of the information must be signed by the applicant, which varies based on the nature of the applicant (individual, partnership, company). |

Guide to Writing Tc1 Tax Clearance

Filling out the TC1 Tax Clearance form is a critical step for individuals, partnerships, and companies in certain situations, such as renewing licenses or securing government contracts. This form ensures that the applicant complies with tax obligations, facilitating a smooth process with the Irish Revenue. The steps outlined below guide you through completing the TC1 form correctly.

- Applicant’s Name and Address: Enter the full name and address of the individual, partnership, or company applying for the tax clearance certificate.

- Specify the Purpose: Clearly state why the tax clearance certificate is required. If it’s for the renewal of a specific license (e.g., Liquor Retailer, SPSV Driver’s License), identify the type of license.

- Applicant’s Tax Reference Number(s): Provide all relevant tax reference numbers associated with the applicant. This includes the PPS Number/Corporation Tax Number, Employer PAYE/PRSI Number, VAT Number, RCT Number, and, if applicable, Spouse’s PPS Number and Group Remitter VAT Number.

- Partnership Details:

- If the applicant was or is a member of a partnership, list the name of the partnership, the applicant’s period of membership, and all relevant tax numbers.

- If the applicant is a partnership, list the full names and tax reference numbers of each partner. Use additional sheets if necessary.

- For company applicants, provide the names and tax reference numbers of persons with significant control over the company’s share capital. Mark 'P' if not applicable.

- Previous Business Activity: If the business activity related to this application was carried on by another entity connected to the applicant in the last five years, provide details of the former entity, including name, address, and VAT Number. Also, describe the basis of the business transfer and the applicant’s relationship with the previous entity.

- Tax Clearance for Criminal Justice Legal Aid Scheme: If applicable, furnish details about your employer, including the name, VAT Number, and Employer’s PAYE/PRSI Number.

- Non-Resident Applicants: If the applicant is non-resident and requires the certificate for a government contract, specify the nature of the contract and the location of the work.

- Declaration: The declaration must be completed in line with the applicant's status (individual, partnership member, company director, or company secretary). Provide the Signatory’s Name, Signature in Block Capitals, Position, Date, Daytime Telephone Number, and Email Address. Check the box if you consent to online verification of your Tax Clearance Certificate to third parties.

After completing the TC1 form, submit it to your Local Revenue District. The address for submission is available on the Revenue website at www.revenue.ie, which also provides information for non-resident applicants. Accurate and thorough completion of the TC1 form facilitates the processing of your tax clearance certificate.

Understanding Tc1 Tax Clearance

- What is a Tax Clearance Certificate and why do I need one?

- How do I apply for a Tax Clearance Certificate using the TC1 form?

- What tax reference numbers are necessary for the TC1 form?

- Is a Tax Clearance Certificate required for renewing all types of licenses?

- What should I do if my business activity was previously carried out by another entity?

- Can non-residents apply for a Tax Clearance Certificate?

- How can I verify my Tax Clearance Certificate online?

A Tax Clearance Certificate is an official document that proves you or your business has no tax liabilities outstanding. It is required for various reasons, such as renewing licenses (e.g., liquor retailer, SPSV driver's license), participating in government contracts, or when applying for grants. Ensuring you have a valid certificate is crucial for compliance with tax obligations and for conducting business smoothly.

To apply, you must complete the TC1 application form with accurate details including your name, address, the purpose for requiring the certificate, and your tax reference numbers. If you're applying as a partnership or a company, you need to provide additional information such as partnership details or beneficial owners. The declaration section must be signed to confirm the information provided is true. Submit the completed form to your Local Revenue District, details of which can be found on the Revenue website.

When filling out the form, include all relevant tax reference numbers. This could include your PPS Number, Corporation Tax Number, Employer PAYE/PRSI Number, and VAT Number, among others. For partnerships and companies, you will need to provide the reference numbers for each member or beneficial owner respectively. Ensuring accurate and complete reference numbers are provided is essential for the successful processing of your application.

Not all licenses require a Tax Clearance Certificate for renewal. However, specific types such as liquor retailer licenses, hydrocarbon licenses, and SPSV driver's licenses do require it. It's advisable to check with the relevant licensing authority or the Revenue to confirm whether your specific license renewal requires a tax clearance.

If the business activity for which you're applying was previously managed by another person, company, or partnership connected to you, you must indicate this by answering 'yes' to question 5(a) on the TC1 form. You'll also need to provide the name, address, VAT Number, and relationship with the previous entity in sections 5(b) to 5(d). This information helps Revenue understand the background of your business for accurate processing of your application.

Yes, non-residents can apply for a Tax Clearance Certificate, especially when it is required for contracting with the government. Non-residents should specify the nature of the contract and where the work will be performed in question 7 of the TC1 form. Remember to use the specific address for non-resident applicants when sending your form, which can be found on the Revenue website.

Once your application is processed and you receive your Tax Clearance Certificate, you or third parties can verify its validity online. There's an option on the form to permit online verification to third parties. Verification can be done through the Revenue's online services, ensuring transparency and ease of access for the certificate's validity status.

Common mistakes

Filling out the TC1 Tax Clearance form accurately is crucial to ensure the swift processing of your application. However, applicants often encounter common pitfalls that can delay or affect their submission. Here are nine mistakes frequently made during this process:

Not providing complete applicant details, including the full name and address. This basic information is essential for identification purposes and any discrepancies can cause unnecessary delays.

Failure to specify the purpose for which the tax clearance certificate is required. The form caters to various purposes like renewals of licenses or applications for certain schemes, and clarity on this ensures the application is processed in the right context.

Omitting the applicant’s tax reference number(s). These numbers are critical for accessing and evaluating the applicant’s tax records. Missing or inaccurate tax reference numbers complicate the verification process.

Incorrectly handling details related to partnerships or companies. This includes both current and past associations. For partnerships, it's important to list all members and their tax reference numbers. Companies must disclose information about individuals who control more than 50% of the share capital.

Neglecting to provide information on previous business activities if the business to which the application relates was previously carried on by another entity connected to the applicant. This history is relevant for a comprehensive tax assessment.

Overlooking the section on the Criminal Justice Legal Aid Scheme, if applicable. This section is crucial for individuals seeking tax clearance to participate in the scheme and requires details about their employer.

For non-resident applicants, not detailing the nature of the government contract and the location of the work. These details are mandatory for applications related to government contracts outside the resident country.

Incomplete or missing declaration. The declaration affirms that all provided information is true and complete. A missing signature or not ticking the box for online verification can render the application invalid.

Failing to check and confirm all information is relevant and accurate before submission. Any inaccuracies, even if unintentional, can lead to complications or rejections of the application.

Attending to these details diligently can significantly streamline the process of obtaining a tax clearance certificate. When applicants ensure that their submissions are thoroughly and correctly filled out, they contribute to a smoother and quicker handling by the tax authorities.

Documents used along the form

When applying for a Tax Clearance Certificate using the TC1 form, it's common practice to need additional documentation to support your application or to fulfill other related requirements. These documents often vary based on the specific circumstances of the applicant but play a crucial role in ensuring full compliance with tax obligations and verification processes.

- Proof of Identification: A government-issued photo ID such as a passport or driver's license is essential to verify the identity of the person or persons applying for the Tax Clearance Certificate. This ensures that the application is legitimate and matches the tax records in the system.

- Business Registration Documents: For companies and partnerships, documents that prove the legal registration and existence of the business are required. This may include a Certificate of Incorporation for companies or a Partnership Agreement for partnerships.

- Financial Statements: Recent financial records or statements that provide an overview of the business's or individual's financial situation. They help in assessing the tax liability and ensuring that all financial information aligns with what is reported to the tax authorities.

- Proof of Address: An official document or utility bill that confirms the address of the applicant. This is crucial for verifying that the applicant is based within the jurisdiction of the taxing authority to which they are applying.

- Previous Tax Returns: Copies of recent tax returns may be requested to ensure that the applicant has a history of compliance with tax obligations. This provides a record of financial activity and tax payments.

Together, these documents complement the TC1 form, providing a comprehensive profile of the applicant and their tax status. It's important for applicants to prepare and organize these documents in advance to ensure a smooth and efficient application process for a Tax Clearance Certificate.

Similar forms

The W-9 form, commonly used in the United States for tax reporting purposes, shares some similarities with the TC1 Tax Clearance form. Like the TC1, the W-9 is used to collect taxpayer identification numbers (TINs), including social security numbers or employer identification numbers, from individuals or entities engaged in financial transactions. Both forms play a crucial role in ensuring compliance with tax obligations and serve as a means for tax authorities to gather necessary information to verify an entity's or individual's tax status.

An application for an Employer Identification Number (EIN), often submitted through the IRS Form SS-4, is another document that shares similarities with the TC1 form. This form is required by entities to apply for an EIN, which is used for tax administration purposes. Similarly, the TC1 form collects tax reference numbers and details about the business or individual, such as VAT numbers or PAYE/PRSI numbers, highlighting the parallel in gathering essential tax-related identifiers for regulatory compliance and record-keeping.

The Individual Taxpayer Identification Number (ITIN) application, often processed on Form W-7, also bears resemblance to the TC1 form. The W-7 form is used by individuals who are not eligible for a Social Security Number but still need to file a tax return or open a tax account with the IRS. Both the W-7 and TC1 forms require detailed personal information to establish one's tax identity and ensure proper association with tax accounts and activities.

The Form 4506-T, Request for Transcript of Tax Return, is used to request past tax return information, which indirectly relates to the purpose behind the TC1 form. The TC1 form’s intention to prove tax compliance for specific activities, such as applying for licenses or contracts, necessitates a clear tax history, which can be obtained through a 4506-T. Both forms are instrumental in providing tax authorities and third parties with access to tax data critical for validating tax status and eligibility for certain engagements.

Another comparable document is the Business License Application form that many local and state governments require. This form often necessitates the disclosure of similar information regarding tax identification numbers, the nature of the business, and ownership details. Both this application and the TC1 form serve as prerequisites for legal operation within a given jurisdiction, ensuring that businesses meet all tax-related requirements.

The Sales Tax Permit Application, required for businesses that intend to sell goods and services subject to sales tax, also shares parallels with the TC1 form. This permit application requires applicants to provide comprehensive information about their business, including tax identification numbers and details about their operations. Like the TC1, this process ensures that businesses comply with tax regulations and are duly registered for tax purposes.

Last, the Non-Resident Tax Form, which is required for individuals or businesses conducting operations in a country where they are not resident, is akin to part of the TC1 form. This form is specifically designed to address tax obligations for non-residents, similar to the TC1 form's provision for non-resident applicants involved in government contracts. Both forms facilitate compliance with local tax laws and enable tax authorities to effectively administer tax obligations for non-resident entities or individuals.

Dos and Don'ts

When filling out the TC1 Tax Clearance Form, it's essential to follow certain guidelines to ensure the process goes smoothly and accurately. Below are things you should and shouldn't do during this process:

- Do ensure all personal and business information is accurately and clearly entered, including the applicant's name, address, and tax reference numbers.

- Do specify the purpose for which the tax clearance certificate is required, as this helps in processing your application appropriately.

- Do include additional sheets if necessary, especially when providing details about partnerships or if the applicant is a company listing persons with significant control.

- Do make sure to complete the declaration section with a signature, position, date, and contact information, verifying that all provided information is true and correct.

- Don't forget to check if the business activity related to the application was previously carried out by another entity connected to you, and provide their details if applicable.

- Don't overlook the requirement for non-resident applicants who require the tax clearance certificate for a government contract to specify the nature and location of the contract.

- Don't leave out any relevant tax reference numbers, such as PPS Number, VAT Number, or Employer PAYE/PRSI Number, which are critical for processing your application.

- Don't submit the application without double-checking all the information for accuracy and completeness, as errors can delay the process.

Remember, the TC1 Tax Clearance Form is an important document, and it's crucial that it is filled out with careful attention to detail. Following these guidelines can help avoid common mistakes and ensure your application is processed efficiently.

Misconceptions

One common misconception is that the TC1 Tax Clearance form is only necessary for individuals or sole traders. However, this form is also essential for partnerships, companies, and non-resident entities seeking to conduct specific types of business in areas such as liquor retailing, money lending, and participating in the Criminal Justice Legal Aid Scheme, among others.

Many people mistakenly believe that obtaining a Tax Clearance Certificate is a one-time requirement. In reality, certificates must be renewed periodically to ensure continued compliance with tax obligations, especially when renewing licenses or engaging in new contracts requiring clear tax records.

A common misunderstanding is that the application process for a Tax Clearance Certificate is lengthy and complicated. While it does require detailed information, the process can be streamlined by accurately compiling the required details before submission, and many find it less cumbersome than expected.

There's a misconception that the TC1 form is the same for both residents and non-residents. Although the form serves the same purpose, non-resident applicants must provide specific details about their contract and work location, adjusting the application process to their particular situation.

Some applicants believe that every section of the TC1 form must be completed. However, only relevant sections need to be filled out, depending on the applicant's business type, structure, and the specific requirement for the tax clearance.

Another false belief is that personal tax compliance is unrelated to obtaining a Tax Clearance Certificate for a business. In certain situations, especially in the case of partnerships or businesses with significant control by an individual, personal tax compliance can impact the eligibility for a clearance certificate.

It's a common fallacy that a Tax Clearance Certificate is only required for doing business with the government or for specific licenses. Actually, it may also be necessary when seeking grants, awards, or other forms of state support, underscoring its broad relevance beyond governmental contracts.

Many assume that the tax reference number of the applicant is the only one that matters. For applications involving partnerships, companies, or business transfers, the tax reference numbers of all partners, beneficial owners, or previous business operators connected to the applicant are also crucial.

Finally, there's a misconception that filling out and submitting the TC1 form guarantees immediate issuance of a Tax Clearance Certificate. The reality is that approval depends on a comprehensive review of the applicant's tax compliance status, and any discrepancies or issues can delay or prevent certification.

Key takeaways

When navigating the complexities of the TC1 Tax Clearance form, individuals and businesses step into a critical process for verifying their tax status, either for initiating or continuing certain types of business activities. The form itself serves as a bridge between compliance and opportunity, stretching across various aspects of tax affairs. Below are six key takeaways to guide anyone through the meticulous journey of filling out and correctly utilizing the TC1 Tax Clearance form.

- Understanding the Purpose: Clearly specifying the purpose for which the Tax Clearance Certificate is required is paramount. The form caters to diverse needs, such as the renewal of licenses for liquor retailers, hydrocarbon auctioneers, and others. This upfront declaration helps tailor the clearance process to specific regulatory requirements.

- Comprehensive Information Is Key: Ensuring all necessary tax reference numbers, including PPS Number, VAT Number, and others as applicable, are accurately filled in avoids processing delays. This information is vital for the Revenue to verify the applicant's tax compliance status.

- Detailing Past and Current Business Endeavors: If the business activity related to the tax clearance was previously conducted by another entity connected to the applicant, detailed information about this transfer is required. This level of transparency aids in establishing a clear tax compliance lineage.

- Special Considerations for Different Entities: The form is designed to accommodate a range of applicants, from individuals and partnerships to companies. Each entity type has specific sections to complete, ensuring that the tax clearance process is tailored to the unique structure and requirements of the applicant.

- Declaration of Accuracy: The declaration section serves as a legal affirmation that all information provided is accurate and complete to the best of the applicant’s knowledge. This commitment to honesty is a foundational aspect of tax compliance and clearance process integrity.

- Submission to the Proper Authority: Knowing where to send the completed form—whether to the local Revenue District or a specified address for non-resident applicants—is crucial for timely processing. The Revenue’s website serves as a valuable resource for this and other related information.

In summary, the TC1 Tax Clearance form is a critical document for ensuring tax compliance in various business transactions and activities. Applicants must approach this document with thoroughness and accuracy, providing detailed information about their tax status, past business activities, and the specific purpose for which the clearance is sought. By adhering to these guidelines, individuals and businesses can navigate the tax clearance process more smoothly, avoiding common pitfalls and ensuring compliance with tax obligations.

Popular PDF Documents

Irs Installment Plan - A legal certificate verifying the payment transactions or agreements of a strata lot owner with the strata corporation under the Strata Property Act.

Kettering Ohio Income Tax - The process for Kettering taxpayers to formally request an extension in filing their income tax returns, aligning with federal extension procedures.

Power of Attorney West Virginia - It also allows representatives to represent the taxpayer in tax audits, appeals, and any judicial proceedings related to tax matters.