Get Taxi Bill Form

Exploring the world of transportation, especially when it comes to airport travel, one often encounters the necessity of a reliable taxi service. A significant part of this journey includes obtaining a record of the trip - a document not only vital for personal record-keeping but also crucial for financial accountability and sometimes, reimbursement purposes. Enter the Taxi Bill form, a simple yet essential piece of paper that marks the completion of your journey. Predominantly observed at bustling hubs like the Washington Dulles International Airport, the Taxi Bill form encapsulates the basic yet most important details of your taxi service. This includes the date of travel, passenger's name, cost of the journey, pick-up and drop-off locations, driver's identification, and the taxicab's registration number. Encompassing these pivotal details, the Taxi Bill serves as a transparent, tangible acknowledgment of the service provided by the Washington Flyer™ Taxi, ensuring every trip from the airport is recorded and remembered.

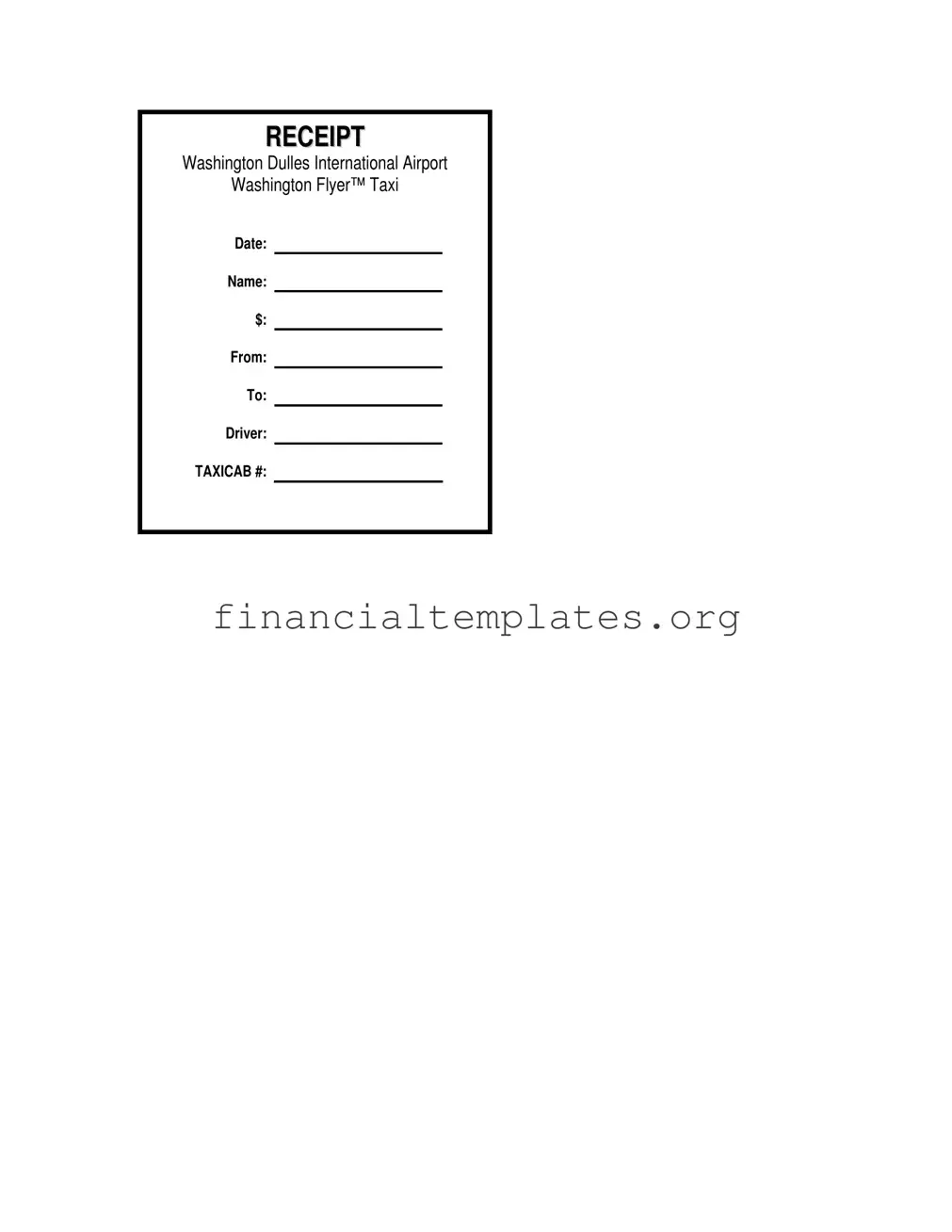

Taxi Bill Example

RECEIPT

Washington Dulles International Airport

Washington Flyer™ Taxi

DATE:

NAME:

$:

FROM:

TO:

DRIVER:

TAXICAB #:

Document Specifics

| Fact | Description |

|---|---|

| Use | The Taxi Bill form serves as an official receipt for services rendered by taxi drivers operating under the Washington Flyer™ Taxi brand at Washington Dulles International Airport. |

| Content | The form contains fields for the date, passenger's name, fare amount ($), origin (FROM), destination (TO), driver's name, and the taxicab number. |

| Governing Law | This receipt is subject to regulations and standards set by the Metropolitan Washington Airports Authority, as Washington Dulles International Airport is under its jurisdiction. |

| Purpose | The form provides a transparent account of the taxi service provided, ensuring passengers have a record of the transaction for reimbursement, tax deduction, or dispute resolution purposes. |

| State-specific | While intended for use at a specific location, the Taxi Bill form must comply with broader transportation and receipt laws within the state of Virginia, where Washington Dulles International Airport is located. |

Guide to Writing Taxi Bill

When accessing transportation services like a taxi, especially for rides linked to business or reimbursements, having a completed Taxi Bill is essential. The details within this form provide a clear and transparent record of the service, including when and where it took place, the monetary transaction involved, and identifying the service provider. Filling out the Taxi Bill form correctly ensures that this information is accurately captured and can be easily referenced for future needs, such as expense reports or personal record-keeping. Follow these steps to fill out the form properly.

- DATE: Enter the date the taxi service was used. Ensure that the format (MM/DD/YYYY) is correct to avoid any confusion.

- NAME: Write the full name of the passenger. If the service was pre-booked, ensure the name matches the booking details.

- $: Specify the total fare amount in dollars and cents. This should include any tolls or surcharges that were applied to the trip.

- FROM: Clearly state the pickup location. Use the complete address or the commonly known name of the location.

- TO: Provide the drop-off destination in the same manner as the pickup location. Accurate details are vital for verification purposes.

- DRIVER: Enter the name of the taxi driver. If you don't know the name, asking the driver politely is okay.

- TAXICAB #: Write down the taxi identification number. This is usually found on the taxi receipt, the vehicle's license plate, or displayed inside the taxi.

After filling out the form, take a moment to review the details for accuracy. The filled-out Taxi Bill now serves as an official record of the transaction. It's smart to keep a copy for your records, whether digital or paper, in case it needs to be referenced later. If the Taxi Bill is for expense reimbursement or accounting purposes, follow the next steps your company or organization requires for submitting such documents.

Understanding Taxi Bill

-

What is a Taxi Bill form?

A Taxi Bill form serves as a receipt for services provided by a taxi. It includes critical details like the date of service, passenger's name, fare amount, starting and ending locations of the journey, driver's name, and the taxi's identification number.

-

Where can I obtain a Taxi Bill form?

This form is typically provided by the driver at the end of your ride. If the driver does not offer one, you may request it. It serves as your proof of payment and journey.

-

Is this form valid for tax purposes?

Yes, the Taxi Bill can be used for tax purposes, especially if you are claiming deductions for work-related travel. It is advisable to keep the receipt for your records and for any potential audits.

-

How can I verify the accuracy of the charges on the Taxi Bill?

Compare the fare amount against the taxi company's rates, which are often posted in the taxi or available online. If there is a discrepancy, bring it up with the driver immediately or contact the taxi company for clarification.

-

Can I use the Taxi Bill form for reimbursement purposes?

Yes, you can use this form to seek reimbursement from your employer or for business expense claims, as it provides detailed information about the travel expense.

-

What if I lose my Taxi Bill form?

It is challenging to obtain a duplicate of a Taxi Bill. It's recommended to take a picture of the receipt with your smartphone or request an email copy, if possible, as a backup.

-

Is the driver's name and taxicab number necessary?

Yes, these details are crucial for identifying the driver in case of disputes, queries, or for leaving feedback. They provide a way to trace the journey specifically to the driver and vehicle used.

-

What should I do if I was overcharged?

If you believe you were overcharged, discuss it with the driver first. If you cannot resolve the issue directly, contact the taxi company with the details on your Taxi Bill. As a last resort, you may need to file a complaint with the local regulatory authority.

-

Can I request a digital Taxi Bill instead of a paper one?

Yes, some taxi services offer a digital receipt option. You can request this from your driver or set it up through the taxi company's app or website, when available.

-

What is the importance of the 'FROM' and 'TO' fields on the Taxi Bill?

These fields document the pickup and drop-off locations, ensuring clarity about the journey's start and end points. This information is essential for verifying the validity of the charges based on the distance traveled.

Common mistakes

When filing out a Taxi Bill form, especially after a ride from Washington Dulles International Airport, many people tend to overlook important details, which could lead to inconveniences later. Here are seven common mistakes to avoid:

Not double-checking the date to ensure it's accurate. This is crucial for tracking expenses and for potential reimbursements.

Failing to print the name clearly. A legible name is vital for identification purposes and if there are any disputes or queries regarding the taxi ride.

Incorrectly reporting the dollar amount charged. Ensure that the amount entered matches the fare displayed on the taximeter to avoid discrepancies.

Omitting the origin and destination details ('FROM' and 'TO') can create confusion, especially if you need to recall the journey or claim expenses.

Not including the driver's name. This information might be necessary if you need to contact the taxi company for lost items or to provide feedback about your ride.

Forgetting the Taxicab number. This is crucial if there are any follow-up queries or if an item is left in the vehicle, as it helps in quickly identifying the cab.

Leaving the receipt unsigned (if required). While not always mandatory, some situations or companies may require a signed receipt for validation of the expense.

Avoiding these common errors not only ensures that your Taxi Bill form is filled out correctly but also helps in maintaining accurate records and can streamline any necessary follow-up activities related to your trip.

Documents used along the form

When accessing transportation services, particularly taxis, a variety of forms and documents are often used in conjunction with the Taxi Bill to ensure a comprehensive and legally sound transaction. These documents play a vital role in maintaining transparency, providing detailed information about the service, ensuring compliance with local regulations, and safeguarding the rights and interests of all parties involved.

- Service Agreement: This outlines the terms and conditions under which the taxi service is provided, including rates, policies on cancellations, and liabilities. It ensures both parties understand their obligations.

- Driver’s Log Sheet: It records the details of the driver's shifts, including mileage, gas, fares, and any incidents. This document is crucial for accounting and regulatory compliance.

- Incident Report Form: In the event of an accident or complaint, this document is used to record details about what happened, who was involved, and any immediate actions taken. It is essential for legal and insurance purposes.

- Customer Feedback Form: This allows passengers to provide feedback on their experience, which can be used to improve service and address any issues.

- Rate Sheet: This document provides a detailed list of fares, including any additional charges that may apply, ensuring passengers are aware of the costs upfront.

- Maintenance Log: It details the maintenance history of the taxi, including routine checks and repairs, ensuring the vehicle remains in safe and working condition.

- Insurance Documentation: This is critical for proving the taxi is insured, including liability and property damage coverage. It protects all parties in the event of an accident.

- License and Certification: Proof of the driver's professional license and any necessary certifications to operate the taxi legally within the jurisdiction. This guarantees the driver meets all regulatory requirements.

In addition to the Taxi Bill, these documents collectively ensure a level of professionalism and safety in the taxi service industry. They provide a clear record of the service provided, prevent disputes, and ensure compliance with legal requirements. As each document serves a unique purpose, they collectively contribute to a transparent, accountable, and high-quality service experience for passengers.

Similar forms

A Taxi Bill form shares common features with a Car Rental Agreement. Both documents outline the service provided, including dates and personal details of the user. A Car Rental Agreement, similar to a Taxi Bill, details the agreement between the service provider and the client, specifying the vehicle used (by model or number in the case of a taxicab), the duration of use, and the financial transaction involved. The primary difference lies in the duration and nature of the service: one is for a short-term ride, and the other is for a longer rental period.

Similar to a Taxi Bill form, a Hotel Bill also provides a itemized list of services used, their costs, and personal details of the client. Both documents serve as proof of transaction between the service provider and the customer. The Hotel Bill, however, extends beyond transportation to include accommodation, meals, and possibly other amenities, showcasing a broader spectrum of services provided during the customer's stay.

An Airline E-Ticket Receipt closely resembles a Taxi Bill form in function by documenting the transaction between the service provider and the user. It includes vital information such as date, name of the passenger, and details of the journey (origin and destination). Both documents act as a proof of payment for the service provided. Unlike a Taxi Bill, which is for ground transport, the Airline E-Ticket Receipt is for air travel, indicating a different mode of transportation.

The format and purpose of a Sales Receipt are similar to those of a Taxi Bill form, in that they both record a transaction between a seller and a buyer. A Sales Receipt includes the date of the transaction, the names or identification of the parties involved, a description of the item or service sold (including a vehicle number in the case of a Taxi Bill), and the amount paid. The main difference lies in the scope; a Sales Receipt can cover a wide range of goods or services, not just transportation.

A Bus Ticket also shares similarities with a Taxi Bill form by representing a financial transaction between the service provider and the passenger, including details like the date, the passenger's name, and the journey information (origin and destination). Both serve as proof of payment for the transportation service availed. However, a Bus Ticket differs in that it is usually for a specified seat on a scheduled service, unlike the personalized, on-demand service documented by a Taxi Bill.

An Event Ticket is akin to a Taxi Bill in that it documents the purchase of a service, including the date of the service, details of the purchaser, and the particulars of the service (e.g., event venue or taxi route). Both act as proof of a transaction. The key difference lies in the nature of the service: an Event Ticket is for entry to an event or venue, while a Taxi Bill is for personal transportation services.

Lastly, the similarity between a Parking Garage Ticket and a Taxi Bill form exists in both documenting the use of a transportation-related service. The Parking Garage Ticket provides details on the vehicle, the date, and the charges incurred for parking. While both serve as proof of service utilized and include a financial transaction, a Parking Garage Ticket concerns the stationary storage of a vehicle, as opposed to the active transport service represented by a Taxi Bill.

Dos and Don'ts

Filling out a Taxi Bill from Washington Flyer™ Taxi, especially after a journey from Washington Dulles International Airport, requires attention to detail. Whether for personal record-keeping, business expense reporting, or submitting claims, the accuracy and completeness of the information you provide are crucial. Here's a guide on what you should and shouldn't do:

Things You Should Do

Write legibly or type the information if the form allows, ensuring every piece of data is easy to read.

Fill in the date of your taxi service to maintain accurate records of your travel.

Include the full name that matches your identification or the entity responsible for payment, such as your employer if it's a business expense.

Ensure the amount ($) charged is accurate, reflecting the total cost of the service including any tips or tolls paid.

Things You Shouldn't Do

Don’t leave any fields blank. If a section does not apply, write 'N/A' to indicate this.

Avoid making corrections or using white-out. If an error is made, start over with a new form to maintain professionalism and readability.

Don't forget to include the taxicab number and driver name; these details are vital for referencing the ride or if issues need to be addressed.

Resist the temptation to guess information. If you’re unsure of a detail, such as the exact fare, verify it before submitting the form.

By following these guidelines, you can ensure your Taxi Bill form is filled out accurately and fully. This not only helps with personal record-keeping but also ensures that you are reimbursed correctly if the taxi fare is a business expense. Keeping a copy for your records is always a good practice.

Misconceptions

Understanding the Taxi Bill form from Washington Flyer™ Taxi, especially when departing from Washington Dulles International Airport, is crucial for both travelers and locals. However, there are several misconceptions about this document that need to be cleared up for the benefit of all passengers:

- It's not a legal document: Contrary to popular belief, the Taxi Bill form serves as a receipt and not a legal document. It primarily records the transaction between the passenger and the taxi service.

- It does not include tip information: The amount displayed on the form represents the fare cost alone. Tips given to drivers, which are customary in the service industry, are not reflected on this bill.

- It's not the only proof of the ride: While the Taxi Bill form is an official record of the journey, other proofs such as credit card statements or mobile-app bookings can also validate the transaction.

- The NAME section always reflects the passenger: People often think the "NAME" section is for the driver. However, it is intended for the passenger's name to be documented, which can sometimes be filled out upon request.

- Date isn't always the service date: The "DATE" field should ideally indicate when the service was rendered. However, in certain cases, the date might reflect when the receipt was printed or processed, which might not always coincide with the journey's date.

- Details in the 'FROM' and 'TO' sections are mandatory: There's a myth that these fields can be left blank or filled out vaguely. In reality, for the receipt to be considered valid, especially for business expense claims, these sections must be accurately completed.

- TAXICAB # is not necessary for disputes: Should there be a dispute or a lost item, while helpful, the TAXICAB # isn't the sole piece of information needed to resolve the issue. The company can trace the journey through other details like the date, time, and fare amount.

- Every taxi bill is the same: Although the format provided is standard for Washington Flyer™ Taxis, different companies may use various formats. Key information remains consistent, but the layout and additional details might vary.

- It guarantees a fixed rate for future rides: The amount listed reflects the charge for a specific trip. Fare rates can fluctuate based on numerous factors, including traffic, route changes, and tariffs. Thus, each journey might incur a different cost.

By demystifying these misconceptions, passengers can better understand what to expect from their Taxi Bill form and ensure smoother transactions and travel experiences with Washington Flyer™ Taxi services.

Key takeaways

When filling out and using a Taxi Bill form, especially after a ride from Washington Dulles International Airport with a Washington Flyer™ Taxi, there are essential details to ensure accuracy and clarity. These details can help both the passenger and the driver by ensuring that the transaction is recorded correctly and can be referenced if needed. Here are five key takeaways to consider:

Complete all fields accurately: Each section of the Taxi Bill form - DATE, NAME, $ (amount), FROM, TO, DRIVER, and TAXICAB # - should be filled out completely. Ensuring that all information provided is accurate and legible can prevent any misunderstandings about the service provided or the fare charged.

Verify the details: Before leaving the taxi, it's advisable for both the passenger and the driver to review the filled-out form together. This step ensures that both parties agree on the fare and the service details, reducing the potential for disputes later on.

Keep the receipt: Passengers should keep their copy of the Taxi Bill. This receipt is essential for various reasons, such as expense reporting, reimbursement, or in case any issues arise regarding the service received.

Report discrepancies immediately: If there are any discrepancies in the information provided on the form or concerning the service received, passengers should contact the taxi service provider immediately. Prompt reporting can help in resolving any issues efficiently.

Use the information for feedback: The details on the Taxi Bill can also be useful for providing feedback about the ride. Whether the feedback is positive or areas for improvement are identified, this information can be vital for service enhancement.

By paying close attention to these key aspects, the process of filling out and using a Taxi Bill form can be smooth and beneficial for both passengers and taxi service providers.

Popular PDF Documents

W2 14 - Filing this form is a proactive step in managing one’s taxes, preventing potential issues with underreported earning down the line.

California Property Tax Exemption - State officers and specific other officials can access the information provided, under strict conditions, for official duties.

Ohio Declaration of Tax Representative - This form elevates the professionalism and accuracy of handling tax matters by involving specialists who are well-versed in tax law.