Get Tax St370 Form

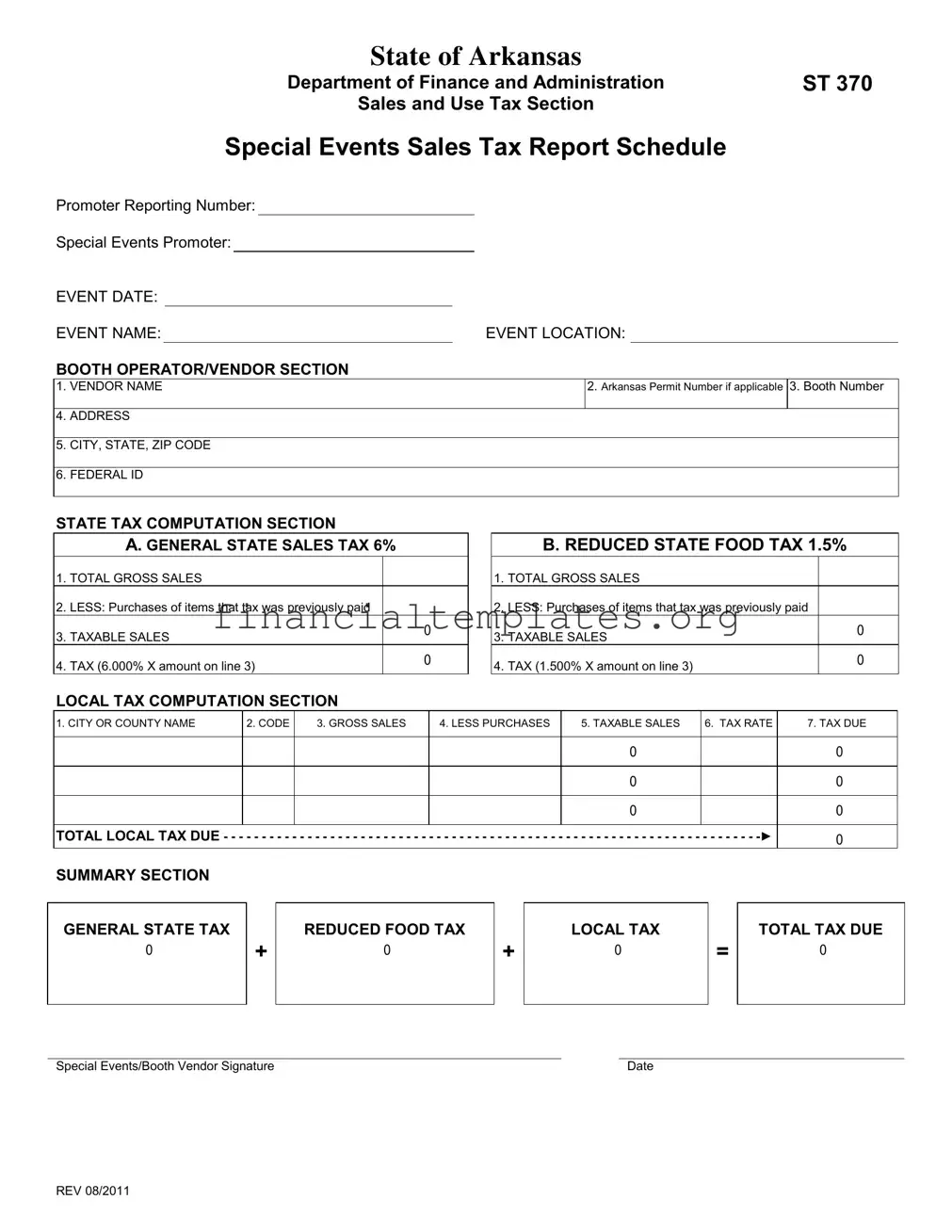

Amidst the myriad responsibilities and excitement of organizing special events in Arkansas, managing sales tax correctly plays a critical role for promoters and vendors alike. The Arkansas Department of Finance and Administration provides the ST 370 Sales and Use Tax Report Schedule as a streamlined tool for this purpose. This form enables event organizers and booth vendors to accurately report and remit the sales tax collected during festivals, fairs, and similar occasions. By breaking down the reporting process into clear sections for vendor details, state and local tax computations, and a final summary, it simplifies the complex task of tax reporting. Vendors are guided to detail their gross sales, subtract previously taxed purchases, and calculate the tax due at both state and local levels, including a reduced rate for food sales. The form also emphasizes the collaboration between event promoters and vendors, as promoters provide essential details like event location, local tax rates, and reporting numbers, ensuring that taxes are correctly allocated and paid. It embodies a comprehensive approach to fulfilling tax obligations, making it easier for all parties to focus on the success of their event.

Tax St370 Example

STATE OF ARKANSAS

Department of Finance and Administration |

ST 370 |

Sales and Use Tax Section |

|

Special Events Sales Tax Report Schedule

Promoter Reporting Number:

Special Events Promoter:

EVENT DATE: |

|

|

|

|

|

EVENT NAME: |

|

EVENT LOCATION: |

|

||

BOOTH OPERATOR/VENDOR SECTION |

|

|

|

|

|

1. VENDOR NAME |

|

2. Arkansas Permit Number if applicable |

3. Booth Number |

||

|

|

|

|

|

|

4. ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

5. CITY, STATE, ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

6. FEDERAL ID |

|

|

|

|

|

|

|

|

|

|

|

STATE TAX COMPUTATION SECTION

A. GENERAL STATE SALES TAX 6%

1.TOTAL GROSS SALES

2.LESS: Purchases of items that tax was previously paid

3. TAXABLE SALES |

0 |

|

|

4. TAX (6.000% X amount on line 3) |

0 |

|

B. REDUCED STATE FOOD TAX 1.5%

1.TOTAL GROSS SALES

2.LESS: Purchases of items that tax was previously paid

3. TAXABLE SALES |

0 |

|

|

4. TAX (1.500% X amount on line 3) |

0 |

|

LOCAL TAX COMPUTATION SECTION

1. CITY OR COUNTY NAME |

2. CODE |

3. GROSS SALES |

4. LESS PURCHASES |

5. TAXABLE SALES |

6. TAX RATE |

7. TAX DUE |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

|

|

|

|

|

|

TOTAL LOCAL TAX DUE - - - |

- - - - - - - |

- - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - |

- - - - - - - - - - - - - - - - - - |

- - - - - - - |

0 |

SUMMARY SECTION

GENERAL STATE TAX

0

+

REDUCED FOOD TAX

0

+

LOCAL TAX

0

=

TOTAL TAX DUE

0

Special Events/Booth Vendor Signature |

Date |

REV 08/2011

INSTRUCTIONS FOR FORM ST370

General Information

The Special Events Sales Tax Report Schedule is a form used by Special Events Promoters. The Promoter will give this form to the booth operators / vendors to complete and report their sales tax collections. It is to be completed and turned in to the Special Events Promoter at the end of the event.

Promoter Section Instructions

01. Reporting Number: The Special Events Promoter inserts his Reporting Number in this blank.

02. Special Events Promoter: Special Events Promoter inserts his name in this blank. NOTE: promoter could use a rubber stamp for the reporting number and name.

03. Event Date: Enter the date of each collection.

04. Event Name: Insert Name of Event. Example is "Big Event Festival"

05. Event Location: Insert City/State where the event is taking place.

Booth Operator/Vendor Section Instructions

06. Block 1. VENDOR NAME Booth operator/vendor name goes in this block.

07. Block 2. PERMIT NUMBER Insert Booth operator/vendor Permit Number if they have one. If the booth operator/ vendor has a permit number, they do not have to report their collections to the Special Events Promoter but, report their sales and tax computations to the department on their

08. Block 3. BOOTH NUMBER This field is for use by the Special Events Promoter in order to help keep track of the booth collections.

09. Block 4. ADDRESS Insert the Booth Vendor mailing address.

10.Block 5. CITY, STATE, ZIP CODE Insert your city, state and zip code.

11.Block 6. FEDERAL ID NUMBER Insert the booth operator's Federal Identification Number.

State Tax Computation Section Instructions

12.Line A1: Enter your total gross sales (excluding food items) for the event.

13.Line A2. Enter the cost of goods of sold on which sales tax has been paid.

14.Line A3: Subtract line A2 from line A1 and enter the difference. This is your taxable sales.

15.Line A4: Multiply the amount on line 3 by the state tax rate (6%) and enter that amount as TAX DUE.

16.Line B1: Enter your total gross FOOD sales for the event.

17.Line B2. Enter the cost of FOOD goods sold on which sales tax has been paid.

18.Line B3: Subtract line B2 from line B1 and enter the difference. This is your taxable sales.

19.Line B4: Multiply the amount on line B3 by the reduced state food tax rate (1.5%) and enter that amount as TAX DUE.

Local Tax Computation Section Instructions

20.Column 1. Enter the city and/or county name where the event is being held. You must collect the local tax for the city and/or county where the event is taking place. You do not collect local taxes for your city and/or county if you are from a different location. The Special Events Promoter should provide the booth operator/vendor with the local taxes that should be collected. If the event is held outside the city limits the city tax does not apply.

21.Column 2. Enter the city and or county local code as defined by the Sales & Use Tax Section of Arkansas. The Special Events Promoter should provide this information.

22.Column 3. The event's gross sales amount is entered here. This amount should be the same as LINE I column A & B in the State Tax Computation Sections.

23.Column 4. Enter the cost of goods sold on which sales tax has been paid.

24.Column 5. Subtract column 4 from column 3 and enter the difference. This is your taxable sales.

25.Column 6. Enter the local tax rate which should be provided by the Special Events Promoter.

26.Column 7. Multiply the amount on column 5 by the local tax rate in column 6 and enter that amount as TAX DUE.

27.TOTAL LOCAL TAX DUE. Add the amounts in column 7 and enter the total on this row.

Summary Section Instructions

28.Enter the amount from line 4 of the appropriate state tax computation section in the STATE TAX block. Enter the amount from the TOTAL LOCAL TAX row in the LOCAL TAX block. Add the STATE TAX block and the LOCAL TAX block and enter the total in the TOTAL TAX block. This is the amount that must be remitted to the Special Events Promoter at the end of the event.

REV 08/2011

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose of the Form ST370 | This form is designed for Special Events Promoters in Arkansas to collect sales tax information from booth vendors/operators at events. |

| Governing Law | The form is governed by Arkansas state sales and use tax laws as administered by the Department of Finance and Administration. |

| Sections of the Form | ST370 includes sections for promoter details, vendor information, state tax computation, local tax computation, and a summary of taxes due. |

| Vendor Permit Number | Vendors with an Arkansas Permit Number can report their sales and tax computations directly using the ET-1 Excise Tax return form, although they still must complete the ST370 for event purposes. |

| State and Local Tax Computations | Separate sections for state (with a general sales tax rate of 6%) and a reduced state food tax rate of 1.5%, alongside computations for local taxes based on event location. |

| Tax Collection Responsibility | Booth vendors/operators are responsible for collecting the appropriate sales taxes based on their sales at the event and must remit the total tax due to the Special Events Promoter. |

| Form Submission | Upon completion, the form is submitted to the Special Events Promoter, who then is responsible for the overall tax reporting and remittance for the event. |

Guide to Writing Tax St370

Filing the ST 370 form is essential for vendors participating in special events in Arkansas. This task helps ensure that the correct amount of sales and use taxes are reported and remitted through the Special Events Promoter. The form can appear daunting at first, but by breaking it down step by step, it becomes much more manageable. Carefully follow the instructions provided to accurately report your sales and tax computations.

- Enter the Reporting Number provided by the Special Events Promoter in the designated space.

- Write the name of the Special Events Promoter in the provided space.

- Fill in the date(s) of the collection(s) in the Event Date section.

- Insert the name of the event in the Event Name section.

- Provide the city and state where the event is taking place in the Event Location section.

- In the Booth Operator/Vendor Section, start by entering the Vendor Name in block 1.

- If applicable, insert the Booth Operator/Vendor Permit Number in block 2.

- Fill in the Booth Number in block 3 as provided by the Special Events Promoter.

- Enter the mailing address of the Booth Vendor in block 4.

- Write the city, state, and zip code of the Booth Vendor in block 5.

- Insert the Federal Identification Number of the booth operator in block 6.

- In the State Tax Computation section, enter your total gross sales in line A1.

- For line A2, enter the cost of goods sold on which sales tax has already been paid.

- Subtract line A2 from line A1 and write the taxable sales amount in line A3.

- Multiply the amount in line A3 by the state tax rate (6%) and enter the tax due in line A4.

- For food sales, enter your total gross sales in line B1.

- Enter the cost of FOOD goods sold on which sales tax has been paid in line B2.

- Subtract line B2 from line B1 and write the taxable sales amount in line B3.

- Multiply the amount in line B3 by the reduced state food tax rate (1.5%) and enter the tax due in line B4.

- In the Local Tax Computation section, enter the city and/or county name where the event is being held in column 1.

- Enter the city and/or county local code in column 2 as provided by the Special Events Promoter.

- Write the gross sales amount in column 3, which should match line I column A & B.

- Enter the cost of goods sold on which sales tax has been paid in column 4.

- Subtract column 4 from column 3 and enter the taxable sales amount in column 5.

- Fill in the local tax rate in column 6 as provided by the Special Events Promoter.

- Multiply the amount in column 5 by the local tax rate in column 6 and enter the tax due in column 7.

- Add the amounts in column 7 and write the total local tax due in the designated row.

- In the Summary Section, enter the amount from line 4 of the appropriate state tax computation section in the STATE TAX block.

- Enter the amount from the TOTAL LOCAL TAX row in the LOCAL TAX block.

- Add the STATE TAX block and the LOCAL TAX block and enter the total in the TOTAL TAX block. This is the amount that must be remitted to the Special Events Promoter at the end of the event.

After completing these steps, review the form to ensure accuracy before submitting it to the Special Events Promoter. Accurate and timely submission not only complies with local tax laws but also supports the smooth operation of special events in Arkansas.

Understanding Tax St370

Understanding the ins and outs of the Tax ST370 form, required for reporting sales and use tax at special events in the State of Arkansas, can seem daunting. Below are answers to some frequently asked questions that aim to shed light on how to properly fill out and utilize this form.

What is the purpose of the Tax ST370 form?

The Tax ST370 form serves a crucial role for Special Events Promoters and vendors or booth operators in Arkansas. It is designed to facilitate the calculation and reporting of sales and use tax collected from sales at special events. This ensures compliance with state tax regulations, allowing for a streamlined process in reporting sales, deductions, and due taxes to the Department of Finance and Administration.

Who is required to complete the ST370 form?

Both Special Events Promoters and booth operators/vendors participating in special events are required to engage with the ST370 form. Promoters must provide the form to each vendor, who then completes and returns it with their sales tax collections at the event's conclusion. Vendors with an Arkansas Permit Number report their sales and tax computations directly on their ET-1 Excise Tax return form in addition to completing the ST370 form for the Promoter.

How is the General State Sales Tax calculated on the ST370 form?

To calculate the General State Sales Tax, vendors must first enter their total gross sales. From this, they subtract the cost of items on which tax was previously paid, resulting in the taxable sales amount. This amount is then multiplied by the state tax rate (6%) to determine the tax due. This calculation ensures that only sales eligible for sales tax are taxed accordingly.

What is the process for calculating Local Tax on the form?

The Local Tax computation requires vendors to note the city or county name where the event is held, alongside the corresponding local code. Gross sales are entered, subtracted by purchases already taxed, to find the taxable sales. This figure is multiplied by the local tax rate provided by the Special Events Promoter to calculate the local tax due. It's important for vendors to collect and remit local taxes for the jurisdiction where the event is actually taking place.

What happens if a vendor has an Arkansas Permit Number?

Vendors with an Arkansas Permit Number are treated slightly differently. While they must still fill out the ST370 for the Promoter, their sales tax obligations do not end there. They are also required to report their sales and tax computations directly to the department using the ET-1 Excise Tax return form. This ensures that all tax obligations are met both at the local and state levels.

When and to whom is the completed ST370 form submitted?

Upon completing the sales event, vendors must submit the filled ST370 form to the Special Events Promoter. The Promoter collects all forms and remits the total tax due to the Department of Finance and Administration. It is mandatory that this process is followed at the conclusion of each event to ensure timely and accurate tax reporting and remittance.

Common mistakes

-

Not filling in the Special Events Promoter's Reporting Number and Promoter Name: The form starts with a requirement for a Promoter Reporting Number and the Special Events Promoter's name. Sometimes, individuals overlook these initial steps, thinking they are only for administrative purposes. However, without them, the report lacks identification and can lead to confusion or misplacement of documents.

-

Incorrect reporting of sales: A common mistake is incorrect entries in the Total Gross Sales sections for both general sales and food sales. It is crucial to accurately report the gross sales, excluding items where tax has been previously paid, to ensure correct tax calculation. Inaccuracy in these figures can lead to either overpayment or underpayment of taxes.

-

Omitting or incorrectly entering the Arkansas Permit Number: Vendors with a permit number are supposed to report their sales directly and not to the event promoter. Failing to include this number if applicable, or incorrectly entering it, can cause unnecessary complications in the tax reporting process.

-

Failure to accurately calculate taxable sales: After deducting purchases on which tax was already paid from the total gross sales, the resulting taxable sales figure is the base for tax calculations. Some individuals mistakenly skip this step or do incorrect subtraction, leading to incorrect tax due amounts being reported.

-

Forgetting to include Local Tax computations: The form requires entry of city or county names and applicable local tax rates for the event's location. It's common for individuals to either skip this section or fill it in incorrectly. This omission or error can result in the wrong total tax due amount, as it doesn't account for local tax obligations.

Documents used along the form

When businesses participate in special events or festivals, one vital aspect of compliance involves managing sales tax obligations. The State of Arkansas, through its Department of Finance and Administration, mandates the use of the ST 370 form, a Special Events Sales Tax Report Schedule, for special events promoters and their participating vendors. This form allows for the orderly reporting and remittance of both state and local sales taxes collected during events. However, the ST 370 form doesn't exist in isolation. To ensure comprehensive tax compliance, several other forms and documents commonly accompany the ST 370 form, each serving a distinct but related purpose.

- ET-1 Excise Tax Return Form: This form is utilized by vendors with an Arkansas Permit Number, allowing them to report their sales and tax computations directly to the department. It's necessary for those who have a more permanent or ongoing sales presence beyond one-time special events.

- AR1000F Full Year Resident Individual Income Tax Return: Individuals who earn income from sales at special events might need to report this income on their personal income tax returns, depending on their total income levels and tax situation.

- AR1100CT Corporation Income Tax Return: Corporations participating as vendors in special events would use this form to report income earned from sales at events, contributing to their overall annual corporate income tax obligations.

- AR1055 Request for Extension of Time to File: This document is essential for those who need additional time to gather their documents and accurately report their taxes. It applies to both individual and corporate tax returns.

- AR1155 Penalty Waiver Request: If a vendor or promoter faces penalties due to late or incorrect tax filings, this form can be submitted to request a waiver or reduction of those penalties, provided there are reasonable grounds for the request.

- Form AR-ST3 Underground Storage Tank Registration and Permit Application: While not directly related to sales tax, vendors who store fuel for sale at special events must register their storage tanks and obtain the necessary permits, ensuring compliance with environmental regulations.

- Form AR-EDP Electronic Data Payment Form: For those who prefer or are mandated to remit their taxes electronically, this form facilitates the setup of electronic payments, streamlining the tax remittance process.

In addition to the ST 370 form, these documents collectively ensure that vendors and promoters not only comply with sales tax reporting requirements but also manage other related tax and regulatory obligations. Whether engaging in occasional events or managing a series of events across Arkansas, understanding and utilizing these forms appropriately is crucial for successful event planning and execution. By carefully managing these obligations, businesses can focus on the other aspects of making their participation in special events both profitable and compliant.

Similar forms

The ST-370 form is closely related to the Uniform Sales & Use Tax Certificate - Multijurisdiction form. Both documents are designed for entities involved in sales and transactions that are subject to sales tax. While the ST-370 form specifically caters to vendors at special events in Arkansas, reporting their sales tax collections, the Uniform Sales & Use Tax Certificate facilitates businesses to purchase goods tax-free for resale in multiple states. The primary similarity lies in their purpose to ensure the correct calculation and reporting of sales tax.

Similar to the ST-370 form, the ET-1 Excise Tax return form is used in Arkansas for tax reporting purposes, but it focuses on the excise taxes related to specific goods such as alcohol and tobacco. Booth vendors with an Arkansas Permit Number can report their sales directly using the ET-1 form, bypassing the need for a ST-370. Both forms play crucial roles in tax administration by helping businesses report relevant taxes efficiently, although they focus on different types of tax.

The ST-370 shares similarities with the Sales and Use Tax Return (Form ST-3) in function and purpose. Both require businesses to report their sales and calculate the taxes due, albeit for different contexts. The ST-3 form is a general form used by retailers or vendors regularly operating in a state, encompassing a broader range of transactions beyond special events. The delineation between these forms underscores their tailored approaches to tax reporting based on the vendor's selling environment.

The Special Event Vendor Sales Tax Return, similar to Arkansas's ST-370, is used in various states to report sales tax collected by vendors at temporary events like fairs and craft shows. These forms ensure that sales tax from temporary vendors is properly reported and paid, reflecting their transient nature and the ad hoc setup of their businesses during such events. The principle of operation – collecting sales tax on transactions occurring within a special event – unites these forms across jurisdictions.

The Marketplace Facilitator Sales Tax Return is a modern adaptation in the realm of tax documents, specially designed to account for sales facilitated through online platforms. Although distinct in application with the ST-370 focusing on physical event sales, both forms address the collection and remission of sales tax. As the digital and physical marketplaces converge, the underlying goal of these forms remains the uniform collection of sales taxes from goods sold to consumers, despite the differing contexts.

The Seller's Permit Application (sometimes referred to as a Sales Tax Permit Application) is foundational to the process leading up to the need for an ST-370 form. This application is a preliminary step that allows a business to legally sell goods or services in a state. Once obtained, the permit requires vendors to collect sales tax on taxable sales, subsequently reported on forms like the ST-370 during special events. The intertwining of these documents highlights the comprehensive fiscal responsibility imparted to businesses.

The Local Business Tax Receipt, formerly known as the Occupational License, parallels the ST-370 in its local tax implications. While the ST-370 form captures sales tax due from transactions at special events, the Local Business Tax Receipt is evidence of payment of local business taxes. Both underscore the multifaceted nature of tax obligations businesses face, from state-level sales tax to local business taxes, contributing to the overall fiscal framework within which businesses operate.

The Voluntary Disclosure Agreement (VDA) Form, though not directly involved in regular sales tax reporting, shares a remedial connection with forms like the ST-370. For businesses that have failed to comply with sales tax regulations, a VDA provides a pathway to rectify past oversights without facing full penalties. This mechanism complements regular reporting forms by offering a resolution for non-compliance, underscoring the importance of accurate tax reporting and remittance.

The Consumer's Use Tax Report is akin to the ST-370 in its focus on tax due from purchases. However, the former targets consumers who buy taxable goods without paying sales tax at the time of purchase, necessitating a separate declaration. The ST-370 and the Consumer's Use Tax Report collectively ensure tax collection from both sides of a transaction – seller and buyer – highlighting the comprehensive strategy employed by tax authorities to capture due revenues.

Dos and Don'ts

Filling out the Tax ST370 form correctly is crucial for vendors participating in special events in Arkansas. This guide presents ten essential do's and don'ts to assist in accurately completing the form and avoiding common mistakes.

- Do ensure you have the correct form. The ST370 form is specifically for Special Events Sales Tax reporting.

- Do clearly print all information to avoid misunderstandings or processing delays due to illegible handwriting.

- Do double-check the Special Events Promoter's Reporting Number and your booth information to ensure accurate identification.

- Do calculate your gross sales meticulously, excluding any food items unless specifically for the reduced state food tax section.

- Do subtract the cost of goods on which tax was already paid to accurately determine your taxable sales.

- Don't forget to include your Arkansas Permit Number if applicable, as this could change how you report your sales tax.

- Don't overlook the importance of accurately reporting your Federal ID Number, as failing to do so can result in processing delays.

- Don't guess local tax rates or codes—these should be provided by the Special Events Promoter according to the event's location.

- Don't neglect to add up the general state tax, reduced food tax, and total local tax due to get the correct total tax amount.

- Don't delay in submitting the completed form to the Special Events Promoter at the event's conclusion to ensure timely tax reporting.

Following these guidelines can simplify the tax reporting process, ensuring compliance and avoiding potential errors or penalties. Always refer to the latest form instructions or consult with a tax professional if you're unsure about any aspects of your tax obligations for special events.

Misconceptions

When it comes to the State of Arkansas Department of Finance and Administration ST 370 Sales and Use Tax Section Special Events Sales Tax Report Schedule, several misconceptions can lead to confusion for both promoters and vendors. Understanding these forms is crucial for accurate reporting and compliance. Here are five common misconceptions explained:

- Only food vendors need to file this report. This is a misconception. The ST370 form is designed for all vendors at special events, not just those selling food. While there is a section dedicated to calculating the reduced state food tax, all vendors, regardless of what they are selling, need to complete the form if they do not have a permanent sales tax permit.

- If I have a sales tax permit, I don’t need to complete this form. This is partially true. Vendors with an Arkansas Permit Number must still fill out the ‘Booth Operator/Vendor’ portion of the ST370 and return it to the Special Events Promoter at the event's conclusion. However, they report their sales and tax computations directly on their regular sales tax return, not through the promoter.

- The form is only for Arkansas-based vendors. Regardless of where the vendor is based, if they are participating in an event in Arkansas, they need to complete the ST370 form. This ensures that all sales tax due from the event is accurately reported and paid to the Arkansas Department of Finance and Administration.

- Local taxes don’t need to be reported on this form if the event is outside city limits. This is incorrect. The local tax computation section must be completed with the applicable city or county tax, even for events held outside city limits. The difference is that city tax may not apply, but county tax still might. It's crucial for vendors to collect and report local taxes for the specific location of the event, as these taxes support local government and community services.

- Completing the ST370 is the responsibility of the event promoter, not the individual vendors/booth operators. While the event promoter plays a significant role in providing the necessary information, such as the local tax rate and codes, it’s the responsibility of each vendor or booth operator to complete their portion of the ST370 form and ensure it is returned to the promoter for submission. The promoter cannot know the specifics of each vendor’s sales and taxable items.

Understanding these misconceptions is key to ensuring compliance and smooth operation during special events in Arkansas. Properly completing and submitting the ST370 form helps support the necessary tax infrastructure, benefiting local communities and the state alike.

Key takeaways

Filling out the Tax ST370 form is a crucial task for vendors participating in special events in Arkansas. This form enables the accurate reporting of sales tax collected during these events. For both seasoned and new vendors, grasping the essentials of this form ensures compliance and smooth operation at events. Here are six key takeaways to guide you through the process:

- Understanding the Purpose: The ST370 form is specifically designed for special event promoters and their vendors, facilitating the proper reporting and remittance of sales taxes collected at events. Make sure you're using this form if you're participating in a temporary event such as a festival, fair, or market.

- Vendor Information is Crucial: The form requires detailed vendor information, including name, permit number if applicable, booth number, and contact details. Providing accurate information ensures that your sales tax reporting is correctly attributed and processed by the Department of Finance and Administration.

- Reporting Sales Accurately: There are separate sections for general state sales and reduced state food tax. It's important to report gross sales accurately, deduct purchases where tax was previously paid, and calculate the taxable sales properly. This division helps in understanding how different items are taxed at varying rates.

- Local Tax Collection: Vendors must be aware of the local taxes applicable to their sales. The form requires the city or county name, a local code, and the calculation of local tax due based on sales. This section emphasizes the importance of collecting and reporting taxes specific to the event's location.

- Summary and Total Tax Due: After filling out the detailed sections, the summary part consolidates all taxes - general state, reduced food, and local taxes - into a total tax due. This figure represents the overall tax amount that vendors must remit, making it a crucial check to ensure all taxes are accounted for.

- Collaboration with Event Promoters: The form serves as a bridge between vendors and event promoters. Vendors must submit this completed form to the event's promoter, who then coordinates with the Department of Finance and Administration. This collaboration ensures tax compliance and smooth operation within the special event's ecosystem.

By keeping these key takeaways in mind, vendors can navigate the complexities of tax reporting with confidence and ensure compliance with Arkansas tax laws. Proper completion and submission of the ST370 form not only adhere to legal requirements but also contribute to the successful operation of special events across the state.

Popular PDF Documents

Political Form - Instructions detail how to round off figures to whole dollars for reporting purposes.

Business Income Source - This form simplifies the declaration process for partnerships and LLCs in NYC with no tax dues.

How Do You File an Extension With the Irs - Seasonal fluctuations in operations and funding can make the extension provided by Form 8868 critical for accurate financial reporting.