Get Tax Rut 50 Form

When purchasing a vehicle in Illinois from a private party, individuals find themselves navigating the path of tax obligations, facilitated by the Illinois Department of Revenue’s RUT-50 form. A crucial document for the 2016 fiscal year, effective from January 1st through December 31st, this form outlines the Private Party Vehicle Use Tax, rooted in the purchase price or the fair market value of the vehicle, with certain exceptions clearly earmarked for motorcycles and various specific conditions. Determining the tax amount due involves referencing Table A or B, contingent on the vehicle’s value, ensuring taxes are accurate according to the vehicle’s age or purchase price. While the form does not permit trade-in deductions, it suggests exemptions for qualified purchasers such as tax-exempt entities or out-of-state residents meeting specific criteria. Furthermore, the RUT-50 form addresses other transactions, emphasizing different tax rates for motorcycles, ATVs, and situations involving estate gifts, highlighting the necessity for meticulous attention to detail when completing this form. Equally, it prompts purchasers to consider local government taxes, necessitating a review of the RUT-6, Form RUT-50 Reference Guide for a comprehensive understanding of all potential tax implications during private vehicle transactions in Illinois.

Tax Rut 50 Example

Illinois Department of Revenue

Effective January 1, 2016, through December 31, 2016

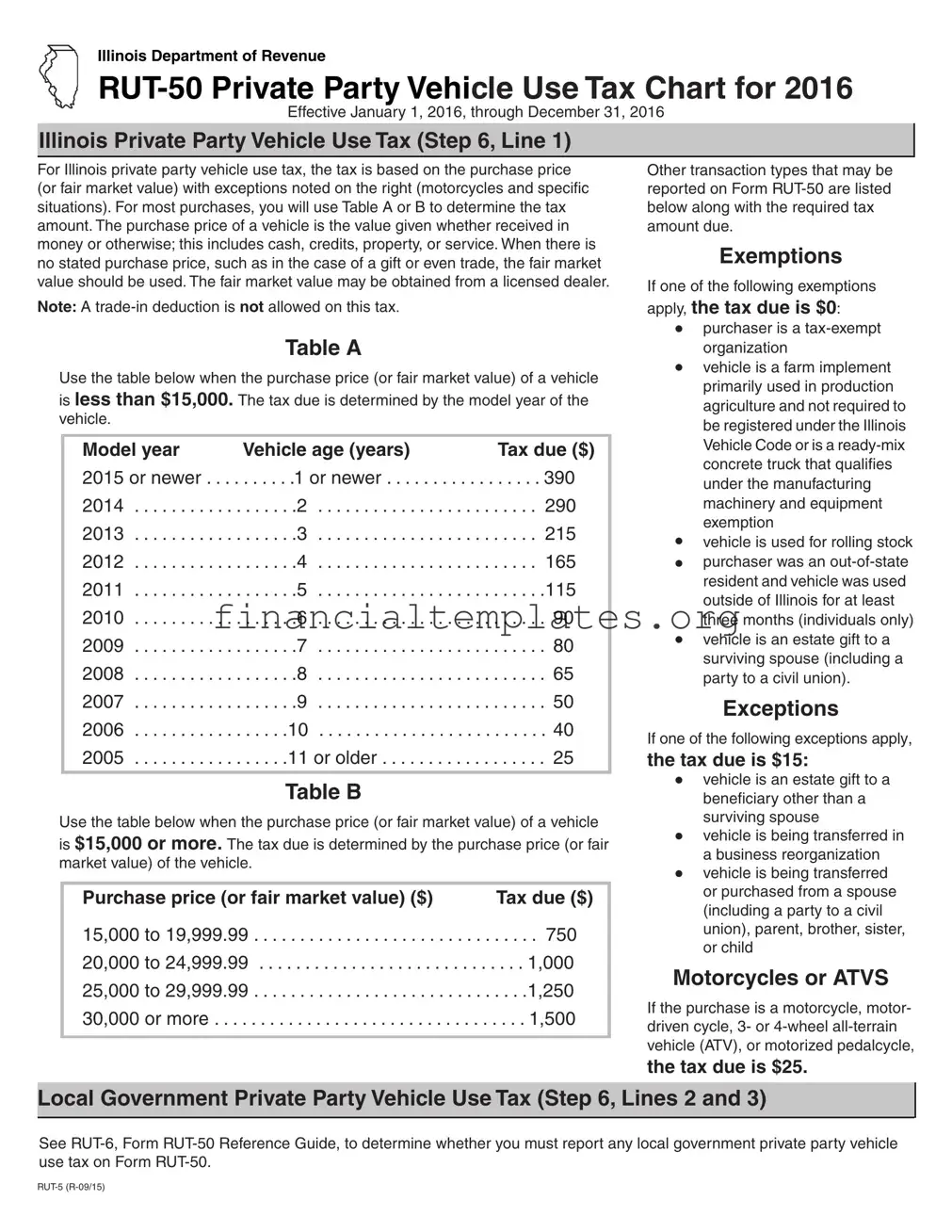

Illinois Private Party Vehicle Use Tax (Step 6, Line 1)

For Illinois private party vehicle use tax, the tax is based on the purchase price (or fair market value) with exceptions noted on the right (motorcycles and specific situations). For most purchases, you will use Table A or B to determine the tax amount. The purchase price of a vehicle is the value given whether received in money or otherwise; this includes cash, credits, property, or service. When there is no stated purchase price, such as in the case of a gift or even trade, the fair market value should be used. The fair market value may be obtained from a licensed dealer.

Other transaction types that may be reported on Form

Exemptions

If one of the following exemptions

Note: A

Table A

Use the table below when the purchase price (or fair market value) of a vehicle is less than $15,000. The tax due is determined by the model year of the vehicle.

Model year |

Vehicle age (years) |

Tax due ($) |

2015 or newer . . . . |

. . . . . .1 or newer |

. . . . . 390 |

2014 |

. . . . . .2 |

. . . . 290 |

2013 |

. . . . . .3 |

. . . . 215 |

2012 |

. . . . . .4 |

. . . . 165 |

2011 |

. . . . . .5 |

. . . . .115 |

2010 |

. . . . . .6 |

. . . . . 90 |

2009 |

. . . . . .7 |

. . . . . 80 |

2008 |

. . . . . .8 |

. . . . . 65 |

2007 |

. . . . . .9 |

. . . . . 50 |

2006 |

. . . . .10 |

. . . . . 40 |

2005 |

. . . . .11 or older |

. . . . . 25 |

|

|

|

Table B

Use the table below when the purchase price (or fair market value) of a vehicle is $15,000 or more. The tax due is determined by the purchase price (or fair market value) of the vehicle.

Purchase price (or fair market value) ($) |

Tax due ($) |

15,000 to 19,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 750 20,000 to 24,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000 25,000 to 29,999.99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .1,250 30,000 or more . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,500

apply, the tax due is $0:

•purchaser is a

•vehicle is a farm implement primarily used in production agriculture and not required to be registered under the Illinois Vehicle Code or is a

•vehicle is used for rolling stock

•purchaser was an

•vehicle is an estate gift to a surviving spouse (including a party to a civil union).

Exceptions

If one of the following exceptions apply,

the tax due is $15:

•vehicle is an estate gift to a beneficiary other than a surviving spouse

•vehicle is being transferred in a business reorganization

•vehicle is being transferred or purchased from a spouse (including a party to a civil union), parent, brother, sister, or child

Motorcycles or ATVS

If the purchase is a motorcycle, motor- driven cycle, 3- or 4‑wheel

the tax due is $25.

Local Government Private Party Vehicle Use Tax (Step 6, Lines 2 and 3)

See

Document Specifics

| Fact Name | Description |

|---|---|

| Form Designation | Illinois Department of Revenue RUT-50 |

| Primary Purpose | Used for reporting and paying Private Party Vehicle Use Tax |

| Effective Date | January 1, 2016, through December 31, 2016 |

| Tax Calculation Basis | Based on the purchase price (or fair market value) of the vehicle, with specific rates for motorcycles and exceptional cases |

| Exemptions | Includes tax-exempt organizations, vehicles used primarily in production agriculture, vehicles used outside of Illinois by out-of-state residents for at least three months, and estate gifts to a surviving spouse |

| Governing Law | Illinois Vehicle Code |

Guide to Writing Tax Rut 50

When handling the transfer of vehicle ownership through a private party sale in Illinois, it is necessary to accurately complete the Form RUT-50. This document is crucial for the calculation and payment of the applicable vehicle use tax. The form requires detailed information about the transaction, including the sale price and the vehicle's specifics. Below are step-by-step guidelines designed to assist individuals in accurately filling out the form and ensuring compliance with state requirements.

- Identify the vehicle's sale price or fair market value. If there is no stated purchase price, for instance, in the case of a gift or trade, the fair market value should be determined, potentially with assistance from a licensed dealer.

- Determine if any exemptions apply to your situation. Exemptions may eliminate the need for tax payment. Some exemptions include vehicles purchased by a tax-exempt organization, farm implements primarily used in agricultural production, or vehicles received as an estate gift by a surviving spouse.

- If the vehicle is a motorcycle, motor-driven cycle, ATV, or motorized pedalcycle, note that the tax due is $25, regardless of the purchase price or fair market value.

- Refer to Table A for vehicles less than $15,000 in value. Find the category that corresponds with the vehicle's model year and use the adjacent tax due amount for your calculation. This table progresses in relation to the vehicle's age and provides specific tax amounts due for vehicles up to 11 years old or older.

- If the vehicle's purchase price or fair market value is $15,000 or more, use Table B to determine the tax due. This table categorizes vehicles based on their purchase price ranges and assigns a fixed tax amount accordingly.

- For local government private party vehicle use tax, consult the RUT-6, Form RUT-50 Reference Guide, to see if additional local taxes apply based on the sale's location. Include any required local tax amounts in Step 6, Lines 2 and 3 of the form.

- Complete all remaining sections of the form that require personal information, vehicle identification, and transaction details. Ensure that every section is filled out with accurate and truthful information to avoid any compliance issues.

- Review the form thoroughly before submission to ensure all data is correct and that no required fields have been missed.

- Submit the completed Form RUT-50 along with the necessary payment for the calculated tax due to the appropriate state department as indicated in the form's submission instructions.

Following these steps meticulously will facilitate a smooth process in reporting and paying the necessary vehicle use tax. Keeping accurate records of this transaction and the submitted form is also recommended for personal records and potential future reference.

Understanding Tax Rut 50

-

What is the RUT-50 form and who needs to file it in Illinois?

The RUT-50 form is a document required by the Illinois Department of Revenue for individuals who purchase a vehicle from a private party. It is used to report and pay the Private Party Vehicle Use Tax. This form must be filed by anyone who buys a vehicle in a private sale in Illinois, where the transaction does not involve a licensed dealer.

-

How is the tax calculated on the RUT-50 form?

Tax calculation on the RUT-50 form is based on the purchase price (or fair market value) of the vehicle. Buyers should use Table A for vehicles with a purchase price (or fair market value) less than $15,000 and Table B for vehicles priced $15,000 or more. The tax amount varies depending on the vehicle's model year and purchase price.

-

Are there any exemptions available when filing RUT-50?

Yes, certain exemptions may apply when filing the RUT-50 form that result in a $0 tax due. These include vehicles purchased by tax-exempt organizations, farm implements primarily used in production agriculture, vehicles used for rolling stock, purchases made by out-of-state residents who used the vehicle outside Illinois for at least three months, and estate gifts to a surviving spouse.

-

Are there exceptions with a different tax amount due?

Yes, there are specific situations that result in a $15 tax due. These include vehicles given as estate gifts to a beneficiary other than a surviving spouse, vehicles transferred in a business reorganization, and vehicles transferred or purchased from a spouse, parent, brother, sister, or child.

-

What is the tax due for motorcycles or ATVs?

For motorcycles, motor-driven cycles, 3- or 4-wheel all-terrain vehicles (ATV), or motorized pedalcycles, the tax due is $25, regardless of the purchase price or fair market value.

-

Is there a local government private party vehicle use tax?

Yes, apart from the state tax, buyers may also be responsible for reporting and paying any applicable local government private party vehicle use tax. The requirements and amounts for this tax can be determined using the RUT-6 form, which serves as the RUT-50 Reference Guide.

-

How can the fair market value of a vehicle be determined?

If there is no stated purchase price for a vehicle, such as in the case of a gift or even trade, the fair market value should be used. This can be obtained from a licensed dealer, which will help accurately determine the tax due on the RUT-50 form.

-

What if the vehicle purchase price is less than $15,000?

For vehicles with a purchase price or fair market value of less than $15,000, buyers should refer to Table A to determine the tax due. This table bases the tax obligation on the model year of the vehicle, with specific amounts designated for each year range.

Common mistakes

When filing the Illinois Department of Revenue RUT-50 Private Party Vehicle Use Tax form, individuals often make mistakes that can delay processing or result in incorrect tax calculations. Recognizing and avoiding these common errors is essential for a smooth transaction. Here are six such mistakes:

- Incorrectly Determining the Vehicle's Value: Many filers mistake the fair market value for either the purchase price or the value they consider accurate without consulting a licensed dealer. It's crucial to accurately determine the vehicle's value since the tax amount is directly correlated with this figure.

- Ignoring the Appropriate Tax Table: The RUT-50 form provides two tables (A and B) based on the vehicle's purchase price or fair market value. Overlooking or selecting the incorrect table can lead to an inaccurate tax amount, causing potential underpayment or overpayment.

- Overlooking Exemptions: Failure to identify qualifying exemptions can lead to unnecessary tax payments. Examples include transfers to a surviving spouse, purchases by tax-exempt organizations, or vehicles primarily used in agricultural production that aren't required to be registered under the Illinois Vehicle Code.

- Misinterpreting the Trade-in Deduction Rule: A common mistake includes assuming a trade-in deduction is allowed, which is not the case for this tax. Understanding that no trade-in deductions are permissible can prevent misunderstanding and incorrect tax filings.

- Incorrect Tax Calculations for Specific Exceptions: If the vehicle falls under certain exceptions (e.g., estate gifts to beneficiaries other than the surviving spouse, business reorganizations, or familial transfers), the tax due is a flat rate of $15. Misapplying these exceptions can lead to incorrect tax reports.

- Failing to Report Local Government Private Party Vehicle Use Tax: In addition to state tax, some local governments require private party vehicle use tax. Not checking the RUT-6 form or assuming no local tax applies can result in incomplete compliance and potential penalties.

Thoroughly reviewing and accurately completing the RUT-50 form is vital for ensuring proper tax payment and compliance with Illinois tax laws. Taxpayers should read instructions carefully, verify all information, and seek clarification if necessary to avoid these common pitfalls.

Documents used along the form

When dealing with vehicle transactions in Illinois, especially in private sales, a number of forms and documents often accompany the Tax RUT-50 form. These documents are key in ensuring all tax obligations are met and the transaction is properly recorded. Let's take a closer look at four such documents that are commonly used in conjunction with the Tax RUT-50 form.

- Title Application (VSD 190): This form is essential for transferring the vehicle's title from the seller to the buyer. It's used to update or change vehicle, title, or registration information. It's vital for officially recording the new ownership of the vehicle with the state.

- Bill of Sale: While not an official form from the Department of Motor Vehicles (DMV) in many states, a Bill of Sale serves as a critical document that provides proof of the transaction between the buyer and seller. It includes information such as the sale date, purchase price, and detailed information about the vehicle.

- Odometer Disclosure Statement: Required for most vehicle sales, this statement is an official declaration of the vehicle's mileage at the time of sale. It's a key component in preventing odometer fraud and ensuring the buyer is aware of the vehicle's condition.

- Form RUT-25: Applicable when a vehicle is purchased from an out-of-state dealer and brought into Illinois for use, this Use Tax Transaction Return form is essential for calculating and reporting the tax due on vehicles acquired in this manner. It's a critical form for ensuring tax compliance on out-of-state purchases.

These documents, together with the Tax RUT-50 form, form a comprehensive packet that ensures vehicle transactions are conducted in accordance with Illinois state law, providing peace of mind and legal protection for both parties involved in the transaction. Understanding the purpose and requirement of each form helps in navigating the process smoothly and ensures compliance with state regulations.

Similar forms

The Form 1040, used for submitting annual federal income tax returns by individuals in the U.S., shares key similarities with the Illinois Department of Revenue RUT-50 form. Both forms are integral to the process of reporting and paying taxes, albeit on different scales and for different types of taxes. Where the Form 1040 is comprehensive, capturing an individual's income, deductions, and credits for federal tax purposes, the RUT-50 is specialized, focusing purely on the transactional tax due from the private purchase of a vehicle. Each form, however, requires detailed information about financial transactions over the previous year, ensuring that taxpayers comply with regulations and contribute their fair share to public funds.

The Form 8283, Noncash Charitable Contributions, is another example that parallels the RUT-50. It is designed for individuals who donate property valued over $500 and need to claim deductions on their federal tax returns. Like the RUT-50, which determines tax based on the vehicle's purchase price or fair market value, Form 8283 requires valuations of donated property to calculate potential deductions properly. Both forms play a critical role in ensuring accurate tax reporting, allowing for exemptions under specific conditions, and maintaining transparency in financial contributions, albeit in distinctly different contexts.

Similarly, the Form 6252, Installment Sale Income, exhibits parallels to the RUT-50. The 6252 form is used by individuals who have sold property and plan to receive payments over future years, affecting how they report income for tax purposes. Comparable to the RUT-50, which calculates tax based on the vehicle's purchase price, Form 6252 necessitates understanding and reporting the financial nuances of a transaction over time. Both forms help individuals comply with tax obligations in situations where financial dealings do not adhere to simple one-time payments.

The Schedule SE (Form 1040), Self-Employment Tax, also shares similarities with the RUT-50 in its focus on specific taxpayer activities. Schedule SE is utilized by individuals who are self-employed to determine the taxes owed on income from self-employment, akin to how the RUT-50 is used by Illinois residents to figure the taxes due on a private vehicle purchase. Both documents are instrumental for taxpayers in calculating and fulfilling their tax responsibilities related to personal and business endeavors, ensuring compliance with state and federal laws.

Finally, the Sales Tax Return forms used by businesses to report collected sales tax from customers bear resemblance to the RUT-50 form. While sales tax forms vary by state, they universally require businesses to report sales activities and remit the appropriate tax to the government, similar to the individual obligation under the RUT-50 to report and pay tax on a vehicle purchase. Though one pertains to routine business transactions and the other to a specific type of personal purchase, both sets of forms are crucial for accurately reporting taxable activities to tax authorities.

Dos and Don'ts

When filling out the Illinois Department of Revenue RUT-50 form for private party vehicle use tax, it's crucial to pay attention to detail to ensure accuracy and compliance. Here's a guide to help you navigate the process effectively:

Do:- Review the entire form before starting: Make sure you understand all the sections and requirements.

- Use Table A or B correctly: Determine the tax based on the purchase price or fair market value of the vehicle, using the appropriate table for your situation.

- Identify applicable exemptions: Check if the vehicle purchase qualifies for any exemptions to avoid unnecessary tax payments.

- Report accurate purchase price: Declare the actual amount paid or the fair market value if the vehicle was a gift or traded.

- Consult a licensed dealer for fair market value: If unsure about the vehicle's value, get a professional assessment to report it accurately.

- Guess the vehicle's value: Reporting incorrect values can lead to problems with your tax calculation.

- Overlook local government taxes: Ensure you also consider any local government private party vehicle use tax that may apply.

- Ignore specific situations: Be aware of exceptions that might lower your tax due, such as for motorcycles or certain vehicle transfers within families.

- Forget to sign and date the form: An unsigned form is incomplete and won't be processed.

- Delay your submission: Late submissions can lead to penalties, so make sure to file the form in a timely manner.

This guidance should help you complete the RUT-50 form accurately and avoid common pitfalls. However, if you're unsure about any part of the process, it might be beneficial to consult with a professional to ensure your tax obligations are met correctly.

Misconceptions

Understanding the Illinois Department of Revenue RUT-50 form is crucial for anyone purchasing a vehicle through a private sale in the state. However, there are several misconceptions surrounding this form and the associated taxes. Let's clear up some of these misconceptions:

- Only Purchases Over $15,000 Are Taxed: It's often thought that vehicles purchased for less than $15,000 are not subject to tax. In reality, the RUT-50 form applies tax to vehicles of all purchase prices, albeit at different rates according to two distinct tables, Table A and Table B, based on the vehicle's purchase price or fair market value.

- Trade-In Deductions Apply: Another common mistake is the belief that trade-in deductions can lessen the taxable amount. The tax calculated through the RUT-50 form does not allow deductions for traded-in vehicles, meaning the tax is based strictly on the purchase price or fair market value of the new vehicle without deductions.

- The Form Applies Only to Cars: While cars are a primary focus, the RUT-50 tax form also applies to motorcycles, motor-driven cycles, all-terrain vehicles (ATVs), motorized pedalcycles, and other vehicles, not just cars. The tax due for these types of vehicles is generally set at $25.

- Fair Market Value Is Always Used: Many believe that the tax is always based on the fair market value. In reality, the tax is based on the purchase price if it's stated. Only when there is no stated purchase price, such as in gifts or even trades, is the fair market value used instead.

- No Exemptions Exist: Contrary to some opinions, there are exemptions where the tax due could be $0. These apply to purchasers like tax-exempt organizations, certain vehicles used primarily in production agriculture, or when the vehicle is a gift to a surviving spouse, among others.

- Out-of-State Purchases Are Exempt: It's falsely assumed at times that vehicles purchased out-of-state are tax-exempt. However, exemptions for out-of-state residents apply only if the vehicle was used outside of Illinois for at least three months by individuals.

- All Vehicles of the Same Age Are Taxed Equally: The tax due also depends on the model year of the vehicle for purchases under $15,000, as outlined in Table A. This means that even for vehicles of the same age, taxes may vary depending on their model year.

- Taxes Are Negotiable: The impression that the tax amount can be negotiated is incorrect. The tax rates are set by the form and must be adhered to based on the applicable criteria, such as purchase price, model year, and if any exemptions apply.

- Local Taxes Don't Apply: Lastly, there's a misconception that only state taxes are relevant. Buyers must also report any local government private party vehicle use tax due on Form RUT-50, as local taxes may indeed apply depending on the transaction.

Correcting these misconceptions can ensure that individuals are better prepared and informed when completing the RUT-50 form for their vehicle purchases, leading to a smoother transaction process without unexpected tax implications.

Key takeaways

Understanding and correctly filling out the Tax RUT-50 form is essential for individuals in Illinois dealing with the private party purchase of a vehicle. Here are five key takeaways to guide you through the process:

- The Tax RUT-50 form is specifically designed for the tax assessment on vehicles purchased from a private party within Illinois for the year 2016 from January 1 to December 31. This includes cars, motorcycles, ATVs, and more.

- Tax calculation is primarily based on the purchase price or the fair market value of the vehicle. For vehicles valued at less than $15,000, Table A should be used, while Table B applies to vehicles with a purchase price or fair market value of $15,000 or more.

- If the vehicle transaction does not involve a straightforward purchase—for instance, if it's a gift or even trade—the fair market value should be used instead of a purchase price. The fair market value can be obtained from a licensed dealer.

- Certain exemptions can reduce the tax due to $0. These exemptions apply to vehicles purchased by tax-exempt organizations, farm implements used primarily in production agriculture, vehicles used for rolling stock, purchases by out-of-state residents who will use the vehicle outside Illinois for at least three months, and estate gifts to surviving spouses. It is crucial to understand if any of these exemptions apply to your situation.

- If your vehicle purchase falls under one of the specific exceptions listed, such as a motorcycle, motor-driven cycle, a 3- or 4-wheel all-terrain vehicle (ATV), or a motorized pedalcycle, a flat tax rate of $25 applies. Additionally, transactions involving estate gifts to beneficiaries other than a surviving spouse, business reorganization transfers, or transactions within immediate family members warrant a $15 tax.

Remember to also check if any local government private party vehicle use tax applies to your situation by consulting the RUT-6, Form RUT-50 Reference Guide. Accurate completion of the RUT-50 form ensures compliance with Illinois tax obligations and helps avoid potential legal issues. Always consult the most current form and guidelines, as tax laws and rates can change.

Popular PDF Documents

Hawaii Department of Taxation - Form ensures businesses report their tax responsibilities in line with state regulations.

Income Based Repayment Eligibility - If you're married, include your spouse's financial details to accurately assess your IBR monthly payment contribution.

IRS 8821 - It provides peace of mind to taxpayers by ensuring that their designated representative can access the information needed to make informed decisions on their behalf.