Get Tax POA wv-2848 Form

The Tax POA wv-2848 form serves as a critical instrument for individuals and entities in West Virginia seeking to delegate authority for tax matters. This comprehensive document enables taxpayers to appoint a trusted representative to manage a wide range of tax-related tasks on their behalf, including filing returns, handling disputes, and conducting transactions with the West Virginia State Tax Department. It's designed to ensure that taxpayers can confidently entrust their tax affairs to another, providing a secure legal framework for representation. The form addresses various pivotal components, such as identifying the taxpayer's information, specifying the representative's powers, and detailing the extent and limitations of the authority granted. To be effective, accuracy and attention to detail in completing the form are paramount. Additionally, understanding the implications and responsibilities associated with the delegation of these powers is essential for both the taxpayer and the authorized representative. Through this form, a path is provided for managing tax affairs efficiently, making it a cornerstone document for those looking to navigate the complexities of tax obligations with the aid of a representative.

Tax POA wv-2848 Example

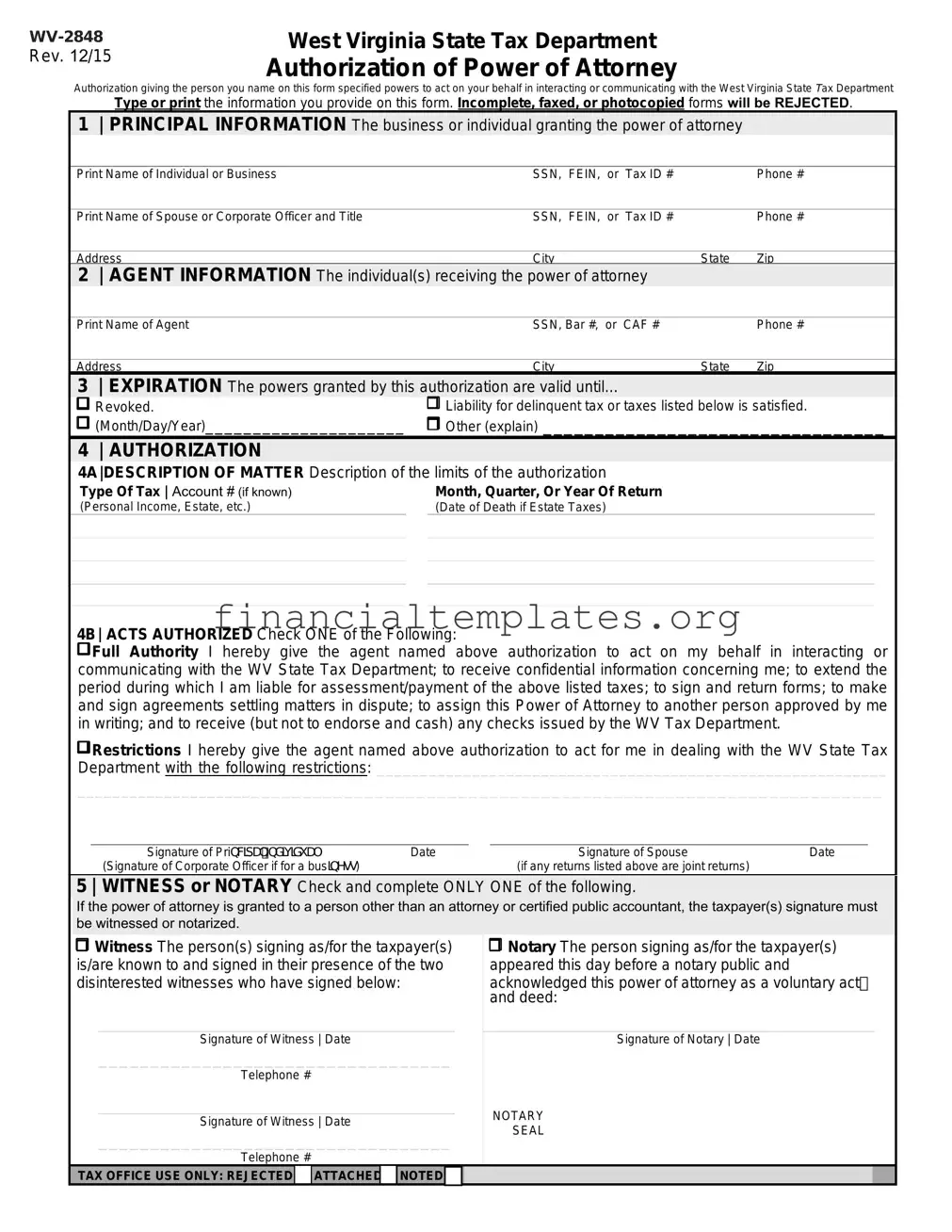

Rev. 12/15

West Virginia State Tax Department

Authorization of Power of Attorney

Authorization giving the person you name on this form specified powers to act on your behalf in interacting or communicating with the West Virginia State Tax Department

Type or print the information you provide on this form. Incomplete, faxed, or photocopied forms will be REJECTED.

1| PRINCIPAL INFORMATION The business or individual granting the power of attorney

Print Name of Individual or Business |

SSN, |

FEIN, |

or |

Tax ID # |

|

Phone # |

|

|

|

|

|

|

|

Print Name of Spouse or Corporate Officer and Title |

SSN, |

FEIN, |

or |

Tax ID # |

|

Phone # |

|

City |

|

|

|

|

|

Address |

|

|

|

State |

Zip |

2| AGENT INFORMATION The individual(s) receiving the power of attorney

Print Name of Agent |

SSN, Bar #, or CAF # |

|

Phone # |

|

City |

|

|

Address |

State |

Zip |

3| EXPIRATION The powers granted by this authorization are valid until…

Revoked. |

Liability for delinquent tax or taxes listed below is satisfied. |

(Month/Day/Year)_____________________ |

Other (explain) _________________________________ |

4 | AUTHORIZATION

4A|DESCRIPTION OF MATTER Description of the limits of the authorization

Type Of Tax | Account # (if known)

(Personal Income, Estate, etc.)

Month, Quarter, Or Year Of Return

(Date of Death if Estate Taxes)

4B| ACTS AUTHORIZED Check ONE of the Following:

4B| ACTS AUTHORIZED Check ONE of the Following:

Full Authority I hereby give the agent named above authorization to act on my behalf in interacting or communicating with the WV State Tax Department; to receive confidential information concerning me; to extend the period during which I am liable for assessment/payment of the above listed taxes; to sign and return forms; to make and sign agreements settling matters in dispute; to assign this Power of Attorney to another person approved by me in writing; and to receive (but not to endorse and cash) any checks issued by the WV Tax Department.

Full Authority I hereby give the agent named above authorization to act on my behalf in interacting or communicating with the WV State Tax Department; to receive confidential information concerning me; to extend the period during which I am liable for assessment/payment of the above listed taxes; to sign and return forms; to make and sign agreements settling matters in dispute; to assign this Power of Attorney to another person approved by me in writing; and to receive (but not to endorse and cash) any checks issued by the WV Tax Department.

Restrictions I hereby give the agent named above authorization to act for me in dealing with the WV State Tax Department with the following restrictions: ___________________________________________________________

Restrictions I hereby give the agent named above authorization to act for me in dealing with the WV State Tax Department with the following restrictions: ___________________________________________________________

_________________________________________________________________________________

_____________________________________________________________________________

Signature of PriQFLSDO,QGLYLGXDO |

Date |

|

Signature of Spouse |

Date |

(Signature of Corporate Officer if for a busLQHVV) |

|

|

(if any returns listed above are joint returns) |

|

5 | WITNESS or NOTARY Check and complete ONLY ONE of the following.

If the power of attorney is granted to a person other than an attorney or certified public accountant, the taxpayer(s) signature must be witnessed or notarized.

Witness The person(s) signing as/for the taxpayer(s) is/are known to and signed in their presence of the two disinterested witnesses who have signed below:

Witness The person(s) signing as/for the taxpayer(s) is/are known to and signed in their presence of the two disinterested witnesses who have signed below:

Signature of Witness | Date

__________________________________

Telephone #

Signature of Witness | Date

__________________________________

Telephone #

Notary The person signing as/for the taxpayer(s) appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed:

Notary The person signing as/for the taxpayer(s) appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed:

Signature of Notary | Date

NOTARY

SEAL

TAX OFFICE USE ONLY: REJECTED  ATTACHED

ATTACHED NOTED

NOTED  ___________________________________________________________

___________________________________________________________

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The WV-2848 form is used to grant another individual the authority to handle tax matters on your behalf with the West Virginia State Tax Department. |

| Form Type | Power of Attorney (POA). |

| Applicable Law | Governed by West Virginia tax law. |

| Who can file | Any taxpayer or entity seeking to designate another person to manage their tax affairs in the state of West Virginia. |

| Who can be appointed | Typically, a trusted individual such as a family member, attorney, or tax professional. |

| Scope of authority | The form allows the appointee to receive and inspect confidential tax information and to perform acts like signing agreements, checks, or other documents related to tax matters. |

| Where to file | The completed form must be filed with the West Virginia State Tax Department. |

Guide to Writing Tax POA wv-2848

Filling out the Tax Power of Attorney (POA) WV-2848 form is a critical step in managing your tax matters in the state of West Virginia. This form grants another individual or entity the authority to handle your tax affairs, enabling them to act on your behalf with the West Virginia State Tax Department. It's a straightforward process, but accuracy is key to ensuring that all your tax-related transactions are handled as per your wishes. Below are the steps you need to follow to accurately complete the form.

- Begin by gathering all necessary information, including your full legal name, address, and taxpayer identification number (SSN or EIN).

- Enter the full name and address of the individual or entity you are appointing as your attorney-in-fact (the person authorized to act on your behalf).

- Specify the tax matters and years for which the attorney-in-fact has authority. This could include, but is not limited to, income tax, sales tax, and payroll tax for specific years or periods.

- Indicate the specific powers you are granting to your attorney-in-fact. This includes actions such as receiving confidential tax information, representing you in tax matters, and making agreements or compromises with the tax authorities.

- If there are any restrictions to the powers granted, clearly describe them in the space provided. This step is crucial for limiting the attorney-in-fact's authority to your specific requirements.

- Include the date the document is being executed. This is important for determining the duration of the power of attorney, as it may be limited to a certain period or until explicitly revoked.

- Sign and date the form in the presence of a notary public. Your signature grants the authority, making it essential for the form’s validity.

- The attorney-in-fact must also sign the form, acknowledging their acceptance of the responsibilities and powers being granted to them.

After completing the form, it's imperative to keep a copy for your records and provide the original to your attorney-in-fact. The form may also need to be submitted to the West Virginia State Tax Department, depending on the nature of the tax matters being handled. This process is not just about filling out a form; it is an important strategy for managing your tax affairs efficiently and with peace of mind, knowing that you have entrusted these responsibilities to a reliable individual or entity. Always ensure to review the filled-out form for accuracy and completeness before final submission.

Understanding Tax POA wv-2848

-

What is a Tax Power of Attorney (POA) WV-2848 form?

A Tax Power of Attorney, known as form WV-2848 in West Virginia, is a legal document that gives an individual or an entity the authority to handle tax matters on behalf of another person. This includes the power to receive confidential tax information and to make filings, decisions, and represent the taxpayer before the tax authorities in West Virginia.

-

Who can be appointed as a representative on the WV-2848 form?

Individuals appointed as representatives on the form WV-2848 can include certified public accountants, attorneys, family members, or any other person the taxpayer trusts to manage or assist with their tax matters. However, the chosen representative should have a good understanding of tax law and the authority to act in a fiduciary capacity.

-

How do you fill out the Tax POA WV-2848 form?

To correctly fill out the WV-2848 form, taxpayers must provide comprehensive information including their full name, tax identification number, and the specific tax matters and years for which the representation is authorized. The chosen representative's information, including their name, address, and telephone number, must also be included. Both the taxpayer and the representative are required to sign the form, indicating their consent to the terms of representation.

-

Is the Tax POA WV-2848 form necessary for all tax matters in West Virginia?

While the WV-2848 is not required for every tax-related interaction in West Virginia, it becomes essential when taxpayers need someone else to manage their tax affairs comprehensively. This includes communication with the West Virginia State Tax Department about specific tax issues, periods, or types of tax. For simple inquiries, this form may not be necessary, but for representation in audits, collections, or appeals, it is critical.

-

Can a Tax POA be revoked?

Yes, a Tax Power of Attorney can be revoked by the taxpayer at any time. To revoke the authorization, the taxpayer needs to send a written notice to the West Virginia State Tax Department, specifying the revocation of the powers granted under the WV-2848 form. It is also a good practice to notify the representative in writing of the revocation.

-

Does the representative need to accept the appointment?

Yes, the representative appointed on the Tax POA WV-2848 form must agree to take on the responsibilities outlined. While the form itself does not always have a specific section for the representative to acknowledge acceptance, the act of signing the document typically indicates their agreement to act on behalf of the taxpayer.

-

How long is the WV-2848 form valid?

The validity of the WV-2848 form is generally specified within the document itself by the taxpayer. Unless a specific expiration date is noted on the form, the power of attorney will remain in effect until it is revoked by the taxpayer. It's important for both the taxpayer and the representative to keep the end date in mind, especially for ongoing tax matters.

-

Where should the completed Tax POA WV-2848 form be sent?

The completed and signed WV-2848 form should be submitted to the West Virginia State Tax Department. The address to which the form should be sent can vary, depending on the specific tax matter or departmental division addressed. It's advisable to check the official West Virginia State Tax Department website or contact their office for the most current submission information.

Common mistakes

Filling out the Tax Power of Attorney (POA) form WV-2848 is a critical step for individuals who need to authorize someone else to handle their tax matters in West Virginia. Unfortunately, mistakes can occur during this process, leading to delays, confusion, or the rejection of the form. Here are seven common errors people make:

Not checking the current form version: The WV-2848 form can be updated, and using an outdated version may result in the submission being rejected.

Failing to provide all requested information: Incomplete forms are a common issue. Every field should be reviewed and filled out accurately.

Incorrectly identifying the representative: The representative’s full legal name, contact information, and identification numbers must be accurately provided.

Misunderstanding the scope of authorization: Taxpayers often do not clearly specify the tax matters and years for which they are granting authority, leading to potential disputes or limitations on the representative’s ability to act.

Not specifying the duration of the POA: Failure to indicate when the POA begins and ends can lead to it being considered void or ineffective for its intended purpose.

Overlooking the need for signatures: Both the taxpayer and the representative must sign the form. Missing signatures can invalidate the entire document.

Ignoring notarization requirements: Depending on the specifics of the situation or additional legal requirements, notarization may be necessary, and overlooking this can result in the POA being considered invalid.

When completing the WV-2848 form, taxpayers should approach the task with attention and care. Avoiding these common mistakes can help ensure that their tax matters are handled efficiently and accurately by the designated representative.

In addition to these specific errors, it's crucial to:

Review the form carefully before submission to catch any inaccuracies or omissions.

Consult with a tax professional or a legal advisor if there are questions about how to properly grant power of attorney for tax purposes.

Keep a copy of the signed form for personal records and provide the representative with a copy as well.

Successfully navigating the complexities of the Tax POA WV-2848 form will help taxpayers ensure that their tax affairs are in good hands.

Documents used along the form

Managing tax matters often requires more than just submitting a single form. In the case of the Tax Power of Attorney (POA) WV-2848, individuals designate a representative to handle their tax affairs with the West Virginia State Tax Department. This crucial form is part of a suite of documents that are frequently used together to ensure comprehensive management of one’s tax responsibilities and legal representation. Understanding each document's purpose can significantly streamline the tax management process.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is commonly used to provide a taxpayer identification number to banks, brokerage firms, or other entities that require it for reporting purposes. It helps prevent tax withholding on interest, dividends, or rentals received.

- Form 1040, U.S. Individual Income Tax Return: The cornerstone of personal tax filing, this form is used to report an individual’s annual income. It is essential for calculating tax liability or determining any potential refund.

- Schedule C, Profit or Loss from Business: For those who operate a sole proprietorship, this document breaks down the business's profits and losses. It's pivotal for small business owners to accurately report their income.

- Form 8821, Tax Information Authorization: This form allows individuals to authorize any person or organization to inspect and receive confidential tax information. It's important for situations where direct representation is not required, but access to information is necessary.

- Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return: If more time is needed to gather documents or resolve issues before filing a tax return, this form comes in handy. It gives taxpayers an extension, although it does not grant extra time to pay taxes owed.

- Form 4506-T, Request for Transcript of Tax Return: This document allows taxpayers to request a transcript of their tax returns. Its usefulness spans loan applications, student financial aid verifications, or setting up a payment plan with the IRS.

Together with the Tax POA WV-2848, these documents form a comprehensive toolkit for handling a wide range of tax-related tasks efficiently and effectively. Whether for personal or business affairs, staying informed about these forms can ensure smoother interactions with tax authorities and help maintain financial health and compliance.

Similar forms

The Tax Power of Attorney (POA) WV-2848 form is closely related to the Federal Tax POA Form 2848. Both documents allow individuals to designate a representative to handle tax matters on their behalf with the tax authorities. Specifically, they enable the appointed person to receive confidential tax information and make decisions regarding tax payments, filings, and disputes. The key difference lies in their jurisdiction; the WV-2848 is specific to the state of West Virginia, while Form 2848 is used for federal tax purposes.

Another similar document is the General Power of Attorney (POA). This broader legal instrument grants an agent the ability to make a wide range of decisions and actions on behalf of the principal, not limited to tax matters. While the Tax POA focuses on tax-related authority only, a General POA encompasses financial, legal, and personal affairs, offering a more comprehensive delegation of power.

The Durable Power of Attorney mirrors the Tax POA in allowing an individual to appoint someone to act on their behalf. The primary distinction is its durability; it remains in effect even if the principal becomes mentally incapacitated. While a Tax POA is specifically for handling tax issues, a Durable POA includes broader powers that can continue despite the principal's health condition, ensuring ongoing management of their affairs.

The Healthcare Power of Attorney is related to the Tax POA through its foundational concept of representation but diverges in its application. It permits an agent to make healthcare decisions on someone else’s behalf, contrasting with the Tax POA’s focus on fiscal matters. This document comes into play in medical situations where the principal cannot make decisions for themselves, highlighting its specificity to health rather than finances or taxes.

The Limited Power of Attorney shares similarities with the Tax POA WV-2848 in that it grants an agent authority to act in specific circumstances. However, it restricts the agent's power to a particular activity or transaction, like selling a property, unlike the Tax POA, which is narrowly tailored to tax representation. The Limited POA is notable for its focus and expiry upon the completion of the task for which it was established.

The Revocation of Power of Attorney form directly connects to the Tax POA by providing a legal method to cancel the powers granted in such agreements. Regardless of its original purpose, be it for taxes, healthcare, or general matters, this document allows individuals to officially terminate any previously granted POA, withdrawing the agent's authority to act on their behalf. Its existence ensures that principals maintain ultimate control over the representation they’ve chosen, allowing for adjustments as their circumstances change.

In conclusion, while each of these documents serves a specific purpose, from broad representation in all affairs to specific tasks like healthcare decisions or tax matters, they all function to authorize another person to act in one's stead. Whether for tax-related issues in West Virginia, broader financial decisions, or health care directives, these documents share the common thread of delegation of authority, tailored to fit the precise needs and circumstances of the individual.

Dos and Don'ts

When handling the Tax Power of Attorney (POA) WV-2848 form, it's important to follow specific guidelines to ensure the process is smooth and error-free. Here's a concise guide on what you should and shouldn't do.

Do:

- Double-check all entered information for accuracy. This includes names, addresses, and identification numbers.

- Make sure that the taxpayer and the appointed representative sign the form in the designated areas.

- Provide detailed information about the tax matters you're authorizing, including types of tax, tax form numbers, and years or periods covered.

- Keep a copy of the completed form for your records to refer back to if necessary.

Don't:

- Leave any sections blank. If a section doesn't apply to your situation, clearly mark it as "N/A" or "Not Applicable" instead of leaving it empty.

- Sign the form without thoroughly reviewing it first. Make sure every part of the form is filled out correctly and that you understand every authorization you're granting.

- Forget to update the Tax POA if there are any changes in your situation, such as changing representatives or if the scope of the authorization changes.

- Overlook the need for a witness or notarization, depending on state requirements. Check the specific requirements for West Virginia to ensure compliance.

Misconceptions

When it comes to understanding the Tax Power of Attorney (POA) WV-2848 form in West Virginia, there are a few common misconceptions that often lead to confusion. The form itself is designed to allow individuals to grant others the authority to handle their tax matters, but the nuances of its use and limitations are not always well understood. Below, we aim to clarify some of these misconceptions.

- It grants unlimited power: A common misunderstanding is that the WV-2848 form gives the agent carte blanche to make any and all decisions regarding the principal's taxes. However, the powers granted can actually be quite specific, limited to certain types of tax matters or periods.

- It's only for individuals: While individuals commonly use the WV-2848 form, it's also applicable to businesses seeking to authorize someone to handle their tax affairs. This versatility means it can serve various entities, including sole proprietorships, partnerships, and corporations.

- It overrides a will: Some believe that the powers granted through the WV-2848 form can override the directives in a will. This is not the case, as the form only pertains to tax matters and does not impact the distribution of assets or other estate planning considerations.

- It's permanent: There's a misconception that once executed, the WV-2848 form remains in effect indefinitely. In reality, the form includes space to specify an expiration date, and the principal can also revoke it at any time, provided they follow the proper procedure to do so.

- It takes effect immediately: While the WV-2848 form can take effect as soon as it's signed and submitted to the appropriate tax authority, there's an option to make it conditional or to specify a future date for it to become active. This allows for flexibility in planning and execution.

- All tax professionals can be agents: People often assume that any tax professional can serve as an agent under this form. However, the agent must be someone authorized to practice before the West Virginia State Tax Department, such as certified public accountants or attorneys specializing in tax law.

- Only one agent can be designated: The WV-2848 form actually allows for the designation of multiple agents. This enables the principal to have various experts handle different tax matters, though it’s important to clearly define the scope of authority for each agent to avoid confusion or overlap.

- It automatically includes all tax types and periods: Another common belief is that the form covers all tax types and periods by default. Principals must specify the tax matters and periods the agent is authorized to deal with, ensuring that the delegation of authority aligns with their needs and intentions.

- Signing the form waives rights to privacy: Some are concerned that by signing the WV-2848 form, they're waiving their rights to privacy regarding their tax matters. While it does grant an agent access to otherwise private tax information, it doesn't mean all rights to privacy are waived. The agent is still bound by confidentiality rules and can only access the specific information necessary to fulfill their duties.

Understanding these misconceptions and the actual scope and limitations of the Tax POA WV-2848 form is crucial for ensuring that it's used effectively and as intended. Whether for personal or business tax matters, it’s a powerful tool for delegating tax-related responsibilities, provided it’s handled with care and precision.

Key takeaways

When you're preparing to use the Tax Power of Attorney (POA) WV-2848 form, it's important to understand its purpose and how to correctly fill it out. This document grants an individual or organization the authority to handle tax matters on your behalf with the West Virginia State Tax Department. Below are seven key takeaways to ensure you correctly complete and use the form.

- Thoroughly identify the parties: Ensure the full names, addresses, and identification numbers (Social Security Number for individuals or Federal Employer Identification Number for businesses) of the principal (person granting the power) and the representative (person receiving the power) are clearly stated.

- Specify the tax matters and periods: Clearly indicate the types of taxes and the specific periods or years for which the POA is granted. Vagueness can lead to processing delays or misunderstandings.

- Understand the powers granted: Acknowledge what the representative can (and cannot) do with the POA. This typically includes filing returns, making payments, and receiving confidential tax information, but may not cover rights to receive refund checks or bind the principal to agreements without specific authorization.

- Multiple representatives: If appointing more than one representative, specify whether each can act independently or if all must act together. This clarification is crucial for effective representation and avoids conflicts.

- Signature requirements are crucial: The principal must sign and date the form. If the principal is a business, an authorized officer or agent must sign. Lack of a proper signature can invalidate the POA.

- Specify the duration: If there is a desired end date for the POA, it must be noted on the form. Without this, the POA will remain in effect until formally revoked or a termination event occurs as defined by West Virginia law.

- Revocation process: Understand the process for revoking the POA if the need arises. This usually requires a written notice to the West Virginia State Tax Department specifying the intent to revoke the grant of authority.

Filling out and submitting the Tax POA WV-2848 form with accuracy and completeness is vital to ensure your tax matters are handled efficiently and according to your wishes. Keep these key points in mind to facilitate a smooth experience with the West Virginia State Tax Department.

Popular PDF Documents

Wisconsin Department of Revenue Forms - This form streamlines the process for tax professionals to assist clients in a more organized and authorized manner.

City of Tiffin Ohio - With dedicated fields for contact details, the form ensures the City Of Tiffin can reach you promptly for any tax-related inquiries.

Loan Estimate Vs Closing Disclosure - The Loan Estimate form outlines the loan terms, confirming there are no prepayment penalties or balloon payments, simplifying your repayment plan.