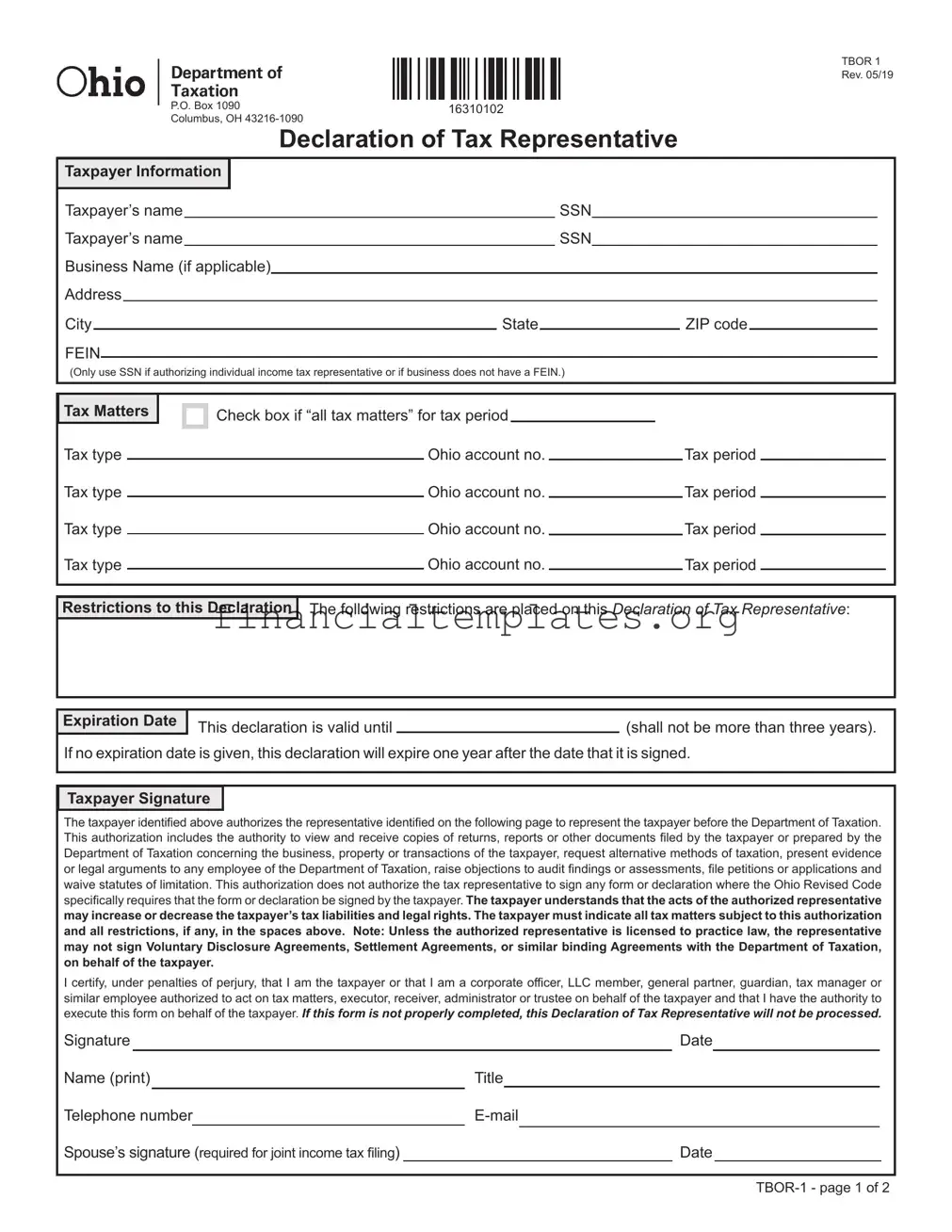

Get Tax POA tbor-1 Form

In the realm of tax management and compliance, individuals and businesses often find themselves navigating the complex interplay between ensuring accurate representation and maintaining control over their financial affairs. Central to striking this balance is the Tax Power of Attorney (POA) TBOR-1 form, a critical document that grants designated representatives the authority to handle tax matters on behalf of the filer. This power includes but is not limited to discussing tax returns, receiving confidential information, and making decisions regarding payments and refunds with the taxing authority. Its significance cannot be overstated, as it directly impacts how taxpayers engage with tax authorities, ensuring that their rights are preserved while facilitating the resolution of tax issues. By authorizing a knowledgeable and trusted individual or entity to act in their stead, taxpayers can navigate the oftentimes intricate tax landscape more effectively, safeguarding their interests and ensuring compliance with applicable tax laws. Understanding the scope, limitations, and proper use of the Tax POA TBOR-1 form is essential for anyone involved in the management of tax-related matters, whether for personal or business purposes.

Tax POA tbor-1 Example

Ohio I ~:::;:ent of |

|

|

IIII |

|

|

I |

|

Ill |

|

|

|

|

|

|

1111111111111111 |

|

|

|

|

|

|

TBOR 1 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rev. 05/19 |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

P.O. Box 1090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

16310102 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

Columbus, OH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Declaration of Tax Representative |

|

|

|

|||||||||||||||||||||

Taxpayer Information |

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Taxpayer’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

|||||

Taxpayer’s name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SSN |

|

|

|

|

||||||

Business Name (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

ZIP code |

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(Only use SSN if authorizing individual income tax representative or if business does not have a FEIN.) |

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Matters I

□ Check box if “all tax matters” for tax period

Tax type |

|

Ohio account no. |

|

Tax period |

|

|

|||

Tax type |

|

Ohio account no. |

|

Tax period |

|

|

|||

Tax type |

|

Ohio account no. |

|

Tax period |

|

|

|||

Tax type |

|

Ohio account no. |

|

Tax period |

|

|

Restrictions to this Declaration I The following restrictions are placed on this Declaration of Tax Representative:

Expiration Date |

This declaration is valid until |

(shall not be more than three years). |

|

If no expiration date is given, this declaration will expire one year after the date that it is signed.

Taxpayer Signature I

The taxpayer identified above authorizes the representative identified on the following page to represent the taxpayer before the Department of Taxation. This authorization includes the authority to view and receive copies of returns, reports or other documents filed by the taxpayer or prepared by the Department of Taxation concerning the business, property or transactions of the taxpayer, request alternative methods of taxation, present evidence or legal arguments to any employee of the Department of Taxation, raise objections to audit findings or assessments, file petitions or applications and waive statutes of limitation. This authorization does not authorize the tax representative to sign any form or declaration where the Ohio Revised Code specifically requires that the form or declaration be signed by the taxpayer. The taxpayer understands that the acts of the authorized representative may increase or decrease the taxpayer’s tax liabilities and legal rights. The taxpayer must indicate all tax matters subject to this authorization and all restrictions, if any, in the spaces above. Note: Unless the authorized representative is licensed to practice law, the representative may not sign Voluntary Disclosure Agreements, Settlement Agreements, or similar binding Agreements with the Department of Taxation, on behalf of the taxpayer.

I certify, under penalties of perjury, that I am the taxpayer or that I am a corporate officer, LLC member, general partner, guardian, tax manager or similar employee authorized to act on tax matters, executor, receiver, administrator or trustee on behalf of the taxpayer and that I have the authority to execute this form on behalf of the taxpayer. If this form is not properly completed, this Declaration of Tax Representative will not be processed.

Signature |

|

|

|

|

Date |

|

|||

Name (print) |

|

Title |

|

||||||

Telephone number |

|

|

|||||||

Spouse’s signature (required for joint income tax filing) |

|

|

|

|

Date |

|

|||

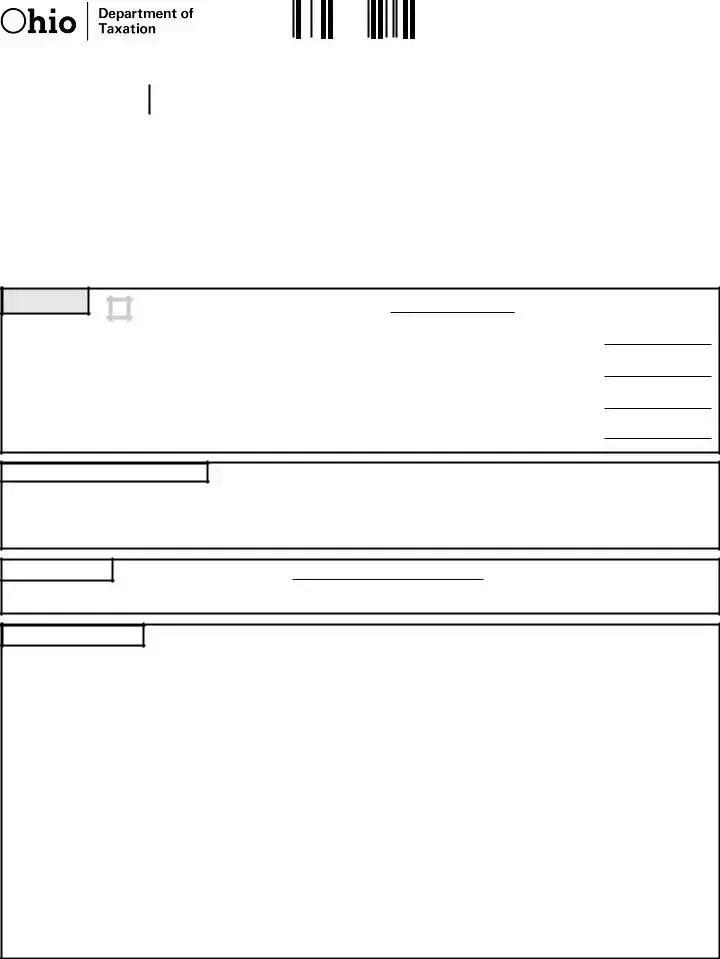

Ohl■O I TaxationDeparJment of |

TBOR 1 |

Rev. 05/19 |

|

IIII IIll 1111111111111111 |

|

P.O. Box 1090 |

16310202 |

Columbus, OH |

|

Representative Information - Please indicate if more than one representative in the space below. I

Representative’s name

Representative’s firm (if applicable)

Address

City |

|

|

|

State |

|

|

ZIP code |

|

|

Telephone number |

|

Fax number |

|

|

|

||||

|

|

|

|

|

|

|

|

||

Declaration of Representative

Under penalties of perjury, I declare that:

• I am not currently under suspension or disbarment from practice within the state of Ohio or any other jurisdiction;

• I am aware of the regulations governing my practice in Ohio and the penalties for false or fraudulent statements provided;

• I am authorized to represent in Ohio the taxpayer(s) identified for the tax matter(s) specified herein; and I am one of the following (please indicate by checking the

box beside the appropiate number):

□ 1. Attorney – a member in good standing of the bar of the highest court of the jurisdiction shown below.

n

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

2. Certified public accountant or public accountant – duly qualified practice in the jurisdiction shown below.

3. Enrolled agent – enrolled as an agent under the requirements of the IRS. ~4. Officer – a bona fide officer of the taxpayer’s organization.

5.

6. Family member – a member of the taxpayer’s immediate family (check appro- priate response) nspouse n parent n child n brother n sister

LJ

7. Other – provide explanation

7. Other – provide explanation

Designation (insert no. 1 - 7) State

License Number

Representative Signature

Date

*Mail: P.O. Box 1090, Columbus, OH |

Fax: (206) |

|

(Use the same method to revoke declaration.) |

*Most secure method |

|

|

||

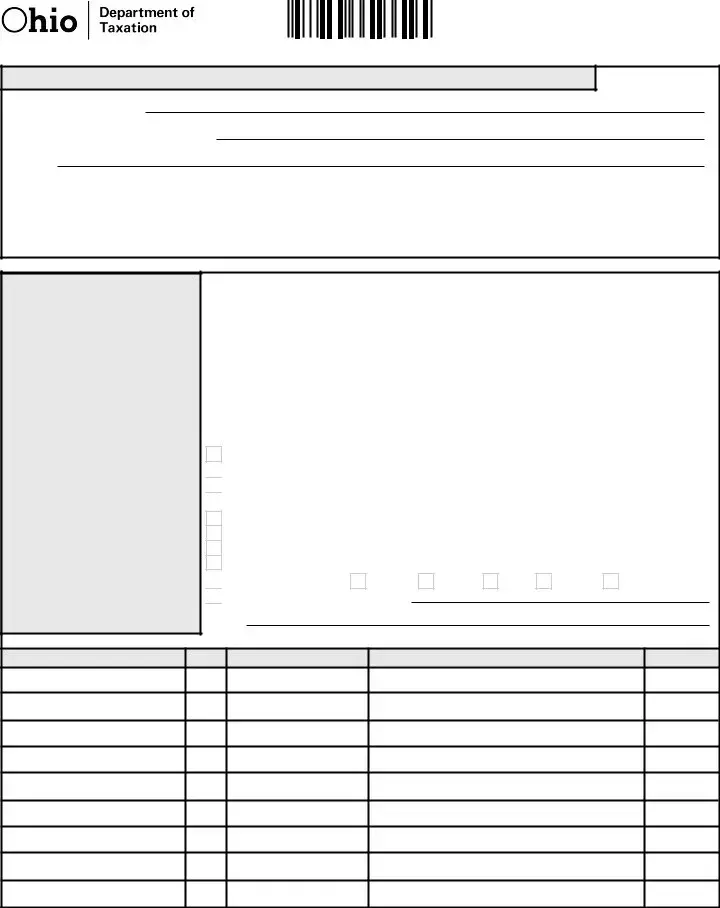

Document Specifics

| Fact Number | Description |

|---|---|

| 1 | The Tax Power of Attorney (POA) form, referred to as TBOR-1 in some states, is a legal document. This form allows individuals to grant authority to another person, enabling them to discuss their tax matters with the tax department and make decisions on their behalf. |

| 2 | Each state has specific requirements and formats for the Tax POA form, including unique form numbers and names. The TBOR-1 form references may indicate a state-specific version, following the unique guidelines of that state's tax governance laws. |

| 3 | The form must be completed with accurate details about the taxpayer and the appointee, including their names, addresses, and identification numbers, to ensure that the tax authorities can properly identify the parties involved. |

| 4 | Governing laws for state-specific Tax Power of Attorney forms, such as the TBOR-1, vary by state. These laws define the extent of the powers granted, how the form should be executed, and how it may be revoked. |

| 5 | Proper execution and submission of the Tax POA form are crucial for it to be recognized by tax authorities. This typically includes signatures from the taxpayer and the appointed representative, and, in some cases, notarization may be required. |

Guide to Writing Tax POA tbor-1

After deciding to delegate the authority to handle tax matters to a trusted individual or entity, the Tax Power of Attorney (POA) tbor-1 form comes into play. This legal document will empower your chosen representative to speak, act, and make decisions regarding your taxes on your behalf. It's crucial to fill out this form carefully and accurately to ensure that the powers are granted correctly and comprehensively. Follow the steps below to complete the Tax POA form efficiently and effectively.

- Begin by collecting all necessary information, including the full legal names, addresses, and Social Security Numbers (or the equivalent) of both the principal (the person granting the power) and the agent (the person being granted the power).

- Locate the section designated for identifying information at the top of the form. Enter the principal's name, address, and Tax Identification Number or Social Security Number.

- In the section provided for the agent's information, input the name, address, and, if applicable, the Tax Identification Number or Social Security Number of the agent being appointed.

- Identify the tax forms or matters for which this power of attorney is being granted. Specify the type of taxes, tax form numbers, and the years or periods covered by the power of attorney.

- If additional rights, such as the ability to receive and inspect confidential tax information, are to be granted to the agent, make sure to check the corresponding box or fill in the relevant section as instructed.

- Review the acts authorized by the POA form to ensure they align with the principal's wishes. This section outlines what the agent can and cannot do on behalf of the principal.

- Find the section reserved for limitations or special conditions. If the principal wishes to restrict or specify certain powers, this information should be clearly noted here.

- Both the principal and the agent must sign and date the form in the designated signature areas. Check if the form requires notarization and, if so, ensure it is properly notarized.

- If there are any additional forms or documentation required to accompany the Tax POA form, such as identification verification, make sure to attach them before submission.

- Submit the completed form to the appropriate tax authority, following their submission guidelines. This may involve mailing a hard copy or submitting it electronically, depending on the options available.

After submitting the Tax POA tbor-1 form, it's wise to follow up with the relevant tax authority to confirm receipt and acceptance. Taking this step ensures that your agent can begin acting on your behalf without any unnecessary delays. Remember, this form plays a crucial role in managing your tax matters efficiently and should be filled out with attention to detail to reflect your exact wishes concerning the delegation of these powers.

Understanding Tax POA tbor-1

-

What is a Tax POA tbor-1 form?

The Tax Power of Attorney (POA) tbor-1 form is a legal document that lets individuals designate a representative to handle tax matters on their behalf with the tax authorities. This representative, often a tax professional, is granted the authority to make decisions, submit documents, and represent the taxpayer in discussions or matters related to their taxes.

-

Who needs to fill out the Tax POA tbor-1 form?

This form is meant for any taxpayer who wishes to give another person the authority to deal with their tax matters. This could include individuals who are not able to handle their tax affairs due to various reasons such as absence, illness, or lack of expertise in tax matters.

-

How can someone fill out and submit the Tax POA tbor-1 form?

Generally, the Tax POA tbor-1 form can be filled out by providing the required personal information of the taxpayer and the representative, as well as the specific tax matters for which the representative is given authority. Once completed, it must be signed by the taxpayer and, in some cases, witnessed or notarized. Submission methods may vary by jurisdiction but often include mailing, faxing, or delivering the form in person to the relevant tax authority's office.

-

What are the limitations of a Tax POA?

The authority granted through a Tax POA is limited to tax matters. The representative cannot make personal decisions unrelated to taxes on behalf of the taxpayer.

It is essential to specify the tax matters and periods covered by the POA as the representative's authority can be restricted to those specifics.

The POA can be revoked at any time by the taxpayer, which means the representative will no longer have the authority to act on the taxpayer's behalf.

Common mistakes

When filling out the Tax Power of Attorney (POA) TBOR-1 form, people often overlook important details, which can result in the submission of an inaccurate or incomplete document. Understanding and avoiding these common mistakes can ensure the process is smooth and your documents are in order.

Failing to use the most current form – The Tax Commission regularly updates forms, including the POA, to reflect current laws and regulations. Using an outdated version can lead to a rejection.

Not specifying the tax matters – It’s crucial to be explicit about which tax years and types of taxes the representative has authority over. A vague description can limit their ability to effectively assist.

Omitting representative information – Every section that requests details about the representative(s) must be completed. Missing information can invalidate the POA.

Incorrect taxpayer information – Even minor errors in the taxpayer’s identification details, such as name or Social Security Number, can lead to processing delays or denials.

Overlooking the need for all parties to sign – If the form requires multiple signatures, each party must sign for the POA to be considered valid.

Using non-allowed abbreviations or unclear handwriting – Clarity is paramount. The use of non-standard abbreviations or poor handwriting can cause misinterpretation or rejection of the form.

Not setting or misunderstanding the scope and limitations – It's vital to clearly state the duration and specific powers granted. Assuming the POA covers more than it legally does can create significant issues.

Forgetting to date the document – A missing date can lead to the automatic invalidation of the form since it's essential for establishing the POA’s timeframe of validity.

Not reviewing before submission – Often, individuals submit the form immediately after completion without double-checking for errors or omissions, leading to unnecessary complications.

To ensure the integrity of your Tax POA TBOR-1 form, pay attention to these common pitfalls. A meticulous approach to filling out the form not only facilitates a smoother processing but also reinforces the validity of the document, enabling your representative to act effectively on your behalf.

Documents used along the form

When managing tax matters, especially in a professional setting or on behalf of another individual, it's important to have a clear understanding of the supportive documentation that often accompanies the Tax Power of Attorney (POA), commonly referred to as the Tax POA tbor-1 form. This form authorizes an individual or entity to handle tax affairs on someone else's behalf, but to fully execute its purpose, additional documents are frequently required to provide context, verify information, and comply with legal and procedural standards. Here's a closer look at some of these critical documents.

- IRS Form 2848 - Power of Attorney and Declaration of Representative: This is a federal document that allows a taxpayer to appoint an individual—usually an accountant, attorney, or other tax professional—to represent them before the IRS. It specifies the tax matters and periods for which representation is authorized.

- Form W-9 - Request for Taxpayer Identification Number and Certification: Often accompanying the Tax POA, this form is used to provide the correct taxpayer identification number (TIN) to the person who is required to file information returns with the IRS on the taxpayer's behalf. It helps in ensuring accuracy in reporting.

- Annual Tax Return - For instance, Form 1040 for individuals: While the Tax POA allows for representation, the actual tax returns are the documents that report income, calculate taxes to be paid to the federal government, or claim refunds. It's the core of what the appointed individual may be handling.

- State-specific Tax POA Forms - Many states have their own version of a tax power of attorney form, which is necessary for handling state tax matters specifically. Similar to the Tax POA tbor-1 form, these documents appoint someone to represent the taxpayer in state tax matters.

- Identity Verification Documents - This might include a photocopy of a government-issued ID or Social Security card. These documents support the Tax POA by verifying the identity of the taxpayer, reducing the risk of fraud, and ensuring compliance with legal standards.

Together, these documents form a comprehensive foundation for managing and authorizing tax-related activities. Whether for personal or business taxes, understanding and correctly utilizing these forms ensures smoother interactions with tax authorities, adherence to legal standards, and the mitigation of potential tax-related issues. Always consult with a tax professional or legal advisor to ensure the proper documentation is completed and submitted per current laws and regulations.

Similar forms

The Tax Power of Attorney (Tax POA) TBOR-1 form shares similarities with the General Power of Attorney document. Both forms designate an individual, known as the agent or attorney-in-fact, to make decisions on behalf of the principal. However, while the Tax POA specifically authorizes an agent to handle tax matters with the tax authority, the General Power of Attorney grants broader powers, allowing the agent to manage a wide range of the principal’s personal, financial, and business affairs.

Comparable to the Tax POA is the Healthcare Power of Attorney. This document allows an individual to appoint someone to make healthcare decisions on their behalf should they become unable to do so. Similar in concept—the delegation of decision-making authority—the key difference lies in their areas of focus. The Tax POA pertains to tax matters, while the Healthcare Power of Attorney covers decisions about medical care and treatment.

The Durable Power of Attorney (DPOA) also aligns with the Tax POA in that it grants someone else the authority to act on the principal’s behalf. The distinction between them hinges on the scope and the duration of the powers granted. A DPOA remains effective even if the principal becomes incapacitated, covering a broad range of affairs, unlike the Tax POA, which is limited to tax-related issues and might not include such enduring powers.

Another document with similarities to the Tax POA is the Limited Power of Attorney. This document allows an individual to grant specific powers to an agent for a limited task or period. Like the Tax POA, which is focused solely on tax matters, a Limited Power of Attorney is narrow in scope but can pertain to various tasks outside of tax issues, such as selling a property or managing certain financial transactions.

The Financial Power of Attorney bears resemblance to the Tax POA as both relate to financial matters. Nonetheless, a Financial Power of Attorney provides a broader authorization, enabling the agent to handle a wide range of financial affairs and transactions on behalf of the principal. In contrast, the Tax POA is exclusively concerned with tax-related activities.

Similarly, the Revocation of Power of Attorney document is associated with the Tax POA, as it pertains to the cancellation of power of attorney arrangements. It directly impacts the validity of the Tax POA by providing the legal means to formally withdraw the powers previously granted. This revocation process is crucial for individuals wishing to change or terminate the authority given to an agent under a Tax POA.

The Estate Planning Power of Attorney is another document related to the Tax POA, designed with the future in mind. It enables an individual to appoint an agent to handle matters specifically related to their estate, which may include certain tax considerations. Although focused more broadly on estate management and planning, it often intersects with tax-related issues, similarly empowering an agent to make decisions on the principal's behalf in specific contexts.

Dos and Don'ts

When tasked with filling out the Tax Power of Attorney (POA) TBOR-1 form, it's crucial to approach the task with attention to detail and accuracy. This document grants another individual the authority to handle your tax matters, making it essential to complete it correctly. Below are key dos and don'ts to guide you through the process.

Do:

- Read instructions thoroughly before beginning. Every section of the form has specific requirements, and understanding them fully ensures the document is filled out correctly.

- Ensure all information is accurate and current, particularly names, addresses, and tax identification numbers. Errors could lead to unnecessary delays or miscommunication with tax authorities.

- Specify the tax matters and years you are authorizing your representative to handle. Being clear about the scope of authority helps prevent any misunderstandings or unauthorized actions.

- Sign and date the form. Your signature is a necessary component for the form's validity, legally authorizing the named individual to act on your behalf.

- Keep a copy of the fully completed and signed form for your records. Having your own copy is useful for future reference or if any disputes arise.

Don't:

- Leave any sections blank unless instructed. If a section does not apply, fill it out with “N/A” to indicate this clearly.

- Forget to update the form if any information changes, such as your address or your representative’s details. Keeping the form current is crucial for maintaining its validity.

- Appoint someone you do not fully trust. The person you designate will have access to sensitive tax information and the authority to make decisions in your stead.

- Overlook the need to notify your representative. Make sure they are aware that you are appointing them and that they accept the responsibility.

Properly completing the Tax POA TBOR-1 form is a serious matter, and following these guidelines will help ensure the process is handled appropriately. If there’s any confusion, consider seeking assistance from a professional who is knowledgeable in tax law and power of attorney matters.

Misconceptions

Understanding the Tax Power of Attorney (POA) TBOR-1 form is essential for individuals and businesses navigating tax matters. However, misconceptions about this document can lead to confusion and improper use. Here are nine common misconceptions about the Tax POA TBOR-1 form:

- All POA forms are the same. The Tax POA TBOR-1 form is specific to tax matters and is not interchangeable with other power of attorney forms that might cover legal or healthcare decisions.

- Completing a Tax POA grants unlimited authority. The scope of authority granted by the TBOR-1 form can be limited to specific tax years or types of taxes, depending on how the form is filled out.

- Any type of tax professional can be designated. Only individuals authorized to practice before the IRS or the state tax department, such as attorneys, certified public accountants, or enrolled agents, can be designated on the TBOR-1 form.

- A physical signature is always required. While a physical signature is often required, some states and the IRS may accept electronic signatures or other forms of verification for the TBOR-1 form.

- Once filed, the TBOR-1 cannot be revoked. The taxpayer can revoke the authority granted in a TBOR-1 form at any time, typically by notifying the tax authority in writing and possibly by filing a revocation form.

- Filing a Tax POA means losing control over tax matters. The taxpayer retains control and can make decisions independently of the tax professional designated on the TBOR-1 form.

- The form is only used for audits. While the TBOR-1 form is often used in the context of tax audits, it can also designate someone to represent the taxpayer in a variety of tax matters, including filings, appeals, and payment plans.

- There's no need to notify the IRS when using a state-specific TBOR-1 form. If the POA is designated for state tax matters, there is no automatic notification or applicability to the IRS; separate forms and notifications may be required for federal tax matters.

- Using a Tax POA TBOR-1 form negates the need for a general POA. The Tax POA TBOR-1 form is specific to tax matters and does not cover legal or financial decisions outside of taxes, so a general POA may still be necessary.

Clearing up misconceptions about the Tax POA TBOR-1 form can help taxpayers and their representatives ensure that their tax matters are handled accurately and in accordance with their wishes.

Key takeaways

Filling out and properly utilizing the Tax Power of Attorney (POA) TBOR-1 form is an essential step for individuals seeking to grant someone else the authority to handle their tax matters. Here are key takeaways to remember:

- Understand the purpose: It's vital to recognize that the TBOR-1 form is designed to give another party, often a tax professional, the legal right to discuss and manage tax affairs with the tax authorities on your behalf.

- Choosing a representative: Carefully select your representative. This individual or organization should be trustworthy and possess the necessary knowledge and experience to competently handle your tax matters.

- Complete the form accurately: Ensure all information on the TBOR-1 form is filled out correctly, including your personal details and the specific tax matters and years you are authorizing.

- Specify the authorization scope: Clearly indicate the extent of the powers you are granting. You can authorize your representative to receive confidential tax information, represent you in discussions with the tax authorities, or make decisions on your behalf.

- Validity period: Pay attention to the duration of the authorization. The TBOR-1 form allows you to specify how long the POA will remain in effect.

- Signature requirements: Ensure that both you and your chosen representative sign the form. Without the proper signatures, the document will not be considered valid.

- Keep a copy: It's important for both you and your appointed agent to keep copies of the completed TBOR-1 form for your records.

- Revocation process: If you wish to revoke the power of attorney before its expiration, you must understand the formal process to do so. Typically, this involves writing to the relevant tax authority and providing a copy of the initial POA along with a revocation notice.

- Seek professional advice if needed: If you're uncertain about any part of the process or the implications of granting a power of attorney for tax purposes, consult with a tax professional or legal advisor.

Handling tax matters is a significant responsibility that requires careful consideration, especially when entrusting this task to someone else. By following these guidelines and ensuring everything on the TBOR-1 form is completed thoughtfully and accurately, you can have peace of mind knowing your tax affairs are in competent hands.

Popular PDF Documents

Schedule a Deductions - With the rise in the standard deduction, fewer taxpayers may find it beneficial to itemize, yet for those with significant deductible expenses, Schedule A remains vital.

Proof of Payment Letter - Facilitates efficient communication between the planholder and Loyola Plans customer service for account modifications.