Get Tax POA sc2848 Form

Navigating the complexities of tax matters can often feel like venturing through a labyrinth, especially when it comes to effectively managing and authorizing the right individuals to handle sensitive tax information and decisions on one’s behalf. This is where the power of a specialized document, the Tax Power of Attorney (POA) Form SC2848, comes into play, providing a beacon of clarity and security. Designed to formally designate a trusted individual or entity with the authority to represent another person before the tax authorities, this form is a crucial tool for individuals seeking to ensure that their tax matters are handled with care and professionalism. The SC2848 allows for a range of actions to be taken on behalf of the taxpayer, from acquiring confidential tax information to making binding decisions. Understanding the scope, limitations, and the proper way to fill out and submit this form are essential steps in safeguarding one's tax interests and maintaining peace of mind through the maze of tax administration.

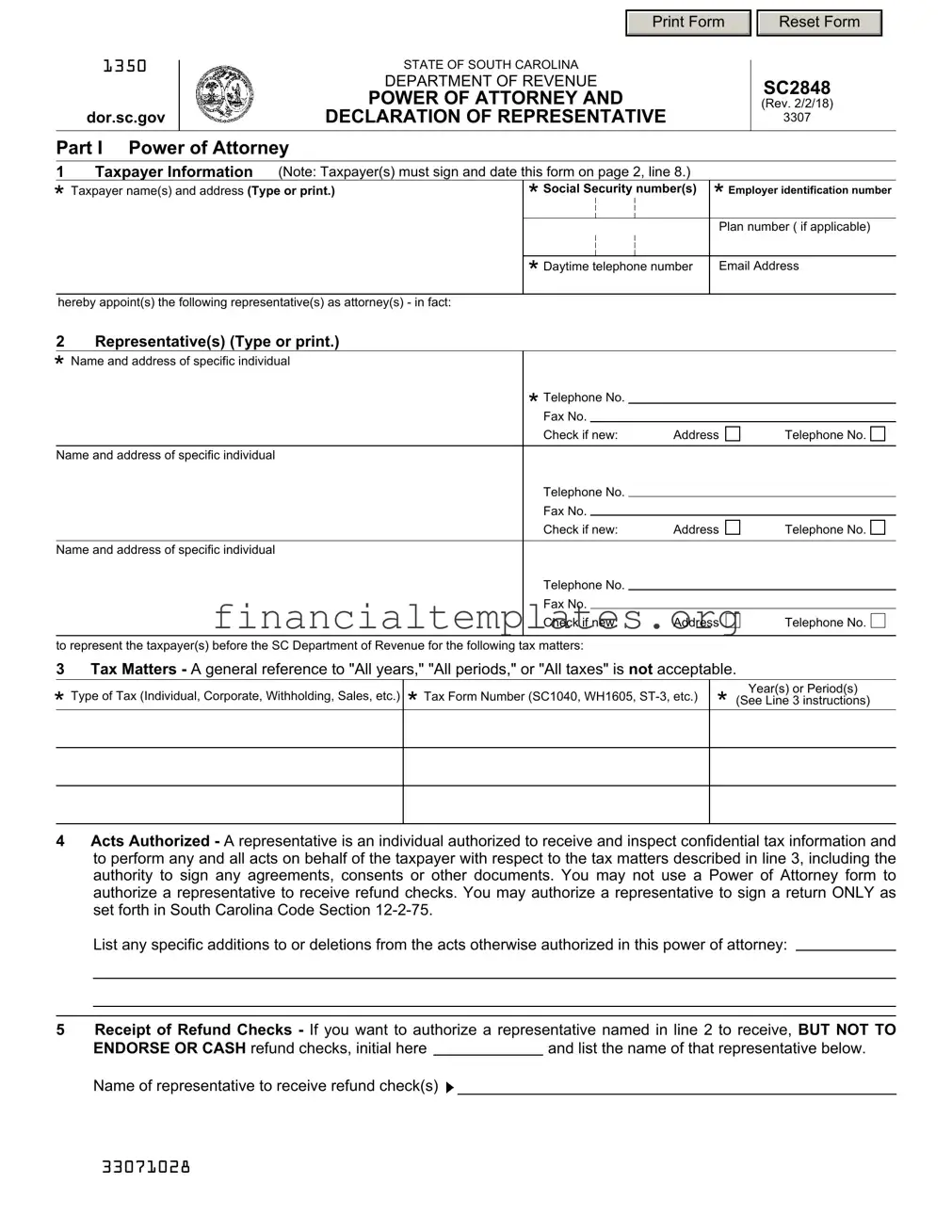

Tax POA sc2848 Example

|

|

|

PRINT FORM |

|

RESET FORM |

|

1350 |

|

|

|

|

|

|

|

STATE OF SOUTH CAROLINA |

|

|

|

||

|

|

|

|

|||

|

|

DEPARTMENT OF REVENUE |

|

SC2848 |

||

|

|

POWER OF ATTORNEY AND |

|

|||

|

|

|

(Rev. 2/2/18) |

|||

dor.sc.gov |

|

DECLARATION OF REPRESENTATIVE |

3307 |

|

||

|

|

|

|

|

|

|

Part I Power of Attorney

1Taxpayer Information (Note: Taxpayer(s) must sign and date this form on page 2, line 8.)

|

|

|

|

|

|

|

|

* Taxpayer name(s) and address (Type or print.) |

*Social |

Security |

|

number(s) |

* Employer identification number |

||

|

|

|

|||||

|

|

|

|||||

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan number ( if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Daytime telephone number |

Email Address |

||||

|

|

|

|

|

|

|

|

|

hereby appoint(s) the following representative(s) as attorney(s) - in fact: |

|

|

|

|

|

|

2Representative(s) (Type or print.)

*Name and address of specific individual

* Telephone No. |

|

|

|

|

|

||

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

|

Name and address of specific individual |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

|

Name and address of specific individual |

|

|

|

Telephone No. |

|

|

|

Fax No. |

|

|

|

Check if new: |

Address |

Telephone No. |

|

|

|

|

|

to represent the taxpayer(s) before the SC Department of Revenue for the following tax matters: |

|

|

|

3Tax Matters - A general reference to "All years," "All periods," or "All taxes" is not acceptable.

*Type of Tax (Individual, Corporate, Withholding, Sales, etc.)

*Tax Form Number (SC1040, WH1605,

Year(s) or Period(s)

*(See Line 3 instructions)

4Acts Authorized - A representative is an individual authorized to receive and inspect confidential tax information and to perform any and all acts on behalf of the taxpayer with respect to the tax matters described in line 3, including the authority to sign any agreements, consents or other documents. You may not use a Power of Attorney form to authorize a representative to receive refund checks. You may authorize a representative to sign a return ONLY as set forth in South Carolina Code Section

List any specific additions to or deletions from the acts otherwise authorized in this power of attorney:

5Receipt of Refund Checks - If you want to authorize a representative named in line 2 to receive, BUT NOT TO

ENDORSE OR CASH refund checks, initial here |

|

and list the name of that representative below. |

Name of representative to receive refund check(s)

33071028

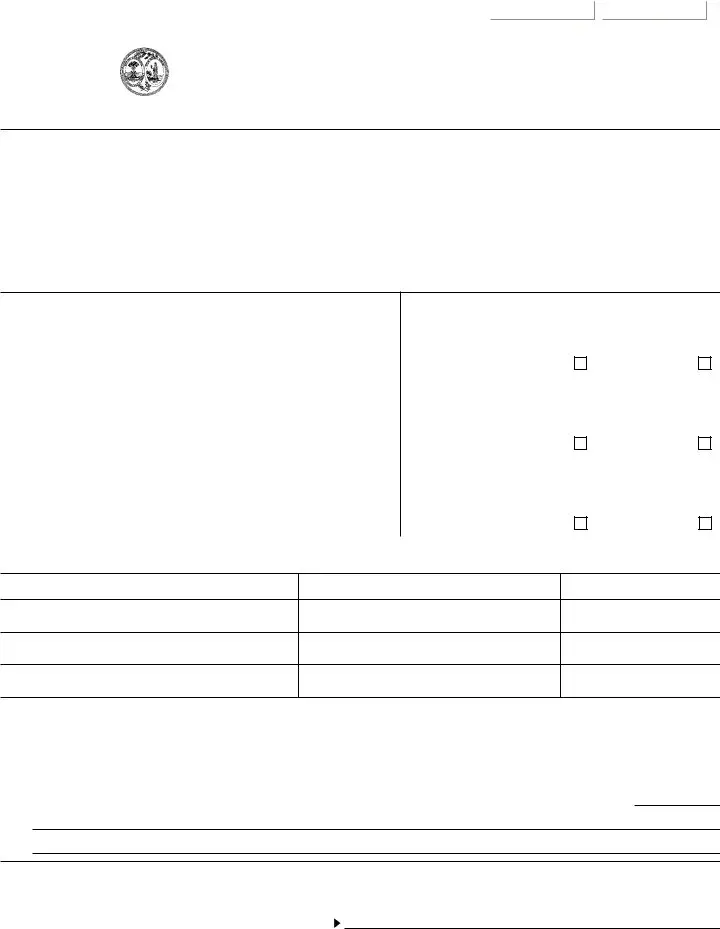

6Retention/Revocation of Prior Power(s) of Attorney - The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the South Carolina Department of Revenue for the same tax matters for years or periods covered by this document .

If you do not want to revoke a prior power of attorney, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT.

7Signature of Taxpayer(s) - If a tax matter concerns a joint return, both taxpayers must sign if joint representation is requested; otherwise, see the instructions for SC2848 concerning signature of taxpayer(s). If signed by a corporate officer, partner, guardian, tax matters partner/person, LLC members, executor, receiver, personal representative, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

The Department will not accept a Power of Attorney that is not signed.

*

*

|

* |

|

|

|

|

Signature |

Date |

|

Title (if |

applicable) |

|

|

|

||||

Print Name |

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Date |

|

Title (if |

applicable) |

Print Name |

|

|

|

|

|

NOTICES AND COMMUNICATIONS

All Notices and Communications will be sent to the taxpayer only. However, if you are unable to forward a copy to your named representative, you may contact our office for assistance.

Part II Declaration of Representative

I declare that:

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and

I am authorized to represent the taxpayer(s) identified in Part I for the tax matter(s) specified; and  I am one of the following:

I am one of the following:

aAttorney - a member in good standing of the bar of the highest court of the jurisdiction shown below.

bCertified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

cEnrolled Agent - enrolled as an agent under the Requirements of the US Treasury Department Circular No. 230. d Officer - a bona fide officer of the taxpayer organization.

e

f Family Member - a member of the taxpayer's immediate family (i.e., spouse, parent, child, brother, or sister). g Return Preparer.

h Other, please explain.

The Department will not accept a Declaration of Representative that is not signed.

The Department will not accept a Declaration of Representative that is not signed.

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief. To wilfully furnish a false or fraudulent statement to the Department is a crime.

*Designation - Insert

above letter

*Jurisdiction (state)

*Signature

*Date

*indicates required field.

33072026

Instructions for SC2848

General Instructions

Purpose of Form

Use SC2848 to grant authority to an individual to represent you before the South Carolina Department of Revenue and to receive tax information. See the instructions for Part I, line 4 for limitations that may apply for certain representatives.

A fiduciary (trustee, executor, administrator, receiver, or guardian) stands in the position of a taxpayer and acts as the taxpayer. Therefore, a fiduciary does not act as a representative and should not file a power of attorney. If a fiduciary wishes to authorize an individual to represent or perform certain acts on behalf of the entity, a power of attorney must be filed and signed by the fiduciary acting in the position of the taxpayer.

Authority Granted

This power of attorney authorizes the individual(s) named to perform any and all acts you can perform, such as signing consents extending the time to assess tax, recording the interview, or executing waivers agreeing to a tax adjustment. However, authorizing someone as your power of attorney does not relieve you of your tax obligations. Delegating authority or substituting another representative must be specifically stated on line 4. However, the authority granted to a power of attorney may not exceed that allowed under SC Code Section

Filing the Power of Attorney

File the original or a photocopy or facsimile transmission (fax) with the applicable office (main or taxpayer service center). The applicable office is the office from which you request information or before which a matter, such as an audit, is pending. Paper forms can be mailed to P.O. Box 125 Columbia, SC

Substitute SC2848

Federal Form 2848 may be substituted for SC2848 even though the instructions for the two forms differ somewhat. Be sure to note the differences and complete the Federal Form 2848 accordingly.

Specific Instructions

Part I - Power of Attorney

Line 1 - Taxpayer Information

Individuals. Enter your name, SSN (and/or EIN, if applicable), and address in the space provided. If a joint return is involved, and you and your spouse are designating the same representative(s), also enter your spouse's name and SSN, and your spouse's address if different from yours.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation

Corporations, partnerships, or LLC's. Enter the name, EIN, and business address. If this form is being prepared for corporations filing a consolidated tax return (SC1120), do not attach a list of subsidiaries to this form. Only the parent corporation information is required on line 1. Also, line 3 should only list SC1120 in the Tax Form Number column. However, a subsidiary must file its own SC2848 for returns that are required to be filed separately from the consolidated return, such as

Trust. Enter the name, title, and address of the trustee, and the name and EIN number of the trust.

Estate. Enter the name, title, and address of the decedent's executor/personal representative, and the name and identification number of the estate. The identification number for an estate includes both the EIN, if the estate has one, and the decedent's SSN.

Line 2 - Representative(s)

Enter the name of your representative(s). Only individuals may be named as representatives. Use the identical name on all submissions. If you want to name more than three representatives, indicate so on this line and attach a list of additional representatives to the form. Be sure to sign and date all attachments.

Line 3 - Tax Matters

You must enter the type of tax, the tax form number, and the year(s) or period(s) in order for the power of attorney to be valid. For example, you may list "income tax, SC1040" for calendar year "2016" and "Sales tax,

You may list the current year/period and any tax years or periods that have already ended as of the date you sign the power of attorney. However, you may include on a power of attorney only future tax periods that end no later than 3 years after the power of attorney is received by the Department of Revenue. The 3 future periods are determined starting after December 31 of the year the power of attorney is received by the department. You must enter the type of tax, the tax form number, and the future year(s) or period(s).

Line 4 - Acts Authorized

If you want to modify the acts that your named representative(s) can perform, describe any specific additions or deletions in the space provided. The authority to substitute another representative or to delegate authority must be specifically stated on line 4.

Certain Limitations:

If any representative you name is someone other than an attorney, CPA or enrolled agent, the acts that person can perform on your behalf may be limited by SC Code Section

Line 5 - Receipt of Refund Checks

If you want to authorize your representative to receive, but not endorse refund checks on your behalf, you must initial and enter the name of that person in the space provided. Treasury Department Circular No. 230 (31 CFR, Part 10) prohibits an attorney, CPA, or enrolled agent, any of whom is an income tax return preparer, from endorsing or otherwise negotiating a tax refund check. If you are in a licensed attorney/client relationship, your refund may be sent to your licensed attorney.

Line 6 - Retention/Revocation of Prior Power(s) of Attorney

If there is any existing power(s) of attorney you do not want to revoke, check the box on this line and attach a copy of the power(s) of attorney. If you want to revoke an existing power of attorney and do not want to name a new representative, send a copy of the previously executed power of attorney to each office where the power of attorney was filed. The copy of the power of attorney must have a current signature of the taxpayer under the signature on line 8. Write "REVOKE" across the top of the form. If you do not have a copy of the power of attorney you want to revoke, send a statement of revocation to each office where you filed the power of attorney. The statement must indicate that the authority of the power of attorney is revoked and must be signed by the taxpayer. Also, the name and address of each recognized representative whose authority is revoked must be listed. A representative can withdraw from representation by filing a statement with each office where the power of attorney was filed. The statement must be signed by the representative and identify the name and address of the taxpayer(s) and tax matter(s) from which the representative is withdrawing.

Line 7 - Signature of Taxpayer(s)

Individuals. You must sign and date the power of attorney. If a joint return has been filed and both taxpayers will be represented by the same individual(s), both must sign the power of attorney unless one spouse authorizes the other, in writing, to sign for both. In that case, attach a copy of the authorization. However, if a joint return has been filed and both taxpayers will be represented by different individuals, each taxpayer must execute his or her own power of attorney on a separate SC2848.

Corporations or associations. An officer having authority to bind the taxpayer must sign.

Partnerships. All partners or members of an LLC must sign unless one partner or member is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under state law, the partner has authority to bind the partnership. A copy of such authorization must be attached. For purposes of executing SC2848, the tax matters partner is authorized to act in the name of the partnership. For dissolved partnerships, see US Treasury Regulations section 601.503(c)(6).

Other. If the taxpayer is a dissolved corporation, deceased, insolvent, or a person for whom or by whom a fiduciary (a trustee, guarantor, receiver, executor, or administrator) has been appointed, see US Treasury Regulations section 601.503(d).

PART II - Declaration of Representative

The representative(s) you name must sign and date this declaration and enter the designation (i.e., items

aAttorney - Enter the

bCertified Public Accountant - Enter the

d Officer - Enter the title of the officer (i.e., President, Vice President, or Secretary). e

f Family Member - Enter the relationship to taxpayer (i.e., spouse, parent, child, brother, or sister).

g Tax Return Preparer - Enter the

Note: If the representation is outside the United States, conditions

Document Specifics

| Fact Name | Description |

|---|---|

| Form Identification | The form in discussion is known as the Tax Power of Attorney (POA), labeled as Form SC2848. |

| Primary Usage | This form is utilized to grant authority to another person to handle matters related to one's taxes on their behalf with the tax authority. |

| Authority Scope | The level of authority can be specifically defined, ranging from discussing tax matters with the authorities to representing the individual in tax proceedings. |

| Parties Involved | Typically, the parties involved include the taxpayer and the appointed representative, who can be a certified public accountant, attorney, or any individual specified by the taxpayer. |

| Validity and Duration | Validity and duration can vary; they often depend on the specifications made within the form or upon completion of the designated tasks. |

| Governing Law(s) | While this form is a general model, state-specific laws and regulations can apply. For instance, some states have their own version of a tax power of attorney form. |

| Revocation | The authority granted can be revoked by the taxpayer at any time, typically requiring a written notice. |

| State-Specific Versions | Many states have their own variations of the tax POA form, tailored to their specific laws and requirements. |

| Completion Requirement | Filling out Form SC2848 requires detailed information about the taxpayer, the representative, and the specific tax matters the form covers. |

Guide to Writing Tax POA sc2848

Filling out a Tax Power of Attorney (POA) form, specifically the SC2848, can seem daunting at first. However, it's a crucial step in ensuring that you have the right representative to handle your tax matters effectively. Whether it's for individual or business taxes, this form allows your chosen professional to speak and act on your behalf with the tax authorities. Knowing the proper steps to complete this form accurately can save you a lot of time and prevent potential issues down the line.

Here are the steps you need to follow to fill out the SC2848 form:

- Identify the taxpayer: Start by providing the full legal name of the individual or entity granting the power of attorney. Include any identification numbers like Social Security Numbers (SSNs) or Employer Identification Numbers (EINs).

- Designate the representative(s): Clearly write the name(s), address(es), and phone number(s) of the individual(s) you're appointing. Make sure to include their CAF number(s) if they have one. If not, leave this blank.

- Specify tax matters: Detail the type(s) of tax, the federal tax form number, the periods, and the specific matter(s) you're granting authority over. It’s important to be precise to prevent any confusion about the extent of the powers granted.

- List acts authorized: This section allows you to outline what your representative can and cannot do on your behalf. If there are specific powers you do not want to grant, make sure to mention them clearly.

- Retention/revocation of prior tax POAs: If you want to keep any previous POAs in effect, mention them here. Alternatively, if filling out this form means revoking prior ones, ensure this section reflects your wishes accurately.

- Signature of the taxpayer(s): The form must be signed and dated by the taxpayer or taxpayers if it concerns joint matters. If a taxpayer cannot sign due to illness, absence, or other valid reasons, a duly authorized agent can sign on their behalf but must provide documentation to support this.

- Declaration of Representative: The appointed representative(s) must declare their qualifications and specify the extent of their authority on this form. They also need to sign and date the declaration.

After completing the form, you should double-check all entries for accuracy to avoid any delays or rejections. Once satisfied, submit the form to the designated address or office as instructed. Filing this form is just the beginning. It paves the way for your representative to start managing your tax affairs. They can now communicate with tax authorities, access records, and perform other authorized activities on your behalf, ensuring your tax matters are handled efficiently and professionally.

Understanding Tax POA sc2848

What is Form SC2848 and when do I need it?

Form SC2848, often referred to as a Tax Power of Attorney (POA), is a document that allows you to designate someone else to handle your tax matters with the tax authority. You might need this form if you want a tax professional to have the authority to discuss your tax records, respond to notices, or represent you in tax matters before the tax department.

Who can I authorize to represent me using Form SC2848?

You can authorize any individual who is eligible to practice before the tax authority. This typically includes licensed attorneys, certified public accountants, enrolled agents, and sometimes other qualified individuals like family members, depending on the specific rules of your tax jurisdiction.

How do I correctly fill out Form SC2848?

To fill out Form SC2848 correctly, you must provide your name, address, and taxpayer identification number (such as your SSN or EIN). You also need to specify the tax forms and years or periods for which you're granting representation. The individual you're authorizing must also provide their information and sign the form. Finally, you or a legally authorized individual must sign and date the form.

Is there a deadline for filing Form SC2848?

There is no specific deadline for filing Form SC2848. However, you should submit it as soon as you realize the need for a representative to handle your tax matters, especially if you're facing deadlines for responses to the tax authority or court proceedings.

Can I revoke the authorization granted on Form SC2848?

Yes, you can revoke the authorization at any time. To do so, you need to notify the tax department in writing. The notice should include your name, taxpayer identification number, and a statement that you're revoking the power of attorney rights granted to the representative. Specifying the date or the document being revoked is also helpful.

What should I do if my representative's information changes?

If your designated representative’s information changes, you should update the Form SC2848. This includes changes to their address, phone number, or professional status. To update, fill out a new form with the current information and submit it to the tax authority.

Do I lose any of my rights by signing a Form SC2848?

Signing Form SC2848 does not strip you of your rights. You retain the authority to take action on your own behalf and contact the tax authority directly. The form simply adds another individual who can also act on your behalf regarding your tax matters.

How will I know if Form SC2848 has been processed?

Once Form SC2848 has been processed, the tax authority typically sends a confirmation to both you and your designated representative. If you do not receive this confirmation within a reasonable time frame, you should contact the tax authority to verify submission and processing status.

Can I authorize multiple representatives on one Form SC2848?

Yes, you can authorize multiple representatives on a single Form SC2848. Each representative’s name, address, and telephone number must be listed. Remember, each representative must also sign and date the form, agreeing to the representation responsibilities.

Common mistakes

Not verifying the form's version: Tax forms are updated regularly. Ensuring that the most current form is being used is crucial, as outdated forms may not be accepted.

Failing to include all necessary information: Each section of the form is important. Leaving out details such as Social Security numbers, addresses, or tax identification numbers can invalidate the POA.

Incorrectly identifying the representative(s): The person granted POA must be clearly identified with accurate information, including their name, address, and phone number. Mistakes here can lead to processing delays.

Not specifying the tax matters adequately: The form requires detailed information about the type of tax, tax form number, and year(s) or period(s) involved. Vague descriptions can make the POA ineffective.

Omitting signatures and dates: A common oversight is forgetting to sign and date the form. The IRS will not process a POA form without the taxpayer’s signature and the date it was signed.

Overlooking the need for state-specific forms: Some states require their own POA form in addition to or instead of the SC2848 form for state tax matters. Not including these can result in incomplete representation.

Not revoking prior POAs: If a new POA is being established, any prior POAs must be revoked in writing. Failing to do so can lead to confusion over who is authorized to act on your behalf.

Ignoring the declaration of the representative section: This crucial part includes a declaration from the representative stating they are eligible to practice before the IRS. This section must be completed to validate their authority.

To avoid these mistakes, here are a few tips:

- Double-check each section for completeness and accuracy before submission.

- Consult with a professional if you are unsure how to properly fill out any part of the form.

- Keep a copy of the completed form for your records and for the representative’s records.

- Regularly review the IRS website or contact their helpline for updates on form requirements and versions.

By paying close attention to the details and ensuring that all information is complete and current, taxpayers can streamline the POA process, ensuring that their tax matters are handled efficiently and correctly.

Documents used along the form

When someone is managing their taxes, especially in more complex situations such as owning a business, dealing with estates or trusts, or living abroad, they might find it necessary to complete not just a Power of Attorney (POA) form but also various other forms and documents to ensure comprehensive management of their tax matters. The Tax Power of Attorney, often referred to using the form number SC2848 in some jurisdictions, grants a designated person the authority to handle tax affairs on behalf of the taxpayer. Alongside the SC2848, there are other forms and documents frequently used to aid in tax preparation, correspondence with the tax authorities, and ensuring compliance with tax laws.

- Form 1040: This is the U.S. Individual Income Tax Return form. It is used by taxpayers to file their annual income tax return with the Internal Revenue Service (IRS).

- Form W-2: The Wage and Tax Statement is issued by employers to their employees and the IRS at the end of the tax year. It reports an employee's annual wages and the amount of taxes withheld from their paycheck.

- Form 1099: Various 1099 forms are used to report income from sources other than wages, such as independent contractor income (1099-NEC), interest and dividends (1099-INT and 1099-DIV), and other types of miscellaneous income.

- Form 4868: This is the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. It is used to request a six-month extension for filing the Form 1040.

- Form 8821: Tax Information Authorization form allows a designated third party to request and inspect confidential tax information but does not allow them to represent you to the IRS.

- Form 4506-T: Request for Transcript of Tax Return form is used to request tax return transcripts, tax account information, W-2 information, and 1099 information, among other documents, for specific years.

- Form 8938: Statement of Specified Foreign Financial Assets. Taxpayers use this form to report their foreign financial assets if the total value exceeds the applicable reporting threshold.

- Form 2848: This is the official Power of Attorney and Declaration of Representative form which is different from the SC2848 but serves the same purpose at a federal level, allowing individuals to authorize another person to represent them before the IRS.

Apart from these forms, individuals and enterprises may need to file additional documents depending on their specific tax situations, such as state tax returns or forms related to international taxation. It is essential to provide all relevant forms and documents when filing taxes to ensure compliance and to accurately represent one's financial situation to the tax authorities. Ensuring accuracy and timeliness in filing these forms can help in avoiding penalties and ensuring that tax affairs are in order.

Similar forms

The Healthcare Power of Attorney (HCPOA) is closely aligned with the tax POA (SC2848) in its foundational purpose: both designate another individual to act on one's behalf. While the HCPOA focuses on medical decisions when one cannot make them, the tax POA grants someone authority to handle tax matters, signifying a shared principle of representing one's interests in crucial areas of life.

Similarly, the Durable Power of Attorney (DPOA) parallels the tax POA by assigning a trusted person the power to manage one's financial affairs. This may include handling investments, managing property, and conducting bank transactions. Like the tax POA, which specifically addresses tax obligations, the DPOA offers broad authority across various financial domains, underscoring the importance of selecting a reliable agent in both instances.

The General Power of Attorney document shares a significant resemblance to the tax POA, with its broad authorization for an agent to perform actions on one's behalf. However, unlike the tax-specific focus of the SC2848 form, a General Power of Attorney encompasses a wider range of activities, from financial decisions to daily personal affairs, yet both exist to facilitate important personal or business matters when direct involvement is not possible.

The Limited Power of Attorney (LPOA) document, while also granting someone else the authority to act in your stead, differs from the tax POA by its scope limitation. The LPOA permits the agent to perform specific acts for a limited duration, contrasting the tax POA's typically broader and more enduring tax-related powers. Both documents, however, streamline the delegation of authority for specific tasks or domains, ensuring that important matters can be attended to without direct personal action.

Finally, the Estate Planning Power of Attorney shares a common theme with the tax POA of preparing for the future. This document focuses more on longer-term financial and estate planning, including the delegation of decisions concerning one’s estate after death. Although the tax POA primarily concerns living individuals' tax matters, both documents highlight the necessity of forward-thinking and delegation in financial planning and personal affairs.

Dos and Don'ts

When it comes time to fill out the Tax Power of Attorney (POA) SC2848 form, knowing what actions you should and shouldn't take can streamline the process and help prevent common mistakes. Below are key dos and don'ts to consider.

What You Should Do

Thoroughly review the form before filling it out to ensure you understand all the requirements and sections. This preliminary step will prepare you for the type of information you need to gather.

Use clear and precise handwriting or, if allowed, type the information to reduce the risk of errors or misinterpretation by the tax authorities. Accuracy is paramount in all legal documents.

Ensure that the tax professional or representative you're authorizing is eligible to practice before the IRS or your state tax board. Verify their credentials to be certain they're in good standing and qualified to handle your tax matters.

Sign and date the form as instructed, since an unsigned or outdated form can result in it being rejected or ignored altogether. Your signature officially authorizes the representative and validates the form.

What You Shouldn't Do

Don't leave any sections incomplete, as missing information can delay processing or lead to the form being rejected. If a section does not apply to your situation, clearly mark it as "N/A" (not applicable).

Avoid giving a blanket authorization without specifying the types of tax matters and tax periods you want the representative to handle. Being specific can help protect your privacy and limit your representative's authority to what's necessary.

Do not forget to revoke previous POAs if you're appointing a new representative and do not want the others to retain their authority. Failing to do so can result in multiple representatives having access to your information and working on your behalf without your current intent.

Don't send the form without making a copy for your records. Having a copy is crucial for your personal records and in the event that the tax authorities or your representative requires you to verify information or the authorization at a later date.

Misconceptions

When it comes to understanding the Tax Power of Attorney (POA), specifically the IRS Form 2848, many misconceptions can lead individuals astray. Here, we aim to demystify some of these common misunderstandings, providing clarity on what the form does and doesn't do.

- Misconception #1: The form grants the power to manage all financial affairs. In reality, Form 2848 only allows the designated individual, often a tax professional, to communicate with the IRS on your behalf regarding your tax matters. It doesn't extend to other financial decisions outside of tax issues.

- Misconception #2: Only a certified public accountant or attorney can be designated. While these professionals are commonly appointed, the IRS also allows enrolled agents to act on your behalf. An enrolled agent is a person who has earned the privilege of representing taxpayers before all administrative levels of the IRS.

- Misconception #3: Form 2848 automatically covers all years and types of taxes. In fact, you must specify which tax forms and years your designated representative is authorized to discuss with the IRS. Without this specification, the authority is not granted.

- Misconception #4: The form remains effective indefinitely. The POA Form 2848 has a general expiration term of up to three years from the date it is signed. It is crucial to renew it if ongoing representation is needed beyond this period.

- Misconception #5: Filing Form 2848 provides your representative with the right to receive your refund checks. Actually, the form does not grant your representative the authority to receive refund checks on your behalf. It only allows them to obtain and provide information to the IRS, sign certain documents, and perform specific acts indicated in the form.

- Misconception #6: Once filed, the form's terms cannot be changed or revoked. If your circumstances change or you wish to revoke the powers granted, you can do so by submitting a new Form 2848 or by providing written notice to the IRS specifying your intentions.

Understanding these nuances of Form 2848 can help ensure that individuals are better informed about their rights and the extent of the powers they are granting to their representatives. It encourages a more informed decision-making process regarding tax matters and representation before the IRS.

Key takeaways

The Power of Attorney (POA) Form SC-2848 is a critical document for individuals who wish to authorize someone else to handle their tax matters with the South Carolina Department of Revenue. Understanding the nuances of completing and using this form can ensure that tax matters are managed smoothly and effectively. Here are five key takeaways:

- Accuracy is paramount. When filling out the SC-2848 form, it's crucial to provide accurate and complete information. This includes the full names, addresses, and identification numbers (e.g., Social Security numbers for individuals or Federal Employer Identification Numbers for businesses) of both the taxpayer and the appointed representative. Errors or omissions can lead to delays or the rejection of the form.

- Carefully select your representative. The person granted a power of attorney must be someone you trust implicitly, as they will have access to sensitive tax information and the authority to make decisions on your behalf. Typically, representatives are professionals such as accountants or attorneys specializing in tax matters.

- Specify the powers granted. The SC-2848 form allows you to define the scope of authority given to your representative. Be specific about what your representative can and cannot do. For example, you might grant them the power to access your tax records, negotiate with the Department of Revenue, and sign documents related to tax disputes or settlements on your behalf.

- Understand the form's duration. The POA remains in effect until its expiration date, if one is specified, or until you revoke it. Remember, revoking a previously granted POA requires you to notify both the Department of Revenue and your representative in writing. Without specifying an expiration date, the POA could potentially last indefinitely.

- Keep records and provide copies. After completing the SC-2848 form, make sure to keep a copy for your records and provide your representative with a copy. This ensures both parties fully understand the extent of the authority granted and have proof of the representative's ability to act on your behalf regarding tax matters.

Popular PDF Documents

2024 Fica Wage Limit - If you're earning above the limit, this form is your roadmap to understanding and paying your additional Medicare tax.

IRS Schedule K-1 1041 - Schedule K-1 (1041) must be filed by the estate or trust for each beneficiary, detailing their share of income, which complements the entity's overall tax obligations.