Get Tax POA RV-F0103801 Form

When faced with tax matters, understanding and managing paperwork is crucial, and among the various documents, the Tax POA RV-F0103801 form plays a significant role. This form essentially allows individuals to grant another person the authority to handle their tax affairs, making it an invaluable tool for those who might not be able to manage these tasks themselves. Whether due to absence, health reasons, or simply a preference to have a professional take the reins, this Power of Attorney (POA) form ensures that taxpayers can have their tax matters addressed without having to be directly involved. The form covers a range of tax-related activities, including the ability to obtain and provide information to the tax authorities, challenge tax assessments, and make payment arrangements on behalf of the grantor. It's a straightforward way to ensure that one's tax obligations are fulfilled competently and on time, offering peace of mind to both the person granting the authority and the individual taking it on.

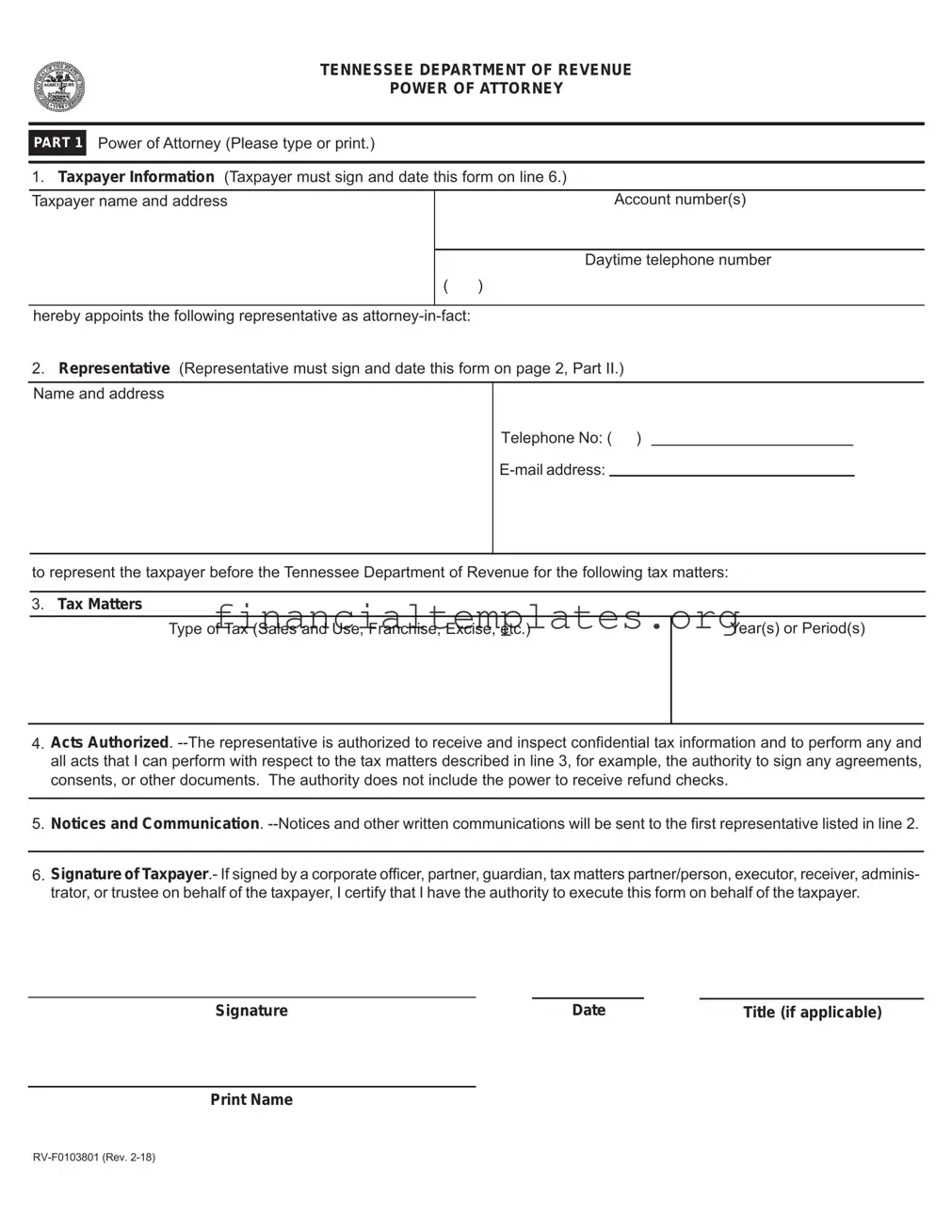

Tax POA RV-F0103801 Example

TENNESSEE DEPARTMENT OF REVENUE

POWER OF ATTORNEY

|

PART 1 |

Power of Attorney (Please type or print.) |

|

|

|

||||

|

||||

|

Taxpayer name and address |

Account number(s) |

||

|

|

|

|

|

|

|

|

|

Daytime telephone number |

( |

) |

|||

hereby appoints the following representative as

2.Representative (Representative must sign and date this form on page 2, Part II.) Name and address

Telephone No: ( )

to represent the taxpayer before the Tennessee Department of Revenue for the following tax matters:

3.Tax Matters

Type of Tax (Sales and Use, Franchise, Excise, etc.)

Year(s) or Period(s)

4.Acts Authorized.

5.Notices and Communication.

6.Signature of Taxpayer.- If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, adminis- trator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

Signature |

Date |

Title (if applicable) |

Print Name

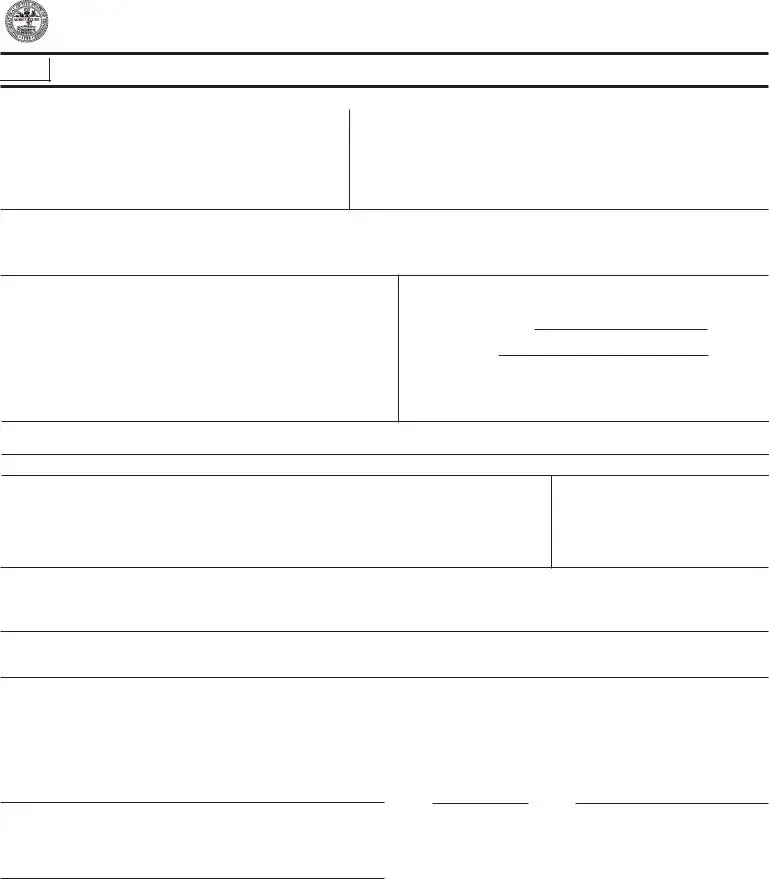

Under.penalties of perjury, I declare that:

. I am authorized to represent the taxpayer(s) identified in Part 1 for the tax matter(s) specified there; and I am one of the following designations:

a. Attorney or Certified Public Accountant

b. Officer or

c.Other

►If this declaration of representative is not signed and dated, the power of attorney will be returned.

Designation |

Jurisdiction (state) |

Signature |

|

above letter |

|||

|

|

||

|

|

|

Please mail this form to: Tennessee Department of Revenue Andrew Jackson Office Building 500 Deaderick Street

Nashville, Tennessee 37242

Date

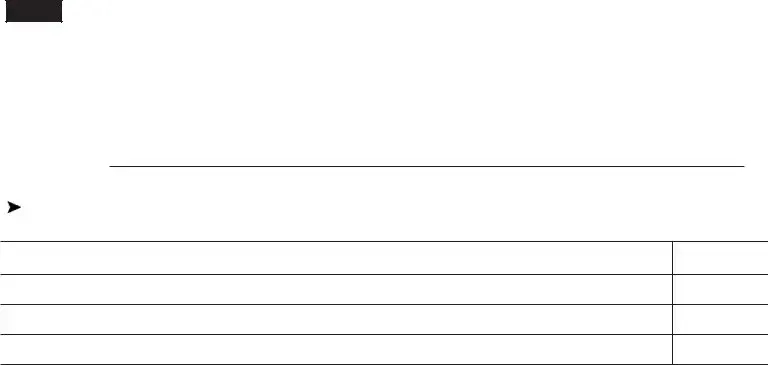

Document Specifics

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose | The form is intended to grant authority to another individual or entity to handle tax-related matters on behalf of the person completing the form. |

| 2 | Applicability | This form is typically used by individuals or businesses needing to appoint someone to represent them with their tax matters. |

| 3 | Governing Law | The form is subject to laws and regulations which govern tax representation and power of attorney in the respective state or jurisdiction. |

| 4 | Form Identification | The identifier "RV-F0103801" uniquely designates this specific tax power of attorney form. |

| 5 | Validity | The period for which the form is valid depends on the specified terms within the document or applicable state laws. |

| 6 | Revocation | The form can be revoked by the principal at any time, given they follow the proper legal procedure for revocation. |

| 7 | Requirements | To be considered valid, the form must be completed in accordance with state-specific guidelines, including signatures and possibly notarization. |

| 8 | Filing | The completed form may need to be filed with a particular state department or tax authority, depending on jurisdictional requirements. |

| 9 | Limitations | The authority granted by the form is limited to tax matters and does not extend to other legal authorities unless specifically stated. |

| 10 | Accessibility | Persons with disabilities may request special accommodations to complete or submit the form, as per applicable laws. |

Guide to Writing Tax POA RV-F0103801

Filling out the Tax Power of Attorney (POA) RV-F0103801 form is an essential step for individuals or businesses needing to grant another person the authority to handle their tax matters. This could include representation before the taxing authority, obtaining confidential tax information, or making decisions about tax payments and filings. It's a formality that ensures your tax matters are in trusted hands while you focus on other aspects of your personal or business life. The following steps guide you through the process of filling out the form accurately to ensure your delegate has clear authorization to act on your behalf.

- Begin by entering the taxpayer's full name and identification number (Social Security Number for individuals or Employer Identification Number for businesses) at the top of the form. This identifies who is granting the power of attorney.

- Specify the tax matters to be handled by your representative, including the type of tax, the state tax forms, periods, or years involved. This ensures that the authorization is specific to your needs.

- Fill in the name and contact information of the individual you are appointing as your power of attorney. This person will act on your behalf concerning the tax matters you've outlined.

- Indicate the specific powers you are granting your representative. This includes whether they can receive confidential information, represent you in hearings, or make decisions about tax payments. Be as specific as possible to avoid any confusion or unauthorized actions.

- If you wish to revoke any previous power of attorney documents, make sure to tick the appropriate box and provide details of the documents being revoked. This prevents any overlap of authority or confusion about who legitimately holds power of attorney.

- Both the taxpayer(s) and the representative(s) must sign and date the form. This formalizes the agreement and confirms that both parties understand and accept their roles and responsibilities. If the taxpayer is a business, an authorized individual must sign on behalf of the company.

- After filling out and signing the form, submit it to the necessary tax authority. Keep a copy for your records and provide one to your appointed representative. This ensures that all parties have the documentation they need for future reference.

Once the form is completed and submitted, your representative will have the authority to act on your behalf regarding the specified tax matters. It's important to communicate clearly with your appointed representative about your expectations and any specific instructions you have regarding the handling of your taxes. Regularly review the arrangement to ensure it continues to meet your needs and make any adjustments as necessary through a new Tax POA RV-F0103801 form if necessary.

Understanding Tax POA RV-F0103801

What is the Tax POA RV-F0103801 form used for?

The Tax POA RV-F0103801 form is a legal document that allows an individual to grant another person or entity the authority to handle their tax matters. This includes the power to access tax records, communicate with tax agencies, and make decisions regarding taxes on behalf of the grantor.

Who can be appointed as a representative on the Tax POA RV-F0103801 form?

Individuals often appoint trusted professionals such as certified public accountants (CPAs), tax attorneys, or enrolled agents as their representatives. However, it is also possible to appoint a family member or friend, provided they are willing and able to take on this responsibility.

How do I complete the Tax POA RV-F0103801 form?

To complete the form correctly, the individual granting the power (the principal) must clearly provide their personal information, specify the tax matters and periods covered, and designate the representative(s). It is crucial to sign and date the form to validate it. Additionally, the appointed representative(s) must also sign the document.

Is there a specific time frame for which the Tax POA RV-F0103801 is valid?

The validity period of the Tax POA RV-F0103801 can vary depending on the terms outlined within the document. The principal can specify a particular end date, or the POA can remain effective until revoked. It is important to note that some tax agencies may require a new POA form after a certain number of years.

Can I revoke the Tax POA RV-F0103801, and if so, how?

Yes, the principal has the right to revoke the power of attorney at any time. To do so, it is typically necessary to send a written notice of revocation to the tax agency and inform the appointed representative. In some cases, completing a new POA form can also automatically cancel the previous one.

What should I do if my representative changes?

If there is a change in representatives, it is advised to complete a new Tax POA RV-F0103801 form. This new form will revoke the authority granted in the previous document and establish the new representative’s authority to act on your behalf in tax matters.

Are there any restrictions on what my representative can do?

The scope of authority given to the representative can be as broad or as limited as the principal desires. This should be clearly defined in the POA form. Generally, representatives can perform tasks such as filing taxes, obtaining tax information, and representing the principal in tax disputes. However, they cannot endorse refund checks or alter the principal’s tax return without explicit permission.

Do I need to file the Tax POA RV-F0103801 with the tax authority?

Yes, after completion, the Tax POA RV-F0103801 form must be filed with the appropriate tax authority. This ensures that the tax agency recognizes the representative’s authority to act on your behalf.

Will my representative have access to all my tax information?

The representative’s access to tax information can be limited or comprehensive, based on the permissions granted in the Tax POA RV-F0103801 form. The document should specify which tax periods and types of tax information the representative is allowed to access.

What should I do if I have questions about completing the Tax POA RV-F0103801 form?

If you have any uncertainties about how to properly complete the Tax POA RV-F0103801 form, it is recommended to consult with a tax professional or attorney. They can provide guidance tailored to your specific situation, ensuring that the power of attorney meets all necessary legal requirements and adequately represents your needs.

Common mistakes

When preparing to fill out the Tax Power of Attorney (POA) form RV-F0103801, it is common for individuals to make several mistakes that can affect the processing and validity of the document. Understanding these errors can help ensure the form is filled out correctly and efficiently.

-

Not reviewing the form instructions carefully: People often overlook the importance of thoroughly reading and understanding the instructions provided with the form, leading to incorrect or incomplete information being entered.

-

Incorrect taxpayer information: Entering wrong taxpayer information, such as the Social Security Number (SSN) or Taxpayer Identification Number (TIN), can result in processing delays or the form being rejected.

-

Omitting representative details: Failing to provide complete information about the representative, including their name, address, telephone number, and tax identification numbers, can invalidate the POA.

-

Not specifying the tax matters correctly: Individuals sometimes do not clearly identify the tax forms and periods for which they are granting authority, leading to confusion and potential unauthorized representation.

-

Forgetting signatures and dates: The POA form is not valid unless it is signed and dated by the taxpayer or their duly authorized representative. Forgetting these can cause significant delays.

-

Failure to specify the extent of authority: Not clearly defining the scope of the representative’s authority, such as whether they are allowed to receive refund checks or make binding agreements, can lead to disputes or limitations in the representative's capabilities.

-

Ignoring revocation of prior POAs: If the individual wishes to revoke a previously granted POA, failing to mention this on the form can result in both the old and new POA being active simultaneously, which might lead to conflicting actions.

By being mindful of these common errors and taking steps to avoid them, individuals can ensure that their Tax Power of Attorney Form RV-F0103801 is filled out accurately and recognized as valid by the relevant tax authority.

Documents used along the form

When handling tax matters, it's essential to have all the necessary paperwork to ensure a smooth and efficient process. Among these, the Tax Power of Attorney (POA) RV-F0103801 form is a crucial document that allows an individual to grant another person the authority to handle their tax affairs. However, this form often doesn't stand alone. Several other forms and documents are commonly used alongside it to fulfill various tax-related functions and requirements. Here is a list of up to eight such forms and documents that are frequently used in conjunction with the Tax POA RV-F0103801 form.

- IRS Form 2848 - Power of Attorney and Declaration of Representative: This document authorizes an individual, such as an accountant or attorney, to represent the taxpayer before the IRS, allowing them to receive and inspect confidential tax information.

- IRS Form 8821 - Tax Information Authorization: It provides appointed individuals with the ability to review someone's tax information but does not allow them to represent the taxpayer to the IRS.

- Form W-9 - Request for Taxpayer Identification Number and Certification: Used to provide the correct taxpayer identification number (TIN) to the person who is required to file an information return with the IRS, such as income paid to you or real estate transactions.

- Form 4506-T - Request for Transcript of Tax Return: Allows individuals or their authorized representatives to request a transcript of their tax returns or other tax-related information.

- Form 8822 - Change of Address: For notifying the IRS of a change in address to ensure all tax correspondence and refunds are correctly directed.

- Form 4868 - Application for Automatic Extension of Time To File U.S. Individual Income Tax Return: Used to apply for an additional six months to file an individual tax return.

- Schedule C (Form 1040) - Profit or Loss from Business: Required for individuals who are self-employed or sole proprietors to report income or loss from a business they operated or a profession they practiced as a sole proprietor.

- Schedule D (Form 1040) - Capital Gains and Losses: Used to report the sale or exchange of capital assets not reported on another form or schedule.

These documents, when used alongside the Tax POA RV-F0103801, facilitate a comprehensive approach to handling tax matters, ensuring that all aspects of the taxpayer's financial life are correctly addressed and represented. Whether for filing taxes, changing personal information with the IRS, or authorizing representation, these forms collectively help in navigating the complexities of tax law and administration.

Similar forms

The Tax Power of Attorney (POA) RV-F0103801 form bears similarities to the IRS Form 2848, Power of Attorney and Declaration of Representative. Both documents serve the crucial function of authorizing an individual, often a tax professional, to represent the taxpayer before tax authorities. This includes handling matters such as providing and receiving confidential information, negotiating, and making agreements. The key difference lies in their jurisdiction: while the RV-F0103801 may be specific to a particular state or tax entity, the IRS Form 2848 is applicable at the federal level, across the United States.

Another document that shares similarities with the RV-F0103801 form is the Form 8821, Tax Information Authorization. Although it doesn't grant an individual the authority to represent a taxpayer, it does allow the designated party to access and review the taxpayer's confidential information. This can be particularly useful for tax preparation or financial planning purposes. Like the Tax POA, this form facilitates communication between tax entities and individuals authorized by the taxpayer, but it limits the scope of authority strictly to information sharing, without extending to representation or negotiation on the taxpayer's behalf.

The General Durable Power of Attorney is a broader document that also shares commonalities with the Tax POA RV-F0103801. Unlike the Tax POA, which is specific to tax matters, a General Durable Power of Attorney encompasses a wide range of authorities that can be granted from one individual to another, including legal and financial decisions. However, if properly stipulated within the document, it can grant an agent the authority to handle tax matters on behalf of the principal. This shows the versatility of the General Durable Power of Attorney, though for tax-specific issues, a document like the RV-F0103801 may be more straightforward and acceptable to tax agencies.

Lastly, the Healthcare Power of Attorney is another type of POA that, while different in its primary purpose, shares the foundational concept of granting authority to another individual. This specific type focuses on medical decisions rather than financial ones. Despite this difference, the fundamental principle of appointing another person to act on one’s behalf is a core similarity. The Tax POA RV-F0103801 involves financial decisions, specifically for tax matters, showing the adaptability of the POA concept across various aspects of one’s personal affairs.

Dos and Don'ts

Understanding how to properly fill out the Tax Power of Attorney (POA) form, specifically the RV-F0103801, is essential for ensuring the process goes smoothly and your tax matters are handled correctly. Below is a list of things you should and shouldn't do when completing this form to guide you through the process.

Things You Should Do:

- Read the instructions carefully before you start filling out the form. This will help you understand every part of the process and ensure accuracy.

- Ensure all the information is accurate and up-to-date, including your personal information, the representative's details, and the tax matters for which you're granting authority.

- Specify the tax forms and years you are granting your representative authority over. Being clear and precise helps avoid confusion and ensures the proper handling of your taxes.

- Sign and date the form. Your signature is required to validate the power of attorney. Ensure the date is correct, as it indicates when the authorization becomes effective.

- Keep a copy of the completed form for your records. Having a copy will help you keep track of who has authorization to act on your behalf and for which tax matters.

Things You Shouldn't Do:

- Don't leave any sections blank. If a section doesn't apply to your situation, enter "N/A" (not applicable) instead of leaving it empty to avoid any assumption of oversight or error.

- Avoid using vague language when describing the powers granted. Be as specific as possible to prevent any misunderstandings or legal issues down the line.

- Don't skip the witness or notarization step if your state requires it. This step is crucial for the document's legality and enforceability.

- Don't forget to inform your representative that you have completed and submitted the form. They should be fully aware of their responsibilities and the extent of their powers.

- Avoid waiting until the last minute to fill out and submit the form. Delays can lead to complications or rushed decisions, especially during tax season.

By following these dos and don'ts, you can ensure that your Tax POA RV-F0103801 form is filled out correctly and efficiently, paving the way for a smooth tax handling process.

Misconceptions

Understanding the Tax Power of Attorney (POA) RV-F0103801 form is critical for effectively managing your tax matters. However, several misconceptions often lead to confusion and potential missteps. Here, we address and clarify some of the most common misunderstandings about this form.

- It Grants Unlimited Power: One major misconception is that by signing the RV-F0103801 form, you’re giving someone complete control over all your financial and legal matters. In reality, this form specifically limits the authority to tax-related matters, allowing the designated individual to act on your behalf with the tax authorities only.

- It’s Irrevocable: Many believe once the Tax POA is signed, it cannot be changed or revoked. This isn’t true. You have the right to revoke or modify this POA at any time as long as the proper procedures are followed.

- One Form Fits All Tax Matters: Another common error is the assumption that a single RV-F0103801 form covers all tax matters for all years. This form requires you to specify the tax matters and years you want your representative to handle. If your needs change, a new form may be necessary.

- It’s Only for Individuals Facing Legal Trouble: The misconception that the Tax POA is only for people with legal issues or disputes with tax authorities is widespread. Anyone, regardless of their tax situation, can benefit from designating a trusted individual to manage their tax affairs, especially for convenience or if they’re unable to do so themselves.

- Any Form of POA Will Work: Some think that any type of Power of Attorney document will suffice for tax purposes. However, the RV-F0103801 is specifically designed for tax matters with the relevant tax office, and a general POA typically does not grant authority in this specific area.

- It Allows the Representative to Transfer the POA to Someone Else: There is a belief that the appointed representative can delegate the authority to another person. The truth is, the power granted by the RV-F0103801 form is not transferable. Only the individual named as the representative has the authority to act on your behalf.

- Signing the Form Means Losing Control Over Your Taxes: Some people hesitate to fill out and sign the form, fearing they will lose control over their tax matters. This form does not take away your ability to manage your taxes but simply adds another authorized individual who can also make decisions and take actions with the tax office on your behalf.

- There’s No Need to Inform the Tax Office When Revoking the Form: Finally, there’s the incorrect assumption that once the form is revoked, there’s no need to notify the tax authorities. For the revocation to take effect, you must inform the tax office, ensuring they are aware that the previously granted powers are no longer valid.

Clearing up these misconceptions about the Tax POA RV-F0103801 form can greatly aid in managing your tax affairs more efficiently and effectively, ensuring that you and your representative understand the scope and limitations of the authority being granted.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) form RV-F0103801 is an important step for taxpayers who need to designate someone else to manage their tax matters. This document empowers an individual or entity to act on your behalf, handling tax affairs with the proper authority. Here are key takeaways to ensure the process is completed smoothly and effectively:

- Understand the Purpose: The Tax POA form RV-F0103801 allows taxpayers to grant authority to a representative, such as a tax attorney, certified public accountant, or another person, to receive confidential tax information and to act on their behalf concerning tax matters with the tax authority.

- Know Who Can Be Appointed: Individuals authorized to receive this power include attorneys, CPAs, enrolled agents, family members or any person you trust to handle your tax matters responsibly. It’s vital to choose someone with the knowledge and experience relevant to your tax situation.

- Fill Out Accurately: Ensure all sections of the form are filled out accurately. This includes personal information, the specific tax matters and periods you are granting authority on, and the details of the representative you are appointing.

- Specify the Powers Granted: Be clear about what your representative can and cannot do. The form allows you to specify the extent of the powers granted, including whether they can receive refunds, make binding agreements, or only have access to certain tax information.

- Sign and Date the Form: Your signature and the date are required to validate the form. In some cases, the representative may also need to sign, acknowledging their acceptance of the responsibilities granted by the POA.

- Keep Records: Always keep a copy of the POA for your records. This ensures you have proof of the authorization you’ve granted and helps in any future disputes or confusion about the representation.

- Revoke When Necessary: You can revoke the powers granted through the form at any time. This is typically done by completing a new POA form that either specifies a new representative or declares that you are revoking the powers granted to the previous representative.

- File with the Tax Authority: For the POA to be effective, it must be filed with the appropriate tax authority. Check the instructions for the RV-F0103801 form to understand the submission process, whether it can be done electronically or if a hard copy needs to be mailed.

Properly executing the Tax POA form RV-F0103801 ensures that your tax matters can be handled competently and legally by your chosen representative. It’s a valuable tool for managing your taxes, especially if you’re unable to do so yourself due to various reasons like travel, health issues, or lack of expertise in tax law. Understanding these key points can alleviate the stress often associated with tax management and representation.

Popular PDF Documents

Apply for Reseller Permit - It emphasizes the use of black or blue ink only, ensuring clarity and readability of the submitted information.

Irs 944 Instructions - Understanding when and how to file Form 944 can significantly streamline tax processes for eligible small businesses.