Get Tax POA POA-1 Form

When dealing with taxes, individuals and businesses often find themselves in need of professional assistance. This is where the Tax Power of Attorney (POA), formally known as POA-1, becomes an essential tool. It allows taxpayers to grant a trusted individual or entity the authority to handle tax matters on their behalf with the tax authorities. This could include anything from receiving confidential information to making decisions and taking actions related to the taxpayer's account. Understanding the scope and limitations of this authorization is crucial for both the grantor and the agent. The form itself details specific powers granted, the duration of the power, and how to revoke it if necessary. Proper completion and submission of this form ensure that tax matters are handled efficiently and with the required legal backing, providing peace of mind to those who need to navigate the often complex world of tax regulations and obligations.

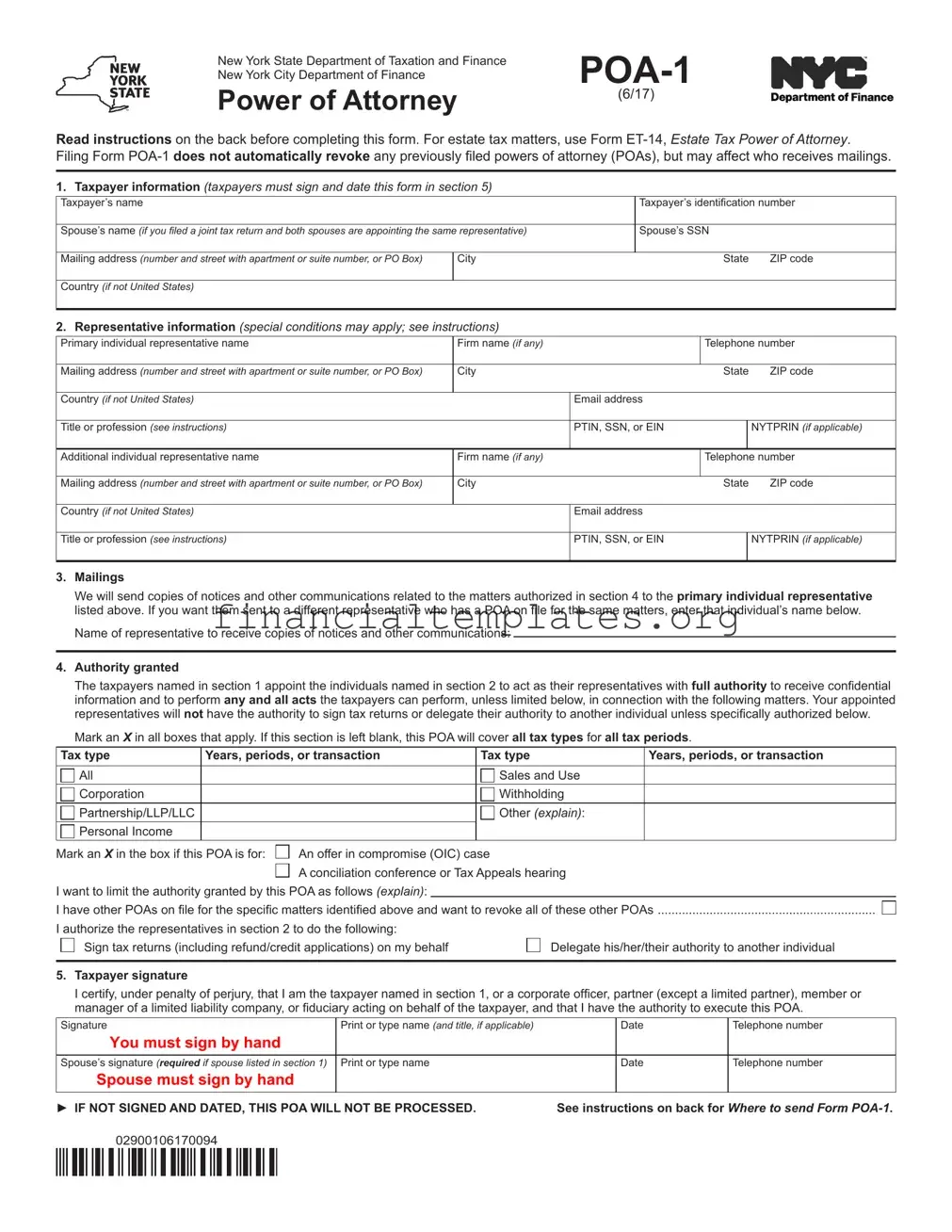

Tax POA POA-1 Example

RK |

New York State Department of Taxation and Finance |

N¥C |

|

w |

New York City Department of Finance |

|

|

4 ATE |

|

|

|

Power of Attorney |

(6/17) |

Department of Finance |

|

|

Read instructions on the back before completing this form. For estate tax matters, use Form

Filing Form

1.Taxpayer information (taxpayers must sign and date this form in section 5)

Taxpayer’s name |

|

|

Taxpayer’s identification number |

||

|

|

|

|

|

|

Spouse’s name (if you filed a joint tax return and both spouses are appointing the same representative) |

|

Spouse’s SSN |

|

||

|

|

|

|

|

|

Mailing address (number and street with apartment or suite number, or PO Box) |

ICity |

|

|

State |

ZIP code |

Country (if not United States) |

|

|

|

|

|

|

|

|

|

|

|

2. Representative information (special conditions may apply; see instructions) |

|

|

|

|

|

|

|

|

|

|

|

Primary individual representative name |

Firm name (if any) |

|

|

ITelephone number |

|

Mailing address (number and street with apartment or suite number, or PO Box) |

City |

|

|

State |

ZIP code |

|

|

|

|

|

|

Country (if not United States) |

|

Email address |

|

|

|

|

|

|

|

|

|

Title or profession (see instructions) |

|

PTIN, SSN, or EIN |

|

NYTPRIN (if applicable) |

|

|

|

|

|

1 |

|

Additional individual representative name |

Firm name (if any) |

|

|

ITelephone number |

|

|

|

|

|

|

|

Mailing address (number and street with apartment or suite number, or PO Box) |

City |

|

|

State |

ZIP code |

|

|

|

|

|

|

Country (if not United States) |

|

Email address |

|

|

|

|

|

|

|

|

|

Title or profession (see instructions) |

|

PTIN, SSN, or EIN |

|

NYTPRIN (if applicable) |

|

|

|

|

|

1 |

|

3.Mailings

We will send copies of notices and other communications related to the matters authorized in section 4 to the primary individual representative listed above. If you want them sent to a different representative who has a POA on file for the same matters, enter that individual’s name below.

Name of representative to receive copies of notices and other communications:

4.Authority granted

The taxpayers named in section 1 appoint the individuals named in section 2 to act as their representatives with full authority to receive confidential

information and to perform any and all acts the taxpayers can perform, unless limited below, in connection with the following matters. Your appointed representatives will not have the authority to sign tax returns or delegate their authority to another individual unless specifically authorized below.

Mark an X in all boxes that apply. If this section is left blank, this POA will cover all tax types for all tax periods.

Tax type |

Years, periods, or transaction |

|

Tax type |

Years, periods, or transaction |

|

|

|

|

|

|

|

|

|

All |

|

|

|

Sales and Use |

|

|

Corporation |

|

|

|

Withholding |

|

|

Partnership/LLP/LLC |

|

|

IB |

Other (explain): |

|

|

I~ Personal Income |

|

|

|

|

|

|

Mark an X in the box if this POA is for: □ An offer in compromise (OIC) case |

|

|

|

|||

|

□ A conciliation conference or Tax Appeals hearing |

|

|

|||

I want to limit the authority granted by this POA as follows (explain): |

|

|

|

|

|

|

I have other POAs on file for the specific matters identified above and want to revoke all of these other POAs |

□ |

|||||

I authorize the representatives in section 2 to do the following:

□ Sign tax returns (including refund/credit applications) on my behalf |

□ Delegate his/her/their authority to another individual |

|

|

5.Taxpayer signature

I certify, under penalty of perjury, that I am the taxpayer named in section 1, or a corporate officer, partner (except a limited partner), member or manager of a limited liability company, or fiduciary acting on behalf of the taxpayer, and that I have the authority to execute this POA.

Signature |

Print or type name (and title, if applicable) |

Date |

Telephone number |

You must sign by hand |

|

|

|

|

|

|

|

Spouse’s signature (required if spouse listed in section 1) |

Print or type name |

Date |

Telephone number |

Spouse must sign by hand |

|

|

|

|

|

|

|

►IF NOT SIGNED AND DATED, THIS POA WILL NOT BE PROCESSED. See instructions on back for Where to send Form

02900106170094

11111111111111111 111111111111111111 II II

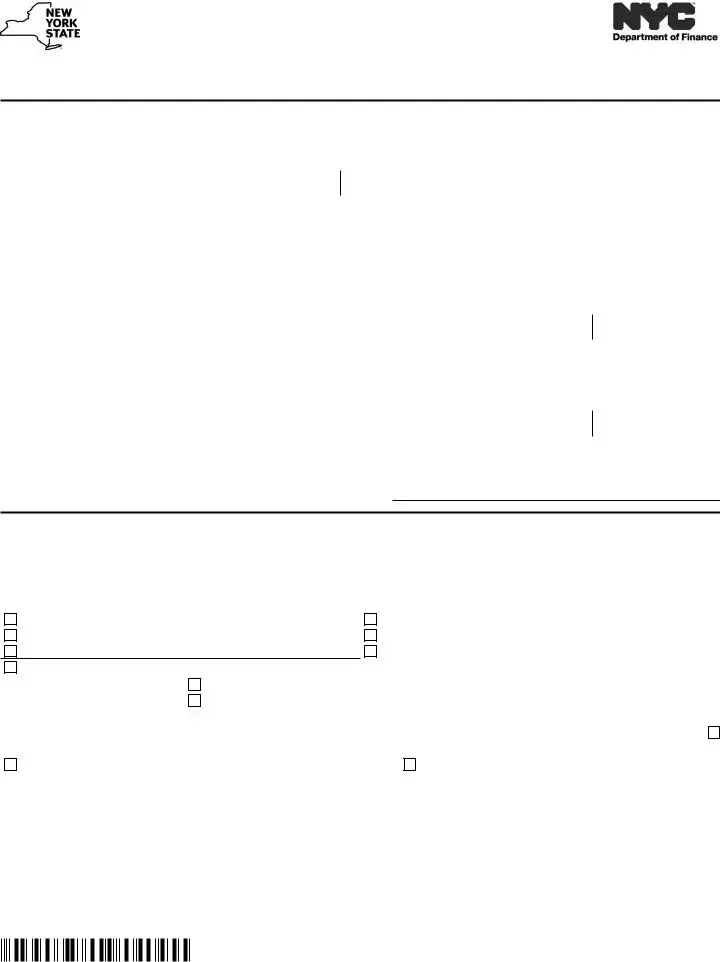

Instructions

General information

Use Form

more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you does not relieve you of your

tax obligations.

Use this form for all matters (except estate tax) imposed by the Tax Law or another statute administered by the New York State (NYS) Department of Taxation and Finance (Tax Department) and the New

York City (NYC) Department of Finance. If you and your spouse filed a joint tax return but have different representatives, you must each file a

separate Form

Unless you limit the authority you grant (see section 4), your appointed representative will be authorized to perform any and all acts you can perform, including but not limited to: receiving confidential information

concerning your taxes, agreeing to extend the time to assess tax, and agreeing to a tax adjustment.

You do not need Form

someone to provide information, or prepare a report or return for you.

Only certain types of professionals may act on your behalf before the NYS Bureau of Conciliation and Mediation Services (BCMS), the NYC Department of Finance Conciliation Bureau or at Tax Appeals. Visit the Tax Department’s POA webpage (at www.tax.ny.gov/poa) for more information.

Revocation and withdrawal – New: This POA will remain active until you (the taxpayer) revoke it or your representative withdraws from representing you. Representatives may not revoke a POA.

For information on ways to revoke a POA, or how a representative

can withdraw, see the Tax Department’s POA webpage (at www.tax.ny.gov/poa).

Specific instructions

For additional information on how to complete Form

who must sign as the taxpayer, visit the Tax Department’s POA webpage (at www.tax.ny.gov/poa).

The taxpayer identification number may be a social security number (SSN), employer identification number (EIN), individual taxpayer identification number (ITIN) issued by the Internal Revenue Service, or a tax identification number issued by the NYS Tax Department.

If you want copies of notices and other communications sent to someone other than the primary individual representative listed in section 2 of this POA, enter the name of that representative on the line provided. This

representative must be someone who is listed as a representative for the matters covered by this POA on this or another valid POA on file.

If you do not want copies of notices and other communications sent to any representative, enter None.

Example: On 2/1/2016 you appoint Mr. Smith as your representative for all tax matters for 2015. Mr. Smith will receive copies of mailings for these matters. On 8/15/2016, you appoint Ms. Jones as your representative for all tax matters for 2015. Ms. Jones will now receive copies of mailings for these matters. However, if you want Mr. Smith to continue to receive mailings, you must list Mr. Smith’s name in section 3 of the POA appointing Ms. Jones. Ms. Jones will not receive mailings.

Use this section to specify the matters covered by this POA. By default, this POA will cover all tax types for all tax periods. If you select a tax type, but do not enter a tax period, this POA will cover the tax type selected for all tax periods. If you enter a tax period, but do not select a tax type, this POA will cover the tax period entered for all tax types. For

tax periods other than calendar years, enter the beginning and ending dates for the periods. For taxes based on a specific transaction, enter

the transaction date.

If your tax type is not listed, or if you are granting authority for a special assessment or fee administered by an agency, mark an X in the Other box and explain. To identify a specific audit case or assessment, mark the Other box and enter a case or assessment ID number.

If you want to limit your representative’s authority, explain the limitation.

For example, you can limit your representative’s authority to only receive confidential information, but make no binding decisions for you. If you

need more space to explain the limitation, attach a sheet. The attached sheet must be signed and dated by each taxpayer named in section 1.

You or someone who is authorized to act for you must sign and date Form

If a joint tax return was filed and both spouses will be represented by the

same representatives, both spouses must sign and date Form

You may use Form

other communications unless you direct otherwise in section 3. If you are appointing more than two representatives, attach a sheet that provides all of the information requested in section 2. The attached sheet must be signed and dated by each taxpayer named in section 1.

Caution: This POA cannot be partially revoked or withdrawn. If you appoint more than one representative on this POA and later choose to revoke one representative or one representative withdraws, the revocation or withdrawal will apply to all representatives, and none will have ongoing authority to represent you. You must file a new POA to appoint the representatives that you want to continue representing you.

All representatives are deemed as authorized to act separately unless you explain that all representatives are required to act jointly on the line in section 4 that allows you to limit the authority granted by this POA.

For each appointed representative, enter the title or profession or, if your representative is not a professional, enter the representative’s relationship to you. If the representative is not licensed in NYS, also

include the state where licensed (for example, Florida attorney). Enter each representative’s federal preparer tax identification number (PTIN),

SSN, or EIN. If applicable, also enter each representative’s New York tax

preparer registration identification number (NYTPRIN).

For matters administered by the NYS Tax Department:

FAX to: (518)

Mail to: NYS TAX DEPARTMENT

POA CENTRAL

W A HARRIMAN CAMPUS

ALBANY NY

See Publication 55, Designated Private Delivery Services, if not using U.S. Mail.

For matters administered by NYC Department of Finance, send to the office in which the matter is pending.

Privacy notification

New York State Law requires all government agencies that maintain a system of records to provide notification of the legal authority for any

request for personal information, the principal purpose(s) for which the

information is to be collected, and where it will be maintained. To view this information, visit our website at www.tax.ny.gov, or, if you do not

have Internet access, call (518)

The Commissioner of the New York City Department of Finance is authorized to require disclosure of identifying numbers by

section

02900206170094

11111111111111111

II

II

I IIIIII I Ill I IIII

I IIIIII I Ill I IIII

II II

II II

Document Specifics

| Fact Name | Description |

|---|---|

| Form Type | Tax Power of Attorney (POA-1) |

| Primary Use | Authorizes an individual to handle tax matters on behalf of someone else. |

| Validity | Valid until revoked or replaced. |

| Governing Law(s) for State-Specific Forms | Varies by state, reflecting each state’s requirements and regulations. |

| Filing Requirement | Must be filed with the relevant state tax authority or the IRS, depending on jurisdiction. |

| Key Sections | Identification of parties, scope of authority granted, duration, and signatures. |

Guide to Writing Tax POA POA-1

After you've decided to authorize someone to handle your tax matters, the POA-1 form becomes an important document to complete. This form is designed to officially delegate the authority to another person, allowing them to act on your behalf with the tax department. The process of filling it out requires attention to detail to ensure all information is accurate and correctly presented. Below you will find step-by-step instructions to navigate through the form smoothly, making sure that your tax matters are in trustworthy hands.

- Begin by filling in your personal information, which includes your full name, Social Security Number (SSN) or Employer Identification Number (EIN), and your complete address including city, state, and zip code.

- Next, fill in the contact information of the person you are authorizing, known as the representative. This includes their name, address, telephone number, and their email address if available. Make sure to include their Preparer Tax Identification Number (PTIN) if they are a tax professional.

- In the section labeled "Tax Matters," you must specify the types of tax and the tax form numbers that your representative will have the authority to handle. This includes, for example, income taxes, sales taxes, and the specific form numbers related to these taxes.

- Identify the tax periods or years your representative will have access to. This could range from a single year to multiple years, depending on your specific needs.

- There's a part of the form where you can grant specific powers to your representative. This involves checking boxes next to actions they are authorized to take, such as signing returns or receiving confidential tax information. Read each item carefully and select the powers you wish to grant.

- If there are any restrictions on the representative's authority, there is a section to list those as well. This might include limitations to access certain information or limitations on the time period their authority is valid.

- Both you and your representative must sign and date the form. Your signatures legally bind the agreement, authorizing the representative to act on your behalf according to the powers and restrictions you've indicated on the form.

Once the form is fully completed and signed, the representative is now authorized to engage with the tax department on your behalf, within the scope you've outlined. It's essential to keep a copy of this form for your records. Should your situation change, or you need to appoint a new representative, a new POA-1 form will be required to reflect these changes accurately.

Understanding Tax POA POA-1

-

What is the purpose of the Tax POA POA-1 form?

The Tax Power of Attorney (POA) POA-1 form is designed to grant an individual or entity, known as the agent, the authority to represent another person, known as the principal, in matters related to tax. This includes but is not limited to communicating with tax authorities, obtaining confidential tax information, and making decisions about tax payments and disputes on behalf of the principal. The form serves as a legal document that confirms this authority.

-

Who should use the Tax POA POA-1 form?

Individuals or businesses facing complex tax situations, or those who prefer to have a professional handle their tax matters, should consider using the Tax POA POA-1 form. Specifically, if someone is unable to manage their tax obligations due to absence, illness, or lack of expertise, appointing a trusted and qualified agent, such as a certified public accountant, tax attorney, or enrolled agent, can be a suitable course of action. It's essential for the principal to trust the agent fully, as they will have access to sensitive tax information and the power to make significant decisions.

-

How can one obtain the Tax POA POA-1 form?

Typically, the Tax POA POA-1 form can be obtained from the tax authority website of the respective state or country. Downloadable PDF versions are often available, which can be printed and filled out manually. Additionally, some tax offices and legal services provide physical copies of the form. It's important to ensure that the latest version of the form is used, as tax laws and requirements can change.

-

What information is needed to complete the Tax POA POA-1 form?

Completing the Tax POA POA-1 form requires providing detailed information about both the principal and the agent. This includes full legal names, addresses, and taxpayer identification numbers (such as Social Security numbers for individuals or EIN for businesses). The specific tax matters and years or periods for which the agent is authorized must also be clearly defined. The form must be signed and dated by the principal, and in some cases, the agent's signature may be required as well.

-

Is it necessary to file the Tax POA POA-1 form with the tax authorities?

Yes, after completion, the Tax POA POA-1 form typically must be filed with the relevant tax authorities to become effective. The filing process might vary depending on the jurisdiction; it could be submitted electronically, by mail, or in person. It's crucial to follow the specific submission requirements of the local tax authority to ensure that the POA is recognized and that the agent can begin acting on the principal's behalf without delay.

-

Can the principal revoke the Tax POA POA-1 form?

The principal has the right to revoke the Tax POA POA-1 at any time. This revocation must be communicated in a clear and legally recognized manner, typically by sending a written notice of revocation to the tax authorities and to the agent. It may also require filling out a specific form or providing a written statement. After revocation, it's important to ensure that the tax authorities update their records to prevent the previously authorized agent from continuing to act on behalf of the principal.

-

Does the Tax POA POA-1 form expire?

Whether the Tax POA POA-1 form expires depends on the terms set forth within the document itself and the laws of the jurisdiction where it is filed. Some POA forms include a specific expiration date, whereas others remain in effect until revoked by the principal. It's vital for both the principal and the agent to be aware of and understand any expiration terms to avoid unintended lapses in representation.

Common mistakes

When filling out the Tax Power of Attorney (POA) Form POA-1, individuals often encounter several common mistakes. These errors can delay the process or cause misunderstandings regarding the authority granted. It's essential to approach this document with attention to detail to ensure all information is accurately represented.

Not verifying the current form version - Tax laws and forms are subject to change. Using an outdated form can lead to the submission being rejected.

Incomplete information - Skipping sections or not providing full details for the taxpayer and the representative can lead to processing delays.

Misunderstanding the authority granted - The POA-1 form enables broad powers. It is crucial to specify limits if the intention is to grant only certain powers to the representative.

Failing to specify tax matters correctly - It's important to clearly identify the tax types, years, or periods involved. Vague or incorrect information can restrict the representative's ability to assist.

Omitting required signatures - Both the taxpayer and the representative must sign the form. Ignoring this requirement invalidates the form.

Incorrect representation information - Representatives must provide accurate identification and contact information. Mistakes here can lead to communication issues.

Not keeping a copy - Once completed and submitted, many forget to retain a copy for their records, which is crucial for future reference.

Avoiding these common mistakes ensures that the POA-1 form is processed smoothly, allowing representatives to act on taxpayers' behalf without unnecessary delays.

Documents used along the form

The Tax Power of Attorney (POA) form, also known as POA-1, is a critical document granting someone the authority to handle tax matters on behalf of another. However, understanding and completing the Tax POA is just one step in managing tax responsibilities. Alongside the POA-1 form, there are several other forms and documents often used to ensure comprehensive tax management and compliance. These documents can vary in purpose, from reporting income to requesting specific tax statuses or deductions.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is used to provide the correct taxpayer identification number (TIN) to the person who is required to file an information return with the IRS. It's often necessary in conjunction with the POA-1 when the agent is handling matters that involve reporting or verification of tax information.

- Form 2848, Power of Attorney and Declaration of Representative: Another POA form used by the IRS, Form 2848 grants a more specified agent or attorney the authority to represent a taxpayer before the IRS. It's used for federal tax matters, as opposed to the POA-1, which is often state-specific.

- Form 8821, Tax Information Authorization: This authorization allows the appointee to request and inspect confidential tax information from the IRS for the taxpayer. Unlike the POA-1, it does not allow the appointee to represent the taxpayer to the IRS.

- Form W-2, Wage and Tax Statement: Crucial for employees, this form reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's often necessary for agents handling tax filing and planning.

- Form 1040, U.S. Individual Income Tax Return: The main form used by individual taxpayers to file their annual income tax returns. An agent under a POA-1 may be responsible for preparing and submitting this form on behalf of the taxpayer.

- Schedule C (Form 1040), Profit or Loss from Business: For individuals who operate a business, this schedule is used to report income or losses. It's particularly relevant when the POA-1 includes authority to manage business-related tax matters.

While the POA-1 form is instrumental in appointing someone to assist with tax affairs, it often works in conjunction with other forms and documents to ensure a broad spectrum of tax-related responsibilities are covered. From authorizations to report and request tax information to forms reporting income and filing taxes, each document plays a vital role in the comprehensive management of an individual's or business's tax obligations.

Similar forms

The Tax Power of Attorney (POA) POA-1 form is similar to the General Power of Attorney form in that they both grant authority to another person, known as an agent or attorney-in-fact, to make decisions on the principal's behalf. However, while the Tax POA specifically authorizes the agent to handle tax matters with tax authorities, the General Power of Attorney usually encompasses a broader scope of financial and legal decisions.

Like the Tax POA, the Healthcare Power of Attorney is a document that allows an individual to designate another person to make decisions on their behalf, but in this case, the decisions are related to healthcare instead of tax matters. This shows the flexibility of POA documents to cater to different aspects of a person’s life, demonstrating the specificity of the Tax POA within the family of Power of Attorney documents.

The Durable Power of Attorney shares a notable feature with the Tax POA: it remains in effect even if the principal becomes mentally incapacitated. The key distinction, however, lies in the scope, as the Durable Power of Attorney can cover a wide range of decisions beyond tax issues, including healthcare and financial decisions, depending on how it is drafted.

The Limited Power of Attorney and the Tax POA are alike because both assign specific powers to the agent. However, while the Tax POA focuses exclusively on tax-related responsibilities, the Limited Power of Attorney can be tailored to any number of specific tasks or time frames, such as selling a property or managing certain financial transactions.

Similarly, the Springing Power of Attorney resembles the Tax POA in that it activates under certain conditions. For the Springing Power of Attorney, these conditions usually pertain to the principal's health status, whereas the Tax POA is specifically enacted for dealing with tax matters, illustrating how conditions can be tailored to the document's purpose.

The IRS Power of Attorney (Form 2848) and the Tax POA serve similar functions but are used in different jurisdictions. While the Tax POA may be used to grant someone the authority to handle state tax affairs, the IRS Power of Attorney is specifically for federal tax matters, allowing an agent to represent the principal before the Internal Revenue Service.

Last, the Financial Power of Attorney, like the Tax POA, allows an individual to designate someone else to manage certain aspects of their finances. The key difference lies in the scope; the Financial Power of Attorney typically covers a broader range of financial responsibilities beyond just tax-related tasks, indicating the more targeted nature of the Tax POA in financial management.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA-1 form) is a significant step in authorizing someone else to handle your tax matters. It's vital to approach this form with care and attention to detail. Here are several dos and don'ts to consider:

- Do ensure you have the correct form. Tax matters are sensitive, and using the right form is crucial.

- Do read instructions carefully before you start filling out the form to avoid common mistakes.

- Do provide accurate and complete information about yourself and the representative you are appointing.

- Do specify the types of tax matters and the tax periods your appointed representative can handle on your behalf.

- Don't leave any sections blank unless the instructions specifically say it's permissible.

- Don't use white-out or correction fluid on the form; if you make a mistake, it's better to start over with a new form.

- Don't forget to sign and date the form. An unsigned form is invalid.

- Don't neglect to keep a copy of the completed form for your records.

Misconceptions

When discussing the Tax Power of Attorney (POA) form, specifically POA-1, some misconceptions commonly arise. Understanding these misconceptions is crucial for individuals and businesses seeking to manage their tax affairs effectively. By demystifying these areas, people can make more informed decisions and avoid potential pitfalls.

A tax POA gives the agent unlimited control over the principal’s financial matters. This is a significant misunderstanding. The POA-1 form is designed specifically for tax matters. This means the agent’s authority is limited to tax-related duties as explicitly outlined in the document. They cannot make non-tax-related financial decisions for the principal.

Completing a POA-1 form is a complicated process that requires a lawyer. While legal guidance is always beneficial, especially in complex situations, the process of completing a POA-1 form is designed to be straightforward. Many individuals can fill out and file this form without legal assistance, provided they follow the instructions carefully and understand the extent of authority they are granting.

Once filed, a POA-1 is difficult to revoke. This misconception could not be further from the truth. Principals have the right to revoke their POA-1 at any time, should their relationship with the agent change or they wish to appoint someone else. Revocation requires a written notice to the relevant tax authority, making it a manageable process.

The tax POA-1 form grants the agent the right to represent the principal in tax court. This is not always the case. The specific rights and limitations of the agent's power to represent the principal in legal matters, such as tax court, depend on the jurisdiction and the exact stipulations of the POA-1 form. In some instances, additional qualifications or authorizations may be necessary for an agent to represent the principal in court.

By addressing these misconceptions head-on, individuals and businesses can leverage the POA-1 form effectively, ensuring their tax matters are handled efficiently and according to their intentions. It’s about giving control and authority to a trusted individual, within specified limits, to act on one’s behalf for tax-related activities. Accurate understanding and application of the POA-1 form can significantly ease the complexity of managing tax affairs.

Key takeaways

Filing the Tax Power of Attorney (POA-1) form is a critical process that allows taxpayers to designate someone else to represent them in tax matters with the tax authority. Understanding the key aspects of filing and using this document can ease the process and enhance its effectiveness. Here are some key takeaways to consider:

Accuracy is paramount when completing the POA-1 form. Every piece of information, from the taxpayer's identification numbers (such as SSN or EIN) to the representative’s qualifications and contact information, must be thoroughly reviewed for correctness. Inaccuracies can lead to delays or the rejection of the form.

The scope of authority granted is customizable. Taxpayers can specify which tax matters and periods the representative is authorized to handle. This flexibility allows for tailored representation, ensuring that the representative can act efficiently in the taxpayer’s best interest.

Choosing the right representative is crucial. Representatives can be attorneys, certified public accountants, enrolled agents, or individuals with sufficient knowledge of tax law. The chosen representative must have the expertise necessary to handle the specific tax issues at hand and should be someone the taxpayer trusts implicitly.

The Tax POA form must be signed and dated by the taxpayer and, in some cases, by the taxpayer’s spouse if filing jointly. This formalizes the grant of authority. It is a testament to the agreement between the taxpayer and the representative, legally enabling the representative to act on behalf of the taxpayer.

Retaining a copy of the form is essential for both the taxpayer and the representative. Once the POA-1 form is duly filled, signed, and submitted, maintaining a copy ensures that both parties have a record of the authority granted. It also helps in resolving any future discrepancies or misunderstandings that may arise with the tax authorities.

By considering these takeaways, taxpayers can navigate the complexities of authorizing a representative more smoothly. Whether dealing with simple tax matters or intricate tax disputes, the POA-1 form serves as a powerful tool in ensuring that taxpayers' rights and interests are well-represented and protected.

Popular PDF Documents

Utah Sales Tax License - Research and development in alternative energy technology is encouraged through tax exemptions on related purchases, promoting innovation in Utah’s energy sector.

Can I Stop Paying Sss After 10 Years - Specified as the "Internet Edition (1/2003)," indicating the form's version and potentially the latest iteration for user reference.

Deferred Loan Payment - It applies to loans under the Direct Loan, FFEL, and Federal Perkins Loan Programs.