Get Tax POA m-5008-r Form

When individuals or businesses in the United States find themselves navigating the complexities of tax matters, the assistance of a trusted representative can be invaluable. This is especially true in the case of dealings with state tax authorities, where understanding and managing obligations requires both precision and depth of knowledge. Enter the Tax Power of Attorney, specifically the m-5008-r form, a crucial document for those in New Jersey seeking to delegate tax-related tasks and decision-making to someone else. Whether it's for routine matters or more intricate tax-related issues, this form establishes a legal relationship that authorizes a chosen representative to act on behalf of the person or entity in dealings with the state's Division of Taxation. From filing returns to addressing disputes, the scope of authority granted can be as broad or as limited as the situation demands. This tool not only simplifies the process of managing tax affairs but also ensures that knowledgeable professionals can provide the necessary guidance and advocacy, thereby offering peace of mind to those who need to focus on other aspects of their lives or businesses.

Tax POA m-5008-r Example

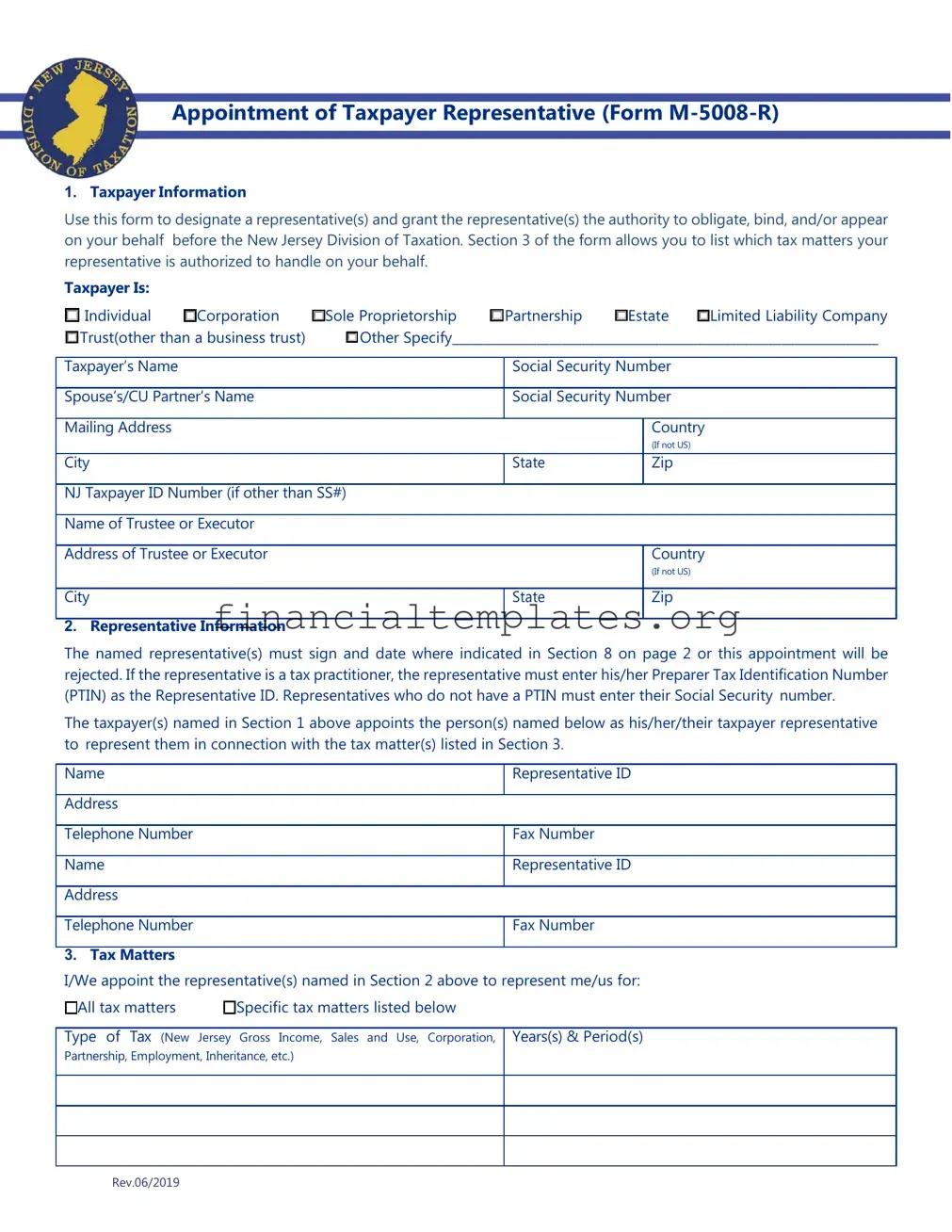

Appointment of Taxpayer Representative (Form

1.Taxpayer Information

Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation. Section 3 of the form allows you to list which tax matters your representative is authorized to handle on your behalf.

Taxpayer Is:

☐Individual ☐Corporation ☐Sole Proprietorship ☐Partnership ☐Estate ☐Limited Liability Company ☐Trust(other than a business trust) ☐Other Specify__________________________________________________________________

Taxpayer’s Name |

Social Security Number |

|

|

|

|

Spouse’s/CU Partner’s Name |

Social Security Number |

|

|

|

|

Mailing Address |

|

Country |

|

|

(If not US) |

City |

State |

Zip |

|

|

|

NJ Taxpayer ID Number (if other than SS#) |

|

|

|

|

|

Name of Trustee or Executor |

|

|

|

|

|

Address of Trustee or Executor |

|

Country |

|

|

(If not US) |

|

|

|

City |

State |

Zip |

|

|

|

2.Representative Information

The named representative(s) must sign and date where indicated in Section 8 on page 2 or this appointment will be rejected. If the representative is a tax practitioner, the representative must enter his/her Preparer Tax Identification Number (PTIN) as the Representative ID. Representatives who do not have a PTIN must enter their Social Security number.

The taxpayer(s) named in Section 1 above appoints the person(s) named below as his/her/their taxpayer representative to represent them in connection with the tax matter(s) listed in Section 3.

Name

Address

Telephone Number

Name

Address

Telephone Number

3.Tax Matters

Representative ID

Fax Number Representative ID

Fax Number

I/We appoint the representative(s) named in Section 2 above to represent me/us for: ☐All tax matters ☐Specific tax matters listed below

Type of Tax (New Jersey Gross Income, Sales and Use, Corporation, Partnership, Employment, Inheritance, etc.)

Years(s) & Period(s)

Rev.06/2019

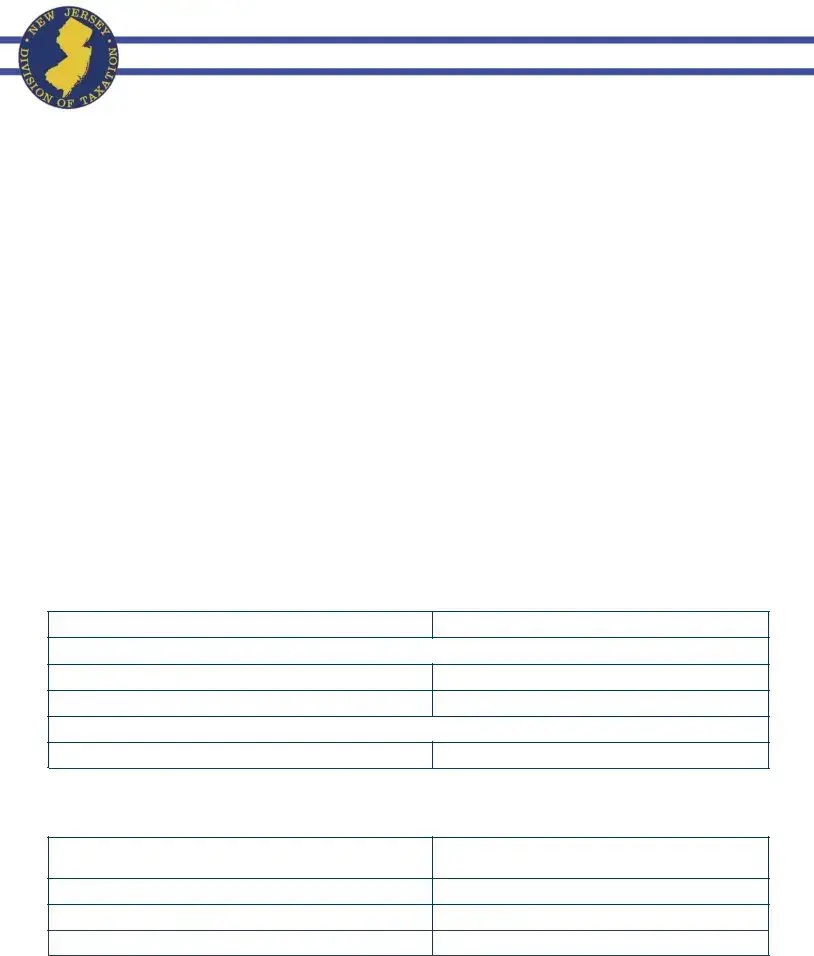

4.Acts Authorized

The representative(s) is/are authorized to receive and inspect confidential tax records and is/are granted full power to act with respect to the tax matters described in Section 3 above, and to do and perform all such acts as I/we could do or perform. The authority granted by this appointment does not include the power to endorse a refund check.

☐If you want the representative(s) to have limited power, provide an explanation on the lines below and check this box. You may attach additional information as well.

5.Notices and Communications (audit correspondence only)

We will send original notices and other written communications to you and a copy (other than automated computer notices) to the first representative listed in Section 2 unless you check one or more of the boxes below.

☐I/We do not want the Division to send any notices or communications to my representative(s).

☐I/We want the Division to send a copy of notices and/or communications (other than automated computer notices) to both representatives listed in Section 2.

6.Retention/Revocation of Prior Appointment(s) or Power(s)

The filing of this form automatically revokes all earlier Appointment(s) of Taxpayer Representative and/or Power(s) of Attorney on file with the Division of Taxation for the tax matters and years or periods listed in Section 3 unless you check the box below.

☐I/We do not want to revoke any prior Appointment(s) of Taxpayer Representative and/or Power(s) of Attorney. If you check this box, you must attach copies of the previous Appointment(s) and/or Power(s) that you do not want to revoke.

7.Signature of Taxpayer(s)

If the tax matters covered by this appointment concern a joint Gross Income Tax return and the representative(s) is/are being appointed to represent both spouses/CU partners, both must sign below.

If a corporate officer, partner, guardian, tax matter partner, executor, administrator, or trustee signs the appointment on behalf of the taxpayer, the signature below certifies that they have the authority to execute this form on behalf of the taxpayer(s).

This Appointment of Taxpayer Representative Is Void if not Signed and Dated

Taxpayer Signature |

|

IDate |

Print Name |

ITitle (if applicable) |

|

Taxpayer Signature |

|

IDate |

Print Name |

ITitle (if applicable) |

|

8.Acceptance of Representation and Signature

I/ We accept the appointment as representative(s) for the taxpayer(s) who has/have executed this Appointment of Taxpayer Representative.

Representative Signature |

|

IDate |

Print Name |

ITitle (if applicable) |

|

Representative Signature |

|

IDate |

Print Name |

ITitle (if applicable) |

|

Rev.06/2019

Instructions for Form

Use this form to designate a representative(s) and grant the representative(s) the authority to obligate, bind, and/or appear on your behalf before the New Jersey Division of Taxation. Section 3 of the form allows you to list which tax matters your representative is authorized to handle on your behalf.

You may authorize the representative(s) to receive your confidential tax information. Unless otherwise indicated, the representative(s) may also perform any and all acts that you can perform regarding your taxes. This includes consenting to extend the time to assess tax or agreeing to a tax adjustment. Representatives may not sign returns or delegate authority unless specifically authorized to do so on this form.

Form

•When an individual appears with you or with a representative who is authorized to act on your behalf. For example, this form is not required if a representative appears on behalf of a corporate taxpayer with an authorized corporate officer;

•If a trustee, receiver, or attorney has been appointed by a court that has jurisdiction over a debtor;

•If an individual merely furnishes tax information or prepares a report or return for you;

•When a fiduciary stands in the position of, and acts as, the taxpayer. However, if a fiduciary wishes to authorize an individual to represent or act on behalf of the taxpayer, the fiduciary must sign and file Form

Limitations

Appointing a representative does not relieve you of tax responsibilities or obligations. This form allows another person to represent you in most matters concerning tax administration, tax investigations, examinations/audits, and other meetings with the Division. Because you remain responsible for your tax obligations, a representative’s authority does not extend to some aspects of the collection process. Examples of the collection process are: judgments, levies, liens, and seizures. In these instances, we may require telephone communication, direct contact, and/or interaction with the taxpayer.

Who Can Execute the Appointment of Taxpayer Representative?

•An individual, if the request pertains to a personal Income or individual Use Tax return filed by that individual (or by an individual and his or her spouse/CU partner if the request pertains to a joint Income Tax return and joint representation is requested). If joint representation is not requested, each taxpayer must file his or her own form.

•If the taxpayer is a limited liability company (LLC), a manager of the LLC. If there is no manager, a member of the LLC authorized to act on tax matters on behalf of the entity.

•A sole proprietor.

•A general partner of a partnership or limited partnership.

•The administrator or executor of an estate.

•The trustee of a trust.

•If the taxpayer is a corporation, a principal officer or corporate officer who is authorized to act on tax matters and has legal authority to reach agreements on behalf of the corporation; any person who is designated by the board of directors or other governing body of the corporation; any officer or employee of the corporation upon written request signed by a principal officer of the corporation and attested by the secretary or other officer of the corporation; or any other person who is authorized to receive or inspect the corporation’s return or return information under I.R.C. §6103(e)(1)(D).

Tax Matters

You may enter more than one tax type and indicate the tax year(s) and/or tax period(s) applicable in Section 3. If you designate a specific tax but no tax year or period, the

Rev.06/2019

Retention/Revocation of Prior Powers of Attorney and/or Appointments of Taxpayer Representative

By executing and filing the

You may not partially revoke a previously filed Form

Signature of Taxpayer(s)

You, or an individual you authorize to execute the Form

Individuals. If the matter for which the appointment is prepared involves a joint Income Tax return and the same individual(s) will represent both spouses/CU partners, both must sign Form

Corporations. The president,

Partnerships. All partners must sign Form

Limited Liability Companies (LLC). A member or manager must sign Form

Fiduciaries. In matters involving fiduciaries under agreements, declarations, or appointments, Form

Estates. The administrator or executor of an estate may execute Form

Others. Form

Instructions for Submission

Completion and submission of this form is only required when you are communicating – either in person or in writing – with the Division on behalf of another person.

In Person

If you are planning to visit a Regional Information Center on behalf of another individual, you must bring:

•The completed form, signed by both the representative and the taxpayer; and

•One form of

In Writing

If you are responding to a notice sent by the Division, submit your documentation to the PO Box on the notice. You must include with your correspondence:

•The completed form, signed by both the representative and the taxpayer;

•A copy of the notice; and

•Any corresponding documentation.

Rev.06/2019

Document Specifics

| Fact Number | Fact Details |

|---|---|

| 1 | The M-5008-R form is a document used to grant Power of Attorney (POA) for tax matters in New Jersey. |

| 2 | This form allows a taxpayer to appoint an individual or a firm to represent them before the New Jersey Division of Taxation. |

| 3 | The appointed representative can receive confidential tax information and make decisions regarding the taxpayer's state tax affairs. |

| 4 | To be valid, the form must be fully completed, including the taxpayer’s information, the representative’s information, and specifics of the tax matters for which the POA is granted. |

| 5 | Both the taxpayer and the appointed representative(s) must sign and date the M-5008-R form. |

| 6 | It's important to specify the tax types, tax periods, and matters for which the POA is being granted to limit the scope of the representative's authority if desired. |

| 7 | The M-5008-R form can be revoked by the taxpayer at any time by sending a written notice of revocation to the New Jersey Division of Taxation. |

| 8 | This form stands governed by the laws of the State of New Jersey. |

| 9 | If a corporation is executing the form, the signature of a corporate officer and the officer’s title are required. A partnership requires the signature of a partner. |

| 10 | The completion and submission of the M-5008-R form do not relieve the taxpayer of their tax obligations; it only authorizes someone else to act on their behalf. |

Guide to Writing Tax POA m-5008-r

Upon undertaking the responsibility of filling out a Tax Power of Attorney (POA) form, specifically the M-5008-R, individuals are embarking on a crucial step toward ensuring their taxation affairs are managed efficiently and precisely. The form acts as a legal document that authorizes a designated representative to handle tax matters on an individual’s behalf with the state's taxation authority. Completing this form accurately is fundamental to facilitating a smooth process. The following steps are designed to guide individuals through this procedure with clarity and precision.

Step-by-Step Instructions for Filling Out the M-5008-R Form

- Identify the taxpayer information section at the top of the form. This includes the taxpayer’s full legal name, social security number, or employer identification number (EIN), as well as their complete address.

- Proceed to specify the representative’s information. This requires entering the name, address, phone number, and, if applicable, the firm’s name of the individual designated as the representative.

- Designate the type of taxes and the specific tax periods for which the representative is being granted authority. This should be done with utmost attention to ensure that all relevant periods and types of tax are included.

- In the section that follows, outline the specific acts authorized by the taxpayer. This involves detailing the extent of the authority granted to the representative, including actions such as receiving confidential information and making agreements. It is crucial to mark any restrictions to the representative’s authority within this section.

- The taxpayer must then sign and date the form. If the taxpayer is a business entity, an authorized individual, such as an officer of the company, must sign on behalf of the organization. Ensure that the title of the person signing is clearly stated next to their signature.

- If applicable, the declaration of the representative must be completed. This section is where the representative affirms their eligibility to represent the taxpayer under the regulations governing the form. The representative’s signature and date are also required in this section.

Following the completion of these steps, the form should be reviewed to ensure that all information is accurate and complete. Once finalized, the form must be submitted according to the instructions provided by the relevant taxation authority. This may involve mailing or electronically submitting the form to the designated address or system. Successfully submitting the M-5008-R Tax POA form is a positive step toward efficient tax management, establishing a clear legal basis for representation in tax matters. It’s advisable to keep a copy of the completed form for personal records and future reference.

Understanding Tax POA m-5008-r

-

What is the Tax POA M-5008-R form?

The Tax Power of Attorney (POA) M-5008-R form is a document that allows an individual or business to grant authority to another person or entity, known as an agent or attorney-in-fact, to represent them before the tax authorities. This representation may include filing taxes, obtaining confidential tax information, and handling other tax-related matters on behalf of the individual or business.

-

Who should use the Tax POA M-5008-R form?

This form is for any taxpayer, whether an individual or a business entity, in the jurisdiction requiring this specific form who wishes to authorize someone else to handle their tax matters. This could be due to the taxpayer's lack of expertise, availability, or preference to have a professional handle their affairs.

-

How do I complete the Tax POA M-5008-R form?

To complete the form, the taxpayer must provide detailed information including their name, address, tax identification number (such as SSN or EIN), and the specific tax matters and years or periods for which the authorization is granted. The form also requires detailed information about the appointed representative, including their name, address, telephone number, and the types of tax matters for which they are authorized. Both the taxpayer and the representative must sign the form for it to be valid.

-

Can I revoke a previously granted Tax POA M-5008-R?

Yes, a taxpayer has the right to revoke a previously granted Tax Power of Attorney at any time. To do so, the taxpayer must provide written notice to the tax authority indicating the revocation. It's also recommended to notify the former representative of the revocation in writing.

-

Is a Tax POA M-5008-R form specific to a certain state or federal tax matters?

Yes, the Tax POA M-5008-R form is specific to the jurisdiction that issues it and is generally not applicable to federal tax matters unless explicitly stated. Taxpayers should use the appropriate form for the state in which they are handling tax matters or the IRS form for federal matters.

-

How long does a Tax POA M-5008-R remain in effect?

The duration of the authorization depends on the specifications outlined in the document itself. Unless a specific expiration date is mentioned, the POA could remain in effect indefinitely or until it is revoked. It's important for the taxpayer to specify the duration of the power of attorney according to their needs or preferences.

-

Do I need a lawyer to complete the Tax POA M-5008-R form?

While it is not mandatory to have a lawyer to complete the Tax POA M-5008-R form, consulting with a tax professional or attorney can provide valuable guidance, especially in complex tax situations or when special legal advice is needed. They can ensure that the form appropriately matches the taxpayer’s intentions and complies with relevant laws.

-

Where do I submit the completed Tax POA M-5008-R form?

The completed form should be submitted to the specific tax authority for which the power of attorney is granted. This could mean mailing or delivering it to a state tax department or another designated agency. It's crucial to check the instructions provided with the form or on the authority's website to ensure it is submitted correctly and to the right place.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form M-5008-R can be a tricky process. People often make mistakes that can lead to delays or complications in handling their tax matters. Here are ten common errors to avoid:

Not using the most current form – Tax laws and forms can be updated frequently. Ensure you're using the latest version of Form M-5008-R.

Omitting necessary information – Every field in the form is important. Leaving out details such as your full name, address, or tax identification numbers can invalidate the document.

Incorrect information – Double-check all entries for accuracy, especially personal identifiers and tax years. Mistakes here can misdirect your POA.

Failing to specify powers granted – Be clear about the tax matters and years your representative can handle. Vagueness can lead to a lack of authority where needed.

Appointing a representative improperly – Ensure your chosen representative is eligible and willing to act on your behalf. Missteps in their information or designation can nullify the POA.

Not signing or dating the form – An unsigned or undated form is not valid. Both you and your representative need to sign and date correctly.

Ignoring the notary section – Depending on your state, you might need to notarize the form. Skipping this step can lead to the rejection of your POA.

Using the wrong form for your needs – The M-5008-R form is specific to tax matters. Using it for other purposes won't give your agent the correct powers.

Forgetting to revoke previous POAs – If you have an older POA that is still active, it's critical to revoke it formally, or you might end up with conflicting agents.

Not keeping a copy – After filing your form, keep a copy for your records. It's essential for future reference or if there are questions about your POA.

Avoiding these mistakes can ensure your Tax Power of Attorney Form M-5008-R accomplishes what you intend without unnecessary delay. Always review your completed form carefully, or consider seeking professional assistance to ensure everything is in order.

Documents used along the form

When navigating the complexities of tax law, understanding the paperwork involved is crucial, both for professionals and laypeople. The Tax Power of Attorney, Form M-5008-R, is one of several important documents that allow individuals to grant others the authority to handle their tax matters. This particular form is instrumental in the state of New Jersey, enabling representatives to act on behalf of taxpayers concerning their state taxes. Alongside Form M-5008-R, there are several other forms and documents often required to ensure comprehensive tax representation and compliance. Each serves a unique function in the broader context of tax planning and resolution.

- Form 1040: The U.S. Individual Income Tax Return is the starting point for personal tax filing. It's used by citizens or residents of the United States to file their annual income taxes. This form is integral to understanding the taxpayer's financial situation, which is necessary when a Power of Attorney is handling their tax affairs.

- Form W-9: Request for Taxpayer Identification Number and Certification is commonly used in conjunction with the Tax POA. It allows the representative to request the taxpayer's ID number, which is necessary for conducting tax-related transactions on their behalf.

- Form 2848: Power of Attorney and Declaration of Representative is the federal equivalent of Form M-5008-R and is used to authorize an individual to represent the taxpayer before the IRS. This form is vital for matters involving federal taxes and needs to be completed alongside the M-5008-R for comprehensive tax representation.

- Form 8821: Tax Information Authorization permits individuals or organizations to request and inspect a taxpayer's IRS records. While it does not allow representation, it is often used together with Form M-5008-R to prepare for or during representation.

- Form NJ-1040: New Jersey Resident Income Tax Return is necessary for residents in New Jersey. It details income, deductions, and credits specific to New Jersey state taxes. Representation on state tax matters requires familiarity with this document.

- Form SS-4: Application for Employer Identification Number (EIN) is used by entities to apply for a unique nine-digit number assigned by the IRS. It is crucial for tax reporting and is often a prerequisite for various tax filings and actions made by representatives.

Each of these documents plays a strategic role in the realm of tax management and legal representation. Understanding and properly utilizing these forms can significantly enhance the efficiency and thoroughness of addressing and resolving tax issues. Especially for representatives acting under a Tax Power of Attorney, familiarity with these documents ensures they are well-equipped to advocate effectively for their client's best interests. As one navigates the often intricate path of tax compliance and strategy, these tools collectively provide the foundation needed for informed decision-making and successful tax management.

Similar forms

The Form 2848, Power of Attorney and Declaration of Representative, is much like the Tax POA M-5008-R form, as both empower individuals to represent taxpayers before a specific governmental body. In the case of Form 2848, it's the Internal Revenue Service (IRS) that recognizes the authority granted by the taxpayer to an attorney, accountant, or other designated person to discuss and deal with tax matters on their behalf. Just like the M-5008-R form, it requires detailed information about the taxpayer and the representative, along with specifics about the tax matters and years in question.

Similar in essence is the Form 8821, Tax Information Authorization, which enables a designated party to access a person's tax records from the IRS. Although it does not allow for representation in discussions, negotiations, or decisions, it shares the foundation of granting access to confidential tax information, akin to the M-5008-R form's purpose within New Jersey's jurisdiction. This parallels lies in both documents facilitating someone other than the taxpayer to receive or review confidential tax information for specified tax years or periods.

The Uniform Power of Attorney Act (UPOAA), adopted by many states to standardize the form and use of powers of attorney, encompasses a wide range of authorizations, including financial matters that could involve tax issues. While the UPOAA provides a broader scaffolding for POAs, some sections could closely match the financial representations and tax-related powers specified in the M-5008-R form. The relationship between the two forms comes from the general authority granted to handle financial matters, which, under certain circumstances, can include tax representation and actions similar to what's described in the M-5008-R.

Lastly, the Health Care Proxy or Medical Power of Attorney is another type of POA that, while primarily focused on medical decisions, shares the core principle of designating another individual to act on one's behalf. The fundamental similarity with the M-5008-R form lies in the empowerment aspect. However, it's important to note that the Health Care Proxy is unrelated to financial or tax matters and solely pertains to health care decisions. The essence of both documents is to ensure that a trusted individual has the authority to act when the principal cannot, demonstrating the broader context of power of attorney in different areas of life and law.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) M-5008-R form, it's important to follow certain guidelines to ensure the process goes smoothly and legally. Below are the dos and don'ts to keep in mind:

Do:- Read the instructions carefully to understand the form’s requirements and the implications of granting a POA.

- Ensure all information provided is accurate, including your name, social security number, and the name and details of the appointed representative.

- Specify the tax matters and years or periods for which the POA is granted, making sure not to leave these sections blank.

- Sign and date the form to validate it. Electronic signatures may not be accepted, so confirm the acceptable methods.

- If appointing more than one representative, clearly state the relationship between representatives if they are expected to work together.

- Review the form for any mistakes or omissions before submitting it.

- Keep a copy of the completed POA form for your records and future reference.

- Leave any required fields blank, as incomplete forms may be rejected.

- Sign the form without fully understanding the extent of authority you're granting to your representative.

- Forget to specify any restrictions or specific powers if you wish to limit the representative's authority in certain areas.

- Use outdated forms or information. Always ensure you are using the most current form version available.

- Neglect to notify your representative of their duties and responsibilities under the POA.

- Fail to revoke a previous POA if this new POA is intended to replace it, ensuring to notify the taxing authority of such revocation.

- Assume the POA grants authority for matters not specifically mentioned in the form. If in doubt, consult a professional.

Misconceptions

The Tax POA M-5008-R Form Is Only for Business Use: A common misconception is that the Tax Power of Attorney (POA) M-5008-R form is solely for businesses. However, this form is designed for both individuals and businesses in New Jersey, allowing them to appoint representatives to handle their tax matters.

Completing the Form Grants Unlimited Power: Many believe that once the Tax POA M-5008-R form is completed, the appointed representative has unlimited power over all tax matters. In reality, the form permits specificity regarding which tax matters and tax years the representative can address, offering control over the extent of the powers granted.

It’s Valid Indefinitely: Another misconception is that once the Tax POA M-5008-R form is filed, it remains effective indefinitely. The truth is, the duration of the power of attorney can be limited by the terms stated in the document. It can also be revoked at any time by the individual who granted it.

It Automatically Includes All State Taxes: People often think that filing the M-5008-R form automatically grants the representative authority to handle all state taxes for the individual or entity. The form requires specific mention of the taxes or tax matters the representative is authorized to manage, ensuring tailored authority is granted.

Lawyer Representation is Required to File It: While professional advice can be vital in certain situations, there's a misconception that a lawyer must represent the filer of a Tax POA M-5008-R form. Individuals and businesses can complete and submit the form without legal representation, although consulting with a tax professional or lawyer can ensure accuracy and compliance.

It Can Only Be Filed by Mail: Some believe the Tax POA M-5008-R form can only be submitted through traditional mail. While mailing is an option, the form can also be filed in person at certain division offices, and depending on the jurisdiction, electronic submission options may be available or become available, offering flexibility in how the form is filed.

The Form Is Complicated and Time-Consuming to Complete: There’s a common belief that the Tax POA M-5008-R form is complicated and requires a significant amount of time to complete. Although thoroughness is necessary, the form is designed to be straightforward, guiding filers through specifying the details of the power of attorney being granted, capable of being completed in a reasonable timeframe with the proper information at hand.

Key takeaways

Understanding how to accurately complete and use the Tax Power of Attorney (POA) M-5008-R form is crucial for anyone needing to grant another person the authority to handle their tax matters. Here are key takeaways to help guide you through this process:

- Know the purpose: The M-5008-R form allows taxpayers to grant permission to a representative, such as an accountant or tax attorney, to communicate with the tax authority and make decisions on their behalf.

- Complete all sections accurately: Ensuring that every section of the form is filled out correctly is crucial. This includes personal information, the specific tax matters and periods you are giving authority over, and any specific limitations to the power you're granting.

- Choose the right representative: Picking a knowledgeable and trustworthy individual to act on your behalf is important. This person will have access to sensitive tax information and make decisions that could significantly impact your financial health.

- Specify the duration: Clearly indicate the timeframe for which the power of attorney will be valid. Without specifying a duration, the form may be considered incomplete, or the POA may not function as intended.

- Understand the limitations: The form limits the representative’s power strictly to tax matters. It does not grant them authority in other financial or legal arenas.

- Sign and date the form: Without the taxpayer's signature and the date on which the form was signed, the POA will not be considered valid. Make sure these elements are not overlooked.

- Keep a copy for your records: After submitting the form to the relevant tax authority, keeping a copy for personal records is advised. This copy will be useful for reference and in case any disputes arise regarding the representation.

Following these guidelines can simplify the process of granting a tax POA, ensuring that your tax matters are handled efficiently and securely.

Popular PDF Documents

Form 1099-c - Debt forgiveness, particularly in large amounts, can have a profound impact on an individual's tax responsibilities through the 1099-C form.

1120s K1 - It contains schedules and sections for reporting special tax treatments, credits, and deductions applicable to S corporations.