Get Tax POA lgl 001 Form

Handling tax matters efficiently requires understanding various forms and documents, among which the Tax Power of Attorney (POA) Legal Form 001 stands out for its significance. This essential document grants an individual the authority to represent another person in their tax affairs, offering a practical solution for those unable to manage their own tax matters due to various reasons. The form is designed to simplify the process of appointing a trusted individual, such as a certified public accountant (CPA), tax attorney, or other qualified representatives, to handle tasks like filing taxes, resolving disputes with tax authorities, and making necessary decisions about tax payments. Through the Tax POA Legal Form 001, the taxpayer ensures that their tax responsibilities are adequately managed while maintaining their rights and interests. It incorporates specific details about the powers granted, limitations, and the duration of the authority, making it a critical tool in tax planning and management. Understanding its components, how to fill it out correctly, and the legal implications of granting someone else the power to act on one's behalf in tax matters cannot be understated.

Tax POA lgl 001 Example

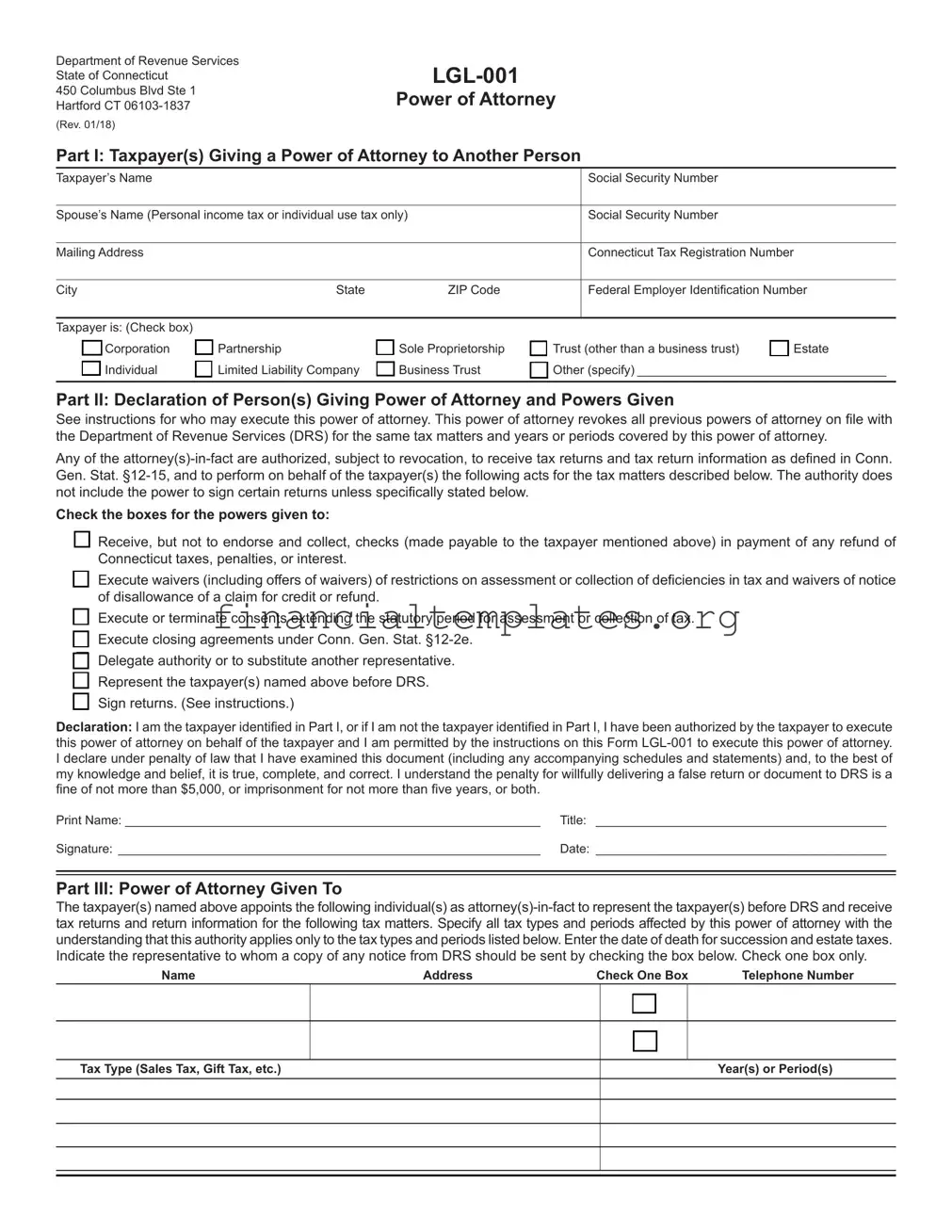

Department of Revenue Services State of Connecticut

450 Columbus Blvd Ste 1 Hartford CT

(Rev. 01/18)

Power of Attorney

Part I: Taxpayer(s) Giving a Power of Attorney to Another Person

Taxpayer’s Name |

|

|

Social Security Number |

|

|

|

|

Spouse’s Name (Personal income tax or individual use tax only) |

|

Social Security Number |

|

|

|

|

|

Mailing Address |

|

|

Connecticut Tax Registration Number |

|

|

|

|

City |

State |

ZIP Code |

Federal Employer Identification Number |

|

|

|

|

Taxpayer is: (Check box) |

|

|

|

|

Corporation |

Partnership |

Sole Proprietorship |

Trust (other than a business trust) |

Estate |

Individual |

Limited Liability Company |

Business Trust |

Other (specify) ____________________________________ |

|

|

|

|

|

|

Part II: Declaration of Person(s) Giving Power of Attorney and Powers Given

See instructions for who may execute this power of attorney. This power of attorney revokes all previous powers of attorney on file with the Department of Revenue Services (DRS) for the same tax matters and years or periods covered by this power of attorney.

Any of the

Check the boxes for the powers given to:

Receive, but not to endorse and collect, checks (made payable to the taxpayer mentioned above) in payment of any refund of Connecticut taxes, penalties, or interest.

Execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of notice of disallowance of a claim for credit or refund.

Execute or terminate consents extending the statutory period for assessment or collection of tax. Execute closing agreements under Conn. Gen. Stat.

Delegate authority or to substitute another representative. Represent the taxpayer(s) named above before DRS. Sign returns. (See instructions.)

Declaration: I am the taxpayer identified in Part I, or if I am not the taxpayer identified in Part I, I have been authorized by the taxpayer to execute this power of attorney on behalf of the taxpayer and I am permitted by the instructions on this Form

Print Name: ____________________________________________________________ |

Title: __________________________________________ |

Signature: _____________________________________________________________ |

Date: __________________________________________ |

Part III: Power of Attorney Given To

The taxpayer(s) named above appoints the following individual(s) as

Name |

Address |

Check One Box |

|

Telephone Number |

||

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

Tax Type (Sales Tax, Gift Tax, etc.) |

|

|

|

|

|

Year(s) or Period(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions

Use

Connecticut law stipulates that all official mailings will be sent to the taxpayer of record at the address on file with DRS. As a matter of policy, DRS also provides taxpayers with the right to have a copy of any notice sent to its counsel or other qualified representative who has properly executed and filed this power of attorney with DRS for the type of tax and tax period that is the subject of the notice. This power of attorney does not change the requirement that DRS send all official mailings directly to the taxpayer.

Part I: Taxpayer(s) Giving a Power of Attorney to Another Person

Provide the taxpayer’s name and address and either your Social Security Number (SSN) or Connecticut Tax Registration Number and Federal Employer Identification Number. If you are a sole proprietor, enter your name and SSN. Do not enter your trade name. Do not use your representative’s address as your own.

Your spouse’s name is not required except for joint personal income tax or individual use tax returns.

If you are filing a joint personal income tax return and you and your spouse have the same representative(s), include your spouse’s name and SSN in the space provided. Otherwise, each spouse must file a separate

Check the box that describes the taxpayer.

Part II: Declaration of the Person Giving Power of Attorney And Powers Given

Any person giving a power of attorney to another person(s) must sign this declaration and must check the box for each act being granted to the

Who may execute this power of attorney?

Any individual if the request is for an income tax return filed by that individual (or filed by that individual and his or her spouse if the request is for a joint income tax return);

Conn. Agencies Regs.

A limited liability company (LLC) member if the taxpayer is an LLC and has no manager or a manager if the taxpayer is an LLC and has managers

The sole proprietor if the taxpayer is a sole proprietorship;

A general partner if the taxpayer is a partnership or a limited partnership;

The administrator or executor if the taxpayer is an estate;

The trustee if the taxpayer is a trust;

If the taxpayer is a corporation, a principal officer or corporate officer (who has legal authority to bind the corporation), any

person who is designated by the board of directors or other governing body of the corporation, any officer or employee of the corporation upon written request signed by a principal officer of the corporation and attested to by the secretary or other officer of the corporation, or any other person who is authorized to receive or inspect the corporation’s return or return information under I.R.C. §6103(e)(1)(D);

The successor, receiver, guarantor, or any assignee of the taxpayer; or

The authorized representative of any of the above.

Part III: Power of Attorney Given To

Provide the name, address, and telephone number of the person(s) designated by you to be your

Enter the tax type and the tax periods or tax years that are the subject of this power of attorney. Be specific about the type of tax at issue (refer to the following examples):

Withholding tax;

Income tax;

Sales and use taxes;

Corporation business tax;

Admissions and dues tax;

Estate tax;

Gift tax;

Motor vehicle fuels tax;

Gross earnings tax (petroleum, gas, hospital, community antenna);

Cigarette tax distributor; and

Individual use tax.

The terms years and periods can indicate various time frames.

A tax year may be a calendar year of 1/1/06 through 12/31/06 or a fiscal year of 7/1/06 through 6/30/07 for corporation tax. A tax period may have one or more monthly or quarterly periods.

Example: A sales and use tax period of 1/1/04 through 12/31/06 may contain 36 monthly or 12 quarterly periods.

Indicate the tax year(s) or tax period(s) to be covered by the power of attorney.

Where to File

Do not send an

Mail, fax, or deliver

Document Specifics

| Fact Number | Detail |

|---|---|

| 1 | The Tax POA (Power of Attorney) LGl 001 form allows individuals to grant others the authority to handle their tax matters. |

| 2 | This form is often used to authorize tax professionals to represent individuals before tax authorities. |

| 3 | The person granting authority is known as the principal, while the receiver of the authority is referred to as the agent or attorney-in-fact. |

| 4 | It includes specific details about which tax matters and years the agent has authority over. |

| 5 | Without this form, tax professionals cannot access personal tax information or make filings on behalf of the principal. |

| 6 | It requires the principal's signature and, in some cases, a witness or notarization for validity. |

| 7 | The validity and requirements of the form may vary by state, including the need for specific disclosures or additional forms. |

| 8 | Some states have their specific form that must be used instead of, or in addition to, the LGl 001 form. |

| 9 | Governing laws for the form depend on the state in which it is executed and the tax matters it covers. |

| 10 | It is crucial to provide accurate and complete information on the form to ensure it is legally effective. |

Guide to Writing Tax POA lgl 001

Once you've received a Tax Power of Attorney (POA) LGL 001 form, it signifies an important step in managing your taxes, particularly if you're appointing someone else to take care of these matters for you. This document grants another person the authority to act on your behalf for tax purposes. It's crucial to fill out this form accurately to ensure that your tax affairs are handled as you wish. Here’s a step-by-step guide to help you complete the form smoothly.

- Start by reading the form thoroughly to understand what information is needed and where. This will help you gather all necessary documents before beginning.

- Enter your full name and address in the designated areas at the top of the form. Ensure that this information matches what the Internal Revenue Service (IRS) has on file.

- Provide your Social Security Number (SSN) or your Individual Taxpayer Identification Number (ITIN) as requested on the form. This is crucial for identification purposes.

- Fill in the name and contact details of the individual or organization you are granting power of attorney to. This person or entity will act on your behalf in tax matters.

- Specify the tax forms and periods for which the POA is granted. Be precise to avoid any confusion or unauthorized access to your information.

- Discuss and agree upon the specific powers you are granting, such as representation before the IRS, signing certain documents, or receiving confidential tax information. Clearly mark these on the form.

- If there are any restrictions you wish to place on the appointee’s authority, detail these in the relevant section. This could include limits on the duration of the POA or specific actions they cannot undertake.

- Both you and the appointed individual or entity must sign the form. Your signatures authorize the document and make it legally binding.

- Date the form. The date is essential as it may determine when the powers come into effect and when they expire.

After carefully completing the Tax POA LGL 001 form, you should make a copy for your records before submitting the original to the relevant tax authority. Depending on your location and the nature of your tax matters, you may be able to submit this form electronically or you may need to mail it. Once submitted, you've successfully taken a significant step in managing your tax affairs efficiently. It's a good idea to stay in contact with the person or organization you've granted power to, to ensure that everything is proceeding as expected.

Understanding Tax POA lgl 001

-

What is the Tax POA lgl 001 form used for?

The Tax Power of Attorney (POA) lgl 001 form is designed to allow individuals to grant another person the authority to manage their tax matters. This may include filing taxes, obtaining confidential tax information, and making decisions about tax payments on behalf of the grantor. It is primarily used when the individual cannot handle their tax affairs due to various reasons such as absence, illness, or lack of expertise.

-

Who can be designated as the agent in the Tax POA lgl 001 form?

Individuals have the freedom to designate any trusted person as their agent. This may include family members, close friends, or professional advisors such as accountants or attorneys. It is crucial that the selected agent is someone reliable and knowledgeable about tax matters, as they will be entrusted with sensitive financial information and decision-making authority.

-

How can someone revoke a Tax POA lgl 001?

To revoke a previously granted Tax POA lgl 001, the individual must complete a formal revocation process. This typically involves preparing a written notice of revocation and ensuring it is received by the previously designated agent and any relevant tax authorities. Some regions might also require that this revocation notice be notarized or filed with a government body to take effect. It is advisable to consult with a legal advisor to comply with the specific requirements of the jurisdiction.

-

Are there any limitations on what the agent can do with the Tax POA lgl 001 form?

Yes, there are limitations on the powers granted through the Tax POA lgl 001. The scope of authority can be tailored to meet the specific needs and preferences of the individual granting the power. This means the form can be customized to limit the agent's powers to certain types of transactions or tax-related matters. Furthermore, the agent is obligated to act in the best interest of the individual, adhering strictly to the powers defined in the POA, and may be held liable for any actions that overstep this authority.

Common mistakes

-

Not reviewing the form thoroughly before filling it out. Individuals often start filling out the form without a comprehensive review. This oversight can lead to misunderstandings about what information is required, causing errors or incomplete sections. It is crucial to take the time to read through the entire form to understand all the requirements fully.

-

Failing to provide complete information. One common mistake is not providing all the necessary details. The Tax POA LGL 001 form requires specific information about the principal (the person granting the power) and the agent (the person receiving the power). Leaving sections blank or providing incomplete information can invalidate the form.

-

Using incorrect or outdated information. Given that tax laws and individual circumstances change, it is essential to ensure that all the information provided on the form is current and accurate. This includes personal details, tax identification numbers, and contact information. Using outdated information can lead to processing delays or the refusal of the form.

-

Not specifying the powers granted clearly. The Tax POA LGL 001 form allows the principal to specify which tax matters and years the agent has the authority to handle. Failing to detail these powers explicitly can lead to confusion or a lack of authority where needed. It's important to be as clear and precise as possible in this section.

-

Omitting required signatures or dates. The completion of the form requires signatures from all relevant parties, including a witness or a notary in some cases, depending on state requirements. Additionally, all signatures must be dated. Overlooking these final but crucial steps can render the document legally ineffective.

To avoid these common mistakes, individuals should approach the Tax POA LGL 001 form with careful attention to detail. By ensuring that all information is complete, accurate, and current, and by providing clear instructions and obtaining all necessary signatures, principals can help ensure that their tax matters are handled as intended.

Documents used along the form

When dealing with matters of taxation, especially when the Tax Power of Attorney (POA) lgl 001 form is used, several other forms and documents may need to be considered to ensure a comprehensive approach. The Tax POA allows an individual to grant authority to another party to handle tax matters on their behalf, but this is often just one step in managing one's tax affairs. Below is a list of documents commonly associated with the Tax POA lgl 001 form, each playing a pivotal role in the tax preparation and representation process.

- IRS Form 1040: The U.S. Individual Income Tax Return is the standard federal income tax form used to report an individual's gross income. It is where taxpayers can calculate their tax liability and figure out the amount of their tax refund or tax owed to the IRS.

- IRS Form 2848: Power of Attorney and Declaration of Representative. This form grants an individual or entity the authorization to represent the taxpayer before the IRS, allowing them to perform acts like receiving confidential information and negotiating a payment plan.

- IRS Form 8821: Tax Information Authorization. This document authorizes any individual, corporation, firm, organization, or partnership to inspect and/or receive the taxpayer's confidential information for a specified type of tax over a specific period.

- IRS Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals. It provides the IRS with information about the taxpayer's financial situation, which is used to establish a payment plan or an offer in compromise.

- IRS Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. This form is used to request an additional six months to file Form 1040, ensuring taxpayers have more time to gather necessary documentation.

- IRS Form 8857: Request for Innocent Spouse Relief. This form allows a taxpayer to seek relief from joint tax liabilities if they believe holding them responsible would be unfair.

- W-2 Forms: These are Wage and Tax Statements provided by employers to employees and the IRS at the end of the tax year, detailing the employee's annual wages and the amount of taxes withheld from their paycheck.

- 1099 Forms: These forms report various types of income other than wages, salaries, and tips. For example, 1099-MISC is used to report payments made to independent contractors.

- Schedule C: Profit or Loss from Business. Used by sole proprietors to report the income or loss from a business or profession practiced as a sole proprietorship.

- State Tax Returns: Depending on the individual's residency, a state tax return may also be required in addition to the federal tax return. These forms vary by state but serve a similar purpose in reporting income, calculating tax liability, and determining refund or tax owed at the state level.

Understanding and managing these forms in conjunction with the Tax POA lgl 001 can provide a clearer and more controlled navigation through one's tax responsibilities. Whether addressing federal and state tax returns, seeking extensions, or dealing with specific tax issues, these documents collectively ensure individuals have the necessary tools at their disposal. Such thorough preparation is pivotal to achieving a desirable outcome in dealings with tax authorities.

Similar forms

The Tax Power of Attorney (POA) form, a critical document that allows an individual to grant another person the authority to handle tax matters on their behalf, shares similarities with various other legal documents. Among these, the General Power of Attorney (POA) document stands out. It is broader in scope, empowering an agent to make a wide range of decisions and perform various actions in the principal's stead, not limited to tax issues but inclusive of financial and legal matters as well.

Comparable to the Tax POA is the Healthcare Power of Attorney. This document appoints someone to make healthcare decisions for the principal when they are unable to do so themselves. While the focus is far different—centering on health decisions rather than financial ones—the underlying principle of appointing a trusted individual to act in the principal's best interest remains consistent.

Another document sharing a common foundation with the Tax POA is the Durable Power of Attorney. The distinguishing feature of this document is its enduring nature, remaining in effect even if the principal becomes incapacitated. Like the Tax POA, it can grant broad or limited powers, but it is designed to ensure continuity of the principal's affairs across various domains, including taxes, beyond any incapacity.

The Limited Power of Attorney is akin to the Tax POA in that it confines the agent's authority to specific matters. However, unlike the Tax POA, which is expressly for tax-related issues, a Limited Power of Attorney can apply to any narrowly defined task or decision, such as selling a property or managing a single transaction.

Similar in function to the Tax POA, the Financial Power of Attorney grants an agent authority to handle the financial affairs of the principal. This often includes managing bank accounts, paying bills, and, notably, dealing with tax matters. The scope can vary widely, from very broad to very specific financial duties, making it a versatile tool for financial management and planning.

The Springing Power of Attorney, which activates under specific conditions, such as the incapacitation of the principal, shares a conditional element with some Tax POA forms that may come into effect only when certain criteria are met. Although used in various contexts, the focal point is the safeguarding of the principal's interests under predefined circumstances, providing a safety net that extends to financial decisions, including taxes.

Last, the Advanced Healthcare Directive, or Living Will, while primarily focused on healthcare decisions rather than financial ones, is similar to the Tax POA in its foresight and planning. It lets individuals dictate their wishes regarding medical treatment and end-of-life care ahead of time, ensuring that their preferences are respected even when they can no longer communicate them directly. Like the Tax POA, it is a testament to the principal's proactive arrangements for personal affairs, showcasing the importance of preparedness in all aspects of life.

Dos and Don'ts

When filling out the Tax POA (Power of Attorney) LGL 001 form, it's important to approach the task with attention to detail and an understanding of the implications. Here's a list of dos and don'ts to guide you through the process.

Do:

- Read all instructions carefully before starting to ensure you understand what's required.

- Use blue or black ink if filling out the form by hand to ensure legibility.

- Provide accurate information for all questions, including full legal names and contact information.

- Specify the tax matters and years/periods clearly for which the POA is granted.

- Make sure the person being appointed as the POA has agreed to take on this responsibility.

- Sign and date the form in the designated areas to validate the document.

- Keep a copy of the completed form for your records before submission.

- Submit the completed form to the appropriate tax authority office as indicated in the instructions.

- Notify the tax authority if there are any changes in representation or if you wish to revoke the POA.

- Consult with a tax professional or legal advisor if you have questions or need assistance with the form.

Don't:

- Don't leave any required fields blank; if a section doesn't apply, write "N/A" for not applicable.

- Don't use pencil or any erasable ink, as this can lead to unauthorized alterations.

- Don't provide false or misleading information, as this can result in legal consequences.

- Don't appoint someone as your POA without their knowledge and consent.

- Don't forget to specify the extent of the authority you are granting, including any limitations.

- Don't ignore the need to update or revoke the POA if your situation changes.

- Don't neglect to notify your tax preparer or advisor about the POA if they are not the ones being appointed.

- Don't submit the form without ensuring all parties involved have signed it.

- Don't overlook jurisdictional requirements that may vary by state or tax authority.

- Don't hesitate to seek professional advice to ensure the POA meets your needs and complies with legal requirements.

Misconceptions

Understanding the Tax Power of Attorney (POA) Legal Form 001 is crucial when dealing with tax matters. However, there are several misconceptions about this form that can lead to confusion and potential mistakes. By clarifying these misconceptions, individuals can approach tax matters with more confidence and accuracy.

- It's only for businesses: A common misconception is that the Tax POA lgl 001 form is exclusively for businesses. In reality, this form is applicable to both individuals and businesses seeking to grant authority to a representative to handle their tax affairs.

- It grants unlimited power: Another misconception is that by signing the Tax POA lgl 001 form, you are giving your representative carte blanche over all your financial matters. However, the form specifically limits the representative’s authority to tax matters, and you can further restrict this scope within the document.

- It's too complicated to fill out without a lawyer: Many believe that completing the Tax POA lgl 001 requires legal assistance. While consulting a professional can be beneficial, especially in complex situations, the form itself is designed to be filled out by taxpayers. Clear instructions are typically provided to guide individuals through the process.

- Once signed, it's permanent: The belief that once the Tax POA lgl 001 is signed, it cannot be revoked, is incorrect. Taxpayers have the right to revoke this power of attorney at any time, provided they follow the necessary steps to inform the relevant tax authorities and, if applicable, the representative named in the form.

- It covers all tax years or periods automatically: Some people think that signing the Tax POA lgl 001 form gives the representative authority over all past, present, and future tax years or periods. Actually, the document typically requires specifying the tax periods or years for which the representative is given authority. Any periods not specified are not covered.

- All tax representatives are the same: Lastly, there's a misconception that anyone you appoint as your tax representative will have the same capabilities. It’s important to understand that the Tax POA lgl 001 form allows you to appoint different types of representatives, such as CPAs, attorneys, or enrolled agents, each of whom may bring different levels of expertise and authority to handle your tax matters.

Key takeaways

Understanding how to navigate the Tax Power of Attorney (POA) LGL 001 form is crucial for allowing someone to handle your tax matters. This guide highlights some key takeaways to ensure the process is completed effectively.

Complete All Required Sections: Ensure every section of the form is filled out accurately. Leaving sections incomplete could invalidate the document, potentially causing delays in your tax matters.

Details of the Representative: Clearly identify the person, or entity, you are authorizing. You must include full legal names, addresses, and contact information. This ensures there's no confusion about who is empowered to act on your behalf.

Scope of Authority: Be explicit about what your representative can and cannot do. You can limit their authority to specific tax years or types of taxes, or you may give them broad access to handle all tax matters.

Sign and Date: The form is not valid unless it is properly signed and dated. Ensure that both you and your designated representative sign the document in the required spots. Without both signatures, the process might be delayed, or the form may be considered invalid.

Keep a Copy: After submitting the form, keep a copy for your records. This can help you monitor the agent’s actions on your behalf and will be useful if any disputes or questions arise concerning their authority or actions taken.

Approaching the Tax POA LGL 001 form with attention and care ensures that the individual or entity you choose can effectively assist with your tax matters without unnecessary hurdles.

Popular PDF Documents

Rushmore Loss Mitigation - To verify rental income, applicants must provide recent bank statements or canceled checks that reflect the rental deposits if bank statements are unavailable.

Sss Form Loan - Recognizing the importance of identification, the application specifies the need for primary and secondary IDs, ensuring borrower authenticity.