Get Tax POA il-2848 Form

Navigating the complexities of tax matters, individuals and businesses often find themselves in need of professional assistance to manage their affairs efficiently and effectively. This is where the power of attorney (POA) becomes a critical tool, particularly in the realm of taxes. The Tax Power of Attorney, known as Form IL-2848 in the state of Illinois, serves as a legal document that authorizes an individual or entity to manage tax-related tasks on behalf of another person. Key to understanding this form is recognizing the broad spectrum of activities it covers, from filing taxes to obtaining confidential tax information. The design of IL-2848 is meant to ensure that taxpayers can delegate tax duties with confidence, knowing that their affairs are being handled by a trusted representative. This form not only simplifies the process of dealing with the Illinois Department of Revenue but also safeguards the taxpayer's rights and privacy by setting a framework within which the appointed representatives can operate. Understanding the responsibilities, limitations, and the correct way to complete and submit this form is essential for anyone looking to establish a tax power of attorney, ensuring that their tax matters are in capable hands without any legal or procedural missteps.

Tax POA il-2848 Example

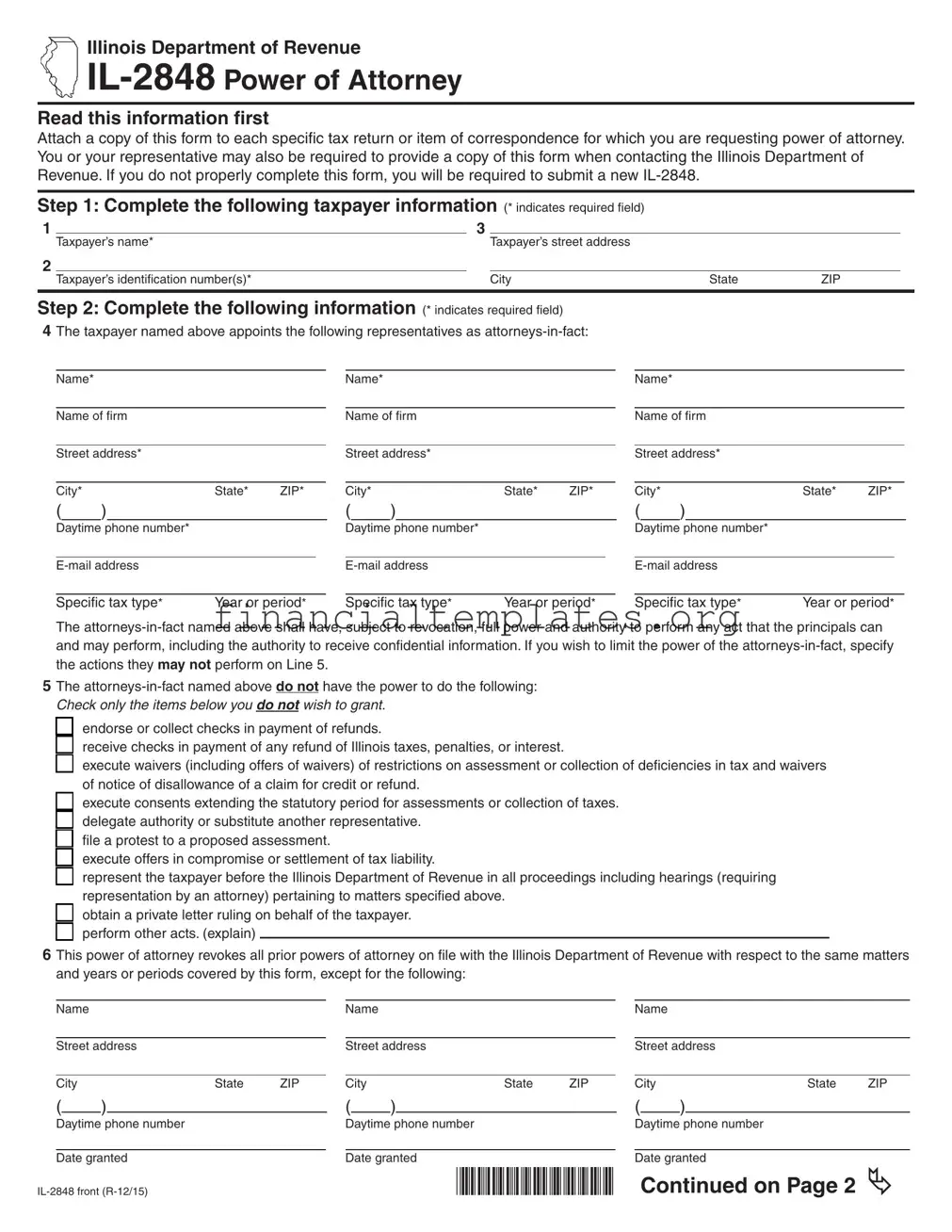

Illinois Department of Revenue

Read this information frst

Attach a copy of this form to each specifc tax return or item of correspondence for which you are requesting power of attorney. You or your representative may also be required to provide a copy of this form when contacting the Illinois Department of Revenue. If you do not properly complete this form, you will be required to submit a new

Step 1: Complete the following taxpayer information (* indicates required feld)

1 |

|

3 |

|

|

|

|

|

Taxpayer’s name* |

|

Taxpayer’s street address |

|

|

|

2 |

|

|

|

|

|

|

|

Taxpayer’s identifcation number(s)* |

|

City |

State |

ZIP |

|

|

|

|

|

|

|

|

Step 2: Complete the following information (* indicates required feld)

4 The taxpayer named above appoints the following representatives as

Name* |

|

|

|

|

|

|

|

Name* |

|

|

|

|

|

|

|

Name* |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Name of frm |

|

|

|

|

Name of frm |

|

|

|

|

Name of frm |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Street address* |

|

|

|

|

Street address* |

|

|

|

|

Street address* |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

City* |

|

|

|

State* |

ZIP* |

City* |

|

|

|

State* |

ZIP* |

City* |

|

|

|

State* |

ZIP* |

||||||||

( |

|

) |

|

|

|

|

( |

|

) |

|

|

|

|

( |

|

) |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Daytime phone number* |

|

|

|

|

Daytime phone number* |

|

|

|

|

Daytime phone number* |

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Specifc tax type* |

Year or period* |

|

Specifc tax type* |

Year or period* |

|

Specifc tax type* |

Year or period* |

||||||||||||||||||

The

5 The

□

endorse or collect checks in payment of refunds.

endorse or collect checks in payment of refunds.

□ receive checks in payment of any refund of Illinois taxes, penalties, or interest.

□ execute waivers (including offers of waivers) of restrictions on assessment or collection of defciencies in tax and waivers of notice of disallowance of a claim for credit or refund.

□

execute consents extending the statutory period for assessments or collection of taxes. □

execute consents extending the statutory period for assessments or collection of taxes. □

delegate authority or substitute another representative.

delegate authority or substitute another representative.

□

fle a protest to a proposed assessment.

fle a protest to a proposed assessment.

□

execute offers in compromise or settlement of tax liability.

execute offers in compromise or settlement of tax liability.

□

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

represent the taxpayer before the Illinois Department of Revenue in all proceedings including hearings (requiring representation by an attorney) pertaining to matters specifed above.

□

obtain a private letter ruling on behalf of the taxpayer. □

obtain a private letter ruling on behalf of the taxpayer. □

perform other acts. (explain)

perform other acts. (explain)

6 This power of attorney revokes all prior powers of attorney on fle with the Illinois Department of Revenue with respect to the same matters and years or periods covered by this form, except for the following:

Name |

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||

Street address |

|

|

|

Street address |

|

|

|

Street address |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City |

|

|

State |

ZIP |

|

City |

|

|

State |

ZIP |

|

City |

|

State |

ZIP |

|||

( |

|

) |

|

|

|

( |

|

) |

|

|

|

( |

|

) |

|

|

||

|

Daytime phone number |

Daytime phone number |

Daytime phone number |

||

|

|

|

|

|

|

|

Date granted |

Date granted |

Date granted |

||

*565201110* |

|

Continued on Page 2 |

|||

7 Copies of notices and other written communications addressed to the taxpayer in proceedings involving the matters listed on the front of this form should be sent to the following:

Name |

|

|

|

|

|

Name |

|

|

|

|

|

Name |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||

Street address |

|

|

|

Street address |

|

|

|

Street address |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

City |

|

|

State |

ZIP |

|

City |

|

|

State |

ZIP |

|

City |

|

State |

ZIP |

|||

( |

|

) |

|

|

|

( |

|

) |

|

|

|

( |

|

) |

|

|

||

Daytime phone number |

|

|

|

Daytime phone number |

|

|

|

Daytime phone number |

|

|||||||||

Step 3: Complete the following if the power of attorney is granted to an attorney, a certifed public accountant, or an enrolled agent

I declare that I am not currently under suspension or disbarment and that I am

•a member in good standing of the bar of the highest court of the jurisdiction indicated below; or

•duly qualifed to practice as a certifed public accountant in the jurisdiction indicated below; or

•enrolled as an agent pursuant to the requirements of United States Treasury Department Circular Number 230.

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

||

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

||

Check one: □Attorney |

□C.P.A. □Enrolled agent |

|

|

|

Jurisdiction (state(s), etc.) |

Signature |

Date |

Step 4: Taxpayer’s signature

If signing as a corporate offcer, partner, fduciary, or individual on behalf of the taxpayer, I certify that I have the authority to execute this power of attorney on behalf of the taxpayer.

Taxpayer’s signature |

Print name |

Title, if applicable |

Date |

|

|

|

|

Spouse’s signature |

Print name |

Title, if applicable |

Date |

|

|

|

|

If corporation or partnership, signature of offcer or partner |

Print name |

Title, if applicable |

Date |

Complete the following if the power of attorney is granted to a person other than an attorney, a certifed public accountant, or an enrolled agent

If the power of attorney is granted to a person other than an attorney, a certifed public accountant, or an enrolled agent, this document must be witnessed or notarized below. Please check and complete one of the following:

Any person signing as or for the taxpayer |

|

|

|

|

□ |

is known to and this document is signed in the presence of |

|

||

|

the two disinterested witnesses whose signatures appear here. |

|

||

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

□ |

appeared this day before a notary public and acknowledged |

|

||

|

this power of attorney as his or her voluntary act and deed. |

|

||

|

|

|

|

Notary seal |

|

Signature of notary |

Date |

||

This form is authorized as outlined under the Illinois Income Tax Act. Disclosure of this information is required. Failure to provide information could result in a penalty.

*565202110*

Document Specifics

| Fact | Description |

|---|---|

| Name of the Form | Tax Power of Attorney, Illinois Form IL-2848 |

| Purpose | Allows individuals to grant authority to another person to handle their tax matters in the state of Illinois. |

| Governing Law | Illinois Compiled Statutes |

| Execution Requirements | Must be signed by the taxpayer and the representative, and in some cases, may need to be notarized. |

| Duration | Can be specified within the document or remains in effect until revoked. |

| Revocation | The taxpayer can revoke the power at any time by writing to the Illinois Department of Revenue. |

| Eligibility to be a Representative | Individuals such as attorneys, CPAs, family members, or others who are eligible as per Illinois regulations. |

| Key Powers Granted | Includes handling matters related to taxes, representing the taxpayer in front of the Illinois Department of Revenue, obtaining confidential tax information, etc. |

| Filing Information | Form IL-2848 needs to be filed with the Illinois Department of Revenue either via mail or electronically, as per the instructions provided on the form. |

| Limitations | The form does not allow the representative to receive refund checks, unless specified, or to endorse documents on behalf of the taxpayer. |

Guide to Writing Tax POA il-2848

Filling out the Tax Power of Attorney (POA) form, officially known as IL-2848 in Illinois, is a critical step for those needing a representative to handle their tax matters with the Illinois Department of Revenue. This legal document allows an individual or business to grant authority to a professional, such as an accountant or attorney, to act on their behalf for tax purposes. Understanding the correct steps to complete this form accurately ensures that your tax matters are managed effectively and according to your wishes. Following is a step-by-step guide to assist in this process.

- Download the form: Begin by downloading the most recent version of the IL-2848 form from the Illinois Department of Revenue's official website to ensure you have the correct and updated document.

- Identify the taxpayer: Enter the full legal name and address of the taxpayer (individual or business) granting the powers. If the taxpayer is a business, include its FEIN (Federal Employer Identification Number) or, if an individual, their SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number).

- Select the representative(s): Designate the representative(s) who will be granted power of attorney. Include the representative's full name, address, and contact information. Illinois allows for the designation of more than one representative, so complete additional sections as necessary for each representative.

- Specify the tax matters: Clearly list the tax matters and years or periods for which the representative will have authority. Be as specific as possible to avoid any future discrepancies or confusion.

- Define the powers granted: Indicate the specific acts the representative is authorized to perform on your behalf. This can range from receiving confidential tax information to making agreements and executing waivers. Read this section carefully to ensure that it aligns with your intentions.

- Signature and date: The taxpayer must sign and date the form. If the taxpayer is a business, an authorized individual, such as an officer of the company, must sign the form. Ensure that the date of signing is clearly indicated next to the signature.

- Representative’s declaration: The designated representative must sign and date the form, agreeing to the declaration that they are authorized to represent the taxpayer. This ensures the form is completed correctly and that the representative acknowledges their responsibilities.

- Review and submit: Before submitting, review the entire form for accuracy and completeness. Once satisfied, submit the form to the Illinois Department of Revenue as directed in the form instructions. It’s advisable to keep a copy of the completed form for your records.

After submitting the IL-2848 form, the Illinois Department of Revenue will process your request. You or your representative may receive correspondence from the department if additional information is needed or to confirm the authorization. It's important to respond promptly to any requests by the department to ensure your tax matters are handled without delay. Properly filling out and submitting the IL-2848 form is a significant step in managing your tax responsibilities efficiently and helps ensure your rights and interests are adequately protected.

Understanding Tax POA il-2848

What is the Tax POA IL-2848 form?

The Tax Power of Attorney (POA) IL-2848 form is a legal document in Illinois. It allows taxpayers to grant an individual, often a tax professional, the authority to represent them before the Illinois Department of Revenue. This representation can include obtaining confidential tax information and making decisions about tax matters on the taxpayer's behalf.

Who can be designated as an agent on the IL-2848 form?

Typically, the agent designated on the IL-2848 form is a tax professional, such as a certified public accountant (CPA), attorney, or an enrolled agent who has the qualifications to deal with tax matters. This agent needs to have a Preparer Tax Identification Number (PTIN) or be appropriately licensed to practice in Illinois.

When should you use the IL-2848 form?

You should use the IL-2848 form when you need a professional to handle your tax matters with the Illinois Department of Revenue. This could include situations where you need help with audits, appeals, or tax debt settlement. It is also useful for individuals who prefer not to deal directly with the tax authorities or are unable to do so.

How do you fill out the IL-2848 form?

- Identify the taxpayer information, including Social Security Number or Federal Employer Identification Number.

- Appoint your agent by providing their name, address, telephone number, and their PTIN or license number.

- Specify the tax matters and years for which the agent is authorized.

- Sign and date the form. If filing jointly, both spouses must sign if they are delegating authority.

Ensure all information is correct and complete to prevent delays or issues.

Can you revoke a previously granted IL-2848 form?

Yes, you can revoke a previously granted IL-2848 form at any time. This is typically done by notifying the Illinois Department of Revenue in writing. You should include your name, identification number (SSN or FEIN), and a statement that you are revoking the power of attorney. Additionally, providing a copy of the previously granted IL-2848 can help ensure the correct document is revoked.

Is there a filing fee for the IL-2848 form?

There is no filing fee for the IL-2848 form with the Illinois Department of Revenue. However, hiring a professional to represent you may incur fees for their services.

How long does the authorization granted by the IL-2848 form last?

The authorization granted by the IL-2848 form remains in effect until it is revoked by the taxpayer. No expiration date is set unless the taxpayer specifies one in the document. It's important to notify the Illinois Department of Revenue if you decide to revoke the authorization.

Where can you find the IL-2848 form?

The IL-2848 form can be found on the Illinois Department of Revenue’s website. You have the option to download the form to fill it out manually or complete it online if available. Tax professionals also often have access to these forms and can assist you with them.

What happens if you don’t file the IL-2848 form?

If you don’t file the IL-2848 form, the Illinois Department of Revenue will not have the authorization to discuss your tax matters with anyone other than you. This means a tax professional cannot represent you or access tax information on your behalf, potentially complicating your ability to manage tax issues effectively.

Common mistakes

When filling out the Tax Power of Attorney (POA) IL-2848 form, individuals often make mistakes that can lead to delays or complications in their tax matters. Recognizing and avoiding these errors can ensure the process proceeds smoothly and efficiently.

Not verifying the current version of the form: The state may update the form periodically, and using an outdated version can invalidate your submission.

Skipping sections or providing incomplete information: Every section of the form is important. Leaving blank spaces or not fully answering questions may result in rejection.

Failing to clearly specify the tax matters and years covered: The POA must detail the specific tax issues and periods for which the representative is authorized.

Incorrectly identifying the representative(s): Full names, addresses, phone numbers, and, where applicable, the representatives’ Internal Revenue Service (IRS) Preparer Tax Identification Numbers (PTINs) must be accurate.

Misunderstanding the authority granted: Taxpayers often do not fully comprehend the extent of the powers they are assigning, which can lead to unintentional consequences.

Forgetting to sign and date the form: An unsigned or undated POA IL-2848 form is not valid and will not be processed.

Omitting necessary attachments: Sometimes, additional documents are required to support the authorization. Not including them can result in a delay.

Using incorrect or unclear language: The form requires clear, precise language to accurately convey the taxpayer’s intents and instructions.

Not coordinating with the representative: Taxpayers should discuss the scope and limitations of the POA with their representative(s) before submission to ensure common understanding and agreement.

Failure to update the POA: If circumstances change (e.g., changing representatives), the taxpayer must file a new form. Failure to do so can lead to confusion and misrepresentation.

Avoiding these common mistakes can help taxpayers ensure their POA IL-2848 forms are filled out accurately and processed without undue delay. Always consult tax professionals or legal advisors for guidance tailored to specific circumstances.

Documents used along the form

When handling tax matters, particularly in Illinois, the Tax Power of Attorney (POA) form IL-2848 is crucial. It authorizes someone to represent you or your business before the Illinois Department of Revenue. However, to ensure a comprehensive approach to tax matters, several other forms and documents often accompany the IL-2848. Understanding these documents is essential for a seamless process, enhancing representation and compliance with state tax laws.

- IL-1040 Form - The Individual Income Tax Return form is essential for residents who need to file their annual state income tax return in Illinois. It is the starting point for personal tax filing from which the authorized representative can work.

- IL-941 Form - This document is the Illinois Quarterly Withholding Income Tax Return. Businesses use it to report income taxes withheld from employees. It’s critical for ensuring that a business complies with state tax withholding requirements.

- CBT-100 Form - Required for corporate business tax returns, this form pertains to corporations operating within the state. It provides detailed information regarding the corporation's income, tax deductions, and credits.

- ST-1 Form - The Sales and Use Tax Return form is necessary for businesses collecting sales tax. It helps businesses report and remit the taxes collected from customers, ensuring compliance with state laws.

- UI-3/40 Form - This Unemployment Insurance form is filed quarterly by employers to report wages paid and unemployment contributions. It is crucial for maintaining accurate unemployment tax accounts.

- Form RUT-50 - A Private Party Vehicle Use Tax Transaction form required when a vehicle is purchased from a private party. It ensures the proper collection of taxes related to the transfer of vehicle ownership.

- Form IL W-5-NR - Employee’s Statement of Nonresidence in Illinois, utilized when an employee claims exemption from Illinois state income tax withholding because they reside in a reciprocal state.

In sum, the proper use and understanding of the Tax POA IL-2848 form along with these accompanying documents ensure individuals and businesses adhere to the myriad of tax laws and regulations. Each document plays a pivotal role in the tax filing and reporting process, underscoring the importance of thorough preparation and accurate completion. With these tools in hand, taxpayers can navigate the complexities of tax compliance with greater ease and assurance.

Similar forms

The Tax Power of Attorney (POA) IL-2848 form is similar to the IRS Form 2848, Power of Attorney and Declaration of Representative. Both forms authorize an individual, often a tax professional, to represent the taxpayer before the respective tax authority, handling matters and making decisions related to the taxpayer's obligations. This includes responding to notices, providing information, and negotiating payment plans. The primary difference lies in their jurisdiction; while IL-2848 is specific to the state of Illinois, IRS Form 2848 applies at the federal level.

Similar in purpose to the Tax POA IL-2848 form is the Healthcare Power of Attorney. This document empowers an agent to make healthcare decisions on behalf of the principal if they become unable to do so themselves. Although it pertains to medical rather than financial matters, the structure and intention—to grant authority to a trusted individual on someone else's behalf—mirror those of the Tax POA IL-2848 form. It reflects a legal instrument designed to act in the best interest of the principal under specified circumstances.

The General Power of Attorney form shares commonalities with the Tax POA IL-2848 form, in that it grants broad powers to an agent to handle a range of financial affairs and decisions for the principal. However, unlike the Tax POA, which is narrowly focused on tax matters, a general power of attorney can encompass a wide array of activities, from managing real estate to handling banking transactions. Despite the broader scope, both serve the essential function of authorizing another person to act on the principal's behalf.

The Durable Power of Attorney for Finances is another document with similarities to the Tax POA IL-2848 form. It specifically allows an agent to act on the principal's behalf concerning their financial affairs. What makes it 'durable' is its resilience; the power remains in effect even if the principal becomes incapacitated. Like the Tax POA, it ensures that someone can manage important financial matters, including taxes, if the principal is unable to do so, but it applies more broadly beyond just taxes.

The Limited Power of Attorney form is somewhat akin to the Tax POA IL-2848, in that it grants an agent specific powers for a limited task or period. While the Tax POA allows a representative to handle tax-related matters, a Limited Power of Attorney might be used for a single transaction, such as selling a vehicle or property. Both documents share the trait of narrowly defining the agent's powers, but they apply those powers in different contexts.

A Revocation of Power of Attorney document, though it serves the opposite purpose, is related to the Tax POA IL-2848. It is used to legally withdraw the powers granted in any Power of Attorney form, effectively ending the agent’s authorization. The relationship between the two documents underscores an essential mechanism within the realm of POAs: the ability to both grant and revoke authority, ensuring that the principal maintains control over their own affairs according to changing circumstances or wishes.

Finally, the Representation Authorization for Businesses (specific to certain states) parallels the Tax POA IL-2848 form in function and purpose for commercial entities. This form allows businesses to designate representatives to handle their tax matters with the state's tax department. Like the Tax POA IL-2848, it specifies who can act on behalf of the entity in discussions and decisions regarding its taxation, emphasizing the importance of representation in financial and legal matters, but from a business perspective.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) IL-2848 form, it's crucial to ensure accuracy and completeness. Below are guidelines on what you should and shouldn't do to facilitate a smooth process.

Do:

- Read the form and instructions thoroughly before beginning. This ensures a clear understanding of the requirements and facilitates accurate completion.

- Use black ink or type the information to ensure legibility. The clarity of your entries is crucial for processing.

- Include all necessary information such as your full legal name, tax identification number, and detailed information about the representative(s) you are appointing.

- Specify the tax matters and years or periods you are authorizing your representative to handle. Being explicit about the scope of authorization helps prevent misunderstandings.

- Sign and date the form. Your signature validates the POA and authorizes the actions stated.

- Keep a copy for your records. Having your own record can be helpful for future reference or in the event of a dispute.

- Review the completed form for accuracy and completeness before submission. A final check can catch any errors or missing information.

Don't:

- Leave sections blank unless they are explicitly marked as optional. Incomplete forms may be rejected or returned for correction.

- Use pencil or any ink color other than black as it may not be accepted or may cause legibility issues.

- Forget to list the specific tax forms or years you're granting access to. Vague or incomplete information can lead to processing delays.

- Appoint a representative without verifying their qualifications and willingness to act on your behalf. Not all individuals may have the expertise or willingness to serve as your representative.

- Ignore the requirement to notify the Illinois Department of Revenue of any changes. Updates to your representation or revocation of the POA should be communicated promptly.

- Overlook the importance of checking the box that allows your representative to receive confidential information. Without this, they may be limited in their ability to fully represent you.

- Omit your signature and the date. An unsigned or undated POA is invalid and will not be processed.

Misconceptions

The Tax Power of Attorney (POA) form, specifically the IL-2848 in Illinois, is surrounded by several misunderstandings. Here are seven common misconceptions:

Any form of written permission will suffice as a Tax POA. In fact, the state of Illinois requires the specific use of form IL-2848 for tax matters, which must be properly filled out and signed to be considered valid.

Completing a Tax POA grants unlimited power. While it's true that the person you designate, your agent, will have significant authority to act on your behalf concerning tax matters, their power is limited to what is explicitly stated within the form.

One Tax POA covers all states. Each state has its specific form and requirements. A Tax POA in Illinois, such as the IL-2848, does not automatically grant authority in another state.

The IL-2848 is only for individuals who are unable to manage their taxes. This misconception fails to recognize that the form can also be used simply for convenience, allowing a trusted professional to handle tax matters efficiently.

The form's powers are immediately effective upon signing. The reality is that the effectiveness of the IL-2848 depends on the terms specified within the document and its successful submission to the appropriate tax authority.

Notaries have to notarize the IL-2848. Illinois law does not require a notary’s signature for this form to be valid; however, the form must be completed accurately and signed by the taxpayer and their designated representative.

The IL-2848 allows the representative to manage non-tax-related matters. The form specifically delegates authority only for tax matters. Any authority beyond that scope would require a different type of legal document.

Understanding these misconceptions about the IL-2848 Tax POA form can help individuals navigate their tax matters more clearly and ensure proper handling of their financial affairs.

Key takeaways

Filling out and correctly using the Tax Power of Attorney (POA) IL-2848 form is a crucial step for taxpayers who want to authorize someone else, like an accountant or attorney, to handle their tax matters in Illinois. Here are six key takeaways to keep in mind:

- Know the purpose: The IL-2848 form allows you to give another person the legal authority to speak, act, and make decisions about your Illinois tax issues on your behalf.

- Complete all sections: It's important to fill out every part of the form accurately. This includes your information, the representative’s information, and the specific tax matters and years you are giving authorization for.

- Choose your representative wisely: The person you authorize will have significant control over your tax matters. Ensure they are trustworthy and have the necessary knowledge or professional qualifications.

- Include specific tax matters: You need to specify which taxes and which years your representative will have authority over. Be as clear as possible to avoid any confusion.

- Signature and date: Both you and your representative must sign and date the form. An unsigned form is not valid and will not be processed.

- Submit the form: Once completed and signed, you’ll need to submit the form to the appropriate Illinois tax office. Keep a copy for your records in case you need to refer to it in the future.

By keeping these points in mind and carefully completing the Tax POA IL-2848 form, you can ensure that your tax matters are handled efficiently and correctly, giving you peace of mind and increasing your personal or business tax compliance.

Popular PDF Documents

Profit and Loss Form - Employing Schedule C, individuals detail business ventures, painting a comprehensive picture of their entrepreneurial activities for the IRS.

Irs 944 Instructions - Businesses must contact the IRS if they wish to switch between filing Form 944 and Form 941.