Get Tax POA ia 2848 Form

Navigating the maze of tax documentation can be daunting for anyone, from individual taxpayers to seasoned professionals managing client finances. One critical piece in this complex puzzle is the Tax Power of Attorney, commonly known as Form 2848. This form serves as a cornerstone for those seeking to appoint a representative, such as a certified public accountant, attorney, or other eligible professionals, to handle their tax matters before the IRS. The authorization provides these representatives with the ability to receive and inspect confidential tax information and to perform acts like signing agreements or waivers on behalf of the taxpayer. Understanding the nuances of Form 2848 is essential, as it ensures that taxpayers can confidently delegate tax-related responsibilities while remaining compliant with IRS regulations. From specifying the type of tax matters and periods covered to detailing the extent of power granted to the representative, the form encapsulates vital elements of taxpayer-representative relationships. Its proper completion and submission are paramount, encapsulating the gravity and specificity of granting such authority, thereby safeguarding both the taxpayer's interests and the integrity of the tax system at large.

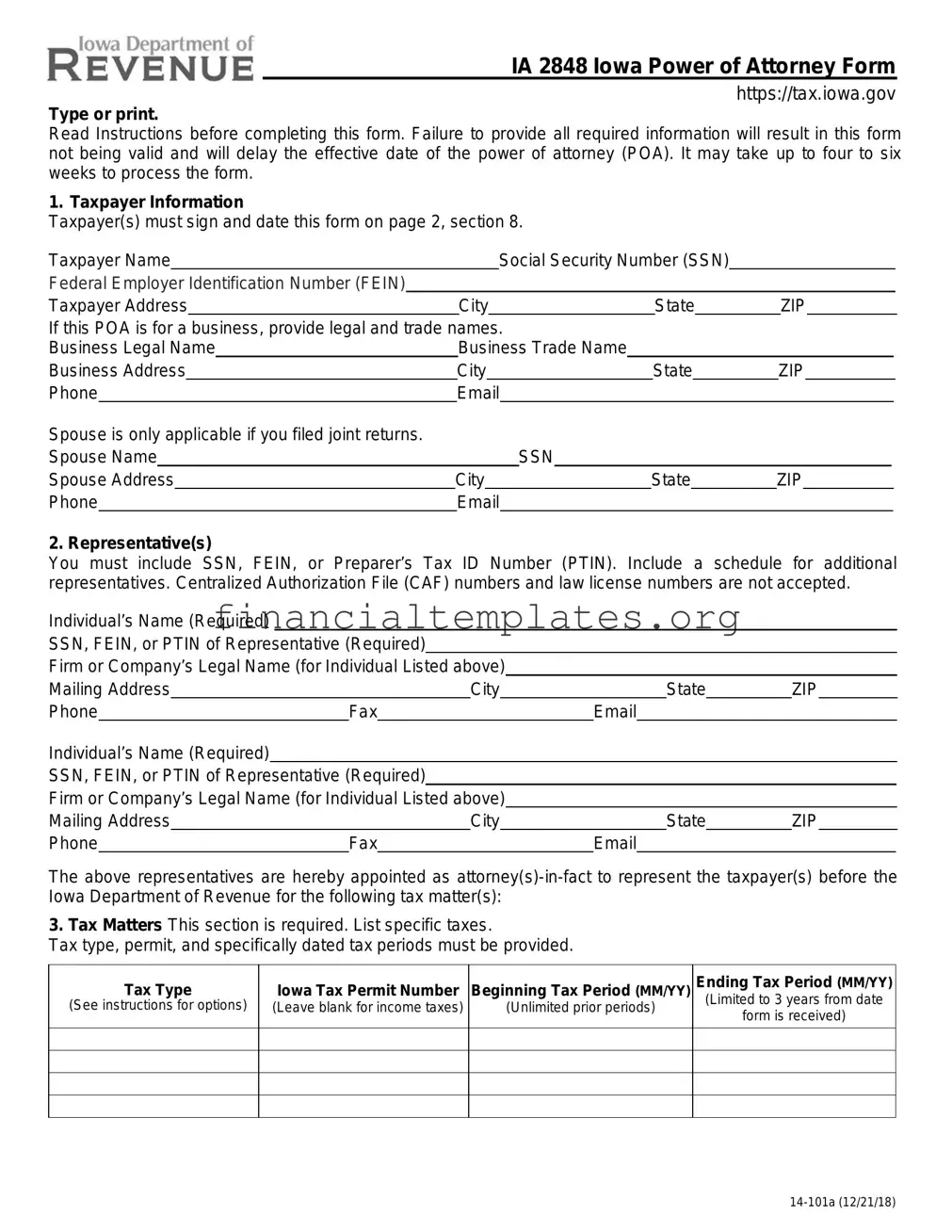

Tax POA ia 2848 Example

REVENUe ____________________

IA 2848 Iowa Power of Attorney Form

https://tax.iowa.gov

Type or print.

Read Instructions before completing this form. Failure to provide all required information will result in this form not being valid and will delay the effective date of the power of attorney (POA). It may take up to four to six weeks to process the form.

1. Taxpayer Information

Taxpayer(s) must sign and date this form on page 2, section 8.

Taxpayer Name |

|

|

Social Security Number (SSN) |

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Federal Employer Identification Number (FEIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Taxpayer Address |

City |

State |

|

ZIP |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

If this POA is for a business, provide legal and trade names. |

|

|

|

|

|

|

|||||||||||||

Business Legal Name |

Business Trade Name |

|

|

|

|

|

|

||||||||||||

Business Address |

|

City |

|

State |

|

ZIP |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Phone |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse is only applicable if you filed joint returns. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Spouse Name |

|

|

SSN |

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse Address |

City |

State |

|

ZIP |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Representative(s)

You must include SSN, FEIN, or Preparer’s Tax ID Number (PTIN). Include a schedule for additional representatives. Centralized Authorization File (CAF) numbers and law license numbers are not accepted.

Individual’s Name (Required)

SSN, FEIN, or PTIN of Representative (Required)

Firm or Company’s Legal Name (for Individual Listed above)

Mailing Address |

|

|

|

City |

|

|

State |

ZIP |

||||

Phone |

|

Fax |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Individual’s Name (Required)

SSN, FEIN, or PTIN of Representative (Required)

Firm or Company’s Legal Name (for Individual Listed above)

Mailing Address |

|

|

|

City |

|

|

State |

ZIP |

||||

Phone |

|

Fax |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

The above representatives are hereby appointed as

3.Tax Matters This section is required. List specific taxes.

Tax type, permit, and specifically dated tax periods must be provided.

Tax Type |

Iowa Tax Permit Number |

Beginning Tax Period (MM/YY) |

(See instructions for options) |

(Leave blank for income taxes) |

(Unlimited prior periods) |

|

|

|

Ending Tax Period (MM/YY) (Limited to 3 years from date form is received)

IA 2848 Iowa Power of Attorney Form, page 2

4.Acts Authorized (Do not name additional representatives in this section.)

Representatives are authorized to receive and inspect confidential tax information and to perform any and all acts with respect to the tax matters described in section 3. For example, the representative may negotiate, sign any agreements, consents, or other documents, and represent the taxpayer(s) in any informal and formal proceeding involving the Department. See Instructions for full list of authorized activities. The authority does not include the power to receive refund checks, unless specifically added in section 5 below. List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

Additions:

Deletions:

5. Receipt of Refund Checks

If you want to authorize a representative named in section 2 to receive, but not to endorse or cash, refund

checks, initial here |

|

and list the name of that representative below. |

Name of representative to receive refund check(s)

6. Notices and Communications

Original notices and other written communications will be sent to you and the taxpayer. A copy will be sent to the first representative listed in section 2.

7. Retention or Revocation of Prior Power(s) of Attorney

The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Iowa Department of Revenue for the same tax matters and tax periods covered by this document.

If you do not want to revoke a prior power of attorney, check here □

You must attach a copy of any power of attorney you want to remain in effect.

8. Signature of Taxpayer(s)

If a tax matter concerns a joint individual income tax return, both spouses are required to sign this form, if represented by the same individual(s).

If signed by a corporate officer, partner, member, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer: I certify that I have the authority to execute this form on behalf of the taxpayer.

If the taxpayer is an entity with more than one owner or member, a second signature of a person authorized to legally bind the entity is required.

If this form is not signed and dated, this power of attorney will not be valid. The form will be returned to you.

Signature ______________________________ |

Date |

____________________________________ |

|

Print Name |

____________________________ |

Title _____________________________________ |

|

Signature ______________________________ |

Date |

____________________________________ |

|

Print Name |

____________________________ |

Title _____________________________________ |

|

Mail to:

Registration Services

Iowa Department of Revenue

PO Box 10470

Des Moines IA

Or fax to:

Purpose of form

Taxpayer information is confidential. The Iowa Department of Revenue will discuss confidential tax information only with the taxpayer, unless the taxpayer has a valid power of attorney form on file with the Department.

A power of attorney is required by the Department when the taxpayer wishes to authorize another person to perform one or more of the following on behalf of the taxpayer:

a. To receive copies of notices or documents sent by the Department, its representatives, or its attorneys.

b. To receive (but not to endorse and collect) checks in payment of any refund of Iowa taxes, penalties, or interest.

c. To request waivers (including offers of waivers) of restrictions on assessment or collection of tax deficiencies and waivers of notice of disallowance of a claim for credit or refund.

d. To request extensions of time for assessment or collection of taxes.

e. To fully represent the taxpayer(s) in any formal or informal meeting with the Department, hearing, determination, final or otherwise, or appeal.

f.To enter into any compromise with the Department.

g.To execute any release from liability required by the Department before divulging otherwise confidential information concerning taxpayer(s).

h.Other acts as expressly stipulated in writing by the taxpayer.

3.Tax Matters

Tax type options

Enter tax type in section 3 and include beginning and ending dates for each. Valid tax types are: Individual Income, Partnership, Corporation, Sales, Use, Withholding, Franchise, Inheritance, Fiduciary, or Other (specify).

Tax periods

Specific tax periods must be identified. Each tax period must be separately stated.

Beginning tax period

An unlimited number of prior tax periods is allowed.

Ending tax period

An

7.Retention / Revocation of prior Power(s) of Attorney Canceling a power of attorney

A power of attorney may be revoked by a taxpayer at any time by filing a statement of revocation with the Department. The statement must indicate that the authority of the previous power of attorney is revoked and must be signed and dated by the taxpayer. Also, the name and address of each representative whose authority is revoked must be listed or a copy of the power of attorney must be included. Revocation of the authority to represent the taxpayer before the Department will be effective on the date received by the Department.

IA 2848 Iowa Power of Attorney Instructions

Submitting a new power of attorney

A new power of attorney for a particular tax type(s) and tax period(s) revokes a prior power of attorney for those tax type(s) and tax period(s), unless the taxpayer indicates on the new power of attorney form that a prior power of attorney is to remain in effect. The effective date of a new power of attorney is the date it is received by the Department.

For a

Withdrawing as a representative

A representative may withdraw from representing a taxpayer by filing a statement with the Department. The statement must be signed and dated by the representative and must identify the name and address of the taxpayer(s) and the matter(s) from which the representative is withdrawing.

8.Signature of Taxpayer(s) Who must sign?

Individual taxpayer. A power of attorney form must be signed by the individual.

Joint returns. If a tax matter concerns a joint individual income tax return, both taxpayers must sign and date.

Corporation. An officer of the corporation having authority to legally bind the corporation must sign the power of attorney form. The corporation must certify that the officer has such authority.

Association. An officer of the association having authority to legally bind the association must sign the power of attorney form. The association must certify that the officer has such authority.

Partnership. A power of attorney must be signed by all partners, or if executed in the name of the partnership, by the partner or partners duly authorized to act for the partnership, who must certify that the partner(s) has such authority.

Federal Power of Attorney

The Federal Power of Attorney form or a Military Power of Attorney is accepted by the Iowa Department of Revenue. To be valid, the federal or military form must include a statement that it is applicable for Iowa purposes at the time it is executed. In the case of a previously executed Federal or Military Power of Attorney subsequently revised to apply for Iowa purposes, it must contain a written statement that indicates it is being submitted for use with State of Iowa forms and the statement needs to be initialed by the taxpayer. Iowa allows married taxpayers to file one Iowa Power of Attorney form on behalf of both spouses. The IRS requires separate Power of Attorney forms for each spouse. If the Federal Power of Attorney is being used for Iowa purposes by married taxpayers, both federal forms must be submitted to Iowa.

Document Specifics

| Fact Name | Description |

|---|---|

| Form Number | IRS Form 2848 |

| Purpose | To authorize an individual to represent the taxpayer before the IRS |

| Who can be appointed | An eligible individual, often a certified public accountant, attorney, or enrolled agent |

| Validity Period | Typically, until revoked or a specified expiration date is reached |

| Governing Law | Federal tax law governs this form |

| State-Specific Forms | Some states require their own form instead of, or in addition to, IRS Form 2848 |

Guide to Writing Tax POA ia 2848

Filling out the Tax Power of Attorney (POA) Form 2848 is a critical step for individuals who need a representative to handle their tax matters before the IRS. This form grants a trusted individual the authority to receive confidential tax information and make decisions regarding taxes on the taxpayer's behalf. It is essential to complete this form accurately to ensure that the designated representative can perform their duties without delay. Following these detailed steps can streamline the process and help avoid common mistakes.

- Begin by entering the taxpayer's full name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated sections at the top of the form.

- Fill in the taxpayer's address, including street, city, state, and ZIP code, ensuring it matches the address on record with the IRS.

- Specify the type of tax, the tax form number, and the year(s) or period(s) for which the POA is granted. If the POA is for all tax years or periods, you can write "All Years" or "All Periods."

- Enter the name and Preparer Tax Identification Number (PTIN) or Social Security Number (SSN) of each individual being appointed as a representative. If the representative does not have a PTIN, other identifiers, such as a Centralized Authorization File (CAF) number, can be used if available.

- Provide the representative's contact information, including their phone number and address. If the representative works for a firm, include the firm’s name.

- Indicate the specific acts authorized by the POA, including receiving confidential tax information and making agreements. It’s also important to specify any acts that the representative is not authorized to perform under the designation of acts section.

- Check the box if a copy of this POA is provided to a third party and fill in the third party's name.

- The taxpayer must sign and date the form at the bottom. If a joint return is involved, both taxpayers must sign if both are granting the POA.

- If the representative is accepting the appointment, they must also sign and date the form, acknowledging their responsibilities under penalties of perjury.

After completing the form, it should be mailed or faxed to the IRS, following the instructions provided with the form. The IRS will review the POA to ensure it meets all requirements, and upon acceptance, the representative will have the authority to act on the taxpayer's behalf. It's also important to keep a copy of the completed form for your records. Completing Form 2848 accurately is a foundational step in ensuring that tax matters are managed effectively by the appointed representative.

Understanding Tax POA ia 2848

What is Form 2848 and when do I need to use it?

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a document used by taxpayers in the United States to authorize an individual, usually an accountant or a tax attorney, to represent them before the Internal Revenue Service (IRS). It grants this representative the power to receive and inspect confidential tax information and to act on the taxpayer’s behalf. You may need to use Form 2848 if you want someone else to handle your tax matters, especially if you cannot deal with the IRS yourself due to various reasons such as health issues, a lack of expertise in tax matters, or being abroad.

Who can be designated as a representative on Form 2848?

Individuals who can be designated as representatives on Form 2848 include attorneys, certified public accountants (CPAs), enrolled agents, and other individuals eligible to practice before the IRS. The form allows for up to three representatives to be named, though the IRS will send correspondence to only one designated representative if more than one is listed. It’s important to choose someone who is knowledgeable and trustworthy, as they will have access to sensitive tax information.

How do I fill out Form 2848?

To complete Form 2848, you must provide specific information about yourself and your chosen representative(s). This includes your name, address, Social Security Number (SSN) or Employer Identification Number (EIN), and your representative’s name, address, and phone number. You must also specify the tax matters and years for which you are granting authority, sign and date the form, and ensure your representative(s) also sign(s) it. Detailed instructions for filling out the form can be found directly from the IRS.

Is there a fee to submit Form 2848 to the IRS?

No, there is no fee charged by the IRS to submit Form 2848. However, the representative you choose, such as a tax attorney or accountant, may charge a fee for their services. It’s advisable to discuss these fees before proceeding to ensure you understand any costs involved.

How long does the power of attorney granted by Form 2848 last?

The duration of the power of attorney granted by Form 2848 can vary. Typically, the form includes a section where you can specify the exact years or periods for which the authorization is valid. If no expiration date is provided, the IRS will consider the authorization valid until it is revoked. However, a power of attorney automatically ends if the taxpayer revokes it, the taxpayer dies, the representative no longer qualifies to represent before the IRS, or when the IRS receives a new Form 2848 that revokes the previous one.

Can I revoke a previously filed Form 2848?

Yes, you can revoke a previously filed Form 2848 at any time. This is done by sending a written statement to the IRS indicating your desire to revoke the power of attorney. The statement must include your name, address, SSN or EIN, and a clear declaration that you’re revoking the authorization. Additionally, if appointing a new representative, submitting a new Form 2848 will automatically revoke any prior ones on file with the IRS for the same tax matters and years.

Where do I file Form 2848?

Where you file Form 2848 depends on your specific tax situation and geographic location. The IRS provides a list of addresses and fax numbers for the submission of Form 2848 in the instructions accompanying the form. It's essential to send it to the correct address or fax number to avoid delays. Additionally, the IRS now allows for electronic submission of Form 2848 through certain tax professionals using the IRS e-services’ Online Authorization Tool.

Common mistakes

The process of filling out the Tax Power of Attorney (POA), IRS Form 2848, often involves intricate details that, if overlooked, can lead to significant problems. Here, we outline ten common mistakes individuals tend to make while completing this form, which grants another person the authority to represent them before the IRS.

Not specifying the tax form number(s) for which the POA is given. It is essential to clearly indicate which tax forms the representative has the authority to handle, to ensure there’s no ambiguity regarding their permissions.

Failure to list the specific tax years or periods. The POA Form 2848 requires detailed identification of the tax years or periods involved. Leaving this field incomplete can invalidate the form.

Choosing a representative who is not eligible. The IRS has stringent guidelines on who can serve as a representative. It is crucial to ensure that the chosen representative meets these qualifications.

Omitting the representative’s CAF number, if they have one. If the representative already has a CAF number, failing to include it can delay processing.

Not clearly stating the specific tax matters. Just as with the tax forms and periods, the scope of authorization must be precisely defined to prevent any misunderstandings regarding the extent of the representative’s authority.

Incorrectly signing and dating the form. The taxpayer’s signature, along with the date, certifies the accuracy and intent of the POA. Any mistake in this area can lead to the form’s rejection.

Not including the name and contact information of the taxpayer. Essential for the IRS’s records, this information must be accurately and completely filled in.

Forgetting to specify any restrictions or additions to the representative’s authority. If there are specific limitations or expansions to the representative’s powers, these must be delineated clearly to avoid future legal challenges or misunderstandings.

Failing to revoke prior POAs. If this new POA is intended to replace any previous ones, it’s necessary to explicitly state that previous POAs are revoked, to prevent conflicts.

Incorrectly completing the declaration of representative section. This section is essential for legitimizing the representative’s authority and must be filled out in accordance with IRS guidelines.

Understanding and avoiding these common errors can greatly smooth the process of granting someone the authority to represent you in tax matters. It is often beneficial to seek guidance or confirmation from a tax professional to ensure all elements of the form are accurately completed.

Documents used along the form

When navigating through tax matters, it’s essential to have all the correct paperwork in order, especially if you're appointing someone else to handle these affairs on your behalf. The Form 2848, also known as the Tax Power of Attorney (POA), is a critical document that allows a designated individual, usually a tax professional, to act on your behalf in matters with the IRS. However, this form is often just one piece of the puzzle. In managing taxes, especially when dealing with complicated issues or delegating authority, several other forms and documents frequently accompany the Tax POA. Understanding these can streamline processes and ensure thorough preparation.

- Form 8821, Tax Information Authorization – While Form 2848 grants comprehensive authority to a designated individual, Form 8821 authorizes someone to inspect and/or receive confidential tax information for the type specified on the form. It’s essential when you want someone to access your tax records but not make decisions or act on your behalf.

- Form 4506-T, Request for Transcript of Tax Return – Often used alongside Form 2848 to facilitate the tax filing process, this form allows the designated representative to request a transcript of a tax return. This document is crucial for verifying past income and tax filings, especially when correcting previous returns or preparing for an audit.

- Form 1040, U.S. Individual Income Tax Return – The staple of tax documentation, Form 1040, is where you report your annual income and deductions. A representative named in a Tax POA may need to access, prepare, or amend this form to ensure accurate filing and compliance with tax laws.

- Form 2848-A, Declaration of Representative – This is a certification of eligibility for the individuals acting as your representative under Form 2848. It outlines their qualifications and authorizes them to represent you before the IRS. Although not a separate form, it’s a crucial part of the Form 2848 submission process.

- W-9, Request for Taxpayer Identification Number and Certification – This form is often required when setting up financial accounts that will report income to the tax authorities. It’s used to provide your Taxpayer Identification Number (TIN) to entities that will pay you or handle your money, ensuring that all your financial movements are properly linked to your tax records.

Together, these forms and documents create a comprehensive framework for managing tax affairs efficiently and effectively. Whether filing annual returns, amending previous submissions, or dealing with intricate tax issues, these documents ensure that you or your designated representative can navigate the complexities of tax law with confidence. It’s crucial to understand the purpose of each and how they complement the authority granted by the Tax POA Form 2848.

Similar forms

The Tax Power of Attorney (POA) Form 2848 is closely related to the General Power of Attorney document. Both empower someone else to act on the principal's behalf, but while the Tax POA specifically authorizes someone to handle tax matters with the IRS, a General POA is broader, covering a wide range of legal and financial affairs. This similarity lies in the structure and purpose of these documents: both designate agents and specify the extent of powers granted, albeit in different areas of the principal's life.

Similarly, the Healthcare Power of Attorney parallels the Tax POA, with a key difference in the area of authority. While the Tax POA appoints someone to deal with tax-related issues, a Healthcare POA assigns an agent to make healthcare decisions on behalf of the principal when they are unable to do so themselves. Both documents share the underlying principle of assigning decision-making power to a trusted individual, reflecting the importance of having someone to represent one's interests in critical matters.

The Durable Power of Attorney for Finances is another document akin to the Tax POA Form 2848. The Durable POA for Finances also grants someone else the authority to manage the financial affairs of the principal. However, it differs in scope, as it is not limited to tax matters but includes a broad range of financial decisions and transactions. Both documents function under similar legal frameworks, ensuring that an individual's financial responsibilities are managed according to their wishes when they are unable to do so themselves.

The Limited Power of Attorney stands out as well due to its similarity to the Tax POA, with its specificity being a common thread. The Limited POA allows the principal to grant an agent powers for a specific task, similar to how the Tax POA allows someone to handle only tax-related issues. Both documents offer a focused approach, giving the agent authority in predefined areas or tasks, providing a tailored solution to specific needs or circumstances of the principal.

Lastly, the Representation Authorization Form, commonly used in various state-level tax matters, shares similarities with IRS Form 2848. Though it specifically pertains to state tax issues, as opposed to federal issues with Form 2848, both serve the purpose of authorizing a representative to act on one's behalf in matters related to taxes. They require similar information about the principal and the representative, implementing a legal framework that facilitates tax-related representation. Both documents underscore the importance of having a trusted individual manage tax affairs, highlighting the specialized nature of tax representation.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA), Form IA 2848, it is crucial to adhere to specific guidelines to ensure the form is completed accurately and effectively. Below are four things you should and shouldn't do:

What You Should Do:

- Ensure all information is accurate and complete. This includes double-checking the taxpayer's identification numbers, full name, and address, as well as the representative's information.

- Specify the tax forms and periods for which the POA is granted. This clarity helps in limiting the scope of the representative's authority to only what is necessary.

- Sign and date the form. Without the taxpayer's signature, the form is not valid. If filing jointly, both individuals must sign if representation is sought for both parties.

- Keep a copy for your records. After submission, retaining a copy is crucial for future reference or in case of disputes.

What You Shouldn't Do:

- Do not leave sections blank. If a section does not apply, consider marking it as "N/A" to indicate that it has been reviewed but is not applicable.

- Avoid using a representative not authorized to practice before the IRS. Only individuals such as attorneys, certified public accountants, or other qualified persons should be designated.

- Do not forget to revoke previous POAs if necessary. If a new Form IA 2848 is meant to replace an older authorization, ensure the previous one is formally revoked to avoid confusion.

- Refrain from providing vague or broad authorizations. Clearly define the scope of authority granted to your representative to prevent undesired access or actions.

Misconceptions

There are common misunderstandings surrounding the Tax Power of Attorney, specifically the IRS Form 2848. It's important to clear up these misconceptions to ensure individuals and businesses are correctly informed about its usage and limitations.

Filing Form 2848 grants unlimited power. A common misconception is that by completing Form 2848, the appointed individual gains unrestricted access to make all decisions on behalf of the taxpayer. In reality, the form allows the representative to perform specific tax-related tasks outlined by the taxpayer. The scope of authority is defined by the taxpayer and can be limited to certain years and specific tax matters.

Any representative can be authorized. Many believe that they can appoint anyone as their representative on Form 2848. However, the IRS requires that the individual must be an eligible practitioner. This includes attorneys, certified public accountants, enrolled agents, and other individuals authorized to practice before the IRS. The person's eligibility must be current, and they must have a Preparer Tax Identification Number (PTIN).

Form 2848 covers all tax-related communication. Another common myth is that once Form 2848 is filed, the IRS will direct all tax communications to the appointed representative. While the form does permit the representative to receive and respond to notices and communications on behalf of the taxpayer, it does not automatically reroute all IRS correspondences. Some notifications, particularly those of a non-administrative nature, will still be sent directly to the taxpayer.

Once filed, Form 2848 is irrevocable. People often think that after submitting Form 2848, the decision is final and cannot be changed. In actuality, taxpayers can revoke the authorization at any time. This is done by submitting a written statement of revocation to the IRS or by filing a new Form 2848 that states it revokes all prior authorizations. The most recent form filed supersedes any prior submissions.

Understanding the specifics of Form 2848 can help ensure that the power of attorney for tax matters is correctly implemented, avoiding potential issues or misunderstandings with the IRS.

Key takeaways

When it comes to dealing with tax matters, having clear guidance is essential, especially if you're entering the territory of providing someone else the authority to handle your taxes. The IRS provides a specific form for this purpose, known as Form 2848, Power of Attorney and Declaration of Representative. This document allows taxpayers to grant certain privileges to a trusted individual, empowering them to act on their behalf with the IRS. Here are seven key takeaways you should know about filling out and using Form 2848:

- Understanding the Purpose: Form 2848 is used to authorize an individual, usually a tax professional, to represent you before the IRS. This representation can include discussion of your tax matters, obtaining confidential tax information, and negotiating and agreeing to a tax resolution on your behalf.

- Identifying the Representative: Clearly identify the person you are appointing as your representative. You'll need to provide their name, address, and telephone number. Additionally, include their CAF number, PTIN, or Bar, CPA, or Enrolled Agent license number, if applicable.

- Specifying the Tax Matters: The form requires you to specify the type of tax, tax form number, and the years or periods for which the power of attorney is granted. Be precise to ensure no confusion about the extent of your representative’s authority.

- Acts Authorized: Form 2848 allows you to define the scope of actions your representative can perform. This might include signing documents, receiving confidential tax information, or appearing on your behalf in hearings. If there are specific acts you do not wish your representative to perform, those should be clearly listed in the form.

- Signature and Date: For the Power of Attorney to be valid, you must sign and date the form. If you're filing jointly, and both parties want the same representative, each of you must fill out a separate Form 2848.

- Filing the Form: Once completed, you should send the form to the IRS office handling your matter. If there is no open case or specific office involved, the form can be sent or faxed to the IRS CAF Unit. The addresses and fax numbers are provided in the instructions for Form 2848.

- Revocation: If you wish to revoke a previously authorized power of attorney without replacing it, you must write "REVOKE" across the top of the first page of the Form 2848 and send it to the IRS. Alternatively, writing a statement declaring the revocation of the power of attorney serves the same purpose if the original Form 2848 cannot be provided.

Empowering someone to handle your tax affairs is not a decision to be taken lightly. By understanding and carefully filling out Form 2848, you can ensure that your tax matters are managed accurately and according to your wishes. Always remember, the IRS website provides a wealth of information and resources to help guide you through the process.

Popular PDF Documents

How Long Can the Irs Freeze Your Bank Account - When the IRS leads to undue bank charges through its levies or check handling, Form 8546 offers a route for reimbursement.

IRS 1098-E - The form serves as documentation supporting the deduction for student loan interest should the IRS question the claim.