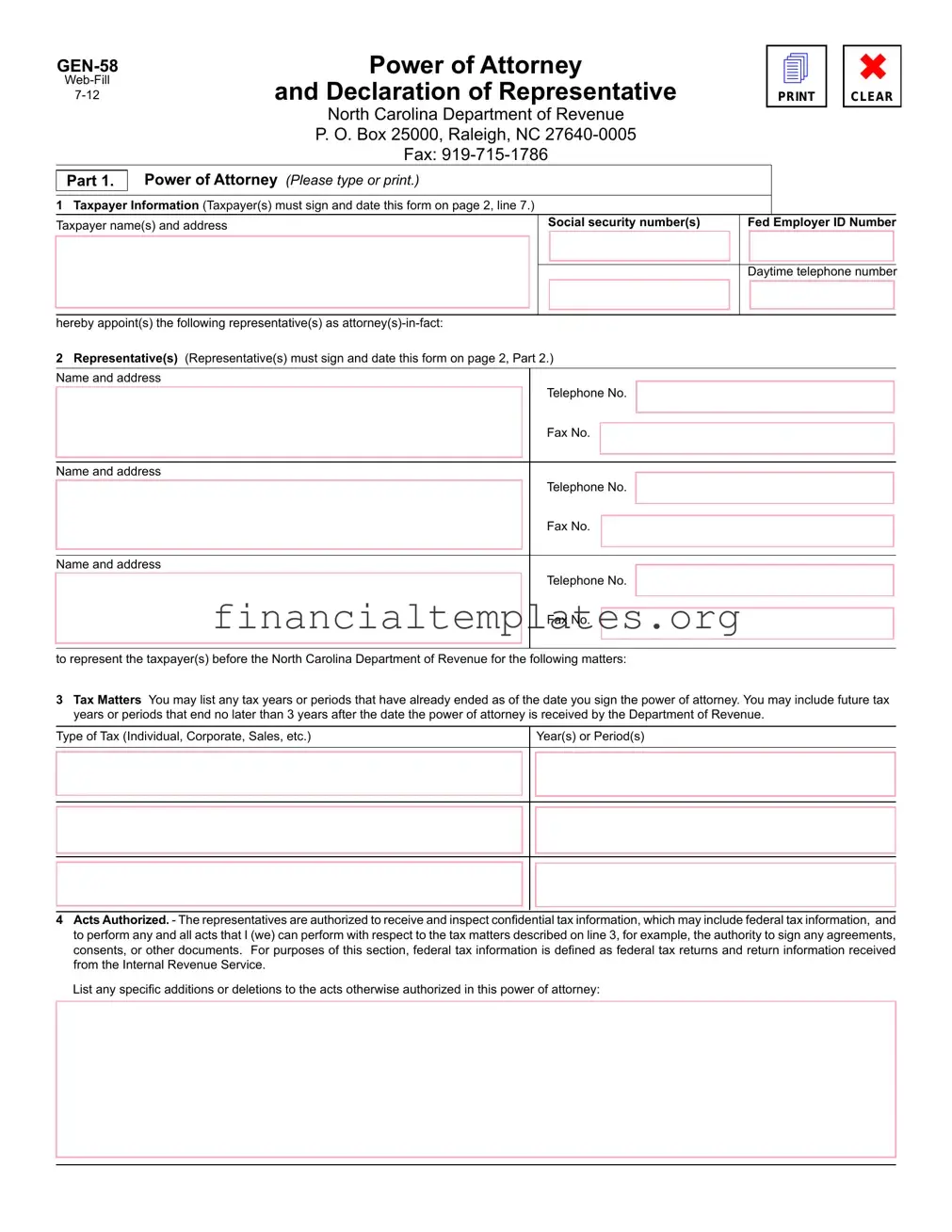

Get Tax POA gen-58 Form

Navigating the complexities of tax matters can often feel like a maze, especially when it comes to authorizing someone else to handle these obligations on your behalf. This is where the Tax POA gen-58 form comes into play, serving as a bridge that allows individuals to grant another person or entity the authority to speak, act, and make decisions regarding their taxes with the tax authorities. Essential for those who are unable to manage their tax affairs for any reason, this form encompasses a range of authorizations, from obtaining confidential tax information to making decisions and submissions. Its proper completion and submission ensure that the designated representative can efficiently manage tax-related matters, providing peace of mind to the granter that their tax affairs are in capable hands. Understanding the significance, requirements, and the exact scope of the authorization granted through the Tax POA gen-58 is paramount for both the granter and the grantee to ensure that the process is seamless, compliant, and aligned with the intended outcomes.

Tax POA gen-58 Example

|

Power of Attorney |

|

4 |

|

✖ |

||||

|

and Declaration of Representative |

|

|

|

|

||||

|

|

|

|

|

CLEAR |

||||

|

|

|

|

|

North Carolina Department of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P. O. Box 25000, Raleigh, NC |

|

|

|

|

|

|

|

|

|

Fax: |

|

|

|

|

|

|

|

|

I |

Power of Attorney (Please type or print.) |

|

|

|

|

I Part 1. |

|

|

|

|

|

||||

|

|

|

|

|

|

||||

1Taxpayer Information (Taxpayer(s) must sign and date this form on page 2, line 7.)

Taxpayer name(s) and address |

Social security number(s) |

Fed Employer ID Number |

||

|

|

|

|

|

Daytime telephone number

hereby appoint(s) the following representative(s) as

2Representative(s) (Representative(s) must sign and date this form on page 2, Part 2.)

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

Name and address

Telephone No.

Fax No.

to represent the taxpayer(s) before the North Carolina Department of Revenue for the following matters:

3Tax Matters You may list any tax years or periods that have already ended as of the date you sign the power of attorney. You may include future tax years or periods that end no later than 3 years after the date the power of attorney is received by the Department of Revenue.

Type of Tax (Individual, Corporate, Sales, etc.)

Year(s) or Period(s)

4Acts Authorized. - The representatives are authorized to receive and inspect confidential tax information, which may include federal tax information, and to perform any and all acts that I (we) can perform with respect to the tax matters described on line 3, for example, the authority to sign any agreements, consents, or other documents. For purposes of this section, federal tax information is defined as federal tax returns and return information received from the Internal Revenue Service.

List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

Page 2

Gen. 58

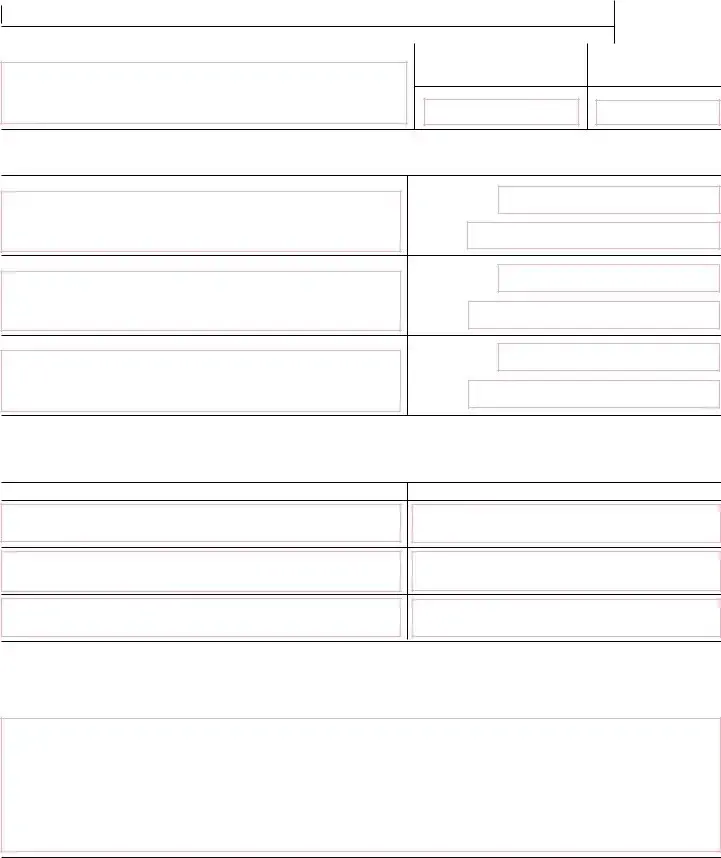

5

Department’s homepage for a list of the online services for businesses that require login to the |

|

PLEASE CHECK THIS BOX IF YOUR REPRESENTATIVE WILL CREATE AN |

|

SERVICES ON YOUR BEHALF |

|

|

|

6Retention/Revocation of Prior Power(s) of Attorney. - The filing of this power of attorney automatically revokes all earlier power(s) of attorney on file with the Department of Revenue for the same tax matters and years or periods covered by this document. If you do not

want to revoke a prior power of attorney, check here |

►□ |

|

|

|

|

YOU MUST ATTACH A COPY OF ANY POWER OF ATTORNEY YOU WANT TO REMAIN IN EFFECT. |

|

|

7Signature of Taxpayer(s). - If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested.

If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, representative, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

►IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED.

Signature |

Date |

Title (if applicable) |

Print Name |

|

|

Signature |

Date |

Title (if applicable) |

Print Name |

|

|

Part 2.

Declaration of Representative

Under penalties of perjury, I declare that:

• |

I am authorized to represent the taxpayer(s) identified in Part 1 for the tax matter(s) specified there; and |

• |

I am one of the following: |

|

a Attorney - a member in good standing of the bar of the highest court of the jurisdiction shown below. |

bCertified Public Accountant - duly qualified to practice as a certified public accountant in the jurisdiction shown below.

cEnrolled Agent - Enrolled as an agent under the requirements of Treasury Department Circular No. 230.

dOfficer - a bona fide officer of the taxpayer’s organization.

e

fFamily Member - a member of the taxpayer’s immediate family (i.e., spouse, parent, child, brother, or sister).

gOther (explain) -

►IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED, THE POWER OF ATTORNEY WILL BE RETURNED.

Designation - Insert

above letter

Jurisdiction (state) or Enrollment Card No.

Signature

Date

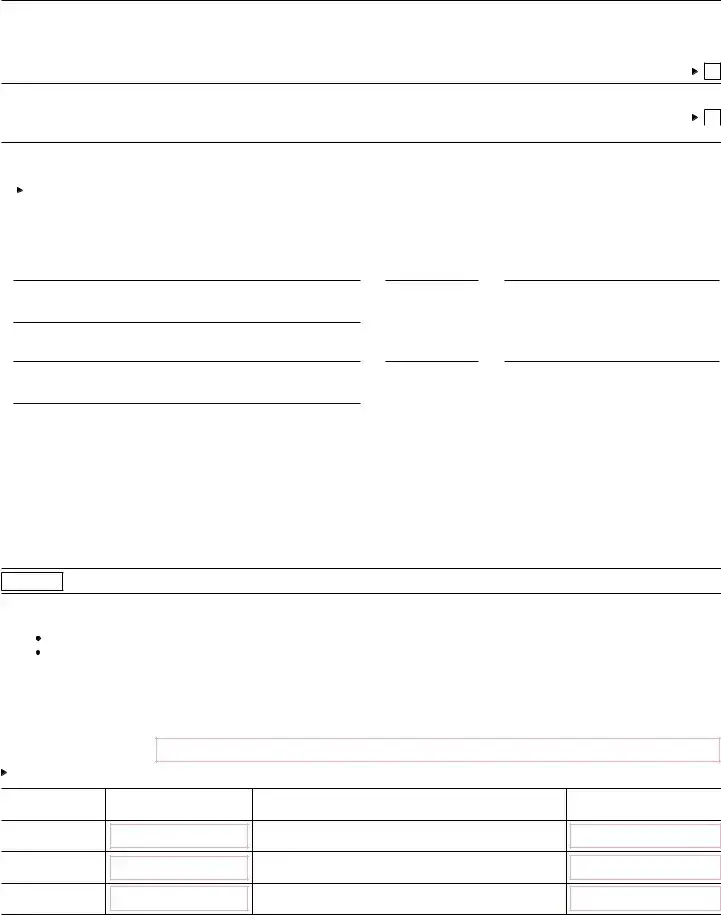

Document Specifics

| Fact Name | Description |

|---|---|

| Purpose | The Tax Power of Attorney (POA) Form GEN-58 is designed to authorize an individual, often a tax professional, to handle tax matters on behalf of another individual or entity. |

| Applicability | This form is specific to certain states and allows the appointed agent to deal with state tax authorities. |

| Governing Law | Pertinent state laws regulate the execution, scope, and limitations of a Tax POA GEN-58, varying from one jurisdiction to another. |

| Agent Powers | The form grants broad powers, including the ability to access tax records, file tax returns, and represent the taxpayer in tax-related matters before state tax agencies. |

| Execution Requirements | Typically, the form must be signed by the taxpayer and the designated agent, sometimes requiring notarization depending on state requirements. |

| Revocation | The taxpayer can revoke the power of attorney at any time, subject to the stipulations of the governing state law and any instructions in the form. |

| Duration | Unless stated otherwise within the document or terminated by the taxpayer, the authority granted by the Tax POA GEN-58 generally remains effective until the specified tasks are completed. |

Guide to Writing Tax POA gen-58

Filling out the Tax Power of Attorney (POA) form, officially known as GEN-58, is an important step in allowing someone else, often a professional, to handle your tax matters. This document gives that person the authority to speak, act, and make decisions regarding your taxes with the tax department. It's crucial to fill out the form accurately to ensure that your tax matters are properly managed and that the right level of authority is granted. Below is a straightforward guide to help you complete the GEN-58 form correctly.

- Start by entering the full legal name, social security number (SSN), or employer identification number (EIN) of the taxpayer. This identifies who the tax matters concern.

- Fill in the complete and accurate address of the taxpayer, including the city, state, and zip code. This ensures any correspondence from the tax department reaches the right place.

- Specify the representative's full name, firm name (if applicable), address, telephone number, and fax number. This section is crucial as it directs the tax department on who to contact regarding the taxpayer's affairs.

- Detail the tax matters by entering the types of tax, the tax form number, and the years or periods being authorized. Be precise to avoid any confusion about what the representative has permission to access.

- Choose the acts authorized for the representative to perform on behalf of the taxpayer by checking the appropriate boxes. This can range from receiving confidential information to making agreements. Pay close attention to what powers you are granting.

- Read through the acts not authorized section to understand what limitations are placed on the representative's power. This clarity is essential for both parties.

- Sign and date the form. The taxpayer's signature authorizes the POA and validates the document. If you're filling out this form for a business, the person signing must have the authority to grant POA on behalf of that entity.

- If applicable, have the representative sign and date the form. This acknowledges their acceptance of the responsibilities the POA entails.

After completing the GEN-58 form, review it thoroughly to ensure all information is correct and complete. Submit the form to the appropriate tax department as directed. Once processed, the representative will have the authority to manage the tax matters specified in the document. Remember, granting someone power of attorney is a significant decision. Ensure you trust the individual or firm you are authorizing to handle your taxes.

Understanding Tax POA gen-58

-

What is the Tax Power of Attorney (POA) GEN-58 Form?

The Tax Power of Attorney (POA) GEN-58 form is a legal document that allows an individual to grant another person the authority to represent them in matters related to their taxes. This can include filing taxes, obtaining confidential tax information, and making decisions about tax payments on behalf of the grantor.

-

Who can be designated as a representative on the GEN-58 Form?

Any individual can be designated as a representative on the GEN-58 Form, including family members, friends, or tax professionals. However, it's crucial to choose someone trustworthy and knowledgeable about tax matters, as they will have access to sensitive information and the power to make important decisions.

-

How can one complete and submit the GEN-58 Form?

The GEN-58 Form can be completed by providing the necessary personal information of the grantor and the designated representative, including their names, addresses, and identification numbers. Once completed, it must be signed by the grantor and, in some cases, witnessed or notarized, depending on the state's requirement. The form can then be submitted to the relevant tax authority, either by mail or, in some jurisdictions, electronically.

-

Is there a validity period for the GEN-58 Form?

Yes, the validity period for the GEN-58 Form varies by state but generally lasts until it is revoked by the grantor or upon the occurrence of a specified event, such as the grantor's death or the completion of the specified tax matter. It's important to check the specific requirements and limitations in the state where the form is filed.

-

Can the GEN-58 Form be revoked?

Yes, the grantor has the right to revoke the GEN-58 Form at any time. To do so, the grantor must provide written notice of the revocation to the tax authority where the form was filed, and it's recommended to also notify the designated representative. The revocation becomes effective upon receipt by the tax authority.

Common mistakes

When filling out forms, especially those related to tax matters like the Tax Power of Attorney (POA) Form GEN-58, attention to detail is paramount. However, common mistakes often slip through, potentially compromising the legitimacy of the form and its intended outcomes. Below, we detail five frequent errors individuals commit when completing this important document.

Not verifying the correct version of the form: The Tax POA GEN-58 form, like other legal documents, may be updated or revised over time. People often mistakenly use an outdated version, not realizing that state tax authorities require the most current iteration for processing. Always check the issuing authority’s website for the latest version.

Failing to provide complete information: Each section of the GEN-58 form is designed to capture specific, critical information. Leaving sections blank or providing incomplete responses can lead to processing delays or outright rejection. It’s crucial to review each part of the form carefully and provide all requested details.

Misunderstanding the scope of authority: The GEN-58 form allows the person granting power (the principal) to specify the extent of authority given to their representative. A common mistake is not clearly defining this scope, which can lead to confusion about what the representative is legally permitted to do on the principal’s behalf. Clearly specify the tax matters and years covered.

Incorrectly identifying the parties involved: On the GEN-58 form, the principal and the representative must be correctly identified with accurate, legal names and taxpayer identification numbers. Any discrepancy in this information can invalidate the document or cause significant delays in its execution.

Forgetting to sign and date the form: Perhaps the most straightforward yet frequently overlooked requirement is the need for the principal’s signature and the date. Without these, the document is considered incomplete and will not be processed. Ensure that these elements are not only present but also placed correctly according to the form’s instructions.

Given the complexities and the importance of the Tax POA GEN-58 form, taking the time to understand and correctly fill out the document is crucial. Avoiding these common mistakes can save time and ensure that your tax matters are handled efficiently and according to your wishes.

Documents used along the form

When dealing with tax matters, particularly when using the Tax Power of Attorney (POA) Form, often denoted as gen-58, individuals may need to gather and fill out several additional forms and documents. These materials play a crucial role in ensuring that all tax-related issues are handled efficiently and in compliance with the law. Each of these forms serves a specific purpose, varying from authorizing a representative to make tax decisions on behalf of someone to reporting individual or business income. Below is a list of other commonly used forms and documents alongside the Tax POA gen-58 form.

- Form 1040: The U.S. Individual Income Tax Return is the standard form used by individuals to file their annual income tax returns with the IRS. This document is essential for reporting an individual's financial income, calculating taxes owed, or determining a refund.

- Form 2848: Power of Attorney and Declaration of Representative is used when individuals want to authorize someone else, usually a tax professional, to represent them before the IRS. This form allows the representative to receive confidential information and make decisions regarding the individual's taxes.

- Form 8821: Tax Information Authorization grants permission to any individual, corporation, firm, organization, or partnership to inspect and/or receive private tax information in any office of the IRS for the type of tax and the years or periods specified.

- Form W-2: Wage and Tax Statement is issued by employers to their employees and the IRS at the end of the fiscal year. It reports employee annual wages and the amount of taxes withheld from their paychecks.

- Form 1099: Various types of Form 1099 are used to report income other than wages, salaries, and tips. This might include independent contractor income, dividends, and interest. It’s crucial for self-employed individuals or those who have other sources of income.

- Schedule C (Form 1040): Profit or Loss from Business is used by sole proprietors to report the income and expenses of their business. This schedule helps in calculating the net profit or loss of the business which is then reported on the Form 1040.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows individuals extra time to file their tax return. This extension applies to the filing of the return, not the payment of taxes due.

- Form 8941: Credit for Small Employer Health Insurance Premiums is used by small employers to calculate the tax credit for health insurance premiums paid for employees. This is part of the Affordable Care Act incentives for small businesses.

Collectively, these forms and documents compose the foundation of tax filing and representation for individuals and businesses. It's important for filers or their representatives to understand the specific requirements and details of each document to ensure accurate and compliant tax reporting and planning. Engaging with these materials alongside the Tax POA gen-58 ensures that all tax-related matters are addressed comprehensively.

Similar forms

The Tax Power of Attorney (POA) Form, often observed in contexts where individuals necessitate third-party assistance for tax matters, bears resemblance to several other legal documents, each designed for its distinct yet analogous function. One such document, the General Power of Attorney, empowers an agent to make broad financial decisions on the principal's behalf, not limited to but inclusive of tax matters. The primary distinction rests in the General Power of Attorney's scope, covering a wider array of financial management facets beyond just tax-related duties.

Similarly, the Healthcare Power of Attorney document shares a foundational premise with the Tax POA, albeit it is tailored to a drastically different domain. This variant grants an agent the authority to make healthcare decisions for the principal under specific circumstances, particularly when they are incapable of doing so themselves. Despite their differing arenas—taxation versus healthcare—both documents are rooted in the trust and delegation of critical personal responsibilities to another party.

The Durable Power of Attorney stands out for its enduring applicability, even when the principal becomes incapacitated. Like the Tax POA, it can be customized to include authority over tax affairs among other financial domains. However, its defining feature is the durability clause, ensuring that the agent's power remains intact should the principal lose the ability to make informed decisions, a protection not inherently specified within the typical Tax POA structure.

Lastly, the Limited Power of Attorney document shares a close kinship with the Tax POA, as it also bestows specific powers to an agent. The key difference lies in the Limited Power of Attorney's customizable nature, allowing the principal to delineate precise tasks, which may or may not include tax-related actions, for a defined duration or under particular circumstances. This document's flexibility makes it a practical tool for those seeking to entrust another with certain responsibilities, be they financial, legal, or personal, without surrendering comprehensive control.

In essence, while each of these documents serves a unique purpose, they collectively embody the principle of delegating authority to a trusted individual or entity. Whether the context is as broad as managing one's entire financial portfolio or as specific as filing taxes, the notion of appointing another to act on one's behalf marks the core similarity among them. The Tax POA, alongside its counterparts, plays a vital role in personal and financial planning, safeguarding interests and ensuring that essential duties are fulfilled even in the principal's absence or incapacitation.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form GEN-58, individuals must adhere to specific guidelines to ensure the form is valid and correctly processed. To assist you, here are seven dos and don'ts:

Do:- Read all instructions carefully before you begin.

- Use blue or black ink for clarity and to ensure the form is legible.

- Provide all required information, including full legal names and identification numbers, to avoid processing delays.

- Specify the exact tax matters and years or periods involved.

- Sign and date the form personally to validate it.

- Keep a copy of the form for your records once completed.

- If necessary, clarify your relationship with the appointee to establish their authority accurately.

- Leave any sections incomplete, as missing information can lead to rejection.

- Use pencil, as it can easily be erased or altered, leading to issues with authenticity.

- Forget to specify the type of taxes and tax years you're granting authority over.

- Sign without ensuring that all the information is correct and accurate.

- Appoint someone you don't trust fully, as they will have significant authority over your tax matters.

- Overlook the necessity of notifying your appointee—they should be aware they are being granted this power.

- Fail to revoke previous POAs if this new one should replace them, to prevent confusion or conflicting authorities.

Misconceptions

Tax issues are complicated for most people, and misunderstandings about forms like the Tax Power of Attorney, commonly referred to as form gen-58, are widespread. This form is crucial for authorizing someone else to handle your tax matters with tax institutions. Misconceptions can lead to confusion or misuse of the form. Here are seven common misconceptions explained to help clarify how this document works.

- It Grants Unlimited Power: There's a common belief that the Tax POA gen-58 form gives the designated individual unlimited power over all financial decisions. In reality, this form specifically limits the authority to tax matters only, allowing the agent to represent the grantor before tax authorities, make filings, and receive confidential tax information.

- It's Permanent: Many think once a Tax POA gen-58 form is signed, it's in effect indefinitely. However, the form's duration can be limited by the grantor. It's possible to specify an expiration date or event upon which the POA will automatically end.

- Only for the Elderly: Some people mistakenly believe that tax POA forms are only necessary for senior citizens. In truth, anyone who may need assistance with their tax affairs, regardless of age, can benefit from delegating this authority to a trusted individual or professional.

- Revocation Is Complicated: There's a misconception that once granted, a tax POA is difficult to revoke. Actually, the grantor can revoke the power at any time, provided they notify all relevant parties in writing and destroy all copies of the form.

- Professional Representation isn't Allowed: Contrary to this belief, the gen-58 form does permit the designation of a professional, such as a certified public accountant or a tax attorney, to act on behalf of the grantor.

- Only Family Members Can Be Designated: Some people think that only a family member can be designated as an agent on the form. The truth is, any trusted individual or professional who the grantor believes is competent can be assigned, regardless of their familial relationship.

- It's the Same in Every State: Many assume the Tax POA gen-58 form is uniform across all states. However, tax laws and requirements can vary by state, and while a generic form might exist, it's essential to use the version specific to the state where it will be filed and to comply with that state's signing requirements.

Understanding these misconceptions about the Tax Power of Attorney gen-58 form can empower individuals to make informed decisions about managing their tax matters more effectively.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) form, commonly known as Form GEN-58, requires careful attention to detail and an understanding of its implications. This form plays a crucial role in enabling an individual or entity to grant authority to another, typically a tax professional, to act on their behalf for tax matters. Below are key takeaways to consider:

- Understanding the purpose: The Tax POA form is designed specifically for matters related to taxes. It allows the appointed individual or entity, known as the agent or attorney-in-fact, to receive confidential information and make decisions regarding the principal's tax affairs.

- Selection of the agent: It is vital to choose an agent who is competent and trustworthy. This person will have access to sensitive information and the ability to make important decisions affecting the principal’s financial and legal standing.

- Completeness is key: Ensuring that every section of the form is filled out accurately and entirely is crucial to avoid processing delays or rejections. Incomplete forms cannot be processed and will necessitate correction and resubmission.

- Specifying tax matters: The form requires the principal to specify which tax matters and years the authorization covers. It is essential to be precise in these definitions to prevent unintended access or decisions beyond the intended scope.

- Validity and duration: Understanding the form’s validity period is important. Some POA forms may have a predefined validity period or remain in effect until explicitly revoked. Clarifying this aspect can prevent future complications.

- Revocation process: The principal retains the right to revoke the POA at any time. This process typically requires a formal written notice specifying the revocation's effective date and, in some cases, notifying the tax authority directly.

- Notarization requirements: Depending on the jurisdiction, the Tax POA form may need to be notarized or witnessed to become legally binding. It's important to follow the specific requirements set forth by the tax authority or legislation in the principal’s region.

- Dual representation: If appointing more than one agent, the form should clearly state whether the agents can act independently or if they need to make decisions jointly. This distinction can significantly impact how tax matters are handled.

- Keep records: Once completed and submitted, it’s advisable for both the principal and the agent to keep copies of the form for their records. The documentation can be crucial for accountability and future reference.

Adhering to these guidelines can facilitate a smoother experience with the Tax POA form, ensuring that the principal's tax matters are handled competently and according to their wishes. It is also advisable to consult with a tax professional or legal advisor to address any complex issues or uncertainties.

Popular PDF Documents

IRS 1310 - Individuals filing this form must remember to attach a copy of the death certificate if required.

Revenue Portal Login - Applicants are asked about their availability for the announced test date and if any religious accommodations are needed to participate.