Get Tax POA form tc-737 Form

When tackling tax matters, it's crucial to understand the tools at your disposal, especially when you need someone else to handle these affairs on your behalf. Herein lies the significance of the Tax Power of Attorney (POA) Form TC-737, a document that performs a pivotal role. This form allows taxpayers to officially authorize another individual to manage their tax matters, making it an essential tool for those who cannot deal directly with the tax authorities due to various reasons. Whether it's due to health issues, absence, or a simple preference for professional assistance, the Tax POA ensures that your tax responsibilities are in capable hands. The form covers a broad spectrum of permissions, from representing you in tax discussions to accessing confidential tax information. While the idea of granting such authority might seem daunting, understanding the scope and limitations of the Tax POA Form TC-737 can significantly ease these concerns. It streamlines the process of managing tax matters through a proxy, making it less burdensome for everyone involved.

Tax POA form tc-737 Example

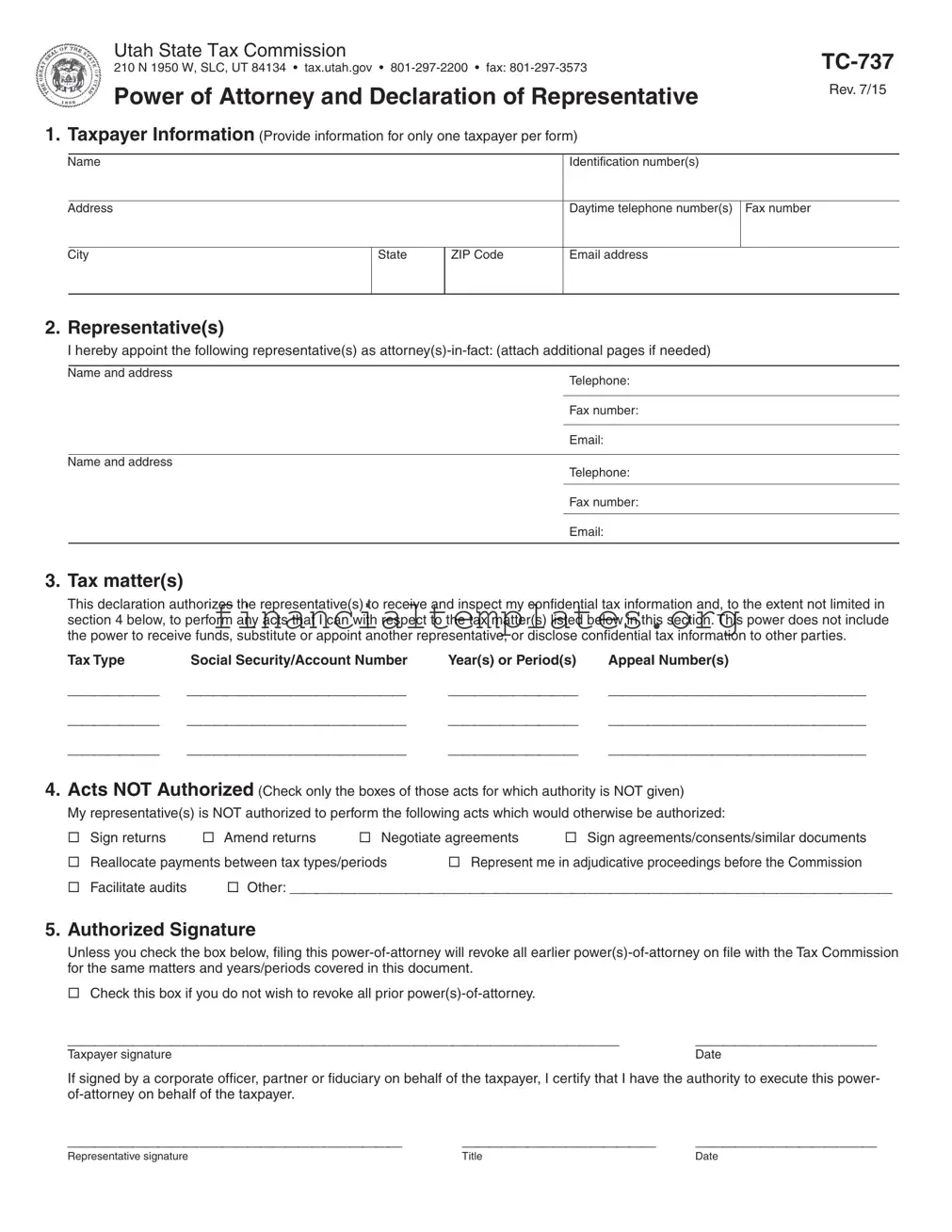

Utah State Tax Commission |

|

210 N 1950 W, SLC, UT 84134 tax.utah.gov |

|

Power of Attorney and Declaration of Representative |

Rev. 7/15 |

|

|

1. Taxpayer Information (Provide information for only one taxpayer per form) |

|

Name

Identification number(s)

Address

Daytime telephone number(s) Fax number

City

State

ZIP Code

Email address

2. Representative(s)

I hereby appoint the following representative(s) as

Name and address

Name and address

Telephone:

Fax number:

Email:

Telephone:

Fax number:

Email:

3. Tax matter(s)

This declaration authorizes the representative(s) to receive and inspect my confidential tax information and, to the extent not limited in section 4 below, to perform any acts that I can with respect to the tax matter(s) listed below in this section. This power does not include the power to receive funds, substitute or appoint another representative, or disclose confidential tax information to other parties.

Tax Type |

Social Security/Account Number |

Year(s) or Period(s) |

Appeal Number(s) |

_______ |

_________________ |

__________ |

____________________ |

_______ |

_________________ |

__________ |

____________________ |

_______ |

_________________ |

__________ |

____________________ |

4.Acts NOT Authorized (Check only the boxes of those acts for which authority is NOT given)

My representative(s) is NOT authorized to perform the following acts which would otherwise be authorized:

|

Sign returns |

Amend returns |

Negotiate agreements |

Sign agreements/consents/similar documents |

|

|

Reallocate payments between tax types/periods |

Represent me in adjudicative proceedings before the Commission |

|||

Facilitate audits Other: _______________________________________________

5.Authorized Signature

Unless you check the box below, filing this

Check this box if you do not wish to revoke all prior

___________________________________________ |

______________ |

Taxpayer signature |

Date |

If signed by a corporate officer, partner or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this power-

__________________________ _______________ ______________

Representative signature |

Title |

Date |

Document Specifics

| Fact | Description |

|---|---|

| Form Title | Tax Power of Attorney (POA) Form TC-737 |

| Purpose | To authorize an individual to represent another person or entity in matters related to state tax. |

| Scope of Authority | Includes, but is not limited to, accessing confidential tax information and making decisions about the tax matters of the individual or entity. |

| Validity | This form is valid only for the specific tax matters and periods stated within it. |

| Revocation | The POA remains in effect until explicitly revoked by the taxpayer. |

| Special Requirements | Some states may require notarization or additional forms for the Tax POA to be considered valid. |

| Governing Laws | Each state has its own set of laws governing the use and validity of Tax POA forms. It is essential to consult state-specific laws. |

Guide to Writing Tax POA form tc-737

Filling out the Tax Power of Attorney (POA) form, designated as TC-737, is a critical step for individuals who wish to authorize someone else to handle their tax matters with the tax authority. This legal document grants the appointed person or entity the ability to access and manage the taxpayer's information, submit documents, and make decisions regarding tax issues on behalf of the taxpayer. Understanding and completing this form accurately is paramount to ensuring that the appointed representative can perform these duties effectively and within the bounds of the law. The following steps have been designed to guide you through the process of filling out the TC-737 form, ensuring clarity and precision in its execution.

- Start by filling in the date: This is crucial as it determines when the POA comes into effect. Include the month, day, and year.

- Enter the taxpayer's information: This should include the taxpayer's full legal name, social security number (SSN) or individual taxpayer identification number (ITIN), and full address. If there is more than one taxpayer (e.g., in the case of joint filings), ensure all parties are properly identified with their respective information.

- Designate the representative(s): Here, you will need to list the name(s), telephone number(s), and address(es) of the person(s) you are authorizing as your representative(s). If granting authority to more than one representative, specify the extent of each representative’s authority in this section.

- Specify the tax matters: Clearly identify the type(s) of tax, the tax form number(s), and the year(s) or period(s) for which the POA is granted. This ensures that the representative’s authority is properly limited to specific matters.

- Define the acts authorized: This part of the form delineates what the representative is permitted to do on your behalf. It includes, but is not limited to, receiving confidential tax information, making agreements, and executing waivers. If there are specific acts you do not wish to authorize, they must be explicitly noted here.

- Retention/revocation of prior POAs: Indicate whether previous POAs are to be retained or revoked. Specifying this ensures clarity regarding the representative's standing and authority level, especially in cases where multiple POAs have been issued over time.

- Taxpayer’s signature: The form must be signed and dated by the taxpayer. If the form is being filled out for joint matters, both parties must sign and date. Signing the form confirms the taxpayer’s consent and the information provided.

- Representative’s declaration: This section is for the representative. They must affirm their acceptance of the appointment, provide their title or relationship to the taxpayer, and, if applicable, include their preparer tax identification number (PTIN). This part is crucial as it validates the representative's capacity to act.

After completing the Tax POA form TC-737, it's essential to keep a copy for your records. The next steps involve submitting the form to the appropriate tax authority, following the specific submission guidelines provided by them. Normally, you would send the form to the address or fax number indicated for POA submissions on the tax authority's website or in their guidance materials. Once received, the tax authority will process the form, which may take a few weeks. They will notify the taxpayer and the authorized representative when the POA becomes active. From this point, the authorized representative can commence with handling the tax matters specified in the form. It's a straightforward but paramount process that facilitates the management of tax affairs through a trusted individual or entity.

Understanding Tax POA form tc-737

-

What is a Tax POA Form TC-737?

A Tax Power of Attorney (POA) Form TC-737 is a legal document in which one party (the principal) grants another party (the agent) the authority to represent them and make decisions regarding their tax matters with the tax authorities. This form is specific to jurisdictions that recognize it, allowing the agent to access the principal's tax information and make filings on their behalf.

-

When should someone use the Tax POA Form TC-737?

This form should be used when an individual or a business entity wishes to appoint another person to handle their tax-related affairs. This could be due to various reasons such as the complexity of tax matters, the need for professional assistance, or the principal's inability to manage their taxes due to health or travel reasons.

-

How do you fill out the Tax POA Form TC-737?

Completing the form generally involves providing detailed information about the principal and the agent, such as their names, contact details, and identification numbers. The specific tax matters and years for which the POA is granted should be clearly listed. Both the principal and the agent must sign the form, possibly in the presence of a witness or notary, depending on jurisdiction requirements.

-

Is there an expiration date for the Tax POA Form TC-737?

Yes, the form may have an expiration date, which is typically specified by the principal at the time of filling it out. If no expiration date is mentioned, the POA might remain in effect until it is formally revoked or upon the occurrence of certain events like the death of the principal.

-

Who can be appointed as an agent on the Tax POA Form TC-737?

The principal can appoint anyone they trust as their agent. However, it is common to appoint legal representatives, certified public accountants, or individuals with experience in handling tax matters because of the complexities involved in tax laws and filings.

-

Can the Tax POA Form TC-737 be revoked?

Yes, the principal can revoke the power of attorney at any time. To do so, they should provide written notice to the agent and the tax authority, indicating that the POA is no longer in effect. It might also be necessary to fill out a specific form or follow certain procedures to ensure the revocation is recognized.

-

Does the agent get compensated for their services using the POA?

Compensation for the agent is not inherent to the POA form and must be agreed upon separately. This agreement should be detailed in a separate document or contract that outlines the scope of work and the payment terms.

-

Are there any limitations to the powers granted in the Tax POA Form TC-737?

The scope of the agent’s power is determined by the specific terms stated in the POA form. The principal can limit the powers to certain tax years, types of taxes, or specific actions. It’s crucial for the principal to clearly define these limitations in the document to avoid any misuse of authority.

-

How is the Tax POA Form TC-737 filed with the tax authority?

The completed and signed form must be submitted to the relevant tax authority. Submission methods can vary; some jurisdictions accept electronic filing, while others may require physical mailing of the documents. It’s important to follow the specific instructions provided by the tax authority to ensure the POA is valid and recognized.

Common mistakes

When it comes to filling out the Tax Power of Attorney (POA) Form TC-737, it's essential to approach it with care and thoroughness. This legal document grants someone else the authority to handle your tax matters, making it crucial to avoid common mistakes that could potentially undermine its validity or lead to unintended consequences.

- Not providing complete information: Many individuals forget to fill out every required field on the form. This includes personal information, tax matters, and periods subjected to the POA. Incomplete forms may lead to processing delays or the rejection of the form.

- Failure to specify the tax matters accurately: The form requires you to detail the specific tax matters and years you're authorizing representation for. Vague or incorrect descriptions can limit your representative's ability to act on your behalf effectively.

- Choosing the wrong representative: It's crucial to select a representative who is not only trustworthy but also has the necessary knowledge and experience in handling tax affairs. Appointing someone without considering their qualifications could lead to mismanagement of your tax matters.

- Overlooking the need for witness or notary signatures: Depending on the requirements, your Tax POA might need to be either witnessed or notarized to be considered valid. Ignoring this step can nullify the entire document.

- Not updating the form when circumstances change: Life changes such as divorce, the death of the designated representative, or a change in your financial situation necessitate an update to your Tax POA form. Failing to renew or amend the form can lead to confusion or legal complications.

- Incorrectly signing or dating the form: The simplest yet one of the most frequent mistakes is signing or dating the form incorrectly. This undermines the document's validity, potentially causing significant delays or the need to re-submit the form.

Being mindful of these common pitfalls when completing the Tax POA Form TC-737 can save individuals from unnecessary complications. It's advisable to review the form thoroughly, consult with a tax professional if needed, and ensure that all the information provided is accurate and up-to-date. Keeping these guidelines in mind can help in navigating the complexities of tax representation effectively.

Documents used along the form

When managing tax matters, especially with the Tax Power of Attorney (POA) form TC-737, several additional forms and documents are often required to ensure comprehensive handling of one's tax affairs. These documents help in providing clearer instructions, reporting relevant financial information, and ensuring that all necessary authorizations are in place for smooth operations with the tax authorities. Below is a list of these crucial documents that are typically used alongside the Tax POA form TC-737.

- Form 2848, Power of Attorney and Declaration of Representative: This IRS form allows individuals to grant authority to a specific person, usually a tax professional, to represent them before the IRS. It covers more detailed representations beyond the state-level Tax POA.

- Form 8821, Tax Information Authorization: Unlike the Power of Attorney, this form allows appointed individuals to inspect and/or receive confidential tax information but does not authorize them to represent you before the IRS or otherwise act on your behalf.

- Form W-9, Request for Taxpayer Identification Number and Certification: Often used in conjunction with the Tax POA to verify the taxpayer’s identification number. This is crucial for tax reporting and withholding purposes.

- Annual Tax Return Forms (e.g., Form 1040 for individuals, Form 1065 for partnerships): Providing the latest tax return to the individual holding the POA can help in understanding the tax situation better, making it easier to address any issues with tax authorities.

- Financial Statements and Records: These include bank statements, income statements, and other financial documents that provide a snapshot of the taxpayer's financial situation. They are necessary for the POA holder to make informed decisions and take actions concerning tax matters.

Together, these documents form a robust framework for addressing a wide range of tax-related issues. By complementing the Tax POA form TC-737 with these forms, individuals can ensure that their tax matters are handled efficiently and with the requisite level of authority. Taking the time to understand and properly execute these documents can save time, reduce stress, and potentially mitigate any tax-related complications.

Similar forms

The IRS Form 2848, Power of Attorney and Declaration of Representative, is closely related to the Tax POA Form TC-737. This document similarly allows a taxpayer to appoint an individual, often a tax professional or attorney, to represent them in dealings with the IRS. Like the TC-737, it specifies the extent of the powers granted, including which tax matters and years are covered.

Form 8821, Tax Information Authorization, shares similarities with the TC-737 as well. Though not a power of attorney, it permits individuals to designate someone to receive and inspect their confidential tax information for specified years. While it doesn't allow representation actions, like signing documents, it is often used alongside power of attorney forms for comprehensive tax planning and management.

The Durable Power of Attorney for Finances is another document akin to the TC-737. It empowers someone to handle a wide range of financial matters on behalf of the individual. Unlike the narrowly focused TC-737, which is specific to tax matters, this document encompasses all financial decisions and transactions, offering a broader representation authority.

A Medical Power of Attorney is a form that, while different in content and purpose, operates on a principle similar to that of the TC-737. It designates someone to make healthcare decisions on an individual's behalf when they are unable to do so themselves. Both documents involve granting another person authority to make critical decisions, highlighting the trust placed in the designated representative.

The General Power of Attorney form grants broad powers to a designated agent to manage an array of tasks and decisions on behalf of the grantor. It is similar to the Tax POA TC-737 in the fundamental concept of representation and delegation of authority, but it is more extensive, covering legal, financial, and personal affairs beyond just tax-related matters.

The Limited Power of Attorney is a document that specifies exactly what powers an agent has, often restricted to a single transaction or a limited period. It shares the concept of designated representation with the TC-737 but is more narrowly tailored, highlighting its use for specific tasks instead of a broad array of tax matters.

The Advance Health Care Directive, or living will, allows individuals to outline their wishes regarding medical treatment should they become incapacitated. While it does not grant representation rights in tax matters like the TC-737, it embodies a similar preparatory mindset, designating authority for personal care decisions when one is unable to make those decisions themselves.

The Revocation of Power of Attorney is a document that, as the name suggests, cancels a previously granted power of attorney. It's relevant to consider in the context of the TC-737 because it represents the control individuals maintain over the powers they delegate, ensuring they can retract those powers if needed, similar to how they might revoke tax representation rights.

The Business Power of Attorney gives an agent authority to act on behalf of a business rather than an individual. Like the TC-737, this document is crucial for delegating decision-making powers, particularly in complex or specialized areas like taxes, but it is geared towards ensuring business operations continue seamlessly.

Finally, the Executorship Documents, part of estate planning, designate an individual to manage and distribute a decedent's estate according to their will. While not a form of power of attorney, it relates to the TC-737 through the delegation of responsibility and authority, focusing on posthumous financial and legal matters instead of personal representation.

Dos and Don'ts

When it comes to filling out the Tax Power of Attorney (POA) Form TC-737, it's essential to approach the task with attention to detail and an understanding of the broader implications. A properly executed POA form grants another individual or entity the authority to handle tax matters on your behalf, making accuracy and clarity paramount. Below are key do’s and don'ts to consider:

Do:Read instructions carefully. The form comes with specific instructions designed to help you fill it out correctly. Understanding these instructions fully before beginning can prevent errors and ensure that the form accurately reflects your intentions.

Provide accurate information. Every detail, from your name and address to your tax identification numbers, must be correct to avoid delays or issues with the tax authority recognizing the POA.

Clearly identify the powers granted. Specify exactly what tax matters and years or periods the POA covers. Being explicit about what the agent is allowed to do prevents confusion and unauthorized actions.

Select an agent wisely. Your agent will have significant responsibilities and access to sensitive information, so choose someone who is trustworthy and, if possible, has experience in tax matters.

Sign and date the form. A Tax POA Form TC-737 is not valid without your signature and the date. This also applies to the agent, who must agree to the responsibilities assigned.

Keep a copy for your records. Once the form is filled out, signed, and submitted, make sure to keep a copy for your own records. This will help you track the POA’s status and prove its existence if needed.

Leave sections blank. If a section does not apply or the information is unknown, be sure to indicate this clearly. Blank sections can cause the form to be returned or processing to be delayed.

Use a POA form that is outdated. Tax laws and forms can change. Always use the most current version of Form TC-737 to ensure compliance with the latest regulations.

Rush through the form. Taking your time to fill out the form diligently will help avoid errors that could complicate your tax matters or delay processing.

Forget to notify your agent. Make sure the person or entity you’re granting power to is aware of their designation and accepts the responsibility before you submit the form.

Overlook the need for a witness or notarization, if required. Some jurisdictions may require your signature to be witnessed or notarized. Failing to meet this requirement could invalidate the POA.

Assume the POA is immediately effective. There may be processing times or additional steps before the POA becomes effective. Understand the process and timeline to manage your expectations accordingly.

Misconceptions

When dealing with tax matters, understanding the ins and outs of specific forms is crucial to navigating these often complex waters. One form that comes up frequently in tax discussions is the Tax Power of Attorney (POA), particularly in some states, the TC-737 form. Like with anything tax-related, there are many misconceptions floating around. Let's clear up some of the more common misunderstandings.

A Tax POA form gives someone the right to do whatever they want with your finances. This is a big misconception. In reality, a Tax POA, such as the TC-737 form, specifically grants an individual the authority to handle tax matters with the tax agency. It does not give blanket permission to access bank accounts, make financial decisions outside of tax matters, or other financial powers unless explicitly stated.

Once signed, a Tax POA is irreversible. Not true. The person who granted the power (the principal) can revoke it at any time as long as they are mentally competent. It's a matter of completing a revocation process that typically involves notifying the agent and the tax agency in writing.

Any POA form will work for tax purposes. Each state has specific forms for tax-related matters. For example, the TC-737 is a form used in a particular state for tax POA purposes. Using the wrong form can result in your POA not being recognized by the tax authority.

The Tax POA form is only for people who are ill or elderly. While it's true that people facing health challenges or the elderly might need to appoint a tax power of attorney more often, anyone who wants someone else to handle their tax matters for any reason can use this form. This could be due to travel, living abroad, or simply preferring to have a professional handle it.

The Tax POA form tc-737 allows the agent to file taxes for any year. The form typically requires you to specify the tax years or periods the agent is authorized to discuss or act on. Without specifying the period, the agent's power may be limited.

You need a lawyer to complete the TC-737 form. While consulting a lawyer can be very helpful, especially in complicated tax situations, it is not a requirement for completing the Tax POA form. The form is designed to be filled out by the taxpayer. However, understanding all legal aspects can maximize the form’s effectiveness and ensure all interests are protected.

The same Tax POA form is used throughout the United States. This is not the case. The TC-737 is specific to certain jurisdictions. Different states may have different forms and requirements for a tax power of attorney. It's important to use the correct form for your state.

Only family members can be designated as your agent on a Tax POA. Actually, you can appoint anyone you trust and who agrees to act on your behalf as your agent. This includes friends, attorneys, certified public accountants, enrolled agents, or family members.

Filing a Tax POA form means you're being audited. Simply filing a Tax POA form does not indicate you are being audited. Many people use the Tax POA for convenience, to allow someone else to handle routine tax matters, or to represent them if there is an issue needing resolution with the tax authorities.

Completing a Tax POA form is a lengthy and complex process. While it's important to be thorough and ensure all information is accurate, completing a Tax POA form like the TC-737 can be straightforward. The form is designed to be simple to fill out, with instructions for each section to guide you through the process.

Understanding these points can demystify the process and purpose of the Tax Power of Attorney form, making it a less daunting undertaking. Whether planning for the future, managing current tax matters, or ensuring your interests are properly represented, knowing the facts about the TC-737 form can help you make informed decisions.

Key takeaways

Filing a Tax Power of Attorney (POA) form, specifically the TC-737 form, is an essential process that allows individuals to grant another person the authority to handle their tax matters. This includes the ability to communicate with tax authorities, access confidential tax information, and make decisions regarding taxes on the individual's behalf. Understanding the key takeaways about filling out and using this form can streamline the process, ensuring it is completed accurately and efficiently. Here are several important points to consider:

- Know the scope of authority you are granting. When filling out the TC-737 form, it's critical to be clear about the extent of power you're giving to your representative. This can range from allowing them to obtain tax information, to representing you in tax matters, or making binding decisions. Specify what your representative can and cannot do on your behalf.

- Choose your representative wisely. The person you designate as your Power of Attorney will have significant control over your tax matters. This can be an accountant, attorney, family member, or any trusted individual. Ensure that the person you choose is reliable, knowledgeable in tax matters, and willing to act in your best interest.

- Complete the form with accurate details. Filling out the TC-737 with accurate information is paramount. This includes your personal information, the representative’s details, the tax matters for which you're granting authority, and the specific tax periods involved. Mistakes or omissions can delay processing or hamper your representative's ability to act on your behalf.

- Sign and date the form. Your signature is required to validate the Tax Power of Attorney. The date of signing is also important as it can affect the timeframe during which the POA is considered valid. Ensure these elements are not overlooked to avoid the need for a resubmission.

- Keep a record and know when it expires. Once the TC-737 form is completed and submitted, keep a copy for your records. Be aware of any expiration dates or conditions that may render the POA obsolete. Staying informed about the status of your Tax POA ensures that it remains effective and serves its intended purpose.

Handling tax matters requires diligence and an understanding of legal documents like the TC-737 Tax Power of Attorney form. By paying careful attention to the details and ensuring that the form is correctly filled out and submitted, taxpayers can navigate tax matters more effectively, with the confidence that their affairs are being managed as they wish.