Get Tax POA form ri-2848 Form

When navigating the complexities of taxation and legal representation, understanding the utility and scope of certain documents becomes paramount for both individuals and entities. Among these critical documents is the Tax Power of Attorney (POA) form, specifically the Rhode Island form RI-2848, which serves a pivotal role in the realm of tax management and representation. This form essentially grants an individual or an entity the authority to appoint another person, typically a tax professional, to handle tax-related matters with the Rhode Island Division of Taxation on their behalf. It encompasses various aspects ranging from discussing tax matters, obtaining confidential tax information, to representing the taxpayer in front of tax authorities. Designed to streamline the process of tax representation, the RI-2848 form is a testament to the organized approach taken by Rhode Island in empowering taxpayers to secure professional assistance with ease and legality. This empowerment ensures not only the proper management of one’s tax affairs but also provides a safeguard against potential legal pitfalls by ensuring representation is both authorized and documented. Understanding the ins and outs, from who can be appointed to the specific powers granted and the form’s expiration, is crucial for leveraging its benefits to the fullest.

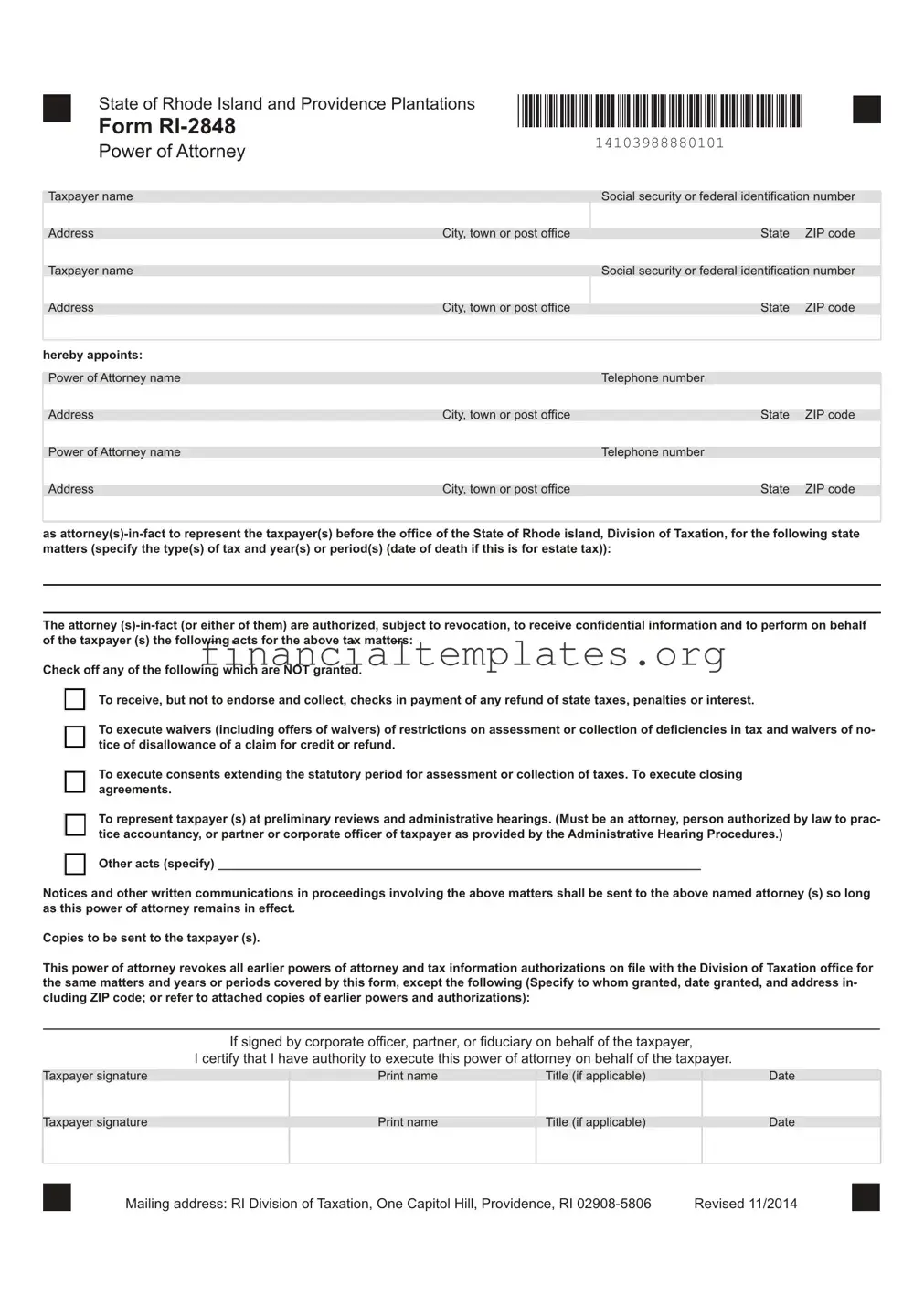

Tax POA form ri-2848 Example

■ |

State of Rhode Island and Providence Plantations |

Illllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll 111111111111111111 |

■ |

Form |

|||

|

Power of Attorney |

14103988880101 |

|

Taxpayer name |

|

Social security or federal identification number |

|

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

|

Taxpayer name |

|

Social security or federal identification number |

|

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

|

hereby appoints: |

|

|

|

|

|

|

|

|

|

Power of Attorney name |

|

Telephone number |

|

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

|

|

|

|

|

Power of Attorney name |

|

Telephone number |

|

|

|

|

|

|

|

Address |

City, town or post office |

State |

ZIP code |

|

as

The attorney

Check off any of the following which are NOT granted.

[ I

[ I

□

□

□

To receive, but not to endorse and collect, checks in payment of any refund of state taxes, penalties or interest.

To execute waivers (including offers of waivers) of restrictions on assessment or collection of deficiencies in tax and waivers of no- tice of disallowance of a claim for credit or refund.

To execute consents extending the statutory period for assessment or collection of taxes. To execute closing agreements.

To represent taxpayer (s) at preliminary reviews and administrative hearings. (Must be an attorney, person authorized by law to prac- tice accountancy, or partner or corporate officer of taxpayer as provided by the Administrative Hearing Procedures.)

Other acts (specify) ______________________________________________________________________

Notices and other written communications in proceedings involving the above matters shall be sent to the above named attorney (s) so long as this power of attorney remains in effect.

Copies to be sent to the taxpayer (s).

This power of attorney revokes all earlier powers of attorney and tax information authorizations on file with the Division of Taxation office for the same matters and years or periods covered by this form, except the following (Specify to whom granted, date granted, and address in- cluding ZIP code; or refer to attached copies of earlier powers and authorizations):

If signed by corporate officer, partner, or fiduciary on behalf of the taxpayer,

I certify that I have authority to execute this power of attorney on behalf of the taxpayer.

Taxpayer signature |

Print name |

Title (if applicable) |

Date |

|

|

|

|

|

|

Taxpayer signature |

Print name |

Title (if applicable) |

Date |

|

|

|

|

|

■ |

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI |

Revised 11/2014 |

■ |

■ |

State of Rhode Island and Providence Plantations |

Illllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll lllll 111111111111111111 |

■ |

Form |

|||

|

Power of Attorney |

14103988880102 |

|

This declaration must be completed by the attorney, certified public accountant, licensed public accountant, or enrolled agent. I declare that I am not currently under suspension or disbarment from practice before the Division of Taxation and that:

□

□

□

[ I

I am a member in good standing of the bar of the highest court of the jurisdiction indicated below; or

I am duly qualified to practice as a certified public accountant in the jurisdiction indicated below; or

I am a licensed public accountant in the jurisdiction indicated below.

I am actively enrolled to practice before the Internal Revenue Service.

Designation |

Jurisdiction |

Signature |

Date |

(Attorney, CPA, LPA or enrolled agent) |

(State, etc) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If the power of attorney is granted to a person other than an attorney, certified public accountant, or licensed public accountant, or enrolled agent, it must be witnessed or notarized below.

The person (s) signing as or for the taxpayer (s): (Check and complete ONE.)

|

|

□ |

|

|

|

is/are known to and signed in the presence of the two disinterested witnesses whose signatures appear here: |

|

|

|

|

|

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of witness |

Date |

|

|

|

|

||||

|

LJ |

|

appeared this day before a notary public and acknowledged this power of attorney as a voluntary act and deed |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of notary |

Date |

NOTARIAL SEAL

■■

Document Specifics

| Fact Number | Fact Description |

|---|---|

| 1 | The RI-2848 form is specifically designed for authorizing a power of attorney (POA) related to tax matters in Rhode Island. |

| 2 | This form allows individuals or businesses to grant authority to a representative to receive confidential tax information and make decisions regarding taxes on their behalf. |

| 3 | The person granted this power can represent the grantor before the Rhode Island Division of Taxation. |

| 4 | It requires detailed information including the name, address, and phone number of the representative, as well as specifics of the tax matters they're authorized to handle. |

| 5 | The form must specify the types of taxes and periods for which the POA is granted. |

| 6 | Both the grantor and the representative must sign the RI-2848 form for it to be effective. |

| 7 | Governing laws for the RI-2848 form include Rhode Island General Laws related to taxation and power of attorney. |

| 8 | Before the form can be used, it must be filed with the Rhode Island Division of Taxation. |

| 9 | Cancellation of the POA requires written notice to the Rhode Island Division of Taxation. |

Guide to Writing Tax POA form ri-2848

Once a taxpayer decides to assign someone else the authority to handle their tax matters with the Rhode Island Division of Taxation, the RI-2848 form becomes an essential document. This authorization enables a designated individual, typically a tax professional, to communicate and perform actions on behalf of the taxpayer. It involves careful completion and accuracy to ensure proper representation and to facilitate the handling of tax affairs without unnecessary delays or errors.

Here are the steps to accurately fill out the RI-2848 Tax Power of Attorney form:

- Begin by entering the taxpayer's full name and address, including city, state, and zip code, in the designated area at the top of the form.

- Next, fill in the taxpayer’s identification number (for individuals, this is typically the Social Security Number, and for businesses, the Employer Identification Number).

- Specify the tax matters and years or periods for which the authorization is granted. Be precise in listing the types of tax and the corresponding year(s) or period(s), such as "Income Tax 2020, 2021".

- Enter the name and address of the appointed representative. If the firm name is applicable, include it alongside the representative's information.

- Fill in the representative’s telephone number, fax number, and email address to ensure they can be contacted by the Rhode Island Division of Taxation.

- Check the box if you want to retain a previously authorized representative on record for the same tax matters and periods covered by this document. If not, leaving this section blank automatically revokes prior authorizations.

- At the bottom of the form, the taxpayer(s) must sign and date the form. If it’s a joint filing, both taxpayers must sign. Also, include the taxpayer’s printed name and title if applicable.

- The designated representative also signs and dates the form to accept the authorization, providing their printed name and indicating their status as a representative.

After the form is filled out, review it to ensure all information is correct and complete. The next step involves submitting the document to the Rhode Island Division of Taxation. This can usually be done via mail or fax, but it's wise to check the latest submission guidelines directly with the state's Division of Taxation. Once submitted, the form will be processed, enabling the appointed representative to act on the taxpayer's behalf for the specified tax matters and period. Keep a copy of the completed form for your records, as it serves as proof of the authorized relationship between the taxpayer and the representative.

Understanding Tax POA form ri-2848

-

What is the Tax POA Form RI-2848 and who needs it?

The Tax Power of Attorney (POA) form RI-2848 is a legal document that allows individuals or entities to grant authority to a designated representative or agent to handle their tax matters before the Rhode Island Division of Taxation. This form is crucial for anyone who wishes to have another party manage their tax-related tasks, such as filing returns, making payments, or addressing tax disputes on their behalf. It's particularly helpful for individuals who may not have the time, knowledge, or ability to deal with tax issues themselves and prefer professional assistance.

-

How do you fill out Form RI-2848?

Filling out Form RI-2848 requires careful attention to detail to ensure that all necessary information is accurately provided. The steps generally include:

- Identifying the taxpayer(s) by providing names, addresses, and identifying numbers (e.g., Social Security Numbers or Employer Identification Numbers).

- Designating the representative(s) by listing their name(s), address(es), and contact information. Each representative's qualifications, such as being an attorney, certified public accountant, or enrolled agent, should also be noted.

- Specifying the tax matters and years or periods for which the POA is granted. It's important to clearly outline the extent of authority being granted.

- Signing and dating the form by both the taxpayer(s) and the representative(s). The form may also need to be witnessed or notarized, depending on state requirements.

Each section of the form provides detailed instructions to guide the process, ensuring the POA is valid and accurately reflects the taxpayer's wishes.

-

Can Form RI-2848 be revoked, and if so, how?

Yes, Form RI-2848 can be revoked by the taxpayer at any time. To revoke the authorization, the taxpayer must provide a written notice to the Rhode Island Division of Taxation stating their intent to revoke the power of attorney. This notice should include the taxpayer's name, identification number, the name of the representative being revoked, and a statement that the taxpayer is revoking the powers granted under the RI-2848 form. It's also advisable to include the date the original POA was signed. Sending a copy of the revocation notice to the former representative is considered best practice to ensure all parties are aware of the change.

-

What are the common mistakes to avoid when filling out Form RI-2848?

A few common mistakes can jeopardize the validity of the Tax POA Form RI-2848, including:

- Not providing complete or accurate taxpayer information, such as incorrect Social Security Numbers or addresses.

- Failing to list the specific tax forms or periods the representative is authorized to handle, which can lead to confusion or limited authority.

- Omitting required signatures from either the taxpayer(s) or the representative(s), which is essential for the form to be legally binding.

- Choosing a representative who does not have the proper qualifications or who the taxpayer does not fully trust, potentially leading to mismanagement of tax matters.

By avoiding these errors, taxpayers can ensure their POA accurately conveys their intentions and is accepted by the Rhode Island Division of Taxation.

-

Where should Form RI-2848 be submitted?

After completing and signing Form RI-2848, the document should be submitted to the Rhode Island Division of Taxation. The specific submission instructions, including the mailing address or online submission options, are typically provided on the form or can be found on the Rhode Island Division of Taxation's website. It's crucial to verify the current submission guidelines to ensure the POA is properly filed and recognized. Taxpayers might also consider keeping a copy of the filed form for their records.

Common mistakes

When completing the Tax Power of Attorney (POA) Form RI-2848, individuals occasionally make errors that can impact the processing and effectiveness of the form. Understanding these mistakes is crucial for ensuring that the Tax POA form is filled out correctly and serves its intended purpose. Here are some common errors:

- Not providing complete information. Completing all the required fields on the form is essential. Missing information can lead to delays or the rejection of the form.

- Failing to specify the type of tax and tax periods covered. The form requires specific details about which taxes and periods the POA applies to. Vague descriptions can render the document ineffective.

- Incorrectly identifying the representative(s). It’s important to accurately provide the name, address, and contact information of the appointed representative(s) to ensure they have the authority to act on your behalf.

- Overlooking the need for signatures. Both the taxpayer and the representative must sign the form. Failing to include these signatures means the POA will not be valid.

- Not specifying limitations. If there are specific powers or time frames you want to limit, failing to note these on the form can lead to a broader authority than intended.

- Forgetting to revoke prior POAs. If you have previously filed a POA and wish to replace it with a new one, you must indicate that the new form revokes all prior authorizations.

To avoid these mistakes:

- Double-check that all sections of the form are completed.

- Clearly define the tax matters and periods the POA covers.

- Ensure the representative’s information is accurate and complete.

- Verify that all necessary signatures are on the form.

- Include any specific restrictions or limitations on the representative’s authority.

- Remember to state clearly if any previous POAs are to be revoked by the new one.

By paying attention to these details, you can ensure that your Tax POA Form RI-2848 is accurately completed and effectively grants the necessary powers to your chosen representative.

Documents used along the form

When managing tax matters, especially when using the Tax Power of Attorney (POA) form RI-2848, it's essential to have a comprehensive understanding of related documents that could support or be required in the process. These documents can range from forms enabling representation by a tax professional to various types of financial statements. Having these documents in order facilitates a smoother interaction with tax authorities and helps ensure that all financial information is accurately represented.

- Form 1040 – Commonly known as the U.S. Individual Income Tax Return, it is the standard federal income tax form individuals use to report their income, claim tax deductions and credits, and determine their tax refund or tax bill.

- Form W-2 – This form is issued by employers to employees, detailing the employee's annual wages and the amount of taxes withheld from their paycheck. It's fundamental for accurately completing a tax return.

- Form 1099 – Often used to report income from sources other than wages, such as independent contractor income, interest and dividends, and government payment, among others.

- Form 8821, Tax Information Authorization – This document authorizes individuals or organizations to review someone's tax records but does not allow them to represent the taxpayer before the IRS.

- Form 8865 – Required for U.S. persons who are involved in certain foreign partnerships. This form reports the activities of the partnership, including income, deductions, and taxes.

- Form 433-A – Collection Information Statement for Wage Earners and Self-Employed Individuals, used to provide financial information necessary to establish an agreement on how to pay a tax debt.

- Form 433-B – Collection Information Statement for Businesses, required when a business owes a tax debt to the IRS, detailing the financial situation of the business.

- Schedule C (Form 1040) – Used by sole proprietors to report profit or loss from a business. This schedule outlines the income, expenses, and potential deductions for the business.

- Form 2848 – A different POA form that gives one or more individuals the authority to represent the taxpayer before the IRS, including performing acts and making decisions.

- Form SS-4 – Application for Employer Identification Number (EIN), necessary for businesses to legally operate. The EIN is required for tax administration purposes.

This collection of forms and documents serves as the backbone for navigating the complex landscape of tax representation and compliance. Whether an individual is dealing with personal tax issues or managing business-related tax matters, having the right forms prepared and understanding their purpose is crucial. The process can be intricate, but thorough preparation and knowledge can greatly simplify handling tax affairs.

Similar forms

The Tax Power of Attorney (POA) form RI-2848 is similar to the IRS Form 2848, "Power of Attorney and Declaration of Representative." Both serve the purpose of granting an individual or entity the authority to represent the signer before the tax authorities. This representation can include discussing the taxpayer’s confidential tax information, signing agreements, or making decisions regarding tax matters on the taxpayer's behalf. The main difference lies in their jurisdictional use; while the RI-2848 is specific to the state of Rhode Island, the IRS Form 2848 is used for federal tax purposes.

Similar to the General Power of Attorney, the Tax POA allows the principal to designate an agent to handle their affairs. However, the scope of the General Power of Attorney is broader, typically covering legal and financial decisions beyond just tax matters. The Tax POA, specifically form RI-2848, is narrowly focused on tax-related issues, limiting the agent’s authority to dealings with tax matters within Rhode Island.

The Durable Power of Attorney for Healthcare is another document akin to the Tax POA form RI-2848 in that it allows an individual to appoint someone to make decisions on their behalf. The primary difference is in the type of decisions the designee is authorized to make; while the Tax POA pertains to tax matters, the Durable Power of Attorney for Healthcare focuses on medical decisions in the event that the principal becomes incapacitated.

The Limited Power of Attorney is a document that, like the Tax POA, grants someone else the authority to act on your behalf in specific circumstances. This similarity lies in the limited and specified nature of the authority granted. However, the Limited Power of Attorney can apply to a variety of situations outside of tax matters, such as selling a particular piece of property, unlike the Tax POA form RI-2848, which is restricted to tax-related activities.

The Advanced Healthcare Directive, while primarily a medical document, shares a foundational concept with the Tax POA form RI-2848: appointing an agent to act on the principal’s behalf. The scope, however, differs significantly; an Advanced Healthcare Directive outlines preferences for medical treatment and end-of-life care, rather than dealing with tax matters.

The Estate Plan, including documents like wills and trusts, shares the Tax POA’s element of planning and designating personal affairs to trusted individuals. Within an Estate Plan, the focus is on the distribution of assets and care of dependents after the principal's death, while the Tax POA focuses on the ongoing management of tax affairs by an appointed agent.

Finally, the Business Power of Attorney is similar to the Tax POA form RI-2848 in that it allows business owners to appoint someone to make decisions and take actions related to their business. This can include financial transactions and legal decisions, providing a mechanism to ensure business operations continue smoothly in the owner's absence. Like the Tax POA, it centers on the principle of granting authority to another, but it’s directed towards the comprehensive needs of a business, beyond just tax matters.

Dos and Don'ts

When completing the Tax Power of Attorney (POA) Form RI-2848, it is crucial to follow specific guidelines to ensure the form is filled out correctly and accurately. This list highlights the do's and don'ts to assist in a smooth and error-free submission process.

- Do provide complete information for all required fields, including full names, addresses, and identification numbers.

- Do review the form thoroughly to confirm that all provided information is accurate and no sections have been overlooked.

- Do use black ink for better legibility, whether filling out the form by hand or typing.

- Do specify the tax periods and types of taxes your representative will have authority over clearly.

- Do ensure that both the taxpayer and the appointed representative sign and date the form, as it will not be valid without both signatures.

- Don't leave any sections blank that are applicable to your situation; incomplete forms may lead to delays or rejections.

- Don't sign the form without verifying that all the information is correct and that you fully understand the powers you are granting to your representative.

- Don't forget to include your phone number and email address, if available, to facilitate quick communication regarding your form.

- Don't use correction fluid or tape on the form; if an error is made, it's better to start with a new form to ensure readability.

- Don't hesitate to seek assistance from a tax professional if you have questions about how to properly fill out the form or if you're unsure about any of the information being requested.

Misconceptions

Understanding the Tax Power of Attorney (POA) form, particularly the RI-2848 form used in Rhode Island, is crucial for individuals managing their tax matters. There exists a range of misconceptions regarding this form, which can lead to unnecessary confusion and errors. The following list debunks some of the common myths about the RI-2848 form to provide clarity.

Only individuals can grant a Tax POA: There's a misconception that the RI-2848 form is exclusively for individual taxpayers. However, this form is not limited to individuals; business entities can also use it to authorize representatives to handle their tax matters.

The form grants unlimited power: Another common misunderstanding is that completing a RI-2848 form gives the representative unrestricted authority over the taxpayer’s affairs. In reality, the scope of authority is defined in the form itself, allowing taxpayers to set specific limits on the powers granted to their representative.

Any tax professional can be appointed: While it's true that taxpayers can choose who to represent them, not everyone qualifies as a representative under the RI-2848 form. Representatives need to be eligible based on the criteria set by tax laws, typically including attorneys, certified public accountants, and other individuals authorized by the IRS or state tax agency.

A Tax POA is permanent: Many believe once granted, a Tax POA lasts indefinitely. This is not the case with the RI-2848 form; it contains provisions for specifying the duration of the power of attorney. Taxpayers can set an expiration date or event that will automatically terminate the authorization.

Filing the form with the IRS: A significant misconception is that the RI-2848 form must be filed with the Internal Revenue Service (IRS). The RI-2848 form, specific to Rhode Island, should be filed with the Rhode Island Division of Taxation. This is because it pertains to tax matters within the state as opposed to federal tax issues handled by the IRS.

Key takeaways

The Tax Power of Attorney (POA) Form RI-2848 is a crucial document that enables individuals to appoint someone else to handle their tax matters with the tax authority. Understanding the appropriate way to fill out and use this form is essential for both the taxpayer and the appointed representative. Here are key takeaways that can help navigate the completion and application of this form:

- Accurate Information is Crucial: When filling out the Tax POA form RI-2848, it's imperative to provide accurate information about both the taxpayer and the representative. This includes full names, addresses, and tax identification numbers. Any errors in this information could lead to delays or issues in the processing of the form.

- Specify Tax Matters: The form allows for the specification of the tax matters and years or periods for which the representative is given authority. Detailing these items clearly ensures that the representative has the right permissions to act on behalf of the taxpayer for specific issues without overstepping their bounds.

- Understand the Authority Granted: By completing and signing the form, the taxpayer grants the representative the authority to perform acts such as receiving confidential tax information and making agreements with the tax authority. It's important for both parties to understand the extent of this authority.

- Keep Records and Revoke if Necessary: Once executed, it’s advisable to keep a copy of the Tax POA form RI-2848 for personal records. Additionally, should the need arise to change or revoke the representative’s authority, it must be done in writing. The taxpayer should understand the process for revocation to ensure they can effectively manage who has the power to handle their tax affairs.

Popular PDF Documents

Tax POA - Having a Tax POA in place can assist in expediting tax refunds by allowing the agent to communicate directly with the IRS.

Form 1065 for Llc - Through Form 1065, partnerships have a structured format to present their financial data for tax assessment purposes.

Where's My Application Irs - Form 8718 is designed to streamline the review of your application for tax exemption, making it a crucial document.