Get Tax POA form rd-1061 Form

In the realm of tax affairs, empowering someone to act on your behalf can streamline processes and ensure compliance with legal requirements. The Tax Power of Attorney (POA) form, specifically the RD-1061, serves as a critical tool in this aspect. It allows individuals or entities to grant authority to a trusted representative, enabling them to handle tax matters efficiently and effectively. This form is not just a document but a peace of mind, ensuring that tax-related tasks are managed by someone with the necessary expertise and understanding. From filing returns to communicating with tax authorities, the RD-1061 form facilitates a wide range of activities, making it an essential component for those seeking to manage their tax responsibilities without direct involvement. Understanding the scope, implications, and proper use of this form is essential for anyone looking to navigate the complexities of tax management with ease and confidence.

Tax POA form rd-1061 Example

Form

CLEAR

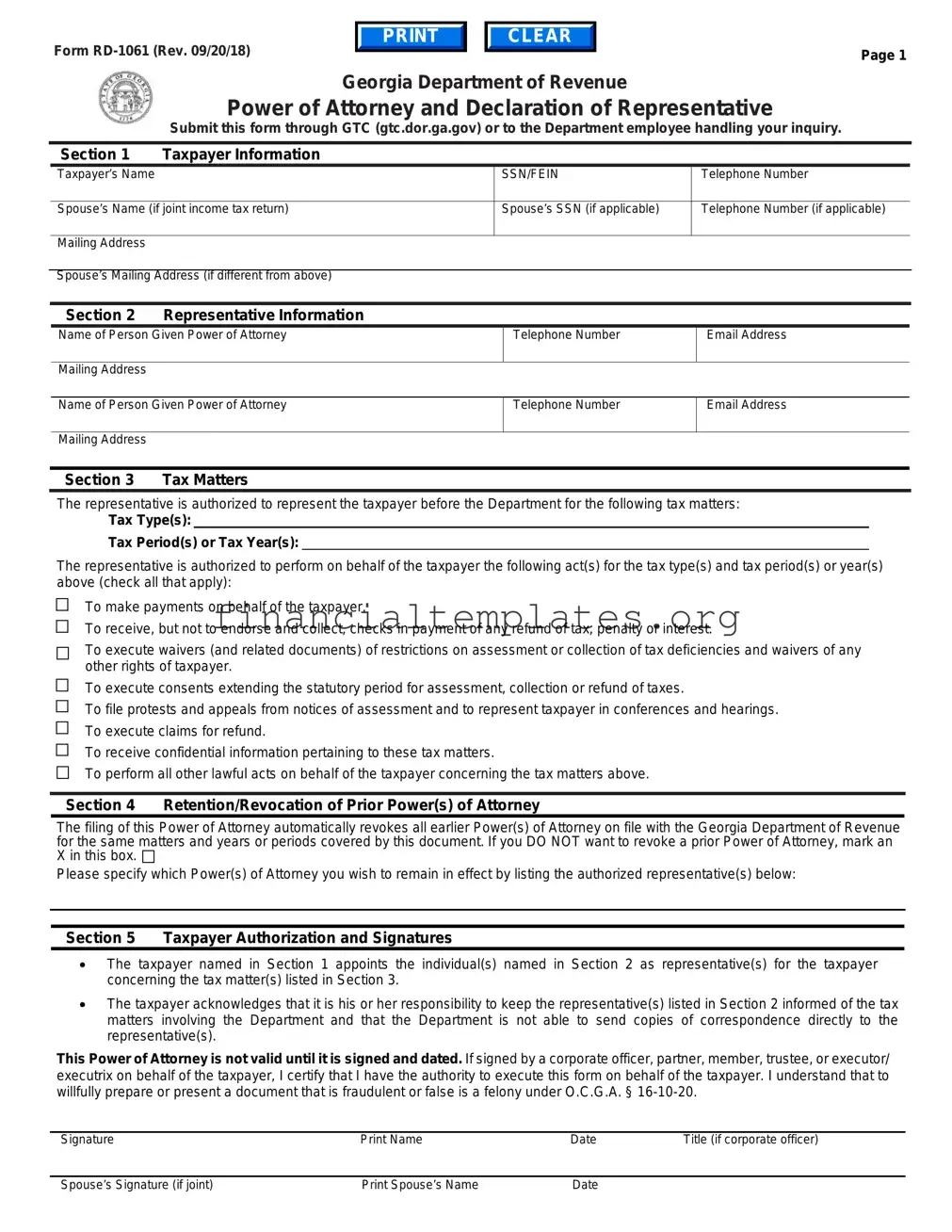

Page 1

Georgia Department of Revenue

Power of Attorney and Declaration of Representative

Submit this form through GTC (gtc.dor.ga.gov) or to the Department employee handling your inquiry.

Section 1 |

Taxpayer Information |

|

|

|

Taxpayer’s Name |

|

SSN/FEIN |

Telephone Number |

|

|

|

|

|

|

Spouse’s Name (if joint income tax return) |

Spouse’s SSN (if applicable) |

Telephone Number (if applicable) |

||

Mailing Address

Spouse’s Mailing Address (if different from above)

Section 2 Representative Information

Name of Person Given Power of Attorney

Mailing Address

Telephone Number

Email Address

Name of Person Given Power of Attorney

Mailing Address

Telephone Number

Email Address

Section 3 |

Tax Matters |

The representative is authorized to represent the taxpayer before the Department for the following tax matters:

Tax Type(s):

Tax Period(s) or Tax Year(s):

The representative is authorized to perform on behalf of the taxpayer the following act(s) for the tax type(s) and tax period(s) or year(s) above (check all that apply):

To make payments on behalf of the taxpayer.

To receive, but not to endorse and collect, checks in payment of any refund of tax, penalty or interest.

To execute waivers (and related documents) of restrictions on assessment or collection of tax deficiencies and waivers of any other rights of taxpayer.

To execute consents extending the statutory period for assessment, collection or refund of taxes.

To file protests and appeals from notices of assessment and to represent taxpayer in conferences and hearings.

To execute claims for refund.

To receive confidential information pertaining to these tax matters.

To perform all other lawful acts on behalf of the taxpayer concerning the tax matters above.

Section 4 Retention/Revocation of Prior Power(s) of Attorney

The filing of this Power of Attorney automatically revokes all earlier Power(s) of Attorney on file with the Georgia Department of Revenue for the same matters and years or periods covered by this document. If you DO NOT want to revoke a prior Power of Attorney, mark an X in this box.

Please specify which Power(s) of Attorney you wish to remain in effect by listing the authorized representative(s) below:

Section 5 Taxpayer Authorization and Signatures

•The taxpayer named in Section 1 appoints the individual(s) named in Section 2 as representative(s) for the taxpayer concerning the tax matter(s) listed in Section 3.

•The taxpayer acknowledges that it is his or her responsibility to keep the representative(s) listed in Section 2 informed of the tax matters involving the Department and that the Department is not able to send copies of correspondence directly to the representative(s).

This Power of Attorney is not valid until it is signed and dated. If signed by a corporate officer, partner, member, trustee, or executor/ executrix on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer. I understand that to willfully prepare or present a document that is fraudulent or false is a felony under O.C.G.A. §

Signature |

Print Name |

Date |

Title (if corporate officer) |

Spouse’s Signature (if joint) |

Print Spouse’s Name |

Date |

|

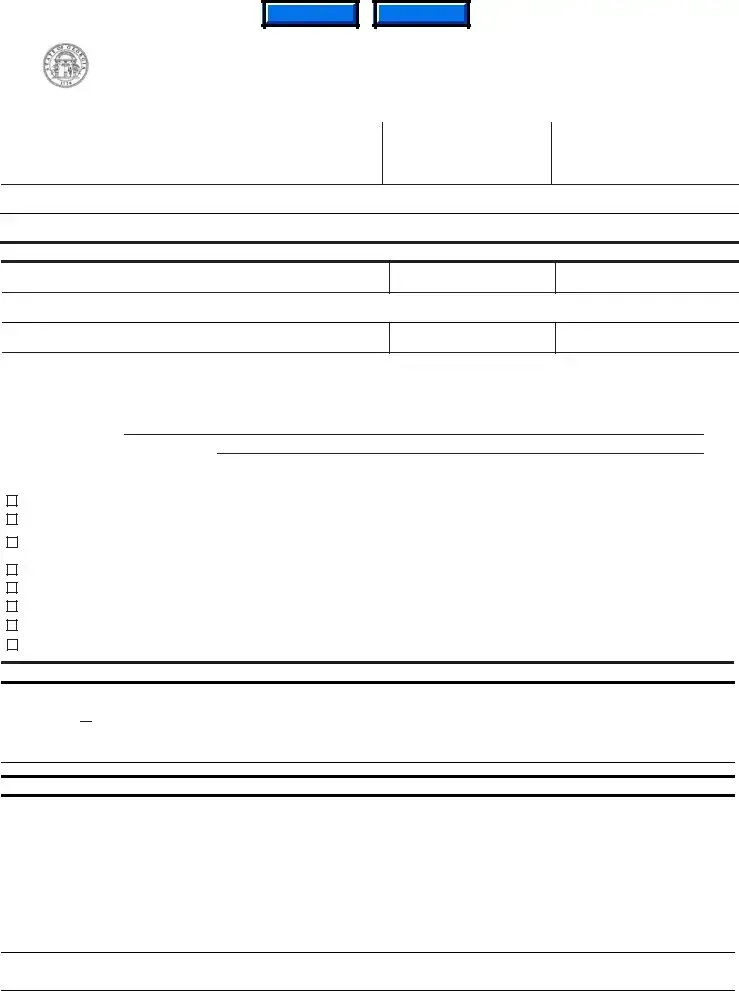

Form |

Page 2 |

Section 6 Acknowledgment of the Power of Attorney

This Power of Attorney must be acknowledged by the taxpayer before a notary public, unless the appointed representative(s) is licensed to practice as an

Acknowledgement of Power of Attorney. The person(s) signing as the taxpayer in Section 5 above appeared this day before a notary public and acknowledged this Power of Attorney as a voluntary act and deed.

Sworn and subscribed before me this __________ day of ______________________, 20_______.

Signature of Notary

Notary Seal

Date

Section 7 Declaration of Representative

Under penalties of perjury, I declare that:

• I am authorized to represent the taxpayer identified in Section 1 for the matter(s) specified in Section 3 of this form; and

•I am one of the following (indicate all thatapply):

1.An

2.A certified public accountant duly qualified to practice in the jurisdiction indicated below.

3.Enrolled as an agent to practice before the Internal Revenue Service under the requirements of Circular 230.

4.A registered public accountant.

Designation – use number(s) from above list

(1 - 4)

Licensing jurisdiction (state) or other licensing authority (if applicable)

Bar, license, certification,

registration, or enrollment number

Signature

Date

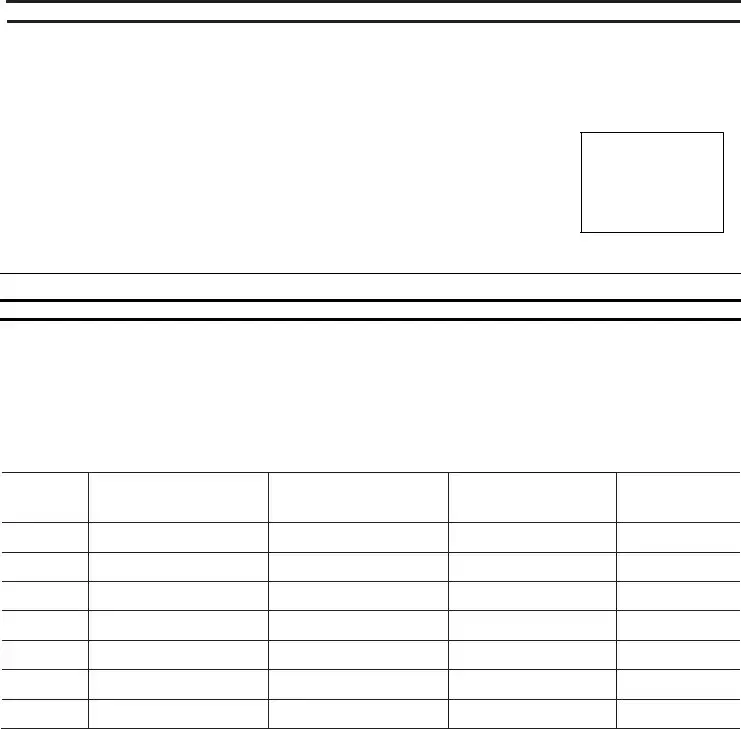

Form |

Page 3 |

Purpose of Form

A taxpayer may use Form

Filing Instructions

Taxpayers should submit Form

To upload to GTC: (1) Login, (2) Under “I Want To” select “See More Links”, (3) Select “Submit Power of Attorney", and (4) Follow the prompts to upload the Form

Revocation

If you have a valid Form

If the taxpayer or representative merely wants to revoke an existing authorization, upload a copy of the previously executed Form

Specific Instructions

Section 1 – Taxpayer Information

Enter the name, address, and contact information of the taxpayer. If the taxpayer is an individual, enter the full Social Security number (SSN). If the taxpayer is a business entity, enter the Federal Employer Identification Number (FEIN). If the taxpayer is granting access to a joint return, enter the spouse’s name, address, and full SSN.

Section 2 – Representative Information

Enter the representatives’ names, addresses and any applicable contact information. A representative must be an individual, not a business entity. If designating authority to more than two representatives, please attach a schedule similar in form to Section 2 signed by the taxpayer.

Section 3 – Tax Matters

Enter the tax type(s) and specific period(s) or year(s) for which the authorization is being granted. The Department will only discuss and/or disclose taxpayer information for the type(s) and period(s) listed. Notices and communications will be sent to the taxpayer, not the representative. The representative may access copies of taxpayer notices and communications via third party access to the taxpayer’s account through GTC.

Form |

Page 4 |

Section 4 – Retention/Revocation of Prior Power(s) of Attorney

All existing Form

Section 5 – Taxpayer Authorization and Signature

The taxpayer must sign in Section 5 for Form

Taxpayer |

Who Must Sign |

|

|

|

|

Individuals |

The individual/sole proprietor must sign (if granting access to a joint return, |

|

spouse must also sign). |

||

|

||

Corporations |

A corporate officer with authority to sign. |

|

|

|

|

Partnerships |

A partner having authority to act in the name of the partnership must sign. |

|

|

|

|

Limited Liability |

A member having authority to act in the name of the company must sign. |

|

Companies |

||

|

||

Trusts |

A trustee must sign. |

|

|

|

|

Estates |

An executor/executrix or the personal representative of the estate must sign. |

|

|

|

Section 6 – Acknowledgment of the Power of Attorney

This POA must be acknowledged by the taxpayer before a notary public, unless an appointed representative is an

Section 7 – Declaration of Representative

If an appointed representative is licensed to practice as an

Document Specifics

| Fact | Description |

|---|---|

| Name of Form | Tax Power of Attorney (POA) Form RD-1061 |

| Purpose | Allows a taxpayer to grant authority to an individual or entity to handle tax matters on their behalf. |

| Use | Used for a broad range of tax-related activities including but not limited to signing documents, obtaining confidential tax information, and representing the taxpayer in front of tax authorities. |

| Validity | Remains in effect until explicitly revoked by the taxpayer. |

| Revocation | Can be revoked by the taxpayer at any time with a written notice to the relevant tax authority. |

| Execution Requirements | Must be signed and dated by the taxpayer and the designated representative, with some jurisdictions requiring witness signatures or notarization. |

| State-Specific Forms | Some states may have their own version of a tax POA form with specific requirements and provision for their tax procedures. |

| Governing Law(s) | Varies by state, as each state may have different laws governing the execution, use, and validity of Tax POA forms. |

Guide to Writing Tax POA form rd-1061

Filling out the Tax Power of Attorney (POA) form is an important step for individuals who need to grant someone else the authority to handle their tax matters. This documentation process is straightforward but requires attention to detail to ensure that the powers granted are clearly understood and correctly assigned. By following these steps, you will be able to complete the form accurately and efficiently. Once the form is filled out and submitted, the designated individual will have the authority to manage tax-related tasks on your behalf, which can include filing taxes, obtaining confidential information, and representing you in front of tax authorities.

- Start by entering the full legal name of the person granting the power (the principal) in the designated space at the top of the form.

- Provide the complete address of the principal, including the city, state, and zip code.

- Enter the principal's taxpayer identification number (TIN) or Social Security Number (SSN) in the corresponding section.

- Fill in the name of the individual or organization being granted the power of attorney. Ensure to double-check the spelling to avoid any future discrepancies.

- Specify the address of the appointed representative, including city, state, and zip code.

- Input the representative's telephone number, fax number, and email address to facilitate easy communication.

- List the tax matters for which the representative is given authority, such as specific tax forms or years. Be precise to limit their power to only the necessary areas.

- Indicate the duration of the power of attorney by specifying the dates of effectiveness. If there's no expiration date, mention that the power remains effective until revoked.

- Review the form to ensure all provided information is correct and complete. Errors or omissions can lead to delays or the rejection of the form.

- Sign and date the form in the presence of a witness if required by your state's law. Both the principal and the representative must sign the form.

- Submit the completed form to the appropriate tax authority office as indicated in the form's instructions.

After the form has been successfully submitted, ensure to keep a copy for your records. The representative you've designated will then be equipped to handle the tax matters specified in the document. It's advisable to maintain open communication with your representative to monitor the progress and discuss any important decisions.

Understanding Tax POA form rd-1061

Welcome to our FAQ section regarding the Tax Power of Attorney (POA) Form RD-1061. This document plays a crucial role when you need someone else to handle your tax matters. Below, we have compiled answers to some of the most common questions to help you navigate through the process smoothly.

-

What is the Tax POA Form RD-1061?

The Tax POA Form RD-1061 is a legal document that allows an individual or entity (the principal) to grant authority to another individual or entity (the agent) to handle tax-related matters on their behalf. This may include filing taxes, obtaining tax information, and making decisions about tax payments and disputes.

-

Who can be appointed as an agent on the Form RD-1061?

Any trustworthy individual or entity with sufficient knowledge about taxes can be appointed as an agent. This often includes certified public accountants (CPAs), tax attorneys, or even trusted family members or friends who can manage these responsibilities effectively.

-

How do I complete the Tax POA Form RD-1061?

To complete the form, you will need to provide detailed information about both the principal and the agent. This includes names, addresses, and taxpayer identification numbers. Specify the tax matters and periods for which the POA is granted. Both the principal and the agent must sign the form, possibly in front of a notary, depending on your state's requirements.

-

Do I need to notarize the Tax POA Form RD-1061?

The necessity to notarize the form can vary by jurisdiction. Some states require notarization for the form to be valid, while others do not. It is important to check with your local regulations to ensure that all legal requirements are met.

-

When does the POA take effect, and how long does it last?

The POA typically takes effect as soon as it is signed and remains valid until it expires, is revoked by the principal, or the specific tax matter is resolved. The duration can be specified in the document itself.

-

Can the Tax POA Form RD-1061 be revoked?

Yes, the principal can revoke the POA at any time. To do so, they should provide written notice to both the agent and the tax authority, specifying the revocation of powers granted on the Form RD-1061.

-

Is there a fee to file the Tax POA Form RD-1061?

Generally, there is no fee to submit the Form RD-1061 to the tax authority. However, if you require the services of a professional to prepare or file the form, they may charge a fee for their services.

-

What should I do if my agent is no longer able or willing to serve?

If your agent can no longer fulfill their duties, you should revoke the current POA and appoint a new agent by completing a new Tax POA Form RD-1061. It is crucial to notify the tax authority about this change.

-

How do I submit the completed Tax POA Form RD-1061?

The completed form can usually be submitted to the appropriate tax authority via mail, fax, or in some cases, electronically. Specific submission instructions, including addresses and fax numbers, can be found on the tax authority’s website or by contacting them directly.

-

Where can I find the Tax POA Form RD-1061?

The form can often be downloaded from the website of your state’s tax department or obtained directly from the tax office. Ensure you are using the most current form to avoid any processing delays.

Understanding and completing the Tax POA Form RD-1061 correctly is crucial for ensuring that your tax matters are handled according to your wishes. Should you have any further questions, consider consulting with a tax professional who can provide guidance specific to your situation.

Common mistakes

When filling out the Tax Power of Attorney (POA) Form RD-1061, careful attention is needed. Mistakes can lead to delays or misunderstandings regarding the authority granted. Here are seven common errors:

Not verifying the form's current version. Tax regulations and forms can change. Using an outdated form may result in processing delays or the rejection of the form.

Failing to provide all necessary details for the taxpayer. Every piece of information asked for on the form is crucial, including full legal names, addresses, and tax identification numbers. Leaving fields blank can cause unnecessary holdups.

Incompletely naming the representative. The POA form must clearly state the name, address, and contact details of the individual granted authority. Ambiguities in this section can limit the effectiveness of the form.

Overlooking the need for specific tax matters and periods. The form requires detailing the types of tax and the periods or years for which the POA is valid. Being too vague or too broad can lead to confusion or limitations on the representative's ability to act.

Unspecified powers. If the form allows, specifying the powers granted to the representative ensures that both the taxpayer and the representative understand the extent of the authority given. This clarity can prevent future disputes.

Ignoring the witness or notarization requirements. Depending on state laws, a POA form might need to be either witnessed or notarized. Failing to comply with these legal formalities can invalidate the entire form.

Forgetting to sign and date the form. Without the taxpayer’s signature and the date, the form is incomplete and cannot be processed, constituting one of the most critical yet overlooked steps.

Individuals should consider these points carefully to ensure their Tax POA Form RD-1061 is filled out correctly and effectively. It’s advisable to consult with a tax professional or attorney if there are questions or concerns about the form or the process.

Documents used along the form

When dealing with tax matters, it’s crucial to have the right paperwork. The Tax Power of Attorney (Tax POA), often known as form RD-1061, plays a significant role in authorizing someone to handle your tax affairs. However, this form doesn't work alone. Several other documents are commonly used in conjunction to ensure comprehensive handling and clarification of one's tax-related matters. Understanding these forms can make navigating the bureaucratic waters of tax administration much more manageable.

- Form 2848 - Power of Attorney and Declaration of Representative: This IRS form is a broader POA that allows an individual to appoint someone else—usually a tax professional—to represent them before the IRS. While RD-1061 might be specific to a state or a particular tax matter, Form 2848 covers representation for federal tax issues, making it essential for dealing with IRS matters.

- Form 8821 - Tax Information Authorization: This document doesn't grant the power to represent you to the IRS but allows the person named on the form to receive your tax records and information. It's often used alongside a Tax POA when the appointed individual needs access to your tax history to make informed decisions or provide appropriate advice.

- Form W-9 - Request for Taxpayer Identification Number and Certification: Although not directly related to representation, Form W-9 is often required when setting up a financial account or arrangement that will have tax implications. This form provides your Taxpayer Identification Number (TIN) or Social Security Number (SSN) to the entity requesting it, ensuring proper reporting and tax compliance.

- Form 4506-T - Request for Transcript of Tax Return: This form is useful for obtaining a copy of your tax return information, which can be necessary for the individual with power of attorney to understand your tax obligations fully. It allows the representative to request a transcript of your tax return directly from the IRS, providing a comprehensive overview of your tax history.

Together with the Tax POA form RD-1061, these forms create a suite of documents that empower individuals and their appointed representatives to manage, understand, and comply with tax obligations effectively. Familiarizing oneself with these documents can significantly ease the burden of tax season and ensure that all arrangements are in order, offering both peace of mind and legal clarity.

Similar forms

The Tax Power of Attorney (POA) Form, often referred to as Form RD-1061, grants an individual the authority to manage another person's tax matters. This form is quite similar to the General Power of Attorney document. The General Power of Attorney provides broad powers to an agent to act on another's behalf, covering a wide range of affairs including financial and business matters, not just taxes. Both documents are pivotal in delegating authority, but the Tax POA is specific to tax issues, whereas the General Power of Attorney encompasses a broader spectrum of powers.

Another document akin to the Tax POA Form RD-1061 is the Durable Power of Attorney. This document remains in effect even if the principal becomes mentally incapacitated. Like the Tax POA, it can grant an agent the authority to handle affairs on behalf of the principal. The key difference lies in the durability aspect; the Tax POA does not inherently include provisions to remain effective during the principal's incapacity, focusing instead on tax-related matters during periods of the principal's competence.

The Limited Power of Attorney document also shares similarities with the Tax POA Form RD-1061. It grants an agent authority to act in specific matters or events, often for a limited time. For example, a Limited Power of Attorney might authorize an agent to sell a particular property. The Tax POA is a type of Limited Power of Attorney with a specific focus on tax matters, granting an agent authority to handle these matters with the tax authority on the principal’s behalf.

Finally, the Medical Power of Attorney is related insofar as it delegates authority to an agent, but this time for decisions regarding the principal's health care. Similar to the Tax POA, it allows someone to act on the principal’s behalf under defined circumstances. However, while the Tax POA deals with financial and tax-related decisions, the Medical Power of Attorney focuses exclusively on healthcare decisions, showing that powers of attorney can vary greatly in their scope and purpose.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) form, specifically the RD-1061, is a critical step for individuals who wish to authorize someone else to handle their tax matters. Ensuring that the form is completed accurately and effectively is vital. Here are some key dos and don'ts to consider:

Do:

- Verify the credentials of the individual or entity you are authorizing. Ensure they have the necessary experience and qualifications to handle your tax matters competently.

- Include all required information accurately, such as your full name, address, and taxpayer identification number (TIN), to avoid any processing delays.

- Clearly specify the tax matters and years for which the authorization is granted. Being precise about the scope and duration will help prevent any unauthorized access to your tax information.

- Sign and date the form. Your signature is a mandatory requirement for the form to be valid and enforceable.

- Keep a copy of the form for your records. Having a record will be helpful if there are any issues or disputes in the future.

Don't:

- Leave any fields blank. Incomplete forms may be rejected or result in delays in processing.

- Authorize someone you do not fully trust. The person or entity you empower will have access to sensitive tax information and the ability to make decisions on your behalf.

- Forget to revoke the POA when it is no longer needed or if you wish to appoint a new representative. An outdated POA can lead to confusion and potential misuse of your tax information.

- Ignore state-specific requirements. Some states may have unique provisions or additional forms that need to be completed in conjunction with the RD-1061 form.

- Fail to consult with a tax professional or attorney if you have questions or concerns about granting power of attorney for tax matters. Professional advice can help ensure that your rights and interests are adequately protected.

Misconceptions

Many people hold misconceptions about the Tax Power of Attorney (POA) form RD-1061. This document is crucial for granting someone else the authority to handle your tax matters, yet misunderstandings about its use and implications are common. Let's clear up some of these misconceptions.

It grants unlimited power: A common belief is that the Tax POA form RD-1061 gives the agent unrestricted power over all financial decisions. However, the form specifically limits the agent’s authority to tax matters. This means the agent can represent you in front of the tax authority, make decisions about tax payments, and access confidential tax information, but they do not have control over other financial or personal decisions.

It’s irreversible: Some think that once you've signed the Tax POA form RD-1061, it cannot be undone. This is not the case. The principal (the person who grants power) can revoke it at any time as long as they are mentally competent. This revocation must be done in writing and in accordance with state laws to be effective.

It continues after death: There’s a misconception that the Tax POA form RD-1061 remains in effect after the principal’s death. In reality, the authority granted through this form ends upon the death of the principal. After death, the executor of the estate takes over the management of all tax and financial affairs.

It's the same as a general POA: People often confuse the Tax POA form RD-1061 with a general Power of Attorney form. Although both forms grant powers to another person, the Tax POA is specific to tax matters, whereas a general POA can cover a wide range of authorities, depending on how it's drafted.

Only family members can be designated: There’s a notion that only family members can be appointed as agents on the Tax POA form RD-1061. In truth, any trusted individual or entity, such as a friend, accountant, or attorney, can be given this authority, as long as they have the principal’s confidence to act on their behalf regarding tax matters.

No tax professional is needed to fill it out: Many believe they can easily fill out and file the Tax POA form RD-1061 without assistance. While it is true that one can complete the form on their own, consulting a tax professional can ensure that it is filled out correctly and that all legal implications are understood. This can prevent potential issues with tax authorities and ensure that the agent can perform their duties effectively.

Understanding these misconceptions about the Tax POA form RD-1061 can smooth the way for more effective tax planning and management. It’s always a good idea to consult with a professional to ensure that you are fully aware of the capabilities and limitations of any legal document you are considering.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) Form RD-1061 is a crucial step for individuals or entities looking to grant authority to another person to handle their tax matters with the tax authority. Understanding the importance and nuances of this form can ensure that the process is handled correctly and efficiently. Here are four key takeaways to consider:

- Complete Information is Crucial: When filling out Form RD-1061, it's imperative to provide complete and accurate information about the taxpayer and the representative. This includes full legal names, addresses, and identification numbers. Any inaccuracies can lead to delays or the rejection of the form.

- Specifying Tax Matters: The form allows the taxpayer to specify which tax matters and years the representative has the authority to handle. Being clear and precise about the scope of authority can help prevent any misunderstandings or legal issues in the future.

- Valid Signature and Date: For Form RD-1061 to be considered valid and binding, it must be signed and dated by the taxpayer. If the taxpayer is a business or an organization, the individual signing on behalf of the entity must have the legal authority to do so. Ensuring the form is properly executed is critical for it to be recognized by the tax authority.

- Understanding Revocation: It's important to know that the authority granted by Form RD-1061 can be revoked at any time by the taxpayer. However, revocation requires a written notice to the tax authority indicating that the taxpayer wishes to terminate the power of attorney previously granted. Being aware of the process for revocation can empower taxpayers to change their representation if needed.

By keeping these key takeaways in mind, individuals and entities can navigate the complexities of granting tax power of attorney with more confidence, ensuring that their tax matters are handled by a trusted representative in accordance with their wishes.

Popular PDF Documents

Carson City Business License - Understanding the City of Carson's requirements for business operation, including zoning and safety regulations, through the business tax certificate process.

Are Irs Whistleblower Anonymous - This document serves as a confidential way for citizens to inform the IRS about individuals or entities they believe are not complying with tax laws.

IRS 5695 - Details the eligibility criteria for receiving tax credits for solar and renewable energy investments in homes.