Get Tax POA form r-7006 Form

The Tax Power of Attorney (POA) form, known formally as form R-7006, is a critical document for individuals and businesses seeking to authorize another person to handle their tax matters. This form facilitates the process of granting a trusted representative the authority to communicate with tax authorities, make decisions, and perform specific actions on behalf of the taxpayer. It's especially crucial during tax season or in situations requiring negotiations or discussions with tax agencies. The R-7006 form covers a wide range of tax-related issues, allowing the designated agent to act within the scope defined by the taxpayer, which can include filing returns, obtaining confidential tax information, and making payment arrangements. Understanding the specifics of this form, how to complete it accurately, and the implications of granting such authority is vital for ensuring that one's tax matters are handled efficiently and confidentially. Handling the Tax POA correctly empowers individuals and businesses to maintain control over their tax affairs through a trusted intermediary, ensuring compliance and peace of mind during what can often be a complicated process.

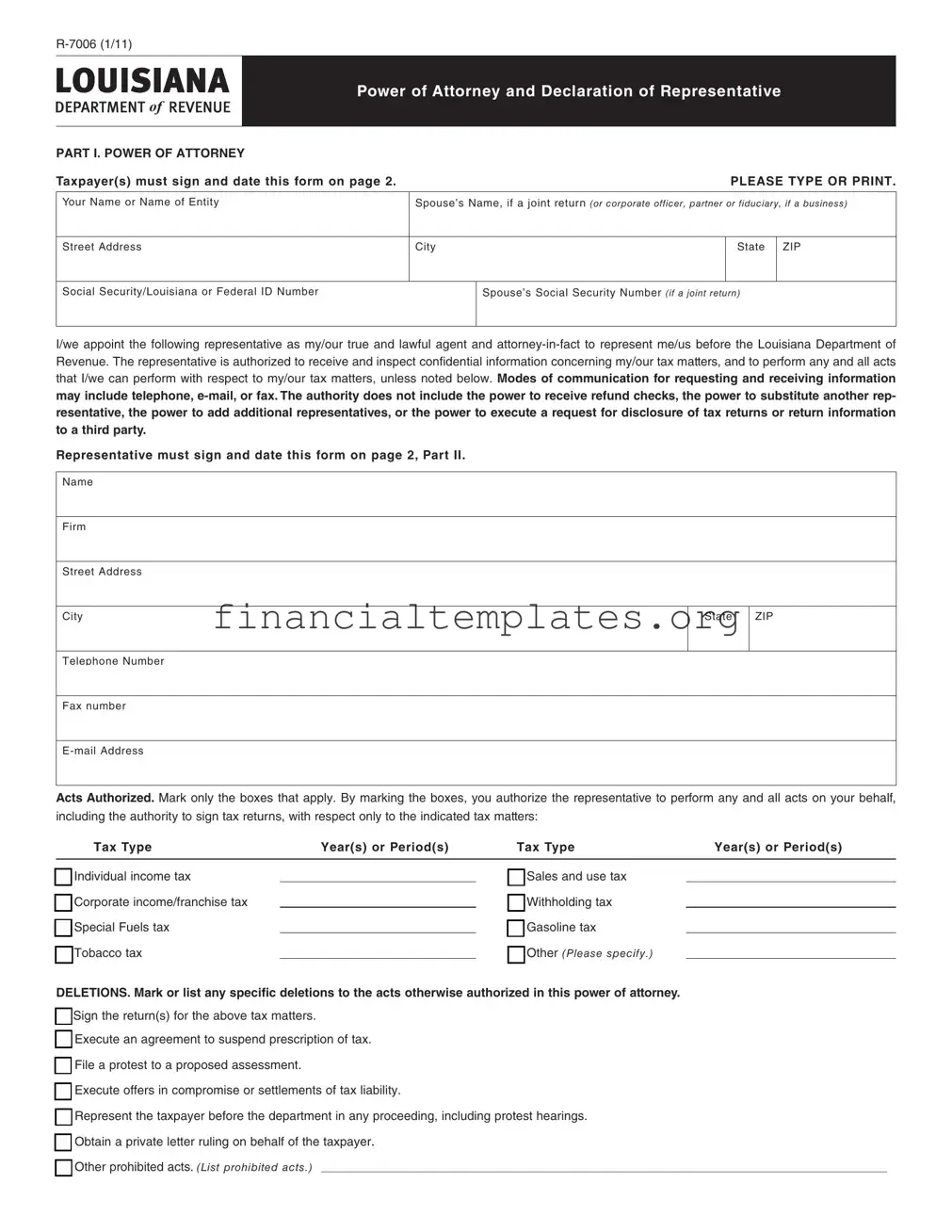

Tax POA form r-7006 Example

LOUISIANA

Power of Attorney and Declaration of Representative

DEPARTMENT of REVENUE

PART I. POWER OF ATTORNEY |

|

|

|

|

Taxpayer(s) must sign and date this form on page 2. |

|

|

PLEASE TYPE OR PRINT. |

|

|

|

|

|

|

Your Name or Name of Entity |

Spouse’s Name, if a joint return (or corporate officer, partner or fiduciary, if a business) |

|||

|

|

|

|

|

Street Address |

City |

|

State |

ZIP |

|

|

I |

|

I |

Social Security/Louisiana or Federal ID Number |

Spouse’s Social Security Number (if a joint return) |

|||

I

I/we appoint the following representative as my/our true and lawful agent and

Representative must sign and date this form on page 2, Part II.

Name

Firm

Street Address

City |

State |

ZIP |

|

I |

I |

Telephone Number |

|

|

( |

) |

|

|

|

|

Fax number |

|

|

( |

) |

|

Acts Authorized. Mark only the boxes that apply. By marking the boxes, you authorize the representative to perform any and all acts on your behalf, including the authority to sign tax returns, with respect only to the indicated tax matters:

Tax Type |

Year(s) or Period(s) |

Tax Type |

Year(s) or Period(s) |

■ Individual income tax |

|

■ Sales and use tax |

|

□ |

|

□ |

|

■ Corporate income/franchise tax |

|

■ Withholding tax |

|

□ |

|

□ |

|

■ Special Fuels tax |

|

■ Gasoline tax |

|

□ |

|

□ |

|

■ Tobacco tax |

|

■ Other (Please specify.) |

|

□ |

|

□ |

|

DELETIONS. Mark or list any specifc deletions to the acts otherwise authorized in this power of attorney.

□■ Sign the return(s) for the above tax matters.

□■ Execute an agreement to suspend prescription of tax. □■ File a protest to a proposed assessment.

□■ Execute offers in compromise or settlements of tax liability.

□■ Represent the taxpayer before the department in any proceeding, including protest hearings. □■ Obtain a private letter ruling on behalf of the taxpayer.

□■ Other prohibited acts. (List prohibited acts.) _____________________________________________________________________________________________________________

Page 2 |

NOTICES AND COMMUNICATIONS. Original notices and other written communications will be sent only to you, the taxpayer. Your representative may request and receive information by telephone,

REVOCATION OF PRIOR POWER(S) OF ATTORNEY. Except for Power(s) of Attorney and Declaration of Representative(s) fled on Form

Signature of Taxpayer(s). If a tax matter concerns a joint return, both husband and wife must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

IF THIS POWER OF ATTORNEY IS NOT SIGNED AND DATED, IT WILL BE RETURNED.

_______________________________________________________________________________________________________________________________________ |

______________________________ |

|

Taxpayer signature |

|

Date (mm/dd/yyyy) |

____________________________________________________________________________________________________________________________________________ |

_________________________________ |

|

Spouse signature |

|

Date (mm/dd/yyyy) |

_________________________________________________________________________________ |

_______________________________________________________ |

_________________________________ |

Signature of duly authorized representative, if the taxpayer |

Title |

Date (mm/dd/yyyy) |

is a corporation, partnership, executor or administrator |

|

|

Part II. DECLARATION OF REPRESENTATIVE

Under penalties of perjury, I declare that:

•I am not currently under suspension or disbarment from practice before the Internal Revenue Service.

•I am authorized to represent the taxpayer(s) identified in Part I for the tax matters specified there; and

•I am one of the following: (insert applicable letter in table below)

a.

b.Certified Public

c.Enrolled

d.

e.

f.Family

g.Other (state the relationship, i.e., bookkeeper or friend)

h.Former Louisiana Department of Revenue Employee. As a representative, I cannot accept representation in a matter with which I had direct involvement while I was a public employee.

IF THIS DECLARATION OF REPRESENTATIVE IS NOT SIGNED AND DATED, THE POWER OF ATTORNEY WILL BE RETURNED.

State Issuing

License

State License Number

Signature

Date

(mm/dd/yyyy)

I |

I |

I |

I |

I |

Document Specifics

| Fact Name | Description |

|---|---|

| Form Purpose | The Tax POA form, known as Form R-7006, is used to grant authority to another person (an agent) to handle tax matters on behalf of the filer with the tax authority. |

| Governing Law | Form R-7006 is governed by state tax laws, and its use and requirements may vary from one state to another. Always check the specific state's laws where the form is being filed. |

| User Base | This form is often used by individuals and businesses seeking to authorize representatives to make filings, receive confidential information, and handle tax affairs effectively. |

| Significance of Accuracy | Accuracy on Form R-7006 is crucial, as mistakes can lead to delays, miscommunication with tax authorities, and potential legal issues. Always ensure the information provided is current and correct. |

Guide to Writing Tax POA form r-7006

The Power of Attorney Form R-7006 is a legal document that allows individuals to grant someone else the authority to handle their tax matters. Completing this form accurately is crucial for ensuring that the designated representative can perform duties related to tax issues effectively. This guide outlines the necessary steps to fill out the form, ensuring clarity and compliance with the requirements. After the form is completed and signed, it becomes a binding legal document, authorizing the appointed person to act on behalf of the individual in tax-related situations.

- Start by entering the full legal name of the taxpayer. This should match the name associated with the Social Security Number or Taxpayer Identification Number.

- Provide the taxpayer's Social Security Number or Taxpayer Identification Number in the designated space.

- Enter the taxpayer's full address, including street, city, state, and zip code.

- Specify the tax matters and tax years or periods that the representative is authorized to handle. This could include specific years and types of taxes.

- Fill in the name and address of the representative who is being granted authority. This person will act on behalf of the taxpayer in tax matters.

- Enter the representative's phone number and, if applicable, their fax number and email address.

- List any specific additions or restrictions to the representative’s authority. This section allows the taxpayer to define or limit the actions the representative can perform.

- The taxpayer must sign and date the form. If filing jointly, both taxpayers must sign the document.

- If the representative is not an individual, such as a firm, provide the firm's name and a list of individuals from the firm authorized to represent the taxpayer.

- Lastly, the representative(s) must sign and date the form, agreeing to the appointment.

Upon completion, the form should be reviewed for accuracy and completeness. It should then be submitted to the appropriate tax authority as directed in the form's instructions. It's important to retain a copy for personal records. By appointing a representative through this form, taxpayers can ensure that their tax matters are handled professionally and efficiently, even if they're unable to manage these issues personally.

Understanding Tax POA form r-7006

-

What is the purpose of the Tax Power of Attorney (POA) Form R-7006?

The Tax POA Form R-7006 is designed to grant a designated individual or entity the authority to handle tax matters on behalf of the person completing the form. This includes the ability to receive confidential tax information and make decisions regarding filings, payments, and disputes with tax authorities. It is commonly used when taxpayers seek the expertise of professionals or when they are unable to manage their tax affairs personally.

-

Who can be designated as a representative on the Form R-7006?

Any individual, such as a family member, or professionally licensed persons including certified public accountants, attorneys, or enrolled agents, can be designated as a representative on the Form R-7006. The important factor is that the taxpayer trusts the individual or entity with their sensitive tax information and decision-making capabilities concerning their tax matters.

-

How is the Form R-7006 submitted?

Submission processes can vary by jurisdiction, but generally, the Form R-7006 must be completed in full, signed by the taxpayer, and then mailed or delivered to the specific tax authority office handling such documents. Some jurisdictions may offer electronic submission options. It is crucial for taxpayers to check with the local tax authority for the most accurate and updated submission guidelines.

-

What happens if the designated representative on the Form R-7006 changes?

If there is a need to change the designated representative, the taxpayer should complete a new Form R-7006, designating the new representative. The updated form must be submitted to the tax authority to replace the previous authorization. Continual communication with the tax authority ensures that the most current representative has authorized access to the taxpayer’s information and can act on their behalf.

Common mistakes

When filling out the Tax Power of Attorney (POA) form, specifically form R-7006, individuals often encounter pitfalls that can complicate their tax matters. Recognizing and avoiding these mistakes is crucial for ensuring the form's effectiveness and for the smooth handling of one's tax affairs.

-

Not specifying the tax matters and years covered: A common mistake is not clearly defining the scope of the authorization. This includes failing to detail the types of taxes or specific tax years for which the POA is granted. It's essential to specify these elements to avoid confusion and to ensure the representative can act effectively on one's behalf.

-

Incorrectly identifying the representative: Accuracy in providing the representative's name, address, and contact information is vital. Any errors here can lead to communication issues, potentially preventing the representative from performing their duties. It's important to double-check this information for correctness.

-

Failing to sign and date the form: It may seem obvious, but neglecting to sign and date the form invalidates it. Both the taxpayer and the representative must sign the form. Without these signatures, the form will not be recognized, and the representative will not be granted the authority to act.

-

Not using the most recent form version: Tax forms are updated regularly, and using an outdated version can lead to processing delays or even rejection of the form. Before filling it out, it's crucial to ensure that you are using the most current version of the R-7006 form.

By paying attention to these common errors and taking the time to fill out the Tax POA form accurately, one can ensure that their tax matters will be handled as intended, with minimal complications.

Documents used along the form

When dealing with tax matters, especially with the complexity of the IRS and state tax departments, you often need more than just the Tax Power of Attorney (POA) Form R-7006. This form allows someone else to take care of your tax affairs on your behalf, but it's usually just the beginning. Other forms and documents also play crucial roles in managing your taxes efficiently and effectively. Here’s a list of seven essential forms and documents that are often used in conjunction with the Tax POA Form R-7006.

- IRS Form 2848, Power of Attorney, and Declaration of Representative: This is the federal counterpart to many state-specific tax POA forms, including the R-7006. It grants an individual the authority to represent you before the IRS, handling tasks such as obtaining confidential tax information and negotiating payment agreements.

- Form 8821, Tax Information Authorization: While not granting the full powers of a POA, this form allows designated individuals to view your tax records, but not to represent you to the IRS. It's useful for situations where full representation rights aren't necessary.

- Form 4506-T, Request for Transcript of Tax Return: Often submitted along with POA forms to request a copy of a previous year's tax return. This can be crucial for your representative to understand your tax situation fully.

- W-9, Request for Taxpayer Identification Number and Certification: This form might be needed when a POA involves financial transactions requiring tax reporting. It ensures that all parties have accurate information for IRS purposes.

- Form 1040, U.S. Individual Income Tax Return: The core form used to file individual federal income tax returns, understanding its details is essential for anyone acting under a POA to manage another’s tax affairs accurately.

- Form 8879, IRS e-file Signature Authorization: When filing taxes electronically, this form authorizes a representative to e-sign the return on behalf of the taxpayer. It confirms that the taxpayer has reviewed the return and agrees with its contents.

- SS-4, Application for Employer Identification Number: This form might be necessary when a POA involves handling business taxes or starting a new business. It's used to obtain an EIN, which is required for tax filing and reporting purposes.

Understanding and gathering the correct forms and documents is a vital step in managing your tax affairs, whether you're handling them personally or entrusting them to a representative. Each of these documents serves a specific purpose, from allowing others to access your tax records to authorizing someone to represent you in IRS matters. Together with the Tax POA Form R-7006, they form a comprehensive toolkit for addressing a wide range of tax-related tasks and challenges.

Similar forms

The Tax Power of Attorney (POA) form, such as the R-7006, shares similarities with other legal documents that authorize someone to act on another's behalf. One such document is the General Power of Attorney. This broad legal document grants an agent the authority to handle a wide array of matters, including financial decisions, for another person. Like the Tax POA, it bestows significant responsibility but differs in that its scope is not limited to tax matters.

Another related document is the Durable Power of Attorney. What makes it akin to the Tax POA is its enduring nature; it remains in effect even if the principal becomes incapacitated. While the Tax POA focuses on tax-related affairs, the Durable Power of Attorney can encompass a variety of decisions including healthcare, financial assets, and personal matters, ensuring continuous management regardless of the principal's health condition.

The Healthcare Power of Attorney also mirrors aspects of the Tax POA in that it designates an agent to make specific decisions on someone’s behalf. However, its scope is confined to medical decisions, unlike the Tax POA, which is limited to tax matters. This document becomes critical when the principal is unable to make their own healthcare decisions, highlighting the importance of appointing a trusted agent.

The Limited Power of Attorney stands out for its specificity. Similar to the Tax POA, it grants an agent powers limited to certain acts or situations. For example, it might allow someone to sell a car or manage specific financial transactions on another's behalf. This document contrasts with broader POAs by focusing power in distinct, often one-time events or transactions, reinforcing the principle of tailoring authority to specific needs.

The Financial Power of Attorney, much like the tax variant, authorizes an agent to handle financial matters. These can range from managing investments to operating bank accounts, and, of course, dealing with tax filings and liabilities. The primary distinction lies in the scope, with the Financial Power of Attorney covering a broader spectrum of financial dealings beyond just taxes, making it crucial for comprehensive financial planning.

Springing Power of Attorney documents share a unique trigger mechanism with some Tax POAs, which specifies that the agent's authority becomes active only under certain conditions, such as the principal's incapacitation. This trigger-based activation is designed to protect the principal's interests by limiting the agent's power until it becomes necessary, blending security with functionality in managing one's affairs.

Last but not least, the Revocable Living Trust is an estate planning tool that, while not a POA, functions similarly by allowing a trustee to manage assets within the trust on behalf of the benefactor or beneficiaries. Like the Tax POA, it involves the act of managing someone's affairs. The distinction, however, is its focus on estate management and its ability to bypass probate, providing a streamlined approach to asset distribution upon the grantor's death.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form R-7006 is an important step in ensuring your tax matters can be handled by someone you trust in your absence. This task requires attention to detail and an understanding of your rights and responsibilities.

Here are critical dos and don'ts to guide you through the process:

Do:- Read all instructions carefully before beginning. Understanding every part of the form is crucial for correct completion.

- Provide accurate and complete information about yourself and the representative you are authorizing. Any inaccuracies can lead to delays or complications.

- Specify the tax matters and years you are giving your representative authority over. Being clear about the scope of their powers can prevent misunderstandings.

- Sign and date the form in the designated areas. Your signature is necessary to validate the document.

- Keep a copy for your records. Having your own copy will help you remember who you've given authority to and over what matters.

- Revise the form periodically. Your circumstances and relationships can change, making it important to ensure the POA is always up-to-date.

- Rush through the process. Taking your time to carefully fill out each section can prevent errors and save time in the long run.

- Use informal language or nicknames when providing names. Always use the full legal name of the individual or organization you are appointing.

- Overlook the necessity to notify your representative. Make sure they are willing and able to take on this responsibility before you put their name on the form.

- Forget to specify limitations, if any, on the representative's authority. If there are any tasks or years you do not want them to handle, clearly state so.

- Assume the form takes immediate effect without proper submission. The completed form must be submitted to the relevant tax authority to be effective.

- Disregard the option to revoke the POA. If you decide to cancel the authorization, you must follow the appropriate steps to ensure it is legally terminated.

Completing the Tax POA Form R-7006 with diligence and care can provide peace of mind, knowing your tax matters will be competently managed according to your wishes. Remember, this form is a legal document, and its proper execution is essential for your financial and legal protection.

Misconceptions

When dealing with the Tax Power of Attorney (POA) Form R-7006, several misconceptions can lead to confusion. Here, we aim to clarify some of the most common misunderstandings to help individuals navigate their tax matters more effectively.

- It's only for business matters: A common misconception is that the Tax POA Form R-7006 is exclusively used for business-related tax issues. However, this form is versatile and can be used by individuals to grant another person the authority to handle their personal tax affairs as well.

- The form grants unlimited power: Some may believe that by signing the Tax POA Form R-7006, they are giving away unrestricted powers over their tax matters. In truth, the scope of authority can be specifically tailored within the document, allowing the principal to limit the actions the agent can perform.

- Any POA form will work for tax matters: A general POA form might not be accepted for tax purposes. The Tax POA Form R-7006 is specifically designed to comply with tax-related matters, ensuring that the designated person has the authority to deal with the IRS or state tax department on your behalf.

- Once signed, it can't be revoked: There's a belief that once the Tax POA Form R-7006 is signed, it is irrevocable. However, the principal retains the right to revoke the power of attorney at any time, as long as they are mentally competent. This action typically requires a formal written notice.

- Filing it with the IRS or state tax department is automatic: Finally, a common misunderstanding is that the Tax POA Form R-7006 will be automatically filed with the relevant tax authorities once completed. The responsibility to ensure the form is correctly filed lies with the individual or the designated agent. Timely and proper filing is crucial for the form to be recognized and for the agent to act on your behalf legally.

Understanding these misconceptions about the Tax POA Form R-7006 can greatly demystify the process of granting someone else the authority to manage your tax affairs. Always ensure that you are fully informed about the extent of the powers you are granting, and keep accurate records of all related documents.

Key takeaways

The Tax Power of Attorney (POA) Form, otherwise referred to as Form R-7006, is a critical document that allows an individual or entity to grant authority to another person or entity to handle their tax matters with the tax authority. Understanding how to correctly fill out and use this form can ensure that tax matters are handled efficiently and effectively. Here are seven key takeaways about filling out and using the Tax POA Form R-7006:

- Identify the parties correctly: It is essential to accurately identify the principal (the person granting the power) and the agent (the person receiving the power) on the form. Include full names, addresses, and identification numbers to prevent any confusion or processing delays.

- Specify the powers granted: The form allows you to specify exactly which tax matters and years you are granting the agent authority over. Be as specific as necessary to ensure the agent has the powers needed to act on your behalf.

- Understand the duration: The POA's validity period must be clearly indicated. Unless a specific termination date is mentioned, the POA will remain in effect indefinitely or until officially revoked.

- Seek professional assistance if needed: If you're unsure about any aspects of the Tax POA Form R-7006 or your specific tax situation, consulting with a tax professional or attorney can prevent mistakes that could impact your tax matters.

- Sign and date the form: The form must be signed and dated by the principal. In some cases, a witness or notarization may be required for the document to be valid, so it's important to adhere to the specific requirements in your jurisdiction.

- Notify and submit to the appropriate tax authority: Once completed and signed, it is critical to notify your agent and submit the form to the correct tax authority. Submission requirements may vary, so ensure to follow the local guidelines where the form is being filed.

- Keep records: Keeping a copy of the filled-out POA form for your records is wise. It can be helpful for future reference or if any disputes arise regarding the authority granted to the agent.

By following these guidelines, individuals and entities can more confidently navigate the process of granting power of attorney for tax purposes, thus ensuring a smoother handling of their tax-related affairs.

Popular PDF Documents

IRS 1040-X - The IRS provides free resources and guides to assist taxpayers in completing the 1040-X accurately.

Irs Installment Plan - An essential form that certifies a strata lot owner's financial dealings have been duly settled or appropriately arranged with the corporation.

Taxpayer Identification Number Australia - Includes detailed guidelines for payers on submitting the form and their obligations for online lodgment.