Get Tax POA form par 101 Form

When individuals or businesses find themselves navigating the complexities of tax issues, understanding and correctly utilizing tools at their disposal becomes paramount. Among these, the Tax Power of Attorney (POA) Form Par 101 stands out as a vital document. This form grants someone else, usually a qualified tax professional, the authority to manage tax affairs on behalf of another person or entity. It plays a crucial role in ensuring that taxes are handled efficiently and accurately, providing a safeguard for those who may not have the expertise or ability to deal with tax matters on their own. The form encompasses not just the appointment of a representative but also specifies the extent of power granted, the duration of this power, and the specific tax matters and years or periods involved. It's a legal document that requires careful consideration and understanding, as it directly impacts financial and legal responsibilities.

Tax POA form par 101 Example

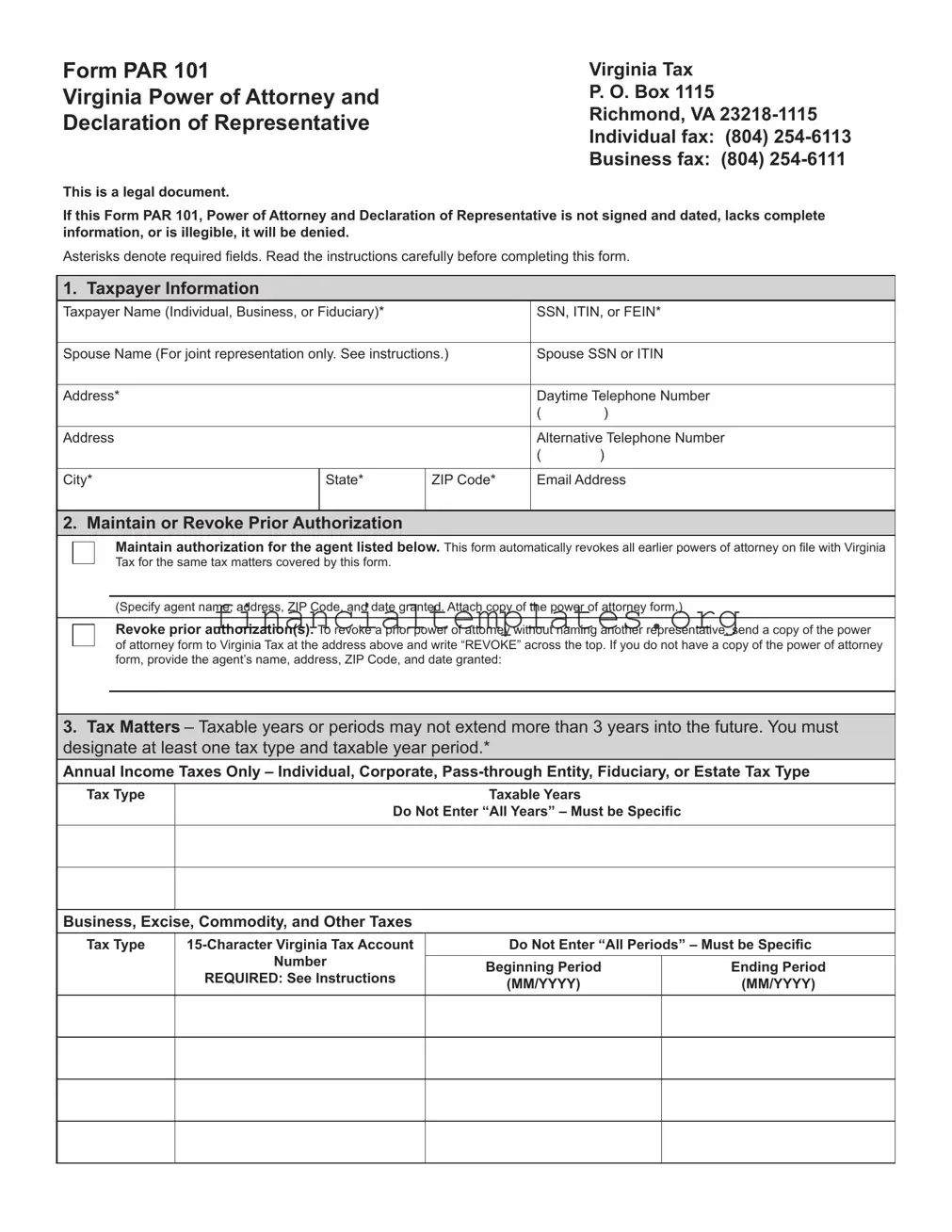

Form PAR 101

Virginia Power of Attorney and

Declaration of Representative

Virginia Tax P. O. Box 1115

Richmond, VA

This is a legal document.

If this Form PAR 101, Power of Attorney and Declaration of Representative is not signed and dated, lacks complete information, or is illegible, it will be denied.

Asterisks denote required fields. Read the instructions carefully before completing this form.

1. Taxpayer Information

Taxpayer Name (Individual, Business, or Fiduciary)* |

|

SSN, ITIN, or FEIN* |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Spouse Name (For joint representation only. See instructions.) |

Spouse SSN or ITIN |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Address* |

|

Daytime Telephone Number |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

Alternative Telephone Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City* |

|

State* |

ZIP Code* |

Email Address |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

2. Maintain or Revoke Prior Authorization |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

Maintain authorization for the agent listed below. This form automatically revokes all earlier powers of attorney on file with Virginia |

||||

|

|

|

|

□ |

|

|

|

|

||||||

|

|

|

|

|

|

|

Tax for the same tax matters covered by this form. |

|

|

|

||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

(Specify agent name, address, ZIP Code, and date granted. Attach copy of the power of attorney form.) |

||||

|

|

|

|

|

|

|

|

|

|

Revoke prior authorization(s). To revoke a prior power of attorney without naming another representative, send a copy of the power |

||||

|

|

|

□ |

|

|

|

|

|

||||||

|

|

|

|

of attorney form to Virginia Tax at the address above and write “REVOKE” across the top. If you do not have a copy of the power of attorney |

||||||||||

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

form, provide the agent’s name, address, ZIP Code, and date granted: |

|

|

||

3. Tax Matters – Taxable years or periods may not extend more than 3 years into the future. You must designate at least one tax type and taxable year period.*

Annual Income Taxes Only – Individual, Corporate,

Tax Type |

Taxable Years |

Do Not Enter “All Years” – Must be Specific

Business, Excise, Commodity, and Other Taxes

Tax Type |

Do Not Enter “All Periods” – Must be Specific |

||

|

Number |

|

|

|

Beginning Period |

Ending Period |

|

|

REQUIRED: See Instructions |

||

|

(MM/YYYY) |

(MM/YYYY) |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

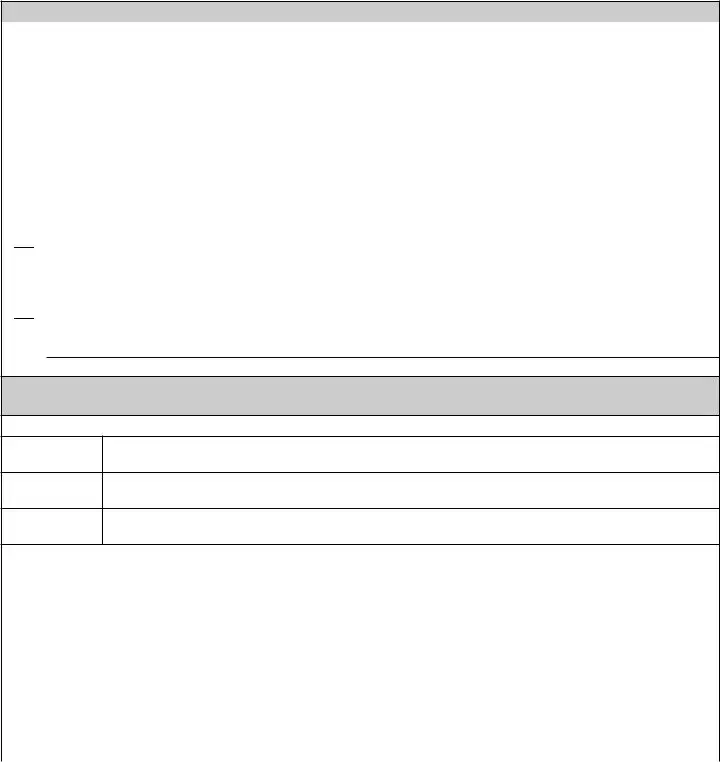

4.Authorized Agent /Representative Information. Additional representatives should be listed on an attached list and may not receive copies of correspondence.

Primary Representative – Must be a person; cannot be a business |

|

Automatic Correspondence |

|||||

First Name* |

Last Name* |

An Authorized Agent will automatically be mailed |

|||||

copies of correspondence regarding the tax |

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|

matters. |

|

Address |

|

|

|

|

|

||

|

|

|

|

A - |

Authorized Agent Number |

||

|

|

|

|

|

_________________________ |

||

Address |

|

|

|

|

|||

|

|

|

|

|

Do NOT mail copies of any correspondence |

||

|

|

|

|

|

□ to agent. |

||

City |

|

State |

|

ZIP Code |

|

Mail copies of email communications to |

|

|

|

|

|

|

□ agent. |

||

Daytime Telephone Number |

Fax Number |

Email Address |

|||||

( |

) |

( |

) |

|

|

|

|

|

|

|

|

||||

Additional Representative – Must be a person; cannot be a business |

|

Automatic Correspondence |

|||||

First Name |

Last Name |

An Authorized Agent will automatically be mailed |

|||||

copies of correspondence regarding the tax |

|||||||

|

|

|

|

|

|||

|

|

|

|

|

|

matters. |

|

Address |

|

|

|

|

|

||

|

|

|

|

A - |

Authorized Agent Number |

||

|

|

|

|

|

_________________________ |

||

Address |

|

|

|

|

|||

|

|

|

|

|

Do NOT mail copies of any correspondence |

||

|

|

|

|

|

|

||

|

|

|

|

|

□ to agent. |

||

City |

|

State |

|

ZIP Code |

|

Mail copies of email communications to |

|

|

|

|

|

|

□ agent. |

||

Daytime Telephone Number |

Fax Number |

Email Address |

|||||

( |

) |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

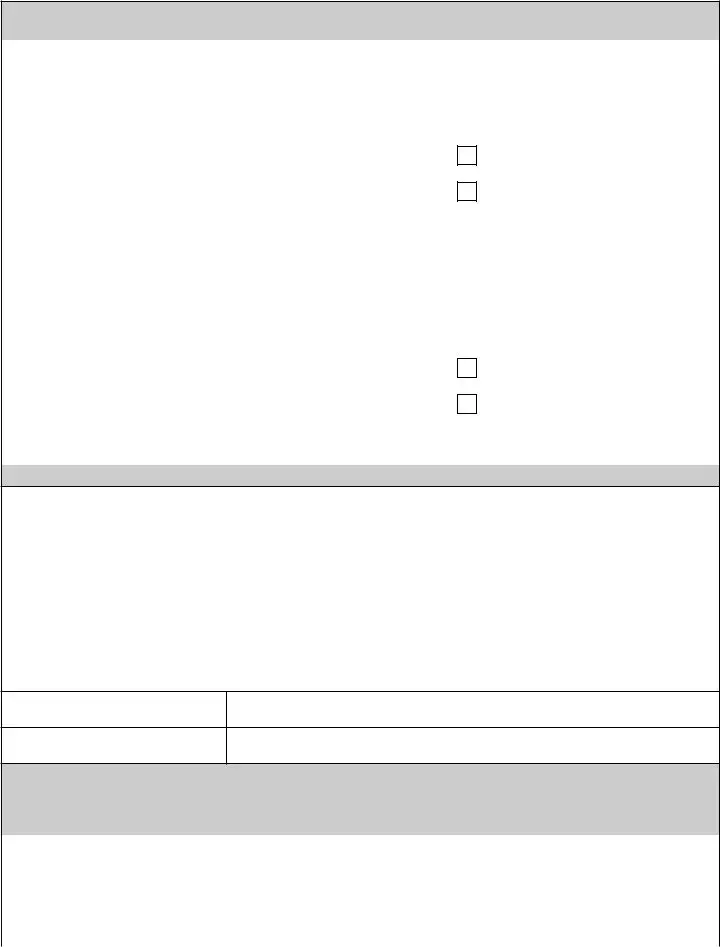

5. Signature of Taxpayer(s) and Acknowledgment of Authorized Acts

By signing this form, I am granting the representative(s) listed in Section 4 the authority to:

•Receive and inspect my confidential tax information for the tax matters listed in Section 3,

•Perform all acts that I can perform with respect to the specified tax matters, and

•Represent me before Virginia Tax, including consenting to extend the time to assess tax and executing consents that agree to a tax adjustment.

•In addition, I understand that the acts of my Authorized Agent may increase or decrease my tax liabilities and legal rights.

The authority does not, however, include the power to receive refund checks, substitute another representative, request a copy of a tax return, sign certain returns, or consent to a disclosure of tax information.

For joint representation, both the taxpayer and the spouse listed in Section 1 must sign and date this form. If this form is signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer, they certify that they have the authority to execute this form on behalf of the taxpayer. This power of attorney will remain in effect until it is revoked by either the taxpayer or the agent.

Print Name*

Print Name

Signature* |

Title |

Date* |

Signature |

Title |

Date |

|

|

|

6.Representative Signature: Under penalties of perjury, I declare I am authorized to represent the taxpayer(s)

listed in Section 1.

A.) Attorney B.) Certified Public Accountant C.) Enrolled Agent D.) Family member or Other (provide relationship below):

Relationship: ____________________________________________________________________________________

|

Designation |

|

|

|

Representative |

Letter from |

Print Name * |

Representative Signature* |

Date* |

|

Above List |

|

|

|

Primary |

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

|

|

INSTRUCTIONS FOR VIRGINIA FORM PAR 101

POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE

Form Purpose

Use Form PAR 101 to:

•Authorize a person to represent you before Virginia Tax with respect to the tax matters you specify, or

•Revoke a prior power of attorney authorization.

THIS IS A LEGAL DOCUMENT: When you submit Form PAR 101, you are authorizing the person you name in Section 4 to be your representative. For the tax matters you specify in Section 3, your representative will be able to receive and inspect your confidential tax information and perform any and all acts you can perform, including consenting to extend the time to assess tax or executing consents that agree to a tax adjustment. The acts of your representative may increase or decrease your tax liabilities and legal rights. Certain exceptions apply. See below.

When to submit Form PAR 101:

The following are examples of when you need to complete and submit Form PAR 101:

1.You are disputing an assessment of tax and a third party is representing you before Virginia Tax,

2.You have been notified that we will be conducting an audit of your account and you have engaged the services of a third party to assist with the audit, or

3.You are the administrator of a deceased individual’s estate and you need to grant access to the decedent’s confidential tax information to a third party in order to perform your duties.

The above list is not

When a Form PAR 101 is NOT required:

Form PAR 101 is not required when a person merely furnishes information or prepares a report or return for you or your business. For example, you do not need to submit Form PAR 101 to:

1.Authorize a tax professional (CPA, Enrolled Agent, tax preparer, or payroll service provider) to discuss routine issues regarding return filings and payments the tax professional submitted on your behalf,

2.Authorize an employee or officer of your business to discuss routine issues regarding return filings and payments submitted by your business, or

3.Authorize a fiduciary (trustee, receiver, or guardian) to act as Authorized Agent, because a fiduciary already stands in the position of the taxpayer.

Virginia Tax will discuss routine issues regarding return filings and payments and related assessments and adjustments with your designated tax professionals and the

employees and officers of a business, provided we are able to verify the person and the person’s relationship to you or your business.

Exceptions - The power of attorney you grant to your representative using Form PAR 101 does not include the power to receive refund checks, the power to substitute another representative, the authority to execute a request for a tax return, the power to sign certain returns for you, or the power to consent to a disclosure of tax information.

Section 1 - Taxpayer Information

Individual - If the tax matter involves a joint return and you and your spouse are designating the same representative, provide your spouse’s name and social security number.

Sole Proprietor - For business tax matters, enter your name and the federal employer identification number for your business.

Corporations, Partnerships, or Associations - Enter the legal name of the organization and the organization’s federal employer identification number. If the tax matter involves a consolidated or a combined tax return filed for a corporation, do not attach a list of subsidiaries or affiliated corporations to this form. Only the parent corporation‘s information is required in Section 1. A subsidiary or affiliate must file its own PAR 101 for returns that it files separately.

Fiduciary/Trust - Enter the name and federal employer identification number of the trust, and the telephone number and email address of the trustee. The trustee must sign the form.

Estate or Inheritance Tax - Applicable only for decedents whose date of death was prior to July 1, 2007. Enter the name and the social security number of the deceased taxpayer and provide the address, telephone number, and email address of the decedent’s personal representative. The taxpayer’s personal representative must sign and date the form.

Section 2 - Revoking or Maintaining Prior Authorization

Check the box that applies. If you are naming a representative, any prior power of attorney on file with Virginia Tax for the same tax matters covered by the Form PAR 101 you are submitting will be automatically revoked unless you attach a copy of any power of attorney you want to remain in effect.

Either the taxpayer or their representative may revoke the power of attorney. This must be done in writing by submitting a copy of Form PAR 101 with “REVOKE” written on the top of the form or by sending a written request. If you wish to revoke the power of attorney for only one spouse on a joint power of attorney, this should be done by a submitting a letter to indicate which spouse is no longer represented.

Section 3 - Tax Matters

Be specific. You should only grant a person your power of attorney for taxable periods for which you have a tax matter.

You may specify taxable periods no more than 3 years into the future. Future periods are determined starting after Dec. 31 of the year in which we receive Form PAR 101. You may list the current taxable year or period and any taxable years or periods that have already ended as of the date you sign Form PAR 101.

Annual Income Taxes - If the tax matter involves individual, corporate,

Business, Excise, Commodity, and Other Taxes - You must enter the tax type and the beginning and ending periods covered by this form. For each tax type, you must also provide your assigned

Exceptions - For the following tax types, leave the Virginia Tax Account Number field blank: Apple Excise Tax, Bank Franchise Tax, and Rolling Stock Tax on Railroads and Freight Car Companies.

Section 4 - Authorized Agent/Representative Information

You must provide complete information for each representative listed on the form. You cannot name a business as your representative. Your representative must be a person. In addition, each representative must sign and date the form. The signature must be an actual signature and cannot be an electronic signature or rubber stamp.

Virginia Tax will automatically mail copies of all outgoing correspondence sent to you regarding the tax matters listed in Section 3 to your Authorized Agent provided that:

•Your Authorized Agent is registered with Virginia Tax, and

•You provide the Authorized Agent’s number, a unique

Virginia Tax will not automatically mail correspondence to your Authorized Agent in the following situations:

•You do not provide your Authorized Agent’s number, or

•You check the box indicating that you do not want correspondence automatically mailed to your Authorized Agent.

We will automatically mail copies of secure email to your Authorized Agent if you have opted to have copies of email communications sent to your agent.

Taxpayers may use secure email to discuss specific questions related to their account. The authorized representative(s) will receive copies of this secure email communication through the U.S mail. To use secure email on Virginia Tax’s website at www.tax.virginia.gov, log in to iFile (business or individual) or iReg, select Secure Message to send and receive secure email.

To register as an Authorized Agent, your representative must submit Virginia Form

www.tax.virginia.gov.

Sections 5 and 6 - Signature of Taxpayer(s),

Acknowledgment of Authorized Acts, and

Representative Signature

Individuals - You must sign and date the form. If the tax matter involves a joint return and you and your spouse are designating the same Authorized Agent(s), your spouse must also sign and date the form.

Corporations or Associations - An officer having authority to bind the taxpayer must sign and date the form.

Partnerships - All partners should sign unless only one partner is authorized to act in the name of the partnership. A partner is authorized to act in the name of the partnership if, under state law, the partner has authority to bind

the partnership. A copy of such authorization should be attached. For dissolved partnerships, see 26 CFR 601.503(c)(6).

All others - If the taxpayer is a dissolved corporation, decedent, insolvent, or a person for whom or by whom a fiduciary (a trustee, guarantor, receiver, executor, or administrator) has been appointed, see 26 CFR 601.503(d).

The representative(s) must sign and date the form.

Note - Generally, the taxpayer signs first, granting the authority and then the Authorized Agent signs, accepting the authority granted. The date for both the taxpayer and the representative must be within 45 days for domestic authorizations and within 60 days for authorization from taxpayers residing abroad. If the taxpayer signs last, then there is no timeframe requirement.

All signatures on the form must be actual and cannot be electronic or rubber stamps.

* * * * *

Mail or fax the completed form and enclosures to:

Virginia Tax

P.O. Box 1115

Richmond, Virginia

Business fax: (804)

Individual fax: (804)

For individual assistance call: (804)

For business assistance call: (804)

Document Specifics

| Fact | Detail |

|---|---|

| Purpose | The Tax Power of Attorney (POA) Form 101 allows an individual to designate another person to handle their tax matters. |

| Governing Law | This form is governed by state-specific tax laws, which vary from one state to another. |

| Scope of Authority | The designated person can perform actions like filing taxes, obtaining confidential tax information, and representing the taxpayer in front of tax authorities. |

| Validity | The validity of the form and the duration of the authority granted can vary, depending on the specifications made in the document and state regulations. |

Guide to Writing Tax POA form par 101

Upon deciding to delegate the authority to handle tax matters to another individual, the Tax Power of Attorney (POA) Form, commonly known as Form PAR 101, becomes a critical document. This form empowers another individual, often a tax professional, to discuss, obtain information, and make decisions regarding your taxes on your behalf. Careful completion of this form ensures that all necessary information is accurately conveyed, allowing for a smooth delegation of these rights. Following are the steps needed to accurately fill out the Tax POA Form PAR 101.

- Identify the taxpayer: Provide the full name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) of the individual or entity granting the power.

- Assign the representative(s): List the name(s), address(es), and telephone number(s) of the individual(s) or firm you are authorizing. If a firm is designated, include the names of the specific individuals authorized to act on your behalf.

- Specify the tax matters: Clearly indicate the type of tax, tax form number, and the year(s) or period(s) for which the authorization applies. Be as specific as possible to avoid any confusion.

- Define the power's scope: Mark the appropriate boxes to delineate the extent of the authority you are granting, including whether your representative(s) can receive refunds, sign returns, or make binding agreements on your behalf.

- Delegation of authority: If you wish to allow your representative(s) to delegate this authority to another individual, you must explicitly indicate this by checking the corresponding box.

- Rights retention: If you wish to retain specific rights (such as the right to receive notices or sign tax returns), clearly state these exceptions in the space provided.

- Signature and date: The form must be signed and dated by the taxpayer. If a non-individual entity is granting the power, the person signing on behalf of the entity must provide their title or position.

- Representative’s acceptance: The designated representative(s) must sign and date the form, acknowledging their acceptance of the authorization. Include the designation (such as CPA, attorney, etc.) next to their signature.

Once the form is completed and signed, it should be submitted to the relevant tax authority as indicated in the instructions specific to your jurisdiction. Submission procedures may vary, so it’s vital to follow the guidance provided for your specific state or the IRS guidelines if the authorization is for federal taxes. Keep a copy of the completed form for your records, as it represents an important part of your financial documentation. Submitting this form is just the beginning of a process where your representative will act on your behalf in tax matters, ensuring that you comply with tax laws while potentially leveraging their expertise to navigate complex tax situations.

Understanding Tax POA form par 101

-

What is a Tax POA Form PAR 101, and why is it needed?

A Tax Power of Attorney (POA) Form PAR 101 is a legal document that authorizes someone else, often referred to as the agent or attorney-in-fact, to handle tax matters on behalf of the person filling out the form (the principal). This form is particularly necessary when individuals need assistance with tax affairs due to lack of expertise, time constraints, or if they are unable to manage their taxes due to health issues. It grants the agent the authority to communicate with tax authorities, obtain confidential tax information, and make decisions about tax payments, arrangements, and disputes.

-

Who can be appointed as an agent on the Tax POA Form PAR 101?

Any individual can be appointed as an agent on the Tax POA Form PAR 101, provided they are competent and willing to handle the responsibilities conferred by the document. Common choices for an agent include family members, trusted friends, or professionals such as accountants or attorneys. It's crucial to choose someone who is not only trustworthy but also has the necessary knowledge or expertise in dealing with tax matters.

-

How can one revoke a Tax POA Form PAR 101?

To revoke a Tax POA Form PAR 101, the principal must provide a written statement declaring the revocation of the power of attorney. This statement should be sent to the tax authorities to whom the original POA was submitted. Additionally, it's advisable to inform the agent in writing about the revocation. For complete removal of the agent's authority, it's essential to ensure that all entities involved in your tax matters are notified of the change.

-

Are there any limitations to what an agent can do with a Tax POA Form PAR 101?

Yes, there are limitations. The scope of the agent’s powers is defined by the specific terms laid out in the Tax POA Form PAR 101 itself. Typically, agents are authorized to perform acts such as filing taxes, accessing tax information, and making payment arrangements. However, they might not be authorized to take actions like redirecting tax refunds to different accounts without explicit permission. Additionally, the principal always has the option to limit the powers granted by explicitly stating such restrictions within the document.

Common mistakes

Filling out the Tax Power of Attorney (POA) Form PAR 101 can be a critical step for individuals who seek assistance in managing their tax matters. However, there are common mistakes made during this process. Understanding and avoiding these errors can ensure that the form is completed accurately, thereby facilitating a smoother interaction with tax authorities.

-

Not providing complete information on the taxpayer and the representative. It is essential for individuals to include all necessary details, such as full legal names, addresses, and social security numbers (or Taxpayer Identification Numbers) for both the taxpayer and the appointed representative. Incomplete information may result in delays or the inability of the representative to act on the taxpayer's behalf.

-

Failure to specify the tax matters and years covered. The POA form requires taxpayers to clearly identify the type of tax, tax form number, and the years or periods that the authorization covers. A common mistake is to leave this section too vague or incomplete, which can lead to confusion and limit the representative’s ability to provide effective assistance.

-

Overlooking the need for original signatures. The validity of the POA often depends on it being signed by the taxpayer and, in some cases, the taxpayer's spouse. Digital or photocopied signatures might not be accepted. Therefore, ensuring that the form has an original signature is crucial to its acceptance by tax authorities.

-

Misunderstanding the scope of the representative’s authority. Taxpayers should carefully consider which powers they are granting to their representative. This includes decisions about discuss, receive confidential tax information, and make agreements with the tax authority. A common mistake is not clearly defining or understanding these powers, which can lead to unintended consequences.

-

Failing to revoke previous POAs. If a new POA form is being submitted to replace an earlier one, it is necessary to explicitly revoke prior authorizations. Without stating this revocation, there may be confusion or conflicts of authority between the new and previous representatives.

By paying close attention to these details, individuals can ensure that their Tax POA Form PAR 101 is filled out correctly, thus enabling their chosen representatives to act effectively on their behalf in tax matters with fewer complications or delays.

Documents used along the form

When handling tax matters, particularly with the Tax Power of Attorney (POA) Form, it is often necessary to gather and prepare additional documents. These forms work collectively to ensure comprehensive authority for handling taxes, provide detailed financial insights, and ensure compliance with tax laws. Below is a list that encompasses several critical documents commonly used in conjunction with the Tax POA Form.

- Form 1040: This is the U.S. Individual Income Tax Return form. It's the primary form used by individuals to file their annual income tax returns with the IRS. This form helps report an individual's financial income, deductions, and credits for the year, playing a crucial role alongside the Tax POA form when authorizing someone to handle personal tax matters.

- Form W-2: The Wage and Tax Statement is issued by employers to their employees and the IRS at the end of each year. It reports annual wages and the amount of taxes withheld from paychecks. It’s essential for preparing accurate tax returns.

- Form W-9: Request for Taxpayer Identification Number and Certification is used by third parties to obtain information from contractors or freelancers for tax reporting purposes. It's crucial for individuals or entities acting under a POA to manage taxes accurately for non-employees.

- Form 4868: Application for Automatic Extension of Time To File U.S. Individual Income Tax Return allows individuals extra time to file their tax returns without incurring penalties, essential in situations where the Tax POA might need more time to gather necessary information.

- Form 8821: Tax Information Authorization permits individuals or businesses to appoint someone to review and receive confidential tax information from the IRS but doesn't authorize them to act on behalf of the taxpayer. It's often used alongside a POA for broader access to information.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. It's important for individuals acting under a POA to report all forms of income accurately to the IRS.

- Form 2848: Power of Attorney and Declaration of Representative is another POA form that authorizes an individual, such as an accountant or attorney, to represent another person before the IRS. It provides specific details on what the representative can and cannot do.

- Form 4506-T: Request for Transcript of Tax Return allows individuals or their authorized representatives to request tax return transcripts, tax account information, W-2 information, and more. This can be crucial for verifying past income and tax filings.

This suite of forms and documents ensures that all facets of managing and reporting taxes can be handled efficiently and comprehensively. Whether it's for filing individual income tax returns, requesting extensions, or authorizing representatives, each document plays a vital role in the tax preparation and management process. Ensuring these documents are properly managed and submitted can help avoid potential complications or legal issues in tax matters.

Similar forms

The General Power of Attorney (POA) form is similar to the Tax POA form par 101 in that it authorizes an individual, known as the agent or attorney-in-fact, to make decisions and take actions on another person's behalf. However, while the Tax POA specifically grants the agent authority to handle tax matters, a General POA usually covers a broader range of financial and legal decisions, unless specifically limited in the document.

A Durable Power of Attorney (DPOA) shares similarities with the Tax POA form par 101 in granting someone else the authority to take care of certain matters on one’s behalf. The critical distinction lies in its effectiveness even after the principal becomes mentally incapacitated. Unlike a standard POA which becomes void if the principal loses mental capacity, a DPOA remains in effect, ensuring that the chosen agent can manage affairs, including tax matters, if specified.

The Medical Power of Attorney differs from the Tax POA form par 101 by focusing on healthcare decisions rather than financial or tax-related issues. It allows the designated agent to make medical decisions for the principal when they are unable to do so themselves. While both documents appoint someone to act on the principal's behalf, the contexts in which they operate are distinct.

The Limited Power of Attorney is akin to the Tax POA form par 101 in that it grants an agent specific powers. As implied by its name, this document is more restrictive, allowing the agent to act in specified situations only. For example, a Limited POA could authorize an agent to sell a particular property, unlike the Tax POA, which is focused solely on tax matters.

The Springing Power of Attorney is a legal document that becomes effective upon the occurrence of a specific event, usually the incapacity of the principal. This characteristic makes it similar to the Tax POA form par 101 insofar as it designates an agent to act on the principal's behalf. However, it is differentiated by its conditional activation, contrasting with the Tax POA’s immediate effectiveness upon signing.

The Financial Power of Attorney shares characteristics with the Tax POA form par 101, primarily in allowing an individual to manage financial affairs for the principal. While both documents can encompass tax matters, the Financial POA is broader, potentially covering banking, real estate, and other financial decisions beyond the scope of tax issues alone.

An Advance Directive is a legal document that outlines a person’s preferences regarding medical treatment and end-of-life care; it contrasts with the Tax POA form par 101, which focuses on tax matters. Although both documents serve to ensure someone's wishes are respected, the Advance Directive specifically addresses healthcare decisions, showing a clear distinction in purpose.

The Real Estate Power of Attorney provides an agent the authority to handle the buying, selling, managing, or refinancing of real estate on behalf of the principal. Like the Tax POA form par 101, it delegates specific responsibilities, yet its application is exclusively in the realm of real estate, diverging from the tax-focused purview of the Tax POA.

The Child Care Power of Attorney allows parents to grant another individual the authority to make decisions and take actions concerning their child's care and welfare. This includes educational and health care decisions, marking a distinct difference from the Tax POA form par 101, which is concerned solely with tax-related matters. Both documents, however, exemplify the principle of delegating authority for a particular set of decisions.

The Business Power of Attorney grants an individual the authority to act on behalf of a business or corporation, managing affairs that can include financial transactions, contractual agreements, and other business-related matters. It is similar to the Tax POA form par 101 in that it delegates decision-making powers, but it specifically pertains to business contexts, as opposed to the personal tax situations addressed by the Tax POA.

Dos and Don'ts

Understanding how to properly fill out the Tax Power of Attorney (POA) Form PAR 101 is crucial for ensuring that your tax matters are handled accurately and efficiently. Here's a straightforward list of dos and don'ts to help guide you through the process.

Do:Read the instructions carefully before beginning. It's important to understand every section to avoid mistakes.

Ensure all information is accurate and complete, including full names, addresses, and taxpayer identification numbers.

Clearly state the tax matters and years or periods involved. Being specific helps to avoid any confusion.

Sign and date the form. Your signature is necessary for the form to be valid.

Keep a copy for your records. It's always a good idea to have a backup for future reference.

Seek professional advice if you're unsure about any part of the form. A tax professional can provide valuable guidance.

Leave any sections blank. If a section doesn't apply, mark it as "N/A" (not applicable) instead of leaving it empty.

Use pencil. Always fill out the form in ink to ensure that your entries are permanent and cannot be altered without your consent.

Ignore the form's expiration date. Make sure you are using the most current version of the Form PAR 101.

Forget to notify your representative. They should be informed that they've been granted authority under this form.

Overlook the need for witnesses or a notary, if required. Some jurisdictions may require these additional steps for validation.

Rush through the process. Taking your time can prevent errors and ensure all information is correct.

Misconceptions

Navigating the complexities of tax issues can sometimes be overwhelming. It’s not uncommon for misconceptions to arise, especially when dealing with forms like the Tax Power of Attorney (POA), officially known as Form PAR 101. This document allows you to grant someone else the authority to handle your tax matters with the tax authority. Let’s clear up some common misunderstandings about this form:

- It grants unlimited authority. A common myth is that the Tax POA form gives the appointee unlimited control over all the taxpayer’s financial affairs. In reality, the scope of authority is limited to tax matters. You can specify what tasks the representative can perform and for which tax years or periods.

- It’s permanent. Many believe once a Tax POA is executed, it’s in effect indefinitely. However, the truth is you can set an expiration date for the POA. If no expiration date is specified, it generally remains in effect until it is revoked or a new POA form is filed.

- Any form can be used in all states. Another misconception is that the Tax POA form is universal. While the form serves a similar purpose across jurisdictions, each state has its own version of the Tax POA form, and it’s important to use the precise form required by your state.

- Only a lawyer can be your representative. It’s often thought that you need to appoint a lawyer as your representative on a Tax POA. In truth, while lawyers can act as your representative, so can accountants, family members, or anyone else you trust to manage your tax affairs, as long as they are eligible under the rules set by your state’s tax authority.

- It’s difficult to revoke. Some people worry that once a Tax POA is set up, it’s a complex process to revoke. Actually, revoking a Tax POA is usually as simple as submitting a written statement to the tax authority that you are revoking the powers granted to your representative or by filing a new Tax POA, which typically nullifies the previous one.

Understanding the specifics of the Tax POA Form PAR 101 can significantly ease the stress of managing tax matters and help ensure that your tax affairs are handled precisely as you wish. Make sure to consult the appropriate guidelines or seek professional advice to navigate these waters effectively.

Key takeaways

Understanding how to correctly fill out and utilize the Tax Power of Attorney (POA) Form PAR 101 is crucial for anyone aiming to grant another individual the authority to handle their tax matters. Below, you'll find key takeaways that will aid in ensuring the process is handled accurately and effectively.

- Accuracy is paramount: When completing the Tax POA Form PAR 101, every detail matters. This form requires the precise identification of the individual being granted power of attorney (the agent), including their full name, address, and telephone number. Similarly, the taxpayer's information, such as their social security number or taxpayer identification number, must be accurately provided to prevent processing delays or denials.

- Scope and limitation: Clearly define the agent’s powers and limitations within the form. The Tax POA Form PAR 101 allows taxpayers to specify which tax matters and for what periods the agent has authority. This could range from filing taxes to representing the taxpayer in audits. Being specific about the scope prevents any unnecessary or unauthorized actions on your behalf.

- Durability: Consider whether the POA should be durable, meaning it remains in effect even if you, the taxpayer, become incapacitated. This decision influences how the form is prepared and may require additional considerations or clauses to ensure that your wishes are accurately represented and legally compliant.

- Signing and Witnessing: Proper execution of the form is a must. The Tax POA Form PAR 101 typically requires the signature of the taxpayer and, in some cases, the signature of the appointed agent. Depending on state laws, witnesses or a notary might also need to sign the form for it to be valid. Always check current state requirements to ensure compliance.

In conclusion, when dealing with the Tax POA Form PAR 101, careful attention to detail, understanding the scope of authority granted, knowledge of the form's durability, and compliance with signing requirements are all critical elements to ensure the form is correctly filled out and legally sound. These steps protect both the taxpayer and the agent, facilitating a smoother management of tax matters.

Popular PDF Documents

D-400 Tax Form - Submission details, including the address for the North Carolina Department of Revenue, are provided to facilitate accurate mailing.

Form 500 Instructions - Overview of the business information section, emphasizing the significance of each detail for your Georgia tax profile.