Get Tax POA form pa-1 Form

When dealing with taxes in Pennsylvania, one might find themselves in need of delegating their tax-related responsibilities to another person. This is where the Tax Power of Attorney (POA) form, specifically the PA-1 form, comes into play. It's an important document that grants someone else—often a professional like an accountant or a lawyer—the authority to handle tax matters on your behalf. This could range from filing taxes to representing you in front of the Pennsylvania Department of Revenue. Understanding the nuances of the PA-1 form is crucial, as it outlines the specific powers granted, the duration of these powers, and important particulars about both the grantor and the grantee. The process of filling out and submitting this form is straightforward but demands attention to detail to ensure that all legal requirements are met and that your tax matters are managed exactly as you wish. It acts as a safeguard, ensuring that your representative can legally make decisions and take actions that are in your best interest, thereby relieating some of the stress associated with tax obligations.

Tax POA form pa-1 Example

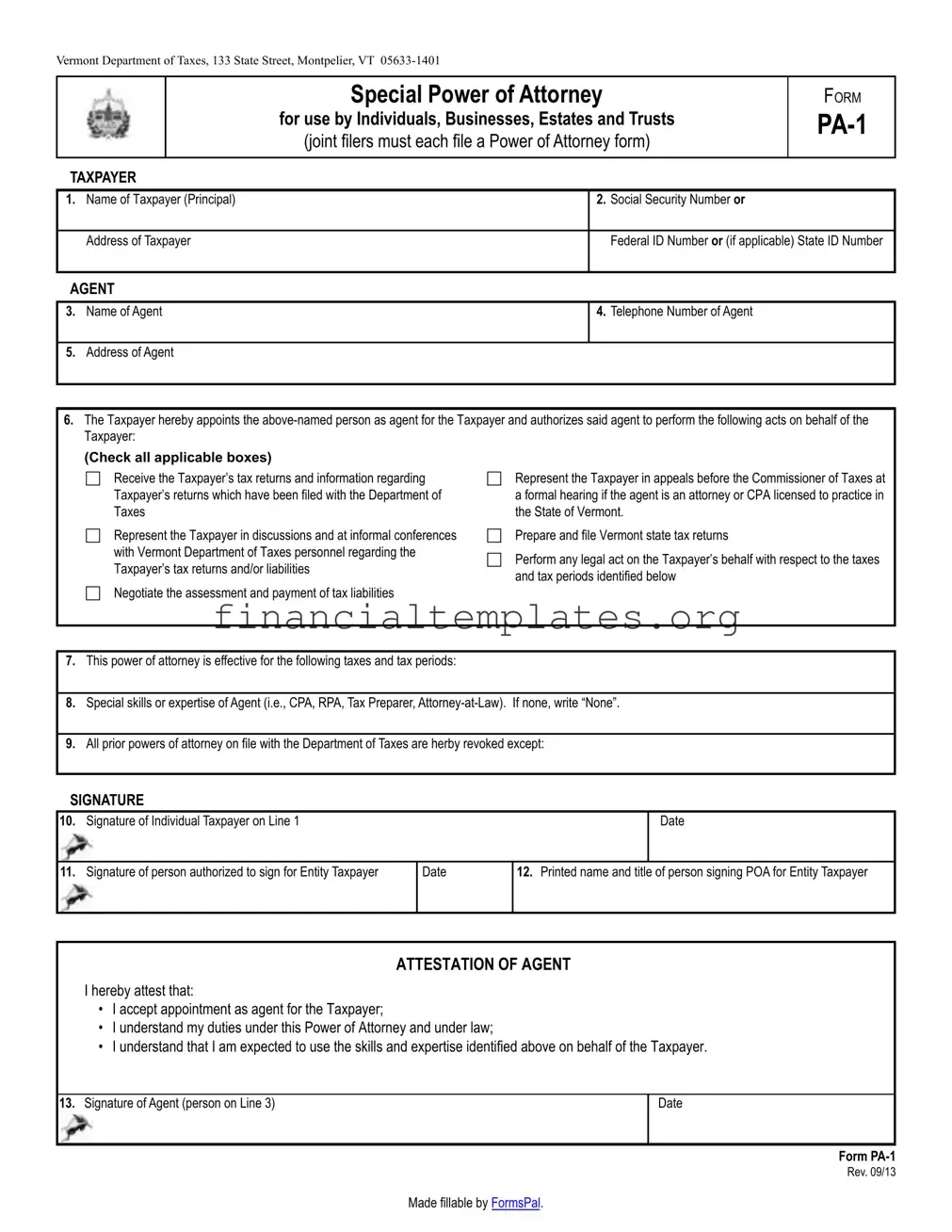

Vermont Department of Taxes, 133 State Street, Montpelier, VT

|

|

|

Special Power of Attorney |

|

FORM |

|

|

|

|

for use by Individuals, Businesses, Estates and Trusts |

|||

|

|

|

(joint filers must each file a Power of Attorney form) |

|

||

TAXPAYER |

|

|

|

|

||

1. |

Name of Taxpayer (Principal) |

|

2. |

Social Security Number or |

|

|

|

|

|

|

|

||

|

Address of Taxpayer |

|

|

Federal ID Number or (if applicable) State ID Number |

||

|

|

|

|

|

||

AGENT |

|

|

|

|

||

|

|

|

|

|

|

|

3. |

Name of Agent |

|

4. |

Telephone Number of Agent |

|

|

|

|

|

|

|

|

|

5. |

Address of Agent |

|

|

|

|

|

|

|

|

|

|

|

|

6. The Taxpayer hereby appoints the

|

Taxpayer: |

|

|

(Check all applicable boxes) |

|

|

Receive the Taxpayer’s tax returns and information regarding |

Represent the Taxpayer in appeals before the Commissioner of Taxes at |

|

Taxpayer’s returns which have been filed with the Department of |

a formal hearing if the agent is an attorney or CPA licensed to practice in |

|

Taxes |

the State of Vermont. |

|

Represent the Taxpayer in discussions and at informal conferences |

Prepare and file Vermont state tax returns |

|

with Vermont Department of Taxes personnel regarding the |

Perform any legal act on the Taxpayer’s behalf with respect to the taxes |

|

Taxpayer’s tax returns and/or liabilities |

|

|

and tax periods identified below |

|

|

Negotiate the assessment and payment of tax liabilities |

|

|

|

|

|

|

|

|

|

|

7. |

This power of attorney is effective for the following taxes and tax periods: |

|

|

|

|

8. |

Special skills or expertise of Agent (i.e., CPA, RPA, Tax Preparer, |

|

|

|

|

9. |

All prior powers of attorney on file with the Department of Taxes are herby revoked except: |

|

|

|

|

SIGNATURE |

|

|

10. |

Signature of Individual Taxpayer on Line 1 |

Date |

? |

|

|

|

|

|

11. |

Signature of person authorized to sign for Entity Taxpayer |

|

Date |

12. Printed name and title of person signing POA for Entity Taxpayer |

|

?- |

|

|

|

|

|

|

|

|

|

||

|

|

ATTESTATION OF AGENT |

|||

|

I hereby attest that: |

|

|

|

|

|

• I accept appointment as agent for the Taxpayer; |

|

|

|

|

|

• I understand my duties under this Power of Attorney and under law; |

|

|

||

|

• I understand that I am expected to use the skills and expertise identified above on behalf of the Taxpayer. |

||||

|

|

|

|

|

|

13. |

Signature of Agent (person on Line 3) |

|

|

|

Date |

|

|

|

|

|

|

Form

Rev. 09/13

Made fillable by FormsPal.

INSTRUCTIONS FOR COMPLETING VERMONT DEPARTMENT OF TAXES

SPECIAL POWER OF ATTORNEY (POA).

•This form may be used by individuals, businesses, estates and trusts. Joint income tax filers must each complete and file a power of attorney form.

•All POA forms submitted to the Department of Taxes must comply with the requirements of chapter 123 of Title 14, except that signatures of a witness and notary are not required.

•POA forms must be signed by the agent. THE DEPARTMENT OF TAXES WILL NOT ACCEPT A POA UNLESS

SIGNED BY THE AGENT.

•By signing, an agent attests that he/she accepts appointment as agent and understands the duties of agent, both under the POA and under the law. In addition, if special skills or expertise of the agent are identifed, the agent must attest that he/ she understands that he/she is expected to use those skills and expertise on behalf of the Taxpayer.

1.Print the name and address of the Taxpayer.

2.Enter the Social Security Number of an individual Taxpayer or Federal ID Number or (if applicable) State ID Number of an entity Taxpayer.

3.Print the name of the Agent.

4.Print the telephone number of the Agent.

5.Print the address of the Agent.

6.Check applicable boxes if you are authorized to prepare and file Vermont state tax returns, the returns must still be signed by the taxpayer.

7.List specific tax types (i.e., “income tax”) and tax periods (i.e., “2002”) for which Agent is authorized to

act on your behalf. If all taxes and tax periods, write “ALL”.

8.Identify any special skills or expertise of Agent which will be exercised by agent on behalf of Taxpayer, such as CPA, RPA, tax preparer,

9.List any prior Powers of Attorney on file with the Department of Taxes which are NOT revoked.

10.Signature of person on Line 1 if an individual Taxpayer.

11.Signature of person signing for an entity Taxpayer.

12.Print the name and title of person signing for an entity taxpayer.

13.Signature of Agent and date agent signed.

Document Specifics

| Name | Fact |

|---|---|

| Form Type | Tax Power of Attorney (POA) Form PA-1 |

| Main Purpose | To grant authority to an individual to handle tax matters on behalf of another person in a specific jurisdiction. |

| Governing Law(s) | Varies by state, specific to the state in which it is being used. For PA-1, it's governed by Pennsylvania state law. |

| Who Uses It? | Individuals or entities needing to grant others the power to handle their tax affairs. |

| Where to File | Submit to the respective state tax department or authority specified by the governing state's laws. |

| Validity Requirements | Must adhere to the state's legal requirements regarding POA forms, including notarization if necessary. |

| Expiration | May expire on a specific date or upon completion of the specified tax matter, depending on the terms set forth within the form. |

| Revocation | The individual granting authority may revoke the POA at any time, typically in writing according to state-specific procedures. |

| Common Uses | Often used for the filing of taxes, representation in tax disputes, and obtaining private tax information. |

Guide to Writing Tax POA form pa-1

Once an individual or a business decides to designate another person or entity to handle their tax matters, it's essential to formalize this authorization through the appropriate documentation. The Tax Power of Attorney (POA) form serves as this formal authorization, enabling the appointed party to undertake various tax-related duties on behalf of the filer. To complete this process accurately and ensure all responsibilities are clearly outlined, following the step-by-step guidelines for filling out the Tax POA PA-1 form is critical.

Here are the steps needed to fill out the form:

- Start by collecting all necessary information including the full legal names, addresses, and contact details of both the individual granting the power of attorney and the appointee.

- Specify the tax matters and years or periods covered by the power of attorney. This clarity is crucial to define the scope of authority being granted.

- The form must include the identification of the taxpayer, which could be Social Security Numbers (SSNs) for individuals or Employer Identification Numbers (EINs) for businesses.

- Detail the specific powers being granted to the appointee. These can range from representing the filer in front of tax authorities to making decisions about tax payments or refunds. Be as specific as possible to avoid future misunderstandings.

- If there are any restrictions or specific conditions attached to the power of attorney, document these clearly in the designated section of the form. This might include limitations on the length of time the POA is valid or particular decisions that the appointee cannot make.

- Both the individual granting power and the appointee must sign the form. Depending on state requirements, witness signatures or notarization may also be necessary. Check the local regulations to ensure compliance.

- Review the completed form for accuracy and completeness. Missing or incorrect information can lead to delays or the refusal of the form.

- Submit the form to the appropriate tax authority. The method of submission (mail, fax, or online) will depend on the specific guidelines of the local or state tax department handling these matters.

By thoroughly following these steps, one can ensure the Tax POA PA-1 form is correctly filled out, paving the way for a smooth handling of tax-related tasks by the appointed person or entity. Remember, the accuracy and completeness of this form not only affect its acceptance by tax authorities but also define the extent and limits of the powers granted.

Understanding Tax POA form pa-1

-

What is a Tax POA Form PA-1?

A Tax Power of Attorney (POA) Form PA-1 is a document that allows an individual, the principal, to grant another person, known as the agent or attorney-in-fact, the authority to handle tax-related matters with the Pennsylvania Department of Revenue on their behalf. This can include filing taxes, obtaining confidential tax information, and making decisions regarding tax issues.

-

Who can be designated as an agent on a Tax POA Form PA-1?

An agent designated on a Tax POA Form PA-1 can be any individual who the principal trusts to manage their tax matters. Often, people choose accountants, attorneys, family members, or close friends. It's crucial that the principal selects someone who is not only trustworthy but also knowledgeable about tax laws and procedures if the matters are complex.

-

How can someone obtain a Tax POA Form PA-1?

The Tax POA Form PA-1 can be obtained by visiting the Pennsylvania Department of Revenue’s official website, where the form can be downloaded for free. Alternatively, individuals can request a paper copy by contacting the Department of Revenue's customer service.

-

Is there a filing fee for the Tax POA Form PA-1?

No, there is no filing fee required to submit a Tax POA Form PA-1 to the Pennsylvania Department of Revenue. However, it is essential to ensure that the form is filled out accurately to avoid any delays or issues with the authorization.

-

How does one fill out the Tax POA Form PA-1 correctly?

Filling out the Tax POA Form PA-1 accurately involves the principal providing detailed information about themselves and their designated agent, including full names, addresses, and taxpayer identification numbers. Additionally, the form must specify the tax matters and periods for which the agent is authorized to act. It's essential for both the principal and the agent to sign and date the form, acknowledging their understanding and agreement to the terms set forth.

-

Where should the Tax POA Form PA-1 be submitted?

Once completed and signed, the Tax POA Form PA-1 should be submitted to the Pennsylvania Department of Revenue. The form can be mailed to the address specified on the form itself, or in some cases, it might be possible to submit the form electronically through the Department's online services portal.

-

How long does it take for a Tax POA Form PA-1 to be processed?

Processing times for the Tax POA Form PA-1 can vary depending on the current workload of the Pennsylvania Department of Revenue. It is advisable to allow several weeks for processing. If the form is needed for a specific deadline, it is recommended to submit it well in advance.

-

Can a Tax POA Form PA-1 be revoked?

Yes, a Tax POA Form PA-1 can be revoked at any time by the principal. To revoke the power of attorney, the principal must send a written notice to the Pennsylvania Department of Revenue indicating their desire to revoke the authorization. Including a copy of the original Tax POA Form PA-1 with the revocation notice is helpful but not required.

-

What happens if the agent can no longer serve?

If the agent appointed on the Tax POA Form PA-1 can no longer serve, due to reasons such as incapacity, resignation, or death, the principal should revoke the current POA and complete a new form designating a new agent to handle their tax matters.

-

Are there any restrictions on what an agent can do with a Tax POA Form PA-1?

Yes, while the Tax POA Form PA-1 grants significant authority to the agent, there are limitations. The agent is authorized to act within the scope specified in the form, which means they can only deal with the tax matters and for the periods expressly listed on the form. They are also bound by laws to act in the best interest of the principal and cannot use their position for personal gain.

Common mistakes

When it comes to managing taxes and legal documents, precision and clarity are paramount. Among the various forms to be vigilant about is the Tax Power of Attorney (POA) form PA-1, a critical document allowing an individual to grant another person the authority to handle their tax matters. Unfortunately, the process of filling out this form is often navigated with mistakes, some minor and others more consequential. Here are ten common mistakes individuals make when completing the Tax POA form PA-1:

Not verifying the correct version of the form: Tax laws and regulations evolve, resulting in updates to forms. Using an outdated version of the Tax POA form can lead to processing delays or outright rejection.

Failing to provide complete information for both the taxpayer and the representative: Every field requiring identification details for both parties must be filled out accurately. Incomplete information can lead to unnecessary confusion or a voided POA.

Overlooking the need to specify the tax matters and periods: The form necessitates clear descriptions of the tax matters and the specific periods the POA covers. A common mistake is providing vague or incomplete descriptions.

Incorrect use of the representative’s qualifications or designation: Representatives might include attorneys, certified public accountants, or other professionals. Specifying incorrect qualifications can invalidate the representation authority.

Skipping the signature and date section: The POA form is not valid unless it is signed and dated by the taxpayer. This oversight is simple yet critical.

Not respecting the witness or notarization requirements: Depending on jurisdiction, a POA form may need to be witnessed or notarized. Ignoring these requirements can lead to the rejection of the document.

Misunderstanding the scope of authority granted: Taxpayers might accidentally give more authority than intended or be unclear about the limitations of the POA, leading to unintended consequences.

Assuming immediate effect without confirmation: Once submitted, the POA does not take immediate effect until processed and confirmed by the relevant tax authority. This misassumption can lead to timing issues.

Omitting contact information for follow-up: Failing to include contact details for either the taxpayer or the representative can make it challenging for the tax authority to clarify or confirm POA details if needed.

Not retaining a copy of the completed form: For record-keeping and future reference, it's vital to keep a copy of the filled-out form which is often overlooked.

In conclusion, filling out the Tax POA form PA-1 demands careful attention to detail and an understanding of the legal and procedural requirements. Reflecting on these common mistakes before submission can help ensure a smoother process in granting a trusted individual the authority to manage tax matters effectively. Taking the time to review each section of the form thoroughly, double-checking information, and understanding the implications of delegating this authority can prevent potential hurdles and safeguard one’s financial and legal interests.

Documents used along the form

When dealing with tax matters, especially in the context of granting someone else the authority to handle these affairs on your behalf, a Tax Power of Attorney (POA) Form, specifically the PA-1 form in Pennsylvania, is critical. However, to ensure comprehensive and effective handling of one’s tax affairs, several other documents often accompany the Tax POA form. Each of these documents serves a distinct purpose, ranging from providing detailed financial information to ensuring compliance with state and federal tax laws. Understanding these forms can significantly streamline the process of managing tax-related matters.

- Form 2848 (Power of Attorney and Declaration of Representative): This IRS form authorizes an individual, such as an accountant or attorney, to represent another person before the IRS, allowing them to make filings and handle tax disputes.

- Form 8821 (Tax Information Authorization): Unlike a power of attorney, this form permits designated parties to access and view someone’s tax records, but it doesn't allow them to represent the taxpayer before the IRS.

- W-9 (Request for Taxpayer Identification Number and Certification): Often used in conjunction with the Tax POA form to provide a taxpayer's identification number to another party, ensuring accurate tax reporting.

- W-4 (Employee's Withholding Certificate): Although not directly related to the PA-1 form, this document is essential for determining the amount of taxes to withhold from an employee's paycheck, impacting overall tax obligations.

- 1040 (U.S. Individual Income Tax Return): The primary form used by individuals to file their annual income tax returns, which may be managed by the representative granted power under the PA-1 form.

- 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return): This form is crucial for requesting additional time to file an individual's 1040 form, often submitted by the authorized representative.

- Schedule C (Profit or Loss from Business): For individuals operating a business, this form accompanies the 1040 form to report profits or losses, directly affecting taxable income.

- Schedule D (Capital Gains and Losses): This form is used alongside the 1040 to report capital gains or losses from investments, which an authorized representative might need to handle.

- 8832 (Entity Classification Election): Relevant for businesses, this form is used to elect a tax classification different from the default, impacting the company’s tax obligations and potentially involving decisions made by the authorized representative.

Navigating tax matters requires diligent attention to appropriate documentation and adherence to legal and procedural guidelines. By thoroughly understanding and properly employing these forms in conjunction with the Tax POA form, individuals and their authorized representatives can ensure a more effective management of tax affairs, reducing complexities and mitigating potential legal issues. Always consult with a tax professional or attorney to ensure the correct use of these forms for your specific situation, as this guidance is based on general circumstances.

Similar forms

The Tax Power of Attorney (POA) form, specifically in Pennsylvania (PA-1), closely resembles the General Power of Attorney form. Both documents empower another person to make decisions on behalf of the signer. However, while the General POA covers a wide range of decisions, including financial, legal, and health-related issues, the Tax POA is specific to tax matters, allowing the appointed person to handle tax filings, disputes, and discussions with tax authorities.

Similarly, the Durable Power of Attorney (Durable POA) shares common attributes with the Tax POA. A Durable POA remains effective even if the principal becomes incapacitated. Like the Tax POA, it grants authority to an agent; however, its scope isn't limited to tax issues. It's the durability aspect and the delegation of decision-making that links these two types of documents, even though their applications differ widely.

The Medical Power of Attorney document, while fundamentally different in purpose — focusing on health care decisions rather than tax issues — also parallels the Tax POA in structure. It designates an agent to make medical decisions on the principal's behalf, underlining the common premise of appointing a trusted individual to act in the signer's best interest when they are unable to do so themselves.

The Financial Power of Attorney shares a closer functional resemblance to the Tax POA, as both involve financial matters. However, the Financial POA typically encompasses a broader range of financial duties beyond tax filing and negotiation, including managing bank accounts, real estate, and other assets. The specificity of the Tax POA to tax affairs is what primarily differentiates it.

Limited Power of Attorney forms are akin to the Tax POA in that they grant specific powers to an agent for discrete tasks. A Limited POA might authorize someone to sell a property, manage certain assets, or make specific financial transactions, paralleling the precise nature of authority granted by a Tax POA for tax-related issues.

Advance Health Care Directive forms, while primarily health-focused, share the principle of appointing someone to make crucial decisions on another's behalf. This fundamental similarity underlines the notion of trust and representation seen in the Tax POA, even as the subject matter diverges significantly.

The Estate Power of Attorney is another document with similarities to the Tax POA. It specifically allows an agent to handle the principal’s estate matters, which can include certain tax aspects. While the Estate POA can encompass broader estate management tasks, its overlap with tax matters speaks to the versatile yet focused nature of the Tax POA.

The IRS Power of Attorney (Form 2848) is a federal document that, like the Tax POA PA-1, specifically authorizes individuals to represent the signer before the IRS, handling tax issues that range from filings to disputes. The main difference lies in the jurisdiction — IRS Form 2848 is for federal tax matters, while the Tax POA PA-1 is for State of Pennsylvania tax issues.

A Business Power of Attorney is designed to allow an individual, often a business owner, to designate an agent to handle specific business-related decisions, which can include tax filings and negotiations among other responsibilities. This parallels the Tax POA's emphasis on handling complex, specific tasks through a trusted agent, albeit within the commercial sphere.

Lastly, the Real Estate Power of Attorney, which empowers an agent to make decisions and act on the principal's behalf regarding property and real estate matters, can sometimes involve tax considerations, such as paying property taxes or handling the tax implications of buying and selling property. This document, therefore, shares a link with the Tax POA through the need to manage tax-related issues within its designated area of authority.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) Form PA-1 requires attention to detail and an understanding of its implications. By following these guidelines, you can ensure that the process is smooth and that the form accurately reflects your intentions. Below are essential dos and don'ts to consider:

- Do ensure that all information provided on the form is accurate and complete. Inaccuracies can lead to unnecessary delays or complications.

- Do specify the tax matters and years for which you are granting authority. Being clear about the scope of the POA ensures that your representative can act effectively on your behalf.

- Do choose a representative who is knowledgeable and trustworthy. This individual will have significant power over your tax matters, so it's crucial to choose wisely.

- Do sign and date the form in the presence of a notary public if required by your state’s law. This step may not be necessary for all locations but is important for validating the document in many jurisdictions.

- Don't leave any sections blank. If a section does not apply, mark it as "N/A" (not applicable). An incomplete form may be considered invalid.

- Don't forget to inform your representative about their appointment and share any pertinent details they need to know to act on your behalf.

- Don't ignore the expiration date of the POA if applicable. Some states require that a new form be filled out after a certain period.

- Don't hesitate to seek professional advice if needed. Complex tax issues or uncertainty about how to fill out the form correctly may warrant the guidance of a tax professional or attorney.

By adhering to these dos and don'ts, you can help ensure that your Tax Power of Attorney Form PA-1 accurately reflects your wishes and that your representative can carry out their duties without unnecessary hurdles.

Misconceptions

Many people hold misconceptions about the Tax Power of Attorney (POA) form, specifically the PA-1 form, which can lead to confusion and errors when attempting to authorize someone to handle their tax matters. It’s important to dispel these myths for a smoother experience.

Only attorneys can be designated on the PA-1 form. This is a common mistake. In fact, any individual, including certified public accountants, enrolled agents, and even family members, can be granted authority as long as they’re competent to deal with the Pennsylvania Department of Revenue on your behalf.

The PA-1 form grants unlimited power. This misconception could cause unnecessary worry. The truth is the form allows you to specify the extent of power granted, including limitations on the types of taxes or the tax years for which they have authority.

Filing the PA-1 form is a lengthy and complex process. While dealing with forms can be daunting, the PA-1 is designed to be straightforward. By accurately completing the required fields and following the provided instructions, you can efficiently file the form without much hassle.

Once filed, the PA-1 form’s designations are permanent. This is inaccurate. You have the flexibility to revoke or modify the power of attorney at any time should your situation or preferences change.

Using the PA-1 form means losing control over your tax matters. This couldn’t be further from the truth. Designating someone as your power of attorney simply allows them to act on your behalf in specific situations that you define. You retain the ultimate control over your tax affairs.

Understanding these key points about the Tax POA PA-1 form can help individuals navigate their tax matters more effectively, facilitating a better relationship with the Pennsylvania Department of Revenue and ensuring their affairs are handled according to their precise wishes.

Key takeaways

Filling out and using the Tax Power of Attorney (POA) form, specifically the PA-1 form, can seem daunting at first. However, understanding a few key points can simplify the process and ensure you complete the form accurately and effectively.

Firstly, the Tax POA form PA-1 allows a taxpayer to grant authority to another individual, known as an agent or attorney-in-fact, to represent them in matters related to the state's Department of Revenue. This includes but is not limited to, discussing tax matters, receiving confidential information, and representing the taxpayer in tax disputes.

It's crucial to accurately fill in all required sections of the form to avoid delays or rejections. This includes personal information about the taxpayer and the designated agent, as well as specifics about the tax matters or periods involved.

One often overlooked section is the specific powers granted to the agent. Clearly outline what the agent is authorized to do on your behalf to prevent misunderstandings or unintentional limitations on their authority.

The taxpayer must sign and date the form for it to be valid. If a taxpayer is unable to sign, a legal guardian or power of attorney already established may sign on the taxpayer's behalf, but additional documentation proving this authority may be required.

Keep in mind that the Tax POA form PA-1 is specific to the state's tax matters and does not extend to federal tax issues or non-tax-related legal matters. For those, separate forms or documents would be necessary.

After completing the form, it's important to file it correctly according to the instructions provided by the state's Department of Revenue. This may involve mailing or faxing the form to a specific address or number.

Finally, it's advisable to keep a copy of the signed form for your records and to stay informed about the status of the POA. If your circumstances change, such as no longer needing the services of your agent, you must inform the Department of Revenue to revoke the POA.

Understanding these key takeaways about the Tax POA form PA-1 can make navigating tax matters simpler and less stressful by ensuring you properly grant the necessary authority to a trusted individual. Remember, when in doubt, consulting with a tax professional can provide additional guidance tailored to your specific situation.