Get Tax POA form n848 Form

When individuals or businesses face the daunting task of addressing tax matters with the Internal Revenue Service (IRS), they often find the need to appoint someone else to act on their behalf. This is where the Tax Power of Attorney (POA) form, officially known as Form N-848, plays a crucial role. It grants an authorized person or entity the legal authority to handle tax affairs, providing a streamlined way to manage communications, decisions, and submissions with the IRS. Understanding the implications, requirements, and the process of completing and submitting this form is essential for anyone looking to navigate their tax responsibilities efficiently and effectively. By ensuring that the right person has the authority to act on their behalf, taxpayers can alleviate the stress often associated with tax matters. The form outlines specific powers granted to the agent, including but not limited to, obtaining confidential tax information and making decisionsabout filing status and disclosures. Hence, the importance of this form cannot be overstated for those seeking to manage their tax matters with greater ease and confidence.

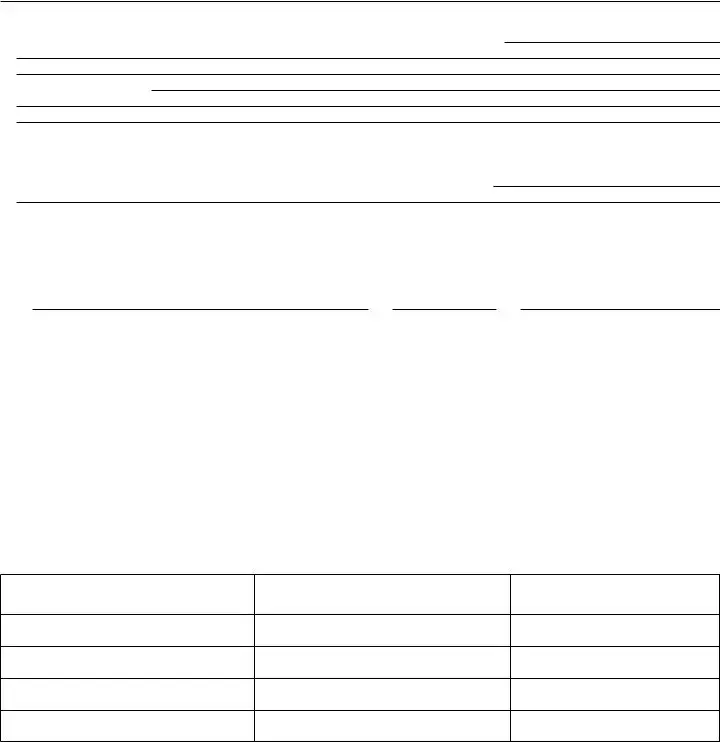

Tax POA form n848 Example

FORM

(REV. 2018)

STATE OF HAWAII - DEPARTMENT OF TAXATION

POWER OF ATTORNEY

(NOTE: References to “married” and “spouse” are also references to “in a civil union” and “civil union partner,” respectively.)

This Power of Attorney will EXPIRE six (6) years from the latest date a Taxpayer signs this document

PART I POWER OF ATTORNEY (Please type or print.)

|

1 Taxpayer Information. Taxpayer(s) must sign and date this form on page 2, line 5. |

Social security number(s) |

Federal employer |

|||||

|

Taxpayer name(s) and address |

|||||||

|

|

|||||||

|

|

|

|

|

|

|

identification number |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daytime telephone number |

Fax number |

||||

|

|

|

( ) |

( ) |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

hereby appoint(s) the following representative(s) as |

|

|

|

|

|

|

|

2Representative(s) must be an individual and must sign and date this form on page 2, Part II.

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|||

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|||

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

||||

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

Check if new: Address |

|

Telephone |

|

Fax |

|

|||||||

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|||

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|||

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

||||

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

Check if new: Address |

|

Telephone |

|

Fax |

|

|||||||

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|||

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|||

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

||||

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

Check if new: Address |

|

Telephone |

|

Fax |

|

|||||||

Individual name and address |

VPID or TMRID |

|

|

|

|

|

|

|

|

|

|||

|

Social Security No. |

|

|

|

|

|

|

|

|

|

|||

|

Telephone No. ( ) |

|

|

|

|

|

|

|

|

||||

|

Fax No. ( ) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

||||

|

Check if new: Address |

|

Telephone |

|

Fax |

|

|||||||

to represent the taxpayer(s) before the Department of Taxation, State of Hawaii, for the following acts:

3Acts authorized (you are required to complete this line 3). (Stating “All Taxes” or “All Periods” on line 3 is NOT acceptable.) With the exception of the acts described in line 4b, I (we) authorize my (our) representative(s) to receive and inspect my (our) confidential tax information and to perform acts that I (we) can perform with respect to the tax matters described below. For example, my (our) representative(s) shall have the authority to sign any agreements, consents, tax clearance applications, or similar documents (but see instructions for authorizing a representative to sign a return). Please note that the tax year(s) or period(s) on line 3 can extend only 3 years after the current year. For example, if Form

Complete a separate line for each specific tax type. All three (3) columns of the line must be completed for the tax type.

Hawaii Tax I.D. Number

(e.g.,

Type of Tax

(Income, General Excise, etc.)

Year(s) or Period(s)

N848_I 2018A 01 VID01

ID NO 01

FORM

FORM |

|

(REV. 2018) |

PAGE 2 |

4a Additional acts authorized. In addition to the acts listed on line 3 above, I (we) authorize my (our) representative(s) to perform the following acts (see instructions): Authorize disclosure to third parties; Substitute or add representatives; Sign a return;

Other acts authorized:

4b Specific acts not authorized. My (our) representative(s) is (are) not authorized to endorse or otherwise negotiate any check (including directing or accepting payment by any means, electronic or otherwise, into an account owned or controlled by the representative(s) or any firm or other entity with whom the representative(s) is (are) associated) issued by the government in respect of a Hawaii tax liability.

List any specific deletions to the acts otherwise authorized in this power of attorney (see instructions):

5Signature of Taxpayer(s). If a tax matter concerns a year in which a joint return was filed, both spouses must sign if joint representation is requested. If signed by a corporate officer, partner, guardian, tax matters partner/person, executor, receiver, administrator, or trustee on behalf of the taxpayer, I certify that I have the authority to execute this form on behalf of the taxpayer.

IF NOT SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED TO THE TAXPAYER.

|

|

|

|

Signature |

|

Date |

|

Title (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print Name |

|

Print name of taxpayer from line 1 if other than individual |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Date |

|

Title (if applicable) |

|

|

|

|

|||||||

|

|

|

|

Print Name |

|

|

|

|

|

|

PART II |

SIGNATURE OF REPRESENTATIVE(S) |

|

|

|

|

|

||

|

|

|

COMPLETED, SIGNED AND DATED, THIS POWER OF ATTORNEY WILL BE RETURNED TO THE TAXPAYER. REPRESENTATIVES |

||||||

|

|

MUST SIGN IN THE ORDER LISTED IN PART I, LINE 2. |

|

|

|

|

|

||

Type or Print Name

Signature

Date

Filing the Power of Attorney

File the original, photocopy, or facsimile transmission (fax) with each letter, request, form, or other document for which the power of attorney is required. For example, if you wish to designate an individual to represent you in obtaining tax clearance certificates, a copy of Form

Hawaii Department of Taxation

P.O. Box 259

Honolulu, HI

or send it by FAX to (808)

QUESTIONS? Call

Document Specifics

| Fact Name | Description |

|---|---|

| Definition | The Tax Power of Attorney (POA) Form, usually known as Form 2848 at the federal level, allows an individual to grant authority to a tax professional or another person to handle tax affairs on their behalf. |

| Purpose | This form is used to authorize a representative to receive confidential tax information and make decisions about taxes, including signing tax returns, on behalf of the person granting the power. |

| State-Specific Versions | Most states have their own version of a Tax POA form, tailored to their state tax laws. The specific name and form number can vary by state. |

| Governing Law(s) | For the federal Tax POA, United States federal tax law governs. State-specific forms are governed by the respective state's tax laws. |

| Duration | The duration of the powers granted can be specified in the form. If not specified, the powers remain in effect until formally revoked or as defined by the governing law. |

| Revocation | The authority granted through a Tax POA can be revoked by the person who granted it at any time, typically by submitting a written notice of revocation to the relevant tax authority. |

Guide to Writing Tax POA form n848

After deciding to delegate authority for tax matters to someone you trust, the next crucial step involves filling out the Tax Power of Attorney (POA) Form N-848. This form empowers your chosen agent to handle tax affairs on your behalf with the taxing authority. Accuracy and clarity in filling out this form are vital, as it outlines the extent of power granted and identifies the parties involved. By following these steps, you can ensure the form is completed thoroughly and correctly, paving the way for your agent to act on your behalf without unnecessary delays or complications.

- Start by entering your full legal name and address in the designated fields at the top of the form. This identifies you as the taxpayer granting the power.

- Fill in your social security number (SSN) or individual taxpayer identification number (ITIN) and your daytime phone number in the appropriate spaces.

- Specify the name and address of the individual or organization you are granting authority to. This is your chosen representative in all tax matters.

- Provide the representative's telephone number, fax number (if available), and email address to ensure they can be contacted by the taxing authority.

- Detail the tax matters and years or periods for which the authorization applies. Be precise to avoid any ambiguity about the extent of the power granted.

- Indicate any specific additions or restrictions to the representative’s authority in the space provided. If the space is insufficient, attach a separate sheet with additional information.

- Both you and your representative must sign and date the form. Your signatures validate the document and officially grant the powers specified in the form.

- Review the entire form to ensure all information is accurate and complete. Missing or incorrect information can lead to delays or the need to submit a new form.

Once the Tax POA Form N-848 is fully completed and signed, you should promptly submit it to the relevant taxing authority. This step officially activates the powers granted and allows your representative to begin handling your tax matters. Keep a copy of the signed form for your records and consider notifying your tax advisor or accountant of this arrangement to ensure a coordinated approach to your tax affairs.

Understanding Tax POA form n848

-

What is the Tax Power of Attorney (POA) Form N-848?

A Tax Power of Attorney, denoted as Form N-848, serves as a legal document. Through this, individuals or businesses can grant authority to a professional, such as an accountant or attorney, to handle their tax matters. This authority empowers the designated representative to communicate with the tax authority on the individual’s behalf, request and inspect confidential tax information, and perform actions like signing agreements or making decisions relevant to tax matters. Importantly, the powers granted can be tailored to the grantor's specific needs and preferences.

-

Who can be appointed as a representative on Form N-848?

On Form N-848, individuals can appoint almost anyone they trust as their representative. This includes, but is not limited to, certified public accountants, attorneys, family members, or trusted friends. The critical factor is that the appointee should be someone the taxpayer trusts to manage their tax affairs responsibly. However, it's beneficial to appoint someone with professional knowledge of tax laws and procedures, as they will be negotiating with the tax authorities and making decisions that could have significant financial implications.

-

How do I complete and file Form N-848?

To properly complete Form N-848, taxpayers need to fill in their personal details, including their name, address, and Tax Identification Number (TIN). They must also specify the tax matters and periods for which they are granting authority. Names and qualifications of the representatives must be listed, and the form must be signed by the taxpayer, and in some cases, by the representative(s) as well. For filing, the completed form should be sent to the appropriate tax authority or office specified by local tax laws or regulations. It is crucial to ensure that the form is completed accurately to avoid any delays or issues with the authorization.

-

Is Form N-848 valid indefinitely?

The validity period of Form N-848 is generally determined by the specifics outlined within the form itself. Taxpayers have the discretion to set a specific expiration date for the POA. If no expiration date is specified, the form’s validity may be subject to the governing laws of the jurisdiction in which it is filed. In some cases, this could mean the POA remains effective indefinitely unless revoked. Taxpayers should consult with a legal or tax professional to ensure that the POA meets their needs and complies with local laws.

-

Can the authority granted by Form N-848 be revoked?

Yes, the authority granted through Form N-848 can be revoked at any time by the taxpayer. To revoke the POA, the taxpayer typically needs to send a written notice of revocation to the tax authority where the POA was filed. This notice should clearly identify the POA to be revoked and the effective date of the revocation. It's also advisable to notify the representative of the revocation. In some jurisdictions, a new POA may automatically revoke a previously filed POA, but it is essential to verify this with local tax law regulations.

-

Is it necessary to use Form N-848 for all tax-related matters?

While Form N-848 is a powerful tool for managing tax-related matters through a representative, it may not be necessary for all situations. For straightforward tax matters, individuals might manage their affairs directly with the tax authorities. However, for complex situations, such as audits, appeals, or negotiating payment plans, having a designated representative with the authority provided by Form N-848 can be highly beneficial. The choice to use this form depends on the individual’s circumstances, the complexity of their tax matters, and their comfort level in dealing with tax authorities.

Common mistakes

When filling out the Tax Power of Attorney (POA) Form, also known as Form N-848, individuals often encounter a variety of pitfalls that can complicate the process or invalidate the document. Below are eight common mistakes to avoid to ensure the form is filled out correctly and effectively:

Not Checking the Most Current Form Version: Tax laws and form requirements can change. Using an outdated version of Form N-848 can lead to the submission being rejected.

Incorrect Personal Information: Entering incorrect names, social security numbers, or addresses for the taxpayer or the representative can cause significant delays or the invalidation of the POA.

Omitting Required Signatures: Both the taxpayer(s) and the designated representative(s) must sign the form. Missing signatures will result in the form not being processed.

Failing to Specify Tax Matters: The form requires detailed information about which tax matters and years the POA covers. Generalized or incomplete descriptions can void the document.

Ignoring the Need for Specific POA Forms for Business Affairs: If the POA is for business tax matters, a separate form or additional documentation may be required, depending on the state or nature of the tax issues.

Not Revoking Previous POAs: If a new POA is intended to replace an older one, it must explicitly state that previous Powers of Attorney are revoked, or there may be confusion as to the valid POA.

Misunderstanding the Representative’s Authority: The POA form outlines specific powers granted to the representative. Overestimating or underestimating this authority may lead to unintended consequences.

Incomplete Clauses: Failing to thoroughly complete all relevant sections, especially those outlining specific conditions or limitations of the POA, can lead to ambiguity and potential legal challenges.

By avoiding these common errors, individuals can ensure their Tax POA form is complete, accurate, and effective in granting the necessary authority to their chosen representative.

Documents used along the form

When handling tax matters, particularly with the Tax Power of Attorney (POA) Form N-848, additional documentation is often necessary for a smooth and comprehensive approach. These forms help in providing all the needed information and authority to carry out tax-related tasks effectively. Let's explore some of these commonly used documents.

- Form 2848, Power of Attorney and Declaration of Representative - This is a federal form used to authorize an individual, such as an accountant or attorney, to represent another person before the IRS. It is similar to the Tax POA but for federal tax purposes.

- Form 8821, Tax Information Authorization - This form grants a third party the permission to access and review an individual’s tax records, but it does not allow them to represent the taxpayer. It is often used alongside the POA for more comprehensive access to tax information.

- Form W-9, Request for Taxpayer Identification Number and Certification - Often required to be filled out and submitted with the Tax POA, it provides the taxpayer’s identification number and certifies that the information is correct, which is crucial for any tax documentation process.

- Form 4506-T, Request for Transcript of Tax Return - This form is used to request a transcript of past tax returns, which may be necessary for the appointed representative to understand the taxpayer's history or for amending previous returns.

- Form SS-4, Application for Employer Identification Number (EIN) - If the Tax POA involves handling affairs for a business or an estate that requires an EIN, this form would be necessary to apply for or confirm the entity’s EIN with the IRS.

It's important to remember that while these forms are commonly used together with the Tax POA Form N-848, the specific needs and circumstances of each taxpayer may lead to the use of additional forms or documents. Ensuring that the correct forms are completed and submitted can help in avoiding delays or complications in tax matters.

Similar forms

The General Power of Attorney (POA) form closely mirrors the Tax POA Form n848 in its basic function: it grants an individual the authority to make decisions on another person's behalf. However, while the Tax POA focuses specifically on tax-related matters, a general POA encompasses a broader range of responsibilities. These might include making financial decisions, handling business transactions, and even addressing certain legal matters. The similarity lies in the core concept of delegated authority, even though the scope and application of that authority differ significantly between the two documents.

A Financial Power of Attorney shares similarities with the Tax POA Form n848, as it specifically grants an agent the ability to manage the financial affairs of the principal. This can include handling investments, managing bank accounts, and making financial decisions. The primary similarity between these documents is their focus on financial matters, although the Tax POA is more narrowly tailored towards tax-related transactions and compliance, demonstrating a focused subset of the broader financial powers covered in a Financial POA.

Healthcare Power of Attorney is another document that, although fundamentally different in its purpose—focusing on health-related decisions rather than financial matters—parallels the Tax POA Form n848 in structure. It designates an agent to make healthcare decisions on behalf of the principal in the event they become incapacitated. This document, like the Tax POA, is based on the principle of representation, entrusting decision-making power to someone else, but it applies specifically to medical, not fiscal, decisions.

The Durable Power of Attorney (DPOA) is characterized by its continuity; it remains effective even if the principal becomes incapacitated. This feature distinguishes it from the Tax POA Form n848, which does not necessarily contain such durability clauses. Both documents empower an agent to act on the principal's behalf, but the DPOA, with its endurance over time and through various conditions of the principal, offers a broader safeguard over the individual’s affairs, extending beyond just tax issues.

Springing Power of Attorney is designed to become effective upon the occurrence of a specific event, typically the principal's incapacity. Its alignment with the Tax POA Form n848 lies in the legal framework of delegating authority from a principal to an agent. However, the Springing POA's unique trigger mechanism—only "springing" into action upon predefined conditions—sets it apart, providing a nuanced approach to the transfer of decision-making power that is not usually found in the more immediately effective Tax POA.

Limited Power of Attorney allows the principal to grant specific powers to the agent for a limited time or task, sharing the concept of assigned authority with the Tax POA Form n848. The similarity lies in both documents' ability to narrow down the agent’s powers to particular tasks. While the Tax POA is inherently specific to tax matters, a Limited POA might be drafted for a variety of specific purposes, including but not limited to financial transactions, selling property, or attending specific legal proceedings.

The Advance Healthcare Directive, often referred to as a living will, provides instructions for one's care in the event of incapacitation. Though its purpose diverges significantly from that of the Tax POA Form n848, focusing on health care preferences rather than financial matters, both documents embody the principle of preparatory decision-making. They serve as proactive measures, allowing individuals to outline their directives (whether for health or tax matters) in anticipation of future events where they might not be able to express their wishes directly.

The Estate Planning Will, or simply a will, differs in nature from the Tax POA Form n848, primarily as it comes into effect after the individual’s death, rather than granting immediate authority during their lifetime. However, both play crucial roles in the management and disposition of personal affairs. While the Tax POA enables someone to manage tax-related matters potentially reducing the estate's tax liabilities, a will delineates how the individual’s assets should be distributed upon their death, thus indirectly influencing the estate’s financial obligations and benefits.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) Form, commonly referred to as Form N-848, understanding what to do and what not to do is crucial. This guidance ensures the process is completed correctly, providing the necessary authorization without complications. Here are the essential dos and don’ts to keep in mind:

Do:

- Read instructions carefully before you start filling out the form to ensure you understand all requirements.

- Use black ink for clarity and legibility, as this is standard for most official documents.

- Provide accurate information regarding your identification, including your full legal name, address, and taxpayer identification number (TIN), to prevent any processing delays.

- Designate a qualified representative. Choose someone you trust and who is legally allowed to represent you. This could be an accountant, attorney, or someone with specific tax preparation knowledge.

- Sign and date the form to validate it. An unsigned form is considered incomplete and will not be processed.

Don't:

- Leave sections blank. If a section does not apply, write "N/A" (not applicable) instead of leaving it empty.

- Use correction fluid or tape. Mistakes should be cleanly crossed out and corrected to avoid suspicions of tampering.

- Forget to specify the tax forms and years you are giving your representative authority over. Being specific avoids any confusion regarding your representative's powers.

- Ignore the need for witness signatures, if required. Some jurisdictions may need an additional witness or notarization, so make sure this is completed.

- Fail to keep a copy for your records. After the form is filled out and submitted, retain a copy in case of disputes or for your personal records.

Misconceptions

The Tax Power of Attorney form, formally known as Form 2848, allows individuals to grant authority to someone else to manage their tax matters. However, several misconceptions surround this critical document. Clearing up these misunderstandings can ensure taxpayers make informed decisions about using a Tax POA.

Only Lawyers Can Be Designated: It's a common belief that only attorneys can be appointed with a Tax POA. However, certified public accountants (CPAs) and enrolled agents, individuals who have passed IRS-administered tests, can also be granted this authority. The key is that the representative must be authorized to practice before the IRS.

Tax POA Grants Unlimited Power: Many think that a Tax POA gives the representative carte blanche over all financial affairs. In reality, the form specifies the tax forms and periods it covers, limiting the agent's authority to those explicitly mentioned areas.

It's Irrevocable: Another misconception is that once a Tax POA is in place, it cannot be revoked. Contrary to this belief, the taxpayer can cancel the POA at any time by simply writing to the IRS revoking the authorization or submitting a new POA, which automatically revokes the previous one for the same matters.

A Tax POA is the Same as a General POA: Some confuse a Tax POA with general powers of attorney. The former solely pertains to tax matters, while a general POA typically encompasses a broader range of financial and legal authorities. It's crucial to understand this distinction to ensure proper handling of one's affairs.

Filing a Tax POA Is a Complicated Process: The procedure for filing a Tax POA might seem daunting. However, the IRS has streamlined the process. The form itself is straightforward and requires basic information about the taxpayer, the representative, and the tax matters in question. Instructions provided by the IRS guide through completing and submitting the form, simplifying the process.

Key takeaways

The Tax Power of Attorney (POA) form, also known as Form n848, plays a pivotal role in granting someone else the authority to manage your tax matters. Here are eight key takeaways to keep in mind when filling out and using this form:

- Understand the scope of authority: Know that by completing the form, you're allowing the designated individual, your agent, to handle tax affairs on your behalf. This includes, but isn't limited to, receiving confidential tax information and making decisions about payments, refunds, and signing documents.

- Choose your agent wisely: The person you designate as your agent should be someone you trust implicitly, as they will have significant control over your financial and tax matters. This could be a family member, trusted friend, or a professional like an accountant or attorney.

- Be specific: When filling out the form, be as specific as possible about the tax matters and years or periods your agent has authority over. Vagueness could lead to unnecessary confusion or a limitation of your agent's ability to act on your behalf.

- Signing requirements must be met: Ensure that the form is correctly signed and dated, meeting any state-specific requirements such as notarization, if applicable. Failing to do so can invalidate the form.

- File promptly: Once the form is correctly completed and signed, file it with the appropriate tax authority to ensure your agent can begin acting on your behalf without delay.

- Revoke if necessary: Understand that you have the right to revoke the power of attorney at any time should your circumstances or wishes change. This typically requires a written notice to both the tax authority and your designated agent.

- Consider the expiration date: Some POA forms have an expiration date. If yours does, be aware of that date and plan to renew the form if you still require your agent's services.

- Keep records: Always keep a copy of the POA form for your records. Additionally, it's wise to keep any correspondence related to the appointment of your agent and actions taken on your behalf.

Properly executed, Form n848 can ensure that your tax matters are handled efficiently and according to your wishes, even when you're not able to manage them yourself. These takeaways can guide you through the process, helping to avoid common pitfalls and ensuring that your financial health is safeguarded.

Popular PDF Documents

Form 50-244 - The inventory tax statement facilitates tax collection on vehicle sales at the county level.

What Is Schedule D - Aids in reconciling investment records with brokerage statements for tax purposes.