Get Tax POA form ID-POA Form

Navigating the complexities of tax matters often involves enlisting the help of professionals, whether for advice, representation, or direct action on one's behalf. In such cases, a critical document comes into play: the Tax Power of Attorney (POA) form, specifically the ID-POA form for residents or taxpayers within a particular jurisdiction. This form serves as a legal instrument, empowering an individual, often a tax attorney, accountant, or other qualified professional, to act in the taxpayer’s stead concerning tax matters. The significance of this form lies not just in its function of delegation, but in the specifics it demands for effective execution - details of the taxpayer, the appointee, the extent of powers granted, and the duration of those powers, amongst other elements. It's a cornerstone for those seeking to manage their taxes through a proxy, ensuring that all actions taken are within the bounds of legal authorization and with the taxpayer's best interests in mind. Understanding its nuances, requirements, and implications is essential for anyone looking to navigate their tax affairs smoothly and efficiently, highlighting the form's role as not just a bureaucratic necessity but as a safeguard for both the taxpayer and their designated representative.

Tax POA form ID-POA Example

IDAHO

State Tax Commission

Form

bL375E

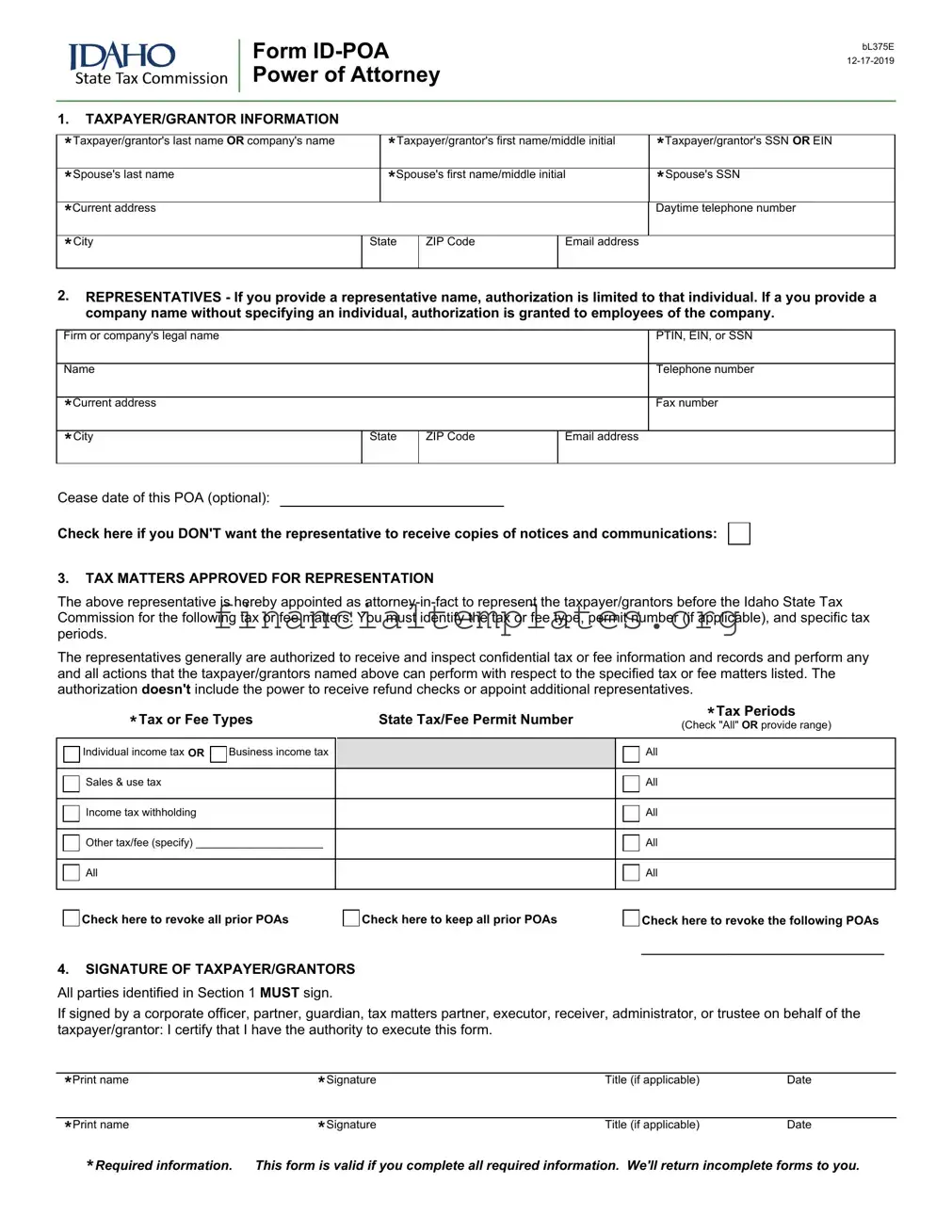

1. TAXPAYER/GRANTOR INFORMATION

|

|

|

|

|

|

|

*Taxpayer/grantor's last name OR company's name |

|

*Taxpayer/grantor's first name/middle initial |

*Taxpayer/grantor's SSN OR EIN |

|||

*Spouse's last name |

|

*Spouse's first name/middle initial |

*Spouse's SSN |

|||

*Current address |

|

|

|

|

Daytime telephone number |

|

*City |

I |

State |

ZIP Code |

Email address |

|

|

|

|

|

I |

I |

|

|

2.REPRESENTATIVES - If you provide a representative name, authorization is limited to that individual. If a you provide a company name without specifying an individual, authorization is granted to employees of the company.

Firm or company's legal name |

|

|

|

PTIN, EIN, or SSN |

|

|

|

|

|

|

|

Name |

|

|

|

Telephone number |

|

|

|

|

|

|

|

*Current address |

|

|

|

Fax number |

|

*City |

I |

State |

ZIP Code |

Email address |

|

|

|

I |

I |

||

Cease date of this POA (optional):

Check here if you DON'T want the representative to receive copies of notices and communications: □

3.TAX MATTERS APPROVED FOR REPRESENTATION

The above representative is hereby appointed as

The representatives generally are authorized to receive and inspect confidential tax or fee information and records and perform any and all actions that the taxpayer/grantors named above can perform with respect to the specified tax or fee matters listed. The authorization doesn't include the power to receive refund checks or appoint additional representatives.

*Tax or Fee Types |

State Tax/Fee Permit Number |

*Tax Periods |

(Check "All" OR provide range) |

||

□Individual income tax OR □Business income tax |

|

□ All |

□ Sales & use tax |

|

□ All |

□ Income tax withholding |

|

□ All |

□ Other tax/fee (specify) _____________________ |

|

□ All |

□ All |

|

□ All |

□Check here to revoke all prior POAs |

□Check here to keep all prior POAs |

□Check here to revoke the following POAs |

|

|

____________________________________ |

4.SIGNATURE OF TAXPAYER/GRANTORS All parties identified in Section 1 MUST sign.

If signed by a corporate officer, partner, guardian, tax matters partner, executor, receiver, administrator, or trustee on behalf of the taxpayer/grantor: I certify that I have the authority to execute this form.

*Print name |

|

*Signature |

Title (if applicable) |

Date |

|

*Print name |

|

*Signature |

Title (if applicable) |

Date |

|

*Required information. This form is valid if you complete all required information. We'll return incomplete forms to you.

Form |

PURPOSE OF FORM

A Power of Attorney (POA) is a legal document authorizing someone to represent you. You, the taxpayer/grantor, must complete, sign, and return this form if you want to grant power of attorney to an accountant, tax return preparer, attorney, family member, or anyone else to act on your behalf with the Idaho State Tax Commission.

SPECIFIC INSTRUCTIONS

SECTION 1 – Taxpayer Information

Individuals. Enter your name, Social Security number (SSN), Individual Taxpayer Identification Number (ITIN), and/or federal Employer Identification Number (EIN), if applicable; your street address or post office box; telephone number; and email address. If you file a tax return that includes a sole proprietorship business (Federal Schedule C) and you're authorizing the listed representatives to represent you for your individual and business tax matters, enter both your SSN (or ITIN) and your business EIN as your taxpayer identification numbers.

Corporations, Partnerships, or Associations. Enter the entity name, EIN, business address, telephone number, and email address.

SECTION 2 – Representatives

Enter the name, mailing address, Paid Preparer Tax Identification Number (PTIN), EIN, or SSN, telephone number, fax number, and email address of your representative. If you're appointing a company (such as a CPA firm) as your representative, the company name is sufficient. You don't need to specify each person who's authorized. If you want to appoint only a specific person in the company as your representative, you must include that person's name.

Cease Date. This form is effective on the date signed and will remain in effect until the cease date or until revoked. If you want to cease the Power of Attorney, provide a specific date on the cease date line provided, such as December 31, 2016. If you don't provide a date, the form is in effect until revoked.

If you don't want your representative to receive copies of notices and communications that we send to you, check the appropriate box under the representative's name and address.

SECTION 3 – Tax Matters Approved for Representation

You can use this form for any matter affecting a tax or fee that the Tax Commission administers, including audit and collection matters. It doesn't apply to matters before other state agencies or federal agencies, including the IRS.

Tax or Fee Types. Check the box for the tax or fee types you're authorizing the representative to discuss. You can check the box for all tax types.

State Tax/Fee Permit Number. Enter the state tax/fee permit number if applicable. If you provide a permit number, authorization is limited to only that account. If you don't provide a number, the form is valid for all accounts the taxpayer has in that tax type.

Tax Periods. Enter the tax periods you're authorizing the representative to discuss. Examples:

•All box – check the box to cover all the tax periods for the past, current and future (Don't provide specific year information)

•Consecutive years – list (2015, 2016, 2017)

•Date range – list year range or month and year

•Specific year – list as calendar year (2015)

•Fiscal years - list the ending month and year (07/2019)

Don't use general references (now, present or today). Forms with a general reference or no reference to an end date will be returned.

bL375E |

Page 1 of 2 |

Form |

Replacing a POA. You can appoint or change representatives at any time by submitting a POA. If you've previously filed a POA with the Tax Commission and are submitting another POA, you must check the appropriate box on the POA form to let us know your intent for the previously filed POAs. If no boxes are checked, the form is considered incomplete and will be returned to you. See the box definitions below.

Check here to revoke all prior POAs. Checking this box revokes all prior POAs on file with the Tax Commission for the same tax matters and years or periods covered by this form.

Check here to keep all prior POAs. Checking this box keeps all prior POAs on file with the Tax Commission and adds this POA for the same tax matters and years or periods covered by this form.

Check here to revoke the following POAs. If you check this box, list on the line which specific POAs you want to revoke.

Revoking a POA. You may revoke a POA or the representative may withdraw at any time by submitting a copy of the previously executed POA with "REVOKE" written across the top of the form with your signature and date. You also can submit a written statement specifying your intent to revoke a POA or withdraw as the representative. You must sign and date the statement and include the name, address, and SSN/EIN of the taxpayer/grantor and the name and address of the representatives whose authority is being revoked or withdrawn.

SECTION 4 - Signature of Taxpayer/Grantors

Individuals. You must sign and date the form. If you filed a joint return, your spouse must also sign and date the form.

Corporations. Officers with the legal authority to bind the corporation must sign and enter their exact titles and date the form.

Partnerships/LLCs. If one partner or member is authorized to act in the name of the partnership or LLC, only that partner or member is required to sign and enter his or her title and date the form.

Estates. If there is more than one executor, only one

FILING THIS FORM

Mail or fax this completed form to the Tax Commission section OR employee you've been working with. Otherwise, mail or fax the completed form to:

Idaho State Tax Commission Account Registration Maintenance

PO Box 36

Boise, ID

Contact us:

In the Boise area: (208)

Hearing impaired (TDD) (800)

tax.idaho.gov/contact

bL375E |

Page 2 of 2 |

Document Specifics

| Fact Name | Detail |

|---|---|

| Purpose | The Tax POA (Power of Attorney) form, ID-POA, is used to authorize an individual to receive confidential information and make decisions regarding the tax matters of another person or entity in the state it is issued. |

| Governing Law | This form is governed by the laws of the state in which it is issued, and it specifically applies to tax matters within that state. |

| Applicability | The ID-POA form is applicable to various tax matters including income tax, sales tax, and other state taxes for individuals, corporations, partnerships, and other entities. |

| Designation of Representative | The form allows for the designation of a representative, who can be an attorney, certified public accountant, or another person authorized under state law to represent the taxpayer. |

| Duration | The duration of the powers granted by the ID-POA form can be specified within the document itself, subject to any limitations under state law. |

| Revocation | The powers granted by the ID-POA can be revoked at any time by the person or entity that granted them, through a written notice or by executing a new POA form. |

| Filing Requirements | The completed ID-POA form must be filed with the appropriate state department or agency that handles tax matters, in accordance with its filing guidelines. |

Guide to Writing Tax POA form ID-POA

Once you have decided to grant someone the authority to handle your tax matters, the Tax Power of Attorney (POA) form ID-POA is a crucial document that you need to complete. This form will enable the person you designate, known as your agent, to receive your tax information and make decisions on your behalf regarding your taxes. The following step-by-step guidance is designed to help you fill out this form accurately and efficiently to ensure that your tax matters are managed according to your wishes.

- Begin by entering your full legal name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated fields at the top of the form.

- Next, provide your current mailing address, including the city, state, and ZIP code, to ensure you receive any correspondence related to your taxes.

- Specify the name of the individual you are appointing as your agent (the person who will have the power to deal with your tax matters). Include their full legal name and contact information.

- If the agent has a Preparer Tax Identification Number (PTIN) or an IRS Enrolled Agent number, make sure to include this information as well. This ensures that the tax authorities can verify their credentials.

- Clearly state the tax matters and years or periods for which the POA is granted. This section is critical for defining the scope of the agent's authority. Be as specific as possible to avoid any ambiguity or misunderstanding.

- If there are any specific acts you do not wish to authorize, list them in the specified area. This could include actions such as signing certain documents or making certain tax elections.

- Sign and date the form in the presence of a witness if required by your state. Some states may also require the signature of the appointed agent, acknowledging their acceptance of the responsibilities this document entails.

- Finally, submit the completed form to the appropriate tax authority as directed. Instructions for submission can vary, so it's important to follow the guidelines provided by your state or the IRS for submitting a Tax POA.

After submitting the Tax POA form, you should receive a confirmation that your agent's authority has been acknowledged and is in effect. This confirmation is essential for your records. Keep in mind, maintaining open communication with your designated agent is key to ensuring your tax matters are handled as you wish. If your circumstances change, remember to review and update your Tax POA accordingly to reflect your current wishes and tax situation.

Understanding Tax POA form ID-POA

What is the Tax POA Form ID-POA?

The Tax POA (Power of Attorney) Form ID-POA is a document that allows an individual to grant someone else the authority to handle their tax matters. This could include signing documents, making decisions, and discussing tax issues with the tax authorities on their behalf. It's mainly used to give a trusted person or a tax professional the power to manage tax-related tasks, which can be overwhelming or require specific knowledge to navigate correctly.

Who can be appointed as an agent on the ID-POA?

Typically, an agent on the ID-POA can be anyone the individual trusts to manage their tax matters. This often includes certified public accountants, attorneys, family members, or close friends. The key is to choose someone who is responsible and knowledgeable enough about tax matters, or someone who is willing to consult with a professional to ensure the correct handling of these tasks.

How do I complete the Tax POA Form ID-POA?

- Identify the agent: Clearly spell out the name and contact information of the person you are appointing.

- Specify the tax matters: Detail the specific taxes or tax years you're giving them authority over. This could include income tax, property tax, etc., for certain tax years or all future years.

- Sign and date: Both you and your appointed agent must sign and date the form, confirming the agreement and power granted.

It's essential to read through the form carefully to ensure all relevant sections are completed accurately to avoid any issues with tax authorities recognizing the form.

Do I need to file the ID-POA with the IRS?

No, the Tax POA Form ID-POA is not filed with the IRS. This form is intended for state tax purposes and should be filed with the specific state tax authority, as required by your state's regulations. Make sure to check with your state tax authority to determine the correct filing procedures.

Can the powers granted in the ID-POA be revoked?

Yes, the powers granted through the Tax POA Form ID-POA can be revoked at any time by the person who granted them. To revoke the powers, you must notify your agent in writing of the revocation. Additionally, it's often recommended to inform any tax authorities or institutions that were aware of the original power of attorney, to ensure they know of its revocation.

What if I need to grant power of attorney for tax matters in more than one state?

If you need to grant power of attorney for tax matters in more than one state, you may need to complete separate POA forms for each state, depending on each state’s requirements. It’s important to check with each state's tax authority to confirm their requirements, as the ID-POA form is state-specific. You might need separate documentation for each jurisdiction where you have tax matters needing representation.

Common mistakes

Filling out the Tax Power of Attorney (POA) form, also known as ID-POA, can often be a daunting task. Unfortunately, many make errors during this process, which can complicate matters. Here, we’ll discuss eight common mistakes to watch out for:

Not verifying the representative’s information: It’s crucial to double-check the details of the person you're authorizing. Errors here can invalidate the POA.

Leaving sections incomplete: Every field in the form should be filled out. Missing information can delay or void the authorization.

Incorrect taxpayer information: If the taxpayer's details are wrong, the POA won’t match Internal Revenue Service (IRS) records, leading to potential rejections.

Failing to specify the tax matters and years: The form requires you to outline the specific tax issues and the years they apply to. Being vague or inaccurate here can limit your representative’s ability to act on your behalf.

Not using the correct form version: Tax forms are updated. Ensure you're using the latest version to avoid processing delays.

Misunderstanding the extent of authority granted: People often mistake the breadth of power they're giving. Understanding and clearly defining the scope of authority is essential to prevent unintended consequences.

Sending the form to the wrong place: Confirm you're submitting the form to the correct IRS office. Mistakes here can result in lost forms and wasted time.

Forgetting to sign and date: Without a signature and the date, the POA form is incomplete and will not be processed.

By steering clear of these mistakes, you can ensure a smoother process in granting someone the authority to handle your tax matters. Always take your time, review each section carefully, and reach out for professional assistance if you're unsure about any part of the form or process. Your diligence can prevent unnecessary complications and secure your financial interests effectively.

Documents used along the form

Navigating the waters of tax documentation can often feel like trying to find your way through a labyrinth, with the Tax Power of Attorney (POA) form being just one crucial piece of the puzzle. This particular form grants an individual the authority to handle tax matters on another's behalf, but it's rarely the only document needed. Whether you're managing taxes for yourself, assisting a client, or stepping in for someone unable to handle their own affairs, understanding the complementary documents often used alongside the Tax POA can streamline the process and ensure all bases are covered.

- Form 1040: Known as the U.S. Individual Income Tax Return, it is the foundational document for an individual’s federal tax filing. This form is where you report your income, claim deductions and credits, and calculate your tax refund or amount owed to the IRS.

- W-2 Form: This wage and tax statement is a crucial document for employees, detailing the income they've received from their employer as well as the taxes withheld over the year. It is essential for accurately completing the Form 1040.

- 1099 Form: For freelancers, independent contractors, and others who receive income outside of traditional employment, the 1099 form reports earnings to the IRS. Like the W-2, it is vital for filling out the Form 1040 accurately.

- Form 4868: Recognized as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, this form is used to request additional time to file Form 1040, giving taxpayers up to six extra months to gather their documents and file.

- Form 8821: The Tax Information Authorization form allows designated individuals to request and inspect a taxpayer’s confidential information for a specified period, but it does not grant authority to represent the taxpayer before the IRS.

- Schedule C: Pertinent for sole proprietors or single-member LLCs, this form is attached to Form 1040 to report profits or losses from a business. It outlines the income, expenses, and potential deductions associated with running the business.

Together, these forms and documents create a comprehensive picture of an individual's tax situation, enabling the appointed Power of Attorney to make informed decisions and take necessary actions. Whether you're preparing for tax season, managing ongoing financial affairs, or stepping in for someone else, being familiar with these documents alongside the Tax POA can make the process more manageable and less daunting. With the right paperwork in hand, navigating the tax landscape can be a straightforward and controlled process.

Similar forms

The Tax Power of Attorney (POA) form, commonly referred to in some states as the ID-POA form, shares similarities with several other legal documents that also deal with the delegation of authority or decision-making powers. For example, a General Power of Attorney is a document that grants broad powers to an agent to act on behalf of the principal in various matters, not just limited to tax issues but extending to financial, legal, and personal affairs. This similarity lies in the core concept of authorizing another individual to make decisions and take actions on one's behalf.

Similarly, a Durable Power of Attorney parallels the Tax POA in its feature that the granted authority remains in effect even if the principal becomes incapacitated or unable to make decisions for themselves. The key difference lies in the scope and permanence of the powers granted. While a Tax POA might be narrowly focused on tax matters and could be limited in duration, a Durable Power of Attorney encompasses a broad range of powers that endure beyond the principal’s capacity to make decisions.

Another related document is the Health Care Power of Attorney, which specifically deals with medical decisions. Like the Tax POA, it allows an individual to appoint someone else to make decisions on their behalf. The principal difference between them is the domain in which the appointed agent can make decisions: the Tax POA covers tax-related matters, whereas the Health Care Power of Attorney focuses on medical and health care decisions.

The Limited Power of Attorney is closely related to the Tax POA form in that it grants specific powers to an agent for a limited purpose. For instance, a Limited Power of Attorney might authorize an agent to sell a particular property, manage certain assets, or handle financial transactions. The similarity with the Tax POA lies in the nature of the authorization—it is specific and limited in scope. The Tax POA, specifically, authorizes someone to handle tax matters and nothing beyond that, mirroring how a Limited Power of Attorney is confined to the particular powers granted within it.

Lastly, the Springing Power of Attorney is akin to the Tax Power of Attorney in terms of conditional effectiveness. This document becomes effective under certain conditions, usually the incapacitation of the principal. The Tax POA might not be structured to become effective under such conditions, but it can be tailored to become effective under specific circumstances, such as the unavailability of the taxpayer during a tax audit or proceedings. Both documents share the conditional activation feature, although the triggers and the scope of authority differ markedly.

Dos and Don'ts

When filling out the Tax Power of Attorney (POA) form, known as ID-POA, there are specific steps you should follow to ensure accuracy and completeness. This form grants someone else the authority to handle your tax matters, making it crucial to fill it out correctly. Here are the do’s and don'ts to consider:

Do's:- Read instructions carefully before filling out the form to avoid any mistakes.

- Provide accurate information about yourself and the representative you are granting authority to. This includes full names, addresses, and taxpayer identification numbers.

- Specify the tax matters and years or periods for which you are granting authority clearly. This ensures that the representative's power is accurately defined.

- Ensure the representative signs the form. The ID-POA is not valid unless the appointed representative agrees to the designation by signing the form.

- Keep a copy of the completed form for your records. It’s important to have your own record of the authorization you’ve granted.

- Submit the form to the appropriate tax authority in a timely manner. Check if it can be submitted electronically or if it needs to be mailed.

- Don’t leave sections blank. If a section does not apply, fill it in with “N/A” to indicate that it’s not applicable.

- Don’t use abbreviations or nicknames. Always use full legal names and addresses to prevent any confusion.

- Don’t forget to specify the extent of authority you are granting. Being vague can lead to misunderstandings or misuse of the power granted.

- Don’t sign without reviewing the entire form to ensure all information is correct and complete.

- Don’t neglect to notify your representative about the specific powers and responsibilities you are granting. Clear communication is key to a successful representation.

- Don’t hesitate to seek professional advice if you are unsure about any part of the form. Tax matters can be complex, and professional guidance can help avoid errors.

Misconceptions

Understanding the Tax Power of Attorney (POA) Form, specifically the ID-POA Form, is crucial for individuals seeking to authorize another person to handle their tax matters. However, misconceptions about this legal document can lead to confusion and misuse. Here are seven common misunderstandings:

- Only Attorneys Can Be Appointed as Agents: Many believe that a Tax POA can only appoint a licensed attorney to act on their behalf. In reality, the ID-POA form allows the taxpayer to designate any trusted individual, such as a family member, friend, or tax professional, to be their agent, as long as the person is eligible and willing to act in this capacity.

- The ID-POA Grants Unlimited Power: Another misconception is that the ID-POA provides the agent with unrestricted power to handle all tax matters. However, the form allows the taxpayer to specify which tax matters and periods the agent can deal with, limiting their authority to only those specified areas.

- A Tax POA Is Permanent: Some people think once a Tax POA is executed, it is irrevocable and remains in effect indefinitely. The truth is the taxpayer can revoke the power of attorney at any time by submitting a written notice to the tax authority or by executing a new tax POA form.

- Filing a Tax POA Form Automatically Fixes Tax Issues: There is a belief that simply filing a Tax POA form with the tax authority will solve any tax issue. This is incorrect. The form merely authorizes someone else to receive confidential information and make decisions on the taxpayer’s behalf; it does not address or resolve tax problems directly.

- Any Tax Form Can Serve as a POA: Some individuals assume that any tax-related form can be used to grant power of attorney. In reality, a specific POA form, such as the ID-POA for Idaho, must be completed and filed to legally appoint a representative for tax matters.

- The ID-POA Cannot Be Used for State Tax Matters: There’s a false belief that the ID-POA form is only applicable for federal tax affairs and cannot be used for state-related tax issues. The ID-POA form is specifically designed for matters concerning the state of Idaho, allowing agents to handle state tax responsibilities.

- Filing the ID-POA Form Is Complicated: Finally, there is a misconception that completing and filing the ID-POA form is a complex process. While it requires careful attention to detail, the form itself provides clear instructions and can be filed without the assistance of a legal professional, simplifying the process of appointing a tax representative.

Key takeaways

Understanding how to complete and utilize the Tax Power of Attorney (POA) form, specifically the ID-POA form, is crucial for individuals or entities aiming to authorize another person to handle their tax matters with the tax authority. Here are key takeaways to ensure the process is smooth and efficient:

- The ID-POA form must be filled out completely to ensure its validity. This includes the full names, addresses, and taxpayer identification numbers (SSN, EIN) of the taxpayer and the representative. Any incomplete information may result in delays or the inability to act on behalf of the taxpayer.

- Clearly specify the tax matters and years or periods for which the authorization is granted. The form allows for detailing the specific taxes and the exact years or periods the representative is allowed to handle, ensuring there is no confusion regarding the scope of the authorization.

- Signing and dating the form is essential. The taxpayer’s signature legally authorizes the representative to act on their behalf. Without a valid signature, the document is not legally binding, and the representative cannot take any actions.

- Understanding the duration of the authorization is important. The ID-POA form typically specifies the duration for which the power of attorney is valid. Taxpayers should note when the authorization will expire and renew it if necessary.

- Submit the completed form to the appropriate tax authority office. The form may need to be mailed or delivered to a specific office, depending on regional guidelines. Ensure it is sent to the correct office to avoid processing delays.

Filling out the ID-POA form accurately and submitting it to the correct authority ensures that the designated representative can act on the taxpayer's behalf efficiently. Attention to detail and understanding the scope of authorization can prevent potential issues and help in managing tax matters effectively.

Popular PDF Documents

Faa 8050-2 - Finally, this document not only signifies a change in ownership but also symbolizes the start of a new chapter for the aircraft under new management.

What Is a Cp575 - Users are cautioned against attempting to file the form without adhering to the strict guidelines set by the IRS.

Ptax 300 - The detailed activity description, down to specific dates and frequencies, allows for a precise evaluation of the property's exempt use.