Get Tax POA form dr 0145 Form

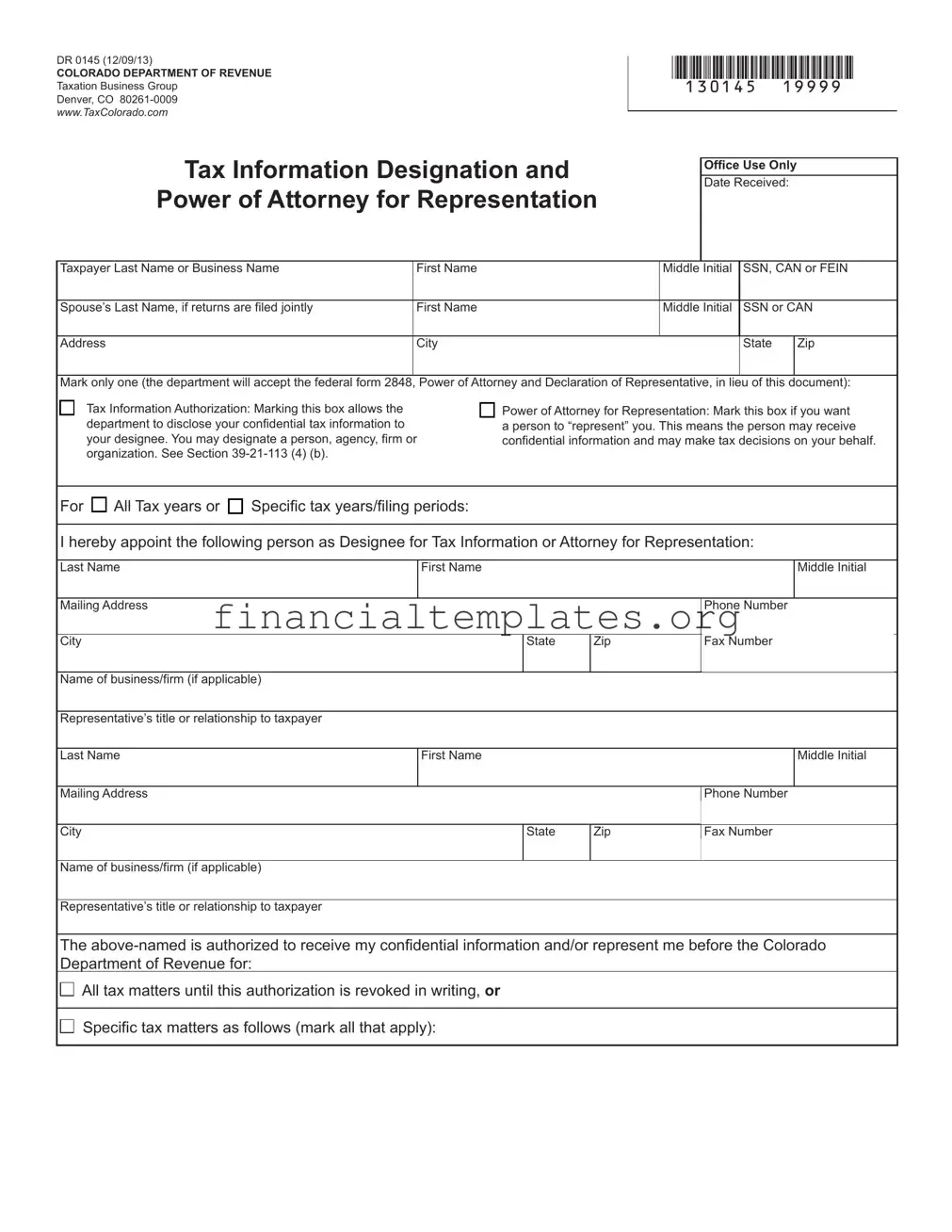

Individuals and businesses alike often find themselves in need of designating someone to handle their tax matters, a task that can be both sensitive and complex. The Tax Power of Attorney (POA) form, specifically the DR 0145 form, serves as a critical tool in this process. This document authorizes a named individual, often an accountant, attorney, or other trusted professional, to communicate with tax authorities, make decisions, and complete actions on behalf of the signer regarding their tax affairs. It covers a range of tasks, from filing taxes to obtaining confidential information and even representing the signer in tax disputes. The inclusion and correct handling of this form are paramount, as it ensures that tax matters are managed efficiently and with the necessary legal backing. Crafting a Tax POA with careful attention to detail and a clear understanding of its implications is essential, as any oversights can lead to complications or misrepresentation in tax-related matters.

Tax POA form dr 0145 Example

DR 0145 (12/09/13) |

|

*130145==19999* |

|

||

Taxation Business Group |

|

|

COLORADO DEPARTMENT OF REVENUE |

|

|

Denver, CO |

|

|

www.TaxColorado.com |

|

|

|

|

|

Tax Information Designation and |

|

|

|

Date Received: |

|||||||

|

|

|

|

|

|

|

|

Office Use Only |

||||

|

Power of Attorney for Representation |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

Taxpayer Last Name or Business Name |

First Name |

|

|

|

|

Middle |

Initial |

|

SSN, CAN or FEIN |

|||

|

|

|

|

|

|

|

|

|

|

|||

Spouse’s Last Name, if returns are filed jointly |

First Name |

|

|

|

|

Middle Initial |

|

SSN or CAN |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

City |

|

|

|

|

|

|

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Mark only one (the department will accept the federal form 2848, |

Power of Attorney and Declaration of Representative, in lieu of this document): |

|||||||||||

□ |

Tax Information Authorization: Marking this box allows the |

|

Power of Attorney for Representation: Mark this box if you want |

|||||||||

department to disclose your confidential tax information to |

□ a person to “represent” you. This means the person may receive |

|||||||||||

|

your designee. You may designate a person, agency, firm or |

confidential information and may make tax decisions on your behalf. |

||||||||||

|

organization. See Section |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

□ All Tax years or □ Specific tax years/filing periods: |

|

|

|

|

|

|

|

|

|

|

|

I hereby appoint the following person as Designee for Tax Information or Attorney for Representation: |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

First Name |

|

|

|

|

|

|

|

|

|

Middle Initial |

|

|

|

I |

|

|

|

|

|

|

|

|

|

I |

Mailing Address |

|

|

|

|

|

|

Phone Number |

|

|

|||

|

|

|

|

|

|

|

|

( |

) |

|

|

|

City |

|

|

|

State |

|

Zip |

|

Fax Number |

|

|

||

|

|

|

l |

l |

|

|

|

|

|

|

||

|

|

|

|

( |

) |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of business/firm (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative’s title or relationship to taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Last Name |

First Name |

|

|

|

|

|

|

|

|

|

Middle Initial |

|

|

|

I |

|

|

|

|

|

|

|

|

l |

|

Mailing Address |

|

|

|

|

|

|

Phone Number |

|

|

|||

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

Zip |

|

Fax Number |

|

|

||

|

|

|

|

I |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

||

Name of business/firm (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Representative’s title or relationship to taxpayer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

The |

||||||||||||

Department of Revenue for: |

|

|

|

|

|

|

|

|

|

|

|

|

□ All tax matters until this authorization is revoked in writing, or |

|

|

|

|

|

|

|

|

|

|

||

□ Specific tax matters as follows (mark all that apply): |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

*130145==29999* |

|

|

|

|

|

|

|

|

|

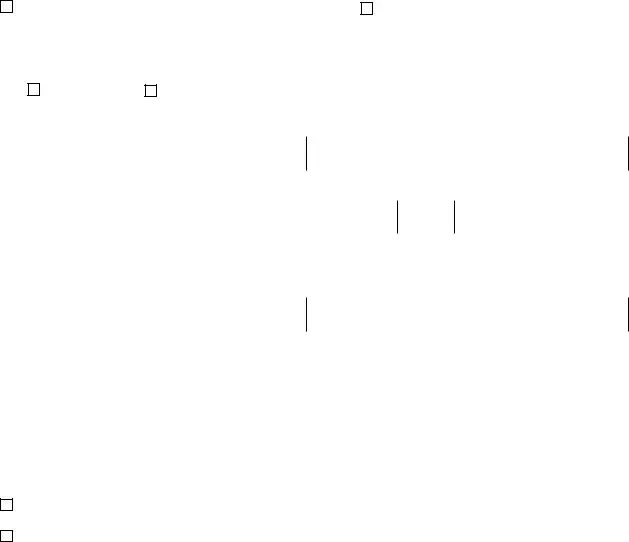

□ |

State Sales Tax |

Period |

□ |

Partnership Income Tax |

|

Period |

|

– |

|

– |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

□ |

State Consumer Use Tax |

Period |

□ |

Withholding Income Tax |

|

Period |

|

– |

|

– |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

□ |

Individual Income Tax |

Period |

□ |

All Department- |

|

Period |

|

– |

Administered Sales Taxes |

|

– |

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

□ Corporate Income Tax |

Period |

|

All Department- |

|

Period |

||

– |

□ |

|

– |

||||

|

Administered Consumer Use Taxes |

|

|||||

□ |

Fiduciary Income Tax |

Period |

□ |

Other tax (specify) |

|

Period |

|

– |

|

– |

|||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

If other, please explain |

|

|

|

|

|

|

|

Signature of Taxpayer(s)

•I acknowledge the following provision: Actions taken by a Power of Attorney representative are binding, even if the representative is not an attorney. Proceedings cannot later be declared legally defective because the representative was not an attorney.

•Corporate officers, partners, fiduciaries, or other qualified persons signing on behalf of the taxpayer(s):

I am authorized to sign this form on behalf of the entity or person identified above as the taxpayer because:

I am the taxpayer

The taxpayer is a corporation, and I am the corporate officer

The taxpayer is a partnership, and I am a partner

The taxpayer is a trust, and I am the trustee

The taxpayer is a decedent’s estate, and I am the estate administrator

The taxpayer is a receivership, and I am the receiver

Other (if none of the above, then explain what representative capacity you have for the taxpayer)

•If a tax matter concerns a joint return, both spouses must sign if joint representation is requested. Taxpayers filing jointly may authorize separate representatives.

Signature |

Print Name |

|

|

|

Date (MM/DD/YY) |

|

|

I |

|

|

|

|

|

Title (if applicable) |

|

|

Daytime telephone number |

|||

|

|

I( |

) |

|

|

|

Spouse Signature (if joint representation) |

Print Name |

|

|

|

Date (MM/DD/YY) |

|

I

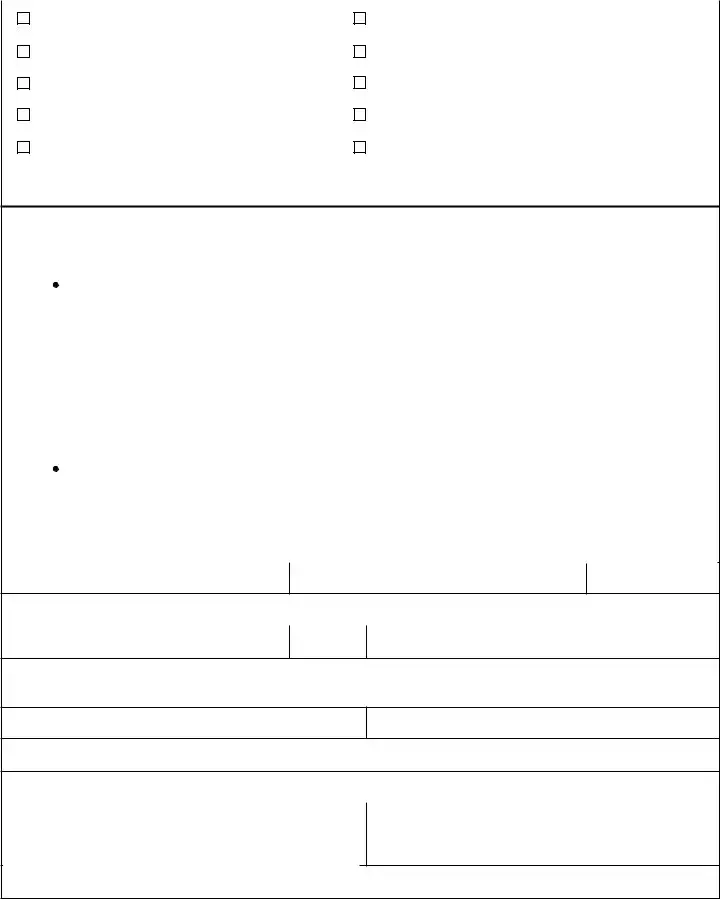

Declaration of Representative — I am authorized to represent the taxpayer(s) identified above for the tax matter(s) specified.

Signature |

Date (MM/DD/YY) Title |

I

Note: This authorization form automatically revokes and replaces all earlier tax information designations and/or earlier powers of attorney for representation on file with the Colorado Department of Revenue for the same tax matters and years or periods covered by this form. Attach a copy of any other tax information authorization or power of attorney you want to remain in effect.

If you do not want to revoke a prior authorization, taxpayer sign here |

Spouse signature if returns are filed jointly |

Please complete the following, if known (for routing purposes only). Otherwise, you may mail this document or submit an electronically scanned copy of the document through Revenue Online, www.Colorado.gov/RevenueOnline

Revenue Employee

Division |

Section |

||

|

|

||

Telephone Number |

Fax Number |

||

( |

) |

( |

) |

Send to: Colorado Department of Revenue Denver, CO

If this tax information authorization or power of attorney form is not signed, it will be returned.

Instructions for DR 0145

This form is used for two purposes:

•Tax information disclosure authorization. You authorize the department to disclose your confidential tax information to another person. This person will not receive original notices we send to you.

•Power of attorney for representation. You authorize another person to represent you and act on your behalf. The person must meet the qualifications listed here. Unless you specify differently, this person will have

full power to do all things you might do, with as much binding effect, including, but not limited to: providing information; preparing, signing, executing, filing, and inspecting returns and reports; and executing statute of limitation extensions and closing agreements.

SSN: Social Security Number

CAN: Colorado Account Number

FEIN: Federal Employer Identification Number

This form is effective on the date signed. Authorization terminates when the department receives written revocation notice or a new form is executed (unless the space provided on the front is initialed indicating that prior forms are still valid). If this tax information designation and power of attorney for representation form is used for taxpayers on a joint return, both the primary taxpayer and spouse must sign this form.

Unless the appointed representative has a fiduciary relationship to the taxpayer (for example, personal representative, trustee, guardian, conservator), an original Notice of Deficiency will be mailed to the taxpayer as required by law. A copy will be provided to the appointed representative when requested.

For corporations, “taxpayer” as used on this form, must be the corporation that is subject to Colorado tax. List fiscal years by year end date.

An individual who prepares and either signs your tax return or who is not required to sign your tax return (by the instructions or by rule), may represent you during an audit of that return. That individual may not represent you for any other purpose unless they meet one of the qualifications listed above.

Generally, declarations for representation in cases appealed beyond the Department of Revenue must be in writing to the local jurisdiction district court. A person recognized by a district court will be recognized as your representative by the department.

Taxpayer Assistance

General tax information

www.TaxColorado.com

Revenue Online account access www.Colorado.gov/RevenueOnline

Telephone

Document Specifics

| Fact Name | Description |

|---|---|

| Form Title | Tax Power of Attorney Form (DR 0145) |

| Primary Use | Allows a person to grant another individual the authority to handle their tax matters. |

| Governing Law | The form is governed by state tax laws, and its use and requirements can vary by state. |

| Where to File | This form is submitted to the relevant state's Department of Revenue or Taxation. |

| Validity | The duration of the authority granted can be specified within the form and is subject to state laws. |

| Key Sections | Includes sections on taxpayer information, representative designations, tax matters, and the specific powers granted. |

| Signatory Requirements | Typically requires the signatures of the taxpayer and the appointed representative, witnessed or notarized as per state requirements. |

Guide to Writing Tax POA form dr 0145

After deciding to delegate authority for tax matters, completing the Tax Power of Attorney (POA) form, specifically the DR 0145 form, is the next crucial step. This document empowers a chosen individual to handle tax affairs on one's behalf. It's a process that demands attention to detail to ensure that all sections are filled out correctly, providing the necessary permissions without any unintended consequences. Follow these guidelines to complete the form systematically.

- Start by entering the full name of the taxpayer(s) granting the power of attorney in the designated space at the top of the form. This includes first, middle, last names, and any suffixes if applicable.

- Include the taxpayer's identification numbers next. For individuals, this will be the Social Security Number (SSN). For businesses, use the Employer Identification Number (EIN).

- Proceed to fill in the taxpayer's full address. This should include the street address, city, state, and ZIP code, ensuring that any correspondence can be correctly directed.

- Next, detail the name(s) and address(es) of the appointed representative(s). Similar to step 3, include all pertinent information such as street address, city, state, and ZIP code.

- Specify the tax matters for which authority is being granted. This involves detailing the type of tax, the tax form number, and the years or periods covered. Be as precise as possible to avoid any ambiguity regarding the extent of the granted powers.

- For each representative named, provide their telephone number, fax number, and CAF (Centralized Authorization File) number if they have one. This ensures they can be readily contacted regarding the taxpayer’s matters.

- Sign and date the form at the bottom. The taxpayer(s) granting the power must sign and date the form. If a taxpayer is unable to sign due to health reasons, a representative holding a valid power of attorney can sign on their behalf, provided the original POA document specifies this allowance.

- If applicable, ensure the representative(s) also sign(s) the form. This acknowledges their acceptance of the responsibilities entailed in the POA.

Once the form is fully completed and signed by all required parties, it should be submitted following the instructions provided by the issuing authority. Submission methods can vary, so it’s important to check whether digital submission is accepted or if a hard copy needs to be mailed. After submission, it’s advisable to keep a copy of the form for personal records and track the progress of the POA's acceptance to ensure that the appointed individual can begin acting on the taxpayer’s behalf without delay.

Understanding Tax POA form dr 0145

-

What is the Tax POA Form DR 0145?

The Tax Power of Attorney (POA) Form DR 0145 is a legal document used in the state to authorize someone else to handle your tax matters. This could include filing taxes, obtaining tax information, and making decisions on your behalf related to taxes. It's especially helpful if you're unable to manage these affairs yourself.

-

How can I fill out the Tax POA Form DR 0145?

To fill out the form, you'll need to provide your personal information, including your name, Social Security Number, or ITIN (Individual Tax Identification Number), and address. You will also need to specify the details of the appointed representative, such as their name, address, and contact information. The form must be signed and dated by you and your appointed representative to be valid.

-

Do I need a lawyer to fill out the Tax POA Form DR 0145?

While it's not mandatory to have a lawyer to fill out the Tax POA Form DR 0145, consulting with one can be beneficial. A lawyer can help clarify any legal terms and ensure that the form accurately reflects your wishes. Additionally, they can provide advice on choosing an appropriate representative.

-

How long is the Tax POA Form DR 0145 valid?

The validity period of the Tax POA Form DR 0145 can vary depending on your state's laws and any stipulations mentioned in the document. Typically, it remains in effect until it's revoked. To revoke the Power of Attorney, you must notify your representative and the relevant tax authorities in writing.

Common mistakes

Filling out tax documents can feel overwhelming. For those granting another person the power to handle their tax matters, the Tax Power of Attorney (POA), specifically the DR 0145 form, plays a crucial role. However, mistakes can happen. Being aware of these common errors can help avoid unnecessary complications.

-

Not specifying the tax matters correctly: Individuals often provide vague descriptions of the tax matters for which they are granting authority. It's vital to be specific about the years and types of taxes the representative is allowed to handle.

-

Forgetting to sign and date the form: This simple oversight can invalidate the entire document. The principal must sign and date the form, confirming their consent and the document's validity.

-

Choosing the wrong representative: The designated representative should have the appropriate expertise in tax matters. Appointing a friend or relative without the necessary knowledge can lead to mismanagement of tax affairs.

-

Not specifying the duration of the power: Failing to indicate when the POA starts and ends can lead to confusion and legal issues. Clearly state the duration to ensure the POA is effective for the intended period.

-

Skipping contact information: The form requires contact details for both the principal and the representative. Overlooking these details can hamper communication between the tax authorities and the parties involved.

-

Omitting necessary documentation: Sometimes, additional documentation is required to support the POA. Not attaching these documents can result in delays or rejection of the form.

Understanding and avoiding these mistakes can streamline the process, ensuring that tax matters are managed efficiently and accurately. Always review the form carefully before submission to avoid common pitfalls.

Documents used along the form

When dealing with tax matters, particularly in the state where the Tax Power of Attorney (POA) Form DR 0145 is required, it's common to encounter other forms and documents that are essential for comprehensive tax management and legal clarity. These documents work in tandem with the Tax POA to ensure that one's financial affairs are in order, compliance with tax laws is maintained, and representatives have the necessary authority to act on one's behalf. Let's explore some of these additional forms and documents which often accompany the Tax POA, outlining their purposes and functionalities.

- Form 1040: This is the standard Internal Revenue Service (IRS) form individuals use to file their annual income tax returns. A representative named in a Tax POA might need access to this document to accurately prepare and submit tax returns on behalf of the individual.

- W-9 Form: Often used in conjunction with the Tax POA, the W-9 is requested by businesses or individuals that pay you to provide your Taxpayer Identification Number. This form ensures that the correct taxpayer identification is on file and can be required when opening a new account or setting up payments under the authority granted by a POA.

- 8821 Form: Tax Information Authorization form allows appointed individuals or organizations to request and inspect confidential tax information. While it does not permit them to represent you to the IRS, it's crucial for individuals acting under a POA who need to access tax records to ensure compliance or for planning purposes.

- Declaration of Representative: This is an essential form that accompanies the POA, where the representative declares their qualifications and acknowledges their responsibilities and the limitations of their authority. It’s a crucial document for setting the relationship's scope between the taxpayer and the representative.

In summary, navigating the complexities of tax law and representation requires not just the Tax POA Form DR 0145 but also a thorough preparation involving several other forms and documents. Each plays a unique role in ensuring that tax matters are handled efficiently and in compliance with relevant laws. Whether you're a taxpayer appointing a representative or a representative taking on this responsibility, understanding and utilizing these forms correctly is key to managing tax affairs effectively.

Similar forms

The Tax Power of Attorney (POA) form, known in some jurisdictions as DR 0145, grants someone the authority to handle tax matters on another's behalf. A similar document is the General Power of Attorney. This form allows an individual, known as the principal, to grant broad authority to another, the agent, to perform a wide range of legal acts on their behalf, such as buying or selling property, managing financial accounts, or entering contracts, not limited to just tax matters.

The Durable Power of Attorney is closely aligned with the Tax POA but with a crucial distinction: it remains effective even if the principal becomes mentally incapacitated. This aspect ensures that the agent can continue to manage all appointed affairs, including tax issues, healthcare decisions, and personal financial management, without interruption due to the principal's health condition.

Similarly, the Healthcare Power of Attorney designates someone to make medical decisions on another's behalf, unlike the Tax POA, which is focused on fiscal matters. Nonetheless, both documents operate under the principle of granting an agent authority to act in the principal's best interest within specified domains—taxes for the former and healthcare for the latter.

The Limited Power of Attorney narrows the scope significantly more than the Tax POA form. It grants the agent authority to act in specific situations, for a limited time, or for particular transactions. For instance, someone may use a Limited POA to authorize an agent to sell a car or represent them at a single legal proceeding, contrasting with the Tax POA's broader tax-related authorization.

The Springing Power of Attorney is designed to become effective only under certain conditions, typically the principal's incapacitation, similar to the Durable POA's enduring nature. However, unlike the Tax POA, which is effective immediately upon signing, a Springing POA lies dormant until specific triggering events occur, ensuring the principal retains control until absolutely necessary.

Revocation of Power of Attorney forms serve the opposite purpose of the Tax POA. While the Tax POA form establishes a relationship allowing an agent to act on the principal's behalf, a Revocation of Power of Attorney form is used to terminate such a relationship, ensuring the principal can reclaim full authority over their affairs whenever desired.

The Advance Healthcare Directive, while principally concerned with healthcare decisions, shares a common foundation with the Tax POA—preparing for situations where the principal cannot make decisions. This document outlines desires for end-of-life care and can appoint an agent, showing a similar respect for the principal's wishes in a different domain.

The Executorship Deeds, often part of estate planning, designate an individual to manage and distribute an estate after someone's death. While not a POA, it entrusts significant responsibilities to another, similar to how a Tax POA grants an agent the authority to handle tax issues, showcasing the trust placed in another individual to manage personal affairs.

The Business Power of Attorney (also known as a Commercial Power of Attorney) specifically relates to business matters, allowing an agent to make decisions ranging from financial management to employee supervision. Although it focuses on the business context, rather than personal taxes, it similarly conveys a comprehensive delegation of authority in its specified field, akin to the Tax POA.

Lastly, the Financial Power of Attorney is yet another document akin to the Tax POA, with a primary focus on the principal's financial affairs. It can encompass handling investments, managing bank accounts, and, notably, taking care of tax filings and obligations, overlapping with the Tax POA's functions but within a broader financial management scope.

Dos and Don'ts

Filling out the Tax Power of Attorney (POA) form, known as DR 0145, is a crucial step for individuals who wish to grant someone else the authority to handle their tax matters. Below are essential guidelines highlighting what to do and what to avoid during this process. This advice seeks to ensure that the POA form is completed accurately and effectively.

Things You Should Do:

- Thoroughly review all the sections of the form before starting to fill it out. Understanding each part ensures that all necessary information is correctly provided.

- Ensure the person you're granting power to is trustworthy and has a good understanding of tax matters. This individual will act on your behalf concerning tax issues, so their reliability and knowledge are paramount.

- Provide specific details about the tax matters and years you're granting control over. Being precise helps prevent any confusion or unauthorized actions.

- Sign and date the form in the presence of a witness or notary, if required by your state's law. This step is crucial for the document's validity.

Things You Shouldn't Do:

- Don't leave any fields blank. If a section doesn't apply, enter "N/A" (Not Applicable) to indicate that you didn't overlook it.

- Avoid choosing someone without a background in tax law or accounting. The POA grants significant authority, and the agent should have the requisite knowledge and experience.

- Don't forget to specify the expiration date of the POA if you wish the authorization to be time-limited. Failure to do so might result in the POA remaining in effect indefinitely.

- Refrain from submitting the form without retaining a copy for your records. Having a copy is essential for future reference or if disputes arise regarding the POA.

Misconceptions

When it comes to the Tax Power of Attorney (POA) form, specifically the DR 0145 form, several misconceptions can lead to confusion or mismanagement. Understanding these can help individuals navigate the process with more confidence and ensure their tax matters are handled accurately.

Only for Businesses: Many believe the DR 0145 form is solely for business-related tax matters. In reality, this form is versatile and can be used by individuals to grant others the authority to handle their personal tax affairs as well.

Grants Complete Control: There is a misconception that by signing a DR 0145 form, you are granting someone complete control over all your financial affairs. However, the scope of authority is specific to tax matters and can be further limited within the document.

Permanent and Irrevocable: Some think once the Tax POA is executed, it's permanent. This isn't the case; the form allows for the specification of an expiration date, and the grantor can revoke it at any time as long as they are mentally competent.

Immediate Effect: Another misconception is that the DR 0145 form takes effect immediately upon signing. While this is a common practice, the parties involved can specify a future date or condition for the POA to become effective.

Legal Expertise Not Required: It's often assumed that filling out and filing a Tax POA does not require any legal knowledge. While the form may seem straightforward, understanding the implications and ensuring proper completion can benefit from professional advice.

One Size Fits All: Many believe that the DR 0145 form is a "one size fits all" solution for tax POA needs. The truth is, tax situations vary, and the form should be tailored to meet the specific requirements and authorizations relevant to the individual’s circumstances.

Doesn't Need to be Filed with the Tax Authority: A common error is the belief that once completed, the DR 0145 form doesn't need to be filed with the tax authority. For the POA to be recognized and effective, the form must be submitted to and processed by the appropriate tax agency.

Correcting these misconceptions ensures that individuals understand their rights and responsibilities when using the Tax POA form DR 0145. It's always a good idea to consult with a tax professional or attorney to navigate specific needs and ensure the form is filled out accurately.

Key takeaways

The Tax Power of Attorney (POA) form, designated as DR 0145, plays a crucial role in how individuals can authorize representatives to handle their tax matters within specific jurisdictions. Here are four key takeaways about completing and utilizing the DR 0145 form effectively:

- Accuracy is Key: When filling out the DR 0145 form, it's essential to provide accurate and complete information about both the taxpayer and the appointed representative. Inaccuracies can lead to delays or confusion, potentially complicating tax matters further.

- Designating a Representative: The form allows taxpayers to designate an individual, such as an accountant or attorney, to act on their behalf. It’s vital to choose someone who is not only trustworthy but also possesses the requisite knowledge of tax laws and regulations pertinent to the taxpayer's needs.

- Scope and Limitations: The DR 0145 form enables taxpayers to specify the extent of the power granted to their representative. This could range from accessing tax records to representing the taxpayer in tax disputes. Clear definition of these powers helps prevent unauthorized actions and clarifies the representative's role.

- Validity and Revocation: The effectiveness of the DR 0145 form is subject to the laws governing the jurisdiction in which it is being used. Taxpayers should be aware of how long the form remains valid and understand the process for revoking the power of attorney if the need arises. This ensures that taxpayers retain control over their tax affairs.

In conclusion, the DR 0145 form is a critical document for anyone needing to authorize a representative for their tax related tasks. By paying attention to detail, selecting the right representative, setting clear boundaries, and understanding the form’s lifecycle, taxpayers can navigate their tax responsibilities more efficiently and securely.

Popular PDF Documents

Tax Form for Hsa - IRS 8889 is necessary for reporting any earnings on your HSA, ensuring these are tax-exempt if used for medical expenses.

How Much Does Workers Comp Pay in Alabama - The form asks for the incident's specifics: when, where, and how the injury or occupational disease occurred, ensuring a clear incident narrative.